Key Insights

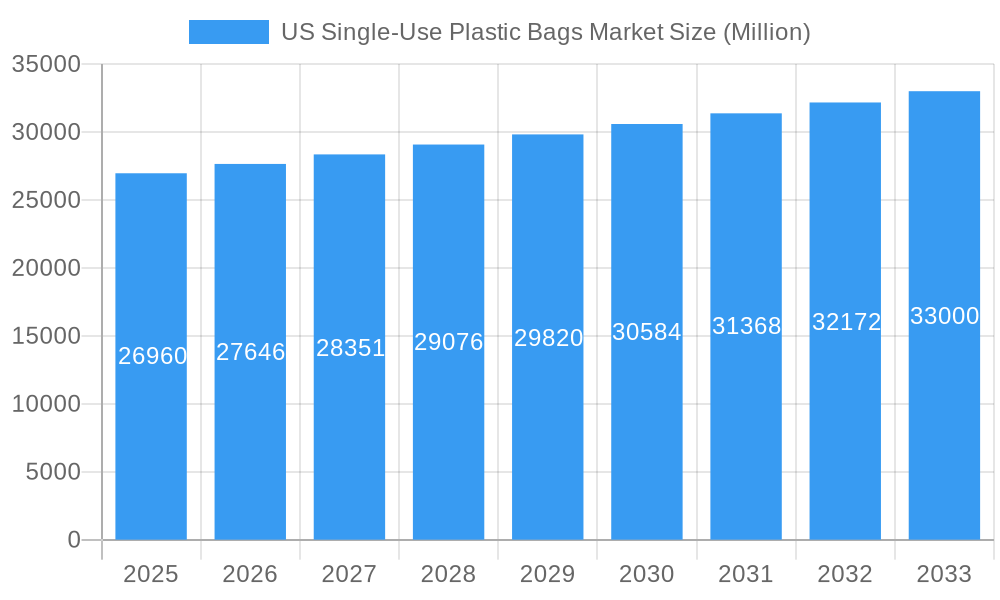

The US single-use plastic bag market, valued at $26.96 billion in 2025, is projected to experience steady growth, driven primarily by the burgeoning food and beverage sectors, as well as the continued demand within healthcare and personal care industries. The market's Compound Annual Growth Rate (CAGR) of 2.72% from 2025 to 2033 reflects a consistent, albeit moderate, expansion. Key growth drivers include increasing consumer convenience, the cost-effectiveness of plastic bags compared to alternative packaging solutions, and the established infrastructure supporting their widespread use. However, growing environmental concerns regarding plastic waste and increasing governmental regulations aimed at reducing plastic consumption pose significant restraints to market expansion. The shift towards sustainable alternatives, such as biodegradable and compostable bags, presents a challenge, yet also represents a potential avenue for market diversification and innovation within the segment. The market is segmented by end-user industry (food, beverage, healthcare, personal care, and others) and material type (paper and paperboard, plastics, aluminum, and others), with plastic bags currently dominating due to their low cost and versatility. Regional analysis within the US suggests varying levels of market penetration, likely influenced by local regulations and consumer behavior. Future growth will likely depend on finding a balance between meeting consumer demands for convenience and addressing mounting environmental concerns through sustainable innovations and responsible disposal practices.

US Single-Use Plastic Bags Market Market Size (In Billion)

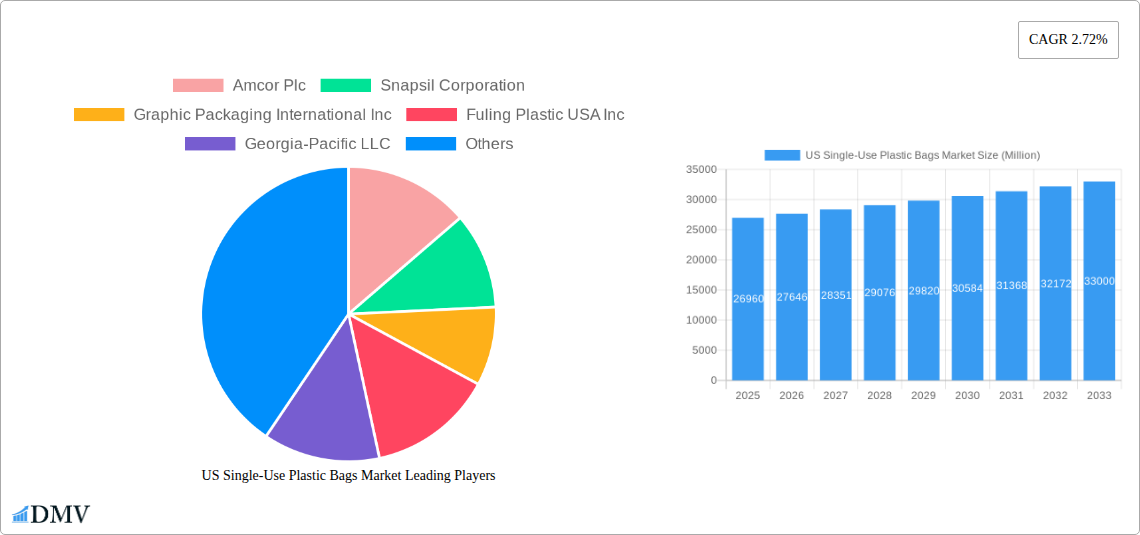

The competitive landscape is characterized by a mix of large multinational corporations and smaller regional players. Key players like Amcor Plc, Graphic Packaging International Inc, and Berry Global Inc are heavily involved in developing and supplying innovative packaging solutions, including single-use plastic bags. These companies' strategies frequently involve investments in research and development to explore sustainable alternatives, reflecting the pressures from both consumers and regulations. The ongoing evolution of consumer preferences, along with government policies regarding plastic waste management and recycling infrastructure, will significantly impact the future trajectory of the US single-use plastic bag market. Companies focused on sustainability and innovation are best positioned to capture a significant market share in the coming years.

US Single-Use Plastic Bags Market Company Market Share

US Single-Use Plastic Bags Market: A Comprehensive Market Analysis Report (2019-2033)

This insightful report provides a detailed analysis of the US Single-Use Plastic Bags Market, offering a comprehensive overview of market dynamics, growth drivers, challenges, and future opportunities. Covering the period from 2019 to 2033, with a focus on 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on this evolving market. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

US Single-Use Plastic Bags Market Market Composition & Trends

This section provides a comprehensive analysis of the US single-use plastic bag market, dissecting its key components and prevailing trends. We offer a granular view of market concentration, detailing the market share held by prominent players including Amcor Plc, Snapsil Corporation, Graphic Packaging International Inc, Fuling Plastic USA Inc, Georgia-Pacific LLC, PPC Flexible Packaging LLC, Pactiv LLC, Novolex, Berry Global Inc, and Dart Container Corporation. Our investigation delves into the primary drivers of innovation, such as breakthroughs in material science and advancements in manufacturing methodologies, alongside the dynamic regulatory framework that influences both the production and consumption of these bags. Additionally, the report includes an in-depth examination of substitute products like reusable bags and paper bags, profiles of end-users across diverse sectors (Food & Beverage, Healthcare, Personal Care, and others), and significant Mergers & Acquisitions (M&A) activities, complete with associated deal values. We also assess the competitive intensity within the market, identifying key strategic alliances and competitive pressures shaping the industry landscape.

- In-depth Market Share Analysis of the Top 10 Key Players

- Detailed Examination of M&A Activities, covering the period from 2019 to 2024

- Comprehensive Assessment of the Regulatory Landscape and its Multifaceted Impact

- Thorough Evaluation of Substitute Products and their Market Penetration Rates

- Analysis of Consumer Behavior Shifts and their Influence on Market Dynamics

- Exploration of Emerging Business Models and Distribution Channels

US Single-Use Plastic Bags Market Industry Evolution

This section offers a granular view of the US single-use plastic bag market's evolution. We meticulously trace the market's growth trajectory from 2019 to 2024, highlighting significant growth rates and adoption metrics across different segments. Technological advancements, such as the development of biodegradable and compostable plastics, are analyzed alongside their impact on market dynamics. The report explores the shifting consumer demands, including the growing preference for sustainable and eco-friendly alternatives, and their influence on market segmentation and product innovation. Detailed analysis of the impact of the COVID-19 pandemic on consumption patterns is also presented. We examine the trends shaping the future of the market, considering factors like increasing environmental consciousness and evolving government regulations.

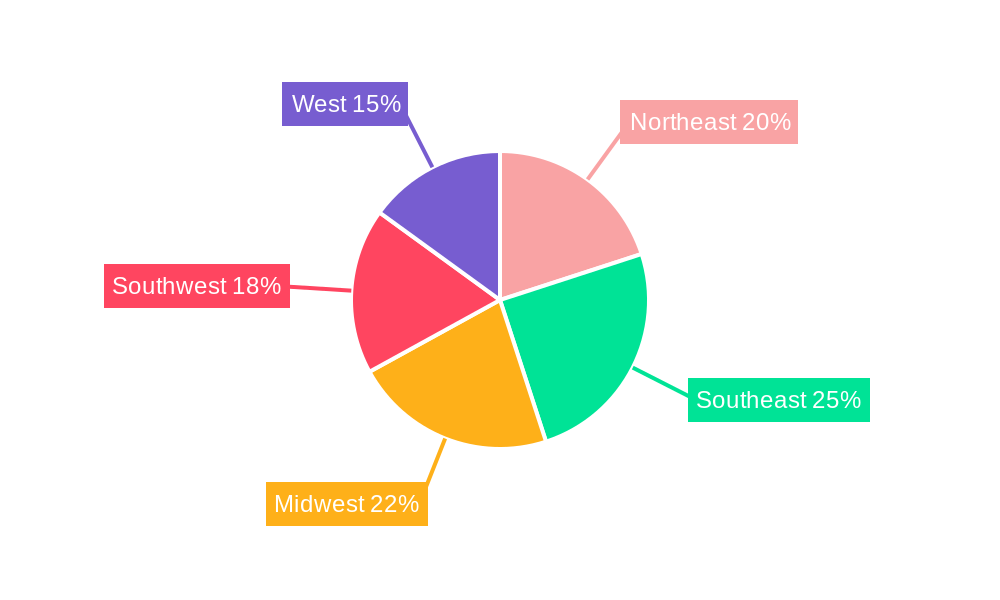

Leading Regions, Countries, or Segments in US Single-Use Plastic Bags Market

This section identifies the dominant regions, countries, and segments within the US single-use plastic bag market. We analyze market performance across different end-user industries (Food, Beverage, Healthcare & Pharmaceutical, Personal Care, Other) and materials (Paper & Paperboard, Plastics, Aluminium, Other).

By End-user Industry:

- Food & Beverage: High volume consumption due to widespread use in grocery stores and restaurants. Drivers include strong demand, established distribution networks, and relatively low cost.

- Healthcare & Pharmaceutical: Stringent hygiene requirements and demand for sterile packaging drive growth in this segment. Regulatory compliance and safety standards are major factors.

- Personal Care: Usage in packaging of cosmetics, toiletries, and other personal care products. Demand is influenced by consumer preferences and product packaging trends.

By Material:

- Plastics: Dominates the market due to its cost-effectiveness, durability, and versatility. However, this is countered by growing environmental concerns.

- Paper & Paperboard: Growing due to increasing consumer preference for eco-friendly alternatives. Technological advancements are improving their performance and usability.

US Single-Use Plastic Bags Market Product Innovations

This section highlights cutting-edge product innovations, evolving applications, and key performance metrics within the US single-use plastic bag market. Significant advancements in material science are paving the way for the development of more sustainable alternatives, including biodegradable and compostable bag options. These innovations serve as unique selling propositions, emphasizing environmental responsibility and appealing to a growing eco-conscious consumer base. The report further details how these advancements are enhancing the recyclability of plastic bags and actively reducing their overall environmental footprint. Moreover, we explore the integration of advanced manufacturing technologies aimed at boosting operational efficiency and driving down production costs, ensuring competitiveness in a dynamic market.

Propelling Factors for US Single-Use Plastic Bags Market Growth

The growth of the US single-use plastic bag market is fueled by several factors. The continued expansion of the food and beverage industry is a major driver, with increasing demand from grocery stores, restaurants, and other food service establishments. Furthermore, advancements in packaging technology, leading to improved functionality and convenience, contribute to market growth. Favorable economic conditions and robust consumer spending also play a significant role. Finally, although facing increasing regulatory scrutiny, the relatively low cost of plastic bags compared to alternatives maintains its strong position.

Obstacles in the US Single-Use Plastic Bags Market Market

The US single-use plastic bag market faces significant headwinds. Stringent environmental regulations, including bans and taxes on plastic bags in several states and cities, pose considerable challenges. Supply chain disruptions, particularly those experienced in recent years, can lead to production delays and increased costs. Intense competition from manufacturers of alternative packaging solutions, like reusable bags and paper bags, creates pressure on market share. The fluctuating price of raw materials also contributes to uncertainty.

Future Opportunities in US Single-Use Plastic Bags Market

Emerging opportunities lie in the development and adoption of biodegradable and compostable plastic bags, aligning with growing consumer demand for eco-friendly products. Innovative designs and improved functionality are key areas of opportunity. The expansion into new market segments, such as specialized applications in healthcare and industrial settings, presents further potential. Moreover, partnerships with recycling facilities and waste management companies can help address environmental concerns and enhance the sustainability of the industry.

Major Players in the US Single-Use Plastic Bags Market Ecosystem

- Amcor Plc

- Snapsil Corporation

- Graphic Packaging International Inc

- Fuling Plastic USA Inc

- Georgia-Pacific LLC

- PPC Flexible Packaging LLC

- Pactiv LLC

- Novolex

- Berry Global Inc

- Dart Container Corporation

Key Developments in US Single-Use Plastic Bags Market Industry

- September 2022: Novolex significantly boosted its commitment to sustainability by investing USD 10 Million in expanding its Indiana recycling facility. This strategic investment is set to augment its capacity to recycle up to 28 Million lbs (12,698 MT) of plastic bags and polyethylene films annually, marking a substantial step towards circular economy principles.

- July 2022: Novolex introduced an innovative new stand for its Cutlerease disposable utensil dispenser. This enhancement is designed to optimize usability and conserve space, offering a more efficient solution for food service businesses seeking to streamline operations.

- Ongoing: Continuous research and development into bio-based and recycled content materials are shaping the future of single-use plastic bag production, with a focus on meeting stringent environmental regulations and consumer demand for greener packaging solutions.

Strategic US Single-Use Plastic Bags Market Market Forecast

The US single-use plastic bag market is anticipated to experience steady growth, propelled by the persistent demand from crucial end-user industries. Despite navigating an increasingly stringent regulatory environment and facing competition from alternative solutions, the market's future trajectory will be largely dictated by the pace of innovation, particularly in the realm of sustainable materials and advanced recycling technologies. Significant opportunities lie in the development of environmentally responsible products that not only meet evolving consumer expectations but also maintain cost-effectiveness. The market is projected to exhibit moderate growth over the forecast period, presenting promising avenues for companies that prioritize sustainability, operational efficiency, and resilient supply chains.

US Single-Use Plastic Bags Market Segmentation

-

1. Material

- 1.1. Paper and Paperboard

- 1.2. Plastics

- 1.3. Aluminium

- 1.4. Other Materials

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Healthcare and Pharmaceutical

- 2.4. Personal Care

- 2.5. Other End-user Industries

US Single-Use Plastic Bags Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Single-Use Plastic Bags Market Regional Market Share

Geographic Coverage of US Single-Use Plastic Bags Market

US Single-Use Plastic Bags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Trend Toward Lightweight and Use of Sustainable Solutions (such as Paper-based Cups); Flexible Single-use Packaging Products Offering Increased Convenience and Utility

- 3.3. Market Restrains

- 3.3.1. High upfront and operational cost for deploying coding and making equipment

- 3.4. Market Trends

- 3.4.1. Flexible Single-use Plastic Packaging Products Offering Increased Convenience and Utility

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Single-Use Plastic Bags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paper and Paperboard

- 5.1.2. Plastics

- 5.1.3. Aluminium

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Healthcare and Pharmaceutical

- 5.2.4. Personal Care

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America US Single-Use Plastic Bags Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Paper and Paperboard

- 6.1.2. Plastics

- 6.1.3. Aluminium

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Healthcare and Pharmaceutical

- 6.2.4. Personal Care

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America US Single-Use Plastic Bags Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Paper and Paperboard

- 7.1.2. Plastics

- 7.1.3. Aluminium

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Healthcare and Pharmaceutical

- 7.2.4. Personal Care

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe US Single-Use Plastic Bags Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Paper and Paperboard

- 8.1.2. Plastics

- 8.1.3. Aluminium

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Healthcare and Pharmaceutical

- 8.2.4. Personal Care

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa US Single-Use Plastic Bags Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Paper and Paperboard

- 9.1.2. Plastics

- 9.1.3. Aluminium

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Healthcare and Pharmaceutical

- 9.2.4. Personal Care

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific US Single-Use Plastic Bags Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Paper and Paperboard

- 10.1.2. Plastics

- 10.1.3. Aluminium

- 10.1.4. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Healthcare and Pharmaceutical

- 10.2.4. Personal Care

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amcor Plc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Snapsil Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Graphic Packaging International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fuling Plastic USA Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Georgia-Pacific LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PPC Flexible Packaging LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pactiv LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Novolex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Berry Global Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dart Container Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Amcor Plc

List of Figures

- Figure 1: Global US Single-Use Plastic Bags Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Single-Use Plastic Bags Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America US Single-Use Plastic Bags Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America US Single-Use Plastic Bags Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America US Single-Use Plastic Bags Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America US Single-Use Plastic Bags Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America US Single-Use Plastic Bags Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Single-Use Plastic Bags Market Revenue (Million), by Material 2025 & 2033

- Figure 9: South America US Single-Use Plastic Bags Market Revenue Share (%), by Material 2025 & 2033

- Figure 10: South America US Single-Use Plastic Bags Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: South America US Single-Use Plastic Bags Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: South America US Single-Use Plastic Bags Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America US Single-Use Plastic Bags Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Single-Use Plastic Bags Market Revenue (Million), by Material 2025 & 2033

- Figure 15: Europe US Single-Use Plastic Bags Market Revenue Share (%), by Material 2025 & 2033

- Figure 16: Europe US Single-Use Plastic Bags Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Europe US Single-Use Plastic Bags Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe US Single-Use Plastic Bags Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe US Single-Use Plastic Bags Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Single-Use Plastic Bags Market Revenue (Million), by Material 2025 & 2033

- Figure 21: Middle East & Africa US Single-Use Plastic Bags Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: Middle East & Africa US Single-Use Plastic Bags Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Middle East & Africa US Single-Use Plastic Bags Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Middle East & Africa US Single-Use Plastic Bags Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Single-Use Plastic Bags Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Single-Use Plastic Bags Market Revenue (Million), by Material 2025 & 2033

- Figure 27: Asia Pacific US Single-Use Plastic Bags Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Asia Pacific US Single-Use Plastic Bags Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific US Single-Use Plastic Bags Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific US Single-Use Plastic Bags Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific US Single-Use Plastic Bags Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Material 2020 & 2033

- Table 5: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Material 2020 & 2033

- Table 11: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Material 2020 & 2033

- Table 17: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Material 2020 & 2033

- Table 29: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Material 2020 & 2033

- Table 38: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 39: Global US Single-Use Plastic Bags Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Single-Use Plastic Bags Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Single-Use Plastic Bags Market?

The projected CAGR is approximately 2.72%.

2. Which companies are prominent players in the US Single-Use Plastic Bags Market?

Key companies in the market include Amcor Plc, Snapsil Corporation, Graphic Packaging International Inc, Fuling Plastic USA Inc, Georgia-Pacific LLC, PPC Flexible Packaging LLC, Pactiv LLC, Novolex, Berry Global Inc, Dart Container Corporation.

3. What are the main segments of the US Single-Use Plastic Bags Market?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Trend Toward Lightweight and Use of Sustainable Solutions (such as Paper-based Cups); Flexible Single-use Packaging Products Offering Increased Convenience and Utility.

6. What are the notable trends driving market growth?

Flexible Single-use Plastic Packaging Products Offering Increased Convenience and Utility.

7. Are there any restraints impacting market growth?

High upfront and operational cost for deploying coding and making equipment.

8. Can you provide examples of recent developments in the market?

September 2022: Novolex, a North American company, invested USD 10 million to expand the Indiana, United States, recycling facility's capacity, enabling the recycling of plastic bags and other PE films. After the procurement of mechanical recycling equipment, the plant will be able to produce up to 28 million lbs (12,698 MT) of recycled material yearly to generate new goods made from post-consumer or post-industrial recycled material.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Single-Use Plastic Bags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Single-Use Plastic Bags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Single-Use Plastic Bags Market?

To stay informed about further developments, trends, and reports in the US Single-Use Plastic Bags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence