Key Insights

The United Arab Emirates (UAE) car rental market is projected for substantial growth, expected to reach 2456 million by 2024, driven by a compound annual growth rate (CAGR) of 13.1%. This expansion is attributed to the UAE's robust tourism industry, its status as a global business nexus attracting international visitors, and the increasing demand for flexible transportation solutions. The market is segmented by rental duration, booking method, driving preference, and vehicle type, serving a broad customer base. Short-term rentals are anticipated to lead, influenced by tourism and project-specific business requirements, while long-term leases are gaining favor among residents and corporations for cost-effective mobility. The growing adoption of online booking platforms is a key trend, enhancing accessibility and user experience, and thereby stimulating market penetration.

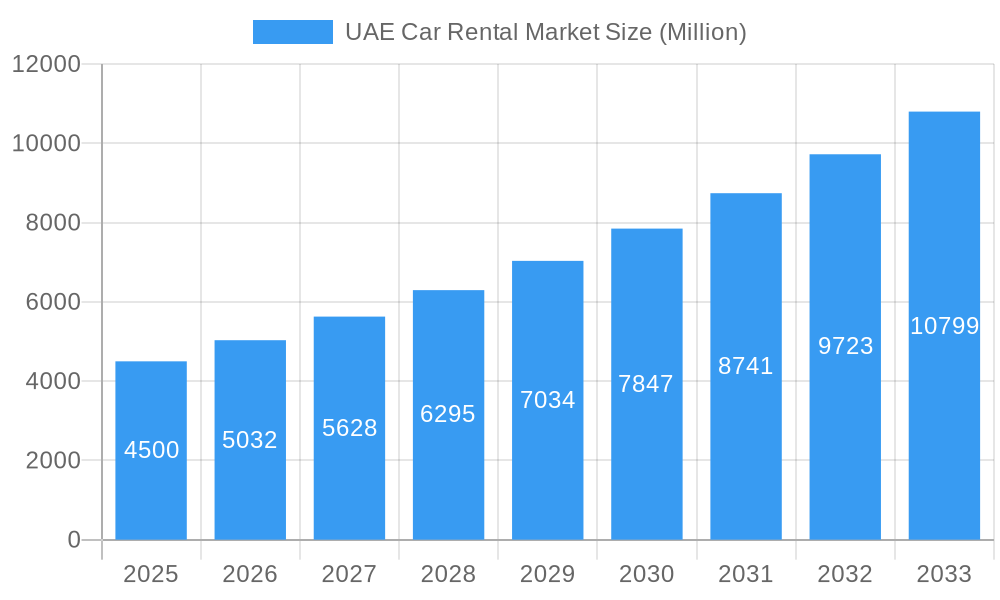

UAE Car Rental Market Market Size (In Billion)

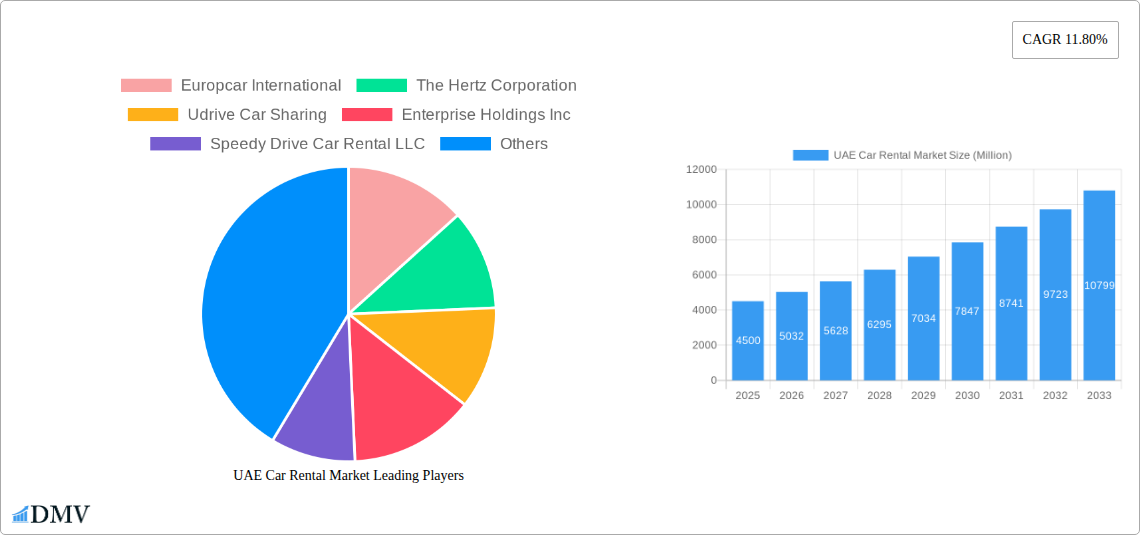

The competitive environment comprises established global operators and dynamic local providers. Key players, including Europcar International, The Hertz Corporation, Enterprise Holdings Inc., and SIXT SE, are actively expanding their fleets and digital offerings. Concurrently, innovative car-sharing and pay-per-use platforms like Udrive Car Sharing and eZhire Technologies FZ LLC are attracting younger demographics and users requiring short-term rentals. While regulatory frameworks and fuel price volatility present challenges, government initiatives supporting smart mobility and infrastructure development are expected to mitigate these factors. The market's trajectory emphasizes technological integration, sustainability, and personalized customer experiences, promising continued innovation and growth.

UAE Car Rental Market Company Market Share

Comprehensive UAE Car Rental Market Report: Navigating Growth, Innovation, and Future Trends (2019-2033)

This in-depth market research report provides a panoramic view of the UAE car rental market, offering critical insights into its composition, evolution, and future trajectory. With a robust study period spanning from 2019 to 2033, and a base and estimated year of 2025, this report is an indispensable tool for stakeholders seeking to understand car rental UAE, rental cars Dubai, and car hire Abu Dhabi. We meticulously analyze market dynamics, identify growth drivers, and forecast future opportunities within this rapidly expanding sector.

UAE Car Rental Market Market Composition & Trends

The UAE car rental market is characterized by a dynamic competitive landscape, with a significant presence of both global giants and agile local players. Market concentration is influenced by ongoing M&A activities, which have seen significant deal values, contributing to consolidation and the emergence of stronger entities. Innovation catalysts are diverse, ranging from the adoption of advanced booking platforms and fleet management systems to the integration of cutting-edge vehicle technologies. The regulatory landscape, while supportive of business growth, also presents evolving compliance requirements that companies must navigate. Substitute products, such as ride-sharing services, continue to exert pressure, but the inherent flexibility and convenience of car rental maintain its appeal. End-user profiles are increasingly segmented, with distinct needs catered to by various service offerings.

- Market Share Distribution: Detailed analysis of market share held by key players, including Europcar International, The Hertz Corporation, Enterprise Holdings Inc., Avis Budget Group Inc., and prominent local operators like Speedy Drive Car Rental LLC.

- Mergers & Acquisitions (M&A) Value: Significant M&A deals have reshaped the market, with an estimated total value of over XXX Million in the historical period, driving market consolidation and strategic expansion.

- Innovation Focus: Emphasis on digital transformation, customer experience enhancement, and sustainable fleet options.

UAE Car Rental Market Industry Evolution

The UAE car rental industry has witnessed remarkable evolution, driven by a confluence of economic growth, a burgeoning tourism sector, and a highly mobile population. Market growth trajectories have been consistently upward, fueled by increasing disposable incomes and a rising demand for convenient transportation solutions. Technological advancements have been a cornerstone of this evolution, with the widespread adoption of online booking platforms, mobile applications, and sophisticated fleet management software significantly enhancing operational efficiency and customer accessibility. Shifting consumer demands have also played a pivotal role, with a growing preference for flexible rental durations, a desire for premium and luxury vehicles, and an increasing interest in self-driven options over chauffeur-driven services. The introduction of car sharing services by players like Udrive Car Sharing and eZhire Technologies FZ LLC has further diversified the market, catering to shorter-term mobility needs. The UAE car rental market forecast indicates continued robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period.

- Growth Rate: The market is projected to grow from an estimated XXX Million in 2025 to XXX Million by 2033.

- Adoption Metrics: Over XX% of bookings are now made online, reflecting a significant shift from traditional offline methods.

- Technological Integration: Increased investment in AI-powered customer service, predictive maintenance for fleets, and advanced telematics.

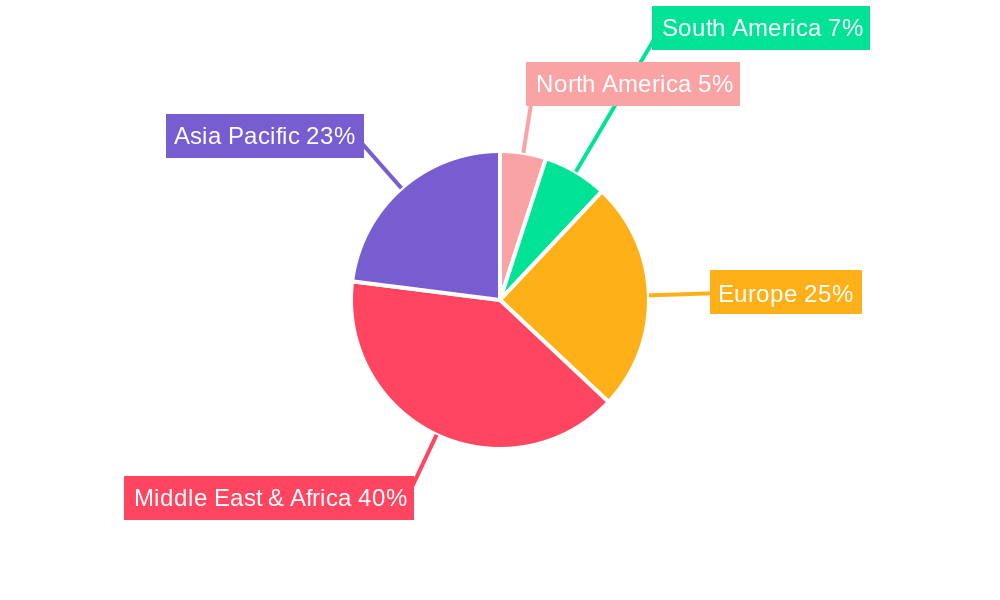

Leading Regions, Countries, or Segments in UAE Car Rental Market

Within the dynamic UAE car rental market, certain regions and segments exhibit dominant performance. Dubai consistently leads as the primary hub, driven by its status as a global tourist destination, its thriving business environment, and its extensive transportation infrastructure. Abu Dhabi follows as another significant market, with its own unique demand drivers stemming from government initiatives and corporate presence.

- Dominant Region: Dubai accounts for an estimated XX% of the total UAE car rental market revenue, attracting a substantial volume of both leisure and business travelers.

- Rental Duration: The short-term car rental segment remains dominant, particularly for tourists and temporary residents, accounting for approximately XX% of market volume. However, the long-term car rental segment is experiencing significant growth, driven by expatriate demand and corporate leasing needs, showing an XX% CAGR.

- Booking Type: Online bookings have become the preferred method for the majority of consumers, capturing an estimated XX% of all transactions. This reflects the ease and convenience offered by digital platforms.

- Driving Type: Self-driven rentals constitute the largest segment, representing approximately XX% of the market, catering to the desire for independence and flexibility among renters. Chauffeur-driven services are more prevalent in the luxury and business segments.

- Vehicle Type: The budget/economy vehicle segment holds the largest market share due to its affordability and broad appeal. However, the premium/luxury vehicle segment is experiencing rapid expansion, driven by increasing disposable incomes and a desire for enhanced travel experiences, with an estimated XX% market share. Investment trends in luxury vehicle acquisition and strategic partnerships with high-end hotels are key drivers.

UAE Car Rental Market Product Innovations

Product innovations in the UAE car rental market are increasingly focused on enhancing customer experience and operational efficiency. Companies are deploying AI-powered chatbots for instant customer support, virtual reality (VR) for virtual vehicle tours, and advanced telematics for real-time fleet tracking and predictive maintenance. The integration of connected car technology is also gaining traction, offering features like contactless pick-up and drop-off, personalized in-car experiences, and enhanced safety. The unique selling proposition lies in seamless digital journeys, from booking to return, and a commitment to offering diverse, well-maintained fleets that cater to specific needs.

Propelling Factors for UAE Car Rental Market Growth

The UAE car rental market is propelled by a robust combination of factors. The nation's thriving tourism industry, consistently attracting millions of visitors annually, creates a sustained demand for rental vehicles. Economic diversification and government initiatives aimed at boosting trade and investment further fuel business travel, necessitating reliable transportation solutions. Technological advancements, particularly in digital booking platforms and fleet management, are enhancing accessibility and convenience, making car rental a more attractive option. Furthermore, a growing expatriate population contributes to the demand for flexible and long-term rental agreements.

Obstacles in the UAE Car Rental Market Market

Despite its robust growth, the UAE car rental market faces certain obstacles. Intense competition, particularly from ride-sharing platforms and established local players, can lead to price wars and pressure on profit margins. Regulatory changes, while generally supportive, can introduce compliance complexities and operational adjustments. Supply chain disruptions, though less frequent, can impact fleet availability and maintenance schedules, leading to potential service delays. High operational costs, including fleet acquisition, insurance, and maintenance, also present ongoing challenges for market participants.

Future Opportunities in UAE Car Rental Market

Emerging opportunities in the UAE car rental market are abundant. The expansion of electric vehicle (EV) rental options presents a significant growth avenue, aligning with the UAE's sustainability goals. The increasing adoption of subscription-based car rental models offers recurring revenue streams and caters to evolving consumer preferences for flexible mobility solutions. Partnerships with airlines, hotels, and event organizers can unlock new customer segments and distribution channels. Furthermore, the development of integrated mobility platforms, offering a comprehensive suite of transportation services, holds immense potential.

Major Players in the UAE Car Rental Market Ecosystem

- Europcar International

- The Hertz Corporation

- Udrive Car Sharing

- Enterprise Holdings Inc.

- Speedy Drive Car Rental LLC

- SIXT SE

- Uber Technologies Inc.

- eZhire Technologies FZ LLC

- Avis Budget Group Inc.

Key Developments in UAE Car Rental Market Industry

- 2023 December: Launch of new premium EV fleet by Europcar International in Dubai, enhancing sustainable mobility options.

- 2023 November: Udrive Car Sharing expands its presence to new residential communities, increasing accessibility for car sharing.

- 2023 October: Enterprise Holdings Inc. announces strategic partnership with a major airline for bundled travel packages.

- 2023 September: Speedy Drive Car Rental LLC invests in advanced fleet management software to optimize operations.

- 2023 August: Avis Budget Group Inc. enhances its digital booking portal with AI-powered personalization features.

- 2023 July: SIXT SE introduces flexible long-term rental packages targeting corporate clients.

- 2023 June: eZhire Technologies FZ LLC secures significant funding to expand its subscription-based car rental services.

- 2023 May: The Hertz Corporation partners with a leading tourism board to promote car rental services to international visitors.

Strategic UAE Car Rental Market Market Forecast

The strategic UAE car rental market forecast indicates sustained and robust growth, fueled by ongoing economic development, a dynamic tourism sector, and a commitment to technological innovation. The increasing adoption of electric vehicles and the burgeoning popularity of subscription-based models represent significant future opportunities. Continued investment in digital infrastructure and a focus on customer-centric services will be crucial for maintaining a competitive edge. The market is poised for further expansion, offering lucrative prospects for both established players and new entrants looking to capitalize on the evolving mobility landscape in the UAE.

UAE Car Rental Market Segmentation

-

1. Rental Duration

- 1.1. Short Term

- 1.2. Long Term

-

2. Booking Type

- 2.1. Online

- 2.2. Offline

-

3. Driving Type

- 3.1. Self-Driven

- 3.2. Chauffeur-Driven

-

4. Vehicle Type

- 4.1. Budget/Economy

- 4.2. Premium/Luxury

UAE Car Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Car Rental Market Regional Market Share

Geographic Coverage of UAE Car Rental Market

UAE Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for ADAS likely Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Growing Demand for Travel to Propel The Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rental Duration

- 5.1.1. Short Term

- 5.1.2. Long Term

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Driving Type

- 5.3.1. Self-Driven

- 5.3.2. Chauffeur-Driven

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Budget/Economy

- 5.4.2. Premium/Luxury

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Rental Duration

- 6. North America UAE Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Rental Duration

- 6.1.1. Short Term

- 6.1.2. Long Term

- 6.2. Market Analysis, Insights and Forecast - by Booking Type

- 6.2.1. Online

- 6.2.2. Offline

- 6.3. Market Analysis, Insights and Forecast - by Driving Type

- 6.3.1. Self-Driven

- 6.3.2. Chauffeur-Driven

- 6.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.4.1. Budget/Economy

- 6.4.2. Premium/Luxury

- 6.1. Market Analysis, Insights and Forecast - by Rental Duration

- 7. South America UAE Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Rental Duration

- 7.1.1. Short Term

- 7.1.2. Long Term

- 7.2. Market Analysis, Insights and Forecast - by Booking Type

- 7.2.1. Online

- 7.2.2. Offline

- 7.3. Market Analysis, Insights and Forecast - by Driving Type

- 7.3.1. Self-Driven

- 7.3.2. Chauffeur-Driven

- 7.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.4.1. Budget/Economy

- 7.4.2. Premium/Luxury

- 7.1. Market Analysis, Insights and Forecast - by Rental Duration

- 8. Europe UAE Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Rental Duration

- 8.1.1. Short Term

- 8.1.2. Long Term

- 8.2. Market Analysis, Insights and Forecast - by Booking Type

- 8.2.1. Online

- 8.2.2. Offline

- 8.3. Market Analysis, Insights and Forecast - by Driving Type

- 8.3.1. Self-Driven

- 8.3.2. Chauffeur-Driven

- 8.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.4.1. Budget/Economy

- 8.4.2. Premium/Luxury

- 8.1. Market Analysis, Insights and Forecast - by Rental Duration

- 9. Middle East & Africa UAE Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Rental Duration

- 9.1.1. Short Term

- 9.1.2. Long Term

- 9.2. Market Analysis, Insights and Forecast - by Booking Type

- 9.2.1. Online

- 9.2.2. Offline

- 9.3. Market Analysis, Insights and Forecast - by Driving Type

- 9.3.1. Self-Driven

- 9.3.2. Chauffeur-Driven

- 9.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.4.1. Budget/Economy

- 9.4.2. Premium/Luxury

- 9.1. Market Analysis, Insights and Forecast - by Rental Duration

- 10. Asia Pacific UAE Car Rental Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Rental Duration

- 10.1.1. Short Term

- 10.1.2. Long Term

- 10.2. Market Analysis, Insights and Forecast - by Booking Type

- 10.2.1. Online

- 10.2.2. Offline

- 10.3. Market Analysis, Insights and Forecast - by Driving Type

- 10.3.1. Self-Driven

- 10.3.2. Chauffeur-Driven

- 10.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 10.4.1. Budget/Economy

- 10.4.2. Premium/Luxury

- 10.1. Market Analysis, Insights and Forecast - by Rental Duration

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Europcar International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Hertz Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Udrive Car Sharing

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Enterprise Holdings Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Speedy Drive Car Rental LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SIXT SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Uber Technologies Inc *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 eZhire Technologies FZ LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Avis Budget Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Europcar International

List of Figures

- Figure 1: Global UAE Car Rental Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America UAE Car Rental Market Revenue (million), by Rental Duration 2025 & 2033

- Figure 3: North America UAE Car Rental Market Revenue Share (%), by Rental Duration 2025 & 2033

- Figure 4: North America UAE Car Rental Market Revenue (million), by Booking Type 2025 & 2033

- Figure 5: North America UAE Car Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 6: North America UAE Car Rental Market Revenue (million), by Driving Type 2025 & 2033

- Figure 7: North America UAE Car Rental Market Revenue Share (%), by Driving Type 2025 & 2033

- Figure 8: North America UAE Car Rental Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 9: North America UAE Car Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: North America UAE Car Rental Market Revenue (million), by Country 2025 & 2033

- Figure 11: North America UAE Car Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America UAE Car Rental Market Revenue (million), by Rental Duration 2025 & 2033

- Figure 13: South America UAE Car Rental Market Revenue Share (%), by Rental Duration 2025 & 2033

- Figure 14: South America UAE Car Rental Market Revenue (million), by Booking Type 2025 & 2033

- Figure 15: South America UAE Car Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 16: South America UAE Car Rental Market Revenue (million), by Driving Type 2025 & 2033

- Figure 17: South America UAE Car Rental Market Revenue Share (%), by Driving Type 2025 & 2033

- Figure 18: South America UAE Car Rental Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 19: South America UAE Car Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: South America UAE Car Rental Market Revenue (million), by Country 2025 & 2033

- Figure 21: South America UAE Car Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe UAE Car Rental Market Revenue (million), by Rental Duration 2025 & 2033

- Figure 23: Europe UAE Car Rental Market Revenue Share (%), by Rental Duration 2025 & 2033

- Figure 24: Europe UAE Car Rental Market Revenue (million), by Booking Type 2025 & 2033

- Figure 25: Europe UAE Car Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 26: Europe UAE Car Rental Market Revenue (million), by Driving Type 2025 & 2033

- Figure 27: Europe UAE Car Rental Market Revenue Share (%), by Driving Type 2025 & 2033

- Figure 28: Europe UAE Car Rental Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 29: Europe UAE Car Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Europe UAE Car Rental Market Revenue (million), by Country 2025 & 2033

- Figure 31: Europe UAE Car Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa UAE Car Rental Market Revenue (million), by Rental Duration 2025 & 2033

- Figure 33: Middle East & Africa UAE Car Rental Market Revenue Share (%), by Rental Duration 2025 & 2033

- Figure 34: Middle East & Africa UAE Car Rental Market Revenue (million), by Booking Type 2025 & 2033

- Figure 35: Middle East & Africa UAE Car Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 36: Middle East & Africa UAE Car Rental Market Revenue (million), by Driving Type 2025 & 2033

- Figure 37: Middle East & Africa UAE Car Rental Market Revenue Share (%), by Driving Type 2025 & 2033

- Figure 38: Middle East & Africa UAE Car Rental Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 39: Middle East & Africa UAE Car Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 40: Middle East & Africa UAE Car Rental Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East & Africa UAE Car Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific UAE Car Rental Market Revenue (million), by Rental Duration 2025 & 2033

- Figure 43: Asia Pacific UAE Car Rental Market Revenue Share (%), by Rental Duration 2025 & 2033

- Figure 44: Asia Pacific UAE Car Rental Market Revenue (million), by Booking Type 2025 & 2033

- Figure 45: Asia Pacific UAE Car Rental Market Revenue Share (%), by Booking Type 2025 & 2033

- Figure 46: Asia Pacific UAE Car Rental Market Revenue (million), by Driving Type 2025 & 2033

- Figure 47: Asia Pacific UAE Car Rental Market Revenue Share (%), by Driving Type 2025 & 2033

- Figure 48: Asia Pacific UAE Car Rental Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 49: Asia Pacific UAE Car Rental Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 50: Asia Pacific UAE Car Rental Market Revenue (million), by Country 2025 & 2033

- Figure 51: Asia Pacific UAE Car Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UAE Car Rental Market Revenue million Forecast, by Rental Duration 2020 & 2033

- Table 2: Global UAE Car Rental Market Revenue million Forecast, by Booking Type 2020 & 2033

- Table 3: Global UAE Car Rental Market Revenue million Forecast, by Driving Type 2020 & 2033

- Table 4: Global UAE Car Rental Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global UAE Car Rental Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global UAE Car Rental Market Revenue million Forecast, by Rental Duration 2020 & 2033

- Table 7: Global UAE Car Rental Market Revenue million Forecast, by Booking Type 2020 & 2033

- Table 8: Global UAE Car Rental Market Revenue million Forecast, by Driving Type 2020 & 2033

- Table 9: Global UAE Car Rental Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 10: Global UAE Car Rental Market Revenue million Forecast, by Country 2020 & 2033

- Table 11: United States UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Canada UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Mexico UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Global UAE Car Rental Market Revenue million Forecast, by Rental Duration 2020 & 2033

- Table 15: Global UAE Car Rental Market Revenue million Forecast, by Booking Type 2020 & 2033

- Table 16: Global UAE Car Rental Market Revenue million Forecast, by Driving Type 2020 & 2033

- Table 17: Global UAE Car Rental Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 18: Global UAE Car Rental Market Revenue million Forecast, by Country 2020 & 2033

- Table 19: Brazil UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Argentina UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global UAE Car Rental Market Revenue million Forecast, by Rental Duration 2020 & 2033

- Table 23: Global UAE Car Rental Market Revenue million Forecast, by Booking Type 2020 & 2033

- Table 24: Global UAE Car Rental Market Revenue million Forecast, by Driving Type 2020 & 2033

- Table 25: Global UAE Car Rental Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 26: Global UAE Car Rental Market Revenue million Forecast, by Country 2020 & 2033

- Table 27: United Kingdom UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Germany UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: France UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Italy UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Spain UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Russia UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: Benelux UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Nordics UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Global UAE Car Rental Market Revenue million Forecast, by Rental Duration 2020 & 2033

- Table 37: Global UAE Car Rental Market Revenue million Forecast, by Booking Type 2020 & 2033

- Table 38: Global UAE Car Rental Market Revenue million Forecast, by Driving Type 2020 & 2033

- Table 39: Global UAE Car Rental Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 40: Global UAE Car Rental Market Revenue million Forecast, by Country 2020 & 2033

- Table 41: Turkey UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Israel UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: GCC UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: North Africa UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: South Africa UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: Global UAE Car Rental Market Revenue million Forecast, by Rental Duration 2020 & 2033

- Table 48: Global UAE Car Rental Market Revenue million Forecast, by Booking Type 2020 & 2033

- Table 49: Global UAE Car Rental Market Revenue million Forecast, by Driving Type 2020 & 2033

- Table 50: Global UAE Car Rental Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 51: Global UAE Car Rental Market Revenue million Forecast, by Country 2020 & 2033

- Table 52: China UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 53: India UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Japan UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 55: South Korea UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 56: ASEAN UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 57: Oceania UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific UAE Car Rental Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Car Rental Market?

The projected CAGR is approximately 13.1%.

2. Which companies are prominent players in the UAE Car Rental Market?

Key companies in the market include Europcar International, The Hertz Corporation, Udrive Car Sharing, Enterprise Holdings Inc, Speedy Drive Car Rental LLC, SIXT SE, Uber Technologies Inc *List Not Exhaustive, eZhire Technologies FZ LLC, Avis Budget Group Inc.

3. What are the main segments of the UAE Car Rental Market?

The market segments include Rental Duration, Booking Type, Driving Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2456 million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for ADAS likely Drive the Market.

6. What are the notable trends driving market growth?

Growing Demand for Travel to Propel The Demand.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Car Rental Market?

To stay informed about further developments, trends, and reports in the UAE Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence