Key Insights

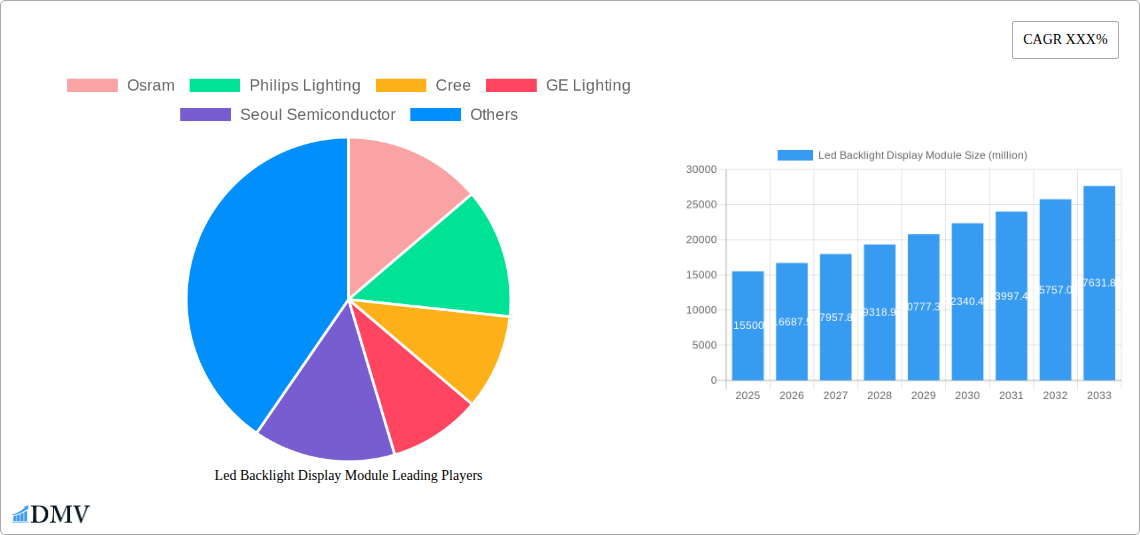

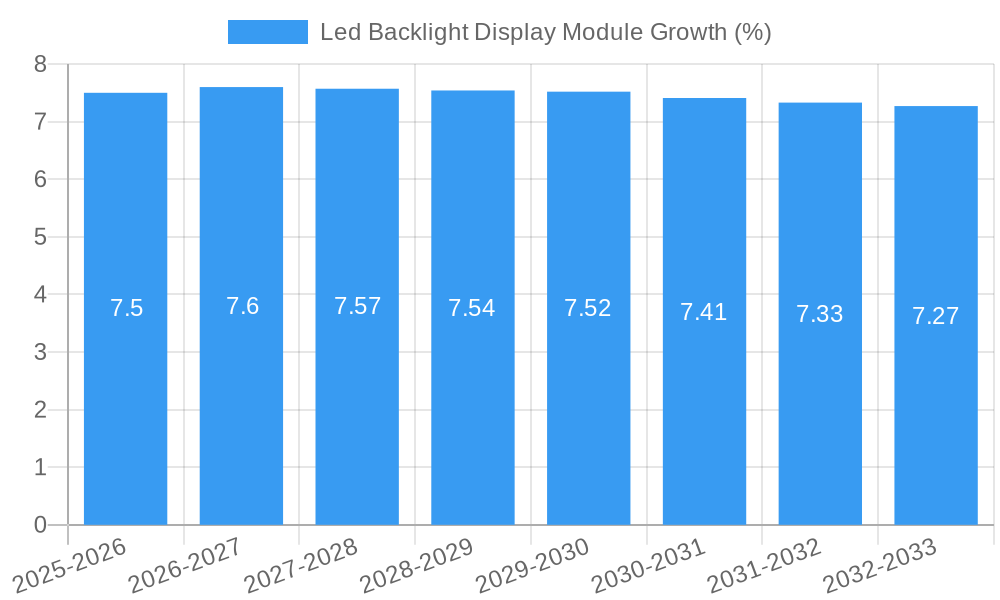

The LED backlight display module market is poised for robust expansion, projected to reach a substantial market size of approximately $15,500 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This significant growth is primarily fueled by the relentless demand for advanced display technologies across a multitude of consumer electronics, from smartphones and tablets to televisions and wearables. The automotive sector's increasing integration of sophisticated in-car displays for infotainment, navigation, and advanced driver-assistance systems (ADAS) further propels this market. Moreover, the burgeoning adoption of LED backlighting in medical imaging devices and industrial control panels, where superior brightness, color accuracy, and energy efficiency are paramount, adds considerable impetus to market dynamics. Innovations in display technologies, such as Mini-LED and Micro-LED, promising enhanced contrast ratios and deeper blacks, are also expected to drive market evolution and adoption of premium display solutions.

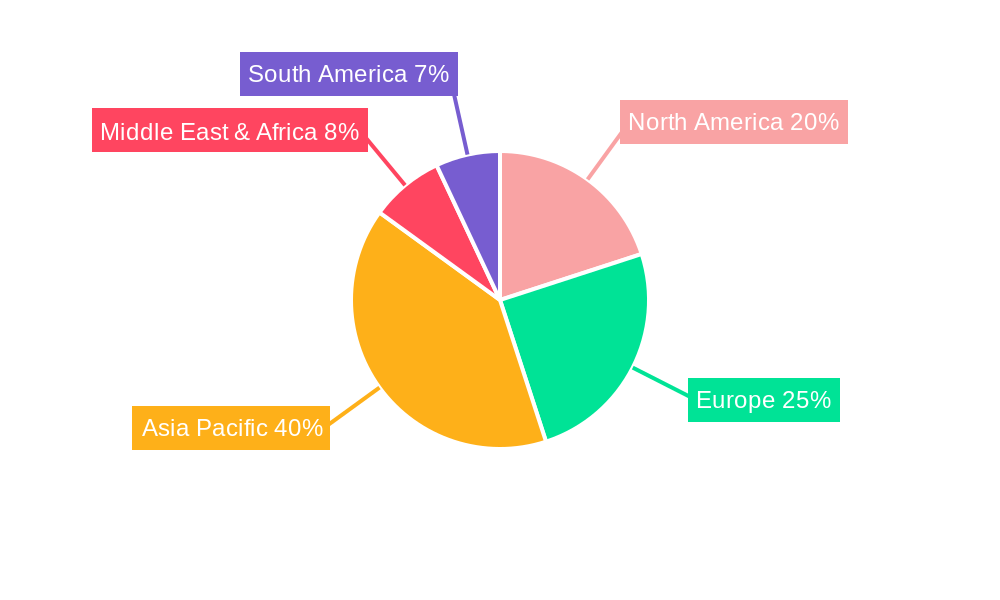

Despite the strong growth trajectory, certain factors could present headwinds. While not explicitly stated, potential price pressures on components, especially as manufacturing scales up, could impact profit margins. Furthermore, the increasing complexity of display technologies might necessitate significant R&D investments, potentially straining smaller players. However, the overarching trend towards thinner, brighter, and more energy-efficient displays across all applications, coupled with the ongoing digital transformation necessitating more visually interactive interfaces, firmly positions the LED backlight display module market for sustained and impressive growth. Key market participants such as Osram, Philips Lighting, Cree, GE Lighting, Samsung, and LG Innotek are actively investing in R&D and expanding production capacities to cater to this expanding global demand, especially within the Asia Pacific region, which is expected to dominate market share due to its extensive manufacturing base and burgeoning consumer market.

Led Backlight Display Module Market Composition & Trends

This comprehensive report delves into the dynamic Led Backlight Display Module market, offering an in-depth analysis of its intricate composition and prevailing trends. The market is characterized by a moderate concentration, with key players such as Samsung, LG Innotek, and Nichia holding significant market share. Innovation catalysts are primarily driven by advancements in LED efficiency, miniaturization, and color spectrum control, enabling brighter and more power-efficient displays across diverse applications. The regulatory landscape is evolving, with an increasing focus on energy efficiency standards and environmental compliance, impacting manufacturing processes and product certifications. Substitute products, while present in niche segments, are largely outpaced by the superior performance and cost-effectiveness of advanced LED backlight modules. End-user profiles range from the high-volume Consumer Electronics sector, demanding premium visual experiences, to the critical Medical and Automotive industries, requiring high reliability and specific performance metrics. M&A activities have been observed, with strategic acquisitions aimed at consolidating market share, acquiring innovative technologies, and expanding geographical reach. For instance, recent M&A deals within the LED component manufacturing sector are estimated to be in the range of several hundred million dollars, signaling consolidation and growth. The market share distribution indicates a strong presence of established players, with emerging innovators gradually gaining traction.

Led Backlight Display Module Industry Evolution

The Led Backlight Display Module industry has witnessed a remarkable evolution over the Study Period (2019–2033), driven by relentless technological innovation and surging demand across a spectrum of applications. From its foundational role in enhancing display clarity, the industry has transformed into a critical component enabling the next generation of visual experiences. During the Historical Period (2019–2024), the market experienced robust growth, fueled by the widespread adoption of LED technology in televisions, smartphones, and tablets. This period saw a shift away from traditional CCFL backlights, with LED modules offering significant advantages in terms of energy efficiency, slimmer profile, and superior contrast ratios. The Base Year (2025) serves as a pivotal point, reflecting a mature yet still expanding market, with an estimated market size in the billions of dollars.

Technological advancements have been the primary engine of this evolution. Innovations in LED chip design, quantum dots, and micro-LED technology have continuously pushed the boundaries of display performance. The development of High Voltage LED Driver Modules, Medium Voltage LED Driver Modules, and Low Voltage LED Driver Modules has catered to the diverse power requirements of different display sizes and applications. For instance, the adoption of mini-LED and micro-LED technologies, which utilize significantly smaller LEDs and higher LED densities, has enabled enhanced local dimming capabilities, leading to unprecedented contrast ratios and HDR performance. This has been particularly impactful in the premium Consumer Electronics segment, with adoption rates for such advanced displays reaching substantial percentages.

Consumer demand has also played a crucial role. As consumers increasingly seek immersive and visually engaging content, the demand for high-quality displays with vibrant colors, deep blacks, and high brightness has grown exponentially. This trend is evident not only in the consumer electronics market but also in the Automotive sector, where advanced display technologies are being integrated into infotainment systems and digital cockpits, and in the Medical field, where high-resolution displays are essential for accurate diagnostics. The Industrial Control segment also benefits from the reliability and longevity of LED backlights in demanding environments.

The Forecast Period (2025–2033) is projected to witness continued expansion, albeit at a moderated pace as the market matures. However, emerging technologies and new application areas are expected to provide significant growth opportunities. The Estimated Year (2025) marks a point of significant market penetration and ongoing innovation, with an estimated market value in the tens of billions of dollars. The industry's trajectory is characterized by a consistent upward trend in market size, with projected Compound Annual Growth Rates (CAGRs) in the single to low double digits, driven by a blend of incremental improvements in existing technologies and disruptive innovations in nascent fields like micro-LED. The increasing integration of advanced display modules into wearable devices and augmented reality (AR)/virtual reality (VR) headsets also signifies a new frontier for industry growth.

Leading Regions, Countries, or Segments in Led Backlight Display Module

The global Led Backlight Display Module market is a dynamic landscape, with several regions, countries, and segments demonstrating significant leadership and influence. In terms of regional dominance, Asia Pacific, particularly East Asia, stands out as the primary hub for both manufacturing and consumption of LED backlight display modules. Countries like South Korea, Taiwan, Japan, and China are home to leading display panel manufacturers and significant LED component suppliers, including giants like Samsung, LG Innotek, and Nichia. This region benefits from a well-established electronics manufacturing ecosystem, robust government support for technological innovation, and a massive domestic consumer market. Investment trends in this region are consistently high, with substantial capital allocated towards research and development of next-generation display technologies. Regulatory support, including incentives for high-tech manufacturing and export promotion, further solidifies Asia Pacific's leadership position.

Within the application segments, Consumer Electronics unequivocally leads the charge. The insatiable demand for smartphones, televisions, laptops, tablets, and gaming consoles drives a substantial portion of the global LED backlight display module market. The sheer volume of units produced and consumed in this segment, with billions of devices incorporating these modules annually, makes it the most impactful. Investment in this segment is primarily focused on improving picture quality, power efficiency, and reducing bezel sizes to enhance user experience.

However, other segments are exhibiting rapid growth and increasing importance. The Automotive sector is a significant emerging leader. As vehicles become more sophisticated with advanced infotainment systems, digital dashboards, and driver-assistance displays, the demand for high-performance, reliable, and durable LED backlight modules is skyrocketing. Countries with strong automotive manufacturing bases, such as Germany, Japan, and the United States, are witnessing considerable growth in this application segment. Investment trends here are geared towards enhancing brightness for daytime visibility, improving contrast for safety-critical information, and ensuring long operational lifespans under harsh automotive conditions. Regulatory support is also evolving, with increasing mandates for advanced driver-assistance systems and digital cockpits.

The Medical sector, while smaller in volume, is a high-value segment that demands exceptional precision, color accuracy, and reliability. Medical imaging displays, surgical monitors, and diagnostic equipment rely on LED backlight modules that can reproduce images with utmost fidelity. Investment in this segment focuses on achieving superior color gamut, high contrast ratios, and long-term color stability. Regulatory compliance, particularly for medical device certification, is a critical factor in this segment.

The Industrial Control segment, encompassing everything from factory automation displays to ruggedized control panels, also presents a significant market. These applications require robust, long-lasting LED backlight modules that can withstand challenging environmental conditions, including extreme temperatures, vibration, and dust. Investment in this segment is directed towards enhancing durability and reliability.

In terms of Type, the market is witnessing a balanced demand across High Voltage LED Driver Modules, Medium Voltage LED Driver Modules, and Low Voltage LED Driver Modules. The specific type employed is largely dictated by the display size, power budget, and application requirements. For example, large-format displays and high-brightness applications often utilize High Voltage LED Driver Modules, while portable devices and smaller screens rely on Low Voltage LED Driver Modules. The overall market dynamics are a testament to the versatility and indispensable nature of LED backlight technology across a wide array of industries.

Led Backlight Display Module Product Innovations

Product innovations in LED backlight modules are continuously pushing the boundaries of display technology, leading to enhanced visual experiences and new application possibilities. Key advancements include the development of mini-LED and micro-LED technologies, offering superior contrast ratios and brightness levels through the use of significantly smaller and more numerous LEDs. This allows for finer local dimming control, resulting in deeper blacks and more vibrant colors. Quantum dot enhancement films are also being integrated to achieve wider color gamuts and more accurate color reproduction, crucial for applications in Consumer Electronics and Medical imaging. Furthermore, innovations in thermal management and driver ICs are leading to more power-efficient and longer-lasting modules, essential for battery-powered devices and demanding industrial applications. Performance metrics such as luminance uniformity, color accuracy (Delta E), and energy efficiency (lumens per watt) are continuously improving, with cutting-edge modules achieving luminance values exceeding several thousand nits and color gamuts covering over 100% of DCI-P3.

Propelling Factors for Led Backlight Display Module Growth

Several key factors are propelling the growth of the Led Backlight Display Module market. Foremost among these is the relentless demand for higher-quality visual experiences in consumer electronics, driven by the proliferation of high-resolution content and the desire for immersive entertainment. Technological advancements, such as the development of mini-LED and micro-LED technologies, offer superior contrast, brightness, and color accuracy, making LED backlights indispensable. The increasing adoption of advanced display technologies in the automotive sector, for in-car infotainment and digital cockpits, represents a significant growth avenue. Furthermore, stringent energy efficiency regulations across various industries are favoring LED backlights due to their inherent power-saving capabilities compared to older technologies. The growing healthcare sector's need for high-precision medical imaging displays also contributes to market expansion.

Obstacles in the Led Backlight Display Module Market

Despite its robust growth, the Led Backlight Display Module market faces several obstacles. Intense price competition, particularly from manufacturers in low-cost regions, can erode profit margins for suppliers. The complex global supply chain for critical components, such as LED chips and driver ICs, is susceptible to disruptions, as evidenced by recent semiconductor shortages, which can lead to production delays and increased costs, potentially impacting market growth by hundreds of millions of dollars in lost revenue. Evolving environmental regulations and the need for sustainable manufacturing practices can also impose additional compliance costs. Furthermore, the high initial investment required for advanced manufacturing facilities and R&D for next-generation technologies can be a barrier for smaller players.

Future Opportunities in Led Backlight Display Module

The Led Backlight Display Module market is poised for significant future opportunities. The burgeoning market for augmented reality (AR) and virtual reality (VR) devices presents a substantial growth avenue, requiring high-resolution, high-brightness, and compact LED backlight solutions. The continued expansion of the automotive industry's reliance on sophisticated in-car displays, including flexible and transparent displays, offers immense potential. Emerging markets in developing economies are also expected to drive demand as consumer electronics and automotive penetration increase. Furthermore, the ongoing miniaturization of electronic devices and the increasing demand for ultra-thin displays will continue to fuel innovation in compact and efficient LED backlight module designs. The development of more advanced lighting control technologies, enabling even greater energy savings and visual fidelity, also represents a promising area.

Major Players in the Led Backlight Display Module Ecosystem

- Osram

- Philips Lighting

- Cree

- GE Lighting

- Seoul Semiconductor

- Panasonic

- Nichia

- JF

- Acuity Brands

- Samsung

- LG Innotek

- Eaton

- Toshiba

- Toyoda Gosei

- Opple

- OMRON

- Minebea

- e-LITECOM

- Radiant Opto-Electronics

- LONGLI TECHNOLOGY

- PTOMA LIMITED

- Dongguan Sanxie Precision Technology

- Wai Chi Holdings

- Shenzhen Baoming Technology

- Xiamen Honghan Optoelectronic Technology

- Shen Zhen Australis Electronic Technology

- Shenzhen Sanbum Optoelectronics

- Highbroad Advanced Material

- Shenzhen Jufei Optoelectronics

- Ways Electron

Key Developments in Led Backlight Display Module Industry

- 2023 (H2): Launch of next-generation mini-LED backlight modules with enhanced local dimming zones, providing improved contrast ratios for premium television displays.

- 2024 (Q1): Major manufacturers announce increased investment in micro-LED research and development, targeting commercialization in high-end displays within the next five years.

- 2024 (Q2): Growing adoption of advanced LED driver ICs for improved power efficiency and thermal management in automotive display modules.

- 2024 (Q3): Strategic partnerships formed between LED component suppliers and display panel manufacturers to accelerate the integration of new backlight technologies.

- 2025 (Q1): Emergence of foldable and rollable display technologies incorporating flexible LED backlight modules, opening new possibilities for portable devices.

- 2025 (Q2): Increased focus on sustainable manufacturing processes and materials within the LED backlight industry, driven by environmental regulations.

- 2025 (Q3): Significant advancements in quantum dot technology leading to wider color gamuts and more accurate color reproduction in LED backlight modules.

- 2026 (Q1): Expected introduction of AR/VR specific LED backlight solutions optimized for high brightness and resolution in compact form factors.

- 2027 (Q1): Continued consolidation within the industry through strategic mergers and acquisitions, aiming to enhance market share and technological capabilities.

- 2029-2033: Anticipated widespread adoption of micro-LED technology in consumer-grade displays, driving significant market transformation.

Strategic Led Backlight Display Module Market Forecast

The strategic Led Backlight Display Module market forecast indicates continued robust growth, fueled by the relentless pursuit of superior visual experiences and the expanding applications of display technology. Key growth catalysts include the ongoing demand from the Consumer Electronics sector, the rapidly evolving Automotive industry's integration of advanced displays, and the increasing use of high-precision modules in the Medical field. Emerging opportunities in AR/VR, coupled with advancements in mini-LED and micro-LED technologies, are expected to drive significant market expansion. The forecast highlights a market poised for innovation, with a strong emphasis on energy efficiency, enhanced performance metrics, and the development of specialized solutions for diverse end-user requirements. The market potential remains substantial, driven by technological advancements and shifting consumer preferences.

Led Backlight Display Module Segmentation

-

1. Application

- 1.1. Consumer Electronics

- 1.2. Automotive

- 1.3. Medical

- 1.4. Industrial Control

- 1.5. Other

-

2. Type

- 2.1. High Voltage LED Driver Module

- 2.2. Medium Voltag LED Driver Module

- 2.3. Low Voltage LED Driver Module

Led Backlight Display Module Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Led Backlight Display Module REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Led Backlight Display Module Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Consumer Electronics

- 5.1.2. Automotive

- 5.1.3. Medical

- 5.1.4. Industrial Control

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. High Voltage LED Driver Module

- 5.2.2. Medium Voltag LED Driver Module

- 5.2.3. Low Voltage LED Driver Module

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Led Backlight Display Module Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Consumer Electronics

- 6.1.2. Automotive

- 6.1.3. Medical

- 6.1.4. Industrial Control

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. High Voltage LED Driver Module

- 6.2.2. Medium Voltag LED Driver Module

- 6.2.3. Low Voltage LED Driver Module

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Led Backlight Display Module Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Consumer Electronics

- 7.1.2. Automotive

- 7.1.3. Medical

- 7.1.4. Industrial Control

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. High Voltage LED Driver Module

- 7.2.2. Medium Voltag LED Driver Module

- 7.2.3. Low Voltage LED Driver Module

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Led Backlight Display Module Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Consumer Electronics

- 8.1.2. Automotive

- 8.1.3. Medical

- 8.1.4. Industrial Control

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. High Voltage LED Driver Module

- 8.2.2. Medium Voltag LED Driver Module

- 8.2.3. Low Voltage LED Driver Module

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Led Backlight Display Module Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Consumer Electronics

- 9.1.2. Automotive

- 9.1.3. Medical

- 9.1.4. Industrial Control

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. High Voltage LED Driver Module

- 9.2.2. Medium Voltag LED Driver Module

- 9.2.3. Low Voltage LED Driver Module

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Led Backlight Display Module Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Consumer Electronics

- 10.1.2. Automotive

- 10.1.3. Medical

- 10.1.4. Industrial Control

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. High Voltage LED Driver Module

- 10.2.2. Medium Voltag LED Driver Module

- 10.2.3. Low Voltage LED Driver Module

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Osram

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Philips Lighting

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cree

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Lighting

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Seoul Semiconductor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Panasonic

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nichia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JF

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Acuity Brands

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Samsung

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 LG Innotek

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eaton

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Toshiba

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Toyoda Gosei

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Opple

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 OMRON

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Minebea

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 e-LITECOM

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Radiant Opto-Electronics

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 LONGLI TECHNOLOGY

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 PTOMA LIMITED

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Dongguan Sanxie Precision Technology

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Wai Chi Holdings

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Shenzhen Baoming Technology

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Xiamen Honghan Optoelectronic Technology

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Shen Zhen Australis Electronic Technology

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Shenzhen Sanbum Optoelectronics

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Highbroad Advanced Material

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Shenzhen Jufei Optoelectronics

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 Ways Electron

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.1 Osram

List of Figures

- Figure 1: Global Led Backlight Display Module Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Led Backlight Display Module Revenue (million), by Application 2024 & 2032

- Figure 3: North America Led Backlight Display Module Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Led Backlight Display Module Revenue (million), by Type 2024 & 2032

- Figure 5: North America Led Backlight Display Module Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Led Backlight Display Module Revenue (million), by Country 2024 & 2032

- Figure 7: North America Led Backlight Display Module Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Led Backlight Display Module Revenue (million), by Application 2024 & 2032

- Figure 9: South America Led Backlight Display Module Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Led Backlight Display Module Revenue (million), by Type 2024 & 2032

- Figure 11: South America Led Backlight Display Module Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Led Backlight Display Module Revenue (million), by Country 2024 & 2032

- Figure 13: South America Led Backlight Display Module Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Led Backlight Display Module Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Led Backlight Display Module Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Led Backlight Display Module Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Led Backlight Display Module Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Led Backlight Display Module Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Led Backlight Display Module Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Led Backlight Display Module Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Led Backlight Display Module Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Led Backlight Display Module Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Led Backlight Display Module Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Led Backlight Display Module Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Led Backlight Display Module Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Led Backlight Display Module Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Led Backlight Display Module Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Led Backlight Display Module Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Led Backlight Display Module Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Led Backlight Display Module Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Led Backlight Display Module Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Led Backlight Display Module Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Led Backlight Display Module Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Led Backlight Display Module Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Led Backlight Display Module Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Led Backlight Display Module Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Led Backlight Display Module Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Led Backlight Display Module Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Led Backlight Display Module Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Led Backlight Display Module Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Led Backlight Display Module Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Led Backlight Display Module Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Led Backlight Display Module Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Led Backlight Display Module Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Led Backlight Display Module Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Led Backlight Display Module Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Led Backlight Display Module Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Led Backlight Display Module Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Led Backlight Display Module Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Led Backlight Display Module Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Led Backlight Display Module Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Led Backlight Display Module?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Led Backlight Display Module?

Key companies in the market include Osram, Philips Lighting, Cree, GE Lighting, Seoul Semiconductor, Panasonic, Nichia, JF, Acuity Brands, Samsung, LG Innotek, Eaton, Toshiba, Toyoda Gosei, Opple, OMRON, Minebea, e-LITECOM, Radiant Opto-Electronics, LONGLI TECHNOLOGY, PTOMA LIMITED, Dongguan Sanxie Precision Technology, Wai Chi Holdings, Shenzhen Baoming Technology, Xiamen Honghan Optoelectronic Technology, Shen Zhen Australis Electronic Technology, Shenzhen Sanbum Optoelectronics, Highbroad Advanced Material, Shenzhen Jufei Optoelectronics, Ways Electron.

3. What are the main segments of the Led Backlight Display Module?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Led Backlight Display Module," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Led Backlight Display Module report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Led Backlight Display Module?

To stay informed about further developments, trends, and reports in the Led Backlight Display Module, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence