Key Insights

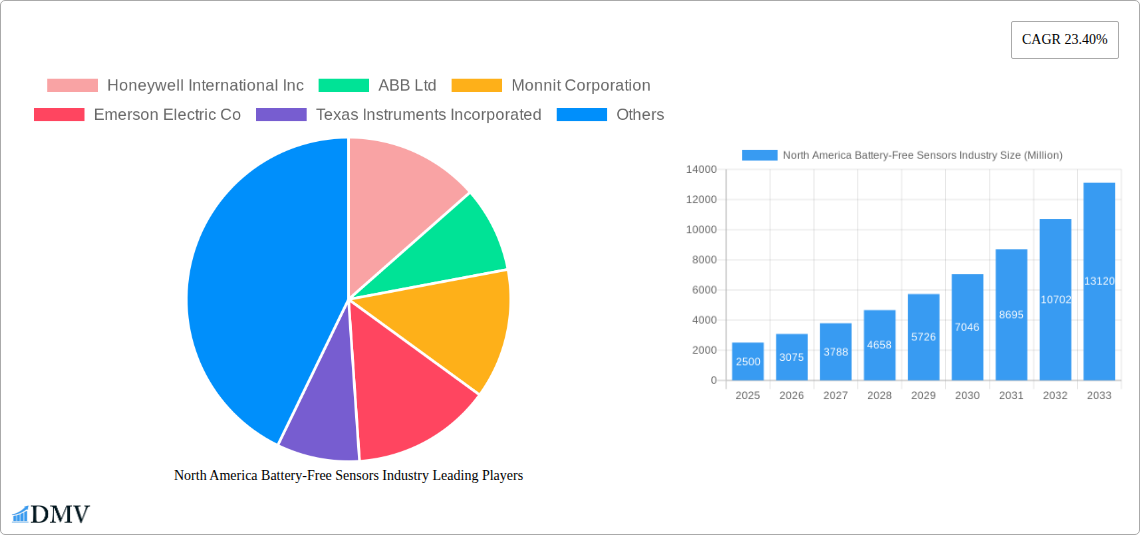

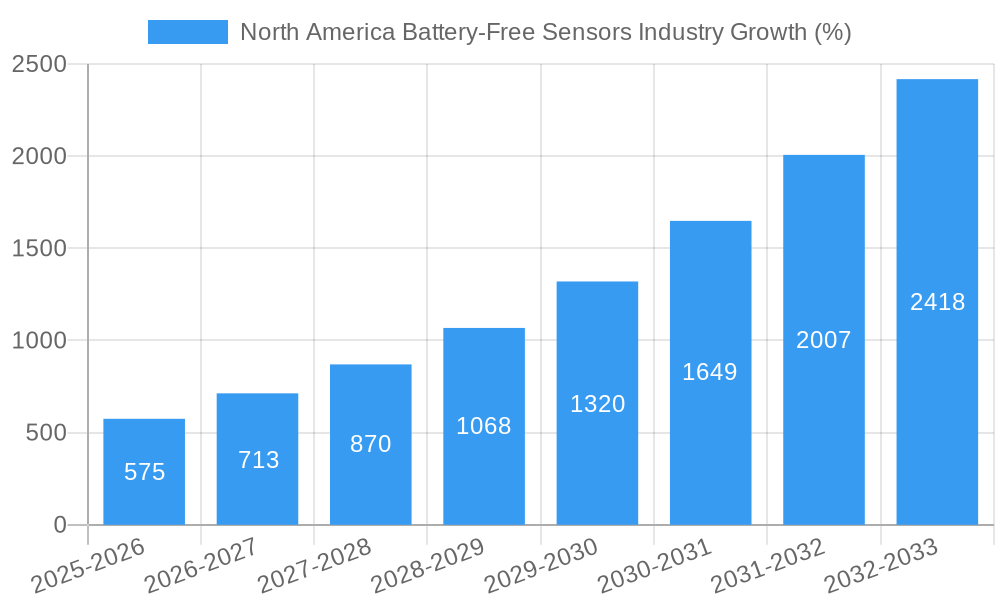

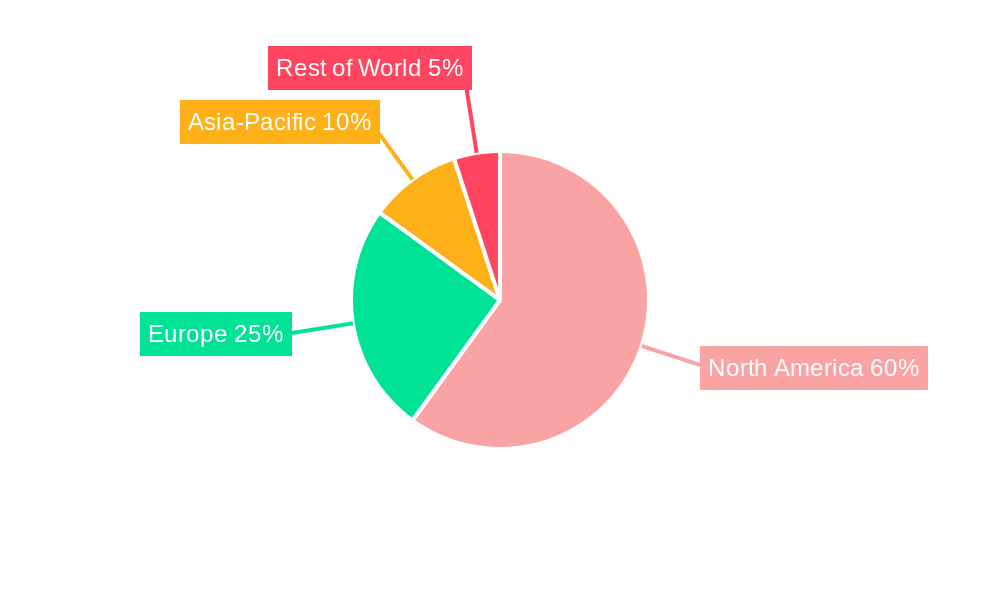

The North American battery-free sensor market is experiencing robust growth, driven by the increasing demand for energy-efficient and maintenance-free solutions across various sectors. With a Compound Annual Growth Rate (CAGR) of 23.40% from 2019 to 2024, the market is projected to reach significant value by 2033. Key drivers include the rising adoption of IoT (Internet of Things) devices, the need for real-time data monitoring in applications like automotive, healthcare, and industrial automation, and the increasing focus on reducing operational costs. The market is segmented by sensor type (pressure, temperature, chemical/gas, position/proximity, and others) and end-user industry (automotive, healthcare, aerospace & defense, energy & power, food & beverage, and others). The United States and Canada represent the largest market segments within North America, fueled by technological advancements and strong government support for technological innovation. While the market faces restraints such as high initial investment costs and the need for robust wireless communication infrastructure, the long-term benefits of reduced operational expenses, enhanced safety and efficiency, and improved data analytics are expected to overcome these challenges.

The competitive landscape is characterized by a mix of established players like Honeywell International Inc., ABB Ltd., and Emerson Electric Co., alongside smaller, specialized companies such as Phoenix Sensors LLC and Monnit Corporation. These companies are constantly innovating, introducing new sensor technologies, and expanding their product portfolios to cater to the growing demand. The forecast period (2025-2033) anticipates continued strong growth, driven by the expanding applications of battery-free sensors in smart infrastructure, environmental monitoring, and industrial automation. Further market segmentation analysis, focusing on specific application areas within each end-user industry, would offer valuable insights into potential market niches and opportunities for growth. The increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) with battery-free sensor networks will also contribute significantly to market expansion, enabling advanced data analysis and predictive maintenance capabilities.

North America Battery-Free Sensors Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America battery-free sensors industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils key trends, growth drivers, and challenges shaping the industry's future. The market is projected to reach xx Million by 2033.

North America Battery-Free Sensors Industry Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, and regulatory factors impacting the North America battery-free sensors market. We examine market concentration, revealing the market share distribution among key players like Honeywell International Inc, ABB Ltd, Monnit Corporation, Emerson Electric Co, Texas Instruments Incorporated, Phoenix Sensors LLC, Pasco Scientific, and Schneider Electric (list not exhaustive). The report also details the prevalent M&A activities, including deal values and their impact on market dynamics. Innovation is assessed through the lens of technological advancements and their adoption rates across various segments. Furthermore, the influence of regulatory landscapes and the presence of substitute products are thoroughly investigated. Finally, the report profiles end-users, detailing their specific needs and preferences, contributing to a complete understanding of the market's composition and trends. The analysis includes a detailed examination of the market's competitive dynamics, revealing key players’ strategies and competitive advantages. Specific metrics such as market share distribution and M&A deal values (in Millions) are provided, offering a quantitative perspective on market trends and competitive forces.

North America Battery-Free Sensors Industry Industry Evolution

This section provides a detailed analysis of the North America battery-free sensors market's evolutionary journey. It traces the market's growth trajectory from 2019 to 2024, highlighting key inflection points and analyzing the forces driving its expansion. The report delves into the technological advancements that have fueled the industry's growth, emphasizing innovations in sensor technology, communication protocols, and data analytics. It also examines shifts in consumer demands, highlighting the increasing preference for energy-efficient and cost-effective solutions. Specific data points, such as compound annual growth rates (CAGRs) and adoption rates of various sensor technologies, are provided to quantify the market's evolution. The analysis incorporates an assessment of the market's response to external factors, such as economic fluctuations and technological disruptions.

Leading Regions, Countries, or Segments in North America Battery-Free Sensors Industry

This section pinpoints the leading regions, countries, and segments within the North American battery-free sensors market. A detailed analysis of the dominance factors for each key segment (By Country: United States, Canada; By Type: Pressure Sensor, Temperature Sensor, Chemical and Gas Sensor, Position and Proximity Sensor, Other Types; By End-user Industry: Automotive, Healthcare, Aerospace and Defense, Energy and Power, Food and Beverage, Other End-user Industries) is provided.

- Key Drivers (United States): Strong R&D investment, robust regulatory support for technological advancements, and a large, diversified end-user base.

- Key Drivers (Canada): Government initiatives promoting energy efficiency and technological innovation in various sectors.

- Key Drivers (Pressure Sensors): High demand from automotive and industrial automation applications.

- Key Drivers (Healthcare): Growing adoption of remote patient monitoring and advancements in medical diagnostics.

- Key Drivers (Automotive): Increasing focus on vehicle safety and autonomous driving technologies.

The dominance of specific regions and segments is analyzed, considering factors such as market size, growth rate, and technological adoption. The analysis incorporates detailed explanations of the factors contributing to the dominance of each leading segment.

North America Battery-Free Sensors Industry Product Innovations

Recent years have witnessed significant advancements in battery-free sensor technology, leading to the development of more efficient, reliable, and versatile sensors. Innovations include energy harvesting techniques such as piezoelectric and solar power, enabling longer operational lifespans and eliminating the need for battery replacements. These advancements have expanded the application range of battery-free sensors, particularly in areas like environmental monitoring, industrial automation, and healthcare. Improved performance metrics such as increased sensitivity, wider operating temperature ranges, and enhanced data transmission capabilities are key features of the latest innovations. The unique selling propositions of these new sensors include their self-powered nature, extended lifespan, reduced maintenance requirements, and improved reliability in harsh environments.

Propelling Factors for North America Battery-Free Sensors Industry Growth

Several factors are driving the growth of the North America battery-free sensors market. Technological advancements, particularly in energy harvesting and low-power electronics, are enabling the development of smaller, more efficient, and cost-effective sensors. The increasing demand for remote monitoring and automation across various industries is fueling the adoption of these sensors. Furthermore, favorable government regulations and incentives promoting energy efficiency and environmental sustainability are stimulating market growth. The rising focus on data-driven decision-making and the increasing integration of IoT devices are further propelling market expansion.

Obstacles in the North America Battery-Free Sensors Industry Market

Despite significant growth potential, the North America battery-free sensors market faces certain challenges. High initial investment costs associated with the development and deployment of these advanced technologies can act as a barrier to entry for some market players. Supply chain disruptions and potential material shortages can impact the production and availability of battery-free sensors. Moreover, the existence of established players with strong market presence can create significant competitive pressure. Strict regulatory compliance requirements and potential safety concerns could also affect the market's growth trajectory.

Future Opportunities in North America Battery-Free Sensors Industry

The future of the North America battery-free sensors industry presents exciting opportunities. The expansion into emerging markets, such as smart homes and smart cities, holds significant potential. Advancements in materials science and energy harvesting technologies could lead to even more efficient and cost-effective sensors. The growing integration of AI and machine learning into sensor networks will enable the creation of intelligent sensor systems capable of self-diagnosis and predictive maintenance. New applications in areas like precision agriculture, environmental monitoring, and infrastructure management represent further growth opportunities.

Major Players in the North America Battery-Free Sensors Industry Ecosystem

- Honeywell International Inc

- ABB Ltd

- Monnit Corporation

- Emerson Electric Co

- Texas Instruments Incorporated

- Phoenix Sensors LLC

- Pasco Scientific

- Schneider Electric *List Not Exhaustive

Key Developments in North America Battery-Free Sensors Industry Industry

- January 2021: Swift Sensors launched a secure wireless vaccine storage unit monitoring and alert system.

- March 2021: MIT researchers developed a wireless sensing and AI system for improved medication adherence.

These developments showcase the industry's innovation and its potential to address critical healthcare and logistical challenges.

Strategic North America Battery-Free Sensors Industry Market Forecast

The North America battery-free sensors market is poised for significant growth in the coming years, driven by technological advancements, increasing demand for remote monitoring, and the growing adoption of IoT devices across various sectors. The market's future potential is considerable, especially in emerging applications and new market segments. The continued development of energy harvesting technologies and improvements in sensor performance will further fuel market expansion. The integration of advanced analytics and AI capabilities will create new opportunities for data-driven decision-making and enhanced operational efficiencies, ultimately leading to substantial market growth.

North America Battery-Free Sensors Industry Segmentation

-

1. Type

- 1.1. Pressure Sensor

- 1.2. Temperature Sensor

- 1.3. Chemical and Gas Sensor

- 1.4. Position and Proximity Sensor

- 1.5. Other Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Healthcare

- 2.3. Aerospace and Defense

- 2.4. Energy and Power

- 2.5. Food and Beverage

- 2.6. Other End-user Industries

North America Battery-Free Sensors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Battery-Free Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation)

- 3.3. Market Restrains

- 3.3.1. False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems

- 3.4. Market Trends

- 3.4.1. Automotive is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Battery-Free Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pressure Sensor

- 5.1.2. Temperature Sensor

- 5.1.3. Chemical and Gas Sensor

- 5.1.4. Position and Proximity Sensor

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Healthcare

- 5.2.3. Aerospace and Defense

- 5.2.4. Energy and Power

- 5.2.5. Food and Beverage

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Battery-Free Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Battery-Free Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Battery-Free Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Battery-Free Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Monnit Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Emerson Electric Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Texas Instruments Incorporated

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Phoenix Sensors LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Pasco Scientific

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Schneider Electric*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Battery-Free Sensors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Battery-Free Sensors Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Battery-Free Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Battery-Free Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Battery-Free Sensors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: North America Battery-Free Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Battery-Free Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Battery-Free Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: North America Battery-Free Sensors Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: North America Battery-Free Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Battery-Free Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Battery-Free Sensors Industry?

The projected CAGR is approximately 23.40%.

2. Which companies are prominent players in the North America Battery-Free Sensors Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Monnit Corporation, Emerson Electric Co, Texas Instruments Incorporated, Phoenix Sensors LLC, Pasco Scientific, Schneider Electric*List Not Exhaustive.

3. What are the main segments of the North America Battery-Free Sensors Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Wireless Technologies (Especially in Harsh Environments); Emergence of Smart Factory Concepts (Industrial Automation).

6. What are the notable trends driving market growth?

Automotive is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

False Triggering of Switch and Inconsistency Issues Associated with Wireless Network Systems.

8. Can you provide examples of recent developments in the market?

March 2021 - MIT researchers have developed wireless sensing and AI system that could help improve patients' techniques with self-administered medications such as inhalers and insulin pens. The wireless sensors could detect errors in self-administered medication, ranging from swallowing pills and injecting insulin. According to MIT, users can install the system in their homes, and it can alert patients and caregivers to medication errors and potentially reduce unnecessary hospital visits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Battery-Free Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Battery-Free Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Battery-Free Sensors Industry?

To stay informed about further developments, trends, and reports in the North America Battery-Free Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence