Key Insights

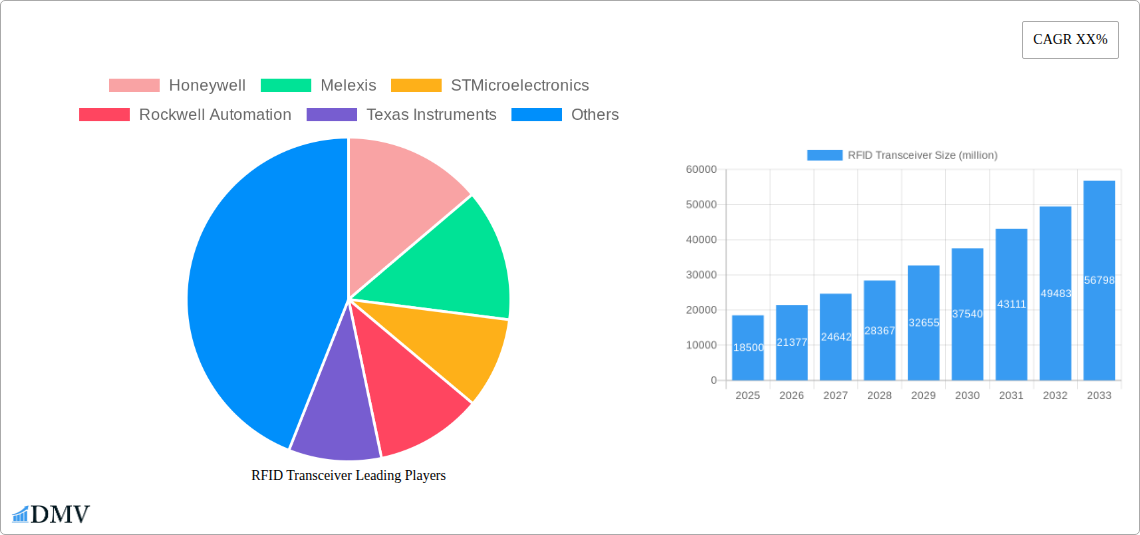

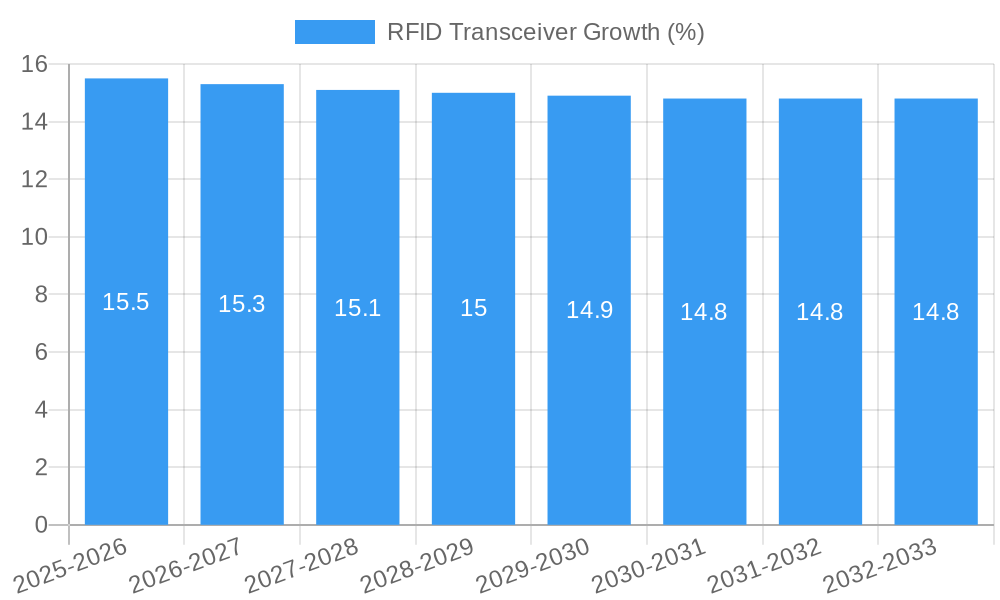

The global RFID transceiver market is poised for substantial growth, projected to reach an estimated market size of $18,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 15.5% expected to propel it to approximately $37,700 million by 2033. This robust expansion is fueled by the escalating demand for enhanced inventory management, supply chain visibility, and automation across diverse industries. Key drivers include the increasing adoption of RFID technology in retail for shrinkage reduction and improved customer experience, as well as its critical role in securing and tracking assets in logistics and warehousing. Furthermore, the evolving landscape of the aerospace and defense sectors, with their stringent requirements for asset tracking and operational efficiency, presents significant growth opportunities. The military segment, in particular, is a substantial contributor due to the need for secure and reliable identification and tracking of personnel and equipment.

The market's trajectory is further shaped by several key trends. The proliferation of the Internet of Things (IoT) is a significant enabler, integrating RFID transceivers into smart environments for seamless data exchange and real-time monitoring. Advancements in miniaturization and power efficiency are making RFID transceivers more accessible and adaptable for a wider range of applications, from high-power industrial solutions to low-power consumer devices. However, the market is not without its restraints. The initial cost of implementation and the need for robust data security infrastructure can pose challenges for smaller enterprises. Integration complexities with existing legacy systems also require careful planning and investment. Despite these hurdles, the inherent benefits of RFID technology, such as improved operational efficiency, reduced manual errors, and enhanced data accuracy, are expected to outweigh the challenges, driving continued market penetration.

This in-depth report provides a definitive analysis of the global RFID Transceiver market, encompassing historical trends, current dynamics, and future projections. With a study period from 2019 to 2033, a base year of 2025, and a forecast period spanning 2025-2033, this research equips stakeholders with critical insights into market composition, evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. The report delves into the intricate landscape of this vital technology, vital for supply chain management, asset tracking, and secure authentication across numerous industries. Understand the competitive positioning of major players like Honeywell, Melexis, STMicroelectronics, Rockwell Automation, Texas Instruments, SparkFun Electronics, DLP Design, Omron, ON Semiconductor, and Analog Devices, Inc. and their contributions to market advancements.

RFID Transceiver Market Composition & Trends

The global RFID Transceiver market exhibits a dynamic composition influenced by technological innovation and evolving application demands. Market concentration is moderate, with a few key players holding substantial market share while a growing number of specialized vendors contribute to a vibrant ecosystem. Innovation catalysts are primarily driven by the demand for smaller, more efficient, and secure RFID transceivers, coupled with advancements in semiconductor technology and antenna design. Regulatory landscapes are generally supportive, with industry-specific standards and compliance requirements influencing product development and adoption. Substitute products, such as QR codes and NFC technology, exist but often cater to different use cases or offer less robust functionality for high-volume or long-range applications. End-user profiles are diverse, ranging from large enterprises in logistics and manufacturing to specialized government and defense agencies. Mergers and acquisitions (M&A) activities are strategic, aimed at expanding product portfolios, acquiring intellectual property, and consolidating market presence. For instance, anticipated M&A deal values in the coming years are projected to reach several hundred million dollars, reflecting the strategic importance of RFID transceiver technologies. The market share distribution for key players is constantly shifting due to ongoing R&D investments and competitive product launches.

RFID Transceiver Industry Evolution

The RFID Transceiver industry has witnessed a remarkable evolution over the past decade, characterized by sustained growth, disruptive technological advancements, and a palpable shift in consumer and industrial demands. From 2019 to 2024, the market experienced a compound annual growth rate (CAGR) of approximately 12.5%, driven by the increasing adoption of automation and the need for enhanced visibility in supply chains. This growth trajectory is projected to continue, with an estimated CAGR of 14.2% from 2025 to 2033. Technological advancements have been instrumental in this evolution. We've seen a significant transition towards smaller form factors, increased read ranges, improved data security features, and enhanced power efficiency in RFID transceivers. Low Power RFID transceivers, in particular, have seen a surge in demand due to their suitability for battery-less applications and the Internet of Things (IoT) ecosystem. High Power RFID transceivers continue to be critical for applications requiring extensive read distances and robust performance in challenging environments. Consumer demand, though indirect, has also played a role, with the expectation of seamless inventory management and efficient product delivery pushing industries to adopt more advanced tracking technologies. The integration of RFID with other emerging technologies like artificial intelligence (AI) and machine learning (ML) is further propelling the industry forward, enabling predictive analytics and smarter operational decision-making. The development of advanced materials for antenna construction and semiconductor fabrication has also contributed to the performance enhancements and cost reductions seen in RFID transceivers. The number of connected devices globally, now in the billions, underscores the foundational role RFID transceivers play in building the infrastructure for a hyper-connected world.

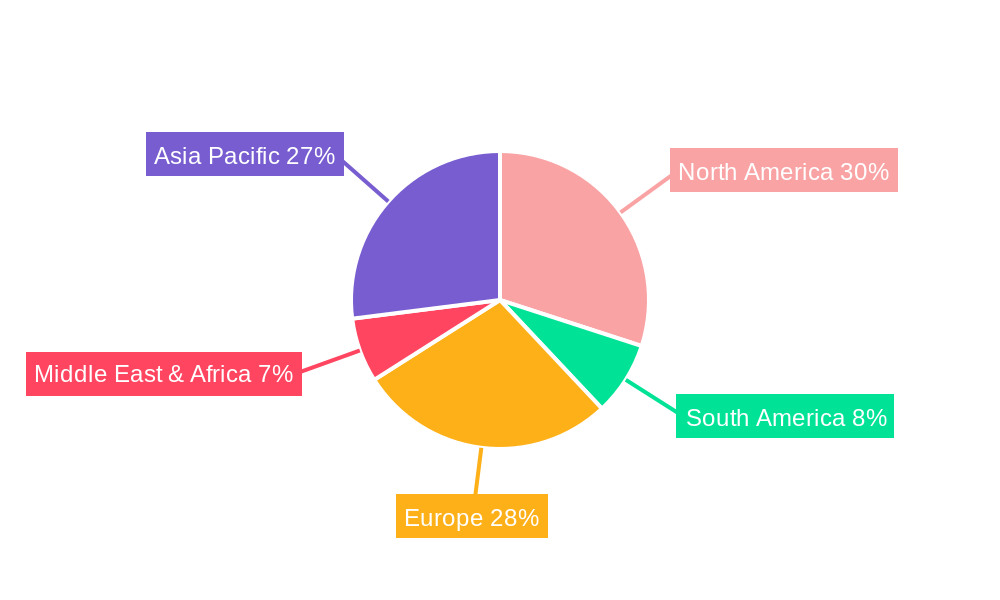

Leading Regions, Countries, or Segments in RFID Transceiver

The global RFID Transceiver market is characterized by distinct regional dominance and significant growth in specific application and type segments. North America currently leads the market, driven by substantial investments in advanced manufacturing, robust supply chain logistics, and a strong military and aerospace sector. The United States, in particular, accounts for a significant portion of this regional dominance, fueled by extensive research and development initiatives and the early adoption of RFID technologies across various industries.

Application Dominance:

- Aerospace: This segment is a major driver due to stringent requirements for asset tracking, maintenance, repair, and overhaul (MRO) operations, and component identification. The need for high reliability and security in aviation makes RFID transceivers indispensable, with billions of dollars invested annually in aircraft and component tracking solutions.

- Military: The defense sector relies heavily on RFID for inventory management, battlefield logistics, personnel tracking, and equipment identification. Security and operational efficiency are paramount, leading to continuous demand for advanced RFID solutions, with defense budgets allocating hundreds of millions for such systems.

- Telecom: The telecommunications industry is increasingly utilizing RFID for infrastructure management, asset tracking of equipment, and subscriber identification, contributing hundreds of millions in annual spending.

Type Dominance:

- High Power: Essential for applications requiring long read ranges and the ability to penetrate challenging materials, such as industrial asset tracking, toll collection, and port management. Investment trends in these areas are in the hundreds of millions of dollars annually.

- Low Power: Experiencing rapid growth due to its suitability for battery-operated devices and the expanding Internet of Things (IoT) landscape. This segment is critical for smart retail, healthcare, and consumer electronics, with adoption rates in the billions of units projected over the forecast period.

Regulatory support, such as mandates for supply chain visibility and security standards, further bolsters the adoption of RFID transceivers in leading regions. Countries like Germany, the UK, and Japan also exhibit strong market presence, driven by advanced industrial automation and sophisticated logistics networks, with significant R&D investments often in the hundreds of millions.

RFID Transceiver Product Innovations

Recent product innovations in the RFID Transceiver market are focused on enhancing performance, miniaturization, and integration capabilities. Leading companies are introducing transceivers with extended read ranges exceeding 30 meters and improved read speeds, enabling faster inventory counts and real-time asset visibility. Advanced features such as enhanced encryption for data security, on-chip tamper detection, and ultra-low power consumption for extended battery life or battery-less operation are becoming standard. These innovations are crucial for demanding applications in aerospace and military sectors, where reliability and security are paramount. The development of smaller, more robust form factors is also a key trend, allowing for easier integration into a wider range of devices and environments, from small electronic components to large industrial equipment. Performance metrics such as data transfer rates of several megabits per second and operational temperatures ranging from -50 to +150 degrees Celsius are increasingly being achieved.

Propelling Factors for RFID Transceiver Growth

Several key factors are propelling the growth of the RFID Transceiver market. Technologically, the continuous miniaturization of components, coupled with advancements in power management and data encryption, is making RFID solutions more accessible and versatile. Economically, the rising demand for automation and real-time visibility across supply chains, manufacturing, and retail sectors is a significant driver. Industries are recognizing the substantial ROI from improved inventory management, reduced labor costs, and enhanced operational efficiency, leading to multi-billion dollar investments. Regulatory pushes for enhanced supply chain security and track-and-trace capabilities, particularly in pharmaceuticals and defense, are also creating substantial market opportunities, with compliance often necessitating RFID implementation.

Obstacles in the RFID Transceiver Market

Despite robust growth, the RFID Transceiver market faces certain obstacles. Regulatory challenges, particularly concerning data privacy and spectrum allocation in certain regions, can slow down adoption rates. Supply chain disruptions, such as shortages of critical semiconductor components, have historically impacted manufacturing capacity and pricing, leading to increased lead times and costs, potentially affecting project timelines worth millions. Furthermore, the initial cost of implementation, including infrastructure and tag deployment, can be a barrier for smaller businesses, despite the long-term cost savings. Competitive pressures from alternative technologies like NFC and advanced barcode systems also necessitate continuous innovation and price competitiveness from RFID transceiver manufacturers to maintain market share.

Future Opportunities in RFID Transceiver

Emerging opportunities in the RFID Transceiver market are vast and diverse. The continued expansion of the Internet of Things (IoT) ecosystem presents a massive opportunity for low-power RFID transceivers in smart homes, wearable technology, and connected industrial machinery. New markets in healthcare for patient tracking and medication management, as well as in the agricultural sector for livestock and crop monitoring, are rapidly developing. Technological advancements in ultra-high frequency (UHF) RFID, enabling longer read ranges and higher data densities, will unlock new applications in smart cities and large-scale asset management. Furthermore, the integration of RFID with AI and blockchain technologies promises enhanced security, traceability, and data analytics, opening up new revenue streams for innovative solutions.

Major Players in the RFID Transceiver Ecosystem

- Honeywell

- Melexis

- STMicroelectronics

- Rockwell Automation

- Texas Instruments

- SparkFun Electronics

- DLP Design

- Omron

- ON Semiconductor

- Analog Devices, Inc.

Key Developments in RFID Transceiver Industry

- January 2024: Launch of new ultra-low power RFID transceivers with enhanced security features, enabling battery-less IoT applications.

- November 2023: A major aerospace manufacturer integrated advanced RFID transceivers across its global supply chain, improving asset visibility by an estimated 20% and saving millions in operational costs.

- July 2023: Strategic partnership formed between a leading semiconductor manufacturer and a major telecommunications company to develop next-generation RFID solutions for 5G infrastructure.

- March 2023: Acquisition of a specialized RFID tag manufacturer by a global automation solutions provider, strengthening its end-to-end RFID offering and expanding its market reach by hundreds of millions in potential revenue.

- September 2022: Introduction of ruggedized high-power RFID transceivers designed for extreme environmental conditions in the military and oil & gas sectors.

Strategic RFID Transceiver Market Forecast

- January 2024: Launch of new ultra-low power RFID transceivers with enhanced security features, enabling battery-less IoT applications.

- November 2023: A major aerospace manufacturer integrated advanced RFID transceivers across its global supply chain, improving asset visibility by an estimated 20% and saving millions in operational costs.

- July 2023: Strategic partnership formed between a leading semiconductor manufacturer and a major telecommunications company to develop next-generation RFID solutions for 5G infrastructure.

- March 2023: Acquisition of a specialized RFID tag manufacturer by a global automation solutions provider, strengthening its end-to-end RFID offering and expanding its market reach by hundreds of millions in potential revenue.

- September 2022: Introduction of ruggedized high-power RFID transceivers designed for extreme environmental conditions in the military and oil & gas sectors.

Strategic RFID Transceiver Market Forecast

The strategic RFID Transceiver market forecast indicates continued robust growth, driven by ongoing technological advancements and expanding application horizons. Key growth catalysts include the increasing demand for automation, the proliferation of IoT devices, and the persistent need for enhanced supply chain visibility and security. Emerging opportunities in sectors like smart cities, healthcare, and advanced manufacturing will further fuel market expansion. The market is projected to witness significant value creation, with investments in new product development and market penetration expected to reach billions. The increasing adoption of low-power and high-power transceivers, coupled with innovations in integration and data analytics, positions the RFID transceiver market for sustained and significant growth over the forecast period.

RFID Transceiver Segmentation

-

1. Application

- 1.1. Aerospace

- 1.2. Telecom

- 1.3. Military

-

2. Types

- 2.1. High Power

- 2.2. Low Power

RFID Transceiver Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

RFID Transceiver REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global RFID Transceiver Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aerospace

- 5.1.2. Telecom

- 5.1.3. Military

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. High Power

- 5.2.2. Low Power

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America RFID Transceiver Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aerospace

- 6.1.2. Telecom

- 6.1.3. Military

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. High Power

- 6.2.2. Low Power

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America RFID Transceiver Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aerospace

- 7.1.2. Telecom

- 7.1.3. Military

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. High Power

- 7.2.2. Low Power

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe RFID Transceiver Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aerospace

- 8.1.2. Telecom

- 8.1.3. Military

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. High Power

- 8.2.2. Low Power

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa RFID Transceiver Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aerospace

- 9.1.2. Telecom

- 9.1.3. Military

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. High Power

- 9.2.2. Low Power

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific RFID Transceiver Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aerospace

- 10.1.2. Telecom

- 10.1.3. Military

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. High Power

- 10.2.2. Low Power

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Melexis

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 STMicroelectronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rockwell Automation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SparkFun Electronics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DLP Design

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Omron

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ON Semiconductor

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Analog Devices

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Inc.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Honeywell

List of Figures

- Figure 1: Global RFID Transceiver Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America RFID Transceiver Revenue (million), by Application 2024 & 2032

- Figure 3: North America RFID Transceiver Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America RFID Transceiver Revenue (million), by Types 2024 & 2032

- Figure 5: North America RFID Transceiver Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America RFID Transceiver Revenue (million), by Country 2024 & 2032

- Figure 7: North America RFID Transceiver Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America RFID Transceiver Revenue (million), by Application 2024 & 2032

- Figure 9: South America RFID Transceiver Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America RFID Transceiver Revenue (million), by Types 2024 & 2032

- Figure 11: South America RFID Transceiver Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America RFID Transceiver Revenue (million), by Country 2024 & 2032

- Figure 13: South America RFID Transceiver Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe RFID Transceiver Revenue (million), by Application 2024 & 2032

- Figure 15: Europe RFID Transceiver Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe RFID Transceiver Revenue (million), by Types 2024 & 2032

- Figure 17: Europe RFID Transceiver Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe RFID Transceiver Revenue (million), by Country 2024 & 2032

- Figure 19: Europe RFID Transceiver Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa RFID Transceiver Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa RFID Transceiver Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa RFID Transceiver Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa RFID Transceiver Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa RFID Transceiver Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa RFID Transceiver Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific RFID Transceiver Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific RFID Transceiver Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific RFID Transceiver Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific RFID Transceiver Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific RFID Transceiver Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific RFID Transceiver Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global RFID Transceiver Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global RFID Transceiver Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global RFID Transceiver Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global RFID Transceiver Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global RFID Transceiver Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global RFID Transceiver Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global RFID Transceiver Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global RFID Transceiver Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global RFID Transceiver Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global RFID Transceiver Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global RFID Transceiver Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global RFID Transceiver Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global RFID Transceiver Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global RFID Transceiver Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global RFID Transceiver Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global RFID Transceiver Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global RFID Transceiver Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global RFID Transceiver Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global RFID Transceiver Revenue million Forecast, by Country 2019 & 2032

- Table 41: China RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific RFID Transceiver Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the RFID Transceiver?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the RFID Transceiver?

Key companies in the market include Honeywell, Melexis, STMicroelectronics, Rockwell Automation, Texas Instruments, SparkFun Electronics, DLP Design, Omron, ON Semiconductor, Analog Devices, Inc..

3. What are the main segments of the RFID Transceiver?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "RFID Transceiver," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the RFID Transceiver report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the RFID Transceiver?

To stay informed about further developments, trends, and reports in the RFID Transceiver, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence