Key Insights

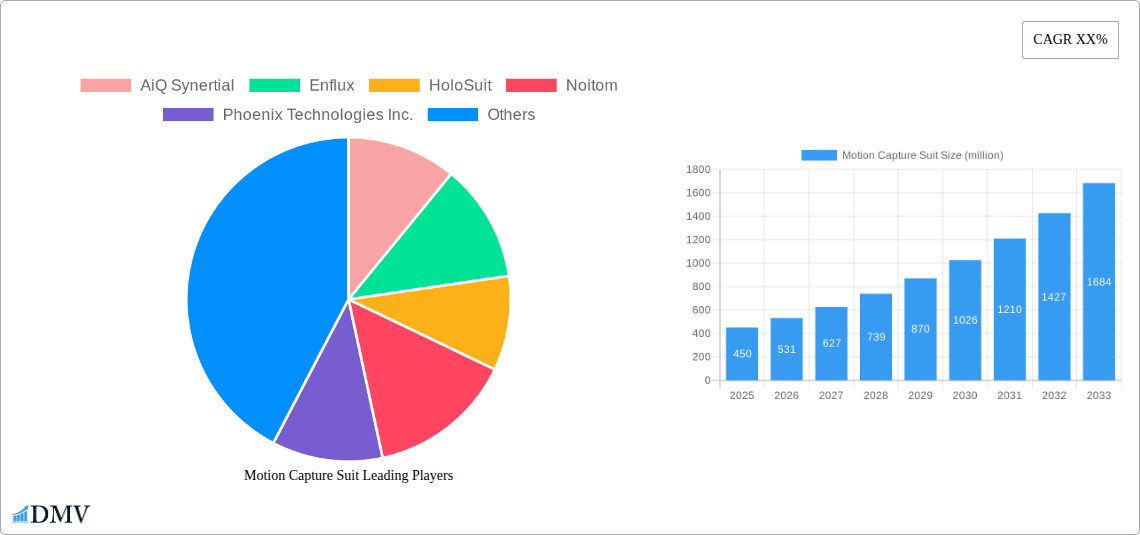

The global Motion Capture Suit market is poised for significant expansion, projected to reach approximately $450 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 18% from 2025 to 2033. This robust growth is primarily fueled by the increasing adoption of motion capture technology across diverse sectors, most notably in entertainment and gaming for realistic character animation and immersive experiences. The burgeoning sports industry also represents a key driver, utilizing these suits for advanced athlete performance analysis, injury prevention, and rehabilitation. Emerging applications in the medical field, such as gait analysis, prosthetics development, and virtual reality-assisted therapy, are further augmenting market demand. The technological advancements in sensor accuracy, wireless connectivity, and real-time data processing are making motion capture suits more accessible and versatile, thereby expanding their reach into new and evolving market segments.

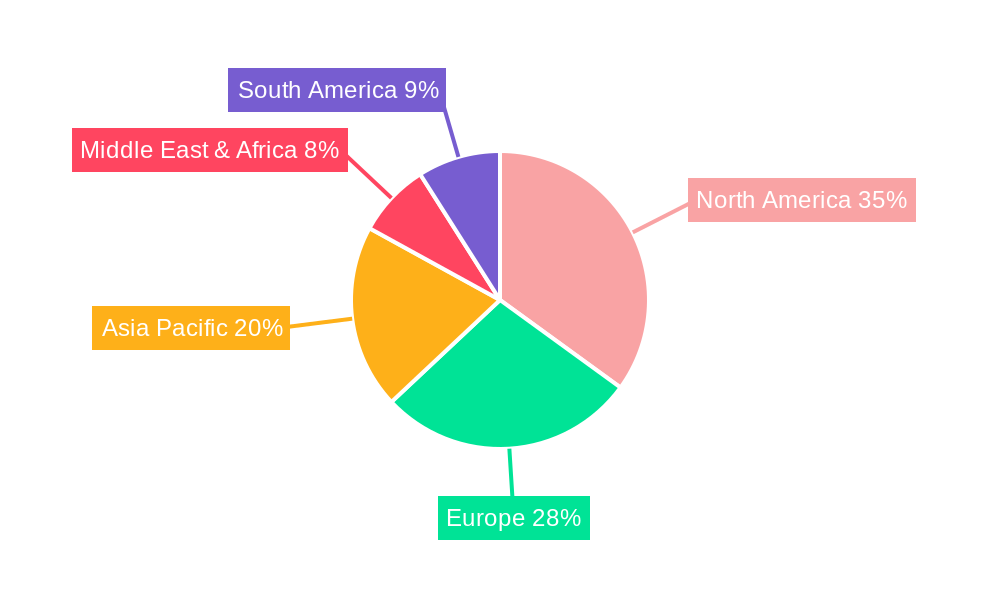

Despite the optimistic growth trajectory, certain restraints could influence market dynamics. The high initial cost of sophisticated motion capture suit systems may present a barrier for smaller organizations or individual creators. Furthermore, the need for specialized expertise in data interpretation and software integration can also pose a challenge, necessitating ongoing training and development. However, the continuous innovation in product design, leading to more affordable and user-friendly solutions, alongside the growing availability of cloud-based platforms and AI-driven analytics, is expected to mitigate these restraints. The market is segmented by type, with Optical Motion Capture leading due to its high precision, followed by Magnetic and Mechanical variants, each catering to specific application needs. Geographically, North America and Europe currently dominate the market, driven by their established entertainment and technological industries, while the Asia Pacific region is anticipated to witness the fastest growth due to increasing investments in gaming, animation, and advanced technology.

The global motion capture suit market is characterized by a dynamic and evolving landscape, driven by rapid technological advancements and increasing adoption across diverse industries. Market concentration is moderately high, with a few key players like Vicon, Qualisys, and Xsens holding significant market share, alongside emerging innovators such as AiQ Synertial, Enflux, HoloSuit, Noitom, Phoenix Technologies Inc., Rokoko, and Teslasuit. Innovation catalysts are primarily fueled by the demand for more accurate, affordable, and user-friendly motion capture solutions, particularly for real-time applications. The regulatory landscape, while not overtly restrictive, is influenced by data privacy concerns and the standardization of motion capture data for interoperability. Substitute products, such as markerless motion capture systems and traditional camera-based optical tracking, offer alternatives but often lack the comprehensive biomechanical data provided by suits. End-user profiles are increasingly sophisticated, spanning the entertainment industry (film, gaming, VR/AR), professional sports (performance analysis, training), medical rehabilitation and biomechanics research, and even industrial applications for robotics and ergonomics. Merger and acquisition (M&A) activities are anticipated to play a crucial role in consolidating market share and fostering innovation. While specific deal values remain proprietary, the overall M&A trend is indicative of a maturing market seeking strategic partnerships and technology acquisition. The market share distribution is projected to see shifts, with specialized suit manufacturers gaining traction in niche applications. We anticipate a total market value exceeding one hundred million dollars by the end of the forecast period.

Motion Capture Suit Industry Evolution

The motion capture suit industry has witnessed a remarkable trajectory of evolution, moving from specialized, high-cost systems to more accessible and versatile solutions. The historical period from 2019 to 2024 saw steady growth, fueled by the burgeoning demand for realistic digital content in entertainment and the increasing sophistication of sports analytics. This era was marked by incremental improvements in sensor technology, battery life, and software integration, leading to a broader adoption base. The base year of 2025 represents a pivotal point, with the market poised for accelerated expansion. Technological advancements have been the primary engine of this evolution. Early magnetic motion capture systems, while offering a good degree of freedom, were susceptible to interference. Mechanical systems provided robust tracking but were often cumbersome. The advent and refinement of optical motion capture, along with the development of inertial measurement unit (IMU) based suits like those offered by Rokoko (Smartsuit Pro) and Teslasuit, have revolutionized the market. These IMU-based suits offer a compelling combination of portability, ease of use, and high-fidelity data capture, making them ideal for a wider range of applications.

Consumer demands have also shifted significantly. Initially, high-end studios and research institutions were the primary adopters. However, the desire for immersive experiences in virtual reality (VR) and augmented reality (AR) gaming, coupled with the growing emphasis on data-driven performance optimization in sports, has democratized the market. Athletes and coaches are now seeking affordable yet powerful tools for movement analysis and injury prevention. In the medical field, the need for precise biomechanical data for rehabilitation and gait analysis is driving demand for wearable motion capture solutions. The forecast period from 2025 to 2033 is projected to witness exponential growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 15-20%. This growth will be further propelled by advancements in AI and machine learning, enabling more sophisticated data interpretation and real-time feedback. For instance, advancements in markerless optical capture are also impacting the market, offering alternatives where full suits might not be practical. The industry is moving towards a future where motion capture is seamlessly integrated into daily life, from interactive entertainment to personalized healthcare. The estimated market size by 2025 is projected to be several hundred million dollars, with significant potential for further expansion.

Leading Regions, Countries, or Segments in Motion Capture Suit

The dominance within the motion capture suit market is multifaceted, with specific regions and application segments showcasing exceptional growth and adoption. North America, particularly the United States, consistently leads due to its robust entertainment industry (Hollywood, major gaming studios), advanced sports science infrastructure, and significant investment in R&D. The presence of key players like Vicon and Qualisys, along with numerous innovative startups, further solidifies its position. Europe, driven by countries like the UK, Germany, and France, is a strong contender, with a burgeoning VR/AR sector and a well-established medical research ecosystem. Asia-Pacific is emerging as a rapid growth region, fueled by the expanding gaming and animation industries in China and South Korea, and increasing investments in sports technology across the region.

In terms of application segments, Entertainment remains the largest and most influential driver. The insatiable demand for realistic character animation in films, video games, and virtual experiences directly translates to a high demand for advanced motion capture suits. The integration of motion capture into VR and AR platforms is a key growth catalyst, offering unparalleled immersion. The Sports segment is experiencing rapid growth, with professional teams and athletes utilizing motion capture for performance analysis, biomechanical assessments, injury prevention, and rehabilitation. This segment is characterized by a growing need for portable and easy-to-deploy solutions. The Medical segment, while currently smaller, holds immense future potential. Applications include physical therapy, gait analysis for neurological disorders, surgical training, and prosthetics development, all of which benefit from accurate motion capture data. Others, encompassing industrial automation, robotics, and research, are also contributing to market expansion, albeit at a more measured pace.

Within the Types of motion capture, Optical Motion Capture has historically dominated due to its precision and widespread adoption in high-end production. However, Magnetic Motion Capture and Mechanical Motion Capture continue to find niche applications where specific advantages are required. The most significant shift is the rise of IMU-based motion capture suits, often falling under the broader umbrella of inertial or optical tracking depending on the underlying technology, which are increasingly being adopted across all segments due to their versatility, portability, and decreasing cost.

- Key Drivers in North America:

- Dominance of the global film and video game industries.

- High investment in sports analytics and performance training.

- Strong presence of leading motion capture technology providers.

- Government funding and initiatives supporting technology development.

- Key Drivers in Entertainment Application:

- Demand for realistic CGI and character animation.

- Growth of the VR and AR gaming market.

- Advancements in real-time motion capture for live performances.

- Key Drivers in Sports Application:

- Data-driven approach to athlete performance optimization.

- Focus on injury prevention and rehabilitation.

- Development of advanced sports training programs.

- Key Drivers in Optical Motion Capture:

- High accuracy and fidelity of data capture.

- Established infrastructure and expertise.

- Continued innovation in markerless tracking technologies.

The market value in this segment is expected to surpass several hundred million dollars by 2025.

Motion Capture Suit Product Innovations

Product innovations in the motion capture suit market are consistently pushing the boundaries of accuracy, usability, and affordability. Recent advancements include the development of lighter, more flexible suits with integrated sensors that require less calibration. Companies like Teslasuit are integrating haptic feedback and biosensors for advanced physiological monitoring, while Rokoko's Smartsuit Pro offers wireless connectivity and intuitive software for quick setup. Enflux and HoloSuit are focusing on highly accurate, markerless tracking solutions that can be implemented with greater ease. These innovations are leading to enhanced performance metrics such as reduced latency, improved battery life extending to several hours of continuous use, and increased degrees of freedom captured, enabling more nuanced and natural movement replication. The unique selling proposition often lies in the seamless integration of hardware and software, providing users with actionable data and intuitive control.

Propelling Factors for Motion Capture Suit Growth

Several key factors are propelling the growth of the motion capture suit market. Technologically, advancements in sensor miniaturization, improved battery efficiency, and sophisticated algorithms for data processing are making suits more practical and accurate. Economically, the decreasing cost of production and increasing competition are making motion capture solutions more accessible to a wider range of users, from indie game developers to individual athletes. Regulatory landscapes are also indirectly contributing by fostering industries that heavily rely on motion capture, such as virtual reality and digital entertainment, which are seeing increased investment and consumer interest. Furthermore, the growing demand for realistic digital content in entertainment, coupled with the burgeoning adoption in sports for performance analytics and in the medical field for rehabilitation, are significant growth drivers. The market is projected to see substantial growth, exceeding several hundred million dollars in value by the end of the forecast period.

Obstacles in the Motion Capture Suit Market

Despite robust growth, the motion capture suit market faces several obstacles. Regulatory challenges, particularly around data privacy and ownership, can hinder widespread adoption in sensitive applications like healthcare. Supply chain disruptions, as seen in recent global events, can impact the availability and cost of critical electronic components, affecting production timelines and pricing. Competitive pressures from alternative tracking technologies, such as markerless optical systems and advanced drone-based capture, continue to challenge the market. Furthermore, the initial investment cost, though decreasing, can still be a barrier for smaller organizations or individual users. The complexity of some systems and the need for specialized training can also present a hurdle for seamless integration. These factors can collectively impact market penetration, potentially slowing growth by several percentage points.

Future Opportunities in Motion Capture Suit

The future of the motion capture suit market is ripe with emerging opportunities. The continued expansion of the metaverse and the increasing demand for immersive VR/AR experiences present a significant avenue for growth. The integration of AI and machine learning will unlock more sophisticated data analysis and real-time feedback mechanisms, making motion capture suits invaluable for personalized training and rehabilitation programs. New markets, such as live broadcasting of virtual events and advanced robotics control, are opening up. Technological opportunities lie in the development of even lighter, more ergonomic suits with enhanced haptic feedback and biosensing capabilities. Consumer trends are leaning towards more accessible and user-friendly solutions, creating a demand for plug-and-play motion capture systems. The market is anticipated to reach a valuation of several hundred million dollars in the coming years.

Major Players in the Motion Capture Suit Ecosystem

- AiQ Synertial

- Enflux

- HoloSuit

- Noitom

- Phoenix Technologies Inc.

- Qualisys

- Rokoko

- Xsens

- Teslasuit

- Vicon

Key Developments in Motion Capture Suit Industry

- 2023/08: Rokoko launched the Smartsuit Pro II, featuring enhanced sensor accuracy and wireless capabilities, significantly impacting the independent creator market.

- 2023/05: Teslasuit announced advancements in its haptic feedback technology, aiming to provide more immersive and realistic sensations for training simulations.

- 2022/11: Vicon introduced new software updates for its high-end optical systems, improving real-time data processing and integration with game engines.

- 2022/07: Xsens unveiled its next-generation IMU-based motion capture sensors, offering improved battery life and a more compact design for wearable applications.

- 2021/03: AiQ Synertial showcased its proprietary bio-sensing technology integrated into motion capture suits, expanding applications into health and wellness monitoring.

- 2020/10: Noitom introduced its Perception Neuron Pro system, offering a more affordable and accessible solution for professional motion capture.

- 2019/09: Qualisys expanded its optical motion capture offerings with new camera models, enhancing resolution and frame rates for demanding production environments.

Strategic Motion Capture Suit Market Forecast

- 2023/08: Rokoko launched the Smartsuit Pro II, featuring enhanced sensor accuracy and wireless capabilities, significantly impacting the independent creator market.

- 2023/05: Teslasuit announced advancements in its haptic feedback technology, aiming to provide more immersive and realistic sensations for training simulations.

- 2022/11: Vicon introduced new software updates for its high-end optical systems, improving real-time data processing and integration with game engines.

- 2022/07: Xsens unveiled its next-generation IMU-based motion capture sensors, offering improved battery life and a more compact design for wearable applications.

- 2021/03: AiQ Synertial showcased its proprietary bio-sensing technology integrated into motion capture suits, expanding applications into health and wellness monitoring.

- 2020/10: Noitom introduced its Perception Neuron Pro system, offering a more affordable and accessible solution for professional motion capture.

- 2019/09: Qualisys expanded its optical motion capture offerings with new camera models, enhancing resolution and frame rates for demanding production environments.

Strategic Motion Capture Suit Market Forecast

The strategic motion capture suit market forecast indicates a period of sustained and significant growth, driven by convergence of technological innovation and escalating adoption across key sectors. Future opportunities in the metaverse, advanced sports analytics, and personalized healthcare will serve as critical growth catalysts. The continuous refinement of IMU-based and optical motion capture technologies, alongside advancements in AI for data interpretation, will democratize access and enhance the utility of these suits. Strategic investments in research and development, coupled with potential market consolidations through mergers and acquisitions, are expected to shape the competitive landscape. The market is projected to expand substantially, exceeding one hundred million dollars in value by the end of the forecast period, indicating a robust and promising future.

Motion Capture Suit Segmentation

-

1. Application

- 1.1. Entertainment

- 1.2. Sports

- 1.3. Medical

- 1.4. Others

-

2. Types

- 2.1. Magnetic Motion Capture

- 2.2. Mechanical Motion Capture

- 2.3. Optical Motion Capture

Motion Capture Suit Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Motion Capture Suit REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motion Capture Suit Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Entertainment

- 5.1.2. Sports

- 5.1.3. Medical

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Magnetic Motion Capture

- 5.2.2. Mechanical Motion Capture

- 5.2.3. Optical Motion Capture

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Motion Capture Suit Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Entertainment

- 6.1.2. Sports

- 6.1.3. Medical

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Magnetic Motion Capture

- 6.2.2. Mechanical Motion Capture

- 6.2.3. Optical Motion Capture

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Motion Capture Suit Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Entertainment

- 7.1.2. Sports

- 7.1.3. Medical

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Magnetic Motion Capture

- 7.2.2. Mechanical Motion Capture

- 7.2.3. Optical Motion Capture

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Motion Capture Suit Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Entertainment

- 8.1.2. Sports

- 8.1.3. Medical

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Magnetic Motion Capture

- 8.2.2. Mechanical Motion Capture

- 8.2.3. Optical Motion Capture

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Motion Capture Suit Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Entertainment

- 9.1.2. Sports

- 9.1.3. Medical

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Magnetic Motion Capture

- 9.2.2. Mechanical Motion Capture

- 9.2.3. Optical Motion Capture

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Motion Capture Suit Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Entertainment

- 10.1.2. Sports

- 10.1.3. Medical

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Magnetic Motion Capture

- 10.2.2. Mechanical Motion Capture

- 10.2.3. Optical Motion Capture

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AiQ Synertial

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Enflux

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 HoloSuit

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Noitom

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Phoenix Technologies Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Qualisys

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rokoko

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Xsens

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Teslasuit

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vicon

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Smartsuit Pro

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 AiQ Synertial

List of Figures

- Figure 1: Global Motion Capture Suit Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Motion Capture Suit Revenue (million), by Application 2024 & 2032

- Figure 3: North America Motion Capture Suit Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Motion Capture Suit Revenue (million), by Types 2024 & 2032

- Figure 5: North America Motion Capture Suit Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Motion Capture Suit Revenue (million), by Country 2024 & 2032

- Figure 7: North America Motion Capture Suit Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Motion Capture Suit Revenue (million), by Application 2024 & 2032

- Figure 9: South America Motion Capture Suit Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Motion Capture Suit Revenue (million), by Types 2024 & 2032

- Figure 11: South America Motion Capture Suit Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Motion Capture Suit Revenue (million), by Country 2024 & 2032

- Figure 13: South America Motion Capture Suit Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Motion Capture Suit Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Motion Capture Suit Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Motion Capture Suit Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Motion Capture Suit Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Motion Capture Suit Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Motion Capture Suit Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Motion Capture Suit Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Motion Capture Suit Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Motion Capture Suit Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Motion Capture Suit Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Motion Capture Suit Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Motion Capture Suit Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Motion Capture Suit Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Motion Capture Suit Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Motion Capture Suit Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Motion Capture Suit Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Motion Capture Suit Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Motion Capture Suit Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Motion Capture Suit Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Motion Capture Suit Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Motion Capture Suit Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Motion Capture Suit Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Motion Capture Suit Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Motion Capture Suit Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Motion Capture Suit Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Motion Capture Suit Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Motion Capture Suit Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Motion Capture Suit Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Motion Capture Suit Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Motion Capture Suit Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Motion Capture Suit Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Motion Capture Suit Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Motion Capture Suit Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Motion Capture Suit Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Motion Capture Suit Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Motion Capture Suit Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Motion Capture Suit Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Motion Capture Suit Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motion Capture Suit?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Motion Capture Suit?

Key companies in the market include AiQ Synertial, Enflux, HoloSuit, Noitom, Phoenix Technologies Inc., Qualisys, Rokoko, Xsens, Teslasuit, Vicon, Smartsuit Pro.

3. What are the main segments of the Motion Capture Suit?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motion Capture Suit," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motion Capture Suit report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motion Capture Suit?

To stay informed about further developments, trends, and reports in the Motion Capture Suit, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence