Key Insights

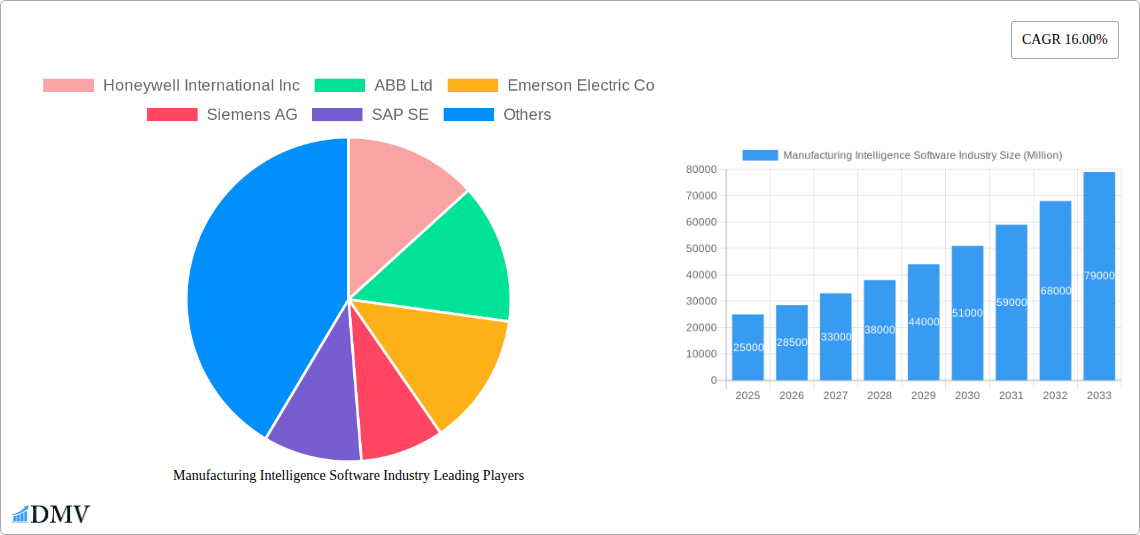

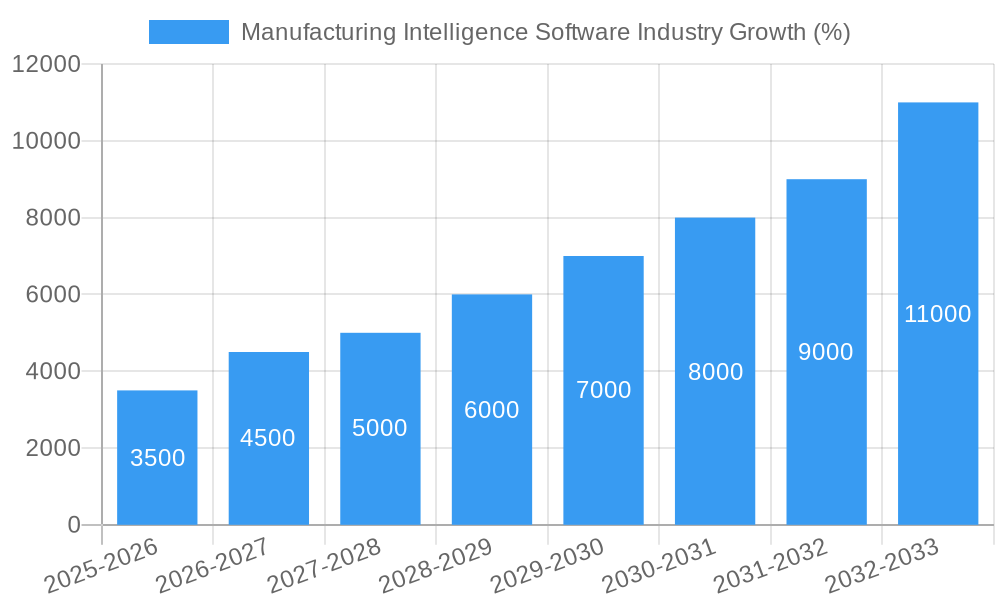

The Manufacturing Intelligence Software market is experiencing robust growth, projected to reach a substantial size within the next decade. The 16% Compound Annual Growth Rate (CAGR) from 2019 to 2033 signifies significant market expansion fueled by several key drivers. The increasing adoption of Industry 4.0 technologies, including the Internet of Things (IoT), big data analytics, and cloud computing, is fundamentally transforming manufacturing processes. Businesses are increasingly recognizing the value of real-time data analysis for optimizing production efficiency, reducing operational costs, and improving product quality. This demand is driving the adoption of sophisticated manufacturing intelligence software solutions across diverse sectors. Furthermore, the growing need for predictive maintenance, facilitated by advanced analytics capabilities embedded in these software platforms, is a significant growth catalyst. The software's ability to anticipate equipment failures and schedule maintenance proactively minimizes downtime and maximizes operational uptime.

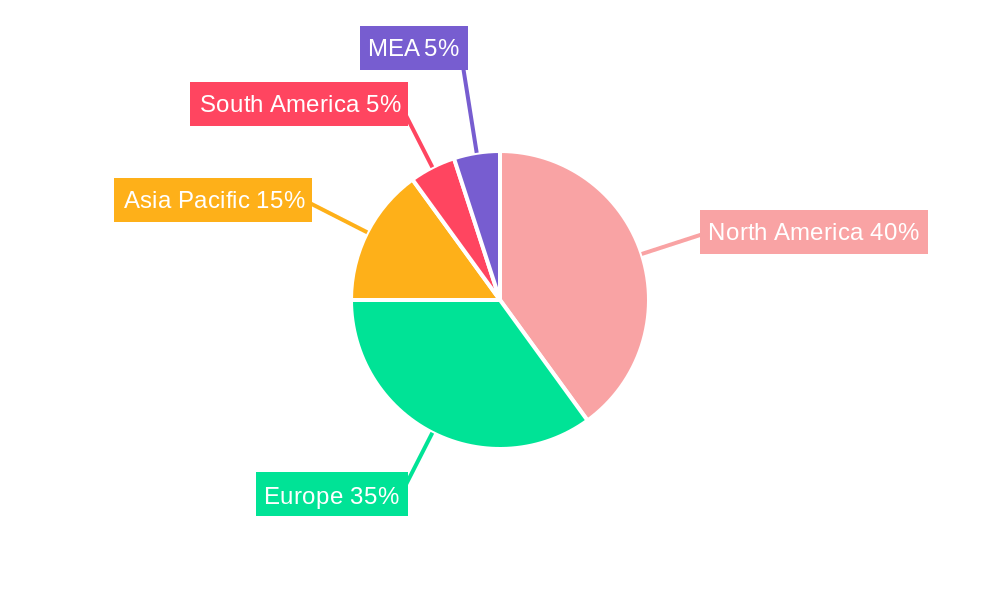

Segmentation analysis reveals that data integration, analytics, and visualization applications are leading the market, reflecting the critical need for comprehensive data management and actionable insights. Within end-user industries, Aerospace & Defense, Automotive, and Electronics sectors are currently major adopters, driven by their complex manufacturing processes and stringent quality control requirements. However, growth is anticipated across all segments, with the Food and Beverage, Pharmaceutical, and Chemical industries showing increasing interest in adopting these solutions to enhance their operational efficiency and compliance. While data security concerns and the initial investment costs associated with implementing these complex systems present some restraints, the long-term benefits of enhanced productivity, reduced waste, and improved decision-making outweigh these challenges, supporting continued market expansion. Geographic expansion is also a key aspect, with North America and Europe currently dominating the market, but significant growth potential exists in the Asia-Pacific region, driven by industrialization and technological advancements.

Manufacturing Intelligence Software Market Report: 2019-2033

This comprehensive report provides a deep dive into the global Manufacturing Intelligence Software market, offering invaluable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously analyzes market trends, competitive landscapes, technological advancements, and future growth prospects, projecting a market value exceeding xx Million by 2033. Key players like Honeywell International Inc, ABB Ltd, Emerson Electric Co, Siemens AG, and SAP SE are profiled, alongside an examination of crucial segments like Data Integration, Analytics & Analysis, and Visualization across diverse end-user industries.

Manufacturing Intelligence Software Industry Market Composition & Trends

The global Manufacturing Intelligence Software market is characterized by a moderately concentrated landscape, with key players holding significant market share. In 2025, the top five companies, including Honeywell International Inc., ABB Ltd., Siemens AG, SAP SE, and Rockwell Automation Inc., collectively held an estimated xx% market share. Market concentration is influenced by factors such as high barriers to entry (significant R&D investment and specialized expertise), economies of scale, and brand recognition. Innovation is driven by advancements in AI, IoT, and cloud computing, leading to enhanced data analytics capabilities and predictive maintenance solutions. Regulatory landscapes, varying by region, influence data privacy and security standards, impacting software adoption. Substitute products, such as legacy systems and manual processes, face increasing pressure from the cost-effectiveness and efficiency of Manufacturing Intelligence Software. Mergers & Acquisitions (M&A) activity has been significant, with deal values exceeding xx Million in the past five years, driven by a desire for market expansion and technology integration. End-user profiles are diversifying, with growth across various industries like Automotive, Electronics, and Pharmaceuticals.

- Market Share Distribution (2025): Top 5 players: xx%

- M&A Deal Value (2019-2024): Over xx Million

- Key M&A Activities: [List 2-3 significant M&A events with brief descriptions and years]

Manufacturing Intelligence Software Industry Industry Evolution

The Manufacturing Intelligence Software market has experienced substantial growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to several factors. Firstly, the increasing adoption of Industry 4.0 principles and the proliferation of connected devices within manufacturing environments have generated massive amounts of data, fueling the demand for sophisticated analytics solutions. Secondly, technological advancements like AI and machine learning are transforming data analysis capabilities, enabling predictive maintenance, optimized production processes, and improved quality control. Thirdly, shifting consumer demands for faster delivery times, customized products, and improved product quality are pushing manufacturers to adopt intelligent software solutions to enhance efficiency and responsiveness. The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated CAGR of xx%, driven by factors like expanding cloud adoption, further development of AI/ML capabilities within the software, and increasing digital transformation initiatives in the manufacturing sector. Adoption rates for Manufacturing Intelligence Software continue to rise, with an estimated xx% of manufacturers utilizing such solutions in 2025, projected to increase to xx% by 2033.

Leading Regions, Countries, or Segments in Manufacturing Intelligence Software Industry

North America currently dominates the Manufacturing Intelligence Software market, driven by high technological adoption rates, substantial investments in R&D, and a strong presence of major players. Within applications, Data Analytics & Analysis enjoys the largest market share, followed by Data Integration and Visualization. Among end-user industries, Automotive and Electronics sectors demonstrate significant demand due to their intensive use of automation and data-driven decision-making.

Key Drivers:

- North America: High technological adoption, strong R&D investment, significant presence of major players.

- Data Analytics & Analysis: Increasing need for actionable insights from manufacturing data.

- Automotive & Electronics: High automation levels, data-intensive operations, and demand for optimized processes.

Dominance Factors:

North America's dominance stems from its established technology infrastructure, strong regulatory support for digital transformation initiatives, and the presence of leading technology vendors and large manufacturing companies. The automotive and electronics industries are driving adoption due to their need for real-time data analysis, predictive maintenance, and supply chain optimization. The strong focus on data analytics is a result of the significant volume of data generated in manufacturing and the need for converting this data into actionable business insights.

Manufacturing Intelligence Software Industry Product Innovations

Recent innovations have focused on enhancing the integration of AI and machine learning for predictive maintenance, improved process optimization, and enhanced real-time visibility across the manufacturing value chain. New products incorporate advanced visualization tools for intuitive data interpretation and improved user experience. Key advancements include enhanced cybersecurity measures to protect sensitive manufacturing data and the development of cloud-based solutions to enable greater accessibility and scalability. These innovations are contributing to increased efficiency, reduced downtime, and optimized resource allocation. A unique selling proposition for many vendors is the ability to seamlessly integrate their software with existing manufacturing systems, minimizing disruption and maximizing return on investment.

Propelling Factors for Manufacturing Intelligence Software Industry Growth

Several factors contribute to the industry’s growth. Technological advancements, such as AI, machine learning, and IoT, are enabling more efficient data analysis and predictive capabilities. Economic factors, such as the increasing need for productivity improvements and cost reductions in manufacturing, are driving the adoption of these solutions. Favorable government regulations and initiatives promoting digital transformation in manufacturing are also playing a crucial role. For instance, government incentives and subsidies for Industry 4.0 adoption in various countries are fostering market growth.

Obstacles in the Manufacturing Intelligence Software Industry Market

Key barriers include high initial investment costs for implementation, the complexity of integrating software with existing legacy systems, and cybersecurity risks associated with handling large volumes of sensitive manufacturing data. Supply chain disruptions can impact the availability of hardware and software components, while intense competition among established players and new entrants creates pricing pressures. The lack of skilled workforce capable of implementing and managing sophisticated software solutions is also a challenge. These factors collectively can impede broader market adoption.

Future Opportunities in Manufacturing Intelligence Software Industry

Future opportunities lie in expanding into new markets, especially in developing economies undergoing rapid industrialization. Advancements in edge computing and 5G technology will create opportunities for real-time data processing and improved connectivity in manufacturing environments. Growing demand for sustainable and environmentally friendly manufacturing practices will drive the development of solutions that optimize resource utilization and minimize waste. The integration of AR/VR technologies promises further enhancements to human-machine interaction and training within manufacturing settings.

Major Players in the Manufacturing Intelligence Software Industry Ecosystem

- Honeywell International Inc

- ABB Ltd

- Emerson Electric Co

- Siemens AG

- SAP SE

- AVEVA Group PLC

- Rockwell Automation Inc

- Dassault Systemes SE

- Aspen Technology Inc

- General Electric Company

Key Developments in Manufacturing Intelligence Software Industry Industry

- 2022 Q3: Siemens AG launched a new cloud-based manufacturing intelligence platform.

- 2023 Q1: Honeywell International Inc. acquired a smaller software company specializing in predictive maintenance.

- 2024 Q2: ABB Ltd. partnered with a major cloud provider to expand its data analytics offerings.

- [Add 2-3 more significant developments with dates]

Strategic Manufacturing Intelligence Software Industry Market Forecast

The Manufacturing Intelligence Software market is poised for robust growth throughout the forecast period. Continued advancements in AI and machine learning, coupled with the increasing adoption of Industry 4.0 principles, will drive significant demand. Expansion into new geographical markets and the development of innovative solutions tailored to specific industry needs will further fuel market expansion. The overall market outlook is highly positive, indicating substantial growth potential for companies operating in this dynamic sector.

Manufacturing Intelligence Software Industry Segmentation

-

1. Application

- 1.1. Data Integration

- 1.2. Analytics and Analysis

- 1.3. Visualization

-

2. End-user Industry

- 2.1. Aerospace and Defense

- 2.2. Automotive

- 2.3. Electronics

- 2.4. Chemical

- 2.5. Food and Beverage

- 2.6. Pharmaceutical

- 2.7. Other End-user Industries

Manufacturing Intelligence Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Manufacturing Intelligence Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Competition among Manufacturers; Increasing Need for Enhanced Operational Efficiency

- 3.3. Market Restrains

- 3.3.1. High Initial Investment

- 3.4. Market Trends

- 3.4.1. Automotive Segment is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Data Integration

- 5.1.2. Analytics and Analysis

- 5.1.3. Visualization

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Aerospace and Defense

- 5.2.2. Automotive

- 5.2.3. Electronics

- 5.2.4. Chemical

- 5.2.5. Food and Beverage

- 5.2.6. Pharmaceutical

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Data Integration

- 6.1.2. Analytics and Analysis

- 6.1.3. Visualization

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Aerospace and Defense

- 6.2.2. Automotive

- 6.2.3. Electronics

- 6.2.4. Chemical

- 6.2.5. Food and Beverage

- 6.2.6. Pharmaceutical

- 6.2.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Data Integration

- 7.1.2. Analytics and Analysis

- 7.1.3. Visualization

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Aerospace and Defense

- 7.2.2. Automotive

- 7.2.3. Electronics

- 7.2.4. Chemical

- 7.2.5. Food and Beverage

- 7.2.6. Pharmaceutical

- 7.2.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Data Integration

- 8.1.2. Analytics and Analysis

- 8.1.3. Visualization

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Aerospace and Defense

- 8.2.2. Automotive

- 8.2.3. Electronics

- 8.2.4. Chemical

- 8.2.5. Food and Beverage

- 8.2.6. Pharmaceutical

- 8.2.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Data Integration

- 9.1.2. Analytics and Analysis

- 9.1.3. Visualization

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Aerospace and Defense

- 9.2.2. Automotive

- 9.2.3. Electronics

- 9.2.4. Chemical

- 9.2.5. Food and Beverage

- 9.2.6. Pharmaceutical

- 9.2.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Data Integration

- 10.1.2. Analytics and Analysis

- 10.1.3. Visualization

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Aerospace and Defense

- 10.2.2. Automotive

- 10.2.3. Electronics

- 10.2.4. Chemical

- 10.2.5. Food and Beverage

- 10.2.6. Pharmaceutical

- 10.2.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. MEA Manufacturing Intelligence Software Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Honeywell International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ABB Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Emerson Electric Co

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Siemens AG

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 SAP SE

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 AVEVA Group PLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Rockwell Automation Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Dassault Systemes SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Aspen Technology Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 General Electric Company

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Manufacturing Intelligence Software Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Manufacturing Intelligence Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Manufacturing Intelligence Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Manufacturing Intelligence Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Manufacturing Intelligence Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Manufacturing Intelligence Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Manufacturing Intelligence Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Manufacturing Intelligence Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Manufacturing Intelligence Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Manufacturing Intelligence Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Manufacturing Intelligence Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Manufacturing Intelligence Software Industry Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Manufacturing Intelligence Software Industry Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Manufacturing Intelligence Software Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Manufacturing Intelligence Software Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Manufacturing Intelligence Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Manufacturing Intelligence Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Manufacturing Intelligence Software Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Manufacturing Intelligence Software Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Manufacturing Intelligence Software Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Manufacturing Intelligence Software Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Manufacturing Intelligence Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Manufacturing Intelligence Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Manufacturing Intelligence Software Industry Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Manufacturing Intelligence Software Industry Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Manufacturing Intelligence Software Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Manufacturing Intelligence Software Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Manufacturing Intelligence Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Manufacturing Intelligence Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Manufacturing Intelligence Software Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Manufacturing Intelligence Software Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Manufacturing Intelligence Software Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Manufacturing Intelligence Software Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Manufacturing Intelligence Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Manufacturing Intelligence Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East Manufacturing Intelligence Software Industry Revenue (Million), by Application 2024 & 2032

- Figure 37: Middle East Manufacturing Intelligence Software Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: Middle East Manufacturing Intelligence Software Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East Manufacturing Intelligence Software Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East Manufacturing Intelligence Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East Manufacturing Intelligence Software Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United Arab Emirates Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Saudi Arabia Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Middle East and Africa Manufacturing Intelligence Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 47: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 48: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 51: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 53: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 54: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 56: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 57: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 59: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 60: Global Manufacturing Intelligence Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Manufacturing Intelligence Software Industry?

The projected CAGR is approximately 16.00%.

2. Which companies are prominent players in the Manufacturing Intelligence Software Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Emerson Electric Co, Siemens AG, SAP SE, AVEVA Group PLC, Rockwell Automation Inc, Dassault Systemes SE, Aspen Technology Inc, General Electric Company.

3. What are the main segments of the Manufacturing Intelligence Software Industry?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Competition among Manufacturers; Increasing Need for Enhanced Operational Efficiency.

6. What are the notable trends driving market growth?

Automotive Segment is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Initial Investment.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Manufacturing Intelligence Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Manufacturing Intelligence Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Manufacturing Intelligence Software Industry?

To stay informed about further developments, trends, and reports in the Manufacturing Intelligence Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence