Key Insights

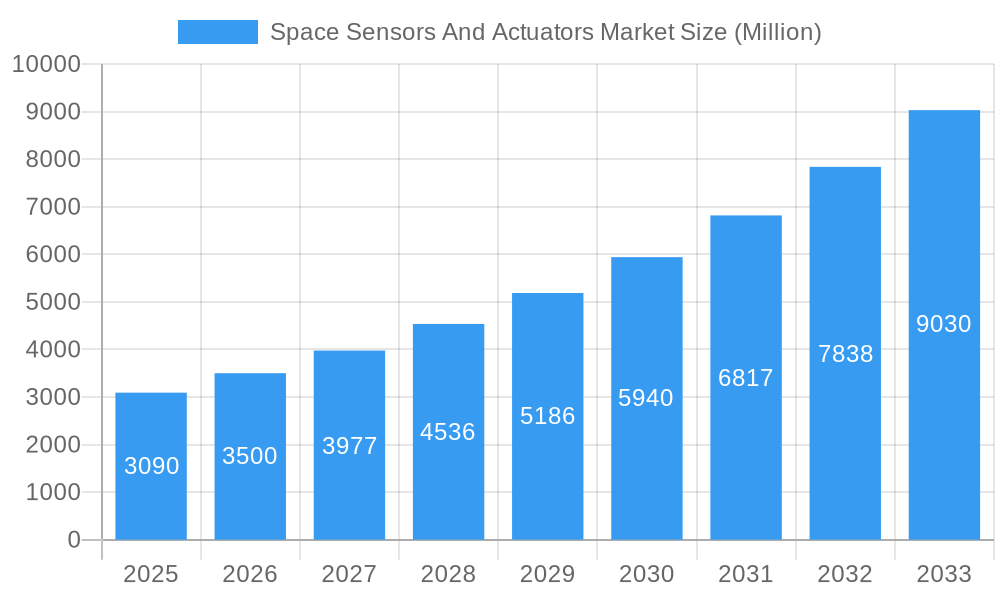

The global Space Sensors and Actuators market, valued at $3.09 billion in 2025, is projected to experience robust growth, driven by the increasing demand for advanced space exploration missions and the burgeoning commercial space industry. A Compound Annual Growth Rate (CAGR) of 13.40% from 2025 to 2033 indicates a significant market expansion, reaching an estimated value exceeding $10 billion by 2033. Key drivers include the miniaturization of sensors and actuators, leading to improved performance and reduced costs; the rising adoption of sophisticated technologies like AI and machine learning for autonomous space operations; and the growing need for precise control and measurement in various spacecraft components. The market segmentation reveals significant opportunities across various product types, including sensors and actuators, with sensors potentially commanding a larger market share due to their widespread use in diverse space applications. The satellite segment is expected to remain a significant contributor, fueled by continuous advancements in satellite technology and the increasing reliance on satellite-based communication and Earth observation. Government and defense sectors continue to be major end-users, though the commercial space sector is rapidly expanding its market share, driven by private companies launching their own space missions and constellations.

Space Sensors And Actuators Market Market Size (In Billion)

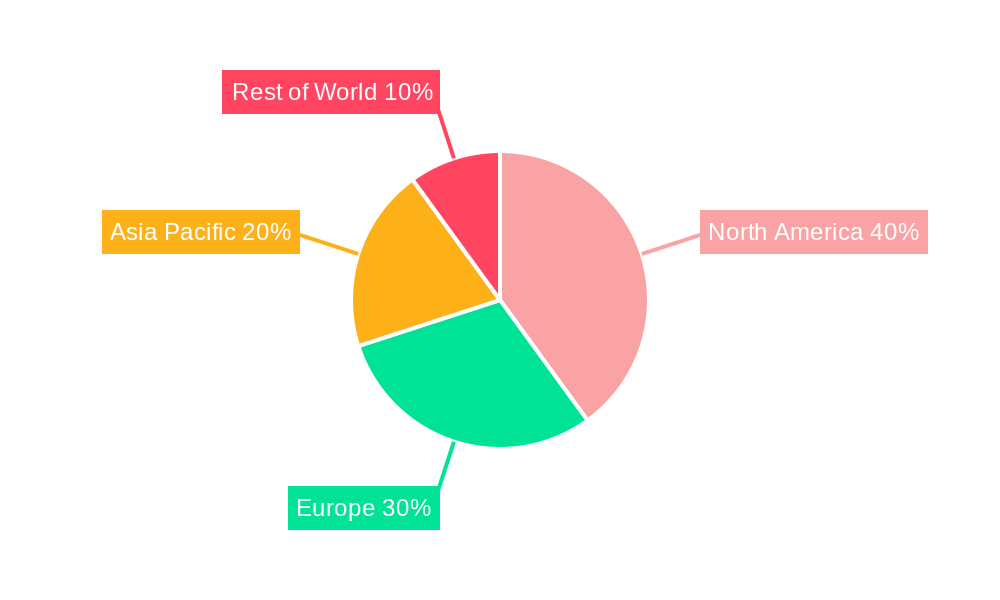

Geographic analysis shows a strong presence of the market in North America and Europe, given the established space agencies and a robust aerospace industry in these regions. However, the Asia-Pacific region presents a significant growth potential, driven by increasing investments in space exploration and the rise of emerging space economies in countries like China and India. Competitive rivalry is intense, with established players like Honeywell, Moog, and RTX competing alongside emerging technology companies. The market landscape necessitates a focus on innovation, strategic partnerships, and technological advancements to maintain a competitive edge. Companies are likely focusing on developing highly reliable, radiation-hardened components, miniaturization, and low-power consumption solutions to meet the demanding requirements of space environments. The ongoing growth indicates substantial opportunities for players throughout the supply chain, from component manufacturers to system integrators.

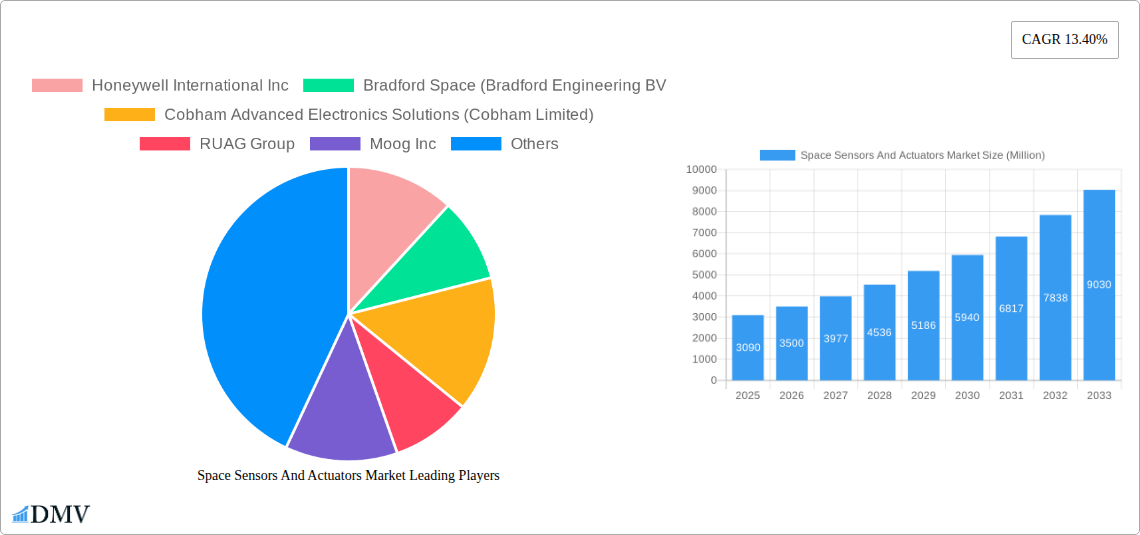

Space Sensors And Actuators Market Company Market Share

This insightful report provides a detailed analysis of the global Space Sensors and Actuators Market, offering a comprehensive overview of market size, growth drivers, challenges, and future opportunities. Spanning the period from 2019 to 2033, with a focus on 2025 as the base and estimated year, this report is an essential resource for stakeholders seeking to understand and capitalize on the dynamic landscape of the space industry. The market is projected to reach xx Million by 2033.

Space Sensors And Actuators Market Market Composition & Trends

The Space Sensors and Actuators market is characterized by a moderately concentrated landscape, with key players like Honeywell International Inc, Bradford Space (Bradford Engineering BV), Cobham Advanced Electronics Solutions (Cobham Limited), RUAG Group, Moog Inc, RTX Corporation, STMicroelectronics NV, Ametek Inc, Maxar Technologies Inc, TE Connectivity Ltd, and Texas Instruments Incorporated holding significant market share. Market share distribution is estimated at approximately 65-70% for the top 5 players in 2025, indicating a competitive yet consolidated market structure. Innovation is a primary driver, fueled by the escalating demand for miniaturized, highly accurate, and radiation-hardened components essential for the demanding conditions of space applications. Stringent regulatory frameworks, particularly those governing safety and reliability, play a pivotal role in market dynamics. Substitute products are limited, a direct consequence of the exceptionally high performance and reliability requirements inherent in space environments. End-users are predominantly governments and defense agencies, with a notable and promising surge in commercial sector participation. Mergers and Acquisitions (M&A) activities have been relatively measured, with estimated deal values reaching approximately $500 Million in the past five years (2019-2024).

- Market Concentration: Moderately concentrated, with top 5 players holding an estimated 65-70% market share (2025).

- Innovation Catalysts: Miniaturization, enhanced accuracy, radiation hardening, improved power efficiency, and increased data processing capabilities.

- Regulatory Landscape: Stringent safety, reliability, and performance standards mandated by space agencies and international bodies.

- Substitute Products: Limited due to the unique and critical performance demands of the space environment.

- End-User Profile: Predominantly government and defense sectors, with robust and expanding commercial satellite, launch services, and space exploration ventures.

- M&A Activity: Estimated deal value of approximately $500 Million over the past five years (2019-2024), reflecting strategic consolidation and technology acquisition.

Space Sensors And Actuators Market Industry Evolution

The Space Sensors and Actuators market has witnessed significant growth, driven by increasing space exploration activities, advancements in satellite technology, and rising demand for reliable space-based communication and navigation systems. The historical period (2019-2024) showed an average annual growth rate (AAGR) of xx%, while the forecast period (2025-2033) is projected to experience an AAGR of xx%, reaching a market value of xx Million by 2033. This growth is fueled by technological advancements such as the development of miniaturized sensors with improved accuracy and power efficiency, the integration of AI and machine learning capabilities into space systems, and the emergence of new materials and manufacturing techniques. The shift towards commercial space exploration is a major driver, with private companies investing heavily in developing and deploying new space-based technologies and applications. Consumer demand for high-bandwidth communication and improved navigation systems continues to fuel innovation and market expansion.

Leading Regions, Countries, or Segments in Space Sensors And Actuators Market

The North American region currently dominates the Space Sensors and Actuators market, driven by strong government spending on space exploration and defense initiatives, a robust aerospace industry, and a large pool of skilled engineers and scientists. However, the Asia-Pacific region is exhibiting significant growth potential, fueled by increasing investment in space research and development programs.

Key Drivers by Segment:

- Product Type:

- Sensors: High demand for advanced sensors (e.g., optical, inertial) drives growth.

- Actuators: Increasing need for precise and reliable actuators (e.g., reaction wheels, thrusters) boosts this segment.

- Platform:

- Satellites: The largest segment due to the high volume of satellite deployments.

- Interplanetary Spacecraft & Probes: Growing demand for long-duration missions drives growth in this niche.

- End User:

- Government and Defense: The largest end-user segment due to substantial government funding and security needs.

- Commercial: Rapid expansion due to increasing commercial space activities and private investment.

Dominance Factors:

North America's dominance stems from its established aerospace industry, substantial government investment in space programs (e.g., NASA), and a mature technological infrastructure. The Asia-Pacific region's growing influence is attributed to increasing government funding for space exploration, a burgeoning commercial space sector, and a large, growing population with increasing technological demands. Europe also holds a significant market share thanks to its robust space agencies (e.g., ESA).

Space Sensors And Actuators Market Product Innovations

Recent and ongoing innovations in the Space Sensors and Actuators market are heavily focused on the development of smaller, more sensitive, and exceptionally radiation-hardened sensors and actuators. Key advancements include the proliferation of MEMS (Microelectromechanical Systems) based sensors and actuators, offering superior precision and reduced size. The integration of novel advanced materials, such as carbon nanotubes and graphene, is enhancing overall performance and durability. Furthermore, the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing data processing and enabling more sophisticated autonomous control capabilities. These technological leaps are instrumental in facilitating more efficient, reliable, and cost-effective space missions. The unique selling propositions defining successful products in this market include enhanced accuracy for critical measurements, improved long-term reliability in harsh environments, extended operational lifespans, and significant reductions in both weight and power consumption, all vital for spaceborne applications.

Propelling Factors for Space Sensors And Actuators Market Growth

Several factors drive market growth: Firstly, the increasing demand for advanced satellite technology for communication, navigation, and earth observation fuels this market. Secondly, government investments in space exploration and defense programs globally inject significant capital into the sector. Finally, the rise of private commercial space ventures and the expanding adoption of NewSpace initiatives contribute to market expansion.

Obstacles in the Space Sensors And Actuators Market Market

Significant barriers include high development and manufacturing costs, strict quality and reliability requirements, lengthy certification processes, and the risk of supply chain disruptions caused by geopolitical factors. The inherent challenges of operating in the harsh space environment necessitate stringent testing and validation procedures, adding complexity and cost.

Future Opportunities in Space Sensors And Actuators Market

The Space Sensors and Actuators market is ripe with significant future opportunities, particularly in the development of advanced sensors designed for deep space exploration missions, enabling the collection of unprecedented scientific data. The burgeoning integration of Internet of Things (IoT) technology into space systems promises enhanced connectivity and data management. The rapid growth of the small satellite sector and the development of large satellite constellations present substantial demand for mass-produced, cost-effective, and high-performance sensors and actuators. Continued advancements in miniaturization, power efficiency, and radiation-hardening technologies will not only consolidate existing market segments but also unlock entirely new markets and applications, such as in-orbit servicing, space debris removal, and interplanetary resource utilization.

Major Players in the Space Sensors And Actuators Market Ecosystem

- Honeywell International Inc

- Bradford Space (Bradford Engineering BV)

- Cobham Advanced Electronics Solutions (Cobham Limited)

- RUAG Group

- Moog Inc

- RTX Corporation

- STMicroelectronics NV

- Ametek Inc

- Maxar Technologies Inc

- TE Connectivity Ltd

- Texas Instruments Incorporated

Key Developments in Space Sensors And Actuators Market Industry

- 2023-06: Honeywell International Inc. unveiled an innovative new series of radiation-hardened sensors specifically engineered for the rigorous demands of deep-space exploration, promising enhanced data integrity in extreme cosmic environments.

- 2022-11: Moog Inc. entered into a strategic partnership with a prominent satellite manufacturer to collaboratively develop cutting-edge actuators for the rapidly expanding small satellite market, focusing on agility and precision.

- 2021-09: RTX Corporation strategically acquired a specialized space technology company, bolstering its portfolio with advanced sensor technologies and expertise, signaling a focus on synergistic growth in the sector. (Note: Specific details regarding the scope and financial implications of smaller acquisitions, as well as precise dates for all industry developments, are subject to ongoing market reporting and may vary.)

- 2024-01: STMicroelectronics announced breakthroughs in ultra-low-power sensors for CubeSats, enhancing mission longevity and data acquisition capabilities for smaller spacecraft.

- 2023-04: Maxar Technologies showcased advanced optical sensors with unprecedented resolution, supporting high-accuracy Earth observation and reconnaissance missions.

Strategic Space Sensors And Actuators Market Market Forecast

The Space Sensors and Actuators market is projected for substantial and sustained growth throughout the forecast period (2025-2033). This expansion will be a direct result of continued, significant investment in space exploration initiatives by governments worldwide, coupled with the accelerating pace of commercial space activities, including satellite constellations, space tourism, and in-orbit servicing. Technological advancements are acting as powerful accelerators, with the forecast period expected to witness considerable market expansion. This growth trajectory will be largely driven by the ongoing development and adoption of next-generation sensor and actuator technologies, particularly AI-powered solutions that enable more complex, autonomous, and resilient space missions. Sustained government support for space research and development, alongside increasing private sector investment, will remain critical pillars supporting this upward market trend.

Space Sensors And Actuators Market Segmentation

-

1. Product Type

- 1.1. Sensors

- 1.2. Actuators

-

2. Platform

- 2.1. Satellites

- 2.2. Capsules/Cargo Modules

- 2.3. Interplanetary Spacecraft & Probes

- 2.4. Rovers/Spacecraft Landers

- 2.5. Launch Vehicles

-

3. End User

- 3.1. Commercial

- 3.2. Government and Defense

Space Sensors And Actuators Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Space Sensors And Actuators Market Regional Market Share

Geographic Coverage of Space Sensors And Actuators Market

Space Sensors And Actuators Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Sensors Segment is Anticipated to Drive the Growth of the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Sensors And Actuators Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sensors

- 5.1.2. Actuators

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Satellites

- 5.2.2. Capsules/Cargo Modules

- 5.2.3. Interplanetary Spacecraft & Probes

- 5.2.4. Rovers/Spacecraft Landers

- 5.2.5. Launch Vehicles

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Government and Defense

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Space Sensors And Actuators Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Sensors

- 6.1.2. Actuators

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Satellites

- 6.2.2. Capsules/Cargo Modules

- 6.2.3. Interplanetary Spacecraft & Probes

- 6.2.4. Rovers/Spacecraft Landers

- 6.2.5. Launch Vehicles

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Commercial

- 6.3.2. Government and Defense

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Space Sensors And Actuators Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Sensors

- 7.1.2. Actuators

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Satellites

- 7.2.2. Capsules/Cargo Modules

- 7.2.3. Interplanetary Spacecraft & Probes

- 7.2.4. Rovers/Spacecraft Landers

- 7.2.5. Launch Vehicles

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Commercial

- 7.3.2. Government and Defense

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Space Sensors And Actuators Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Sensors

- 8.1.2. Actuators

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Satellites

- 8.2.2. Capsules/Cargo Modules

- 8.2.3. Interplanetary Spacecraft & Probes

- 8.2.4. Rovers/Spacecraft Landers

- 8.2.5. Launch Vehicles

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Commercial

- 8.3.2. Government and Defense

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Space Sensors And Actuators Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Sensors

- 9.1.2. Actuators

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Satellites

- 9.2.2. Capsules/Cargo Modules

- 9.2.3. Interplanetary Spacecraft & Probes

- 9.2.4. Rovers/Spacecraft Landers

- 9.2.5. Launch Vehicles

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Commercial

- 9.3.2. Government and Defense

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bradford Space (Bradford Engineering BV

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cobham Advanced Electronics Solutions (Cobham Limited)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 RUAG Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Moog Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 RTX Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 STMicroelectronics NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ametek Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Maxar Technologies Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 TE Connectivity Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Texas Instruments Incorporated

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Space Sensors And Actuators Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Space Sensors And Actuators Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Space Sensors And Actuators Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Space Sensors And Actuators Market Revenue (Million), by Platform 2025 & 2033

- Figure 5: North America Space Sensors And Actuators Market Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America Space Sensors And Actuators Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Space Sensors And Actuators Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Space Sensors And Actuators Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Space Sensors And Actuators Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Space Sensors And Actuators Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Space Sensors And Actuators Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Space Sensors And Actuators Market Revenue (Million), by Platform 2025 & 2033

- Figure 13: Europe Space Sensors And Actuators Market Revenue Share (%), by Platform 2025 & 2033

- Figure 14: Europe Space Sensors And Actuators Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Space Sensors And Actuators Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Space Sensors And Actuators Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Space Sensors And Actuators Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Space Sensors And Actuators Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Space Sensors And Actuators Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Space Sensors And Actuators Market Revenue (Million), by Platform 2025 & 2033

- Figure 21: Asia Pacific Space Sensors And Actuators Market Revenue Share (%), by Platform 2025 & 2033

- Figure 22: Asia Pacific Space Sensors And Actuators Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Space Sensors And Actuators Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Space Sensors And Actuators Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Space Sensors And Actuators Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Space Sensors And Actuators Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Rest of the World Space Sensors And Actuators Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of the World Space Sensors And Actuators Market Revenue (Million), by Platform 2025 & 2033

- Figure 29: Rest of the World Space Sensors And Actuators Market Revenue Share (%), by Platform 2025 & 2033

- Figure 30: Rest of the World Space Sensors And Actuators Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Rest of the World Space Sensors And Actuators Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Rest of the World Space Sensors And Actuators Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Space Sensors And Actuators Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Sensors And Actuators Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Space Sensors And Actuators Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Global Space Sensors And Actuators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Space Sensors And Actuators Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Space Sensors And Actuators Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Space Sensors And Actuators Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 7: Global Space Sensors And Actuators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Space Sensors And Actuators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Space Sensors And Actuators Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Space Sensors And Actuators Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 13: Global Space Sensors And Actuators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Space Sensors And Actuators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Germany Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Space Sensors And Actuators Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Space Sensors And Actuators Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 22: Global Space Sensors And Actuators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Global Space Sensors And Actuators Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Space Sensors And Actuators Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Space Sensors And Actuators Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Space Sensors And Actuators Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 31: Global Space Sensors And Actuators Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Global Space Sensors And Actuators Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Sensors And Actuators Market?

The projected CAGR is approximately 13.40%.

2. Which companies are prominent players in the Space Sensors And Actuators Market?

Key companies in the market include Honeywell International Inc, Bradford Space (Bradford Engineering BV, Cobham Advanced Electronics Solutions (Cobham Limited), RUAG Group, Moog Inc, RTX Corporation, STMicroelectronics NV, Ametek Inc, Maxar Technologies Inc, TE Connectivity Ltd, Texas Instruments Incorporated.

3. What are the main segments of the Space Sensors And Actuators Market?

The market segments include Product Type, Platform, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.09 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Sensors Segment is Anticipated to Drive the Growth of the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Sensors And Actuators Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Sensors And Actuators Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Sensors And Actuators Market?

To stay informed about further developments, trends, and reports in the Space Sensors And Actuators Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence