Key Insights

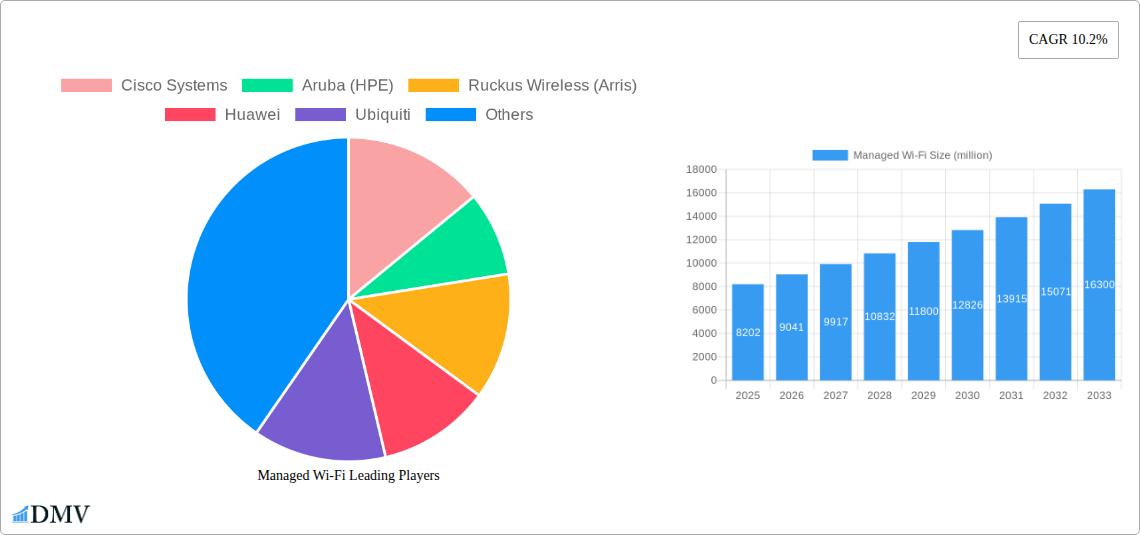

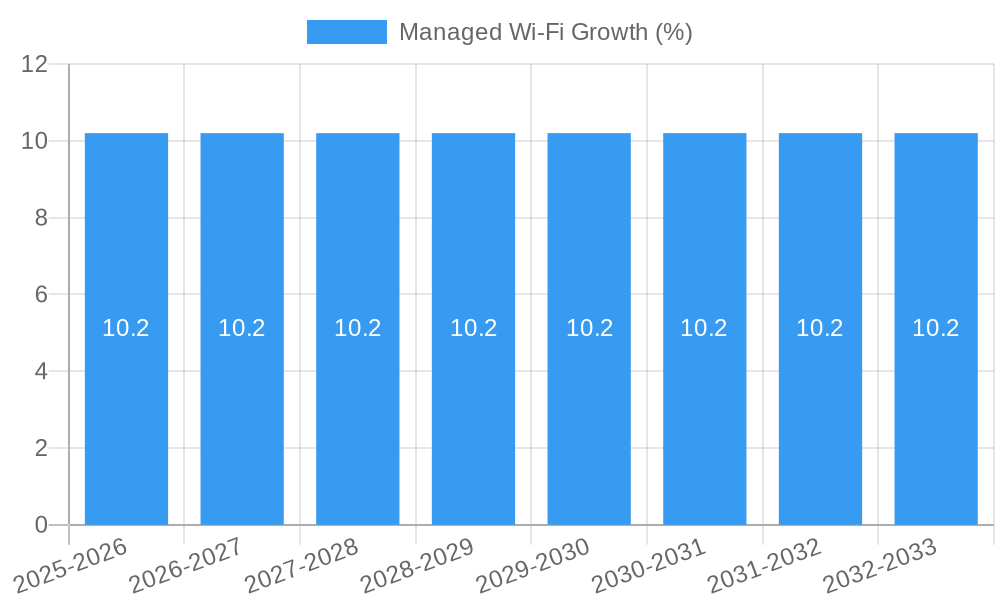

The Managed Wi-Fi market is poised for substantial growth, projected to reach a significant valuation by 2033, driven by an impressive Compound Annual Growth Rate (CAGR) of 10.2%. This robust expansion is fueled by the increasing demand for seamless, reliable, and secure wireless connectivity across a multitude of sectors. Enterprises are increasingly offloading the complexities of network management to specialized providers, allowing them to focus on core business operations. Key growth drivers include the escalating adoption of cloud-based services, the proliferation of IoT devices, and the ongoing digital transformation initiatives across industries. The need for enhanced user experience, improved security protocols, and scalable network infrastructure further bolsters the demand for managed Wi-Fi solutions.

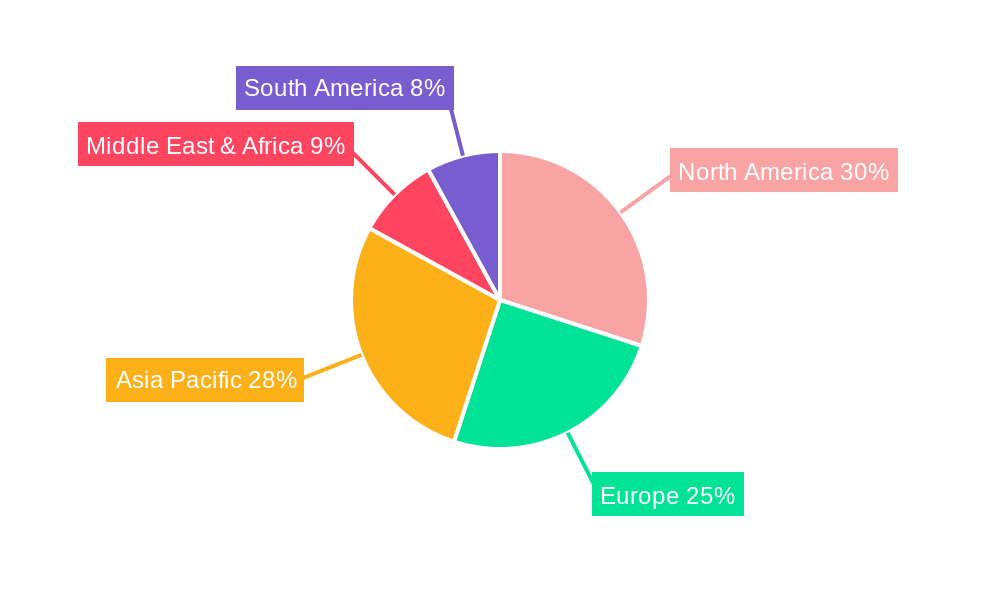

The market is segmented by both application and type, highlighting its diverse reach and offerings. In terms of applications, IT and Telecommunications, BFSI, and Retail are expected to be major contributors, owing to their extensive network requirements and the critical nature of uninterrupted connectivity. Healthcare and Government sectors are also showing significant adoption as they leverage Wi-Fi for patient care, public services, and smart city initiatives. The "Product" segment, encompassing hardware like access points and controllers, and the "Service" segment, including installation, monitoring, and support, are both anticipated to grow in tandem. Leading companies like Cisco Systems, Aruba (HPE), and Huawei are actively shaping the market with innovative solutions and strategic partnerships. Geographically, North America and Asia Pacific are expected to lead market growth due to rapid technological adoption and infrastructure development.

Managed Wi-Fi Market Composition & Trends

The global Managed Wi-Fi market is characterized by a dynamic landscape, with key players like Cisco Systems, Aruba (HPE), Ruckus Wireless (Arris), Huawei, Ubiquiti, Comcast Business, Aerohive, and Mojo Networks shaping its trajectory. Market concentration is moderate, with a few dominant entities holding significant market share, estimated to be in the range of XXX% of the total market value. Innovation remains a critical catalyst, driven by the relentless pursuit of enhanced connectivity, improved security, and seamless user experiences across diverse industries. Regulatory landscapes, while generally supportive of digital infrastructure development, can vary by region, influencing adoption rates and deployment strategies. Substitute products, such as wired Ethernet, continue to exist but are increasingly outpaced by the flexibility and pervasive reach of managed Wi-Fi solutions. End-user profiles span a broad spectrum, from large enterprises in IT and Telecommunications seeking robust network management to SMBs in retail and hospitality requiring cost-effective, scalable wireless solutions. Mergers and acquisitions (M&A) activities are pivotal in consolidating market share and acquiring innovative technologies, with recent deal values estimated to be in the hundreds of millions of dollars. The market share distribution reveals a strong presence in the Product segment, representing approximately XX% of the market value, while the Service segment accounts for the remaining XX%, indicating a growing reliance on outsourced network management.

- Market Share Distribution:

- Product Segment: XX%

- Service Segment: XX%

- M&A Deal Values: Estimated in hundreds of millions of dollars.

- Innovation Focus: Enhanced security, network performance, IoT integration, cloud management.

- Regulatory Impact: Varies by region, affecting spectrum allocation and data privacy compliance.

Managed Wi-Fi Industry Evolution

The managed Wi-Fi industry has witnessed an impressive growth trajectory, evolving from basic wireless connectivity to sophisticated, intelligent network solutions. Over the study period of 2019–2033, with a base year of 2025 and an estimated year of 2025, the market has experienced consistent expansion, projecting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This growth is fueled by an escalating demand for reliable, high-speed internet access across an ever-increasing number of connected devices and the proliferation of the Internet of Things (IoT). Technological advancements have been at the forefront of this evolution. The transition from older Wi-Fi standards to Wi-Fi 6 and the emerging Wi-Fi 7 technologies has significantly boosted network performance, capacity, and efficiency. Innovations in cloud-based management platforms have empowered businesses to monitor, control, and optimize their wireless networks remotely, reducing operational overhead and improving responsiveness. Furthermore, the integration of AI and machine learning into managed Wi-Fi solutions enables predictive analytics for network performance, proactive issue resolution, and personalized user experiences, further differentiating service offerings.

Shifting consumer demands have also played a crucial role. Individuals and businesses now expect ubiquitous, seamless connectivity, whether in their homes, offices, public spaces, or while on the move. This expectation has driven the demand for robust managed Wi-Fi services that can deliver consistent performance, secure access, and a high-quality user experience across various environments. The growing reliance on cloud-based applications, video conferencing, and digital transformation initiatives further accentuates the need for dependable and scalable wireless infrastructure. Adoption metrics reflect this trend, with enterprise adoption of managed Wi-Fi services projected to reach XX% by 2025, up from XX% in 2019. In the service sector, the number of businesses outsourcing their Wi-Fi management has grown by an average of XX% annually. The historical period of 2019–2024 laid the groundwork for this expansion, marked by increasing adoption in key verticals and the foundational development of robust managed Wi-Fi platforms. The estimated year of 2025 will see these trends solidify, with substantial investments expected in upgrading network infrastructure and adopting advanced managed Wi-Fi solutions.

Leading Regions, Countries, or Segments in Managed Wi-Fi

The managed Wi-Fi market’s dominance varies significantly across regions and industries, with North America consistently emerging as a leading market. This leadership is propelled by a mature technological ecosystem, substantial enterprise investment in digital transformation, and a strong regulatory framework supporting robust internet infrastructure. The IT and Telecommunications segment, as a primary adopter and provider of these services, naturally exhibits high demand, accounting for an estimated XX% of the total managed Wi-Fi market value. Within this segment, the need for secure, high-performance, and scalable wireless solutions for enterprise networks, data centers, and customer-facing applications is paramount. The increasing adoption of cloud services and the growing complexity of network management further drive the demand for managed Wi-Fi offerings.

Beyond IT and Telecommunications, the BFSI sector demonstrates significant traction, with an estimated XX% market share. Financial institutions leverage managed Wi-Fi for secure branch operations, customer service kiosks, and employee productivity, prioritizing robust security protocols and reliable connectivity. The Retail segment, representing approximately XX% of the market, utilizes managed Wi-Fi for in-store customer experiences, inventory management, and point-of-sale systems, focusing on seamless guest Wi-Fi and operational efficiency. The Government and Public Sector, with an XX% market share, are increasingly deploying managed Wi-Fi for smart city initiatives, public Wi-Fi hotspots, and secure government facilities. Healthcare, Transportation, Logistics and Hospitality, Manufacturing, and Education also contribute significantly to the market, each with unique requirements driving adoption. The Types segment highlights a strong preference for Service-based managed Wi-Fi, accounting for approximately XX% of the market, reflecting the growing trend of outsourcing network management to specialized providers.

- Key Drivers for North America's Dominance:

- High enterprise spending on advanced IT solutions.

- Early adoption of Wi-Fi 6 and subsequent technologies.

- Supportive government initiatives for broadband expansion.

- Presence of major managed Wi-Fi vendors and service providers.

- Dominant Application Segments:

- IT and Telecommunications (XX% market share)

- BFSI (XX% market share)

- Retail (XX% market share)

- Government and Public Sector (XX% market share)

- Dominant Type Segment:

- Service (XX% market share)

- Factors Driving Segment Dominance:

- IT & Telecom: Need for scalable, secure, and high-performance networks to support evolving digital services.

- BFSI: Stringent security requirements, need for uninterrupted connectivity for critical transactions.

- Retail: Enhancing customer experience, enabling contactless payments, and optimizing inventory management.

- Government: Driving smart city initiatives, providing public services, and securing government operations.

Managed Wi-Fi Product Innovations

Managed Wi-Fi solutions are continuously evolving with cutting-edge product innovations designed to enhance performance, security, and manageability. Leading vendors are integrating advanced features such as AI-powered analytics for proactive network optimization, enabling predictive maintenance and anomaly detection. Enhanced security protocols, including WPA3 encryption and sophisticated threat mitigation capabilities, are becoming standard. The rollout of Wi-Fi 6E and the development of Wi-Fi 7 promise significantly increased speeds, reduced latency, and greater capacity, crucial for bandwidth-intensive applications like augmented reality (AR) and virtual reality (VR). Furthermore, innovations in mesh networking and intelligent beamforming technologies ensure seamless coverage and optimal signal strength across large or complex environments. Unique selling propositions often revolve around ease of deployment, centralized cloud-based management for simplified operations, and robust integration capabilities with existing IT infrastructure. Performance metrics like ultra-low latency (e.g., XX milliseconds), high throughput (e.g., XX Gbps), and XX% network uptime are key benchmarks for these advanced products.

Propelling Factors for Managed Wi-Fi Growth

The managed Wi-Fi market is experiencing robust growth driven by a confluence of technological, economic, and regulatory factors. Technologically, the relentless advancement of Wi-Fi standards, such as Wi-Fi 6 and the upcoming Wi-Fi 7, is enabling faster speeds, greater capacity, and lower latency, essential for supporting the burgeoning number of connected devices and bandwidth-intensive applications. The proliferation of the Internet of Things (IoT) across industries like manufacturing, healthcare, and retail necessitates reliable and scalable wireless connectivity, a core offering of managed Wi-Fi. Economically, the increasing focus on operational efficiency and cost reduction for businesses makes outsourcing network management an attractive proposition, freeing up internal IT resources. The rising adoption of cloud-based services further fuels demand for robust and secure wireless infrastructure. Regulatory support for digital transformation and the expansion of broadband access in underserved areas also act as significant catalysts. For instance, government initiatives promoting smart cities and digital inclusion directly translate into increased demand for managed Wi-Fi deployments.

Obstacles in the Managed Wi-Fi Market

Despite its growth, the managed Wi-Fi market faces several obstacles that could temper its expansion. Regulatory challenges, particularly concerning data privacy and security compliance across different jurisdictions, can complicate deployments and increase operational costs. The increasing sophistication of cyber threats necessitates continuous investment in advanced security measures, which can be a burden for some businesses. Supply chain disruptions, as witnessed in recent years, can impact the availability of essential hardware components, leading to project delays and increased pricing. Furthermore, intense competitive pressures among vendors can lead to price erosion, impacting profit margins. The inherent complexity of integrating new Wi-Fi systems with legacy IT infrastructure can also pose a significant hurdle for some organizations, requiring specialized expertise and considerable time for seamless implementation. The estimated impact of these disruptions on project timelines can be up to XX%, and on project costs, up to XX%.

Future Opportunities in Managed Wi-Fi

The future of the managed Wi-Fi market is ripe with opportunities, driven by emerging technologies and evolving consumer trends. The widespread adoption of 5G technology, rather than being a direct competitor, is expected to complement Wi-Fi by providing seamless offloading and enhancing overall connectivity. The continued expansion of IoT deployments across smart homes, smart cities, and industrial environments will create a massive demand for reliable and secure wireless connectivity. Furthermore, the growth of edge computing, which requires localized data processing, will necessitate robust on-premises wireless networks managed effectively. The increasing demand for enhanced remote work capabilities and hybrid work models will drive the need for highly secure and performant managed Wi-Fi solutions for both enterprise and residential settings. The development of specialized managed Wi-Fi solutions for niche industries like industrial automation and agriculture presents further avenues for growth.

Major Players in the Managed Wi-Fi Ecosystem

- Cisco Systems

- Aruba (HPE)

- Ruckus Wireless (Arris)

- Huawei

- Ubiquiti

- Comcast Business

- Aerohive

- Mojo Networks

Key Developments in Managed Wi-Fi Industry

- 2023: Introduction of Wi-Fi 7 standards, promising unprecedented speeds and lower latency.

- 2023: Increased focus on AI-driven network analytics for predictive maintenance and self-healing networks.

- 2022: Major vendors announce enhanced cybersecurity features and compliance certifications for enterprise deployments.

- 2021: Significant investments in cloud-managed Wi-Fi solutions, offering greater scalability and remote management capabilities.

- 2020: Impact of the COVID-19 pandemic leading to increased demand for robust home and remote work Wi-Fi solutions.

- 2019: Continued consolidation through M&A activities, with companies acquiring innovative technologies and market share.

Strategic Managed Wi-Fi Market Forecast

The strategic managed Wi-Fi market forecast points towards sustained and significant growth, propelled by the insatiable demand for seamless, high-performance wireless connectivity. The ongoing digital transformation across all industries, coupled with the exponential rise of IoT devices, will continue to be primary growth catalysts. The anticipated widespread adoption of Wi-Fi 7 technology will revolutionize network capabilities, enabling new applications and enhancing existing ones, thereby driving upgrades and new deployments. Furthermore, the increasing reliance on cloud-based services and the growing trend of outsourcing IT infrastructure management will solidify the position of managed Wi-Fi service providers. The market is poised to experience substantial expansion as businesses across sectors, from IT and Telecommunications to Healthcare and Retail, prioritize robust, secure, and scalable wireless networks to maintain competitive advantage and drive operational efficiency. The overall market potential remains exceptionally high, promising lucrative opportunities for innovation and investment.

Managed Wi-Fi Segmentation

-

1. Application

- 1.1. IT and Telecommunications

- 1.2. BFSI

- 1.3. Retail

- 1.4. Government and Public Sector

- 1.5. Healthcare

- 1.6. Transportation, Logistics and Hospitality

- 1.7. Manufacturing

- 1.8. Education

- 1.9. Others

-

2. Types

- 2.1. Product

- 2.2. Service

Managed Wi-Fi Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Managed Wi-Fi REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Managed Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. IT and Telecommunications

- 5.1.2. BFSI

- 5.1.3. Retail

- 5.1.4. Government and Public Sector

- 5.1.5. Healthcare

- 5.1.6. Transportation, Logistics and Hospitality

- 5.1.7. Manufacturing

- 5.1.8. Education

- 5.1.9. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Product

- 5.2.2. Service

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Managed Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. IT and Telecommunications

- 6.1.2. BFSI

- 6.1.3. Retail

- 6.1.4. Government and Public Sector

- 6.1.5. Healthcare

- 6.1.6. Transportation, Logistics and Hospitality

- 6.1.7. Manufacturing

- 6.1.8. Education

- 6.1.9. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Product

- 6.2.2. Service

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Managed Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. IT and Telecommunications

- 7.1.2. BFSI

- 7.1.3. Retail

- 7.1.4. Government and Public Sector

- 7.1.5. Healthcare

- 7.1.6. Transportation, Logistics and Hospitality

- 7.1.7. Manufacturing

- 7.1.8. Education

- 7.1.9. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Product

- 7.2.2. Service

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Managed Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. IT and Telecommunications

- 8.1.2. BFSI

- 8.1.3. Retail

- 8.1.4. Government and Public Sector

- 8.1.5. Healthcare

- 8.1.6. Transportation, Logistics and Hospitality

- 8.1.7. Manufacturing

- 8.1.8. Education

- 8.1.9. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Product

- 8.2.2. Service

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Managed Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. IT and Telecommunications

- 9.1.2. BFSI

- 9.1.3. Retail

- 9.1.4. Government and Public Sector

- 9.1.5. Healthcare

- 9.1.6. Transportation, Logistics and Hospitality

- 9.1.7. Manufacturing

- 9.1.8. Education

- 9.1.9. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Product

- 9.2.2. Service

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Managed Wi-Fi Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. IT and Telecommunications

- 10.1.2. BFSI

- 10.1.3. Retail

- 10.1.4. Government and Public Sector

- 10.1.5. Healthcare

- 10.1.6. Transportation, Logistics and Hospitality

- 10.1.7. Manufacturing

- 10.1.8. Education

- 10.1.9. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Product

- 10.2.2. Service

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Cisco Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aruba (HPE)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ruckus Wireless (Arris)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Huawei

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ubiquiti

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Comcast Business

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aerohive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mojo Networks

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Cisco Systems

List of Figures

- Figure 1: Global Managed Wi-Fi Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Managed Wi-Fi Revenue (million), by Application 2024 & 2032

- Figure 3: North America Managed Wi-Fi Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Managed Wi-Fi Revenue (million), by Types 2024 & 2032

- Figure 5: North America Managed Wi-Fi Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Managed Wi-Fi Revenue (million), by Country 2024 & 2032

- Figure 7: North America Managed Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Managed Wi-Fi Revenue (million), by Application 2024 & 2032

- Figure 9: South America Managed Wi-Fi Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Managed Wi-Fi Revenue (million), by Types 2024 & 2032

- Figure 11: South America Managed Wi-Fi Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Managed Wi-Fi Revenue (million), by Country 2024 & 2032

- Figure 13: South America Managed Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Managed Wi-Fi Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Managed Wi-Fi Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Managed Wi-Fi Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Managed Wi-Fi Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Managed Wi-Fi Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Managed Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Managed Wi-Fi Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Managed Wi-Fi Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Managed Wi-Fi Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Managed Wi-Fi Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Managed Wi-Fi Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Managed Wi-Fi Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Managed Wi-Fi Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Managed Wi-Fi Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Managed Wi-Fi Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Managed Wi-Fi Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Managed Wi-Fi Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Managed Wi-Fi Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Managed Wi-Fi Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Managed Wi-Fi Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Managed Wi-Fi Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Managed Wi-Fi Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Managed Wi-Fi Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Managed Wi-Fi Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Managed Wi-Fi Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Managed Wi-Fi Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Managed Wi-Fi Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Managed Wi-Fi Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Managed Wi-Fi Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Managed Wi-Fi Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Managed Wi-Fi Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Managed Wi-Fi Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Managed Wi-Fi Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Managed Wi-Fi Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Managed Wi-Fi Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Managed Wi-Fi Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Managed Wi-Fi Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Managed Wi-Fi Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Managed Wi-Fi?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the Managed Wi-Fi?

Key companies in the market include Cisco Systems, Aruba (HPE), Ruckus Wireless (Arris), Huawei, Ubiquiti, Comcast Business, Aerohive, Mojo Networks.

3. What are the main segments of the Managed Wi-Fi?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 8202 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Managed Wi-Fi," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Managed Wi-Fi report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Managed Wi-Fi?

To stay informed about further developments, trends, and reports in the Managed Wi-Fi, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence