Key Insights

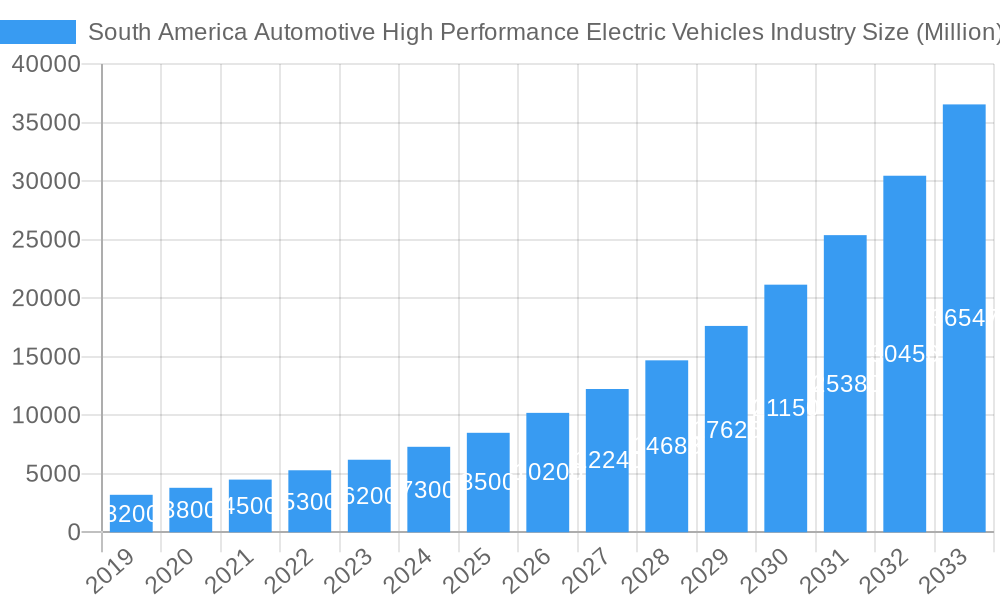

The South American automotive high-performance electric vehicles (EVs) market is poised for explosive growth, projected to surpass $10,000 million by 2025 and maintain a Compound Annual Growth Rate (CAGR) exceeding 20.00% throughout the forecast period (2025-2033). This remarkable expansion is fueled by a confluence of accelerating consumer demand for sustainable transportation, increasing government incentives and favorable regulations across key markets like Brazil and Chile, and the growing availability of diverse, high-performance EV models. Major automotive manufacturers such as Tesla, Volkswagen, Kia, and BMW are actively investing in and launching advanced electric offerings, including plug-in hybrids and pure battery electric vehicles, catering to both the passenger car and commercial vehicle segments. The technological advancements in battery technology, leading to longer ranges and faster charging times, are significantly mitigating range anxiety, a historical barrier to EV adoption. Furthermore, a rising environmental consciousness among South American consumers is driving a preference for cleaner mobility solutions, positioning high-performance EVs as aspirational and practical choices.

South America Automotive High Performance Electric Vehicles Industry Market Size (In Billion)

The market's trajectory is further bolstered by significant investments in charging infrastructure and a growing awareness of the long-term cost savings associated with electric vehicle ownership. While the initial purchase price can be a restraint, government subsidies, lower running costs due to reduced fuel and maintenance expenses, and the availability of financing options are making these vehicles more accessible. Emerging trends include the development of localized charging solutions, increased focus on in-cabin technology and connectivity within high-performance EVs, and a potential rise in the adoption of electric light commercial vehicles for last-mile delivery services. The competitive landscape is intensifying with the presence of both established global players and innovative new entrants like Rimac Automobili, pushing the boundaries of electric performance. The region's commitment to reducing carbon emissions and embracing sustainable energy solutions solidifies the robust growth potential for high-performance electric vehicles across all South American nations.

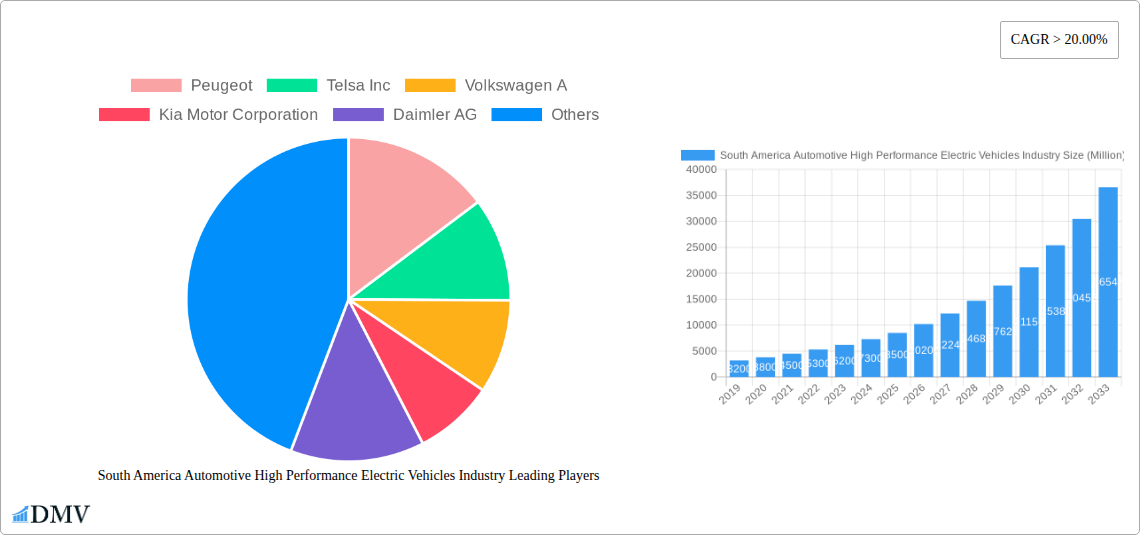

South America Automotive High Performance Electric Vehicles Industry Company Market Share

South America Automotive High Performance Electric Vehicles Industry Market Composition & Trends

This comprehensive report delves into the dynamic South America automotive high-performance electric vehicles (EVs) industry, dissecting market composition and emerging trends from 2019 to 2033. We provide an in-depth analysis of market concentration, identifying key players and their respective market shares, with a focus on the base year of 2025. Innovation catalysts are thoroughly examined, highlighting the technological advancements driving the transition towards high-performance EVs in the region. The report scrutinizes the evolving regulatory landscapes across South America, assessing their impact on EV adoption and market accessibility. Furthermore, we evaluate the threat of substitute products, such as internal combustion engine (ICE) vehicles and lower-performance EVs, and their influence on market dynamics. End-user profiles are meticulously detailed, segmenting consumer preferences and adoption drivers for high-performance EVs. Merger and acquisition (M&A) activities are a critical component, with reported M&A deal values and their strategic implications for market consolidation and growth. The report provides a detailed outlook on the market share distribution for the Battery or Pure Electric segment, projected to reach xx Million by 2025, and the Plug-in Hybrid segment, expected to reach xx Million by the same year. M&A deal values are estimated to range between xx Million and xx Million during the forecast period.

- Market Share Distribution (Base Year 2025):

- Battery or Pure Electric: xx Million

- Plug-in Hybrid: xx Million

- M&A Deal Values (Forecast Period 2025-2033):

- Estimated Range: xx Million - xx Million

- Key Market Concentration Factors:

- Dominance of Battery or Pure Electric vehicles.

- Emerging players challenging established automotive giants.

- Strategic partnerships for battery technology and charging infrastructure.

- Innovation Catalysts:

- Advancements in battery density and charging speed.

- Development of lighter and more aerodynamic vehicle designs.

- Integration of advanced driver-assistance systems (ADAS) and connectivity features.

- Regulatory Landscape:

- Government incentives for EV adoption (tax credits, subsidies).

- Stricter emission standards for ICE vehicles.

- Investment in charging infrastructure development.

- Substitute Products:

- High-performance ICE vehicles.

- Conventional ICE vehicles.

- Lower-performance electric vehicles.

- End-User Profiles:

- Environmentally conscious consumers.

- Technology enthusiasts seeking cutting-edge performance.

- Fleet operators looking for operational cost savings.

South America Automotive High Performance Electric Vehicles Industry Industry Evolution

The South America automotive high-performance electric vehicles industry is on an unprecedented growth trajectory, driven by a confluence of technological breakthroughs, evolving consumer preferences, and supportive governmental policies. The historical period from 2019 to 2024 witnessed a nascent yet significant surge in interest and early adoption of high-performance EVs, laying the groundwork for the accelerated expansion projected from 2025 to 2033. Market growth trajectories are characterized by an aggressive upward trend, with compound annual growth rates (CAGRs) projected to surpass xx% for Battery or Pure Electric passenger cars and xx% for Plug-in Hybrid passenger cars. This sustained growth is underpinned by continuous technological advancements, particularly in battery technology. Innovations in lithium-ion batteries are yielding higher energy densities, leading to increased range and reduced charging times, thereby addressing range anxiety, a key historical barrier. Furthermore, advancements in electric motor efficiency and powertrain optimization are pushing the boundaries of performance, offering exhilarating acceleration and superior handling that rivals and often surpasses their internal combustion engine counterparts. The integration of sophisticated battery management systems and regenerative braking technologies further enhances efficiency and driver engagement.

Shifting consumer demands are playing a pivotal role in this evolution. There's a palpable shift towards sustainable mobility solutions, with consumers increasingly prioritizing environmental impact alongside performance and advanced features. The aspirational appeal of high-performance EVs, combined with growing awareness of climate change and the benefits of zero-emission transportation, is fueling demand. This is particularly evident in urban centers where air quality concerns are paramount. Adoption metrics are showing a steady increase, with the penetration rate of high-performance EVs in the passenger car segment expected to reach xx% by 2033. For commercial vehicles, the focus is shifting towards electrifying fleets for reduced operational costs and a greener corporate image, with adoption rates projected to climb to xx% within the same timeframe. The study period, encompassing 2019–2033, allows for a thorough examination of this transformative phase, from initial market penetration to eventual mainstream adoption. The base year of 2025 serves as a crucial benchmark for understanding the current state of the market and projecting future advancements with precision.

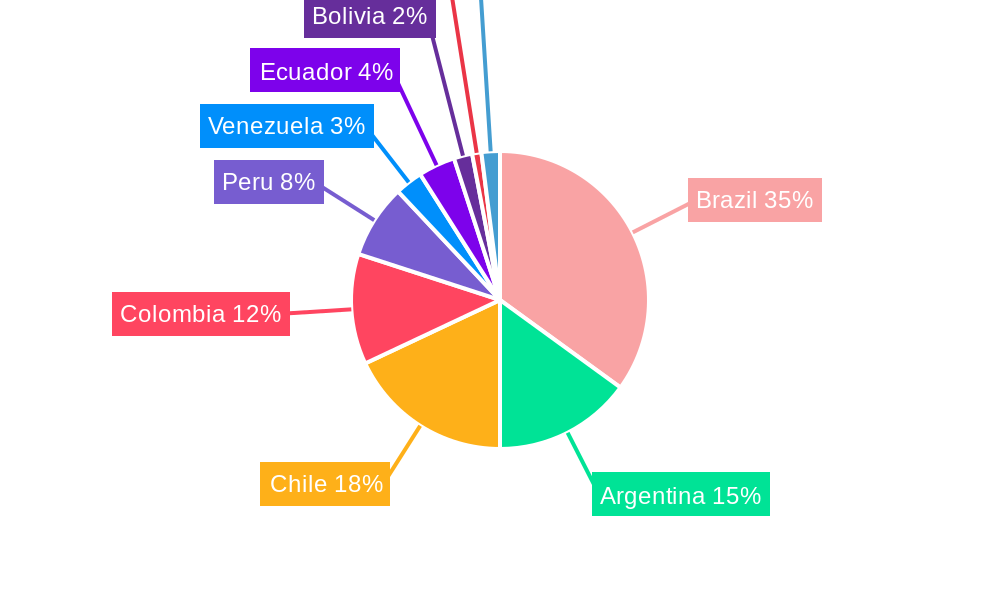

Leading Regions, Countries, or Segments in South America Automotive High Performance Electric Vehicles Industry

The South America automotive high-performance electric vehicles industry is experiencing a dynamic geographical and segmental shift, with several key regions and segments demonstrating remarkable leadership and growth potential. Among the Drive Types, Battery or Pure Electric vehicles are emerging as the dominant force, driven by advancements in battery technology, expanding charging infrastructure, and increasing consumer awareness of environmental benefits. This segment is projected to capture a significant market share, estimated at xx% of the total high-performance EV market by 2025. The Plug-in Hybrid segment, while still significant, is expected to see a steadier, though slower, growth rate as the pure electric ecosystem matures.

In terms of Vehicle Type, Passenger Cars represent the leading segment for high-performance EVs in South America. This is attributed to their higher affordability compared to commercial vehicles, wider availability of models appealing to individual consumers, and the growing trend of adopting EVs as a primary mode of transportation. The luxury and performance segments within passenger cars are particularly driving this trend, with manufacturers introducing sportier, higher-range EV models that attract affluent buyers. Commercial vehicles, while a smaller segment currently, are showing strong growth potential, especially in urban logistics and ride-sharing services, where operational cost savings and emissions reduction are paramount. Countries like Brazil and Argentina are emerging as frontrunners due to their substantial automotive manufacturing bases, favorable government incentives, and growing consumer disposable income. Chile, with its strong focus on renewable energy sources, is also a key market for EV adoption, particularly for high-performance models.

Dominant Drive Type: Battery or Pure Electric

- Key Drivers:

- Rapid advancements in battery technology leading to longer ranges and faster charging.

- Increasing government incentives and subsidies for pure electric vehicle purchases.

- Expanding public and private charging infrastructure network across major cities.

- Growing consumer preference for zero-emission mobility solutions.

- Dominance Factors: The superior performance capabilities, lower running costs, and positive environmental impact of pure electric vehicles make them increasingly attractive to South American consumers and businesses seeking high-performance and sustainable transportation options. The continued decline in battery costs will further solidify this dominance.

- Key Drivers:

Dominant Vehicle Type: Passenger Cars

- Key Drivers:

- Wider availability of high-performance EV models across various price points.

- Growing consumer desire for advanced technology and driving experience.

- Increasing acceptance of EVs for daily commutes and personal transportation.

- Government policies favoring personal vehicle electrification.

- Dominance Factors: The passenger car segment benefits from a broader appeal to individual consumers who are increasingly prioritizing performance, sustainability, and cutting-edge technology. The aspirational nature of high-performance EVs also resonates strongly within this segment.

- Key Drivers:

Leading Countries/Regions:

- Brazil: Significant automotive market, strong government support for EVs, and growing manufacturing capabilities.

- Argentina: Favorable import policies for EVs, increasing consumer interest, and developing charging infrastructure.

- Chile: Strong commitment to renewable energy, making it an attractive market for electric mobility.

South America Automotive High Performance Electric Vehicles Industry Product Innovations

The South America automotive high-performance electric vehicles industry is a hotbed of innovation, continuously pushing the boundaries of performance, efficiency, and user experience. Product innovations are primarily centered around enhancing battery technology, with significant strides made in increasing energy density and reducing charging times to under 30 minutes for a substantial range. Advanced electric motor designs are delivering instant torque and exhilarating acceleration, rivaling or surpassing traditional performance vehicles. Aerodynamic designs, lightweight materials like carbon fiber composites, and sophisticated suspension systems are contributing to improved handling and agility. Furthermore, the integration of advanced driver-assistance systems (ADAS), AI-powered infotainment, and seamless connectivity are defining the next generation of high-performance EVs, offering a sophisticated and engaging driving experience. Unique selling propositions often revolve around the combination of electrifying performance with a sustainable footprint.

Propelling Factors for South America Automotive High Performance Electric Vehicles Industry Growth

Several key growth drivers are propelling the South America automotive high-performance electric vehicles industry forward. Technologically, advancements in battery energy density, faster charging capabilities, and more efficient electric powertrains are crucial. Economically, declining battery costs, government incentives like tax credits and subsidies for EV purchases, and the long-term operational cost savings associated with EVs (reduced fuel and maintenance expenses) are making them increasingly attractive. Regulatory influences, such as stricter emission standards for internal combustion engine vehicles and government mandates for EV adoption, are also significant catalysts. The growing environmental consciousness among consumers and the increasing availability of a wider range of high-performance EV models are further fueling market expansion.

Obstacles in the South America Automotive High Performance Electric Vehicles Industry Market

Despite the robust growth, several obstacles impede the widespread adoption of high-performance electric vehicles in South America. Regulatory challenges can include inconsistent policy frameworks across different countries and a lack of standardization in charging infrastructure. Supply chain disruptions, particularly concerning the availability of critical battery materials and semiconductor chips, can impact production volumes and costs. Competitive pressures from established automakers with strong ICE portfolios and the higher upfront cost of many high-performance EVs compared to their ICE counterparts also present significant barriers. Furthermore, the availability and reliability of public charging infrastructure, especially outside major urban centers, remain a concern for many potential buyers.

Future Opportunities in South America Automotive High Performance Electric Vehicles Industry

The South America automotive high-performance electric vehicles industry is ripe with emerging opportunities. The untapped potential in burgeoning markets within South America presents a significant avenue for expansion. Advancements in battery swapping technology and the development of more affordable high-performance EV models will democratize access to this technology. The growing demand for electric commercial vehicles, particularly for last-mile delivery and ride-sharing services, offers a substantial growth segment. Furthermore, the integration of vehicle-to-grid (V2G) technology and smart charging solutions can unlock new revenue streams and enhance grid stability, creating further opportunities for innovation and market penetration.

Major Players in the South America Automotive High Performance Electric Vehicles Industry Ecosystem

- Peugeot

- Tesla Inc.

- Volkswagen A

- Kia Motor Corporation

- Daimler AG

- Nissan Motor Company Ltd

- Renault

- BMW Group

- Mitsubishi Motors Corporation

- Rimac Automobili

- Ford Motor Company

Key Developments in South America Automotive High Performance Electric Vehicles Industry Industry

- 2023/10: Tesla Inc. announces plans to expand its charging network in Brazil.

- 2024/01: Volkswagen A launches its new performance electric SUV in Argentina.

- 2024/03: Kia Motor Corporation unveils its high-performance EV sedan for the South American market.

- 2024/06: Daimler AG partners with a local Chilean energy company for charging infrastructure development.

- 2024/09: Renault introduces its latest generation of electric performance vehicles in Colombia.

- 2025/01: BMW Group announces significant investments in its South American EV production capabilities.

- 2025/04: Mitsubishi Motors Corporation explores partnerships for battery recycling in South America.

- 2025/07: Rimac Automobili confirms its entry into the South American high-performance EV market.

- 2025/10: Ford Motor Company showcases its upcoming high-performance electric truck for the region.

- 2025/12: Nissan Motor Company Ltd announces a new fast-charging technology deployment.

Strategic South America Automotive High Performance Electric Vehicles Industry Market Forecast

The strategic South America automotive high-performance electric vehicles market forecast indicates robust growth driven by technological advancements, favorable government policies, and a rising consumer appetite for sustainable and high-performance mobility. Key growth catalysts include the increasing affordability of Battery or Pure Electric vehicles, the expansion of charging infrastructure, and the introduction of innovative models tailored to regional preferences. The forecast period of 2025–2033 is expected to witness a significant shift in market share towards electric solutions, with passenger cars leading the charge and commercial vehicles presenting substantial future potential. Investments in local manufacturing and supply chain development will further solidify the region's position in the global EV landscape.

South America Automotive High Performance Electric Vehicles Industry Segmentation

-

1. Drive Type

- 1.1. Plug-in Hybrid

- 1.2. Battery or Pure Electric

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

South America Automotive High Performance Electric Vehicles Industry Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Automotive High Performance Electric Vehicles Industry Regional Market Share

Geographic Coverage of South America Automotive High Performance Electric Vehicles Industry

South America Automotive High Performance Electric Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 20.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Travel and Tourism Industry is Driving the Car Rental Market

- 3.3. Market Restrains

- 3.3.1. Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market

- 3.4. Market Trends

- 3.4.1. Increased performance of BEV is boosting the sales of Electric Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Automotive High Performance Electric Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 5.1.1. Plug-in Hybrid

- 5.1.2. Battery or Pure Electric

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Drive Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Peugeot

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Telsa Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volkswagen A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kia Motor Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daimler AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nissan Motor Company Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Renault

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BMW Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Motors Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rimac Automobili

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ford Motor Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Peugeot

List of Figures

- Figure 1: South America Automotive High Performance Electric Vehicles Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Automotive High Performance Electric Vehicles Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Automotive High Performance Electric Vehicles Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 2: South America Automotive High Performance Electric Vehicles Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: South America Automotive High Performance Electric Vehicles Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South America Automotive High Performance Electric Vehicles Industry Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 5: South America Automotive High Performance Electric Vehicles Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: South America Automotive High Performance Electric Vehicles Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Automotive High Performance Electric Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Automotive High Performance Electric Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile South America Automotive High Performance Electric Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia South America Automotive High Performance Electric Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Peru South America Automotive High Performance Electric Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Venezuela South America Automotive High Performance Electric Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Ecuador South America Automotive High Performance Electric Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Bolivia South America Automotive High Performance Electric Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Paraguay South America Automotive High Performance Electric Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Uruguay South America Automotive High Performance Electric Vehicles Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Automotive High Performance Electric Vehicles Industry?

The projected CAGR is approximately > 20.00%.

2. Which companies are prominent players in the South America Automotive High Performance Electric Vehicles Industry?

Key companies in the market include Peugeot, Telsa Inc, Volkswagen A, Kia Motor Corporation, Daimler AG, Nissan Motor Company Ltd, Renault, BMW Group, Mitsubishi Motors Corporation, Rimac Automobili, Ford Motor Company.

3. What are the main segments of the South America Automotive High Performance Electric Vehicles Industry?

The market segments include Drive Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Travel and Tourism Industry is Driving the Car Rental Market.

6. What are the notable trends driving market growth?

Increased performance of BEV is boosting the sales of Electric Vehicles.

7. Are there any restraints impacting market growth?

Increasing Popularity of Ride-Sharing Services Pose Challenges for the Conventional Car Rental Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Automotive High Performance Electric Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Automotive High Performance Electric Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Automotive High Performance Electric Vehicles Industry?

To stay informed about further developments, trends, and reports in the South America Automotive High Performance Electric Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence