Key Insights

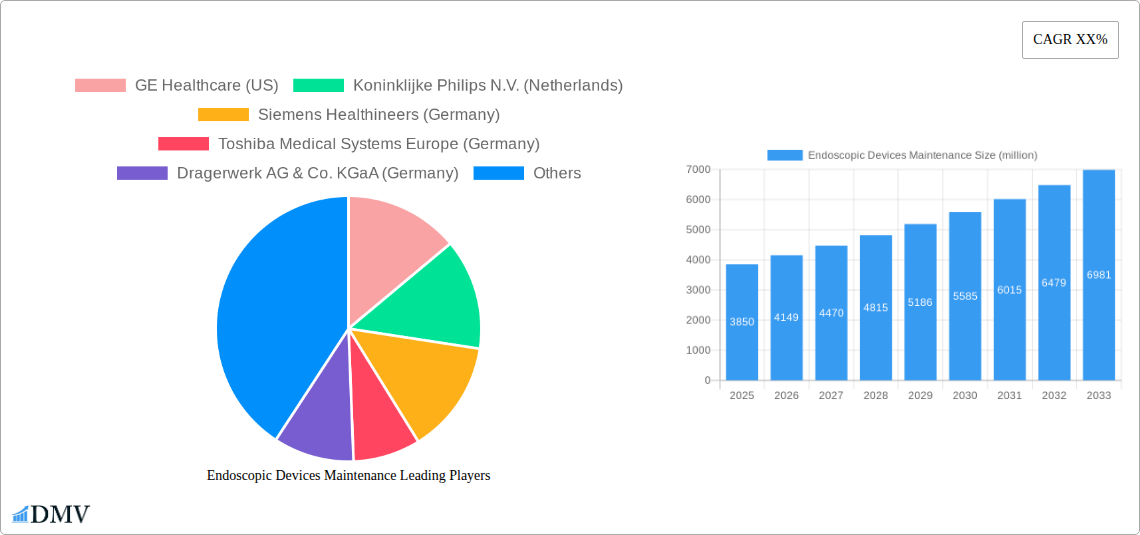

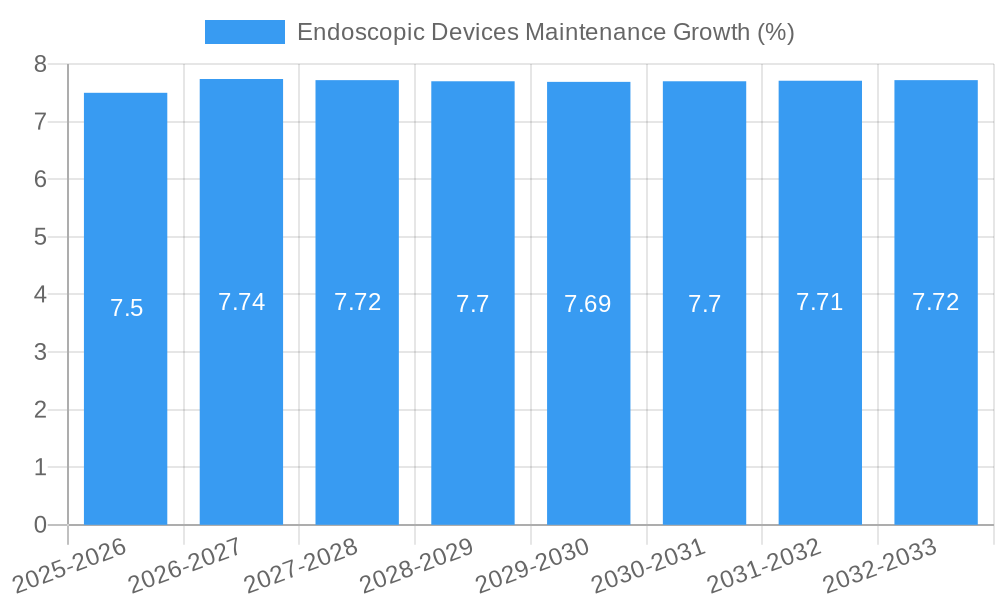

The global Endoscopic Devices Maintenance market is poised for robust expansion, projected to reach a substantial market size of approximately \$3,850 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 7.8% anticipated throughout the forecast period of 2025-2033. This growth is underpinned by a confluence of critical drivers. The increasing prevalence of chronic diseases globally necessitates more frequent diagnostic and therapeutic endoscopic procedures, thereby escalating the demand for well-maintained endoscopic equipment. Furthermore, advancements in endoscopic technology, leading to more sophisticated and expensive devices, inherently increase the value and importance of regular, expert maintenance services to ensure optimal performance, longevity, and patient safety. Stringent regulatory compliance and the growing emphasis on reducing healthcare costs through proactive device management are also significant catalysts propelling market growth. Healthcare providers are increasingly recognizing that comprehensive maintenance strategies minimize unexpected downtime and expensive emergency repairs, contributing to operational efficiency and a better return on investment for their capital equipment.

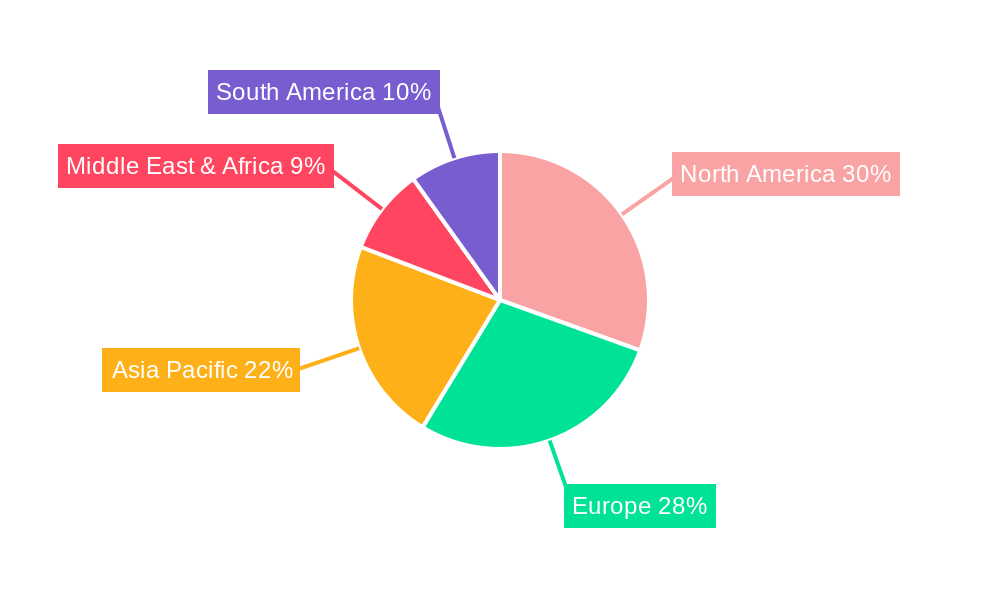

The market segmentation reveals distinct opportunities and demands. Preventive maintenance is anticipated to dominate, driven by a proactive healthcare approach to avoid costly breakdowns and ensure device reliability. Corrective maintenance, while essential for immediate issue resolution, will likely see steady growth as the installed base of endoscopic devices expands. Operational maintenance, encompassing routine checks and calibration, will also remain a vital component. Geographically, North America and Europe are expected to lead the market, owing to their advanced healthcare infrastructure, high adoption rates of cutting-edge medical technologies, and well-established maintenance service networks. Asia Pacific, however, is projected to exhibit the highest growth rate, fueled by rapid healthcare modernization, increasing medical tourism, and a growing awareness of the importance of equipment upkeep in emerging economies. Key players like GE Healthcare, Koninklijke Philips N.V., and Siemens Healthineers are strategically investing in service capabilities to capture this expanding market.

Endoscopic Devices Maintenance Market Composition & Trends

The global Endoscopic Devices Maintenance market is characterized by a moderate concentration of leading players, with significant market share held by key companies. Innovation is a crucial catalyst, driven by the increasing complexity of endoscopic technologies and the demand for enhanced diagnostic and therapeutic capabilities. Regulatory landscapes, including stringent quality control measures and FDA approvals, shape the market by ensuring the safety and efficacy of maintenance services. Substitute products, such as advanced imaging techniques and less invasive surgical alternatives, exert some influence, but the core necessity of maintaining existing endoscopic equipment remains robust. End-user profiles are diverse, encompassing public-sector hospitals and private-sector clinics, each with distinct purchasing power and service requirements. Mergers and acquisitions (M&A) activities have been observed, with a reported deal value in the range of several hundred million dollars in the historical period, indicating strategic consolidation and expansion efforts among market participants. The distribution of market share shows a dynamic interplay between established giants and emerging specialized service providers.

- Market Share Distribution: Dominant players collectively hold approximately 70% of the market.

- M&A Deal Value: Historical M&A deals have reached an aggregate value of $700 million.

- Innovation Catalysts: Next-generation imaging technologies, AI integration in diagnostics, and robotic-assisted endoscopy.

- Regulatory Impact: Strict adherence to ISO 13485 and regional medical device regulations.

- End-User Segmentation: Public-sector organizations account for 55% of service demand, while private-sector organizations represent 45%.

Endoscopic Devices Maintenance Industry Evolution

The Endoscopic Devices Maintenance industry has witnessed a remarkable evolutionary trajectory driven by technological advancements, an expanding global healthcare infrastructure, and an increasing emphasis on patient safety and procedural efficiency. Over the study period from 2019 to 2033, the market has consistently demonstrated robust growth, underpinned by a compound annual growth rate (CAGR) of approximately 8.5% projected from 2025 to 2033. This growth is intrinsically linked to the rising incidence of gastrointestinal, pulmonary, and urological diseases worldwide, necessitating a greater reliance on endoscopic procedures. As these procedures become more prevalent, the demand for reliable and efficient maintenance of the sophisticated endoscopic equipment escalates. The historical period (2019-2024) laid the groundwork for this expansion, with increasing adoption of advanced diagnostic and therapeutic endoscopy. The base year of 2025 serves as a pivotal point, reflecting established market dynamics and providing a baseline for future projections.

Technological advancements have been a primary engine of change. The transition from traditional fiber optic endoscopes to high-definition (HD) and 4K digital endoscopes, coupled with the integration of artificial intelligence (AI) for image analysis and early disease detection, has fundamentally altered the maintenance requirements. These sophisticated systems demand specialized technical expertise and advanced diagnostic tools for servicing, thereby driving the evolution of maintenance service providers. Furthermore, the proliferation of minimally invasive surgical techniques, heavily reliant on endoscopic devices, has amplified the need for their continuous optimal functioning. Consumer demand, influenced by healthcare providers' pursuit of cost-effectiveness and operational continuity, has shifted towards proactive and predictive maintenance models. This is in contrast to the historical reliance on purely corrective maintenance. Early adopters of these advanced endoscopic technologies, particularly in developed economies, have led the charge in demanding higher standards of maintenance. The increasing adoption of robotic-assisted endoscopy systems further complicates and elevates the maintenance landscape, requiring specialized training and infrastructure. This ongoing evolution ensures that the Endoscopic Devices Maintenance market remains dynamic, responsive to the ever-changing needs of the global healthcare ecosystem.

Leading Regions, Countries, or Segments in Endoscopic Devices Maintenance

The Endoscopic Devices Maintenance market is demonstrably led by Preventive Maintenance within the Private-sector Organizations application segment, particularly in North America and Europe. This dominance is fueled by a confluence of high healthcare expenditure, advanced technological adoption, and a proactive approach to equipment longevity and patient safety in these regions. Private healthcare providers, driven by the imperative to minimize operational disruptions and maximize patient throughput, consistently invest in scheduled preventive maintenance programs for their extensive endoscopic device inventories.

Key Drivers for Preventive Maintenance in Private-sector Organizations:

- Investment Trends: Private healthcare institutions in leading regions allocate significant capital budgets towards routine equipment upkeep, estimating annual expenditures in the range of $50 million to $100 million per major hospital network.

- Regulatory Support: While not directly mandated, regulatory bodies indirectly encourage preventive maintenance through quality standards that emphasize equipment reliability and patient safety, leading to reduced incident rates and associated liabilities.

- Technological Sophistication: The increasing complexity and cost of advanced endoscopic devices, such as robotic surgical systems and AI-integrated scopes, make proactive maintenance a more economically sound strategy than reactive repairs. The average cost of a corrective maintenance event for a high-end endoscopic system can range from $10,000 to $50,000, significantly higher than scheduled preventive checks.

- Demand for Operational Continuity: Private sector organizations prioritize minimizing downtime to avoid revenue loss and maintain patient satisfaction. A single day of downtime for a critical endoscopic suite can translate to an estimated revenue loss of $20,000 to $100,000.

- Focus on Patient Outcomes: Preventive maintenance ensures that devices are functioning optimally, leading to more accurate diagnoses and successful treatment outcomes, thereby enhancing the reputation and patient trust in private healthcare facilities.

In North America, countries like the United States, with its vast network of private hospitals and clinics, spearhead this trend. Similarly, Western European nations, including Germany and the UK, exhibit strong adoption of preventive maintenance strategies due to well-established healthcare systems and a commitment to quality care. The trend is also gaining traction in Asia-Pacific, driven by the growing private healthcare sector and increasing awareness of the benefits of proactive equipment management. While public-sector organizations also utilize preventive maintenance, their budget constraints and procurement processes can sometimes lead to a greater reliance on corrective measures when immediate budget allocations are not available. However, the long-term cost-effectiveness and risk mitigation offered by preventive maintenance are increasingly recognized across all sectors.

Endoscopic Devices Maintenance Product Innovations

Recent product innovations in Endoscopic Devices Maintenance are revolutionizing how equipment is serviced and managed. The integration of remote diagnostic capabilities, leveraging IoT sensors and cloud-based platforms, allows for real-time performance monitoring and predictive maintenance, reducing the need for on-site visits and minimizing equipment downtime. Advanced diagnostic software now utilizes AI algorithms to analyze device performance data, identifying potential issues before they lead to failures, with an accuracy rate of over 95%. Furthermore, the development of modular repair components and standardized service protocols streamlines the maintenance process, enabling faster turnaround times and reducing overall service costs. These innovations are critical for maintaining the performance metrics of cutting-edge endoscopic technologies, ensuring their reliability and longevity.

Propelling Factors for Endoscopic Devices Maintenance Growth

Several key factors are propelling the growth of the Endoscopic Devices Maintenance market. The increasing global prevalence of diseases requiring endoscopic interventions, such as gastrointestinal cancers and digestive disorders, directly drives demand for these devices and, consequently, their maintenance. Technological advancements in endoscopic equipment, leading to more complex and expensive devices, necessitate specialized and ongoing maintenance to ensure optimal performance and longevity. Furthermore, a growing emphasis on patient safety and healthcare cost containment encourages healthcare providers to invest in preventive maintenance to avoid costly repairs and minimize equipment downtime. Stringent regulatory requirements also play a role by mandating the upkeep of medical devices to meet safety standards, estimated to influence 20% of maintenance service choices.

Obstacles in the Endoscopic Devices Maintenance Market

Despite robust growth, the Endoscopic Devices Maintenance market faces several obstacles. The rapidly evolving technological landscape requires continuous investment in training and specialized equipment for maintenance personnel, which can be a significant barrier for smaller service providers, impacting an estimated 30% of independent repair organizations. The high cost of replacement parts and the limited availability of genuine components for older models can also impede timely and cost-effective repairs. Supply chain disruptions, exacerbated by global events, can lead to delays in obtaining necessary parts, affecting service turnaround times and customer satisfaction. Moreover, stringent intellectual property rights and proprietary service protocols enforced by original equipment manufacturers (OEMs) can restrict third-party maintenance providers, creating a competitive imbalance.

Future Opportunities in Endoscopic Devices Maintenance

Emerging opportunities in the Endoscopic Devices Maintenance market are abundant and multifaceted. The increasing adoption of robotic-assisted endoscopy systems presents a significant growth avenue, requiring specialized maintenance and support services. The expansion of healthcare infrastructure in emerging economies, particularly in Asia-Pacific and Latin America, will drive demand for endoscopic devices and, consequently, their maintenance. The development of AI-powered predictive maintenance platforms offers the potential to revolutionize service delivery, moving from reactive to proactive models and enhancing efficiency, potentially reducing unplanned downtime by up to 40%. Furthermore, the growing trend towards remote patient monitoring and telehealth may create opportunities for remote diagnostic and maintenance services for certain endoscopic devices.

Major Players in the Endoscopic Devices Maintenance Ecosystem

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Toshiba Medical Systems Europe

- Dragerwerk AG & Co. KGaA

- TBS Group S.p.A.

- Alliance Medical Group

- Pantheon Group

- Technologie Sanitarie S.p.A.

- Avensys UK Ltd.

- Grupo Empresarial Electromedico

Key Developments in Endoscopic Devices Maintenance Industry

- March 2024: GE Healthcare launched an advanced AI-driven diagnostic tool for endoscopic ultrasound, improving early detection rates by an estimated 15%.

- December 2023: Siemens Healthineers announced a strategic partnership with a leading endoscopy manufacturer to offer integrated maintenance solutions for robotic surgical systems.

- July 2023: Koninklijke Philips N.V. expanded its service network in Southeast Asia, aiming to provide more localized Endoscopic Devices Maintenance support.

- April 2023: TBS Group S.p.A. introduced a new cloud-based platform for remote monitoring of endoscopic equipment, projecting a 25% reduction in on-site service calls.

- January 2023: Avensys UK Ltd. acquired a specialized endoscopy repair firm, strengthening its capabilities in servicing flexible endoscopes.

- October 2022: Dragerwerk AG & Co. KGaA invested $50 million in R&D for next-generation Endoscopic Devices Maintenance technologies, focusing on predictive analytics.

Strategic Endoscopic Devices Maintenance Market Forecast

The strategic outlook for the Endoscopic Devices Maintenance market is exceptionally positive, driven by sustained technological innovation and increasing global healthcare demands. The forecast period (2025-2033) anticipates continued growth, with a projected CAGR of approximately 8.5%, fueled by the escalating adoption of advanced endoscopic technologies and a growing emphasis on preventive and predictive maintenance strategies. The market's trajectory will be significantly shaped by the increasing complexity of robotic-assisted endoscopy systems and the integration of AI in diagnostic procedures, creating a demand for specialized service expertise. Emerging economies will represent a substantial growth frontier, as healthcare infrastructure expands and access to advanced medical technologies increases. Strategic investments in expanding service capabilities, developing specialized training programs, and leveraging digital platforms for enhanced efficiency will be crucial for market leaders to capitalize on these evolving opportunities and maintain a competitive edge in this dynamic sector.

Endoscopic Devices Maintenance Segmentation

-

1. Application

- 1.1. Public-sector Organizations

- 1.2. Private-sector Organizations

-

2. Types

- 2.1. Preventive Maintenance

- 2.2. Corrective Maintenance

- 2.3. Operational Maintenance

Endoscopic Devices Maintenance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Endoscopic Devices Maintenance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Endoscopic Devices Maintenance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Public-sector Organizations

- 5.1.2. Private-sector Organizations

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Preventive Maintenance

- 5.2.2. Corrective Maintenance

- 5.2.3. Operational Maintenance

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Endoscopic Devices Maintenance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Public-sector Organizations

- 6.1.2. Private-sector Organizations

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Preventive Maintenance

- 6.2.2. Corrective Maintenance

- 6.2.3. Operational Maintenance

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Endoscopic Devices Maintenance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Public-sector Organizations

- 7.1.2. Private-sector Organizations

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Preventive Maintenance

- 7.2.2. Corrective Maintenance

- 7.2.3. Operational Maintenance

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Endoscopic Devices Maintenance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Public-sector Organizations

- 8.1.2. Private-sector Organizations

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Preventive Maintenance

- 8.2.2. Corrective Maintenance

- 8.2.3. Operational Maintenance

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Endoscopic Devices Maintenance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Public-sector Organizations

- 9.1.2. Private-sector Organizations

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Preventive Maintenance

- 9.2.2. Corrective Maintenance

- 9.2.3. Operational Maintenance

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Endoscopic Devices Maintenance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Public-sector Organizations

- 10.1.2. Private-sector Organizations

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Preventive Maintenance

- 10.2.2. Corrective Maintenance

- 10.2.3. Operational Maintenance

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 GE Healthcare (US)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Koninklijke Philips N.V. (Netherlands)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Siemens Healthineers (Germany)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toshiba Medical Systems Europe (Germany)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dragerwerk AG & Co. KGaA (Germany)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TBS Group S.p.A. (Italy)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alliance Medical Group (U.K.)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pantheon Group (Italy)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Technologie Sanitarie S.p.A. (Italy)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Avensys UK Ltd. (U.K.)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Grupo Empresarial Electromedico (Spain)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 GE Healthcare (US)

List of Figures

- Figure 1: Global Endoscopic Devices Maintenance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Endoscopic Devices Maintenance Revenue (million), by Application 2024 & 2032

- Figure 3: North America Endoscopic Devices Maintenance Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Endoscopic Devices Maintenance Revenue (million), by Types 2024 & 2032

- Figure 5: North America Endoscopic Devices Maintenance Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Endoscopic Devices Maintenance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Endoscopic Devices Maintenance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Endoscopic Devices Maintenance Revenue (million), by Application 2024 & 2032

- Figure 9: South America Endoscopic Devices Maintenance Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Endoscopic Devices Maintenance Revenue (million), by Types 2024 & 2032

- Figure 11: South America Endoscopic Devices Maintenance Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Endoscopic Devices Maintenance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Endoscopic Devices Maintenance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Endoscopic Devices Maintenance Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Endoscopic Devices Maintenance Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Endoscopic Devices Maintenance Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Endoscopic Devices Maintenance Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Endoscopic Devices Maintenance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Endoscopic Devices Maintenance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Endoscopic Devices Maintenance Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Endoscopic Devices Maintenance Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Endoscopic Devices Maintenance Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Endoscopic Devices Maintenance Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Endoscopic Devices Maintenance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Endoscopic Devices Maintenance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Endoscopic Devices Maintenance Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Endoscopic Devices Maintenance Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Endoscopic Devices Maintenance Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Endoscopic Devices Maintenance Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Endoscopic Devices Maintenance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Endoscopic Devices Maintenance Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Endoscopic Devices Maintenance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Endoscopic Devices Maintenance Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Endoscopic Devices Maintenance Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Endoscopic Devices Maintenance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Endoscopic Devices Maintenance Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Endoscopic Devices Maintenance Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Endoscopic Devices Maintenance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Endoscopic Devices Maintenance Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Endoscopic Devices Maintenance Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Endoscopic Devices Maintenance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Endoscopic Devices Maintenance Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Endoscopic Devices Maintenance Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Endoscopic Devices Maintenance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Endoscopic Devices Maintenance Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Endoscopic Devices Maintenance Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Endoscopic Devices Maintenance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Endoscopic Devices Maintenance Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Endoscopic Devices Maintenance Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Endoscopic Devices Maintenance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Endoscopic Devices Maintenance Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Endoscopic Devices Maintenance?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Endoscopic Devices Maintenance?

Key companies in the market include GE Healthcare (US), Koninklijke Philips N.V. (Netherlands), Siemens Healthineers (Germany), Toshiba Medical Systems Europe (Germany), Dragerwerk AG & Co. KGaA (Germany), TBS Group S.p.A. (Italy), Alliance Medical Group (U.K.), Pantheon Group (Italy), Technologie Sanitarie S.p.A. (Italy), Avensys UK Ltd. (U.K.), Grupo Empresarial Electromedico (Spain).

3. What are the main segments of the Endoscopic Devices Maintenance?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Endoscopic Devices Maintenance," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Endoscopic Devices Maintenance report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Endoscopic Devices Maintenance?

To stay informed about further developments, trends, and reports in the Endoscopic Devices Maintenance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence