Key Insights

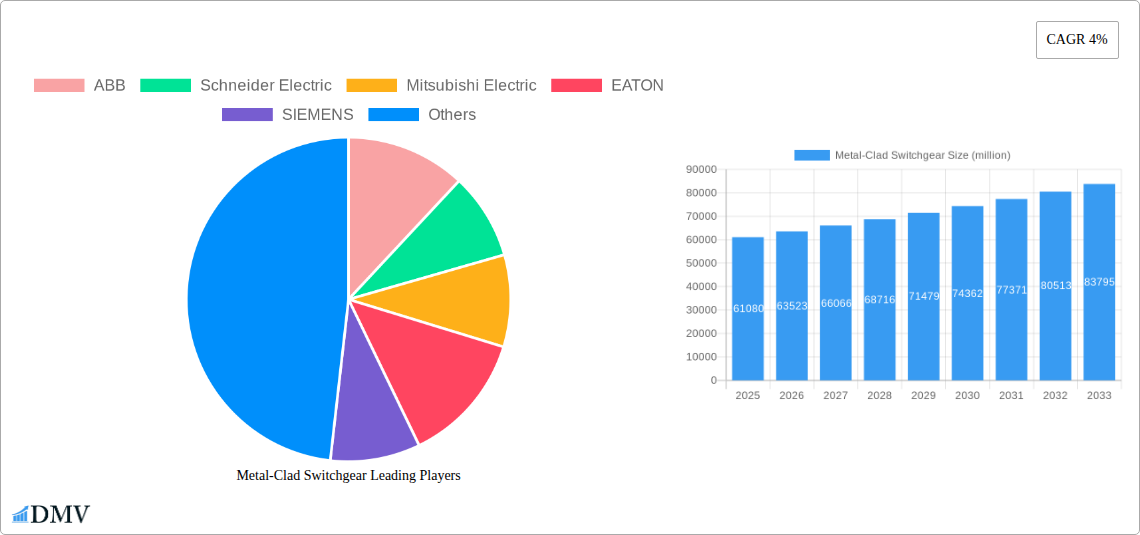

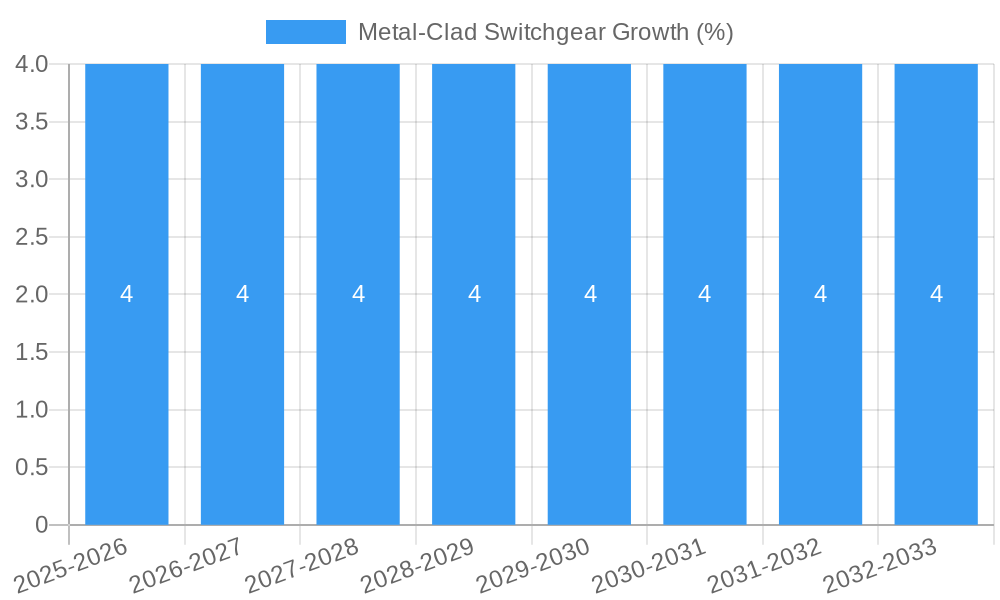

The global Metal-Clad Switchgear market is poised for significant expansion, projected to reach an estimated market size of approximately $83,440 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4% from its base year of 2025. This growth trajectory is underpinned by a strong demand for reliable and safe electrical power distribution solutions across both living and commercial applications. The increasing global emphasis on modernizing aging power infrastructure, coupled with the growing need for enhanced grid stability and fault containment, are the primary drivers fueling this market expansion. Furthermore, the surge in renewable energy integration, requiring robust and advanced switchgear for efficient power management, acts as a significant catalyst. The market is characterized by a robust competitive landscape, featuring established global players such as ABB, Schneider Electric, Mitsubishi Electric, EATON, and SIEMENS, alongside regional specialists like Elimsan and CHINT, all vying for market share through product innovation and strategic partnerships.

The market's evolution is being shaped by several key trends, including the increasing adoption of smart grid technologies that enable remote monitoring and control of switchgear, thereby improving operational efficiency and reducing downtime. The development of compact and modular switchgear designs is also gaining traction, addressing space constraints in urban environments. However, the market faces certain restraints, such as the high initial investment costs associated with advanced metal-clad switchgear, which can deter adoption in price-sensitive regions or for smaller-scale projects. Stringent regulatory compliance and the need for specialized installation and maintenance expertise also present challenges. Despite these hurdles, the anticipated growth in industrialization, urbanization, and the continuous demand for uninterrupted power supply are expected to sustain the positive momentum of the Metal-Clad Switchgear market in the coming years.

Metal-Clad Switchgear Market Composition & Trends

The global Metal-Clad Switchgear market, a critical component in power distribution and industrial automation, exhibits a moderately concentrated landscape. Leading entities like ABB, Schneider Electric, and Siemens command significant market share, estimated to be in the region of 60% combined. Innovation is a primary catalyst, driven by the relentless demand for enhanced grid reliability, smart grid integration, and improved safety standards. The market is influenced by stringent electrical safety regulations and evolving industry standards, which necessitate continuous technological upgrades. Substitute products, such as metal-enclosed switchgear or gas-insulated switchgear for specific applications, exist but often cater to different niche requirements or cost sensitivities.

End-user profiles span across industrial sectors like manufacturing, oil and gas, and mining, alongside essential infrastructure projects and commercial power control applications. The residential power control segment is also witnessing increasing adoption of advanced switchgear solutions for improved safety and energy management. Mergers and Acquisitions (M&A) activities, while not hyperactive, play a strategic role in market consolidation and geographical expansion. Recent M&A deal values have ranged from tens of millions to hundreds of millions of dollars, as larger players seek to acquire specialized technologies or gain access to burgeoning regional markets. This dynamic interplay of market forces shapes the overall competitive environment and future trajectory of the metal-clad switchgear industry.

- Market Share Distribution: Leading players like ABB, Schneider Electric, and Siemens hold approximately 60% of the global market share.

- Innovation Catalysts: Demand for grid reliability, smart grid integration, and enhanced safety standards.

- Regulatory Landscape: Influenced by stringent electrical safety regulations and evolving industry standards.

- Substitute Products: Metal-enclosed switchgear, gas-insulated switchgear.

- End-User Profiles: Manufacturing, oil and gas, mining, infrastructure, commercial power control.

- M&A Activity: Strategic consolidation and geographical expansion, with deal values ranging from tens of millions to hundreds of millions of dollars.

Metal-Clad Switchgear Industry Evolution

The Metal-Clad Switchgear industry has undergone a significant evolution, characterized by robust growth trajectories, groundbreaking technological advancements, and a dynamic shift in consumer demands. From its inception, the primary driver has been the imperative for safe and reliable electrical power distribution and control in an increasingly electrified world. Historically, the focus was on basic functionality and robust construction. However, over the study period from 2019 to 2024, the market has witnessed an accelerated transformation.

Technological advancements have been pivotal. The integration of digital technologies, including sensors, communication modules, and advanced protection relays, has led to the development of intelligent metal-clad switchgear. This evolution has enabled real-time monitoring, predictive maintenance, and seamless integration into smart grids and SCADA systems, thereby enhancing operational efficiency and reducing downtime. The adoption of vacuum interruption technology has become standard for medium-voltage applications, offering superior performance, longevity, and environmental benefits compared to older technologies. Furthermore, the design and manufacturing processes have been refined, leading to more compact, modular, and cost-effective solutions.

Consumer demand has mirrored these technological shifts. End-users, from industrial giants to commercial establishments and even advanced residential complexes, are increasingly demanding switchgear that not only ensures safety but also provides superior energy management capabilities, remote accessibility, and greater operational visibility. The push towards renewable energy integration has also spurred demand for switchgear that can handle the complexities of variable power generation and grid stabilization. Consequently, growth rates in the metal-clad switchgear market have been consistently positive, with an estimated compound annual growth rate (CAGR) of approximately 5.5% during the historical period, reaching a market size estimated at over $20,000 million in 2024. Projections indicate this upward trend will continue, fueled by ongoing infrastructure development, industrial modernization, and the global transition to more sustainable energy systems. The adoption metrics for advanced features like digital communication and remote monitoring have seen a surge, with over 30% of new installations incorporating such capabilities by 2024.

Leading Regions, Countries, or Segments in Metal-Clad Switchgear

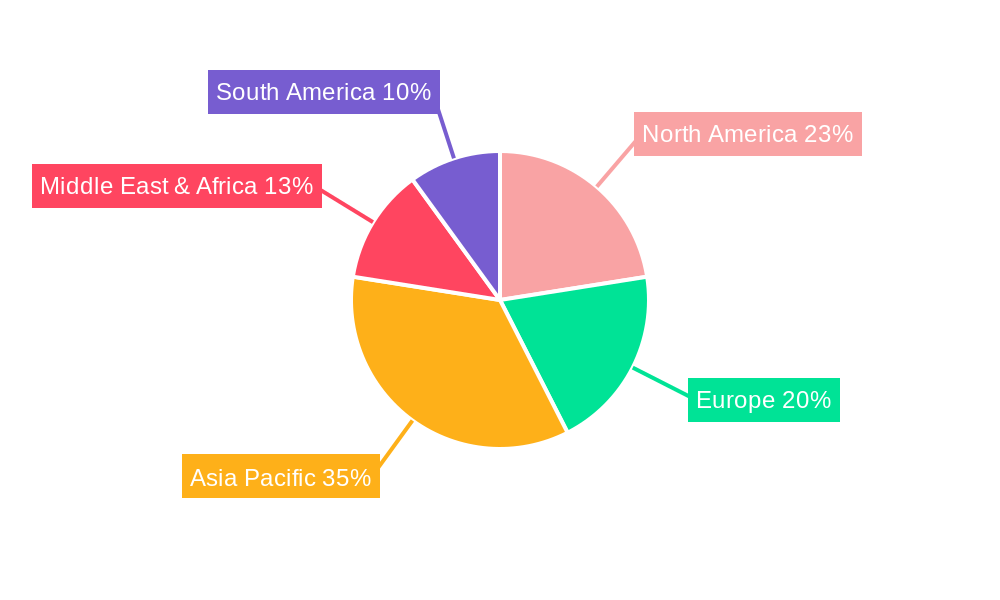

The global Metal-Clad Switchgear market's dominance is intricately linked to regional development, industrialization, and energy infrastructure investments. North America, particularly the United States, stands out as a leading region, driven by a mature industrial base, significant investments in grid modernization, and stringent safety regulations that necessitate advanced switchgear solutions. The extensive network of commercial power control applications, including data centers, large commercial complexes, and manufacturing facilities, further bolsters demand. The segment of 15kV Metal-Clad Switchgear is particularly strong in this region, catering to a wide range of industrial and commercial power distribution needs.

Asia Pacific, especially China and India, represents the fastest-growing market. Rapid industrialization, massive infrastructure development projects, and increasing electrification across both urban and rural areas are key drivers. The demand for robust and reliable power distribution solutions for living power control, including smart homes and apartment complexes, is also on the rise. The 5kV Metal-Clad Switchgear segment sees significant traction in these developing economies due to its application in various industrial settings and utility substations. The 27kV Metal-Clad Switchgear segment is also experiencing notable growth, supporting the expanding power grids and industrial expansion in the region.

Europe, with its strong emphasis on renewable energy integration and smart grid technologies, also plays a crucial role. Countries like Germany, France, and the UK are at the forefront of adopting advanced metal-clad switchgear that supports grid stability and efficiency. The 38kV Metal-Clad Switchgear segment is prevalent here, supporting higher voltage distribution networks and major industrial installations. Regulatory support for energy efficiency and grid resilience further fuels demand.

- Dominant Region: North America (especially the USA) and Asia Pacific (China and India).

- Key Drivers in North America:

- Mature industrial base and extensive commercial power control applications.

- Significant investments in grid modernization and smart grid technologies.

- Stringent safety regulations driving adoption of advanced solutions.

- Strong demand for 15kV Metal-Clad Switchgear.

- Key Drivers in Asia Pacific:

- Rapid industrialization and massive infrastructure development.

- Increasing electrification and demand for living power control.

- Growing industrial power needs, supporting 5kV Metal-Clad Switchgear demand.

- Expansion of power grids, driving demand for 27kV Metal-Clad Switchgear.

- Key Drivers in Europe:

- Strong focus on renewable energy integration and smart grid technologies.

- Regulatory support for energy efficiency and grid resilience.

- Prevalence of 38kV Metal-Clad Switchgear for higher voltage distribution.

- Dominant Segments:

- Application: Commercial Power Control is the largest segment, followed by Living Power Control.

- Types: 15kV Metal-Clad Switchgear holds a substantial market share globally, with 5kV and 27kV segments experiencing significant growth in emerging economies.

Metal-Clad Switchgear Product Innovations

Product innovations in metal-clad switchgear are revolutionizing power distribution and control. Advanced insulation materials, enhanced arc-flash mitigation technologies, and integrated digital communication capabilities are key developments. For instance, the development of compact, modular switchgear units allows for easier installation and space optimization in power substations and industrial facilities. Innovations in vacuum interrupter technology have led to extended service life and improved operational reliability. Furthermore, the integration of IoT-enabled sensors provides real-time data on equipment health, enabling predictive maintenance and reducing downtime. These advancements not only enhance safety and performance but also contribute to operational efficiency and cost savings for end-users.

Propelling Factors for Metal-Clad Switchgear Growth

The growth of the Metal-Clad Switchgear market is propelled by several interconnected factors.

- Increasing Global Electrification: The rising demand for electricity across residential, commercial, and industrial sectors necessitates robust and reliable power distribution infrastructure.

- Smart Grid Development: The global push towards smart grids, with their emphasis on efficiency, reliability, and integration of renewable energy sources, directly fuels the demand for advanced switchgear solutions.

- Industrial Expansion and Modernization: Growing industrial activities, particularly in emerging economies, and the ongoing modernization of existing industrial facilities require updated and safer electrical equipment.

- Stringent Safety Regulations: Evolving and more stringent safety standards worldwide mandate the use of high-performance, secure switchgear to prevent accidents and ensure operational continuity.

- Renewable Energy Integration: The increasing incorporation of renewable energy sources like solar and wind power requires sophisticated switchgear for effective grid connection and management of fluctuating power flows.

Obstacles in the Metal-Clad Switchgear Market

Despite the positive growth outlook, the Metal-Clad Switchgear market faces certain obstacles.

- High Initial Investment Costs: The sophisticated technology and materials used in metal-clad switchgear often translate to higher upfront costs compared to simpler alternatives, which can be a barrier for some budget-constrained projects.

- Supply Chain Volatility: Global supply chain disruptions, geopolitical factors, and raw material price fluctuations can impact manufacturing timelines and the cost of components, leading to potential project delays and increased expenses.

- Skilled Workforce Requirements: The installation, operation, and maintenance of advanced metal-clad switchgear require a highly skilled workforce. A shortage of qualified personnel can hinder widespread adoption and efficient implementation.

- Stringent Certification and Testing Requirements: Meeting international standards and obtaining necessary certifications for high-voltage electrical equipment can be a time-consuming and complex process, potentially delaying product market entry.

Future Opportunities in Metal-Clad Switchgear

The Metal-Clad Switchgear market is ripe with future opportunities, driven by emerging trends and technological advancements.

- Smart City Initiatives: The global proliferation of smart city projects will significantly boost demand for intelligent and connected switchgear solutions for enhanced urban power management and infrastructure resilience.

- Energy Storage Integration: As battery energy storage systems become more prevalent for grid stability and renewable energy management, specialized metal-clad switchgear will be crucial for their seamless integration.

- Digitalization and AI: Further integration of AI-driven analytics for predictive maintenance, fault detection, and optimized grid operations will create new value propositions for switchgear manufacturers.

- Emerging Markets: Continued economic development and infrastructure upgrades in developing nations across Africa, Latin America, and Southeast Asia present substantial untapped market potential.

- Focus on Sustainability: The growing emphasis on eco-friendly materials and manufacturing processes will drive innovation in sustainable switchgear solutions.

Major Players in the Metal-Clad Switchgear Ecosystem

- ABB

- Schneider Electric

- Mitsubishi Electric

- EATON

- SIEMENS

- Elimsan

- Fuji Electric

- Hyundai Heavy Industries

- Toshiba

- CHINT

- Hyosung

- Meidensha Corporation

- Wecome

- LSIS Co. Ltd

- HEAG

- CTCS

- Sunrise Group

- SHVS

- SENTEG

Key Developments in Metal-Clad Switchgear Industry

- 2023 - Q4: ABB launches a new series of intelligent medium-voltage metal-clad switchgear with advanced digital capabilities for enhanced grid automation and remote monitoring.

- 2024 - Q1: Schneider Electric announces strategic partnerships to expand its smart grid solutions portfolio, including enhanced metal-clad switchgear for renewable energy integration.

- 2024 - Q2: Siemens showcases its latest innovations in arc-resistant metal-clad switchgear, setting new benchmarks for safety in industrial power distribution.

- 2024 - Q3: EATON acquires a technology firm specializing in predictive maintenance for electrical infrastructure, signaling a focus on smart solutions for its metal-clad switchgear offerings.

- 2025 - Q1: Mitsubishi Electric announces a significant expansion of its manufacturing capacity for metal-clad switchgear to meet growing demand in the Asia Pacific region.

- 2025 - Q2: CHINT Electric announces its foray into advanced smart substation solutions, integrating its metal-clad switchgear with cutting-edge digital technologies.

Strategic Metal-Clad Switchgear Market Forecast

The Metal-Clad Switchgear market is poised for substantial growth through 2033, driven by a confluence of strategic factors. The continued global push towards electrification, coupled with extensive investments in smart grid infrastructure and the integration of renewable energy sources, will act as primary growth catalysts. Emerging economies will present significant market opportunities as they expand their power distribution networks and industrial capacities. Furthermore, ongoing technological advancements, particularly in digitalization, IoT integration, and enhanced safety features, will drive demand for high-performance and intelligent switchgear solutions. The strategic focus on grid modernization, energy efficiency, and cybersecurity within the power sector will ensure a robust and expanding market for metal-clad switchgear in the coming years, with an estimated market size projected to exceed $35,000 million by 2033.

Metal-Clad Switchgear Segmentation

-

1. Application

- 1.1. Living Power Control

- 1.2. Commercial Power Control

-

2. Types

- 2.1. 5kV Metal-clad Switchgear

- 2.2. 15kV Metal-clad Switchgear

- 2.3. 27kV Metal-clad Switchgear

- 2.4. 38kV Metal-clad Switchgear

- 2.5. Other

Metal-Clad Switchgear Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Metal-Clad Switchgear REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal-Clad Switchgear Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Living Power Control

- 5.1.2. Commercial Power Control

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 5kV Metal-clad Switchgear

- 5.2.2. 15kV Metal-clad Switchgear

- 5.2.3. 27kV Metal-clad Switchgear

- 5.2.4. 38kV Metal-clad Switchgear

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Metal-Clad Switchgear Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Living Power Control

- 6.1.2. Commercial Power Control

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 5kV Metal-clad Switchgear

- 6.2.2. 15kV Metal-clad Switchgear

- 6.2.3. 27kV Metal-clad Switchgear

- 6.2.4. 38kV Metal-clad Switchgear

- 6.2.5. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Metal-Clad Switchgear Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Living Power Control

- 7.1.2. Commercial Power Control

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 5kV Metal-clad Switchgear

- 7.2.2. 15kV Metal-clad Switchgear

- 7.2.3. 27kV Metal-clad Switchgear

- 7.2.4. 38kV Metal-clad Switchgear

- 7.2.5. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Metal-Clad Switchgear Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Living Power Control

- 8.1.2. Commercial Power Control

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 5kV Metal-clad Switchgear

- 8.2.2. 15kV Metal-clad Switchgear

- 8.2.3. 27kV Metal-clad Switchgear

- 8.2.4. 38kV Metal-clad Switchgear

- 8.2.5. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Metal-Clad Switchgear Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Living Power Control

- 9.1.2. Commercial Power Control

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 5kV Metal-clad Switchgear

- 9.2.2. 15kV Metal-clad Switchgear

- 9.2.3. 27kV Metal-clad Switchgear

- 9.2.4. 38kV Metal-clad Switchgear

- 9.2.5. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Metal-Clad Switchgear Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Living Power Control

- 10.1.2. Commercial Power Control

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 5kV Metal-clad Switchgear

- 10.2.2. 15kV Metal-clad Switchgear

- 10.2.3. 27kV Metal-clad Switchgear

- 10.2.4. 38kV Metal-clad Switchgear

- 10.2.5. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ABB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Schneider Electric

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsubishi Electric

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 EATON

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SIEMENS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elimsan

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fuji Electric

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hyundai Heavy Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Toshiba

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CHINT

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hyosung

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Meidensha Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wecome

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 LSIS Co. Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 HEAG

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 CTCS

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Sunrise Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 SHVS

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 SENTEG

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 ABB

List of Figures

- Figure 1: Global Metal-Clad Switchgear Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Metal-Clad Switchgear Revenue (million), by Application 2024 & 2032

- Figure 3: North America Metal-Clad Switchgear Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Metal-Clad Switchgear Revenue (million), by Types 2024 & 2032

- Figure 5: North America Metal-Clad Switchgear Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Metal-Clad Switchgear Revenue (million), by Country 2024 & 2032

- Figure 7: North America Metal-Clad Switchgear Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Metal-Clad Switchgear Revenue (million), by Application 2024 & 2032

- Figure 9: South America Metal-Clad Switchgear Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Metal-Clad Switchgear Revenue (million), by Types 2024 & 2032

- Figure 11: South America Metal-Clad Switchgear Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Metal-Clad Switchgear Revenue (million), by Country 2024 & 2032

- Figure 13: South America Metal-Clad Switchgear Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Metal-Clad Switchgear Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Metal-Clad Switchgear Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Metal-Clad Switchgear Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Metal-Clad Switchgear Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Metal-Clad Switchgear Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Metal-Clad Switchgear Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Metal-Clad Switchgear Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Metal-Clad Switchgear Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Metal-Clad Switchgear Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Metal-Clad Switchgear Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Metal-Clad Switchgear Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Metal-Clad Switchgear Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Metal-Clad Switchgear Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Metal-Clad Switchgear Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Metal-Clad Switchgear Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Metal-Clad Switchgear Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Metal-Clad Switchgear Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Metal-Clad Switchgear Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Metal-Clad Switchgear Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Metal-Clad Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Metal-Clad Switchgear Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Metal-Clad Switchgear Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Metal-Clad Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Metal-Clad Switchgear Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Metal-Clad Switchgear Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Metal-Clad Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Metal-Clad Switchgear Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Metal-Clad Switchgear Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Metal-Clad Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Metal-Clad Switchgear Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Metal-Clad Switchgear Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Metal-Clad Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Metal-Clad Switchgear Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Metal-Clad Switchgear Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Metal-Clad Switchgear Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Metal-Clad Switchgear Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Metal-Clad Switchgear Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Metal-Clad Switchgear Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal-Clad Switchgear?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Metal-Clad Switchgear?

Key companies in the market include ABB, Schneider Electric, Mitsubishi Electric, EATON, SIEMENS, Elimsan, Fuji Electric, Hyundai Heavy Industries, Toshiba, CHINT, Hyosung, Meidensha Corporation, Wecome, LSIS Co. Ltd, HEAG, CTCS, Sunrise Group, SHVS, SENTEG.

3. What are the main segments of the Metal-Clad Switchgear?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 61080 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal-Clad Switchgear," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal-Clad Switchgear report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal-Clad Switchgear?

To stay informed about further developments, trends, and reports in the Metal-Clad Switchgear, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence