Key Insights

The North American Mild Hybrid Electric Vehicle (MHEV) market is demonstrating significant expansion, propelled by evolving fuel efficiency mandates, escalating consumer preference for eco-friendly transportation, and ongoing technological advancements. The market, currently valued at approximately 109019.44 million in the base year of 2024, is forecast to grow at a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This upward trajectory is primarily attributed to increasing fuel prices and heightened environmental awareness, driving demand for fuel-efficient automotive solutions. Furthermore, significant investment by original equipment manufacturers (OEMs) in sophisticated MHEV systems is enhancing the balance between fuel economy and affordability relative to full hybrids and electric vehicles. While passenger cars currently lead market share, the commercial vehicle segment is poised for substantial growth, particularly in light commercial vehicles, as stringent emission standards are implemented across the region. Key industry players, including Volkswagen Group, Toyota Motor Corp, and Honda Motor Corp, are actively innovating and expanding their MHEV offerings to capture this burgeoning market. The competitive environment is marked by vigorous efforts among established automotive leaders to refine MHEV technology and diversify their product lines.

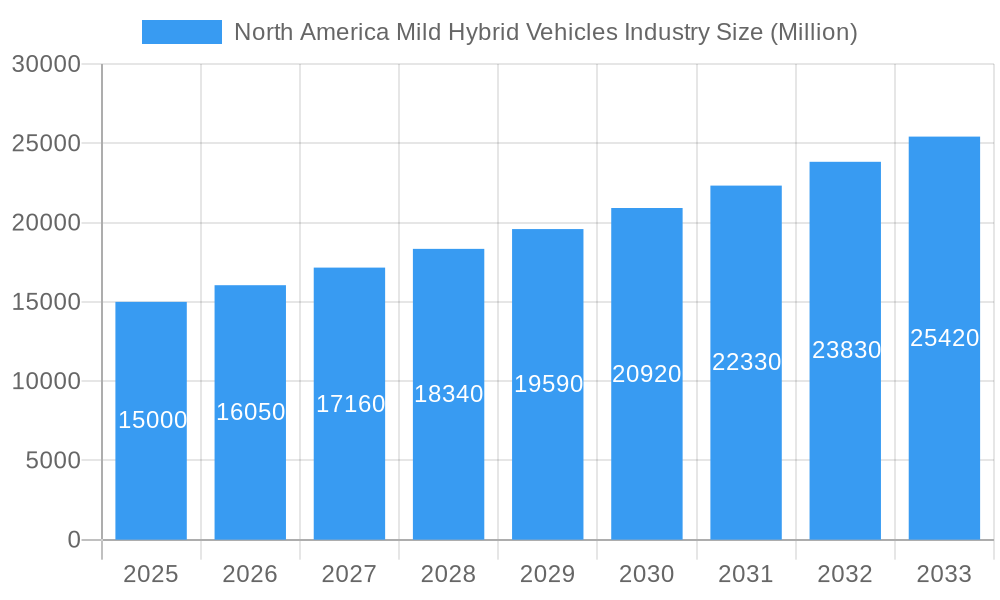

North America Mild Hybrid Vehicles Industry Market Size (In Billion)

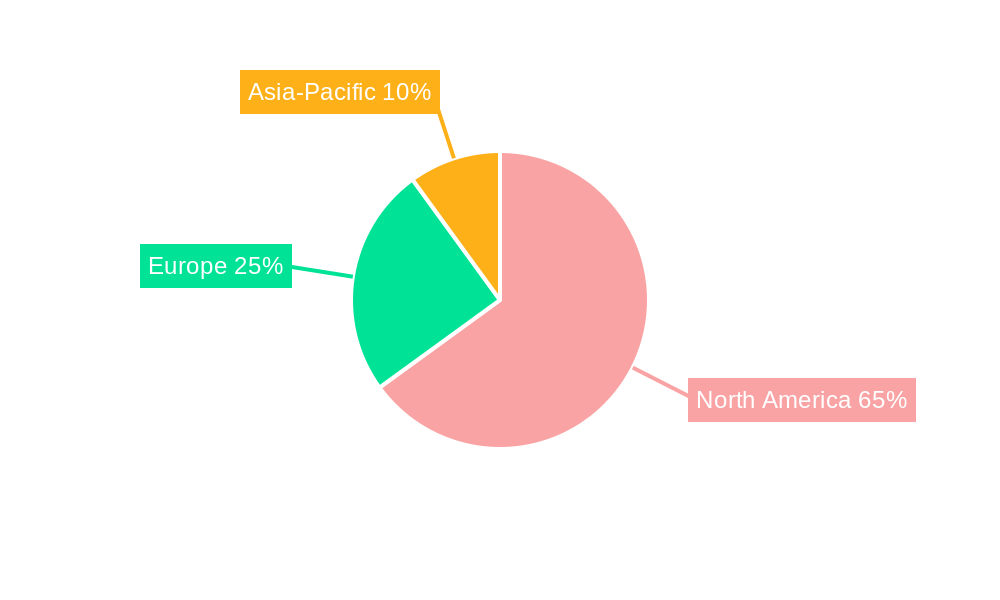

Market dynamics within North America exhibit regional variations. The United States is projected to maintain the largest market share, driven by its extensive automotive sector and favorable policy landscape. Canada is also expected to experience consistent growth, influenced by aligned regulatory frameworks and consumer inclinations. The "Rest of North America" segment, though smaller, will contribute to the region's overall growth. Potential market impediments include the higher upfront cost of MHEVs compared to conventional vehicles and a degree of consumer unfamiliarity with mild hybrid technology benefits. However, government incentives, technological innovations, and persistent increases in fuel prices are anticipated to counterbalance these challenges over the forecast period.

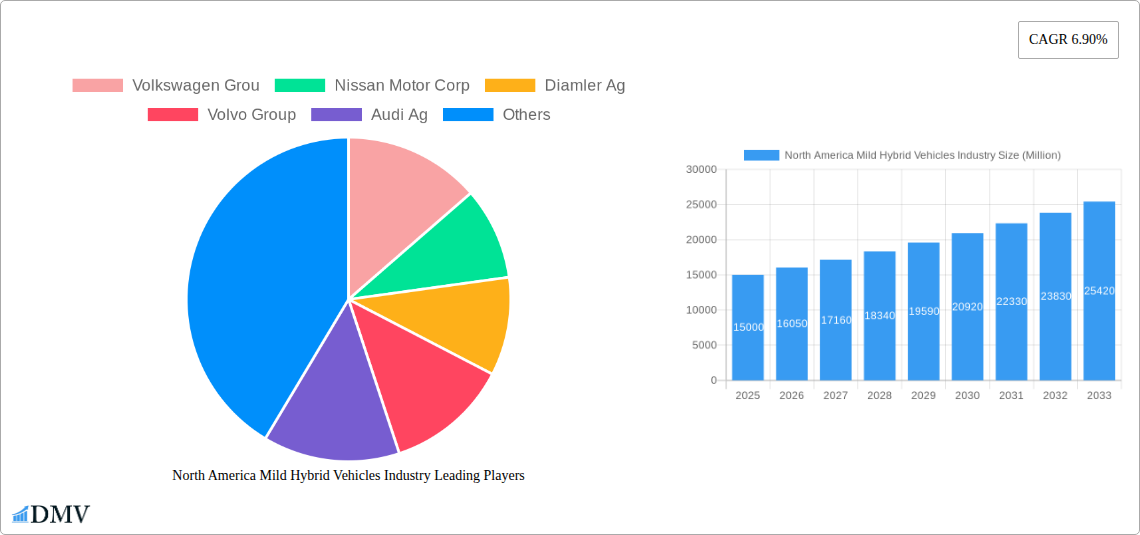

North America Mild Hybrid Vehicles Industry Company Market Share

North America Mild Hybrid Vehicles Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America mild hybrid vehicles industry, offering crucial insights for stakeholders seeking to navigate this rapidly evolving market. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market trends, leading players, technological advancements, and future growth opportunities. The market size is predicted to reach xx Million by 2033, presenting significant investment potential.

North America Mild Hybrid Vehicles Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory factors, and market dynamics within the North American mild hybrid vehicle sector. We analyze market concentration, revealing the market share distribution amongst key players like Toyota Motor Corp, Volkswagen Group, Honda Motor Corp, and others. The report also examines the impact of regulatory changes on market growth, including emission standards and fuel efficiency mandates. Furthermore, we delve into the influence of substitute products, such as fully electric and plug-in hybrid vehicles, and analyze M&A activities, including deal values and their implications for market consolidation. The analysis incorporates data from the historical period (2019-2024), base year (2025), and estimated year (2025), projecting trends into the forecast period (2025-2033).

- Market Share Distribution: Toyota Motor Corp holds an estimated xx% market share in 2025, followed by Volkswagen Group with xx%, and Honda Motor Corp with xx%. Other significant players include Nissan Motor Corp, Daimler AG, Volvo Group, Audi AG, BMW AG, and Suzuki Motor Corp.

- M&A Activity: Analysis of M&A deals in the mild hybrid vehicle sector since 2019, with a focus on deal values and strategic implications for market consolidation. Total deal value for the period is estimated at xx Million.

- Innovation Catalysts: Examination of technological advancements driving innovation within the industry, such as improved battery technology and enhanced energy recovery systems.

North America Mild Hybrid Vehicles Industry Industry Evolution

This section provides a detailed analysis of the evolution of the North American mild hybrid vehicle market, exploring market growth trajectories, technological advancements, and evolving consumer preferences. We examine the growth rate of the market from 2019 to 2024, projecting future growth based on various factors including technological improvements and government regulations. The adoption rate of mild hybrid vehicles across different vehicle segments (passenger cars and commercial vehicles) is also analyzed. Technological advancements, such as improvements in 48V systems and the integration of mild hybrid technology into various vehicle platforms, are explored in detail. Consumer preferences, such as increasing demand for fuel-efficient vehicles and growing environmental awareness, are also considered. The section analyzes the impact of these factors on market growth and future trends. Data points such as CAGR for specific periods and adoption rates are presented to support these findings.

Leading Regions, Countries, or Segments in North America Mild Hybrid Vehicles Industry

This section identifies the dominant regions, countries, and segments within the North American mild hybrid vehicle market.

Dominant Segments:

- Capacity Type: The 48V and above segment is expected to dominate due to its superior performance capabilities.

- Vehicle Type: Passenger cars constitute a larger market share compared to commercial vehicles due to higher consumer demand.

Key Drivers:

- Investment Trends: Significant investments in R&D and manufacturing capabilities are fueling market growth.

- Regulatory Support: Government incentives and stricter emission standards are driving adoption.

In-depth Analysis: The dominance of the 48V and above capacity type is attributed to its ability to deliver better fuel efficiency and performance compared to the less than 48V segment. Similarly, the passenger car segment dominates due to higher consumer demand, influenced by factors such as cost and availability.

North America Mild Hybrid Vehicles Industry Product Innovations

Recent product innovations in mild hybrid vehicles include advancements in battery technology, resulting in improved energy density and extended lifespan. These advancements have enabled manufacturers to integrate more sophisticated energy recovery systems, leading to enhanced fuel efficiency and reduced emissions. The integration of mild hybrid systems with advanced driver-assistance systems (ADAS) is also a noteworthy development. Unique selling propositions now include better fuel economy, lower emissions, and enhanced driving performance.

Propelling Factors for North America Mild Hybrid Vehicles Industry Growth

The growth of the North American mild hybrid vehicle market is propelled by several key factors. Stringent government regulations aimed at reducing carbon emissions are driving the adoption of fuel-efficient vehicles. Furthermore, advancements in battery technology and cost reductions are making mild hybrid vehicles more affordable and accessible to consumers. Growing consumer awareness of environmental issues and a preference for fuel-efficient vehicles further contribute to market growth.

Obstacles in the North America Mild Hybrid Vehicles Industry Market

The North American mild hybrid vehicle market faces several challenges. The high initial cost of mild hybrid vehicles compared to conventional internal combustion engine vehicles can limit their adoption. Supply chain disruptions, especially regarding battery components, can affect production and availability. Furthermore, intense competition from fully electric and plug-in hybrid vehicles poses a significant challenge. These factors can collectively impact market growth by xx% annually.

Future Opportunities in North America Mild Hybrid Vehicles Industry

Future opportunities in the North American mild hybrid vehicle market include the expansion into new markets, such as commercial fleets and light-duty trucks. Further advancements in battery technology, such as the development of solid-state batteries, could significantly enhance the performance and affordability of mild hybrid vehicles. The integration of advanced connectivity features and autonomous driving technologies will also create new market opportunities.

Major Players in the North America Mild Hybrid Vehicles Industry Ecosystem

Key Developments in North America Mild Hybrid Vehicles Industry Industry

- July 2023: Toyota launches a new mild hybrid system with improved fuel efficiency.

- October 2022: Volkswagen announces a significant investment in battery production for mild hybrid vehicles.

- March 2021: Honda and GM announce a joint venture to develop advanced mild hybrid technology. (Further key developments would be added here based on data)

Strategic North America Mild Hybrid Vehicles Industry Market Forecast

The North American mild hybrid vehicle market is poised for substantial growth in the coming years. Driven by technological advancements, tightening emission regulations, and increasing consumer demand for fuel-efficient vehicles, the market is expected to experience significant expansion. Opportunities lie in the development of more affordable and efficient mild hybrid systems, expansion into new vehicle segments, and the integration of advanced technologies. This positive outlook underscores the attractiveness of this market for both established players and new entrants.

North America Mild Hybrid Vehicles Industry Segmentation

-

1. Capacity type

- 1.1. Less than 48V

- 1.2. 48V & Above

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

North America Mild Hybrid Vehicles Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest Of North America

North America Mild Hybrid Vehicles Industry Regional Market Share

Geographic Coverage of North America Mild Hybrid Vehicles Industry

North America Mild Hybrid Vehicles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Warehousing and Logistics Sector to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Purchase Cost to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Mild Hybrid Vehicles will face competition from HEV and PHEV

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Capacity type

- 5.1.1. Less than 48V

- 5.1.2. 48V & Above

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest Of North America

- 5.1. Market Analysis, Insights and Forecast - by Capacity type

- 6. United States North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Capacity type

- 6.1.1. Less than 48V

- 6.1.2. 48V & Above

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Capacity type

- 7. Canada North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Capacity type

- 7.1.1. Less than 48V

- 7.1.2. 48V & Above

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Capacity type

- 8. Rest Of North America North America Mild Hybrid Vehicles Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Capacity type

- 8.1.1. Less than 48V

- 8.1.2. 48V & Above

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Capacity type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Volkswagen Grou

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nissan Motor Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Diamler Ag

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Volvo Group

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Audi Ag

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Honda Motor Corp

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 BMW AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Toyota Motor Corp

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Suzuki Motor Corp

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Volkswagen Grou

List of Figures

- Figure 1: North America Mild Hybrid Vehicles Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Mild Hybrid Vehicles Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Capacity type 2020 & 2033

- Table 2: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 3: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Capacity type 2020 & 2033

- Table 5: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Capacity type 2020 & 2033

- Table 8: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 9: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Capacity type 2020 & 2033

- Table 11: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 12: North America Mild Hybrid Vehicles Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mild Hybrid Vehicles Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the North America Mild Hybrid Vehicles Industry?

Key companies in the market include Volkswagen Grou, Nissan Motor Corp, Diamler Ag, Volvo Group, Audi Ag, Honda Motor Corp, BMW AG, Toyota Motor Corp, Suzuki Motor Corp.

3. What are the main segments of the North America Mild Hybrid Vehicles Industry?

The market segments include Capacity type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 109019.44 million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Warehousing and Logistics Sector to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

Mild Hybrid Vehicles will face competition from HEV and PHEV.

7. Are there any restraints impacting market growth?

High Initial Purchase Cost to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mild Hybrid Vehicles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mild Hybrid Vehicles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mild Hybrid Vehicles Industry?

To stay informed about further developments, trends, and reports in the North America Mild Hybrid Vehicles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence