Key Insights

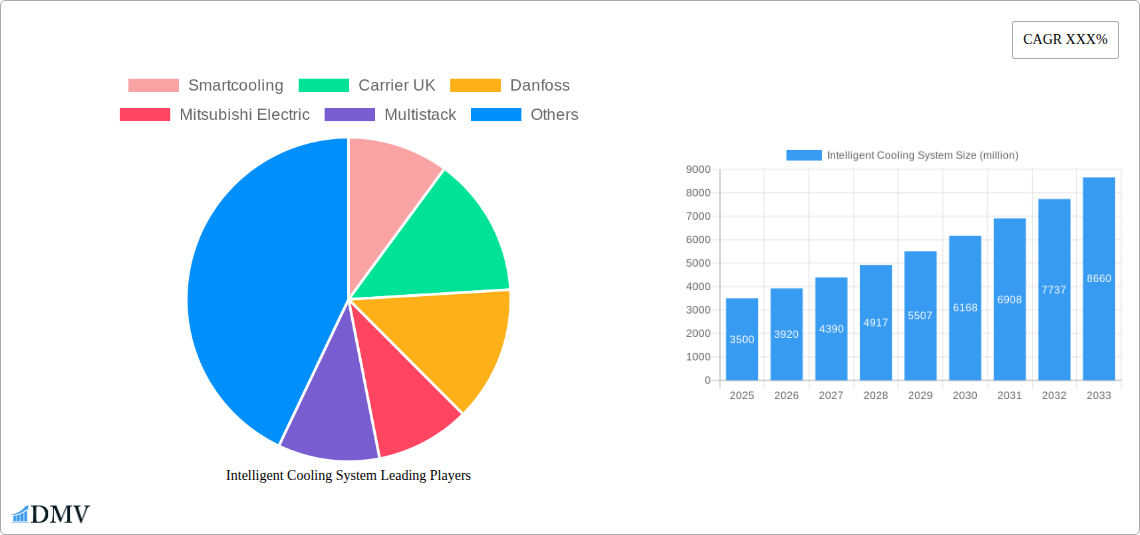

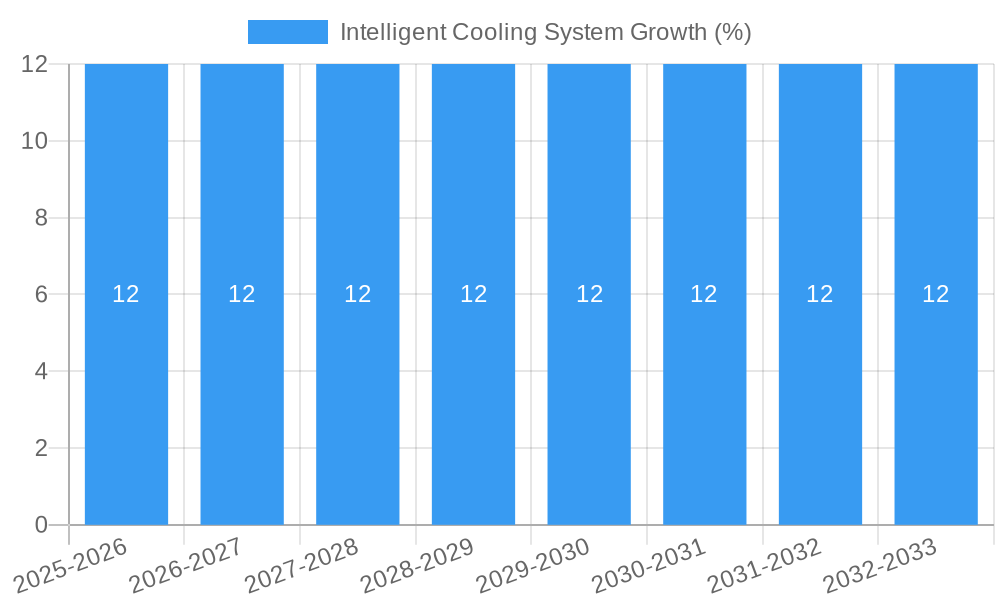

The global Intelligent Cooling System market is poised for substantial growth, projected to reach approximately USD 7,500 million by 2033, with a robust Compound Annual Growth Rate (CAGR) of around 12% from 2025 to 2033. This expansion is primarily fueled by the escalating demand for energy efficiency and sustainability across various industries, including commercial buildings, industrial processes, and data centers. The increasing adoption of IoT and AI technologies for enhanced operational control, predictive maintenance, and optimized cooling performance are significant drivers. Furthermore, stringent government regulations and initiatives promoting reduced energy consumption and carbon footprint are compelling businesses to invest in advanced cooling solutions. The market is segmented by application into commercial, industrial, and residential sectors, with commercial applications currently dominating due to the widespread use of intelligent HVAC systems in offices, retail spaces, and hospitality. By type, the market is bifurcated into chiller-based and non-chiller-based systems, with chiller-based systems expected to hold a larger share owing to their superior efficiency in large-scale cooling operations.

The competitive landscape is characterized by the presence of key players such as Mitsubishi Electric, Daikin, and Carrier UK, who are actively investing in research and development to introduce innovative products and smart functionalities. The trend towards the integration of smart thermostats, advanced sensors, and cloud-based management platforms is set to redefine the intelligent cooling experience. However, the market faces certain restraints, including the high initial investment cost associated with advanced intelligent cooling systems and the need for skilled labor to install and maintain these sophisticated technologies. Despite these challenges, the continuous technological advancements and growing awareness of the long-term economic and environmental benefits are expected to propel the market forward, creating significant opportunities for both established players and new entrants.

Here is an SEO-optimized and insightful report description for the Intelligent Cooling System market:

Intelligent Cooling System Market Composition & Trends

The intelligent cooling system market is characterized by a moderate to high level of fragmentation, with key players such as Smartcooling, Carrier UK, Danfoss, Mitsubishi Electric, Multistack, Andely Teck, Daikin, Arctic Chiller Group, Climacool, Shuangliang Eco-energy, Sushine, Withair Industries, and others contributing to innovation and competition. The sector is witnessing significant innovation catalysts driven by the increasing demand for energy efficiency, smart building integration, and advanced IoT capabilities. Regulatory landscapes are evolving, with a growing emphasis on carbon emission reduction and energy performance standards, compelling manufacturers to develop more sustainable and intelligent cooling solutions. Substitute products, while present in the form of conventional cooling systems, are gradually losing market share to more advanced, data-driven intelligent alternatives. End-user profiles are diverse, encompassing commercial buildings, industrial facilities, data centers, and residential applications, each with unique requirements for optimized thermal management. Mergers and acquisitions (M&A) activity is on the rise as larger entities seek to consolidate market share and acquire cutting-edge technologies. Estimated M&A deal values are in the range of several hundred million to over a billion for significant acquisitions. The market share distribution shows a healthy mix, with a few dominant players holding substantial portions, while a significant number of smaller and specialized companies contribute to the overall market dynamism. This dynamic interplay of established giants and emerging innovators fuels continuous advancements and reshapes the intelligent cooling system landscape.

Intelligent Cooling System Industry Evolution

The intelligent cooling system industry has undergone a remarkable evolution throughout the historical period of 2019–2024, driven by a confluence of technological advancements, shifting consumer demands, and a growing imperative for sustainable operations. The base year of 2025 marks a pivotal point, with the market poised for accelerated growth and widespread adoption of sophisticated cooling solutions. Throughout the historical period, we observed a consistent upward trajectory in market growth, with compound annual growth rates (CAGRs) averaging around 8% to 12% annually. This growth was fueled by the increasing integration of IoT sensors, artificial intelligence (AI), and machine learning (ML) algorithms into cooling systems. These technologies enabled unprecedented levels of predictive maintenance, energy optimization, and remote monitoring, significantly enhancing operational efficiency and reducing energy consumption – a key demand from end-users grappling with rising energy costs and environmental concerns.

Technological advancements have been a primary engine of this evolution. The transition from conventional, reactive cooling systems to proactive, data-driven intelligent solutions has been profound. Early intelligent systems focused on basic automation, but have rapidly evolved to incorporate sophisticated AI for real-time performance analysis, anomaly detection, and dynamic load balancing. This has led to a reduction in energy consumption by an average of 15% to 25% compared to traditional systems, a metric that has become a critical selling point. Adoption metrics have steadily increased, with an estimated XX% of new commercial building projects now specifying intelligent cooling systems, up from approximately XX% in 2019. Consumer demand has shifted from mere functionality to encompass sustainability, cost savings, and seamless integration with smart building ecosystems. The desire for enhanced comfort, improved air quality, and reduced carbon footprints has propelled the adoption of intelligent cooling. Furthermore, industry developments such as the widespread availability of affordable IoT devices and advancements in cloud computing infrastructure have lowered the barrier to entry for deploying and managing these complex systems, further accelerating the industry's transformative journey. The forecast period of 2025–2033 is expected to witness even more rapid innovation and market expansion.

Leading Regions, Countries, or Segments in Intelligent Cooling System

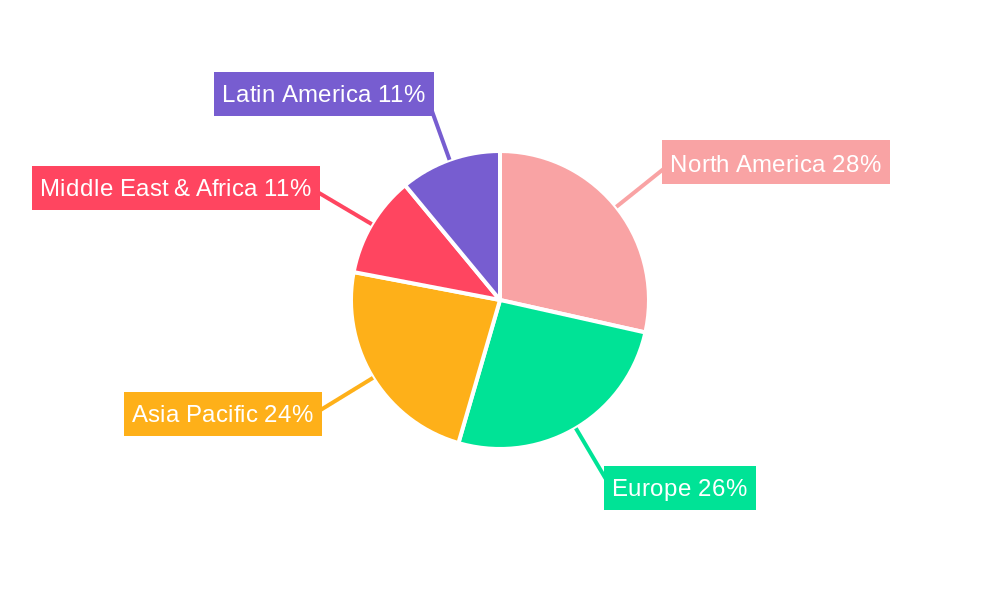

The global intelligent cooling system market is experiencing robust growth, with North America currently leading in terms of market share and influence. This dominance is attributed to several key factors, including a strong emphasis on energy efficiency standards, significant investments in smart building technologies, and a mature industrial base with a high demand for optimized thermal management solutions. The United States, in particular, stands out as a major driver within the North American region.

Application Dominance: Commercial Buildings

- Investment Trends: Significant private and public investments in smart infrastructure and green building initiatives across the US and Canada have created a fertile ground for intelligent cooling system adoption. Government incentives for energy-efficient retrofits and new construction further bolster this trend.

- Regulatory Support: Stringent building codes and energy performance regulations, such as those promoted by the Environmental Protection Agency (EPA) and local authorities, mandate the use of advanced cooling technologies that minimize energy consumption and environmental impact. This regulatory push directly favors intelligent cooling solutions.

- End-User Demand: Commercial real estate developers and facility managers are increasingly prioritizing intelligent cooling systems for their ability to reduce operational expenditures, enhance occupant comfort, and improve overall building value. The demonstrable ROI through energy savings and predictive maintenance is a powerful draw.

Type Dominance: Chiller Systems

- Technological Advancements: The chiller segment has witnessed the most significant integration of intelligent features. Advanced variable speed drives, AI-powered control algorithms, and IoT connectivity are transforming chiller performance, leading to substantial energy savings of up to 20% compared to conventional units.

- Industry Adoption: Large-scale industrial facilities, data centers, and large commercial complexes heavily rely on chillers for their cooling needs. The scalability and efficiency offered by intelligent chiller systems make them the preferred choice for these high-demand applications.

- Market Penetration: Intelligent chiller systems have achieved a high market penetration in North America due to their proven reliability, cost-effectiveness over their lifecycle, and the availability of sophisticated installation and maintenance expertise. The market share for intelligent chillers in new installations in the commercial sector is estimated to be over 60% in the US.

The synergy between supportive government policies, robust private sector investment, and the increasing demand for sustainable and cost-effective cooling solutions solidifies North America's position as the leading region for intelligent cooling systems, with the commercial building application and chiller systems type being the most prominent segments.

Intelligent Cooling System Product Innovations

Product innovations in the intelligent cooling system market are rapidly transforming thermal management. Companies are integrating advanced AI and ML algorithms for predictive maintenance, reducing downtime and optimizing energy consumption by up to 25%. IoT sensors are enabling real-time data collection on temperature, humidity, and occupancy, allowing for dynamic adjustments and personalized comfort control. Novel heat exchanger designs and advanced refrigerants are enhancing efficiency and reducing environmental impact. Performance metrics are increasingly focused on energy efficiency ratios (EER) exceeding 12 and integrated smart controls that seamlessly communicate with Building Management Systems (BMS), offering unparalleled control and cost savings.

Propelling Factors for Intelligent Cooling System Growth

The intelligent cooling system market is experiencing significant growth propelled by several key factors. Technological advancements in AI, IoT, and machine learning are enabling more efficient, predictive, and automated cooling solutions. Growing global awareness and stringent regulations regarding energy conservation and carbon emissions are driving demand for sustainable and energy-efficient technologies. Economic benefits, such as reduced operational costs and extended equipment lifespan through predictive maintenance, are a major incentive for businesses. Furthermore, the increasing adoption of smart building technologies and the demand for enhanced occupant comfort are creating a favorable market environment. For instance, the global smart building market is projected to reach over $100 billion by 2026, directly influencing intelligent cooling system adoption.

Obstacles in the Intelligent Cooling System Market

Despite its robust growth, the intelligent cooling system market faces certain obstacles. High initial investment costs for sophisticated intelligent systems can be a barrier for some small and medium-sized enterprises. The complexity of integrating these advanced systems with existing infrastructure and the need for specialized technical expertise for installation and maintenance pose challenges. Cybersecurity concerns related to connected IoT devices and data privacy are also significant considerations for stakeholders. Furthermore, the availability of affordable conventional cooling solutions and potential supply chain disruptions for critical components can hinder widespread adoption. Regulatory inconsistencies across different regions can also create complexities for manufacturers and end-users.

Future Opportunities in Intelligent Cooling System

Emerging opportunities in the intelligent cooling system market are abundant. The expansion of 5G technology will enable faster data transmission and more responsive control of intelligent cooling systems. The growing demand for sustainable cooling solutions in developing economies presents significant untapped potential. Advancements in energy storage technologies, such as thermal batteries, can further enhance the efficiency and reliability of intelligent cooling systems. The increasing proliferation of electric vehicles and the need for robust charging infrastructure also create opportunities for integrated cooling solutions. Furthermore, the growing focus on health and wellness in buildings, with an emphasis on improved air quality and occupant comfort, will drive the demand for more sophisticated intelligent climate control.

Major Players in the Intelligent Cooling System Ecosystem

- Smartcooling

- Carrier UK

- Danfoss

- Mitsubishi Electric

- Multistack

- Andely Teck

- Daikin

- Arctic Chiller Group

- Climacool

- Shuangliang Eco-energy

- Sushine

- Withair Industries

Key Developments in Intelligent Cooling System Industry

- 2023/08: Daikin launches its new series of intelligent VRV systems with enhanced AI-driven energy optimization features.

- 2023/11: Mitsubishi Electric announces a strategic partnership to integrate its intelligent cooling solutions with leading smart home platforms, expanding reach into the residential sector.

- 2024/01: Carrier UK unveils its next-generation intelligent chiller with advanced predictive maintenance capabilities, projecting a 20% reduction in operational costs for users.

- 2024/03: Danfoss introduces a new range of intelligent valves and sensors designed for enhanced energy efficiency and seamless integration into existing HVAC systems.

- 2024/05: Multistack announces a significant investment in R&D for ultra-efficient, modular intelligent cooling solutions targeting data center applications.

Strategic Intelligent Cooling System Market Forecast

The strategic forecast for the intelligent cooling system market anticipates sustained robust growth, driven by the accelerating adoption of AI, IoT, and sustainability mandates. Market expansion will be significantly influenced by the ongoing digital transformation in building management and the increasing demand for energy-efficient, cost-effective thermal solutions. Emerging economies present substantial growth avenues, while technological innovations in areas like predictive maintenance and enhanced energy storage will further unlock market potential. The market is projected to reach an estimated value of over $50 billion by 2033, indicating a strong future outlook powered by smart technology integration and a global commitment to energy conservation.

Intelligent Cooling System Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Intelligent Cooling System Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Intelligent Cooling System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Intelligent Cooling System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Intelligent Cooling System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Intelligent Cooling System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Intelligent Cooling System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Intelligent Cooling System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Intelligent Cooling System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Smartcooling

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carrier UK

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Danfoss

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Mitsubishi Electric

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Multistack

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Andely Teck

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Daikin

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arctic Chiller Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Climacool

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shuangliang Eco-energy

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sushine

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Withair Industries

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Smartcooling

List of Figures

- Figure 1: Global Intelligent Cooling System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Intelligent Cooling System Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Intelligent Cooling System Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Intelligent Cooling System Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Intelligent Cooling System Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Intelligent Cooling System Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Intelligent Cooling System Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Intelligent Cooling System Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Intelligent Cooling System Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Intelligent Cooling System Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Intelligent Cooling System Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Intelligent Cooling System Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Intelligent Cooling System Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Intelligent Cooling System Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Intelligent Cooling System Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Intelligent Cooling System Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Intelligent Cooling System Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Intelligent Cooling System Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Intelligent Cooling System Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Intelligent Cooling System Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Intelligent Cooling System Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Intelligent Cooling System Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Intelligent Cooling System Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Intelligent Cooling System Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Intelligent Cooling System Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Intelligent Cooling System Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Intelligent Cooling System Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Intelligent Cooling System Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Intelligent Cooling System Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Intelligent Cooling System Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Intelligent Cooling System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Intelligent Cooling System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Intelligent Cooling System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Intelligent Cooling System Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Intelligent Cooling System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Intelligent Cooling System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Intelligent Cooling System Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Intelligent Cooling System Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Intelligent Cooling System Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Intelligent Cooling System Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Intelligent Cooling System Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Intelligent Cooling System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Intelligent Cooling System Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Intelligent Cooling System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Intelligent Cooling System Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Intelligent Cooling System Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Intelligent Cooling System Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Intelligent Cooling System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Intelligent Cooling System Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Intelligent Cooling System Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Intelligent Cooling System?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Intelligent Cooling System?

Key companies in the market include Smartcooling, Carrier UK, Danfoss, Mitsubishi Electric, Multistack, Andely Teck, Daikin, Arctic Chiller Group, Climacool, Shuangliang Eco-energy, Sushine, Withair Industries.

3. What are the main segments of the Intelligent Cooling System?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Intelligent Cooling System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Intelligent Cooling System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Intelligent Cooling System?

To stay informed about further developments, trends, and reports in the Intelligent Cooling System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence