Key Insights

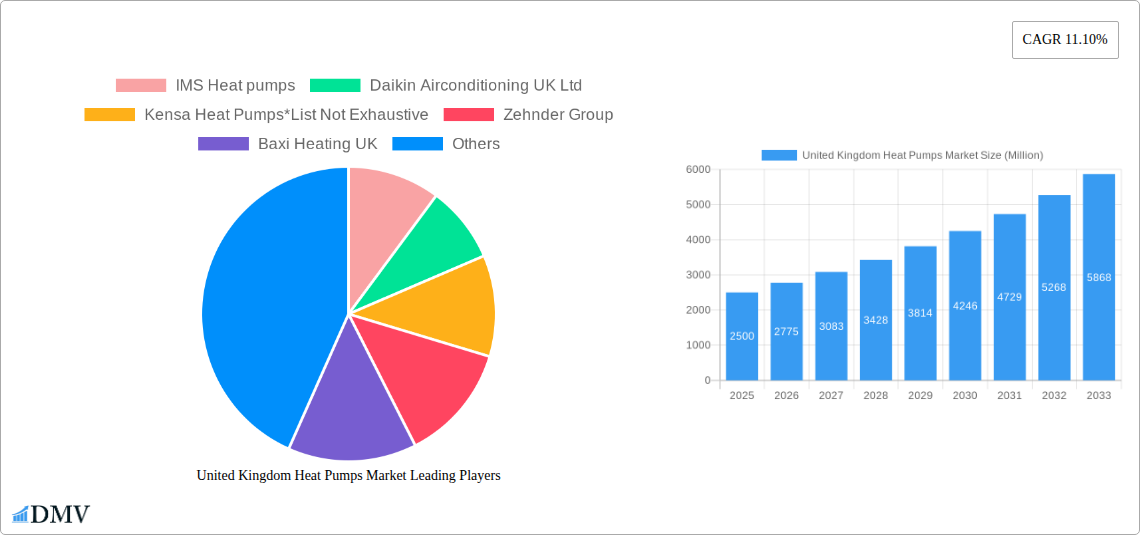

The United Kingdom heat pump market is experiencing robust growth, driven by increasing government incentives aimed at decarbonizing the building sector and reducing reliance on fossil fuels. The UK's commitment to net-zero emissions by 2050 is a significant catalyst, pushing homeowners and businesses towards energy-efficient heating solutions. Air-source heat pumps, due to their relatively lower installation costs compared to ground/water-source options, currently dominate the market. However, the latter is expected to witness significant growth as technological advancements improve efficiency and reduce upfront investment. The residential sector is the largest end-user, propelled by rising energy prices and enhanced consumer awareness of sustainable heating alternatives. Retrofit installations are currently more prevalent than new building integrations, reflecting the existing housing stock in the UK. Leading players like Daikin, Vaillant, and Worcester Bosch are actively expanding their product portfolios and distribution networks to capitalize on the burgeoning market demand. Competition is intensifying, with smaller, specialized companies also emerging, offering innovative solutions and focusing on specific niches. While initial investment costs remain a barrier for some, government grants and financing schemes are mitigating this challenge. Further market expansion hinges on continued technological innovation, streamlining installation processes, and ensuring skilled workforce availability.

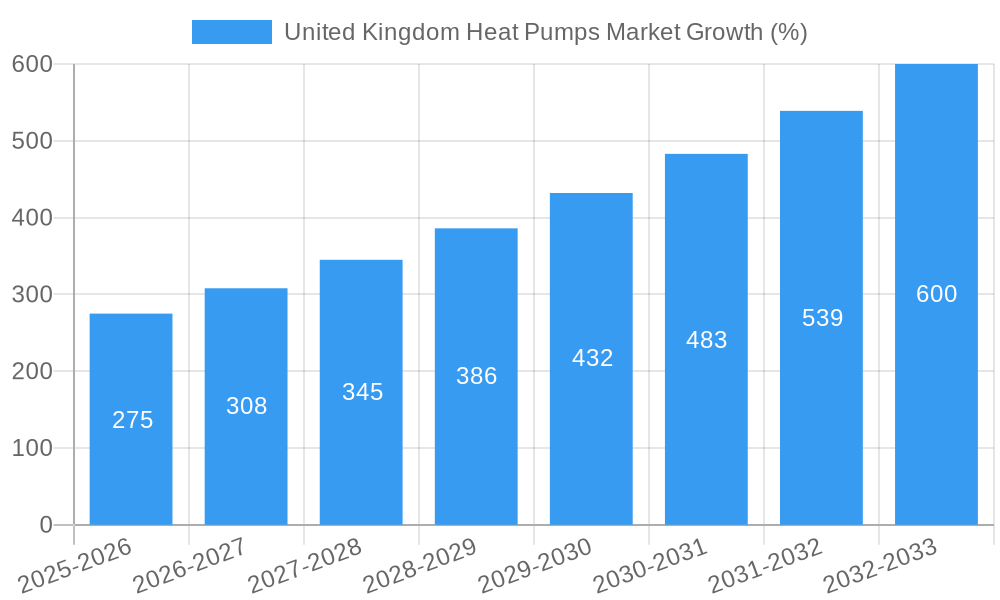

The forecast period (2025-2033) projects sustained growth, fueled by ongoing policy support, increasing consumer demand, and a gradual shift towards more sustainable building practices. The commercial and industrial sectors are also expected to contribute significantly to market expansion, particularly as larger-scale projects adopt heat pump technology for space heating and hot water provision. Challenges remain, including the need for grid infrastructure upgrades to support the increased electricity demand from widespread heat pump adoption and effective public education campaigns to address misconceptions about their performance and cost-effectiveness. Overall, the UK heat pump market presents a compelling investment opportunity, with substantial potential for both established players and new entrants, provided they adapt to evolving market dynamics and proactively address potential limitations.

United Kingdom Heat Pumps Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UK heat pumps market, covering the period 2019-2033. It offers invaluable insights into market dynamics, growth drivers, competitive landscape, and future opportunities, equipping stakeholders with the knowledge needed to navigate this rapidly evolving sector. The report incorporates detailed analysis of key segments, including product type (air-source, ground/water-source), installation type (retrofits, new buildings), and end-user vertical (residential, commercial, industrial). With a base year of 2025 and a forecast period extending to 2033, this report is a crucial resource for businesses, investors, and policymakers seeking to understand and capitalize on the UK's transition to sustainable heating solutions. The market is projected to reach xx Million by 2033.

United Kingdom Heat Pumps Market Composition & Trends

This section delves into the intricate structure of the UK heat pumps market, examining market concentration, innovation, regulations, substitutes, end-user profiles, and mergers & acquisitions (M&A) activities. We analyze the market share distribution amongst key players like Daikin Airconditioning UK Ltd, Vaillant Group, Worcester Bosch Group, Viessmann Group, and others, highlighting the competitive intensity. The report also explores the influence of government policies, such as the UK's commitment to net-zero emissions, on market growth.

- Market Concentration: The UK heat pump market exhibits a [Level of Concentration, e.g., moderately concentrated] structure with [Number] major players holding approximately [Percentage]% of the market share in 2024.

- Innovation Catalysts: Technological advancements in heat pump efficiency and smart home integration are driving market growth.

- Regulatory Landscape: Government incentives and regulations aimed at phasing out fossil fuel heating systems are significantly impacting market adoption.

- Substitute Products: Competition comes primarily from traditional gas boilers, although heat pumps are increasingly presenting a compelling alternative.

- End-User Profiles: The residential sector currently dominates, but commercial and industrial segments are showing significant growth potential.

- M&A Activities: The report details significant M&A activity in the market, including [Number] deals valued at approximately £xx Million in the historical period (2019-2024). Deal values and trends are analyzed in detail.

United Kingdom Heat Pumps Market Industry Evolution

This section provides a detailed analysis of the historical (2019-2024) and forecast (2025-2033) growth trajectories of the UK heat pump market. We examine technological advancements, shifting consumer preferences, and the impact of these factors on market expansion. The report will showcase the growing awareness of energy efficiency and environmental concerns among consumers, pushing increased demand for sustainable heating solutions. Furthermore, we'll analyze how technological innovations, such as improvements in heat pump efficiency and the integration of smart home technology, are accelerating market growth. Data points will include annual growth rates and adoption rates across different segments. Specific examples of advancements, such as improvements in low-temperature heating systems and better integration with renewable energy sources, will be discussed. The impact of government policies, such as grants and incentives, on accelerating market adoption will also be comprehensively examined. We will illustrate these trends with detailed market size projections for each segment over the forecast period.

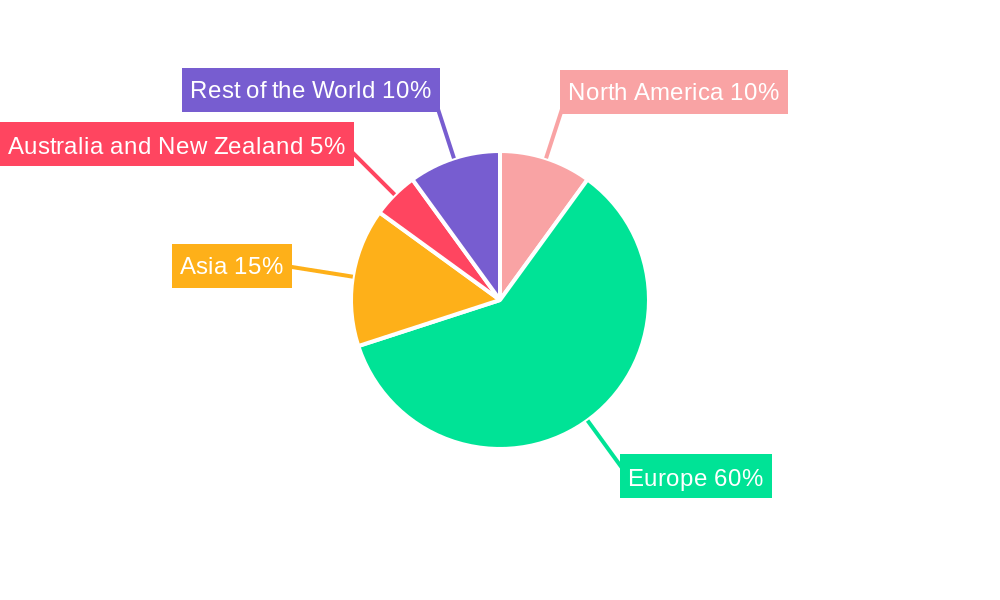

Leading Regions, Countries, or Segments in United Kingdom Heat Pumps Market

This section identifies the dominant regions, countries, or segments within the UK heat pump market. We provide a comprehensive analysis of the factors driving the dominance of specific segments, including investment trends and regulatory support.

- Product Type: Air-source heat pumps are currently the leading product type due to lower installation costs and widespread availability. However, ground/water-source heat pumps are gaining traction due to their higher efficiency and suitability for certain applications.

- Installation Type: Retrofits currently hold the larger market share, but new buildings are adopting heat pumps at a rapidly increasing rate.

- End-User Vertical: Residential applications represent the largest segment, driven by homeowner adoption and government incentives. The commercial segment is demonstrating strong growth potential fueled by energy cost savings and sustainability targets.

Key Drivers:

- Investment Trends: Significant investments in research and development, along with private equity funding (as seen in Heat Geek's recent funding round), are accelerating technological advancements and market expansion.

- Regulatory Support: Government schemes, grants, and policies supporting heat pump installations are acting as significant catalysts.

- Energy Efficiency Targets: Stricter building regulations and corporate sustainability goals are fostering increased demand.

United Kingdom Heat Pumps Market Product Innovations

The UK heat pumps market is witnessing significant product innovations focusing on improved efficiency, reduced environmental impact, and enhanced user experience. Manufacturers are incorporating advanced technologies such as inverter-driven compressors, intelligent controls, and integrated renewable energy sources to enhance performance and reduce running costs. These innovations are designed to address consumer concerns about initial installation costs and running expenses. Unique selling propositions emphasize quieter operation, smaller footprints, and seamless integration with smart home systems.

Propelling Factors for United Kingdom Heat Pumps Market Growth

Several key factors are driving the growth of the UK heat pumps market. Government incentives, such as the Renewable Heat Incentive (RHI) and various grants, significantly encourage adoption. Rising energy prices and increasing awareness of climate change are also pushing homeowners and businesses towards energy-efficient alternatives to traditional gas boilers. Furthermore, advancements in heat pump technology, resulting in improved efficiency and reduced costs, are further propelling market expansion.

Obstacles in the United Kingdom Heat Pumps Market

Despite the growth potential, several obstacles hinder the wider adoption of heat pumps in the UK. High initial installation costs remain a major barrier for many consumers, particularly for those in older properties requiring extensive retrofitting. Furthermore, the skill shortage amongst installers could limit the speed of installations and negatively impact the installation quality and efficiency. The intermittent availability of skilled professionals might cause project delays. Supply chain disruptions and material price volatility pose additional challenges to market growth.

Future Opportunities in United Kingdom Heat Pumps Market

The UK heat pumps market presents significant opportunities for future growth. Expanding into underserved market segments, such as the social housing sector, holds considerable potential. Advancements in hybrid heat pump systems, combining heat pumps with other renewable energy sources, could further enhance efficiency and reduce reliance on the grid. The integration of smart home technology offers additional opportunities to optimize energy consumption and enhance user experience. The development of smaller, more aesthetically pleasing heat pump units to cater to diverse housing styles, will drive adoption.

Major Players in the United Kingdom Heat Pumps Market Ecosystem

- IMS Heat pumps

- Daikin Airconditioning UK Ltd

- Kensa Heat Pumps

- Zehnder Group

- Baxi Heating UK

- Danfoss

- Vaillant Group

- Worcestor Bosch Group

- Ideal Boilers

- Viessmann Group

Key Developments in United Kingdom Heat Pumps Market Industry

- May 2024: British Gas launches the UK's most competitive heat pump rate for its energy customers, significantly incentivizing adoption.

- March 2024: Heat Geek secures €4.9 million in funding to accelerate its nationwide home decarbonization efforts through innovative heat pump technology.

Strategic United Kingdom Heat Pumps Market Forecast

The UK heat pumps market is poised for substantial growth over the forecast period (2025-2033), driven by government policies, technological advancements, and rising energy costs. Continued investment in research and development, coupled with increased consumer awareness of environmental issues, will fuel market expansion. Addressing challenges such as high initial costs and installer shortages will be crucial for unlocking the full potential of this market. The market is expected to witness significant expansion across all segments, with air-source heat pumps maintaining their dominant position while ground/water-source heat pumps gain traction in specific applications.

United Kingdom Heat Pumps Market Segmentation

-

1. Product Type

- 1.1. Air-source Heat Pump

- 1.2. Ground/Water-source Heat Pump

-

2. Installation Type

- 2.1. Retrofits

- 2.2. New Buildings

-

3. End-User Vertical

- 3.1. Commercial

- 3.2. Residential

- 3.3. Industrial

United Kingdom Heat Pumps Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Heat Pumps Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Recovering Office Space Demand and HVAC Retrofits; Government Regulations and Initiatives

- 3.3. Market Restrains

- 3.3.1. Presence of Cheaper Legacy Technologies; Semiconductor Industry Shortages

- 3.4. Market Trends

- 3.4.1. Air-Source Heat Pumps to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Heat Pumps Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Air-source Heat Pump

- 5.1.2. Ground/Water-source Heat Pump

- 5.2. Market Analysis, Insights and Forecast - by Installation Type

- 5.2.1. Retrofits

- 5.2.2. New Buildings

- 5.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.3.1. Commercial

- 5.3.2. Residential

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America United Kingdom Heat Pumps Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 7. Europe United Kingdom Heat Pumps Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 Italy

- 7.1.4 France

- 8. Asia United Kingdom Heat Pumps Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 9. Australia and New Zealand United Kingdom Heat Pumps Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Rest of the World United Kingdom Heat Pumps Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 Mexico

- 10.1.2 Brazil

- 10.1.3 Africa

- 10.1.4 Others

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 IMS Heat pumps

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daikin Airconditioning UK Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kensa Heat Pumps*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Zehnder Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Baxi Heating UK

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danfoss

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vaillant Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Worcestor Bosch Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ideal Boilers

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Viessmann Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 IMS Heat pumps

List of Figures

- Figure 1: United Kingdom Heat Pumps Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom Heat Pumps Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom Heat Pumps Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom Heat Pumps Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: United Kingdom Heat Pumps Market Revenue Million Forecast, by Installation Type 2019 & 2032

- Table 4: United Kingdom Heat Pumps Market Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 5: United Kingdom Heat Pumps Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom Heat Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Heat Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Kingdom Heat Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Kingdom Heat Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: United Kingdom Heat Pumps Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Mexico United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Brazil United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Africa United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Others United Kingdom Heat Pumps Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United Kingdom Heat Pumps Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: United Kingdom Heat Pumps Market Revenue Million Forecast, by Installation Type 2019 & 2032

- Table 27: United Kingdom Heat Pumps Market Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 28: United Kingdom Heat Pumps Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Heat Pumps Market?

The projected CAGR is approximately 11.10%.

2. Which companies are prominent players in the United Kingdom Heat Pumps Market?

Key companies in the market include IMS Heat pumps, Daikin Airconditioning UK Ltd, Kensa Heat Pumps*List Not Exhaustive, Zehnder Group, Baxi Heating UK, Danfoss, Vaillant Group, Worcestor Bosch Group, Ideal Boilers, Viessmann Group.

3. What are the main segments of the United Kingdom Heat Pumps Market?

The market segments include Product Type, Installation Type, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Recovering Office Space Demand and HVAC Retrofits; Government Regulations and Initiatives.

6. What are the notable trends driving market growth?

Air-Source Heat Pumps to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Presence of Cheaper Legacy Technologies; Semiconductor Industry Shortages.

8. Can you provide examples of recent developments in the market?

May 2024: British Gas, in a bid to bolster the adoption of heat pumps in the UK, has introduced the nation's most competitive rate for heat pumps. This move is part of their broader strategy to make low-carbon technology more accessible. The discounted rate is exclusively offered to British Gas energy customers who acquire an air source heat pump through the company, further incentivizing the shift towards heat pump technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Heat Pumps Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Heat Pumps Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Heat Pumps Market?

To stay informed about further developments, trends, and reports in the United Kingdom Heat Pumps Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence