Key Insights

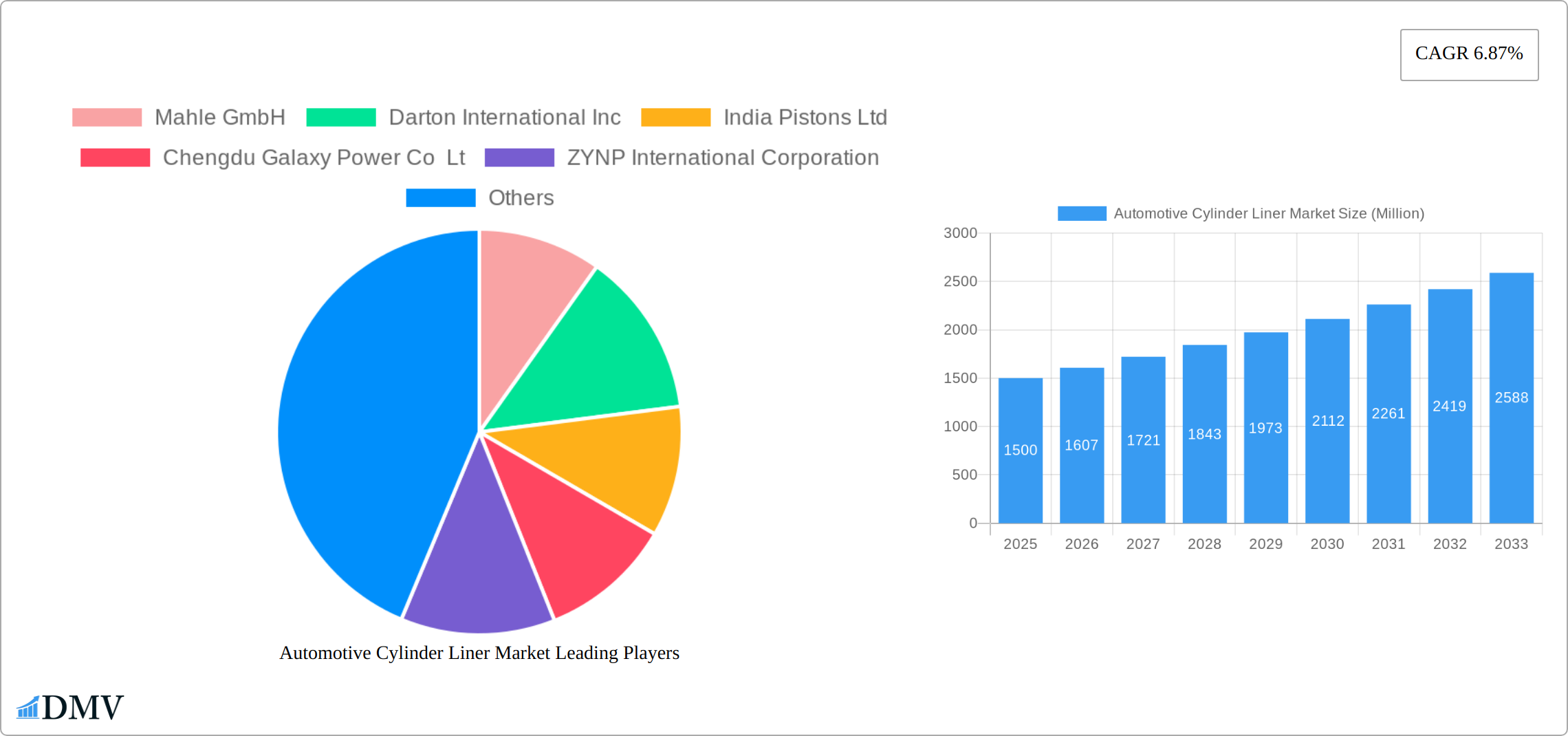

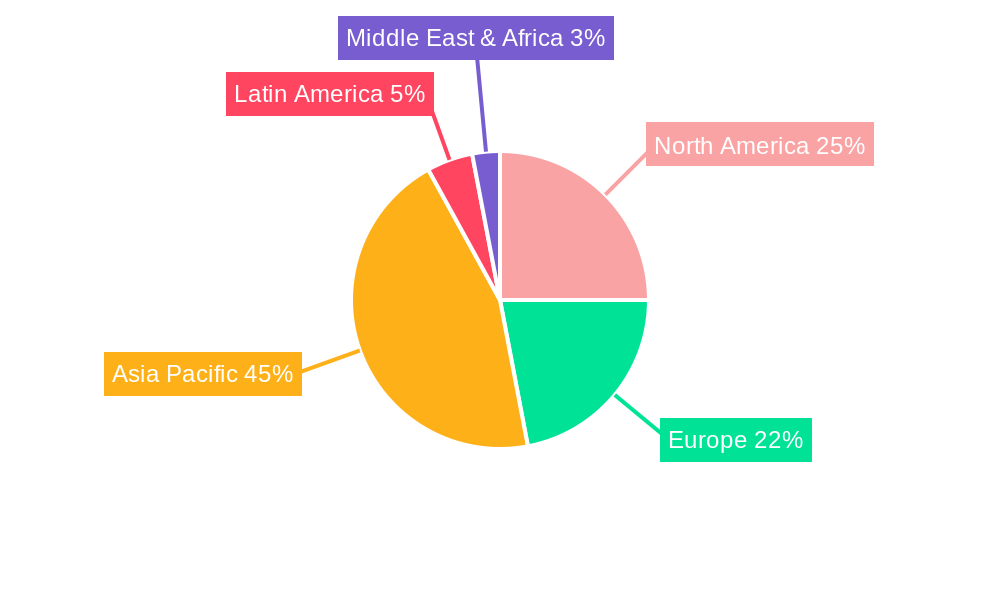

The global automotive cylinder liner market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.87% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for fuel-efficient vehicles, particularly in the passenger car and light commercial vehicle segments, is a significant catalyst. Advancements in material science, leading to the development of lighter and more durable cylinder liners (like aluminum and titanium options), are also contributing to market growth. Furthermore, the rising adoption of advanced engine technologies, such as downsized engines and hybrid powertrains, necessitates the use of high-performance cylinder liners, boosting market demand. The market is segmented by material type (cast iron, stainless steel, aluminum, titanium), fuel type (gasoline, diesel), contact type (wet and dry cylinder liners), and vehicle type (passenger cars, light commercial vehicles, medium and heavy-duty commercial vehicles). While the Asia-Pacific region, particularly China and India, is expected to dominate due to high vehicle production volumes, North America and Europe will also contribute significantly to market growth, fueled by stringent emission regulations and a growing preference for technologically advanced vehicles.

The market's growth trajectory, however, faces some constraints. Fluctuations in raw material prices, particularly for metals like steel and aluminum, can impact production costs and profitability. Furthermore, the increasing adoption of electric vehicles (EVs) poses a long-term challenge, as EVs utilize different powertrain technologies and therefore have reduced reliance on traditional cylinder liners. Despite this, the continued demand for internal combustion engine (ICE) vehicles, especially in developing economies, coupled with ongoing technological innovations within the ICE sector, is likely to support sustained market growth throughout the forecast period. Competitive pressures from numerous established and emerging players further shape the market landscape, driving innovation and price competition.

This comprehensive report provides an in-depth analysis of the Automotive Cylinder Liner Market, projecting robust growth from 2019 to 2033. It meticulously examines market trends, technological advancements, and competitive dynamics, offering crucial insights for stakeholders seeking to navigate this dynamic industry. The report leverages extensive data analysis and market intelligence to forecast market value and identify key opportunities. With a base year of 2025 and a forecast period spanning 2025-2033, this report serves as an invaluable resource for strategic decision-making. The global market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Automotive Cylinder Liner Market Market Composition & Trends

The automotive cylinder liner market presents a dynamic competitive landscape characterized by a moderate level of concentration. Leading global manufacturers such as Mahle GmbH, Tenneco Inc., and India Pistons Ltd, alongside other prominent players like GKN Zhongyuan Cylinder Liner Company Limited and Nippon Piston Ring Co Ltd, command significant market shares. However, the presence of a robust network of smaller, specialized manufacturers fosters a competitive environment that drives innovation and caters to diverse market needs. This intricate ecosystem is shaped by evolving technological frontiers, stringent regulatory frameworks, the emergence of substitute solutions, and strategic corporate activities.

- Market Share Distribution (2024 Estimates): While precise figures fluctuate, key players like Mahle GmbH, Tenneco Inc., and India Pistons Ltd are estimated to hold substantial portions, with a collective share of approximately 40-50%. The remaining share is distributed among numerous other manufacturers, indicating a healthy competitive diversity.

- Innovation Catalysts: The relentless pursuit of enhanced fuel efficiency and reduced emissions is the primary engine for innovation in cylinder liner technology. Advancements in materials science, including the development of advanced alloys and coatings, are crucial for improving wear resistance, reducing friction, and optimizing thermal management. The ongoing evolution of engine designs, such as downsizing and turbocharging, also necessitates the development of more robust and high-performance liners.

- Regulatory Landscape: Global emission standards, such as Euro 7 and EPA regulations, are increasingly stringent, compelling manufacturers to develop cylinder liners that contribute to cleaner combustion and lower exhaust emissions. Fuel economy mandates also play a significant role, driving the demand for lightweight materials and designs that minimize internal engine friction.

- Substitute Products: While direct substitutes for cylinder liners within traditional internal combustion engines are limited, advancements in alternative powertrain technologies, such as electric vehicles (EVs) and hydrogen fuel cell vehicles, represent indirect competition that influences the long-term market trajectory.

- End-User Profiles: The automotive original equipment manufacturers (OEMs) remain the primary consumers of cylinder liners, integrating them into new vehicle production lines. The aftermarket sector, catering to repair and maintenance needs, also represents a substantial and consistent demand source.

- M&A Activities: The automotive cylinder liner market has witnessed strategic mergers and acquisitions aimed at expanding product portfolios, enhancing technological capabilities, and consolidating market presence. Notable examples include consolidation efforts within the supply chain to achieve economies of scale and bolster R&D investments. The total M&A deal value over the past five years is estimated to be in the range of $200-$300 Million, reflecting a strategic consolidation drive.

Automotive Cylinder Liner Market Industry Evolution

The automotive cylinder liner market has undergone significant transformation, evolving from conventional cast iron components to sophisticated engineered solutions. During the historical period (2019-2024), the market demonstrated a Compound Annual Growth Rate (CAGR) of approximately 3.5% to 4.5%, largely propelled by the robust expansion of the global automotive industry and the persistent demand for high-performance and durable engine components. Technological advancements have been a cornerstone of this evolution. The introduction of advanced materials like high-strength aluminum alloys and specialized cast iron variants, coupled with enhanced manufacturing techniques such as plasma spraying and advanced honing, has resulted in cylinder liners with superior wear resistance, improved thermal conductivity, and significantly reduced frictional losses. These innovations directly contribute to greater engine efficiency and extended component lifespan. The growing emphasis on vehicle lightweighting to improve fuel economy, alongside the increasing integration of advanced driver-assistance systems (ADAS) which indirectly influence engine design for better performance, have further catalyzed market growth. Looking ahead, the forecast period (2025-2033) is projected to witness continued, albeit potentially moderated, growth with an estimated CAGR of 3.0% to 4.0%. This sustained expansion will be driven by the burgeoning automotive sectors in emerging economies, particularly in Asia and Africa, and the accelerating adoption of hybrid and electric vehicles, which, while eventually reducing the demand for traditional ICE components, still require advanced cylinder liners for their internal combustion engine elements. A significant driver for the forecast period will be the ongoing development of cylinder liners optimized for alternative fuels and advanced combustion strategies aimed at meeting increasingly stringent environmental regulations.

Leading Regions, Countries, or Segments in Automotive Cylinder Liner Market

The global automotive cylinder liner market exhibits distinct regional dominance and segment preferences, driven by varying industrial strengths, economic conditions, and regulatory landscapes.

- Dominant Region: The Asia Pacific region stands as the largest market for automotive cylinder liners. This dominance is primarily attributed to its status as a global manufacturing hub for automobiles, with substantial production volumes in countries like China, India, and Japan. Supportive government policies promoting automotive manufacturing, significant investments in automotive infrastructure, and a burgeoning middle class driving vehicle demand contribute to this leadership.

- Dominant Material Type: Cast iron, particularly grey cast iron, continues to be the dominant material due to its inherent cost-effectiveness, excellent damping properties, and proven durability in a wide range of applications. However, the demand for advanced materials such as aluminum alloys and stainless steel is on a notable upswing. These materials offer superior lightweighting capabilities and improved thermal management, aligning with the industry's push for fuel efficiency and performance optimization.

- Dominant Fuel Type: Historically, the diesel segment has held a larger market share, largely due to its prevalence in heavy-duty commercial vehicles and certain passenger car segments where torque and fuel efficiency are paramount. However, a gradual shift is observed towards gasoline-powered engines in passenger vehicles, influenced by evolving emission standards and consumer preferences. The growing interest in alternative fuels and the rise of hybrid powertrains are also beginning to reshape this segment's dynamics.

- Dominant Contact Type: Wet cylinder liners, which are directly cooled by the engine's coolant, remain the most widely adopted type due to their established manufacturing processes, superior heat dissipation capabilities, and robustness. Dry cylinder liners, which rely on the surrounding engine block for cooling, are gaining traction in specific applications where space constraints or design optimization favors their use, offering potential for improved thermal efficiency in certain engine configurations.

- Dominant Vehicle Type: Medium and heavy-duty commercial vehicles represent a significant segment for cylinder liner consumption. These vehicles, engaged in long-haul transportation and demanding operational cycles, require engines with higher capacities and greater durability, making robust cylinder liners a critical component. The passenger vehicle segment also contributes substantially due to sheer volume.

Key Drivers:

- Asia-Pacific: Rapid industrialization, substantial growth in vehicle production and sales, and government incentives for local manufacturing.

- Cast Iron: Cost-efficiency, proven reliability and durability, and extensive manufacturing expertise.

- Diesel: Strong presence in commercial vehicle segments, high torque output, and established fuel infrastructure.

- Wet Cylinder Liners: Superior cooling efficiency, robust performance, and widespread adoption in existing engine designs.

- Medium and Heavy-Duty Commercial Vehicles: High operational demands, large engine displacements, and critical need for component longevity.

Automotive Cylinder Liner Market Product Innovations

Recent innovations focus on enhancing durability, reducing friction, and improving fuel efficiency. Materials science advancements have led to the development of lighter and stronger cylinder liners using advanced alloys. Optimized designs and surface treatments further minimize friction and wear, leading to extended engine lifespan and reduced fuel consumption. Some manufacturers are incorporating coatings that enhance heat dissipation and reduce the risk of damage. These advancements result in improved engine performance, reduced emissions, and increased cost-effectiveness.

Propelling Factors for Automotive Cylinder Liner Market Growth

The automotive cylinder liner market's expansion is propelled by a confluence of interconnected factors. The ever-tightening global emission regulations, such as Euro 7 and forthcoming EPA standards, are a primary impetus, compelling automakers to develop more fuel-efficient and cleaner-burning engines, thereby necessitating advanced cylinder liner technologies that minimize friction and optimize combustion. Robust global economic growth, particularly in emerging economies, translates into increased disposable incomes and a subsequent surge in vehicle ownership and demand for new vehicles, directly fueling the need for cylinder liners. Furthermore, continuous technological advancements in materials science and manufacturing processes are instrumental. The development of novel alloys with enhanced strength-to-weight ratios, superior wear resistance, and improved thermal conductivity, alongside sophisticated manufacturing techniques like advanced coatings and precision honing, are continuously enhancing the performance, durability, and efficiency of cylinder liners, making them indispensable components for modern automotive engines.

Obstacles in the Automotive Cylinder Liner Market Market

The market faces challenges from fluctuating raw material prices impacting production costs and profitability. Supply chain disruptions can lead to production delays and shortages. Intense competition among established players and the emergence of new entrants create pressure on pricing and profit margins. Finally, stringent environmental regulations can increase compliance costs and necessitate technological adaptations.

Future Opportunities in Automotive Cylinder Liner Market

The growth of the electric vehicle market represents a potential challenge but also an opportunity. The development of cylinder liners for alternative fuel engines, including hybrid and hydrogen vehicles, presents a significant growth avenue. Moreover, exploring new materials and manufacturing processes can further optimize cylinder liner performance and contribute to market expansion.

Major Players in the Automotive Cylinder Liner Market Ecosystem

- Mahle GmbH

- Darton International Inc

- India Pistons Ltd

- Chengdu Galaxy Power Co Ltd

- ZYNP International Corporation

- TPR Co Ltd

- Motordetal

- Laystall Engineering Co Ltd

- Westwood Cylinder Liners Ltd

- Yangzhou Wutingqiao Cylinder Liner Co Ltd

- Kusalava International

- Nippon Piston Ring Co Ltd

- GKN Zhongyuan Cylinder Liner Company Limited

- Melling Cylinder Sleeves

- Tenneco Inc

- Cooper Corp

- Yoosung Enterprise Co Ltd

- Federal-Mogul Powertrain (now part of Tenneco)

- Roto-Mold (part of A. Raymond Network)

- KS Kolbenschmidt (part of Rheinmetall AG)

Key Developments in Automotive Cylinder Liner Market Industry

- September 2022: Mahle GmbH unveiled CO2-neutral powertrain technologies, including a novel power cell unit with a cylinder liner, impacting the market with a focus on sustainability.

- February 2022: Cummins Inc. announced expansion of its powertrain platforms for lower-carbon fuels, indicating a shift in the industry towards sustainability and impacting cylinder liner demand.

- February 2022: Tenneco Inc.'s merger increased its stake in Federal-Mogul India, a significant player in cylinder liner production, resulting in market consolidation.

Strategic Automotive Cylinder Liner Market Market Forecast

The Automotive Cylinder Liner Market is poised for continued growth, driven by factors such as the increasing demand for fuel-efficient and sustainable vehicles. Technological advancements, stricter emission norms, and the expansion of the global automotive sector are key catalysts. The market is projected to experience robust growth during the forecast period, presenting significant opportunities for established players and new entrants alike. However, maintaining competitiveness will require continuous innovation and adaptation to emerging technological trends and environmental regulations.

Automotive Cylinder Liner Market Segmentation

-

1. Material Type

- 1.1. Cast Iron

- 1.2. Stainless Steel

- 1.3. Aluminum

- 1.4. Titanium

-

2. Fuel Type

- 2.1. Gasoline

- 2.2. Diesel

-

3. Contact

- 3.1. Wet Cylinder Liner

- 3.2. Dry Cylinder Liner

-

4. Vehicle Type

- 4.1. Passenger Cars

- 4.2. Light Commerical Vehicles

- 4.3. Medium and Heavy-duty Commercial Vehicles

Automotive Cylinder Liner Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Automotive Cylinder Liner Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Commercial Vehicles; Others

- 3.3. Market Restrains

- 3.3.1. Rapid Adoption of Electric Vehicles; Others

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment of the Market to Gain Traction during the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Cast Iron

- 5.1.2. Stainless Steel

- 5.1.3. Aluminum

- 5.1.4. Titanium

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Gasoline

- 5.2.2. Diesel

- 5.3. Market Analysis, Insights and Forecast - by Contact

- 5.3.1. Wet Cylinder Liner

- 5.3.2. Dry Cylinder Liner

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Passenger Cars

- 5.4.2. Light Commerical Vehicles

- 5.4.3. Medium and Heavy-duty Commercial Vehicles

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Cast Iron

- 6.1.2. Stainless Steel

- 6.1.3. Aluminum

- 6.1.4. Titanium

- 6.2. Market Analysis, Insights and Forecast - by Fuel Type

- 6.2.1. Gasoline

- 6.2.2. Diesel

- 6.3. Market Analysis, Insights and Forecast - by Contact

- 6.3.1. Wet Cylinder Liner

- 6.3.2. Dry Cylinder Liner

- 6.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.4.1. Passenger Cars

- 6.4.2. Light Commerical Vehicles

- 6.4.3. Medium and Heavy-duty Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Cast Iron

- 7.1.2. Stainless Steel

- 7.1.3. Aluminum

- 7.1.4. Titanium

- 7.2. Market Analysis, Insights and Forecast - by Fuel Type

- 7.2.1. Gasoline

- 7.2.2. Diesel

- 7.3. Market Analysis, Insights and Forecast - by Contact

- 7.3.1. Wet Cylinder Liner

- 7.3.2. Dry Cylinder Liner

- 7.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.4.1. Passenger Cars

- 7.4.2. Light Commerical Vehicles

- 7.4.3. Medium and Heavy-duty Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Cast Iron

- 8.1.2. Stainless Steel

- 8.1.3. Aluminum

- 8.1.4. Titanium

- 8.2. Market Analysis, Insights and Forecast - by Fuel Type

- 8.2.1. Gasoline

- 8.2.2. Diesel

- 8.3. Market Analysis, Insights and Forecast - by Contact

- 8.3.1. Wet Cylinder Liner

- 8.3.2. Dry Cylinder Liner

- 8.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.4.1. Passenger Cars

- 8.4.2. Light Commerical Vehicles

- 8.4.3. Medium and Heavy-duty Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Cast Iron

- 9.1.2. Stainless Steel

- 9.1.3. Aluminum

- 9.1.4. Titanium

- 9.2. Market Analysis, Insights and Forecast - by Fuel Type

- 9.2.1. Gasoline

- 9.2.2. Diesel

- 9.3. Market Analysis, Insights and Forecast - by Contact

- 9.3.1. Wet Cylinder Liner

- 9.3.2. Dry Cylinder Liner

- 9.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.4.1. Passenger Cars

- 9.4.2. Light Commerical Vehicles

- 9.4.3. Medium and Heavy-duty Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Cast Iron

- 10.1.2. Stainless Steel

- 10.1.3. Aluminum

- 10.1.4. Titanium

- 10.2. Market Analysis, Insights and Forecast - by Fuel Type

- 10.2.1. Gasoline

- 10.2.2. Diesel

- 10.3. Market Analysis, Insights and Forecast - by Contact

- 10.3.1. Wet Cylinder Liner

- 10.3.2. Dry Cylinder Liner

- 10.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.4.1. Passenger Cars

- 10.4.2. Light Commerical Vehicles

- 10.4.3. Medium and Heavy-duty Commercial Vehicles

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. North America Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Rest of North America

- 12. Europe Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Rest of Europe

- 13. Asia Pacific Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Argentina

- 14.1.4 Rest of Latin America

- 15. Middle East Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. United Arab Emirates Automotive Cylinder Liner Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 Saudi Arabia

- 16.1.2 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Mahle GmbH

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Darton International Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 India Pistons Ltd

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Chengdu Galaxy Power Co Lt

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 ZYNP International Corporation

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 TPR Co Ltd

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Motordetal

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Laystall Engineering Co Ltd

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Westwood Cylinder Liners Ltd

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Yangzhou Wutingqiao Cylinder Liner Co Ltd

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Kusalava International

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Nippon Piston Ring Co Ltd

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 GKN Zhongyuan Cylinder Liner Company Limited

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 Melling Cylinder Sleeves

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 Tenneco Inc

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.16 Cooper Corp

- 17.2.16.1. Overview

- 17.2.16.2. Products

- 17.2.16.3. SWOT Analysis

- 17.2.16.4. Recent Developments

- 17.2.16.5. Financials (Based on Availability)

- 17.2.17 Yoosung Enterprise Co Ltd

- 17.2.17.1. Overview

- 17.2.17.2. Products

- 17.2.17.3. SWOT Analysis

- 17.2.17.4. Recent Developments

- 17.2.17.5. Financials (Based on Availability)

- 17.2.1 Mahle GmbH

List of Figures

- Figure 1: Global Automotive Cylinder Liner Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: United Arab Emirates Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 13: United Arab Emirates Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Automotive Cylinder Liner Market Revenue (Million), by Material Type 2024 & 2032

- Figure 15: North America Automotive Cylinder Liner Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 16: North America Automotive Cylinder Liner Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 17: North America Automotive Cylinder Liner Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 18: North America Automotive Cylinder Liner Market Revenue (Million), by Contact 2024 & 2032

- Figure 19: North America Automotive Cylinder Liner Market Revenue Share (%), by Contact 2024 & 2032

- Figure 20: North America Automotive Cylinder Liner Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 21: North America Automotive Cylinder Liner Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 22: North America Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Automotive Cylinder Liner Market Revenue (Million), by Material Type 2024 & 2032

- Figure 25: Europe Automotive Cylinder Liner Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 26: Europe Automotive Cylinder Liner Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 27: Europe Automotive Cylinder Liner Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 28: Europe Automotive Cylinder Liner Market Revenue (Million), by Contact 2024 & 2032

- Figure 29: Europe Automotive Cylinder Liner Market Revenue Share (%), by Contact 2024 & 2032

- Figure 30: Europe Automotive Cylinder Liner Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 31: Europe Automotive Cylinder Liner Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 32: Europe Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific Automotive Cylinder Liner Market Revenue (Million), by Material Type 2024 & 2032

- Figure 35: Asia Pacific Automotive Cylinder Liner Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 36: Asia Pacific Automotive Cylinder Liner Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 37: Asia Pacific Automotive Cylinder Liner Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 38: Asia Pacific Automotive Cylinder Liner Market Revenue (Million), by Contact 2024 & 2032

- Figure 39: Asia Pacific Automotive Cylinder Liner Market Revenue Share (%), by Contact 2024 & 2032

- Figure 40: Asia Pacific Automotive Cylinder Liner Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 41: Asia Pacific Automotive Cylinder Liner Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 42: Asia Pacific Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Latin America Automotive Cylinder Liner Market Revenue (Million), by Material Type 2024 & 2032

- Figure 45: Latin America Automotive Cylinder Liner Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 46: Latin America Automotive Cylinder Liner Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 47: Latin America Automotive Cylinder Liner Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 48: Latin America Automotive Cylinder Liner Market Revenue (Million), by Contact 2024 & 2032

- Figure 49: Latin America Automotive Cylinder Liner Market Revenue Share (%), by Contact 2024 & 2032

- Figure 50: Latin America Automotive Cylinder Liner Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 51: Latin America Automotive Cylinder Liner Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 52: Latin America Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 53: Latin America Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

- Figure 54: Middle East and Africa Automotive Cylinder Liner Market Revenue (Million), by Material Type 2024 & 2032

- Figure 55: Middle East and Africa Automotive Cylinder Liner Market Revenue Share (%), by Material Type 2024 & 2032

- Figure 56: Middle East and Africa Automotive Cylinder Liner Market Revenue (Million), by Fuel Type 2024 & 2032

- Figure 57: Middle East and Africa Automotive Cylinder Liner Market Revenue Share (%), by Fuel Type 2024 & 2032

- Figure 58: Middle East and Africa Automotive Cylinder Liner Market Revenue (Million), by Contact 2024 & 2032

- Figure 59: Middle East and Africa Automotive Cylinder Liner Market Revenue Share (%), by Contact 2024 & 2032

- Figure 60: Middle East and Africa Automotive Cylinder Liner Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 61: Middle East and Africa Automotive Cylinder Liner Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 62: Middle East and Africa Automotive Cylinder Liner Market Revenue (Million), by Country 2024 & 2032

- Figure 63: Middle East and Africa Automotive Cylinder Liner Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Contact 2019 & 2032

- Table 5: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 6: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: China Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Japan Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: South Korea Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Mexico Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Brazil Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of Latin America Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Saudi Arabia Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Middle East and Africa Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 34: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 35: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Contact 2019 & 2032

- Table 36: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 37: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United States Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Canada Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of North America Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 42: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 43: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Contact 2019 & 2032

- Table 44: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 45: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Germany Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Spain Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Europe Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 52: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 53: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Contact 2019 & 2032

- Table 54: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 55: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: India Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: China Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Japan Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Korea Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 62: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 63: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Contact 2019 & 2032

- Table 64: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 65: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Mexico Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Brazil Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Argentina Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Rest of Latin America Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 71: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 72: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Contact 2019 & 2032

- Table 73: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 74: Global Automotive Cylinder Liner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 75: United Arab Emirates Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Saudi Arabia Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 77: Rest of Middle East and Africa Automotive Cylinder Liner Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Cylinder Liner Market?

The projected CAGR is approximately 6.87%.

2. Which companies are prominent players in the Automotive Cylinder Liner Market?

Key companies in the market include Mahle GmbH, Darton International Inc, India Pistons Ltd, Chengdu Galaxy Power Co Lt, ZYNP International Corporation, TPR Co Ltd, Motordetal, Laystall Engineering Co Ltd, Westwood Cylinder Liners Ltd, Yangzhou Wutingqiao Cylinder Liner Co Ltd, Kusalava International, Nippon Piston Ring Co Ltd, GKN Zhongyuan Cylinder Liner Company Limited, Melling Cylinder Sleeves, Tenneco Inc, Cooper Corp, Yoosung Enterprise Co Ltd.

3. What are the main segments of the Automotive Cylinder Liner Market?

The market segments include Material Type, Fuel Type, Contact, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Commercial Vehicles; Others.

6. What are the notable trends driving market growth?

Passenger Car Segment of the Market to Gain Traction during the forecast period.

7. Are there any restraints impacting market growth?

Rapid Adoption of Electric Vehicles; Others.

8. Can you provide examples of recent developments in the market?

September 2022: Mahle GmbH (Mahle) unveiled its CO2-neutral powertrain technologies for commercial vehicles during the IAA Transportation event in Hanover, Germany. The presentation included the introduction of a novel power cell unit that comprises pistons, piston rings, conrods, pins, a cylinder liner, and a high-pressure impactor designed for crankcase flushing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Cylinder Liner Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Cylinder Liner Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Cylinder Liner Market?

To stay informed about further developments, trends, and reports in the Automotive Cylinder Liner Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence