Key Insights

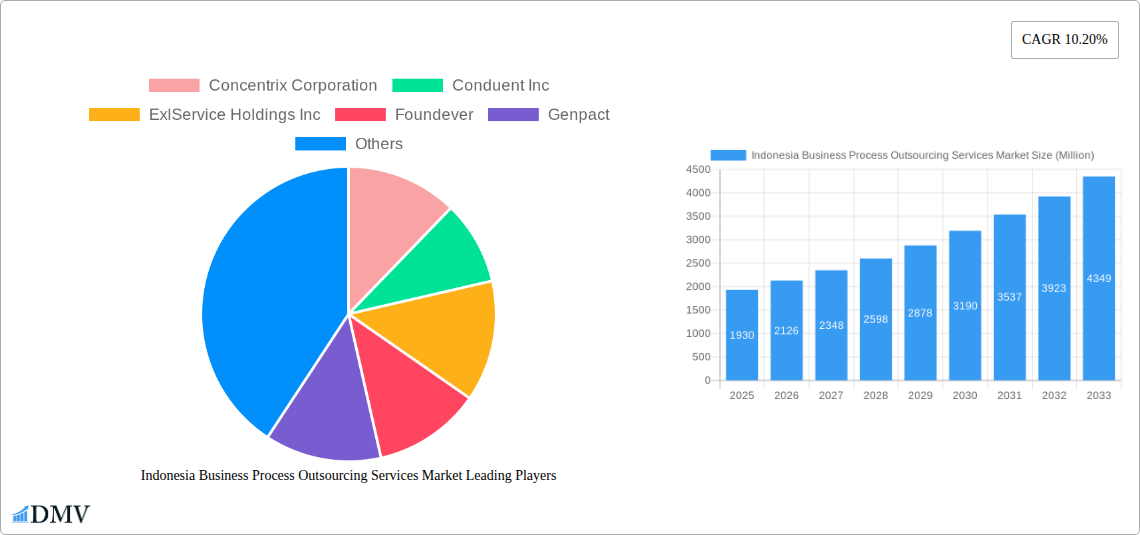

The Indonesia Business Process Outsourcing (BPO) services market is experiencing robust growth, projected to reach a market size of $1.93 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 10.20% from 2019 to 2033. This expansion is fueled by several key drivers. Firstly, Indonesia's burgeoning digital economy and increasing internet penetration create a significant demand for BPO services across various sectors, including finance, healthcare, and telecommunications. Secondly, a large, young, and relatively low-cost workforce provides a competitive advantage for Indonesian BPO providers. Furthermore, government initiatives promoting digital transformation and attracting foreign investment further bolster market growth. However, challenges such as infrastructure limitations in certain regions and the need for continuous upskilling of the workforce to meet evolving technological demands present some restraints. The market is segmented by service type (e.g., back-office processing, customer service, knowledge process outsourcing), industry vertical, and geographic location. Key players, including Concentrix Corporation, Conduent Inc., and others listed, are actively competing to capitalize on this expanding market. The forecast period (2025-2033) anticipates continued strong growth, driven by further digitalization and increasing outsourcing preferences by businesses aiming for cost optimization and enhanced efficiency.

The Indonesian BPO market's future prospects are bright, driven by sustained economic growth, increased foreign direct investment, and the government's ongoing efforts to improve infrastructure and digital literacy. While challenges exist, the potential for growth remains considerable. The strategic expansion of companies like Concentrix, Conduent, and others signals confidence in the market's ability to deliver consistent returns. The ongoing focus on technological advancements, such as AI and automation, will redefine the BPO landscape and present new opportunities for both established players and emerging businesses. The market is poised for sustained growth throughout the forecast period, making it an attractive investment destination. Competition will likely intensify as companies strive to deliver innovative solutions and meet the evolving needs of clients.

Indonesia Business Process Outsourcing Services Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Indonesia Business Process Outsourcing (BPO) services market, offering crucial data and projections from 2019 to 2033. The study covers market size, segmentation, key players, growth drivers, challenges, and future opportunities, equipping stakeholders with actionable insights for strategic decision-making. The report utilizes a robust methodology, incorporating both historical data (2019-2024) and future forecasts (2025-2033), with 2025 serving as the base year. The market is projected to reach xx Million by 2033, exhibiting significant growth potential.

Indonesia Business Process Outsourcing Services Market Composition & Trends

This section delves into the dynamic landscape of the Indonesian BPO market, analyzing market concentration, innovation, regulations, and competitive activities. The market exhibits a moderately concentrated structure, with several large multinational players and a growing number of domestic firms. Market share distribution in 2025 is estimated as follows: Top 5 players hold approximately 60% of the market, while remaining players contribute the rest. The Indonesian government's focus on digital transformation and supportive policies fuels innovation. However, regulatory complexities and evolving data privacy laws present ongoing challenges. The substitution of BPO services with in-house solutions is a minor factor, influenced by cost and skills gaps. End users primarily comprise multinational corporations (MNCs) across various sectors such as IT, finance, and healthcare. Significant M&A activity has been observed in the last five years, with deal values exceeding xx Million in aggregate.

- Market Concentration: Moderately concentrated, top 5 players holding approximately 60% market share in 2025.

- Innovation Catalysts: Government digital transformation initiatives, technological advancements.

- Regulatory Landscape: Evolving data privacy regulations, potential for increased complexity.

- Substitute Products: Limited substitution, primarily driven by cost considerations and skills gaps.

- End-User Profile: MNCs across IT, finance, healthcare, and other sectors.

- M&A Activity: Significant activity in the past five years, with aggregate deal values exceeding xx Million.

Indonesia Business Process Outsourcing Services Market Industry Evolution

The Indonesian BPO market has experienced substantial growth over the past five years, driven by factors such as the rising adoption of technology, increasing demand for cost-effective solutions, and a skilled yet relatively affordable labor pool. This growth trajectory is expected to continue into the forecast period, with a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Technological advancements, particularly in artificial intelligence (AI) and automation, are transforming the industry, enabling businesses to enhance efficiency and service delivery. The changing needs of consumers, demanding personalized and seamless experiences, are further reshaping BPO service offerings. Adoption of cloud-based solutions, for instance, has grown by approximately xx% annually since 2020. The increasing demand for specialized services like data analytics and cybersecurity is further driving market expansion. The shift towards digital transformation has boosted demand for digital marketing, customer relationship management (CRM) and other BPO services.

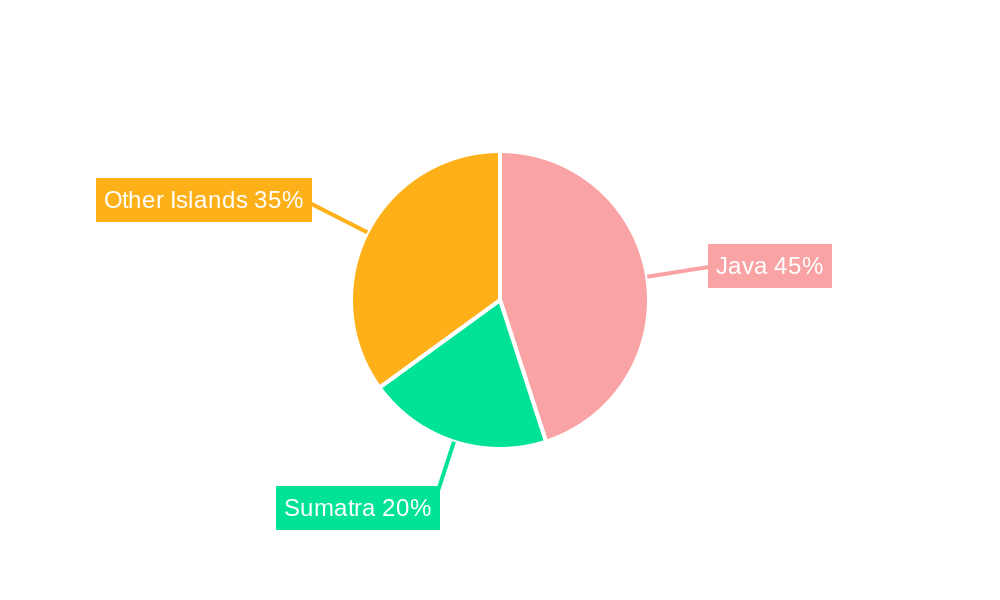

Leading Regions, Countries, or Segments in Indonesia Business Process Outsourcing Services Market

Jakarta and surrounding areas dominate the Indonesian BPO market, contributing over 70% of the total revenue in 2025. This dominance is attributable to several key factors:

- Concentrated Infrastructure: Major telecommunication networks, data centers, and skilled workforce.

- Government Support: Targeted incentives and initiatives to attract BPO investments.

- Talent Pool: Large pool of English-speaking graduates equipped with IT skills.

Other regions are witnessing growth, albeit at a slower pace. The IT-BPM segment holds the largest market share (approximately 65%) of the total BPO market in 2025, followed by customer service and back-office support segments. Expansion is being driven by the government's "Making Indonesia 4.0" initiative, focusing on digital transformation and promoting the growth of digital businesses.

Indonesia Business Process Outsourcing Services Market Product Innovations

Recent innovations in the Indonesian BPO market include the adoption of AI-powered chatbots and virtual assistants for customer service, advanced analytics for business intelligence, and the integration of blockchain technology for enhanced data security. These innovations enhance efficiency, improve customer experience, and deliver enhanced value propositions. Key advancements include improved automation capabilities, more robust security measures, and sophisticated analytics tools. The unique selling propositions center around a balance of cost-effectiveness and technological proficiency, particularly relevant in attracting multinational clients.

Propelling Factors for Indonesia Business Process Outsourcing Services Market Growth

Several factors contribute to the growth of Indonesia's BPO market. Government initiatives, such as the "Making Indonesia 4.0" program and the "Golden Indonesia 2045" initiative, heavily promote digital transformation. This policy environment, coupled with the relatively low labor costs and a large, young, and English-speaking population, makes Indonesia an attractive destination for BPO investment. The increasing adoption of technology such as AI and cloud computing also fuels market growth.

Obstacles in the Indonesia Business Process Outsourcing Services Market

The Indonesian BPO market faces challenges such as infrastructure limitations in certain regions, skill gaps in specialized areas, and competition from other regional BPO hubs. Regulatory inconsistencies and fluctuating exchange rates also pose risks. These issues can impact operational efficiency and profitability. Addressing these challenges is vital for sustainable market expansion.

Future Opportunities in Indonesia Business Process Outsourcing Services Market

Emerging opportunities exist in specialized BPO services such as data analytics, AI-driven solutions, and cybersecurity. Expansion into underserved regions within Indonesia also presents significant growth potential. The increasing demand for digital services by both domestic and multinational businesses is further creating new avenues.

Major Players in the Indonesia Business Process Outsourcing Services Market Ecosystem

- Concentrix Corporation

- Conduent Inc

- ExlService Holdings Inc

- Foundever

- Genpact

- KPSG

- Majorel

- Relia Inc

- Teleperformance

- TELUS

- Transcom

- Transcosmos Inc

- TTEC Holdings Inc

- VADS BERHAD

- WNS (Holdings) Ltd

Key Developments in Indonesia Business Process Outsourcing Services Market Industry

- April 2024: Microsoft pledges a USD 1.7 Billion investment over four years to bolster Indonesia's digital evolution, upskilling 840,000 Indonesians.

- January 2023: TTEC Holdings Inc. partners with Google Cloud to leverage AI-powered Contact Center-as-a-Service capabilities.

Strategic Indonesia Business Process Outsourcing Services Market Forecast

The Indonesian BPO market is poised for significant growth, driven by government support, technological advancements, and the increasing demand for outsourcing services. The market's projected CAGR of xx% from 2025 to 2033 highlights its substantial potential. Continued investments in infrastructure and talent development will further solidify Indonesia's position as a leading BPO hub in Southeast Asia.

Indonesia Business Process Outsourcing Services Market Segmentation

-

1. Process

- 1.1. HR

- 1.2. Sales and Marketing

- 1.3. Customer Care

- 1.4. Others

-

2. End User

- 2.1. BFSI

- 2.2. Telecom and IT

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Others

Indonesia Business Process Outsourcing Services Market Segmentation By Geography

- 1. Indonesia

Indonesia Business Process Outsourcing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations

- 3.3. Market Restrains

- 3.3.1. Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations

- 3.4. Market Trends

- 3.4.1. Customer Care to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Business Process Outsourcing Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. HR

- 5.1.2. Sales and Marketing

- 5.1.3. Customer Care

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. BFSI

- 5.2.2. Telecom and IT

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Concentrix Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Conduent Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ExlService Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Foundever

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Genpact

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KPSG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Majorel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Relia Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Teleperformance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TELUS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Transcom

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Transcosmos Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TTEC Holdings Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 VADS BERHAD

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 WNS (Holdings) Lt

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Concentrix Corporation

List of Figures

- Figure 1: Indonesia Business Process Outsourcing Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Business Process Outsourcing Services Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Process 2019 & 2032

- Table 4: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Process 2019 & 2032

- Table 5: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by End User 2019 & 2032

- Table 7: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Process 2019 & 2032

- Table 10: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Process 2019 & 2032

- Table 11: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by End User 2019 & 2032

- Table 12: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by End User 2019 & 2032

- Table 13: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Business Process Outsourcing Services Market?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the Indonesia Business Process Outsourcing Services Market?

Key companies in the market include Concentrix Corporation, Conduent Inc, ExlService Holdings Inc, Foundever, Genpact, KPSG, Majorel, Relia Inc, Teleperformance, TELUS, Transcom, Transcosmos Inc, TTEC Holdings Inc, VADS BERHAD, WNS (Holdings) Lt.

3. What are the main segments of the Indonesia Business Process Outsourcing Services Market?

The market segments include Process , End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations.

6. What are the notable trends driving market growth?

Customer Care to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations.

8. Can you provide examples of recent developments in the market?

April 2024 - Microsoft pledged a USD 1.7 billion investment over the next four years, underlining its commitment to bolster Indonesia's digital evolution. A key emphasis of this investment will be on upskilling 840,000 Indonesians, equipping them for roles in the burgeoning cloud and AI domains. This move resonates with Indonesia's broader vision outlined in the "Golden Indonesia 2045" initiative, which aspires to position the nation as a frontrunner in Southeast Asia's digital economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Business Process Outsourcing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Business Process Outsourcing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Business Process Outsourcing Services Market?

To stay informed about further developments, trends, and reports in the Indonesia Business Process Outsourcing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence