Key Insights

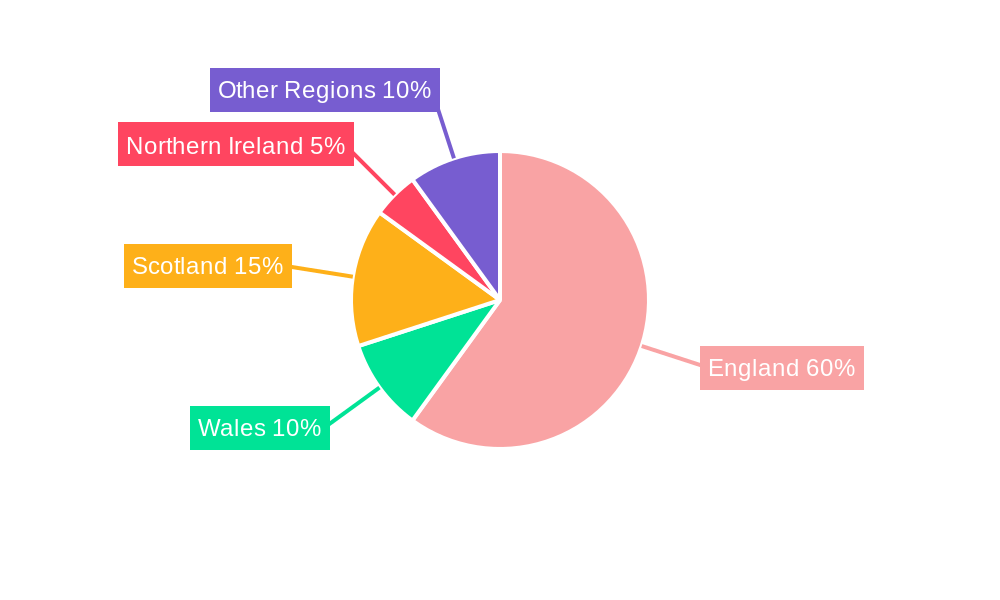

The UK residential real estate market, valued at £360.27 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.75% from 2025 to 2033. This expansion is driven by several key factors. Strong population growth, particularly in urban centers like London, fuels consistent demand for housing. Furthermore, increasing urbanization and a shift towards smaller, more sustainable housing options (apartments and condominiums) contribute to market dynamism. Government initiatives aimed at increasing housing affordability, while potentially impacting certain segments, overall contribute to market activity. However, the market faces challenges including persistent inflation, rising interest rates impacting mortgage affordability, and potential regulatory changes influencing construction and development. The market is segmented geographically (England, Wales, Scotland, Northern Ireland, and other regions) and by property type (apartments/condominiums and landed houses/villas). Competition is high, with major players like Berkeley Group, Barratt Developments, and Redrow dominating the market alongside numerous smaller developers and housing trusts. The forecast period suggests a continued upward trajectory, although the rate of growth may fluctuate based on macroeconomic conditions.

The segmentation reveals significant regional variations. London and the South East are expected to remain high-growth areas due to their economic strength and population density. However, other regions, particularly those with more affordable housing options, may also experience substantial growth, driven by increased affordability relative to the higher-priced areas. The type of housing also plays a crucial role. The increasing popularity of apartments and condominiums, particularly within urban centers, is expected to continue driving market growth in this segment, while demand for landed houses and villas likely remains dependent on location and affordability. The ongoing development and renovation projects will significantly influence the overall growth trajectory of the market.

UK Residential Real Estate Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the UK residential real estate market, covering historical performance (2019-2024), the current state (2025), and future projections (2025-2033). It offers a deep dive into market trends, key players, and emerging opportunities, equipping stakeholders with the crucial information needed for strategic decision-making. The report leverages extensive data analysis, covering key regions, property types, and significant industry developments, all presented in a clear, concise manner. The base year for this analysis is 2025, with a forecast period extending to 2033. The total market value is predicted to reach £xx Million by 2033.

UK Residential Real Estate Market Composition & Trends

This section delves into the intricate composition of the UK residential real estate market, examining key trends shaping its evolution. We analyze market concentration, identifying leading players and their respective market shares. The report also explores innovation catalysts, such as technological advancements and shifting consumer preferences, influencing market dynamics. Furthermore, it analyzes the regulatory landscape and its impact on market activity, examines substitute products, and provides a comprehensive profile of end-users. Finally, it meticulously details the mergers and acquisitions (M&A) activity, including deal values.

- Market Share Distribution: The market is characterized by a moderately concentrated structure, with a few large players like Berkeley Group, London and Quadrant Housing Trust, Foxtons Ltd, Redrow, Places for People, Mears, Kier Group, Countrywide PLC, Countryside Properties PLC, Barratt Developments PLC, Galliard Homes Limited, Native Land Limited, Bellway PLC, Crest Nicholson PLC, and Miller Homes holding a significant share, estimated at xx% collectively in 2025. Smaller players constitute the remaining xx%.

- M&A Activity: The historical period (2019-2024) witnessed a total M&A deal value of approximately £xx Million, with an average deal size of £xx Million. The forecast period is expected to see increased activity, driven by consolidation and expansion strategies.

UK Residential Real Estate Market Industry Evolution

This section meticulously analyzes the evolution of the UK residential real estate market, focusing on growth trajectories, technological advancements, and evolving consumer preferences. We examine the impact of factors like urbanization, population growth, and changing lifestyle choices on the demand for various property types. We explore the adoption of innovative technologies such as PropTech solutions for property management and online platforms. We further analyze the changing landscape of financing options, from traditional mortgages to alternative financing models. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, and is projected to grow at a CAGR of xx% between 2025 and 2033.

Leading Regions, Countries, or Segments in UK Residential Real Estate Market

This section pinpoints the dominant regions and segments within the UK residential real estate market. We analyze regional variations in market dynamics, identifying key drivers and factors contributing to the dominance of specific areas. We also analyze the performance of different property types, such as apartments, condominiums, landed houses, and villas.

- Key Drivers (By Region):

- England: High population density, robust economic activity, and significant investment inflow.

- Scotland: Attractive natural landscapes and a growing tourism sector.

- London: Strong financial services sector, high concentration of affluent individuals, and limited supply.

- Key Drivers (By Type):

- Apartments and Condominiums: High demand in urban areas, affordability relative to landed properties.

- Landed Houses and Villas: Preference for larger living spaces, particularly in suburban and rural areas.

The dominance of England and London is primarily due to their established economies, high population density, and significant investment in infrastructure. The high demand for apartments and condominiums in urban areas reflects the increasing preference for compact and convenient living spaces.

UK Residential Real Estate Market Product Innovations

The UK residential real estate market is undergoing a period of significant transformation, driven by innovative products and services. Smart home technology is rapidly becoming a standard feature, enhancing convenience and energy efficiency. The increasing focus on sustainability is reflected in the widespread adoption of eco-friendly building materials and design principles, leading to the proliferation of green building certifications like BREEAM and LEED. Furthermore, the build-to-rent (BTR) sector continues its rapid expansion, offering a diverse range of rental options and catering to evolving lifestyle preferences. These innovations are not only enhancing living experiences but also attracting a new generation of environmentally conscious buyers and renters. Features such as advanced security systems, high-speed broadband infrastructure, and EV charging points are increasingly becoming key selling points, reflecting the changing priorities of the modern homeowner.

Propelling Factors for UK Residential Real Estate Market Growth

Several factors contribute to the growth of the UK residential real estate market. These include robust economic growth, increased urbanization, government initiatives promoting affordable housing, and continuous investment in infrastructure. The development of new housing estates and regeneration projects further fuels market expansion. The increasing adoption of PropTech enhances efficiency and transparency within the sector.

Obstacles in the UK Residential Real Estate Market Market

Despite the growth potential, the market faces challenges. These include stringent planning regulations, supply chain disruptions impacting construction timelines and costs, competition from established players and new entrants, and fluctuating interest rates affecting affordability. These obstacles may lead to temporary market slowdowns.

Future Opportunities in UK Residential Real Estate Market

Despite the challenges, the UK residential real estate market presents compelling opportunities for growth and innovation. The burgeoning demand for sustainable and eco-friendly housing aligns perfectly with global environmental concerns, driving investment in green technologies and creating a market for high-performance, energy-efficient properties. The rapid advancements in PropTech, encompassing innovative solutions across the entire property lifecycle, are streamlining processes, enhancing efficiency, and improving the overall customer experience. The persistently high demand for rental properties, particularly in urban areas, fuels continued growth in the BTR sector. Expanding beyond traditional hotspots like London to explore regional markets offers significant potential for investors seeking diversified portfolios and less saturated markets. These diverse opportunities are shaping a dynamic and exciting future for the UK residential real estate industry.

Major Players in the UK Residential Real Estate Market Ecosystem

- Berkeley Group

- London and Quadrant Housing Trust

- Foxtons Ltd

- Redrow

- Places for People

- Mears

- Kier Group

- Countrywide PLC

- Countryside Properties PLC

- Barratt Developments PLC

- Galliard Homes Limited

- Native Land Limited

- Bellway PLC

- Crest Nicholson PLC

- Miller Homes

Key Developments in UK Residential Real Estate Market Industry

- May 2023: Rasmala Investment Bank's launch of a USD 2bn UK multifamily strategy, focusing on serviced apartments and BTR in and around London, underscores significant international investor confidence in the UK residential market's long-term prospects.

- November 2022: ValuStrat's acquisition of an interest in Capital Value Surveyors demonstrates the ongoing attraction of the UK real estate sector to international players, signaling a healthy and competitive market.

- [Add another recent development here, with date and brief description]

Strategic UK Residential Real Estate Market Market Forecast

The UK residential real estate market is poised for continued growth, driven by sustained economic performance, demographic shifts, and ongoing investment in infrastructure and technology. The long-term outlook is positive, with opportunities for both established players and new entrants to thrive in a dynamic and evolving market. However, navigating regulatory challenges and managing supply chain risks remain crucial for success.

UK Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

UK Residential Real Estate Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for New Dwellings Units; Government Initiatives are driving the market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions; Lack of Skilled Labour

- 3.4. Market Trends

- 3.4.1. Increasing in the United Kingdom House Prices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Landed Houses and Villas

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. England UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Berkeley Group

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 London and Quadrant Housing Trust**List Not Exhaustive 7 3 Other Companies (Foxtons Ltd Redrow Places for People Mears Kier Group Countrywide PLC

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Countryside Properties PLC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Barratt Developments PLC

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Galliard Homes Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Native Land Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Bellway PLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Crest Nicholson PLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Miler homes

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.1 Berkeley Group

List of Figures

- Figure 1: Global UK Residential Real Estate Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Residential Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Residential Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Residential Real Estate Market Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UK Residential Real Estate Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UK Residential Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 7: North America UK Residential Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America UK Residential Real Estate Market Revenue (Million), by Type 2024 & 2032

- Figure 9: South America UK Residential Real Estate Market Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America UK Residential Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America UK Residential Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe UK Residential Real Estate Market Revenue (Million), by Type 2024 & 2032

- Figure 13: Europe UK Residential Real Estate Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: Europe UK Residential Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe UK Residential Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa UK Residential Real Estate Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Middle East & Africa UK Residential Real Estate Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Middle East & Africa UK Residential Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa UK Residential Real Estate Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific UK Residential Real Estate Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Asia Pacific UK Residential Real Estate Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Pacific UK Residential Real Estate Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific UK Residential Real Estate Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UK Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: England UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Wales UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Scotland UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Ireland UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Russia UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Benelux UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Nordics UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UK Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global UK Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific UK Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Residential Real Estate Market?

The projected CAGR is approximately 5.75%.

2. Which companies are prominent players in the UK Residential Real Estate Market?

Key companies in the market include Berkeley Group, London and Quadrant Housing Trust**List Not Exhaustive 7 3 Other Companies (Foxtons Ltd Redrow Places for People Mears Kier Group Countrywide PLC, Countryside Properties PLC, Barratt Developments PLC, Galliard Homes Limited, Native Land Limited, Bellway PLC, Crest Nicholson PLC, Miler homes.

3. What are the main segments of the UK Residential Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 360.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for New Dwellings Units; Government Initiatives are driving the market.

6. What are the notable trends driving market growth?

Increasing in the United Kingdom House Prices.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions; Lack of Skilled Labour.

8. Can you provide examples of recent developments in the market?

May 2023: A UAE-based investment manager, Rasmala Investment Bank, has launched a USD 2bn ( €1.8bn) UK multifamily strategy for a five-year period to build a USD 2bn portfolio of UK residential properties. The strategy is focused on the UK market for multifamily properties through a Shariah-compliant investment vehicle, initially targeting the serviced apartment (SAP) and BTR (build-to-rent) subsectors within and around London. Seeded by Rasmala Group, the strategy is backed by an active investment pipeline for the next 12 – 18 months.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the UK Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence