Key Insights

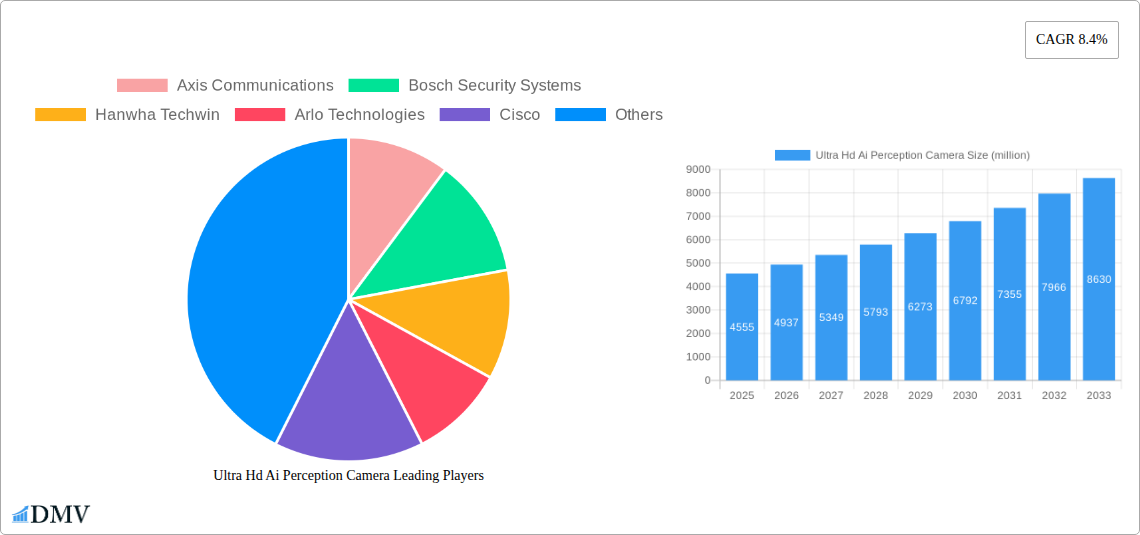

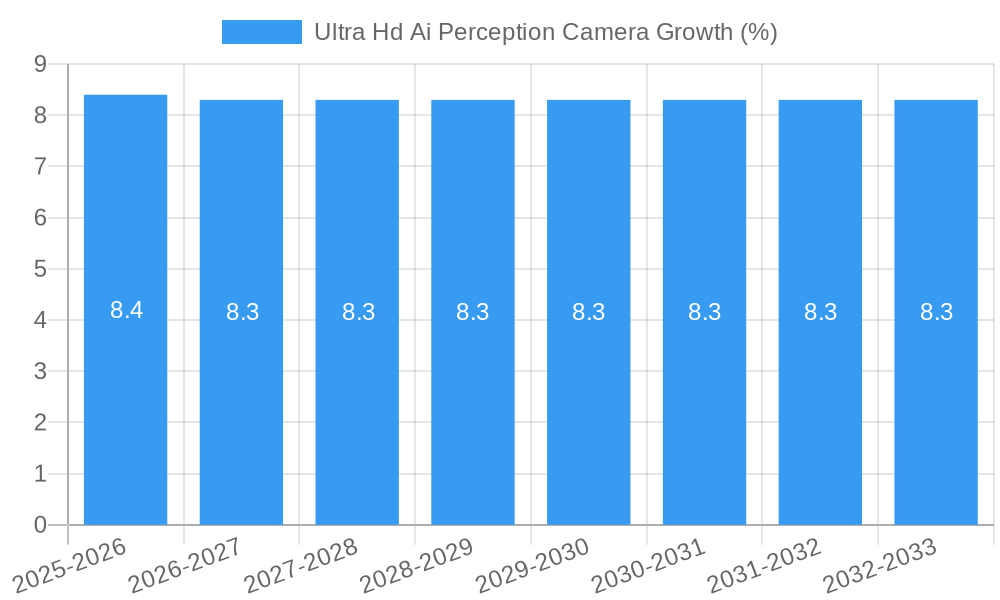

The global Ultra HD AI Perception Camera market is poised for significant expansion, with an estimated market size of USD 4,555 million and a projected Compound Annual Growth Rate (CAGR) of 8.4% from 2025 to 2033. This robust growth is primarily fueled by the escalating demand for enhanced surveillance and intelligent monitoring across diverse sectors. The "drivers" of this market growth are multifactorial, including the increasing adoption of smart city initiatives, the need for advanced security solutions in both public and private spaces, and the rapid integration of Artificial Intelligence (AI) with high-definition imaging technology. AI-powered perception cameras offer advanced capabilities such as object recognition, facial detection, anomaly detection, and real-time analytics, making them indispensable for crime prevention, traffic management, and operational efficiency. The value of these solutions is intrinsically linked to their ability to provide actionable insights beyond mere video recording, thereby driving significant investment.

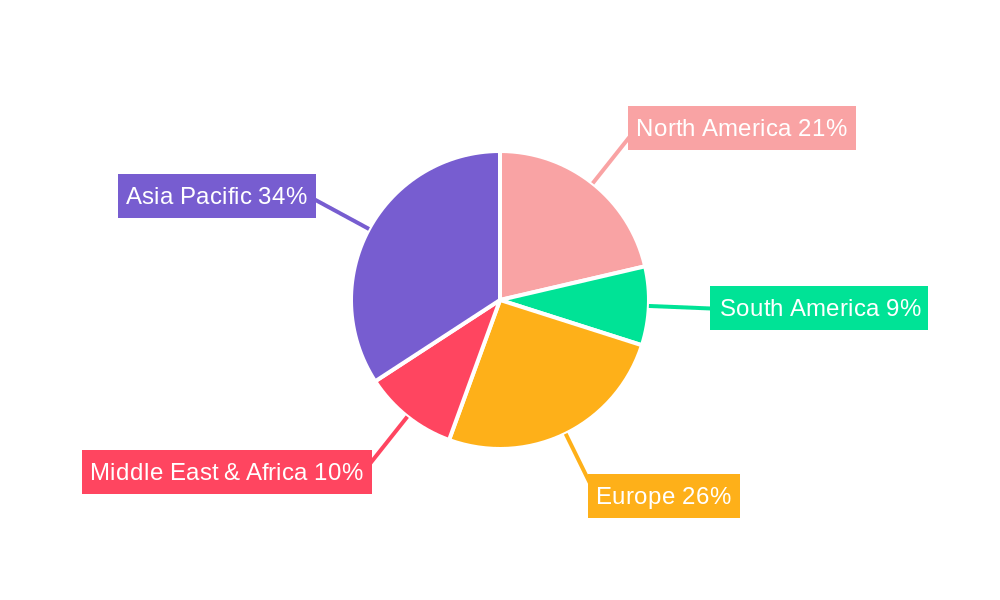

The market is segmented by application, with the Transportation Industry, Security Industry, and Industrial sectors emerging as key growth areas. These industries benefit immensely from the precision and proactive capabilities of Ultra HD AI Perception Cameras in areas like vehicle tracking, access control, predictive maintenance, and operational monitoring. The technological evolution within "type" – specifically the advancements in Cylinder Machines and Hemisphere cameras – are further democratizing access to these sophisticated systems. Geographically, Asia Pacific, led by China and India, is expected to witness substantial growth due to rapid urbanization, burgeoning infrastructure development, and government investments in smart technologies. North America and Europe, already mature markets, will continue to be significant contributors driven by ongoing upgrades to existing security infrastructure and the deployment of advanced AI-driven systems. While the market is experiencing rapid innovation, potential "restrains" such as high initial investment costs and data privacy concerns are factors that market players will need to address to ensure sustained and widespread adoption. Key companies like Hikvision, Dahua Technology, Axis Communications, and Bosch Security Systems are at the forefront of this innovation, driving technological advancements and market penetration.

Ultra HD AI Perception Camera Market: In-depth Analysis and Future Outlook (2019-2033)

This comprehensive report offers a definitive analysis of the Ultra HD AI Perception Camera market, exploring its current composition, evolutionary trajectory, and promising future. Leveraging a study period from 2019 to 2033, with a base year of 2025 and an extended forecast period, this report provides critical insights for stakeholders in the Security Industry, Transportation Industry, Industrial, and other burgeoning sectors. With advanced features like object detection, facial recognition, and real-time analytics, these cameras are revolutionizing how we perceive and interact with our environment.

Ultra HD AI Perception Camera Market Composition & Trends

The Ultra HD AI Perception Camera market exhibits a dynamic and evolving landscape characterized by moderate market concentration. Key players are heavily investing in research and development to enhance AI algorithms and processing power, driving innovation catalysts. The regulatory landscape, while still developing, is increasingly focused on data privacy and ethical AI deployment, influencing product design and market entry strategies. Substitute products, such as traditional CCTV systems with limited AI capabilities, are gradually being phased out as the demand for intelligent video surveillance escalates. End-user profiles are diverse, ranging from large enterprises in the Financial Industry and Industrial sectors requiring sophisticated security solutions to urban planners in the Transportation Industry aiming to optimize traffic flow and public safety. Mergers and acquisitions (M&A) activities are on the rise, with significant M&A deal values of over XXX million indicating consolidation and strategic expansion by leading companies. The market share distribution sees a gradual shift towards manufacturers with superior AI integration and ultra-high-definition imaging capabilities.

- Market Concentration: Moderate, with key players focusing on technological differentiation.

- Innovation Catalysts: Advancements in AI algorithms (e.g., deep learning), edge computing, and image sensor technology.

- Regulatory Landscapes: Growing emphasis on data privacy, AI ethics, and cybersecurity standards.

- Substitute Products: Traditional CCTV, basic surveillance cameras with limited analytics.

- End-User Profiles: Government (public safety, transportation), Commercial (retail, banking), Industrial (manufacturing, logistics), Residential.

- M&A Activities: Strategic acquisitions to gain market share, acquire specialized AI talent, and expand product portfolios. Anticipated M&A deal values are expected to exceed XXX million within the forecast period.

Ultra HD AI Perception Camera Industry Evolution

The Ultra HD AI Perception Camera industry has witnessed a remarkable evolution, transforming from rudimentary surveillance tools into sophisticated perception systems. Over the historical period of 2019-2024, the market experienced a compounded annual growth rate (CAGR) of approximately XX%, driven by the increasing need for intelligent automation and enhanced security. The base year of 2025 marks a significant inflection point, with the market projected to grow at a CAGR of over XX% during the forecast period of 2025-2033. This robust growth is fueled by relentless technological advancements. The integration of Artificial Intelligence, particularly deep learning algorithms, has empowered these cameras to perform complex tasks such as anomaly detection, predictive analytics, and behavioral analysis with unparalleled accuracy. The shift from cloud-based AI processing to edge AI processing has further accelerated adoption, offering real-time insights and reducing latency. Consumer demand has evolved significantly; end-users are no longer satisfied with mere video recording but demand proactive threat detection, automated incident response, and actionable intelligence derived from video feeds. This has propelled the development of cameras capable of distinguishing between human and vehicle traffic, identifying unattended baggage, and even analyzing crowd density for crowd management. The adoption metrics are evident in the increasing market penetration of AI-enabled cameras across various segments, with an estimated XX% of newly deployed surveillance cameras incorporating AI capabilities by 2025. The transition to 4K and higher resolutions in Ultra HD is becoming a standard, providing the granular detail necessary for sophisticated AI analysis, capturing events with exceptional clarity even in challenging lighting conditions. The industry is moving towards more integrated solutions, where AI perception cameras act as the sensory input for broader smart city and intelligent automation platforms, demonstrating a clear growth trajectory driven by technological innovation and evolving market needs.

Leading Regions, Countries, or Segments in Ultra HD AI Perception Camera

The Ultra HD AI Perception Camera market is witnessing dominant growth and adoption in several key regions and segments, driven by a confluence of technological innovation, robust infrastructure investment, and supportive regulatory frameworks. Within the Application segmentation, the Security Industry stands out as the primary driver, accounting for an estimated XX% of the market share in 2025. This dominance is fueled by escalating global security concerns, the need for advanced threat detection, and the increasing adoption of smart city initiatives that rely heavily on intelligent surveillance. The Transportation Industry is a rapidly growing segment, projected to experience a CAGR of XX% during the forecast period. This growth is attributed to the deployment of AI perception cameras for intelligent traffic management, autonomous vehicle support, public transportation security, and infrastructure monitoring. Countries like China and the United States are leading in investment trends within these sectors, with substantial government funding allocated to smart city projects and public safety enhancements.

In terms of Type, the Cylinder Machine segment is currently leading, representing approximately XX% of the market in 2025, owing to its versatility, ease of installation, and suitability for outdoor surveillance. However, the Hemisphere (dome) camera segment is experiencing a faster growth rate, projected to see a CAGR of XX%, driven by their discreet design and wider field of view, making them ideal for indoor surveillance and areas requiring comprehensive coverage.

Geographically, Asia Pacific is emerging as the most significant region, expected to hold a market share of over XX% by 2025. This dominance is propelled by rapid urbanization, substantial government initiatives for smart cities and digital infrastructure development in countries like China, South Korea, and Japan, and the presence of leading manufacturing hubs. North America and Europe follow closely, with significant adoption in the Financial Industry for fraud detection and enhanced security, and in the Industrial sector for process monitoring and safety compliance. Regulatory support for AI adoption and data analytics plays a crucial role in driving investments, with governments actively promoting the use of advanced technologies to improve efficiency and security.

- Dominant Application Segment: Security Industry (XX% market share in 2025).

- Key Drivers: Rising crime rates, demand for real-time threat detection, smart city integration, corporate security needs.

- Investment Trends: Significant government and private sector investments in intelligent surveillance systems.

- Fastest Growing Application Segment: Transportation Industry (XX% CAGR).

- Key Drivers: Autonomous vehicle development, traffic flow optimization, public safety enhancement, smart city initiatives.

- Regulatory Support: Government mandates for intelligent traffic management systems.

- Leading Camera Type: Cylinder Machine (XX% market share in 2025).

- Key Drivers: Robustness, ease of deployment, wide-ranging applications in outdoor surveillance.

- Fastest Growing Camera Type: Hemisphere (XX% CAGR).

- Key Drivers: Discreet design, panoramic view capabilities, suitability for diverse indoor and outdoor environments.

- Dominant Geographical Region: Asia Pacific (XX% market share by 2025).

- Key Drivers: Rapid urbanization, strong government support for smart city projects, presence of leading AI technology providers and manufacturers.

- Influencing Factors: Government policies on AI and data utilization, technological infrastructure development, economic growth.

Ultra HD AI Perception Camera Product Innovations

The Ultra HD AI Perception Camera market is abuzz with groundbreaking product innovations, pushing the boundaries of intelligent surveillance. Manufacturers are integrating advanced AI algorithms directly into the camera hardware, enabling sophisticated edge computing capabilities. This allows for real-time object detection, facial recognition with high accuracy rates exceeding XX%, and intelligent video analytics that can identify behavioral anomalies and predict potential threats with unprecedented precision. Innovations in low-light performance, with cameras now capable of capturing clear, detailed images in near-total darkness (lux ratings as low as XX lux), significantly enhance security applications. Features like multi-spectral imaging, thermal sensing, and advanced image stabilization further expand the operational capabilities across diverse environments. The development of AI models trained on massive datasets ensures continuous improvement in object classification and scene understanding, leading to reduced false alarms and more actionable insights. These technological leaps translate into tangible benefits such as enhanced public safety in the Transportation Industry, improved operational efficiency in the Industrial sector, and more robust security measures for the Financial Industry.

Propelling Factors for Ultra HD AI Perception Camera Growth

The Ultra HD AI Perception Camera market is being propelled by a confluence of powerful drivers. The escalating global demand for enhanced security and public safety remains a primary catalyst, prompting increased adoption across various sectors. Technological advancements, particularly in Artificial Intelligence, machine learning, and image processing, are continually pushing the capabilities of these cameras, enabling more sophisticated analytics and real-time decision-making. The growing trend towards smart cities and the increasing implementation of IoT devices create a fertile ground for intelligent video surveillance solutions. Economic factors, such as the declining cost of advanced processing units and the growing ROI observed by businesses in terms of crime reduction and operational efficiency, are also significantly contributing to market expansion. Furthermore, supportive government initiatives and regulations aimed at promoting the adoption of advanced surveillance technologies for public safety and infrastructure management are creating a favorable environment for growth.

- Rising Security Concerns: Increased incidents of crime and terrorism driving demand for advanced surveillance.

- AI and ML Advancements: Continuous innovation in algorithms for object recognition, facial analysis, and anomaly detection.

- Smart City Initiatives: Government investments in connected infrastructure and intelligent urban management systems.

- IoT Integration: Seamless integration with other smart devices for comprehensive data analysis.

- Cost-Effectiveness and ROI: Declining hardware costs and proven business benefits in loss prevention and operational efficiency.

- Government Support: Favorable policies and funding for AI-powered security solutions.

Obstacles in the Ultra HD AI Perception Camera Market

Despite its promising growth, the Ultra HD AI Perception Camera market faces several significant obstacles. Concerns surrounding data privacy and ethical AI usage remain a major challenge, with stringent regulations like GDPR and CCPA influencing deployment strategies and requiring robust data anonymization and consent management protocols. The high initial cost of some advanced AI camera systems can be a barrier for smaller businesses and organizations with limited budgets. Supply chain disruptions, particularly for specialized components and high-performance processors, can impact production and lead times, leading to price volatility. Furthermore, the complexity of integrating and managing sophisticated AI systems requires skilled personnel, leading to a talent gap in some regions. Cybersecurity threats targeting video surveillance systems pose a constant risk, necessitating robust security measures and ongoing vigilance.

- Data Privacy and Ethical Concerns: Stringent regulations and public apprehension regarding surveillance data.

- High Initial Investment Costs: The upfront expense of advanced AI camera systems can deter some adopters.

- Supply Chain Vulnerabilities: Dependence on global supply chains for critical components.

- Talent Gap: Shortage of skilled professionals for AI system integration, maintenance, and data analysis.

- Cybersecurity Threats: Vulnerabilities to hacking and data breaches.

Future Opportunities in Ultra HD AI Perception Camera

The Ultra HD AI Perception Camera market is poised for significant future opportunities, driven by emerging technologies and evolving consumer needs. The expansion of 5G networks will enable ultra-low latency and high-bandwidth data transmission, unlocking new possibilities for real-time AI processing and remote management of camera networks. Advancements in edge AI will lead to more powerful and autonomous cameras capable of performing complex analytics directly on the device, reducing reliance on cloud infrastructure. The increasing adoption of autonomous vehicles presents a substantial opportunity for AI perception cameras used in navigation, object detection, and safety systems. Furthermore, the growing demand for hyper-personalization in retail and customer service can be met through advanced facial recognition and behavioral analysis capabilities. The integration of AI perception cameras with augmented reality (AR) and virtual reality (VR) technologies offers innovative applications in training, remote assistance, and immersive experiences. The development of specialized AI models for niche applications, such as environmental monitoring or industrial defect detection, will also open new market avenues.

- 5G Network Expansion: Enabling real-time AI processing and remote capabilities.

- Advancements in Edge AI: More powerful, autonomous cameras for on-device analytics.

- Autonomous Vehicle Integration: Critical for navigation, safety, and object detection systems.

- Hyper-Personalization: Leveraging AI for tailored customer experiences in retail and beyond.

- AR/VR Integration: Innovative applications in training, remote assistance, and immersive experiences.

- Niche AI Model Development: Specialized applications in industrial automation, environmental monitoring, and healthcare.

Major Players in the Ultra HD AI Perception Camera Ecosystem

- Axis Communications

- Bosch Security Systems

- Hanwha Techwin

- Arlo Technologies

- Cisco

- Logitech

- EZVIZ

- Hikvision

- MEGVII

- GUANGZHOU BOSMA CORP

- ALCIDAE

- SmartSens Technology

- KINGSUN

- Reolink

- HUNAN SHARING

- Maxvision

- Dahua Technology

Key Developments in Ultra HD AI Perception Camera Industry

- 2023 January: Launch of new AI-powered edge analytics chipsets by SmartSens Technology, enabling real-time object detection and classification directly on camera hardware.

- 2023 March: Axis Communications unveils a new line of ultra-high-definition cameras with advanced cybersecurity features and built-in forensic analytics capabilities.

- 2023 May: Hanwha Techwin announces strategic partnerships to enhance AI algorithm development for its Wisenet camera range, focusing on deep learning for improved threat detection.

- 2023 July: Hikvision releases a new generation of deep learning cameras featuring enhanced low-light performance and AI-powered intrusion detection.

- 2023 September: Arlo Technologies introduces AI-powered cloud services for its home security cameras, offering advanced person detection and package detection.

- 2024 February: Dahua Technology showcases its latest AI perception cameras with sophisticated behavioral analysis for smart city applications.

- 2024 April: MEGVII expands its AI solutions portfolio to include advanced facial recognition and crowd analysis capabilities for enterprise-level security.

- 2024 June: Bosch Security Systems announces the integration of its AI-powered video analytics with its Building Integration System (BIS) for enhanced security management.

- 2024 August: Reolink launches a new range of ultra-HD AI cameras with built-in spotlights and sirens for proactive deterrence.

- 2024 October: Logitech introduces AI-enabled webcams with advanced auto-framing and noise cancellation for remote collaboration and security monitoring.

- 2025 Q1: Expected release of new AI models from various manufacturers focusing on predictive analytics and anomaly detection in industrial settings.

- 2025 Q3: Anticipated advancements in edge AI processing power, enabling more complex AI tasks on smaller, more energy-efficient devices.

- 2026-2028: Growing integration of AI perception cameras with 5G and edge computing for widespread deployment in smart transportation and public safety.

- 2029-2033: Maturation of AI perception technology, leading to widespread adoption for highly specialized applications and seamless integration into broader smart infrastructure.

Strategic Ultra HD AI Perception Camera Market Forecast

The strategic forecast for the Ultra HD AI Perception Camera market is exceptionally positive, driven by an anticipated CAGR of over XX% from 2025 to 2033. This robust growth is underpinned by continuous technological innovation, particularly in AI algorithms, edge computing, and image sensor technology, which will enhance camera capabilities and reduce processing latency. The increasing global focus on smart city development, intelligent transportation systems, and enhanced security infrastructure will further fuel demand. The declining costs of hardware and the proven return on investment from intelligent video analytics will make these solutions more accessible to a wider range of businesses and government entities. Emerging markets are expected to contribute significantly to this growth, driven by rapid urbanization and the adoption of advanced technologies. The market is poised for significant opportunities in areas like predictive analytics, autonomous systems, and personalized security solutions, ensuring sustained expansion and innovation.

Ultra Hd Ai Perception Camera Segmentation

-

1. Application

- 1.1. Transportation Industry

- 1.2. Security Industry

- 1.3. Construction Industry

- 1.4. Industrial

- 1.5. Financial Industry

- 1.6. Others

-

2. Type

- 2.1. Cylinder Machine

- 2.2. Hemisphere

Ultra Hd Ai Perception Camera Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Ultra Hd Ai Perception Camera REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Ultra Hd Ai Perception Camera Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Transportation Industry

- 5.1.2. Security Industry

- 5.1.3. Construction Industry

- 5.1.4. Industrial

- 5.1.5. Financial Industry

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Cylinder Machine

- 5.2.2. Hemisphere

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Ultra Hd Ai Perception Camera Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Transportation Industry

- 6.1.2. Security Industry

- 6.1.3. Construction Industry

- 6.1.4. Industrial

- 6.1.5. Financial Industry

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Cylinder Machine

- 6.2.2. Hemisphere

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Ultra Hd Ai Perception Camera Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Transportation Industry

- 7.1.2. Security Industry

- 7.1.3. Construction Industry

- 7.1.4. Industrial

- 7.1.5. Financial Industry

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Cylinder Machine

- 7.2.2. Hemisphere

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Ultra Hd Ai Perception Camera Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Transportation Industry

- 8.1.2. Security Industry

- 8.1.3. Construction Industry

- 8.1.4. Industrial

- 8.1.5. Financial Industry

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Cylinder Machine

- 8.2.2. Hemisphere

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Ultra Hd Ai Perception Camera Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Transportation Industry

- 9.1.2. Security Industry

- 9.1.3. Construction Industry

- 9.1.4. Industrial

- 9.1.5. Financial Industry

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Cylinder Machine

- 9.2.2. Hemisphere

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Ultra Hd Ai Perception Camera Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Transportation Industry

- 10.1.2. Security Industry

- 10.1.3. Construction Industry

- 10.1.4. Industrial

- 10.1.5. Financial Industry

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Cylinder Machine

- 10.2.2. Hemisphere

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Axis Communications

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bosch Security Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hanwha Techwin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Arlo Technologies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Logitech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 EZVIZ

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hikvision

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MEGVII

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GUANGZHOU BOSMA CORP

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ALCIDAE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SmartSens Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 KINGSUN

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Reolink

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 HUNAN SHARING

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Maxvision

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Dahua Technology

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Axis Communications

List of Figures

- Figure 1: Global Ultra Hd Ai Perception Camera Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Ultra Hd Ai Perception Camera Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Ultra Hd Ai Perception Camera Revenue (million), by Application 2024 & 2032

- Figure 4: North America Ultra Hd Ai Perception Camera Volume (K), by Application 2024 & 2032

- Figure 5: North America Ultra Hd Ai Perception Camera Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Ultra Hd Ai Perception Camera Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Ultra Hd Ai Perception Camera Revenue (million), by Type 2024 & 2032

- Figure 8: North America Ultra Hd Ai Perception Camera Volume (K), by Type 2024 & 2032

- Figure 9: North America Ultra Hd Ai Perception Camera Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Ultra Hd Ai Perception Camera Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Ultra Hd Ai Perception Camera Revenue (million), by Country 2024 & 2032

- Figure 12: North America Ultra Hd Ai Perception Camera Volume (K), by Country 2024 & 2032

- Figure 13: North America Ultra Hd Ai Perception Camera Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Ultra Hd Ai Perception Camera Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Ultra Hd Ai Perception Camera Revenue (million), by Application 2024 & 2032

- Figure 16: South America Ultra Hd Ai Perception Camera Volume (K), by Application 2024 & 2032

- Figure 17: South America Ultra Hd Ai Perception Camera Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Ultra Hd Ai Perception Camera Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Ultra Hd Ai Perception Camera Revenue (million), by Type 2024 & 2032

- Figure 20: South America Ultra Hd Ai Perception Camera Volume (K), by Type 2024 & 2032

- Figure 21: South America Ultra Hd Ai Perception Camera Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Ultra Hd Ai Perception Camera Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Ultra Hd Ai Perception Camera Revenue (million), by Country 2024 & 2032

- Figure 24: South America Ultra Hd Ai Perception Camera Volume (K), by Country 2024 & 2032

- Figure 25: South America Ultra Hd Ai Perception Camera Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Ultra Hd Ai Perception Camera Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Ultra Hd Ai Perception Camera Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Ultra Hd Ai Perception Camera Volume (K), by Application 2024 & 2032

- Figure 29: Europe Ultra Hd Ai Perception Camera Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Ultra Hd Ai Perception Camera Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Ultra Hd Ai Perception Camera Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Ultra Hd Ai Perception Camera Volume (K), by Type 2024 & 2032

- Figure 33: Europe Ultra Hd Ai Perception Camera Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Ultra Hd Ai Perception Camera Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Ultra Hd Ai Perception Camera Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Ultra Hd Ai Perception Camera Volume (K), by Country 2024 & 2032

- Figure 37: Europe Ultra Hd Ai Perception Camera Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Ultra Hd Ai Perception Camera Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Ultra Hd Ai Perception Camera Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Ultra Hd Ai Perception Camera Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Ultra Hd Ai Perception Camera Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Ultra Hd Ai Perception Camera Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Ultra Hd Ai Perception Camera Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Ultra Hd Ai Perception Camera Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Ultra Hd Ai Perception Camera Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Ultra Hd Ai Perception Camera Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Ultra Hd Ai Perception Camera Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Ultra Hd Ai Perception Camera Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Ultra Hd Ai Perception Camera Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Ultra Hd Ai Perception Camera Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Ultra Hd Ai Perception Camera Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Ultra Hd Ai Perception Camera Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Ultra Hd Ai Perception Camera Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Ultra Hd Ai Perception Camera Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Ultra Hd Ai Perception Camera Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Ultra Hd Ai Perception Camera Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Ultra Hd Ai Perception Camera Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Ultra Hd Ai Perception Camera Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Ultra Hd Ai Perception Camera Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Ultra Hd Ai Perception Camera Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Ultra Hd Ai Perception Camera Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Ultra Hd Ai Perception Camera Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Ultra Hd Ai Perception Camera Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Ultra Hd Ai Perception Camera Volume K Forecast, by Country 2019 & 2032

- Table 81: China Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Ultra Hd Ai Perception Camera Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Ultra Hd Ai Perception Camera Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ultra Hd Ai Perception Camera?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the Ultra Hd Ai Perception Camera?

Key companies in the market include Axis Communications, Bosch Security Systems, Hanwha Techwin, Arlo Technologies, Cisco, Logitech, EZVIZ, Hikvision, MEGVII, GUANGZHOU BOSMA CORP, ALCIDAE, SmartSens Technology, KINGSUN, Reolink, HUNAN SHARING, Maxvision, Dahua Technology.

3. What are the main segments of the Ultra Hd Ai Perception Camera?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4555 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ultra Hd Ai Perception Camera," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ultra Hd Ai Perception Camera report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ultra Hd Ai Perception Camera?

To stay informed about further developments, trends, and reports in the Ultra Hd Ai Perception Camera, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence