Key Insights

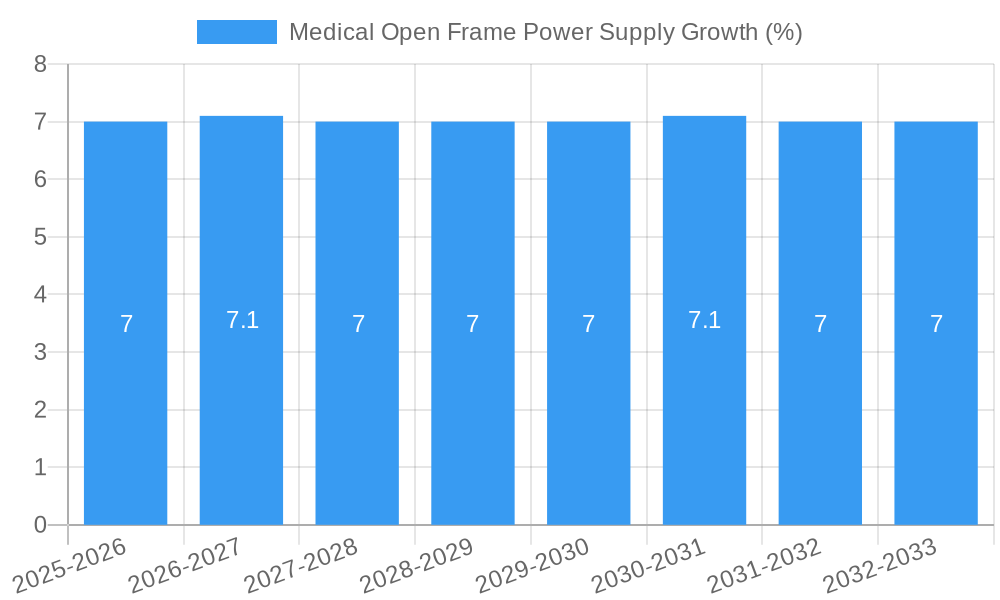

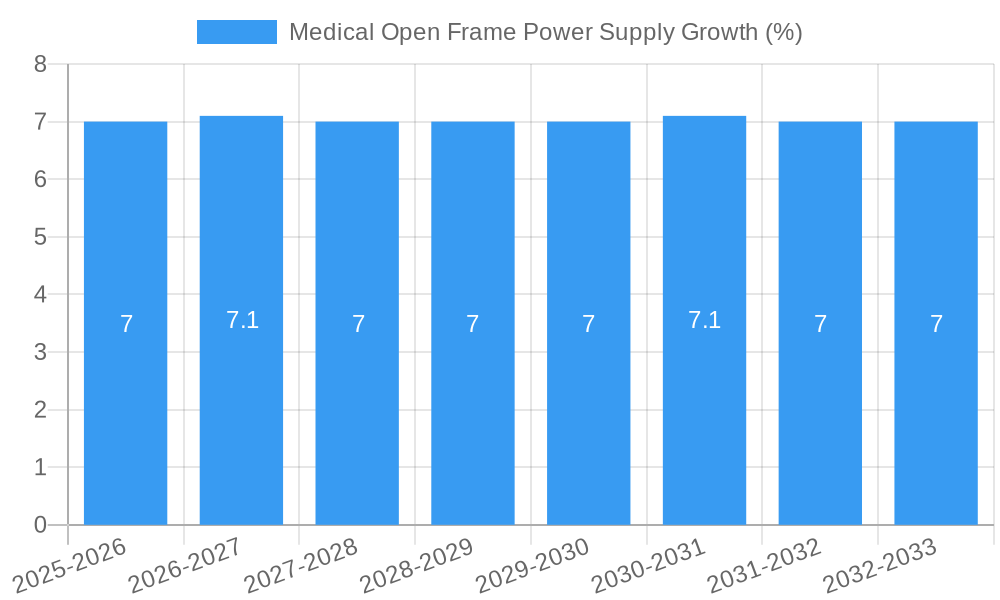

The global Medical Open Frame Power Supply market is poised for robust expansion, driven by the escalating demand for advanced medical devices across a multitude of applications. With an estimated market size of approximately $1.2 billion in 2025, the sector is projected to witness a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This sustained growth is fundamentally fueled by the increasing prevalence of chronic diseases, the aging global population, and continuous technological advancements in healthcare, leading to a greater need for reliable and efficient power solutions in critical medical equipment. Key applications like dialysis equipment, medical imaging, and ventilators are particularly significant contributors, necessitating high-performance, compact, and safe power supplies. The market is also benefiting from increased healthcare expenditure globally and the ongoing expansion of healthcare infrastructure, especially in emerging economies.

The market dynamics are further shaped by an evolving technological landscape and a competitive supplier base. Trends such as the miniaturization of medical devices, the integration of IoT capabilities for remote patient monitoring, and the stringent regulatory requirements for medical electrical equipment are influencing product development and market strategies. While the demand for high-wattage solutions (above 300W) is substantial, particularly for imaging and large-scale equipment, the growth in lower-wattage segments (below 300W) is equally important, catering to the increasing number of portable and point-of-care diagnostic devices. Key players like TDK-Lambda, MEAN WELL, and XP Power are actively innovating to offer power supplies with enhanced energy efficiency, improved thermal management, and robust safety certifications, essential for medical applications. However, potential restraints include the complex and lengthy medical device approval processes and the volatility in raw material costs, which could impact profit margins. Asia Pacific is emerging as a significant growth region due to its expanding healthcare sector and manufacturing capabilities.

Medical Open Frame Power Supply Market Research Report: Analysis, Trends, and Forecast (2019–2033)

This comprehensive report delivers an in-depth analysis of the global Medical Open Frame Power Supply market, providing critical insights for stakeholders across the healthcare and electronics industries. Spanning a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report examines market composition, industry evolution, regional dynamics, product innovations, growth drivers, challenges, and future opportunities. Leveraging advanced analytical techniques and a wealth of industry data, this report is an indispensable resource for strategic planning and decision-making. The report includes detailed breakdowns for applications such as Laboratory Equipment, Dialysis Equipment, Ultrasound Equipment, Aesthetic Laser Equipment, Medical Imaging Equipment, Medical Electronics Equipment, Clean Room Equipment, Operating Room Equipment, Ventilators, and others, as well as power output types including Below 100W, 100W to 300W, and Above 300W.

Medical Open Frame Power Supply Market Composition & Trends

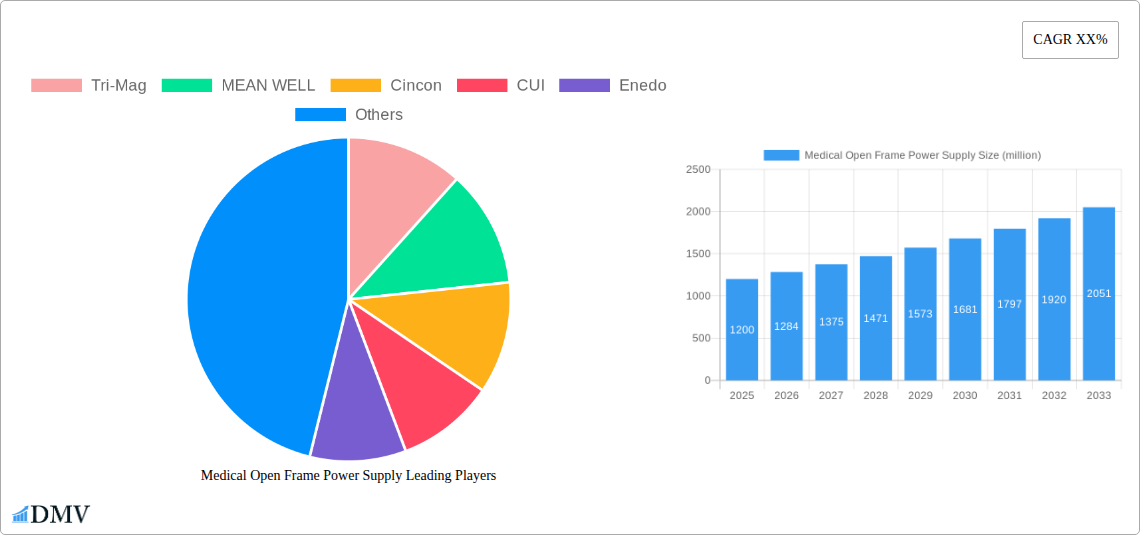

The Medical Open Frame Power Supply market exhibits a moderate concentration, driven by a blend of established global manufacturers and specialized regional players. Innovation catalysts are primarily fueled by the increasing demand for miniaturization, higher power densities, and enhanced energy efficiency in medical devices. Regulatory landscapes, including stringent FDA and CE certifications, play a pivotal role in shaping product development and market entry strategies. Substitute products are limited due to the critical safety and reliability requirements of medical applications, although advancements in alternative power management solutions are being monitored. End-user profiles are diverse, encompassing original equipment manufacturers (OEMs) of diagnostic, therapeutic, and monitoring equipment, as well as system integrators. Merger and acquisition (M&A) activities are strategically focused on expanding product portfolios, geographical reach, and technological capabilities. The market share distribution for major players in 2025 is projected to be: Tri-Mag (12%), MEAN WELL (11%), Cincon (8%), CUI (7%), Enedo (6%), XP Power (10%), Bicker Elektronik (5%), Advanced Energy (9%), Delta (10%), Adapter Technology (3%), FSP (4%), Traco Power (5%), Ideal Power (2%), TDK-Lambda (7%), Powerbox (3%), EOS Power (2%), TT Electronics (3%), Integrated Power Designs (IPD) (2%), Cosel (4%), TDK (6%), SynQor (5%), Inventus Power (2%), RECOM (3%), Globtek (2%), Astrodyne TDI (5%). Projected M&A deal values in the forecast period are expected to reach over $500 million annually.

Medical Open Frame Power Supply Industry Evolution

The Medical Open Frame Power Supply industry has witnessed remarkable evolution driven by relentless technological advancements and the escalating global demand for sophisticated medical devices. From 2019 to 2024, the market experienced a steady compound annual growth rate (CAGR) of approximately 5.5%, largely propelled by the increasing adoption of advanced healthcare technologies and a growing awareness of preventive healthcare measures. The base year, 2025, is estimated to witness a market size of over $5 billion, with a projected CAGR of 6.2% during the forecast period of 2025–2033. This accelerated growth is attributed to several key factors, including the burgeoning healthcare infrastructure in emerging economies, the increasing prevalence of chronic diseases, and the growing need for portable and efficient medical equipment. Technological advancements have been a cornerstone of this evolution. Innovations in power conversion topologies, such as resonant converters and multi-stage designs, have led to significantly higher power densities, reduced component counts, and improved thermal management. This has enabled medical device manufacturers to develop smaller, lighter, and more energy-efficient devices, crucial for patient comfort and mobility. Furthermore, the integration of advanced control mechanisms and digital monitoring capabilities has enhanced the reliability and safety of medical power supplies, crucial for life-support systems and diagnostic equipment. Shifting consumer demands, influenced by the COVID-19 pandemic and the subsequent surge in telehealth and remote patient monitoring, have further accelerated the need for robust and compact power solutions. The trend towards decentralized healthcare models and the increased use of point-of-care devices have also fueled the demand for medical open frame power supplies that can be easily integrated into diverse medical equipment. The adoption of high-efficiency power supplies has also been driven by increasing environmental regulations and the desire for reduced operational costs for healthcare facilities. Overall, the industry's trajectory is characterized by a continuous pursuit of miniaturization, increased performance, and adherence to stringent medical-grade certifications, ensuring the safety and efficacy of critical medical applications.

Leading Regions, Countries, or Segments in Medical Open Frame Power Supply

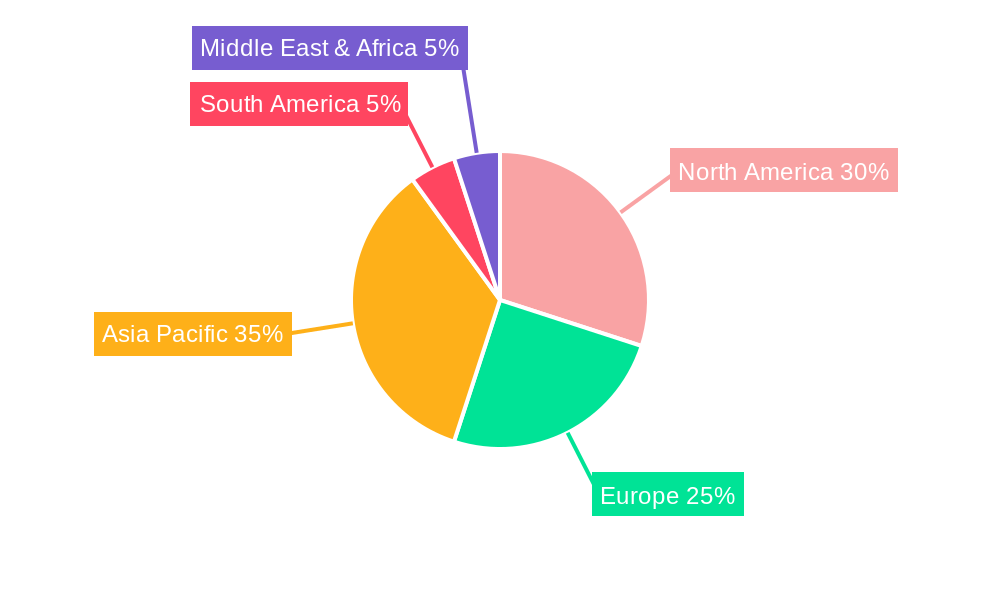

North America currently dominates the Medical Open Frame Power Supply market, driven by its advanced healthcare infrastructure, substantial investment in medical research and development, and the presence of leading medical device manufacturers. The United States, in particular, is a powerhouse, accounting for over 35% of the global market share. Key drivers for this dominance include robust government funding for healthcare innovation, a high adoption rate of cutting-edge medical technologies, and stringent regulatory frameworks that necessitate high-quality, reliable power solutions. The Medical Imaging Equipment application segment is a significant contributor to North America's leadership, with an estimated market share of 20% within the region. This is fueled by the continuous demand for advanced MRI, CT scanners, and ultrasound devices, which require highly specialized and efficient power supplies. The Above 300W power type segment also shows strong performance due to the power-intensive nature of many medical imaging and diagnostic systems.

In Europe, the market is characterized by a strong focus on innovation and a high concentration of medical device manufacturers in countries like Germany, Switzerland, and the United Kingdom. Europe accounts for approximately 28% of the global market share. The robust regulatory environment, including MDR compliance, and a growing aging population with increased healthcare needs are key growth propellers. The Laboratory Equipment application segment, with an estimated 18% share within Europe, is a significant driver, supported by substantial investments in life sciences research and diagnostic testing. The 100W to 300W power type segment is particularly strong in this region, catering to a wide array of analytical instruments and medical devices.

Asia Pacific, however, is the fastest-growing region, projected to witness a CAGR of over 7.5% during the forecast period, driven by rapid infrastructure development, increasing healthcare expenditure, and a growing medical tourism sector. China and India are key markets within this region, expected to collectively account for over 25% of the global market by 2033. The increasing demand for affordable yet high-quality medical devices, coupled with government initiatives to improve healthcare access, is fueling this growth. The Dialysis Equipment and Ventilators application segments are experiencing substantial growth, with an estimated combined market share of 25% in the region, driven by the rising incidence of renal diseases and respiratory conditions. The Below 100W power type segment is also experiencing significant expansion, supporting the increasing demand for portable and home-use medical devices.

The Medical Electronics Equipment segment globally represents a substantial opportunity, with its broad applicability across various medical devices, and is projected to grow at a CAGR of 6.8% during the forecast period. The Operating Room Equipment segment also remains a critical area, demanding high reliability and safety from power supplies, contributing a consistent demand for power solutions.

Medical Open Frame Power Supply Product Innovations

Recent product innovations in the Medical Open Frame Power Supply sector have focused on enhancing efficiency, reducing size, and improving thermal performance to meet the evolving demands of medical devices. Manufacturers are increasingly incorporating advanced semiconductor technologies, such as GaN and SiC, to achieve higher power densities and superior energy efficiency, often exceeding 95%. These advancements enable the development of medical devices that are smaller, lighter, and require less cooling. Unique selling propositions often lie in adherence to stringent medical safety certifications (e.g., IEC 60601-1), low leakage current, and robust electromagnetic compatibility (EMC) performance, crucial for sensitive medical environments. Performance metrics are consistently being pushed, with power supplies now offering improved reliability, extended operational lifespans, and enhanced protection features, ensuring patient safety and device integrity.

Propelling Factors for Medical Open Frame Power Supply Growth

Several key factors are propelling the growth of the Medical Open Frame Power Supply market. Technological advancements, including the miniaturization of components and the adoption of high-frequency switching techniques, enable the development of smaller, more efficient power supplies essential for portable and implantable medical devices. Economic factors, such as increased healthcare spending globally, particularly in emerging economies, and the rising disposable income of populations, are driving demand for advanced medical equipment. Regulatory influences, while stringent, also act as a catalyst by mandating higher safety and reliability standards, thereby encouraging manufacturers to invest in superior power solutions. The growing prevalence of chronic diseases and an aging global population are further increasing the need for a wide array of medical devices, directly boosting the demand for their power components.

Obstacles in the Medical Open Frame Power Supply Market

Despite the robust growth, the Medical Open Frame Power Supply market faces several obstacles. Stringent and evolving regulatory compliance requirements (e.g., FDA 510(k) clearance, IEC 60601 standards) can be time-consuming and costly for manufacturers, particularly for smaller companies. Global supply chain disruptions, exacerbated by geopolitical events and material shortages, can impact lead times and increase component costs, potentially affecting pricing strategies. Intense competitive pressures from both established players and new entrants can lead to price erosion in certain market segments. Furthermore, the need for specialized certifications and rigorous testing adds to the overall cost of development and production, acting as a barrier to entry for some.

Future Opportunities in Medical Open Frame Power Supply

Emerging opportunities in the Medical Open Frame Power Supply market are abundant and diverse. The burgeoning fields of telehealth, remote patient monitoring, and wearable medical devices present significant growth avenues, demanding compact, low-power, and highly reliable solutions. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in medical diagnostics and treatment planning will require advanced power management systems capable of supporting complex computational loads. Furthermore, the development of personalized medicine and advanced therapies will necessitate specialized power solutions tailored to unique device requirements. Expansion into underserved emerging markets with rapidly developing healthcare sectors also represents a substantial opportunity for market penetration.

Major Players in the Medical Open Frame Power Supply Ecosystem

- Tri-Mag

- MEAN WELL

- Cincon

- CUI

- Enedo

- XP Power

- Bicker Elektronik

- Advanced Energy

- Delta

- Adapter Technology

- FSP

- Traco Power

- Ideal Power

- TDK-Lambda

- Powerbox

- EOS Power

- TT Electronics

- Integrated Power Designs (IPD)

- Cosel

- TDK

- SynQor

- Inventus Power

- RECOM

- Globtek

- Astrodyne TDI

Key Developments in Medical Open Frame Power Supply Industry

- 2023 January: MEAN WELL launched a new series of compact, high-efficiency medical open frame power supplies designed for critical care equipment, featuring advanced thermal management.

- 2023 March: XP Power announced the acquisition of a leading provider of specialized power solutions for the medical industry, expanding its portfolio of medical-grade power supplies.

- 2023 June: TDK-Lambda introduced a new range of ultra-compact medical open frame power supplies with enhanced safety features and lower leakage currents, targeting diagnostic imaging applications.

- 2023 September: CUI announced significant advancements in its GaN-based power supply technology, enabling higher power densities and improved thermal performance for medical devices.

- 2024 February: Delta Electronics unveiled its latest generation of medical open frame power supplies, focusing on increased energy efficiency and compliance with the latest international medical safety standards.

- 2024 April: SynQor announced the development of novel resonant converter topologies for medical applications, promising improved efficiency and reduced EMI.

- 2024 July: Astrodyne TDI introduced a new line of medical power supplies with extended temperature ranges, suitable for demanding environmental conditions in operating rooms and clean rooms.

- 2024 October: Traco Power showcased its latest innovations in medical power supply design, emphasizing robust reliability and comprehensive protection features for life-support systems.

Strategic Medical Open Frame Power Supply Market Forecast

The strategic forecast for the Medical Open Frame Power Supply market points towards continued robust growth, driven by sustained innovation and increasing global healthcare demands. The market is projected to expand at a CAGR of approximately 6.2% from 2025 to 2033, reaching an estimated market size exceeding $8 billion by the end of the forecast period. This growth will be fueled by the accelerating adoption of advanced medical technologies, the expanding healthcare infrastructure in emerging economies, and the growing need for portable and energy-efficient medical devices. Opportunities will arise from the increasing demand for power solutions in telehealth, diagnostic imaging, and therapeutic applications, further solidifying the market's strategic importance within the global healthcare ecosystem.

Medical Open Frame Power Supply Segmentation

-

1. Application

- 1.1. Laboratory Equipment

- 1.2. Dialysis Equipment

- 1.3. Ultrasound Equipment

- 1.4. Aesthetic Laser Equipment

- 1.5. Medical Imaging Equipment

- 1.6. Medical Electronics Equipment

- 1.7. Clean Room Equipment

- 1.8. Operating Room Equipment

- 1.9. Ventilators

- 1.10. Others

-

2. Types

- 2.1. Below 100W

- 2.2. 100W to 300W

- 2.3. Above 300W

Medical Open Frame Power Supply Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Medical Open Frame Power Supply REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Open Frame Power Supply Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Laboratory Equipment

- 5.1.2. Dialysis Equipment

- 5.1.3. Ultrasound Equipment

- 5.1.4. Aesthetic Laser Equipment

- 5.1.5. Medical Imaging Equipment

- 5.1.6. Medical Electronics Equipment

- 5.1.7. Clean Room Equipment

- 5.1.8. Operating Room Equipment

- 5.1.9. Ventilators

- 5.1.10. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Below 100W

- 5.2.2. 100W to 300W

- 5.2.3. Above 300W

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Medical Open Frame Power Supply Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Laboratory Equipment

- 6.1.2. Dialysis Equipment

- 6.1.3. Ultrasound Equipment

- 6.1.4. Aesthetic Laser Equipment

- 6.1.5. Medical Imaging Equipment

- 6.1.6. Medical Electronics Equipment

- 6.1.7. Clean Room Equipment

- 6.1.8. Operating Room Equipment

- 6.1.9. Ventilators

- 6.1.10. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Below 100W

- 6.2.2. 100W to 300W

- 6.2.3. Above 300W

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Medical Open Frame Power Supply Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Laboratory Equipment

- 7.1.2. Dialysis Equipment

- 7.1.3. Ultrasound Equipment

- 7.1.4. Aesthetic Laser Equipment

- 7.1.5. Medical Imaging Equipment

- 7.1.6. Medical Electronics Equipment

- 7.1.7. Clean Room Equipment

- 7.1.8. Operating Room Equipment

- 7.1.9. Ventilators

- 7.1.10. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Below 100W

- 7.2.2. 100W to 300W

- 7.2.3. Above 300W

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Medical Open Frame Power Supply Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Laboratory Equipment

- 8.1.2. Dialysis Equipment

- 8.1.3. Ultrasound Equipment

- 8.1.4. Aesthetic Laser Equipment

- 8.1.5. Medical Imaging Equipment

- 8.1.6. Medical Electronics Equipment

- 8.1.7. Clean Room Equipment

- 8.1.8. Operating Room Equipment

- 8.1.9. Ventilators

- 8.1.10. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Below 100W

- 8.2.2. 100W to 300W

- 8.2.3. Above 300W

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Medical Open Frame Power Supply Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Laboratory Equipment

- 9.1.2. Dialysis Equipment

- 9.1.3. Ultrasound Equipment

- 9.1.4. Aesthetic Laser Equipment

- 9.1.5. Medical Imaging Equipment

- 9.1.6. Medical Electronics Equipment

- 9.1.7. Clean Room Equipment

- 9.1.8. Operating Room Equipment

- 9.1.9. Ventilators

- 9.1.10. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Below 100W

- 9.2.2. 100W to 300W

- 9.2.3. Above 300W

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Medical Open Frame Power Supply Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Laboratory Equipment

- 10.1.2. Dialysis Equipment

- 10.1.3. Ultrasound Equipment

- 10.1.4. Aesthetic Laser Equipment

- 10.1.5. Medical Imaging Equipment

- 10.1.6. Medical Electronics Equipment

- 10.1.7. Clean Room Equipment

- 10.1.8. Operating Room Equipment

- 10.1.9. Ventilators

- 10.1.10. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Below 100W

- 10.2.2. 100W to 300W

- 10.2.3. Above 300W

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tri-Mag

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MEAN WELL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cincon

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CUI

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Enedo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 XP Power

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bicker Elektronik

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Advanced Energy

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Delta

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Adapter Technology

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 FSP

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Traco Power

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ideal Power

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TDK-Lambda

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Powerbox

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 EOS Power

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 TT Electronics

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Integrated Power Designs (IPD)

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Cosel

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 TDK

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 SynQor

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Inventus Power

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 RECOM

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Globtek

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Astrodyne TDI

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Tri-Mag

List of Figures

- Figure 1: Global Medical Open Frame Power Supply Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Medical Open Frame Power Supply Revenue (million), by Application 2024 & 2032

- Figure 3: North America Medical Open Frame Power Supply Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Medical Open Frame Power Supply Revenue (million), by Types 2024 & 2032

- Figure 5: North America Medical Open Frame Power Supply Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Medical Open Frame Power Supply Revenue (million), by Country 2024 & 2032

- Figure 7: North America Medical Open Frame Power Supply Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Medical Open Frame Power Supply Revenue (million), by Application 2024 & 2032

- Figure 9: South America Medical Open Frame Power Supply Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Medical Open Frame Power Supply Revenue (million), by Types 2024 & 2032

- Figure 11: South America Medical Open Frame Power Supply Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Medical Open Frame Power Supply Revenue (million), by Country 2024 & 2032

- Figure 13: South America Medical Open Frame Power Supply Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Open Frame Power Supply Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Medical Open Frame Power Supply Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Medical Open Frame Power Supply Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Medical Open Frame Power Supply Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Medical Open Frame Power Supply Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Medical Open Frame Power Supply Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Medical Open Frame Power Supply Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Medical Open Frame Power Supply Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Medical Open Frame Power Supply Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Medical Open Frame Power Supply Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Medical Open Frame Power Supply Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Medical Open Frame Power Supply Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Medical Open Frame Power Supply Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Medical Open Frame Power Supply Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Medical Open Frame Power Supply Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Medical Open Frame Power Supply Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Medical Open Frame Power Supply Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Medical Open Frame Power Supply Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Open Frame Power Supply Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Open Frame Power Supply Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Medical Open Frame Power Supply Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Medical Open Frame Power Supply Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Medical Open Frame Power Supply Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Medical Open Frame Power Supply Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Medical Open Frame Power Supply Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Medical Open Frame Power Supply Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Medical Open Frame Power Supply Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Medical Open Frame Power Supply Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Medical Open Frame Power Supply Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Medical Open Frame Power Supply Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Medical Open Frame Power Supply Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Medical Open Frame Power Supply Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Medical Open Frame Power Supply Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Medical Open Frame Power Supply Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Medical Open Frame Power Supply Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Medical Open Frame Power Supply Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Medical Open Frame Power Supply Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Medical Open Frame Power Supply Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Open Frame Power Supply?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Medical Open Frame Power Supply?

Key companies in the market include Tri-Mag, MEAN WELL, Cincon, CUI, Enedo, XP Power, Bicker Elektronik, Advanced Energy, Delta, Adapter Technology, FSP, Traco Power, Ideal Power, TDK-Lambda, Powerbox, EOS Power, TT Electronics, Integrated Power Designs (IPD), Cosel, TDK, SynQor, Inventus Power, RECOM, Globtek, Astrodyne TDI.

3. What are the main segments of the Medical Open Frame Power Supply?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Open Frame Power Supply," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Open Frame Power Supply report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Open Frame Power Supply?

To stay informed about further developments, trends, and reports in the Medical Open Frame Power Supply, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence