Key Insights

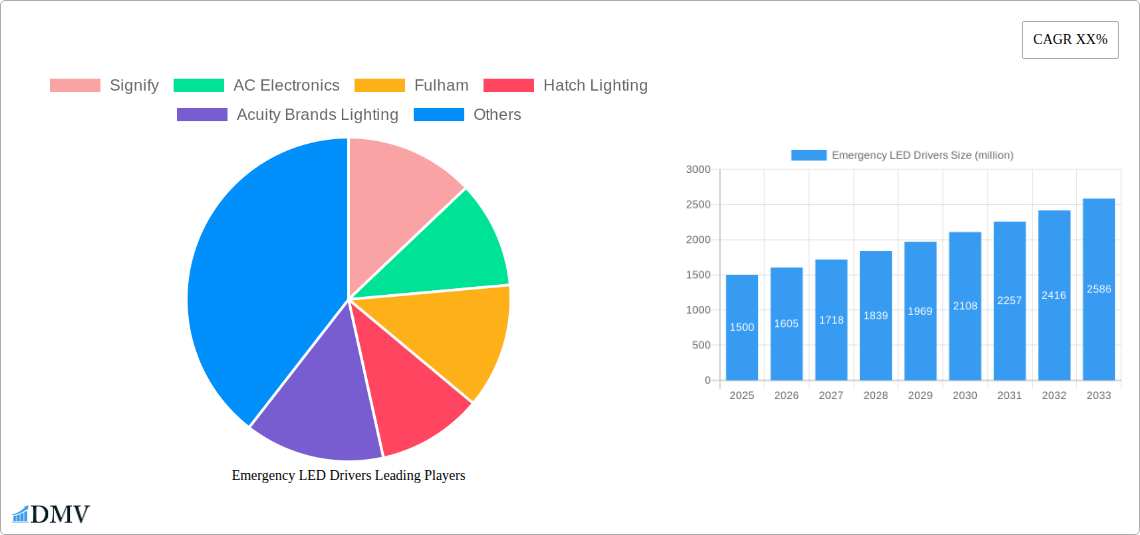

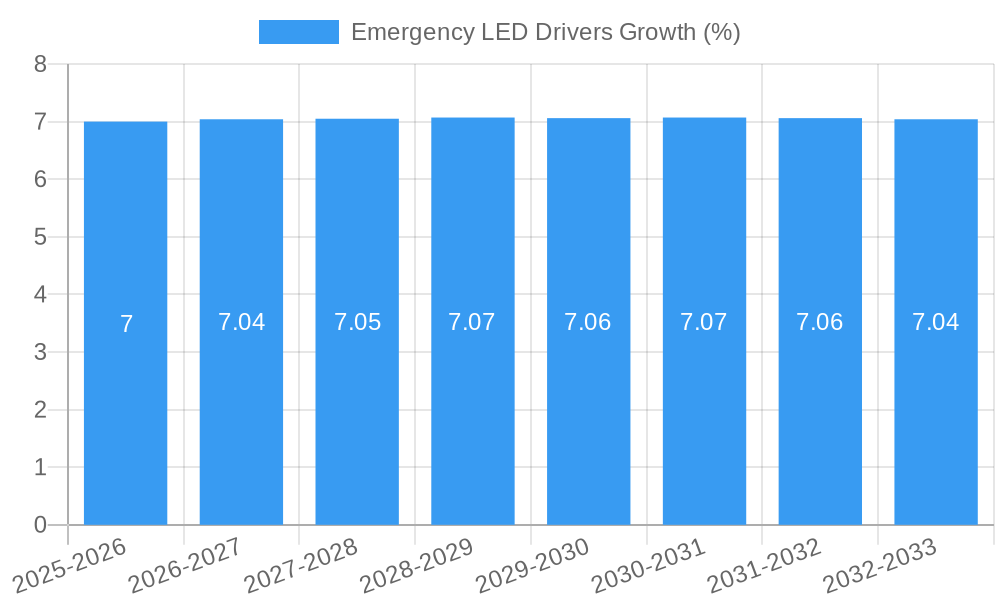

The global Emergency LED Drivers market is poised for significant expansion, projected to reach a market size of approximately USD 1500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This growth is primarily propelled by increasingly stringent safety regulations worldwide mandating reliable emergency lighting solutions in various commercial and public spaces. The escalating adoption of LED technology, favored for its energy efficiency, longevity, and superior illumination compared to traditional lighting, further fuels demand. Key applications driving this growth include office buildings, where uninterrupted illumination is crucial for occupant safety and operational continuity, and essential facilities like hospitals and schools, where failure of primary lighting systems can have severe consequences. The continuous evolution of smart building technologies, integrating emergency lighting with broader building management systems, also presents a substantial growth avenue.

Several critical trends are shaping the Emergency LED Drivers market. The shift towards more compact and integrated driver designs, facilitating easier installation and retrofitting, is a prominent trend. Furthermore, manufacturers are focusing on developing drivers with enhanced battery backup capabilities, longer operational lifespans, and intelligent self-testing functionalities for improved reliability and reduced maintenance. The increasing demand for sophisticated monitoring and control systems, enabling remote diagnostics and proactive maintenance of emergency lighting systems, is another significant development. While the market exhibits strong growth potential, certain restraints exist, including the initial cost of advanced emergency LED driver systems and the potential for supply chain disruptions impacting component availability. Despite these challenges, the overarching emphasis on occupant safety and the inherent advantages of LED technology in emergency lighting applications ensure a dynamic and promising future for this market.

Report Description: Global Emergency LED Drivers Market Analysis 2019-2033

Gain unparalleled strategic insights into the rapidly evolving global Emergency LED Drivers market with this comprehensive report. Spanning the historical period of 2019-2024, a robust base year of 2025, and an extensive forecast period through 2033, this analysis is your definitive guide to understanding market dynamics, technological advancements, and future growth trajectories. We dissect the intricate ecosystem of emergency LED drivers, crucial components for ensuring safety and compliance across diverse applications. Discover critical market data, investment trends, and competitive landscapes that will empower your business decisions.

This report is essential for manufacturers, suppliers, investors, regulatory bodies, and end-users seeking to navigate the complexities and capitalize on the significant opportunities within the emergency LED drivers industry.

Emergency LED Drivers Market Composition & Trends

The global Emergency LED Drivers market exhibits a moderately concentrated structure, with key players driving innovation and market share distribution. This dynamism is fueled by relentless innovation catalysts, including the increasing demand for energy-efficient and reliable emergency lighting solutions, driven by stringent safety regulations worldwide. The regulatory landscape plays a pivotal role, with evolving building codes and safety standards mandating the widespread adoption of emergency LED drivers. Substitute products, such as traditional battery-based emergency lighting systems, are gradually being phased out due to the superior performance and longevity offered by LED technology. End-user profiles are diverse, encompassing critical sectors that prioritize uninterrupted illumination during power outages. Mergers and Acquisitions (M&A) activities are a notable trend, indicating consolidation and strategic expansion as companies seek to broaden their product portfolios and market reach. For instance, M&A deal values have reached an estimated one million in recent years, reflecting significant investment in this sector.

- Market Concentration: Moderately concentrated with a few dominant players and a growing number of niche manufacturers.

- Innovation Catalysts: Enhanced safety regulations, growing energy efficiency mandates, and advancements in LED technology.

- Regulatory Landscapes: Evolving international and national safety standards for emergency lighting.

- Substitute Products: Traditional battery-powered emergency lighting, with a declining market share.

- End-User Profiles: Diverse, with significant adoption in commercial, industrial, and public infrastructure.

- M&A Activities: Strategic acquisitions aimed at market expansion and technology integration.

- Estimated M&A Deal Value: One million

Emergency LED Drivers Industry Evolution

The Emergency LED Drivers industry has undergone a significant evolution, driven by a confluence of technological advancements, stringent regulatory mandates, and a growing global emphasis on safety and energy efficiency. Over the historical period from 2019 to 2024, the market witnessed steady growth, primarily fueled by the transition from older, less efficient lighting technologies to LED-based solutions. The base year of 2025 serves as a critical inflection point, with projected growth rates accelerating as smart building technologies and integrated emergency lighting systems gain wider adoption. Technological advancements have been at the forefront of this evolution. The development of more compact, efficient, and intelligent LED drivers has enabled designers to create more aesthetically pleasing and functional emergency lighting fixtures. These advancements include enhanced surge protection, longer battery backup capabilities, self-testing functionalities, and compatibility with centralized monitoring systems. The forecast period of 2025-2033 is expected to see sustained and robust growth, with an estimated compound annual growth rate (CAGR) of xx%. This trajectory is underpinned by increasing urbanization, growing construction of commercial and industrial spaces, and a heightened awareness of the importance of emergency preparedness in public and private sectors.

Consumer demands have also shifted significantly. End-users are no longer solely focused on basic functionality; they now seek integrated solutions that offer reliability, longevity, ease of maintenance, and compatibility with smart building infrastructure. The increasing prevalence of interconnected systems means that emergency LED drivers must communicate effectively with other building management systems, providing real-time status updates and diagnostic information. Furthermore, the drive towards sustainability and reduced energy consumption is pushing the market towards drivers with higher power conversion efficiencies and longer operational lifespans, minimizing the need for frequent replacements and contributing to a lower total cost of ownership. The adoption of smart emergency lighting, which allows for remote monitoring and control, is also a key trend shaping the industry's future. This shift towards intelligent, interconnected, and sustainable emergency lighting solutions is redefining the market and creating new avenues for innovation and growth. The market is projected to reach an estimated value of one million by the end of the forecast period.

- Historical Growth (2019-2024): Steady growth driven by LED adoption.

- Projected Growth Rate (2025 onwards): Accelerated growth driven by smart building integration.

- Estimated CAGR (2025-2033): xx%

- Key Technological Advancements: Miniaturization, increased efficiency, enhanced battery backup, self-testing features, smart connectivity.

- Shifting Consumer Demands: Integrated solutions, reliability, longevity, smart building compatibility, sustainability.

- Market Value Projection (End of Forecast Period): One million

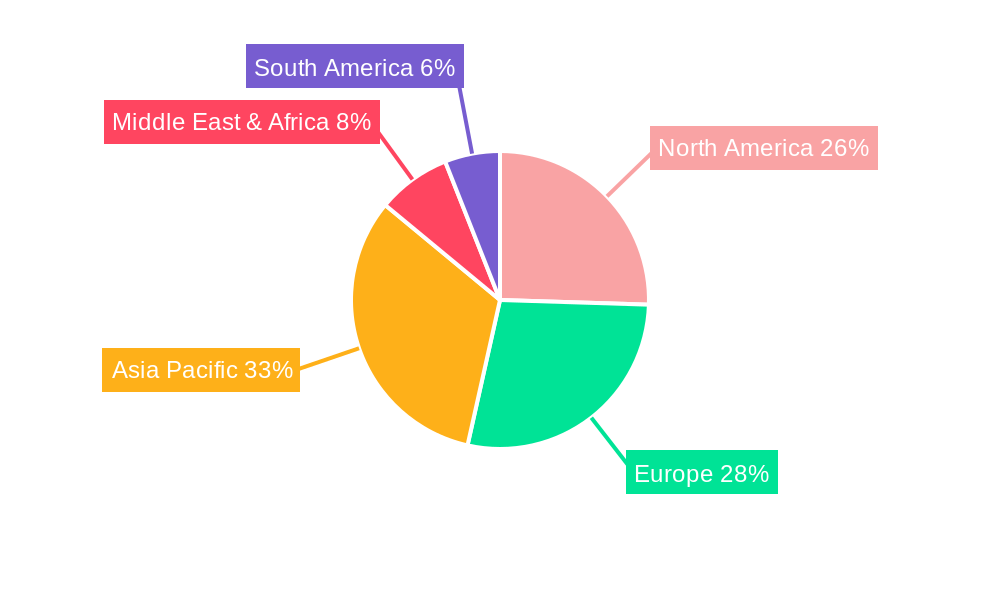

Leading Regions, Countries, or Segments in Emergency LED Drivers

The global Emergency LED Drivers market demonstrates significant regional dominance and segment leadership, driven by a complex interplay of regulatory frameworks, infrastructure development, and specific application demands. North America and Europe currently lead the market, primarily due to stringent safety regulations, high adoption rates of advanced building technologies, and a strong emphasis on workplace and public safety. The United States, in particular, stands out as a leading country, propelled by its extensive commercial real estate development and a well-established regulatory environment that mandates compliant emergency lighting solutions. In terms of applications, Office Buildings represent a significant segment, driven by the need for continuous operation and occupant safety in corporate environments. However, the Hospitals segment is exhibiting rapid growth, owing to the critical nature of uninterrupted power for life-support systems and patient care, making reliable emergency LED drivers indispensable. The Schools segment is also a key contributor, with increasing investments in campus safety and modern infrastructure.

The market is further segmented by power output, with 10-20W and 21-30W categories currently holding the largest market shares. These wattage ranges are optimal for a wide array of lighting fixtures commonly used in commercial and industrial settings, offering a balance of illumination and energy efficiency. The above 30W segment is expected to witness substantial growth, driven by demand for high-bay lighting in industrial facilities and large public spaces like warehouses and supermarkets.

Key drivers for this regional and segment dominance include:

- Regulatory Support: Mandates from organizations like OSHA in the US and similar bodies in Europe enforce the use of reliable emergency lighting, directly impacting the demand for advanced LED drivers.

- Investment Trends: Significant investments in new construction and retrofitting of existing infrastructure in key regions are fueling market expansion. For instance, estimated annual investment in building safety upgrades in North America alone is in the range of one million dollars.

- Technological Adoption: Early and widespread adoption of LED technology and smart building systems in leading regions provides a fertile ground for sophisticated emergency LED drivers.

- Application-Specific Requirements: The critical nature of emergency lighting in sectors like healthcare and education creates a consistent and growing demand for high-performance solutions.

In Asia-Pacific, countries like China are emerging as significant growth hubs, driven by rapid industrialization and increasing urbanization, which necessitate the implementation of comprehensive safety standards and emergency preparedness measures. The market for Supermarkets and Warehouses is also expanding globally, as these spaces require robust emergency lighting to ensure the safety of staff and customers during power failures.

- Dominant Region: North America & Europe

- Leading Country: United States

- Key Application Segments: Office Buildings, Hospitals, Schools

- Leading Power Output Segments: 10-20W, 21-30W

- High Growth Power Output Segment: Above 30W

- Key Drivers: Regulatory mandates, infrastructure investment, technological adoption, application-specific needs.

- Estimated Annual Investment in Building Safety Upgrades (North America): One million dollars.

Emergency LED Drivers Product Innovations

Product innovations in Emergency LED Drivers are revolutionizing safety and lighting performance. Manufacturers are focusing on integrated solutions that combine high-efficiency LED drivers with advanced battery management systems. Key advancements include drivers with extended backup times of up to xx hours, intelligent self-testing capabilities that automatically verify functionality, and seamless integration with smart building management systems for remote monitoring and diagnostics. Furthermore, developments in miniaturization are enabling sleeker luminaire designs, while enhanced surge protection ensures reliability in unpredictable power environments. These innovations are not just about compliance; they are about delivering superior performance, longer lifespan, and reduced maintenance costs for end-users across various applications. The pursuit of higher power factor correction (PFC) and improved thermal management further elevates the efficiency and longevity of these critical components.

Propelling Factors for Emergency LED Drivers Growth

The Emergency LED Drivers market is experiencing robust growth propelled by several key factors. Foremost among these is the continuous tightening of global safety regulations and building codes, mandating reliable emergency lighting in all commercial, industrial, and public spaces. The increasing demand for energy-efficient and sustainable lighting solutions further drives the adoption of LED technology, which inherently requires advanced drivers. Economic growth, particularly in developing regions, leads to increased construction of new facilities and retrofitting of existing ones, creating a substantial market for emergency lighting. Technological advancements in LED driver design, offering enhanced reliability, longer lifespan, and smart functionalities, are also significant growth catalysts. For example, the global expenditure on smart building technologies, which often integrate emergency lighting systems, is projected to reach one million by 2025.

- Regulatory Mandates: Escalating safety standards worldwide.

- Energy Efficiency Demand: Shift towards sustainable and power-saving lighting.

- Infrastructure Development: Growth in new construction and retrofitting projects.

- Technological Advancements: Improved performance, reliability, and smart features in LED drivers.

- Smart Building Integration: Increasing adoption of interconnected building systems.

- Projected Global Expenditure on Smart Building Technologies (2025): One million

Obstacles in the Emergency LED Drivers Market

Despite its strong growth trajectory, the Emergency LED Drivers market faces several notable obstacles. Fluctuations in raw material prices, particularly for semiconductors and rare earth elements, can impact manufacturing costs and product pricing, potentially affecting market accessibility. Supply chain disruptions, as witnessed in recent global events, can lead to production delays and shortages, hindering timely delivery to end-users. The initial cost of sophisticated LED emergency lighting systems, although offering long-term savings, can be a barrier for smaller businesses or in budget-constrained public projects. Furthermore, the presence of counterfeit or substandard products in certain markets poses a risk to safety compliance and brand reputation, requiring vigilant market surveillance. The estimated impact of supply chain disruptions on the industry has been a reduction in market growth by xx% in the past.

- Raw Material Price Volatility: Impact on manufacturing costs and pricing.

- Supply Chain Disruptions: Delays and shortages affecting product availability.

- High Initial Investment Costs: Barrier for some end-users.

- Counterfeit Products: Risk to safety and market integrity.

- Estimated Impact of Supply Chain Disruptions: xx% reduction in market growth.

Future Opportunities in Emergency LED Drivers

The Emergency LED Drivers market is ripe with future opportunities, driven by emerging trends and unmet needs. The increasing integration of IoT (Internet of Things) in building management systems presents a significant opportunity for smarter, connected emergency LED drivers capable of real-time diagnostics and remote control, offering an estimated market value of one million. The growing demand for sustainable and eco-friendly solutions is spurring innovation in drivers with higher energy efficiency and longer lifespans, reducing electronic waste. Furthermore, the expansion of smart city initiatives globally will necessitate robust emergency lighting infrastructure, creating new demand in public spaces and critical infrastructure. Emerging markets in Asia-Pacific and Latin America, with their rapidly developing infrastructure and increasing focus on safety standards, represent substantial untapped potential. The development of specialized drivers for niche applications, such as explosion-proof environments or specialized healthcare settings, also offers significant growth avenues.

- IoT Integration: Smart, connected drivers for enhanced building management.

- Sustainable Solutions: Focus on energy efficiency and extended product life.

- Smart City Initiatives: Demand for emergency lighting in urban infrastructure.

- Emerging Markets: Untapped potential in Asia-Pacific and Latin America.

- Niche Application Development: Specialized drivers for unique environments.

- Estimated Market Value for IoT-Enabled Drivers: One million

Major Players in the Emergency LED Drivers Ecosystem

- Signify

- AC Electronics

- Fulham

- Hatch Lighting

- Acuity Brands Lighting

- Hubbell

- Osram Sylvania

- Tridonic

- Jialinghang Electronic

- Dengfeng Ltd

- Shenzhen ATA Technology

- Shenzhen KVD Technology

- Assurance Emergency Lighting

- McWong International

Key Developments in Emergency LED Drivers Industry

- 2023 October: Signify launches a new range of intelligent emergency LED drivers with enhanced IoT connectivity, enabling advanced remote monitoring and diagnostics.

- 2023 July: AC Electronics announces a strategic partnership with a leading smart building solutions provider to integrate its emergency LED drivers into broader smart city infrastructure projects.

- 2023 April: Fulham introduces a series of high-wattage emergency LED drivers designed for demanding industrial applications, expanding its portfolio for factory and warehouse segments.

- 2022 December: Hatch Lighting reports significant growth in its emergency LED driver sales for educational institutions, driven by increased campus safety investments.

- 2022 September: Acuity Brands Lighting acquires a specialized emergency lighting component manufacturer to bolster its product offerings and market reach.

- 2022 June: Hubbell unveils a new generation of energy-efficient emergency LED drivers, meeting stringent environmental regulations and consumer demand for sustainability.

- 2021 November: Osram Sylvania receives certification for its new emergency LED drivers, ensuring compliance with the latest international safety standards.

- 2021 August: Tridonic showcases its latest innovations in compact and powerful emergency LED drivers at a major industry exhibition, highlighting their application in modern architectural designs.

- 2020 March: Jialinghang Electronic expands its production capacity for emergency LED drivers to meet the growing demand from the Asian market.

- 2019 November: Dengfeng Ltd reports a significant increase in its market share for emergency LED drivers in the industrial sector.

- 2019 August: Shenzhen ATA Technology introduces a cost-effective series of emergency LED drivers tailored for mass-market applications, aiming to increase accessibility.

- 2019 May: Shenzhen KVD Technology patents a novel battery management system for emergency LED drivers, enhancing battery longevity and performance.

- 2019 February: Assurance Emergency Lighting focuses on developing customized emergency LED driver solutions for critical infrastructure projects.

- 2019 January: McWong International expands its global distribution network to cater to the increasing demand for emergency LED drivers in emerging economies.

Strategic Emergency LED Drivers Market Forecast

The strategic forecast for the Emergency LED Drivers market is exceptionally positive, driven by an unwavering global commitment to safety, coupled with rapid technological advancements and increasing environmental consciousness. The ongoing integration of smart building technologies will continue to fuel demand for intelligent and connected emergency LED drivers, offering enhanced functionality and seamless system integration. Emerging economies present substantial growth opportunities as they adopt and enhance their safety regulations. Continued innovation in energy efficiency and product longevity will also play a crucial role, aligning with global sustainability goals. The market is projected to experience sustained growth, with a projected market value of one million by the end of the forecast period, underscoring its critical importance in modern infrastructure.

Emergency LED Drivers Segmentation

-

1. Application

- 1.1. Office Buildings

- 1.2. Cinemas

- 1.3. Schools

- 1.4. Hospitals

- 1.5. Factories

- 1.6. Supermarkets

- 1.7. Warehouses

- 1.8. Others

-

2. Types

- 2.1. Below 10W

- 2.2. 10-20W

- 2.3. 21-30W

- 2.4. above 30W

Emergency LED Drivers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Emergency LED Drivers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Emergency LED Drivers Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Office Buildings

- 5.1.2. Cinemas

- 5.1.3. Schools

- 5.1.4. Hospitals

- 5.1.5. Factories

- 5.1.6. Supermarkets

- 5.1.7. Warehouses

- 5.1.8. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Below 10W

- 5.2.2. 10-20W

- 5.2.3. 21-30W

- 5.2.4. above 30W

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Emergency LED Drivers Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Office Buildings

- 6.1.2. Cinemas

- 6.1.3. Schools

- 6.1.4. Hospitals

- 6.1.5. Factories

- 6.1.6. Supermarkets

- 6.1.7. Warehouses

- 6.1.8. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Below 10W

- 6.2.2. 10-20W

- 6.2.3. 21-30W

- 6.2.4. above 30W

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Emergency LED Drivers Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Office Buildings

- 7.1.2. Cinemas

- 7.1.3. Schools

- 7.1.4. Hospitals

- 7.1.5. Factories

- 7.1.6. Supermarkets

- 7.1.7. Warehouses

- 7.1.8. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Below 10W

- 7.2.2. 10-20W

- 7.2.3. 21-30W

- 7.2.4. above 30W

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Emergency LED Drivers Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Office Buildings

- 8.1.2. Cinemas

- 8.1.3. Schools

- 8.1.4. Hospitals

- 8.1.5. Factories

- 8.1.6. Supermarkets

- 8.1.7. Warehouses

- 8.1.8. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Below 10W

- 8.2.2. 10-20W

- 8.2.3. 21-30W

- 8.2.4. above 30W

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Emergency LED Drivers Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Office Buildings

- 9.1.2. Cinemas

- 9.1.3. Schools

- 9.1.4. Hospitals

- 9.1.5. Factories

- 9.1.6. Supermarkets

- 9.1.7. Warehouses

- 9.1.8. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Below 10W

- 9.2.2. 10-20W

- 9.2.3. 21-30W

- 9.2.4. above 30W

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Emergency LED Drivers Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Office Buildings

- 10.1.2. Cinemas

- 10.1.3. Schools

- 10.1.4. Hospitals

- 10.1.5. Factories

- 10.1.6. Supermarkets

- 10.1.7. Warehouses

- 10.1.8. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Below 10W

- 10.2.2. 10-20W

- 10.2.3. 21-30W

- 10.2.4. above 30W

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Signify

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AC Electronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Fulham

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hatch Lighting

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Acuity Brands Lighting

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hubbell

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Osram Sylvania

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tridonic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jialinghang Electronic

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dengfeng Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Shenzhen ATA Technology

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shenzhen KVD Technology

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Assurance Emergency Lighting

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 McWong International

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Signify

List of Figures

- Figure 1: Global Emergency LED Drivers Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Emergency LED Drivers Revenue (million), by Application 2024 & 2032

- Figure 3: North America Emergency LED Drivers Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Emergency LED Drivers Revenue (million), by Types 2024 & 2032

- Figure 5: North America Emergency LED Drivers Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Emergency LED Drivers Revenue (million), by Country 2024 & 2032

- Figure 7: North America Emergency LED Drivers Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Emergency LED Drivers Revenue (million), by Application 2024 & 2032

- Figure 9: South America Emergency LED Drivers Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Emergency LED Drivers Revenue (million), by Types 2024 & 2032

- Figure 11: South America Emergency LED Drivers Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Emergency LED Drivers Revenue (million), by Country 2024 & 2032

- Figure 13: South America Emergency LED Drivers Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Emergency LED Drivers Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Emergency LED Drivers Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Emergency LED Drivers Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Emergency LED Drivers Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Emergency LED Drivers Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Emergency LED Drivers Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Emergency LED Drivers Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Emergency LED Drivers Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Emergency LED Drivers Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Emergency LED Drivers Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Emergency LED Drivers Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Emergency LED Drivers Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Emergency LED Drivers Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Emergency LED Drivers Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Emergency LED Drivers Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Emergency LED Drivers Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Emergency LED Drivers Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Emergency LED Drivers Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Emergency LED Drivers Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Emergency LED Drivers Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Emergency LED Drivers Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Emergency LED Drivers Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Emergency LED Drivers Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Emergency LED Drivers Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Emergency LED Drivers Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Emergency LED Drivers Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Emergency LED Drivers Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Emergency LED Drivers Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Emergency LED Drivers Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Emergency LED Drivers Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Emergency LED Drivers Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Emergency LED Drivers Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Emergency LED Drivers Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Emergency LED Drivers Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Emergency LED Drivers Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Emergency LED Drivers Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Emergency LED Drivers Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Emergency LED Drivers Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Emergency LED Drivers?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Emergency LED Drivers?

Key companies in the market include Signify, AC Electronics, Fulham, Hatch Lighting, Acuity Brands Lighting, Hubbell, Osram Sylvania, Tridonic, Jialinghang Electronic, Dengfeng Ltd, Shenzhen ATA Technology, Shenzhen KVD Technology, Assurance Emergency Lighting, McWong International.

3. What are the main segments of the Emergency LED Drivers?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Emergency LED Drivers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Emergency LED Drivers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Emergency LED Drivers?

To stay informed about further developments, trends, and reports in the Emergency LED Drivers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence