Key Insights

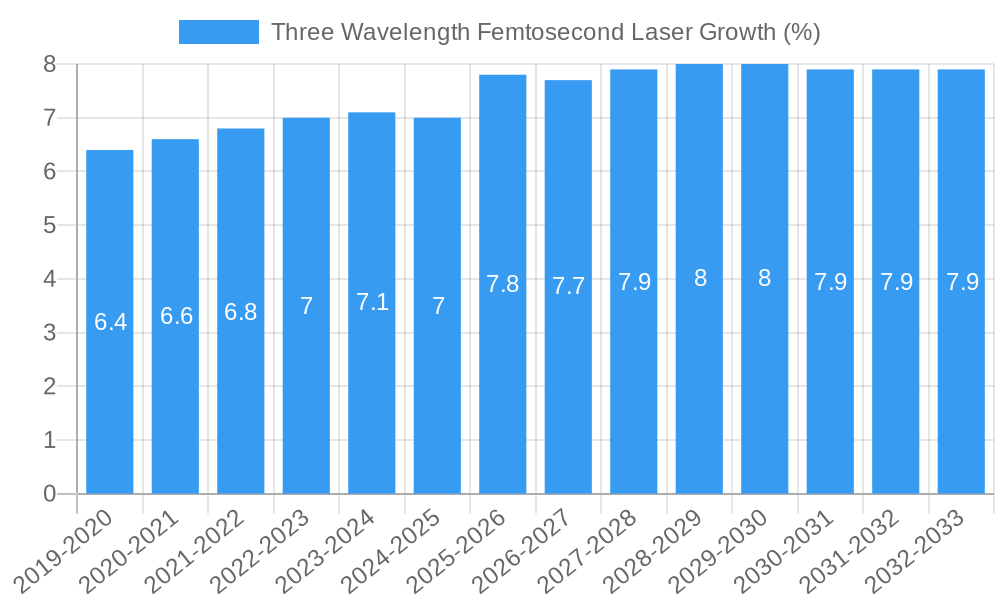

The global Three Wavelength Femtosecond Laser market is projected to witness substantial growth, reaching an estimated market size of approximately $1.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 8.5% projected for the forecast period of 2025-2033. This robust expansion is primarily fueled by the increasing adoption of femtosecond lasers across diverse high-tech applications, notably in pump-probe spectroscopy and multi-photon excitation microscopy. The precision and ultra-short pulse durations offered by these lasers are crucial for advanced scientific research, enabling detailed investigations into ultrafast phenomena in fields such as material science, chemistry, and biology. The growing demand for faster, more accurate analytical techniques in pharmaceutical research and development, coupled with advancements in semiconductor manufacturing requiring intricate laser processing, are further significant drivers. The market's value is expected to exceed $2.2 billion by 2033, underscoring the technology's critical role in scientific and industrial progress.

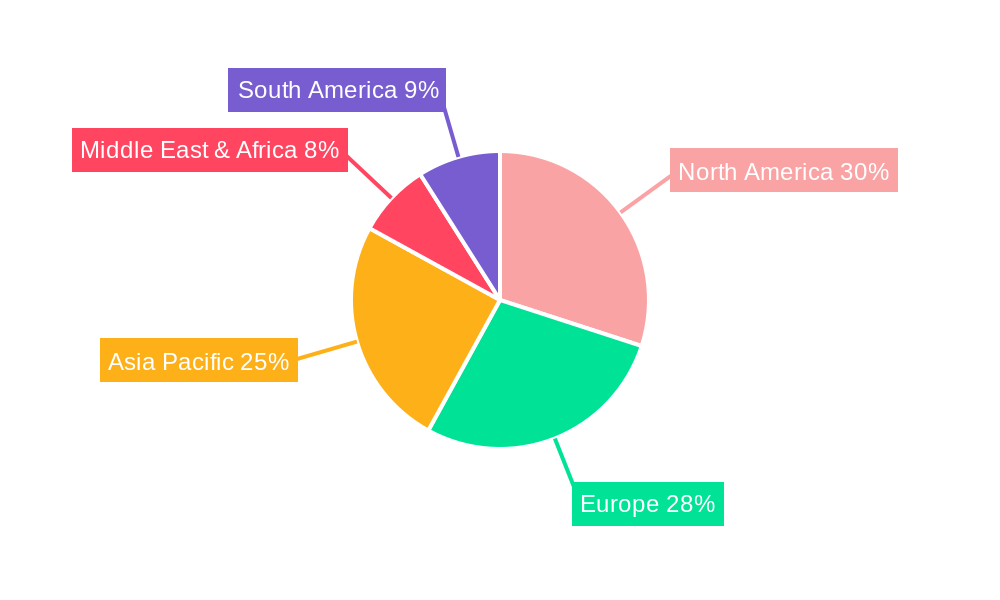

The market is segmented into single-wavelength and dual-wavelength femtosecond lasers, with dual-wavelength systems gaining traction due to their enhanced versatility in multi-dimensional spectroscopy and advanced imaging techniques. While the demand is strong, certain restraints exist, including the high initial cost of sophisticated femtosecond laser systems and the need for specialized technical expertise for operation and maintenance. However, continuous innovation in laser design, power efficiency, and cost reduction strategies by leading companies like TRUMPF Group, KMLabs, and IPG Photonics Corporation are expected to mitigate these challenges. Geographically, North America and Europe are currently leading the market due to significant investments in R&D and established industrial infrastructure. Asia Pacific, particularly China and Japan, is anticipated to emerge as a rapidly growing region, driven by increasing government initiatives supporting scientific research and the burgeoning high-tech manufacturing sector.

Three Wavelength Femtosecond Laser Market Composition & Trends

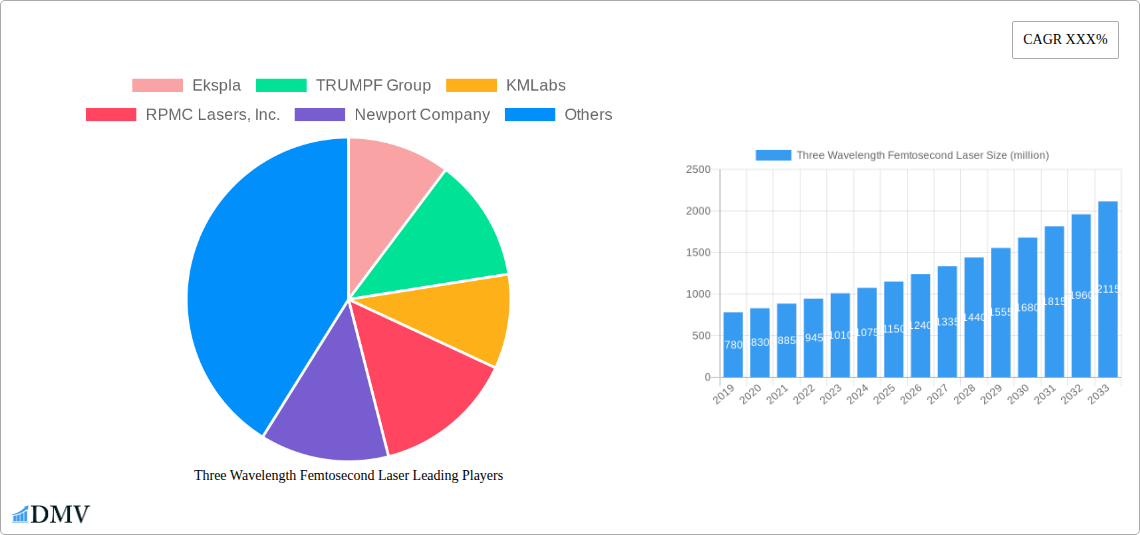

The global Three Wavelength Femtosecond Laser market is characterized by moderate concentration, with key players like Ekspla, TRUMPF Group, KMLabs, RPMC Lasers, Inc., Newport Company, and IPG Photonics Corporation driving innovation and market share. This dynamic landscape is fueled by continuous technological advancements and increasing demand across sophisticated scientific and industrial applications. Innovation catalysts include the persistent need for higher resolution imaging, faster data acquisition in spectroscopy, and advancements in materials processing. Regulatory landscapes, while generally supportive of scientific research, can vary by region, influencing adoption rates. Substitute products, such as pulsed lasers with longer pulse durations or different wavelength combinations, are present but often lack the precision and unique capabilities offered by femtosecond lasers. End-user profiles span academic research institutions, pharmaceutical companies, biotechnology firms, and advanced manufacturing facilities. Merger and acquisition (M&A) activities, while not consistently high, have historically been strategic, aimed at consolidating market positions and acquiring specialized technologies. For instance, past M&A deals in the broader ultrafast laser segment have seen valuations in the tens to hundreds of million dollars, indicating the strategic importance of these acquisitions. The market share distribution among the top players is estimated to be in the range of 60-70%, with the remaining share held by smaller, specialized manufacturers. Ongoing research and development investments are projected to be in the hundreds of million dollars annually, further solidifying the competitive environment.

Three Wavelength Femtosecond Laser Industry Evolution

The Three Wavelength Femtosecond Laser industry has witnessed a remarkable evolution driven by relentless innovation and expanding application horizons. Over the historical period of 2019–2024, the market experienced steady growth, with a Compound Annual Growth Rate (CAGR) of approximately 8% to 12%, propelled by breakthroughs in laser technology and increased adoption in cutting-edge research. The base year, 2025, marks a pivotal point, with an estimated market value projected to reach several hundred million dollars. The forecast period, 2025–2033, anticipates sustained and accelerated growth, with an estimated CAGR of 10% to 15%. This expansion is attributed to several key factors. Firstly, advancements in generating and precisely controlling multiple femtosecond laser wavelengths simultaneously have unlocked unprecedented capabilities in areas like quantum computing research, advanced materials science, and highly sensitive biological imaging. The ability to tune and combine wavelengths with femtosecond precision allows for the study of complex molecular interactions and the manipulation of matter at its most fundamental level. Secondly, the increasing sophistication of analytical techniques across industries, particularly in life sciences and advanced manufacturing, necessitates the precision and speed offered by these lasers. For example, in pump-probe spectroscopy, the ability to generate synchronized pulses at distinct wavelengths allows for the investigation of ultrafast chemical reactions and energy transfer processes with picosecond to femtosecond resolution. Similarly, in multi-photon excitation microscopy, the use of specific, often multiple, excitation wavelengths enhances imaging depth, reduces photodamage, and improves signal-to-noise ratios, leading to more detailed cellular and tissue analysis. The industry's growth trajectory is further bolstered by an increasing number of research publications and patents filed related to femtosecond laser applications, indicating a vibrant innovation ecosystem. The adoption rate of these advanced laser systems, though initially high-priced, is steadily increasing as their value proposition becomes more evident in terms of scientific discovery and technological advancement. The market size is projected to grow from an estimated XXX million dollars in 2024 to over XXX million dollars by 2033, reflecting a significant expansion driven by both unit sales and increasing average selling prices for more sophisticated systems.

Leading Regions, Countries, or Segments in Three Wavelength Femtosecond Laser

The global Three Wavelength Femtosecond Laser market exhibits distinct regional leadership and segment dominance, driven by research infrastructure, industrial investment, and technological adoption rates. North America and Europe currently stand out as leading regions, largely due to their robust academic research ecosystems, significant government funding for scientific endeavors, and the presence of major pharmaceutical, biotechnology, and advanced manufacturing companies that are early adopters of cutting-edge laser technologies. In North America, the United States leads with a high concentration of research universities and biotech hubs, fostering substantial demand for femtosecond lasers in applications such as Pump-probe Spectroscopy and Multi-photon Excitation Microscopy. Government initiatives and private sector investments, often in the hundreds of millions of dollars for research infrastructure, further catalyze this demand.

Europe, particularly countries like Germany, the UK, and France, mirrors this trend with strong research institutions and a thriving industrial base, especially in photonics and high-tech manufacturing. The region's commitment to fundamental scientific research, supported by substantial research grants, fuels the demand for advanced laser systems.

Within the Application segment, Pump-probe Spectroscopy and Multi-photon Excitation Microscopy are the dominant applications, accounting for an estimated 70% to 80% of the total market demand.

- Pump-probe Spectroscopy: This application leverages the femtosecond pulse duration to initiate and probe ultrafast dynamic processes in molecules and materials. The ability to use multiple wavelengths allows for detailed studies of complex reaction pathways and energy transfer mechanisms. Demand is driven by research in physical chemistry, materials science, and condensed matter physics.

- Multi-photon Excitation Microscopy: This advanced imaging technique offers superior resolution, deeper tissue penetration, and reduced phototoxicity compared to conventional microscopy. The use of specific wavelengths is crucial for exciting fluorescent probes without damaging biological samples. This drives demand from neuroscience, developmental biology, and preclinical research.

The Time Domain Resolved Spectroscopy application, while a significant area, is slightly smaller in market share compared to the top two, but is experiencing rapid growth.

- Others: This category encompasses emerging applications in areas like ultrafast materials processing, quantum optics research, and advanced sensing, which are steadily gaining traction.

Regarding Type, the market is currently leaning towards Dual Wavelength systems due to their enhanced capabilities for selective excitation and probing, particularly in complex molecular systems. However, Single Wavelength systems remain crucial for many established applications and are expected to continue holding a substantial market share due to their cost-effectiveness and proven reliability. The development of advanced Three Wavelength systems, though niche, is a growing area of innovation, catering to highly specialized research needs.

Three Wavelength Femtosecond Laser Product Innovations

Recent product innovations in Three Wavelength Femtosecond Lasers are revolutionizing research and industry. Manufacturers are focusing on developing systems with enhanced tunability, higher peak powers, and improved pulse synchronization across multiple wavelengths, often exceeding millions of dollars in research and development investment. These advancements enable unprecedented control over light-matter interactions. Key innovations include integrated tunable optics, ultra-fast gain switching, and sophisticated feedback control mechanisms that ensure stable and precise operation. Applications are expanding into fields like quantum information processing, where entangled photons at specific wavelengths are critical, and in advanced medical diagnostics, where targeted molecular interactions can be precisely studied. The performance metrics are also seeing significant improvements, with pulse durations consistently in the femtosecond range (e.g., 10 femtoseconds to 500 femtoseconds) and peak powers reaching gigawatts to terawatts. The ability to generate distinct, synchronized wavelength outputs with sub-femtosecond timing jitter is a major unique selling proposition of the latest systems.

Propelling Factors for Three Wavelength Femtosecond Laser Growth

The growth of the Three Wavelength Femtosecond Laser market is primarily propelled by rapid advancements in scientific research and technological innovation. The insatiable demand for higher resolution and faster temporal resolution in fields like Pump-probe Spectroscopy and Multi-photon Excitation Microscopy is a significant driver. For example, breakthroughs in understanding ultrafast chemical reactions, drug discovery, and neurological processes directly rely on the precise control offered by these lasers. Furthermore, the expanding applications in advanced materials science, such as laser-induced forward transfer (LIFT) for precise material deposition and the fabrication of novel nanostructures, are creating new market opportunities. Government funding for scientific research and development, often in the hundreds of millions of dollars globally, plays a crucial role in supporting the acquisition of these sophisticated laser systems by academic institutions and research laboratories. The increasing sophistication of industries like semiconductor manufacturing and advanced analytics also contributes to the demand for femtosecond lasers for high-precision processing and characterization.

Obstacles in the Three Wavelength Femtosecond Laser Market

Despite its promising growth, the Three Wavelength Femtosecond Laser market faces several obstacles. The primary restraint is the high cost of these advanced laser systems, with individual units often priced in the hundreds of thousands to millions of dollars, limiting accessibility for some research groups and smaller companies. Furthermore, the complexity of operation and the requirement for specialized expertise to maintain and utilize these lasers effectively can be a barrier to widespread adoption. Supply chain disruptions, particularly for specialized components and rare earth materials, can lead to extended lead times and increased production costs, impacting manufacturers and end-users alike. Intense competition among key players, while fostering innovation, can also lead to pricing pressures and reduced profit margins for certain product segments. Regulatory hurdles related to laser safety standards and export controls in some regions can also influence market dynamics and slow down the expansion of certain applications.

Future Opportunities in Three Wavelength Femtosecond Laser

The future of the Three Wavelength Femtosecond Laser market is brimming with opportunities. Emerging applications in quantum computing and quantum information science represent a significant growth area, where precise control over entangled photons at multiple wavelengths is paramount. The development of next-generation medical diagnostics and therapeutics, utilizing the unique interaction of femtosecond lasers with biological tissues for targeted treatments and advanced imaging, presents another lucrative avenue. The expansion of additive manufacturing and advanced materials processing, where femtosecond lasers enable the fabrication of novel materials and complex microstructures with unparalleled precision, is a steadily growing market. Furthermore, the integration of artificial intelligence (AI) and machine learning with femtosecond laser systems can lead to more autonomous operation, enhanced data analysis, and optimized experimental designs, opening up new frontiers in research and industrial applications. The exploration of new wavelength combinations and pulse shaping techniques will also unlock novel functionalities.

Major Players in the Three Wavelength Femtosecond Laser Ecosystem

- Ekspla

- TRUMPF Group

- KMLabs

- RPMC Lasers, Inc.

- Newport Company

- IPG Photonics Corporation

Key Developments in Three Wavelength Femtosecond Laser Industry

- 2023 Q4: Launch of a new generation of compact, high-energy femtosecond laser systems with enhanced tunability across multiple spectral regions, enabling advanced pump-probe spectroscopy.

- 2024 Q1: Significant advancements in synchronized dual-wavelength femtosecond laser technology for improved multi-photon microscopy, leading to deeper tissue penetration and reduced photodamage.

- 2024 Q2: Major investment by a leading photonics company in expanding manufacturing capabilities for ultrafast laser components to meet growing demand, with investments in the tens of millions of dollars.

- 2024 Q3: Introduction of novel pulse-shaping capabilities for femtosecond lasers, allowing for more precise control in materials processing and laser-induced science experiments.

- 2024 Q4: A strategic partnership formed between a laser manufacturer and a leading academic institution to accelerate research into femtosecond laser applications for quantum computing.

Strategic Three Wavelength Femtosecond Laser Market Forecast

The strategic forecast for the Three Wavelength Femtosecond Laser market indicates robust and sustained growth, driven by escalating demand for high-precision scientific instrumentation and advanced industrial processes. Key growth catalysts include ongoing breakthroughs in ultrafast spectroscopy, multi-photon imaging, and quantum technology research, each requiring the unique capabilities of these lasers. The expanding industrial applications in materials science and advanced manufacturing, coupled with increasing global investments in R&D—often in the hundreds of millions of dollars annually—will continue to fuel market expansion. The development of more compact, cost-effective, and user-friendly systems will further broaden accessibility. Opportunities in emerging markets and novel applications, alongside continuous technological refinements, position the market for significant expansion throughout the forecast period, with market valuations expected to reach billions of dollars.

Three Wavelength Femtosecond Laser Segmentation

-

1. Application

- 1.1. Pump-probe Spectroscopy

- 1.2. Multi-photon Excitation Microscopy

- 1.3. Time Domain Resolved Spectroscopy

- 1.4. Others

-

2. Type

- 2.1. Single Wavelength

- 2.2. Dual Wavelength

Three Wavelength Femtosecond Laser Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Three Wavelength Femtosecond Laser REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Three Wavelength Femtosecond Laser Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pump-probe Spectroscopy

- 5.1.2. Multi-photon Excitation Microscopy

- 5.1.3. Time Domain Resolved Spectroscopy

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single Wavelength

- 5.2.2. Dual Wavelength

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Three Wavelength Femtosecond Laser Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pump-probe Spectroscopy

- 6.1.2. Multi-photon Excitation Microscopy

- 6.1.3. Time Domain Resolved Spectroscopy

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single Wavelength

- 6.2.2. Dual Wavelength

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Three Wavelength Femtosecond Laser Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pump-probe Spectroscopy

- 7.1.2. Multi-photon Excitation Microscopy

- 7.1.3. Time Domain Resolved Spectroscopy

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single Wavelength

- 7.2.2. Dual Wavelength

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Three Wavelength Femtosecond Laser Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pump-probe Spectroscopy

- 8.1.2. Multi-photon Excitation Microscopy

- 8.1.3. Time Domain Resolved Spectroscopy

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single Wavelength

- 8.2.2. Dual Wavelength

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Three Wavelength Femtosecond Laser Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pump-probe Spectroscopy

- 9.1.2. Multi-photon Excitation Microscopy

- 9.1.3. Time Domain Resolved Spectroscopy

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single Wavelength

- 9.2.2. Dual Wavelength

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Three Wavelength Femtosecond Laser Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pump-probe Spectroscopy

- 10.1.2. Multi-photon Excitation Microscopy

- 10.1.3. Time Domain Resolved Spectroscopy

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single Wavelength

- 10.2.2. Dual Wavelength

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Ekspla

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TRUMPF Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KMLabs

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 RPMC Lasers Inc.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Newport Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IPG Photonics Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Ekspla

List of Figures

- Figure 1: Global Three Wavelength Femtosecond Laser Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Three Wavelength Femtosecond Laser Revenue (million), by Application 2024 & 2032

- Figure 3: North America Three Wavelength Femtosecond Laser Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Three Wavelength Femtosecond Laser Revenue (million), by Type 2024 & 2032

- Figure 5: North America Three Wavelength Femtosecond Laser Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Three Wavelength Femtosecond Laser Revenue (million), by Country 2024 & 2032

- Figure 7: North America Three Wavelength Femtosecond Laser Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Three Wavelength Femtosecond Laser Revenue (million), by Application 2024 & 2032

- Figure 9: South America Three Wavelength Femtosecond Laser Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Three Wavelength Femtosecond Laser Revenue (million), by Type 2024 & 2032

- Figure 11: South America Three Wavelength Femtosecond Laser Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Three Wavelength Femtosecond Laser Revenue (million), by Country 2024 & 2032

- Figure 13: South America Three Wavelength Femtosecond Laser Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Three Wavelength Femtosecond Laser Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Three Wavelength Femtosecond Laser Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Three Wavelength Femtosecond Laser Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Three Wavelength Femtosecond Laser Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Three Wavelength Femtosecond Laser Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Three Wavelength Femtosecond Laser Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Three Wavelength Femtosecond Laser Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Three Wavelength Femtosecond Laser Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Three Wavelength Femtosecond Laser Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Three Wavelength Femtosecond Laser Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Three Wavelength Femtosecond Laser Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Three Wavelength Femtosecond Laser Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Three Wavelength Femtosecond Laser Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Three Wavelength Femtosecond Laser Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Three Wavelength Femtosecond Laser Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Three Wavelength Femtosecond Laser Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Three Wavelength Femtosecond Laser Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Three Wavelength Femtosecond Laser Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Three Wavelength Femtosecond Laser Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Three Wavelength Femtosecond Laser Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Three Wavelength Femtosecond Laser?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Three Wavelength Femtosecond Laser?

Key companies in the market include Ekspla, TRUMPF Group, KMLabs, RPMC Lasers, Inc., Newport Company, IPG Photonics Corporation.

3. What are the main segments of the Three Wavelength Femtosecond Laser?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Three Wavelength Femtosecond Laser," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Three Wavelength Femtosecond Laser report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Three Wavelength Femtosecond Laser?

To stay informed about further developments, trends, and reports in the Three Wavelength Femtosecond Laser, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence