Key Insights

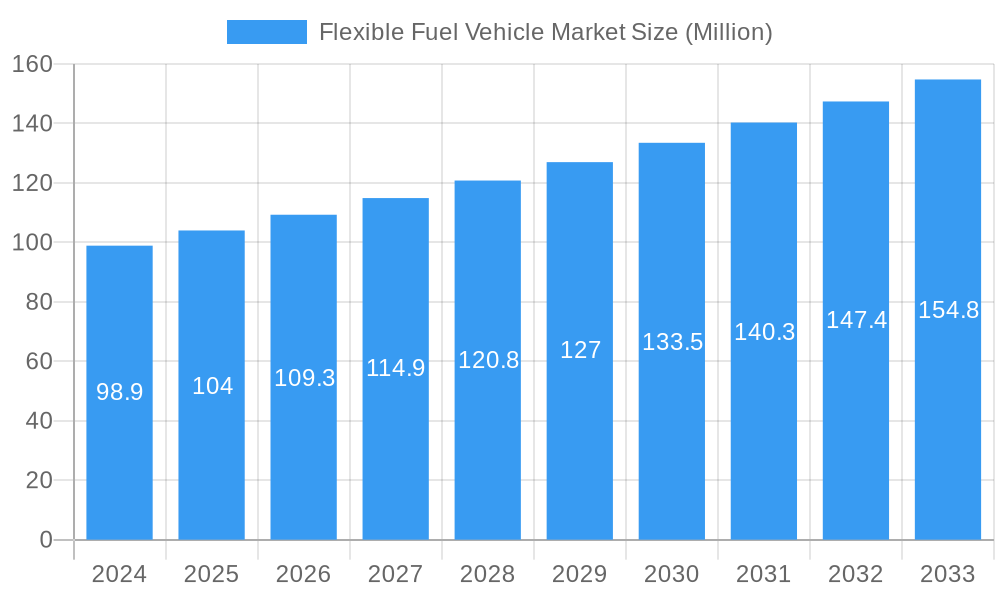

The global Flexible Fuel Vehicle (FFV) market is poised for robust expansion, projected to reach a market size of approximately USD 104 million with a compelling Compound Annual Growth Rate (CAGR) exceeding 5.00% through 2033. This growth is primarily propelled by increasing environmental consciousness and governmental initiatives promoting the adoption of alternative fuels to curb greenhouse gas emissions. The rising demand for fuel-efficient and eco-friendly vehicles, coupled with the cost-effectiveness of biofuels like ethanol, is further fueling this market trajectory. Technological advancements in engine design and fuel delivery systems are enhancing the performance and reliability of FFVs, making them an increasingly attractive option for consumers worldwide. The market's expansion is also supported by supportive regulatory frameworks and incentives encouraging the production and sale of vehicles capable of running on a blend of gasoline and ethanol.

Flexible Fuel Vehicle Market Market Size (In Million)

The FFV market is segmented across various ethanol blend types, with E10 to E25, E25 to E85, and E85 and above segments all contributing to market demand. Passenger cars represent a dominant segment, driven by consumer preference for environmentally conscious personal transportation, while commercial vehicles are also witnessing growing adoption due to long-term operational cost savings and emission reduction mandates. The transition from traditional petrol and diesel fuels to biofuels like ethanol is a significant trend, supported by the widespread availability of fuel infrastructure in key regions. While the market presents substantial opportunities, restraints such as the initial cost of FFVs compared to conventional vehicles and the fluctuating prices of ethanol could pose challenges. However, the overarching trend towards sustainability and the strategic investments by major automotive manufacturers in developing and promoting FFV technology are expected to outweigh these limitations, ensuring sustained market growth.

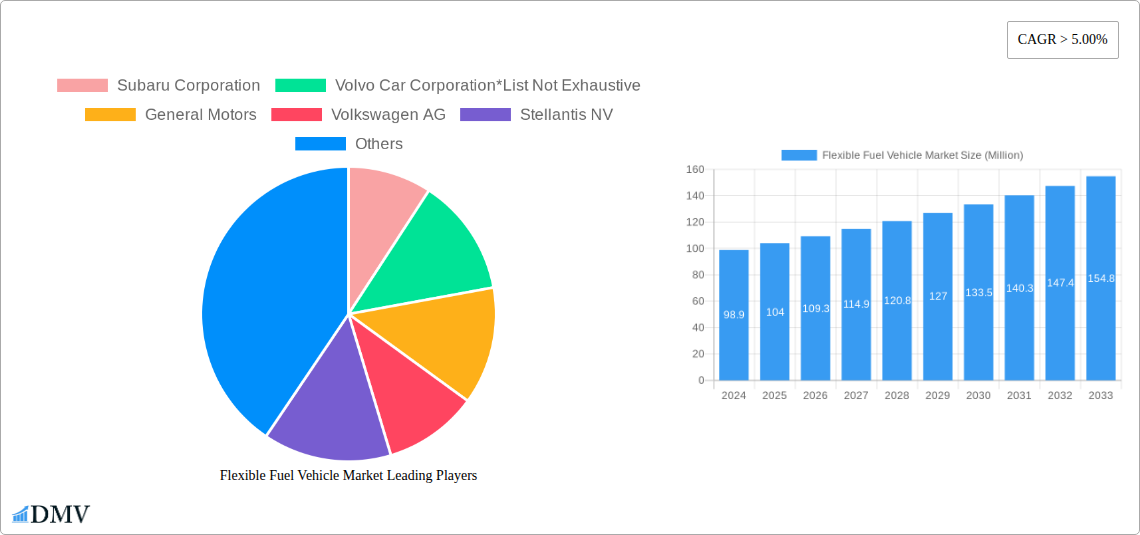

Flexible Fuel Vehicle Market Company Market Share

Explore the dynamic Flexible Fuel Vehicle (FFV) market with our in-depth report, providing critical insights for stakeholders seeking to navigate this rapidly evolving sector. This comprehensive analysis delves into market composition, industry evolution, regional dominance, product innovations, growth drivers, market challenges, and future opportunities. Our report leverages a study period from 2019 to 2033, with a base year of 2025, offering a robust forecast period from 2025 to 2033 and covering historical data from 2019-2024. Discover how ethanol blend types like E10 to E25, E25 to E85, and E85 and Above, coupled with vehicle types such as Passenger Cars and Commercial Vehicles, are shaping the future of sustainable transportation.

Flexible Fuel Vehicle Market Market Composition & Trends

The flexible fuel vehicle market exhibits a moderate to high degree of concentration, driven by significant investments in research and development by major automotive manufacturers. Innovation catalysts include the increasing global demand for alternative fuels, stringent emission regulations, and government incentives promoting fuel diversity. Regulatory landscapes are progressively favoring FFVs, particularly in regions with robust biofuel production capabilities. Substitute products, such as battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs), present competitive pressures, but FFVs offer a compelling bridge technology due to their flexibility and existing fueling infrastructure. End-user profiles range from environmentally conscious consumers to fleet operators seeking cost-effective and sustainable mobility solutions. Mergers and acquisition (M&A) activities are anticipated to intensify as companies aim to bolster their portfolios in the clean energy vehicle space. The market share distribution is influenced by regional adoption rates and the strategic decisions of key players. M&A deal values are projected to see substantial growth as consolidation occurs to achieve economies of scale and expand technological expertise.

Flexible Fuel Vehicle Market Industry Evolution

The flexible fuel vehicle market has witnessed a significant evolution, driven by a confluence of technological advancements, shifting consumer preferences, and a global push towards decarbonization. Over the historical period (2019-2024), the market saw steady growth, fueled by early adopters and supportive policies in key automotive hubs. The base year of 2025 marks a pivotal point, with an estimated compound annual growth rate (CAGR) of approximately 8-10% projected through the forecast period (2025-2033). This upward trajectory is underpinned by continuous innovation in engine technology, allowing FFVs to seamlessly operate on a wider spectrum of ethanol blends. Consumer demand is increasingly aligning with sustainable mobility solutions, making the inherent flexibility of FFVs a significant draw. Furthermore, the development of advanced biofuels and improved ethanol production methods contribute to the economic viability and environmental appeal of these vehicles. The industry's evolution is also marked by strategic partnerships between automakers and biofuel producers, aiming to secure a stable supply chain and optimize the performance of FFV powertrains. The petrol and diesel fuel types for FFVs are being augmented by the increasing dominance of ethanol blends. The adoption metrics are showing a clear trend towards higher ethanol concentrations, especially in markets where government mandates or incentives are actively promoting their use.

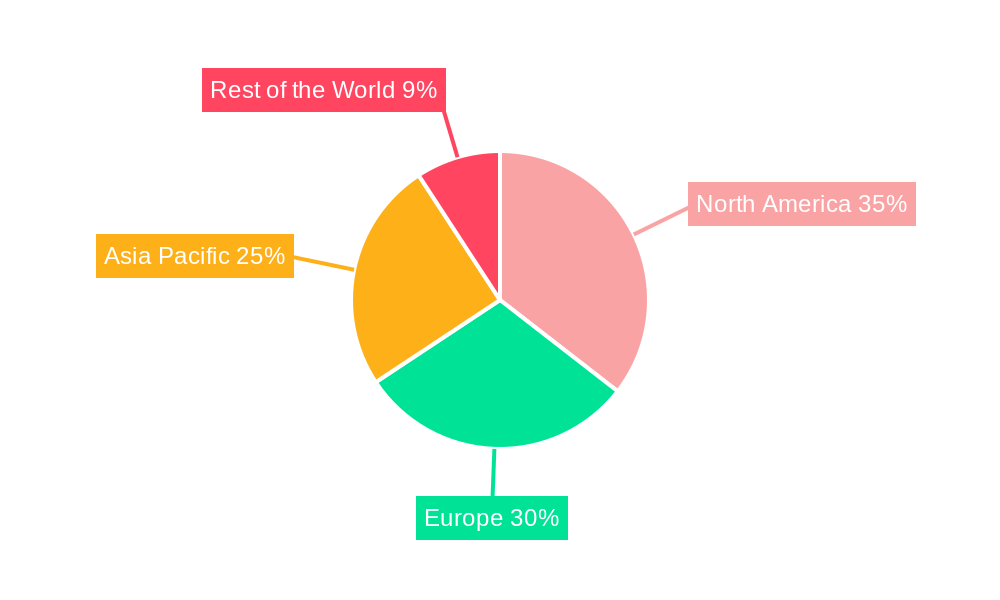

Leading Regions, Countries, or Segments in Flexible Fuel Vehicle Market

The flexible fuel vehicle market is experiencing robust growth across several key regions, with Brazil and the United States historically leading adoption rates due to established biofuel infrastructures and supportive government policies. However, the forecast period anticipates significant expansion in Asia, particularly in India, driven by initiatives to reduce reliance on imported fossil fuels and leverage domestic agricultural resources for biofuel production.

Ethanol Blend Type Dominance:

- E85 and Above: This segment is poised for substantial growth, especially in markets with a strong commitment to higher biofuel content. Its dominance is driven by its superior environmental benefits and the increasing availability of higher ethanol blends at fueling stations.

- E25 to E85: This segment currently holds a significant market share and is expected to remain a strong contender, offering a balanced approach between environmental impact and engine compatibility.

- E10 to E25: While historically significant, this segment's growth is projected to be slower compared to higher blends, as regulatory bodies and consumer preferences lean towards more potent biofuel utilization.

Vehicle Type Dynamics:

- Passenger Cars: This segment will continue to be the primary driver of FFV adoption, catering to a broad consumer base seeking fuel flexibility and reduced emissions.

- Commercial Vehicles: The adoption of FFVs in commercial fleets is gaining momentum, driven by the potential for lower operating costs and corporate sustainability goals. This segment is expected to show accelerated growth, especially for light commercial vehicles.

Fuel Type Influence:

- Petrol: FFVs primarily utilize petrol as a base fuel, with ethanol acting as the flexible component. The continued presence of petrol infrastructure ensures the practicality of FFVs.

- Diesel: While some early FFV concepts explored diesel compatibility, the market focus has overwhelmingly shifted towards petrol-based FFVs due to the technical challenges and market demand for higher ethanol blends.

The dominance of these segments is propelled by factors such as:

- Investment Trends: Significant investments are being channeled into developing FFV technology and expanding biofuel production capacities.

- Regulatory Support: Government mandates, tax incentives, and emission standards that favor alternative fuels are crucial in driving adoption.

- Consumer Awareness: Growing environmental consciousness among consumers is a key factor pushing demand for greener transportation alternatives.

Flexible Fuel Vehicle Market Product Innovations

Product innovations in the flexible fuel vehicle market are centered on enhancing engine efficiency, optimizing the performance of various ethanol blends, and expanding the range of compatible vehicle types. Manufacturers are developing advanced fuel injection systems and engine control units capable of dynamically adjusting to different ethanol concentrations, ensuring seamless operation and maximizing fuel economy. Performance metrics are improving, with FFVs now achieving comparable power output and fuel efficiency to their traditional counterparts, regardless of the fuel blend used. Unique selling propositions include the inherent flexibility to choose between petrol and ethanol-based fuels, providing consumers with cost savings and the ability to adapt to fluctuating fuel prices and availability. Technological advancements are also focused on reducing emissions further, making FFVs a more environmentally sustainable choice.

Propelling Factors for Flexible Fuel Vehicle Market Growth

The flexible fuel vehicle market is propelled by a potent combination of factors. Technological advancements in engine management systems enable seamless operation across various ethanol blends, enhancing performance and fuel efficiency. Economic influences, such as fluctuating fossil fuel prices and government incentives like tax credits and subsidies for alternative fuel vehicles, make FFVs a more attractive and cost-effective option for consumers and fleet operators. Regulatory influences, particularly stringent emission standards and mandates for renewable fuel adoption in many countries, directly push the demand for FFVs. For example, the increasing mandates for biofuel blending in gasoline are a direct catalyst for FFV market expansion.

Obstacles in the Flexible Fuel Vehicle Market Market

Despite its promising outlook, the flexible fuel vehicle market faces several obstacles. Regulatory challenges can arise from the inconsistent implementation of biofuel mandates or the lack of standardized regulations across different regions, creating market uncertainty. Supply chain disruptions for biofuels, particularly concerning the availability and price volatility of agricultural feedstocks for ethanol production, can impact the overall cost-effectiveness and accessibility of FFVs. Competitive pressures from rapidly advancing battery electric vehicle (BEV) technology, which offers zero tailpipe emissions, pose a significant threat, although FFVs provide a more immediate and infrastructure-compatible solution for many markets. Quantifiable impacts include potential slowdowns in adoption rates if biofuel supply chains are not adequately secured or if BEV advancements outpace FFV improvements.

Future Opportunities in Flexible Fuel Vehicle Market

Emerging opportunities in the flexible fuel vehicle market are significant. The growing global emphasis on circular economy principles presents opportunities for advanced biofuels derived from waste materials, further enhancing the sustainability credentials of FFVs. The expansion into emerging markets with significant agricultural potential for biofuel production, such as parts of Africa and Southeast Asia, offers new avenues for growth. Furthermore, the development of new ethanol blend types and advanced engine technologies that can utilize even higher concentrations of biofuels will unlock new performance and environmental benefits. Consumer trends towards eco-conscious purchasing and a desire for fuel independence are also strong tailwinds for future FFV market expansion.

Major Players in the Flexible Fuel Vehicle Market Ecosystem

- Subaru Corporation

- Volvo Car Corporation

- General Motors

- Volkswagen AG

- Stellantis NV

- Honda Motor Company

- Hyundai Motor Company

- BMW AG

- Nissan Motor Company

- Toyota Motor Corporation

- Ford Motor Company

Key Developments in Flexible Fuel Vehicle Market Industry

- February 2022: BMW launched a 3-series sedan in Brazil capable of running on ethanol-blended fuel. The new BMW 3 series can function normally even when running entirely on ethanol. A 2.0-liter four-cylinder B48 turbo powers the 3-series that has been slightly tuned to run on ethanol-based fuel, marking a significant entry into a key biofuel market and showcasing advanced engine adaptability.

- December 2022: SIAM, along with the Government of India, conducted a demonstration session where it showcased the vehicle features and technological developments to emphasize the use of FFVs (Flex-fuel vehicles) and future possibilities. During the demonstration, it was emphasized that there is a need for technology that can be used to convert waste to wealth, as India uses a significant amount of fossil fuel in the world. This initiative signals strong governmental support and a strategic push for FFV adoption in a major automotive market, highlighting the potential for waste-to-energy solutions.

Strategic Flexible Fuel Vehicle Market Market Forecast

The flexible fuel vehicle market is poised for sustained growth, driven by a strategic convergence of environmental imperatives and economic advantages. The increasing adoption of higher ethanol blends, coupled with advancements in engine technology, will unlock new levels of fuel efficiency and emission reduction. Government incentives and tightening emissions regulations worldwide will continue to act as powerful catalysts, encouraging manufacturers and consumers alike to embrace FFVs. Emerging markets present substantial untapped potential, offering opportunities for significant market share expansion. The continuous innovation in biofuel production, particularly from sustainable and waste-derived feedstocks, will further solidify the long-term viability and attractiveness of the FFV segment within the broader automotive landscape.

Flexible Fuel Vehicle Market Segmentation

-

1. Ethanol Blend Type

- 1.1. E10 to E25

- 1.2. E25 to E85

- 1.3. E85 and Above

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Fuel Type

- 3.1. Petrol

- 3.2. Diesel

Flexible Fuel Vehicle Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. Spain

- 2.4. United Kingdom

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. South Korea

- 3.4. Japan

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Flexible Fuel Vehicle Market Regional Market Share

Geographic Coverage of Flexible Fuel Vehicle Market

Flexible Fuel Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ratification of Stringent Exhaust Emission Regulations

- 3.3. Market Restrains

- 3.3.1. Increase Sales of Electric Vehicle May Restraint the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Ratification of Stringent Exhaust Emission Regulations will Diesel Fuel Type Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 5.1.1. E10 to E25

- 5.1.2. E25 to E85

- 5.1.3. E85 and Above

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Petrol

- 5.3.2. Diesel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 6. North America Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 6.1.1. E10 to E25

- 6.1.2. E25 to E85

- 6.1.3. E85 and Above

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Fuel Type

- 6.3.1. Petrol

- 6.3.2. Diesel

- 6.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 7. Europe Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 7.1.1. E10 to E25

- 7.1.2. E25 to E85

- 7.1.3. E85 and Above

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Fuel Type

- 7.3.1. Petrol

- 7.3.2. Diesel

- 7.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 8. Asia Pacific Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 8.1.1. E10 to E25

- 8.1.2. E25 to E85

- 8.1.3. E85 and Above

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Fuel Type

- 8.3.1. Petrol

- 8.3.2. Diesel

- 8.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 9. Rest of the World Flexible Fuel Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 9.1.1. E10 to E25

- 9.1.2. E25 to E85

- 9.1.3. E85 and Above

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Fuel Type

- 9.3.1. Petrol

- 9.3.2. Diesel

- 9.1. Market Analysis, Insights and Forecast - by Ethanol Blend Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Subaru Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Volvo Car Corporation*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Motors

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Volkswagen AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Stellantis NV

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Honda Motor Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hyundai Motor Company

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BMW AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nissan Motor Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Toyota Motor Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Ford Motor Company

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Subaru Corporation

List of Figures

- Figure 1: Global Flexible Fuel Vehicle Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Flexible Fuel Vehicle Market Revenue (Million), by Ethanol Blend Type 2025 & 2033

- Figure 3: North America Flexible Fuel Vehicle Market Revenue Share (%), by Ethanol Blend Type 2025 & 2033

- Figure 4: North America Flexible Fuel Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Flexible Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Flexible Fuel Vehicle Market Revenue (Million), by Fuel Type 2025 & 2033

- Figure 7: North America Flexible Fuel Vehicle Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 8: North America Flexible Fuel Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Flexible Fuel Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Flexible Fuel Vehicle Market Revenue (Million), by Ethanol Blend Type 2025 & 2033

- Figure 11: Europe Flexible Fuel Vehicle Market Revenue Share (%), by Ethanol Blend Type 2025 & 2033

- Figure 12: Europe Flexible Fuel Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Flexible Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Flexible Fuel Vehicle Market Revenue (Million), by Fuel Type 2025 & 2033

- Figure 15: Europe Flexible Fuel Vehicle Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 16: Europe Flexible Fuel Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Flexible Fuel Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Flexible Fuel Vehicle Market Revenue (Million), by Ethanol Blend Type 2025 & 2033

- Figure 19: Asia Pacific Flexible Fuel Vehicle Market Revenue Share (%), by Ethanol Blend Type 2025 & 2033

- Figure 20: Asia Pacific Flexible Fuel Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Flexible Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Flexible Fuel Vehicle Market Revenue (Million), by Fuel Type 2025 & 2033

- Figure 23: Asia Pacific Flexible Fuel Vehicle Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 24: Asia Pacific Flexible Fuel Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Flexible Fuel Vehicle Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Flexible Fuel Vehicle Market Revenue (Million), by Ethanol Blend Type 2025 & 2033

- Figure 27: Rest of the World Flexible Fuel Vehicle Market Revenue Share (%), by Ethanol Blend Type 2025 & 2033

- Figure 28: Rest of the World Flexible Fuel Vehicle Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Rest of the World Flexible Fuel Vehicle Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Rest of the World Flexible Fuel Vehicle Market Revenue (Million), by Fuel Type 2025 & 2033

- Figure 31: Rest of the World Flexible Fuel Vehicle Market Revenue Share (%), by Fuel Type 2025 & 2033

- Figure 32: Rest of the World Flexible Fuel Vehicle Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Flexible Fuel Vehicle Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Ethanol Blend Type 2020 & 2033

- Table 2: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Ethanol Blend Type 2020 & 2033

- Table 6: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Ethanol Blend Type 2020 & 2033

- Table 13: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 15: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Ethanol Blend Type 2020 & 2033

- Table 22: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 24: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Ethanol Blend Type 2020 & 2033

- Table 31: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 33: Global Flexible Fuel Vehicle Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: South America Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Flexible Fuel Vehicle Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flexible Fuel Vehicle Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Flexible Fuel Vehicle Market?

Key companies in the market include Subaru Corporation, Volvo Car Corporation*List Not Exhaustive, General Motors, Volkswagen AG, Stellantis NV, Honda Motor Company, Hyundai Motor Company, BMW AG, Nissan Motor Company, Toyota Motor Corporation, Ford Motor Company.

3. What are the main segments of the Flexible Fuel Vehicle Market?

The market segments include Ethanol Blend Type, Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 104 Million as of 2022.

5. What are some drivers contributing to market growth?

Ratification of Stringent Exhaust Emission Regulations.

6. What are the notable trends driving market growth?

Ratification of Stringent Exhaust Emission Regulations will Diesel Fuel Type Segment.

7. Are there any restraints impacting market growth?

Increase Sales of Electric Vehicle May Restraint the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2022: BMW launched a 3-series sedan in Brazil capable of running on ethanol-blended fuel. The new BMW 3 series can function normally even when running entirely on ethanol. A 2.0-liter four-cylinder B48 turbo powers the 3-series that has been slightly tuned to run on ethanol-based fuel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flexible Fuel Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flexible Fuel Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flexible Fuel Vehicle Market?

To stay informed about further developments, trends, and reports in the Flexible Fuel Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence