Key Insights

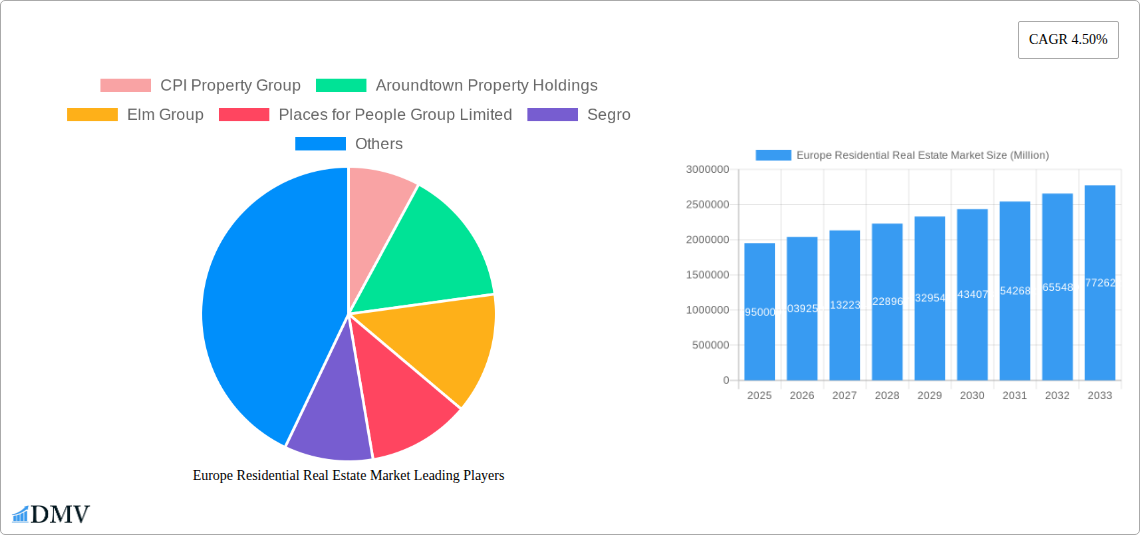

The European residential real estate market, valued at €1.95 trillion in 2025, is projected to experience steady growth, driven by factors such as increasing urbanization, a growing population, and favorable government policies in key regions like Germany and the UK. The market's Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033 indicates a positive outlook, albeit with some regional variations. Strong demand for condominiums and apartments, particularly in urban centers, is expected to continue, alongside a persistent, albeit slower-growing, demand for villas and landed houses in suburban and rural areas. While the market faces challenges like rising construction costs and interest rates potentially acting as restraints, the long-term fundamentals remain positive, fueled by a continued need for housing across various price points and property types. Germany, the United Kingdom, and France represent the largest national markets, with significant contributions from other European nations. Key players like CPI Property Group, Aroundtown Property Holdings, and others are well-positioned to capitalize on this growth, though competition remains intense. The market segmentation by property type (condominiums/apartments vs. villas/landed houses) allows for a nuanced understanding of diverse consumer preferences and investment opportunities. This dynamic interplay between supply, demand, and regulatory frameworks will shape the future trajectory of the European residential real estate sector.

Europe Residential Real Estate Market Market Size (In Million)

The forecast period (2025-2033) anticipates a continued expansion of the market, with the CAGR potentially experiencing some fluctuation based on macroeconomic conditions and shifts in government policies affecting mortgage rates and construction regulations. The ongoing evolution of the market will be influenced by factors including the availability of financing, the impact of technological innovations on construction and property management, and evolving consumer preferences regarding sustainable and smart housing solutions. Specific regional variations in growth rates will depend upon local economic conditions, demographic trends, and the availability of land for development. The competitive landscape will continue to evolve with mergers, acquisitions, and the emergence of new players, while existing companies will focus on innovation and diversification to maintain their market share.

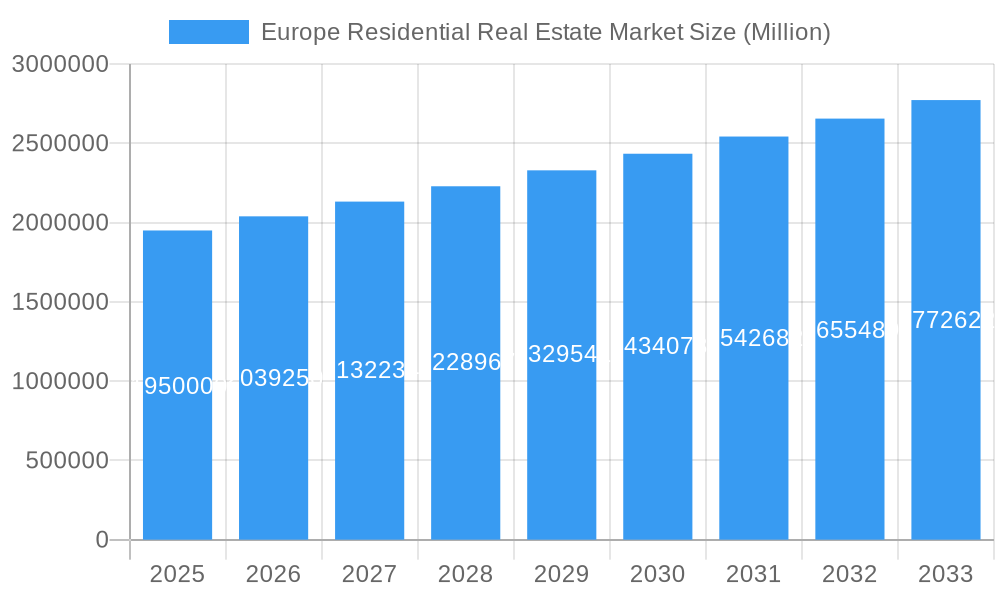

Europe Residential Real Estate Market Company Market Share

Europe Residential Real Estate Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the European residential real estate market, covering the period from 2019 to 2033. We delve into market composition, industry evolution, leading segments, and key players, offering valuable insights for stakeholders seeking to navigate this dynamic sector. The report uses 2025 as its base and estimated year, with a forecast period spanning 2025-2033 and a historical period covering 2019-2024. Discover key trends, growth drivers, and potential obstacles, alongside projections for future opportunities. This report is essential for investors, developers, and industry professionals seeking a comprehensive understanding of the European residential real estate landscape.

Europe Residential Real Estate Market Market Composition & Trends

This section examines the competitive landscape of the European residential real estate market, analyzing market concentration, innovation, regulatory factors, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The analysis encompasses key metrics such as market share distribution and M&A deal values across major European countries.

Market Concentration: The market shows a degree of consolidation, with larger players like CPI Property Group and Aroundtown Property Holdings holding significant market share in specific segments and countries. However, a fragmented landscape persists, especially within niche segments and smaller markets. Precise market share data is currently unavailable (xx%).

Innovation Catalysts: Proptech advancements, such as the recent EUR 12 Million seed funding for DoorFeed, are driving innovation, enhancing efficiency and attracting institutional investment. This is transforming the market and opening up new avenues for investment and growth.

Regulatory Landscape: Varying regulations across European countries influence development activity and investment decisions. Understanding these nuances is critical for successful market participation.

Substitute Products: The availability of alternative housing solutions, such as co-living spaces and rental platforms, influences demand for traditional residential properties.

End-User Profiles: The report profiles key end-user segments, including first-time homebuyers, investors, and families, and their evolving preferences.

M&A Activity: Recent deals, like H.I.G.’s investment in The Grounds Real Estate Development AG, illustrate the ongoing M&A activity in the sector. Total M&A deal value in 2024 was estimated at xx Million.

Europe Residential Real Estate Market Industry Evolution

This section analyzes the historical and projected growth trajectories of the European residential real estate market, tracing its evolution against the backdrop of technological advancements and shifts in consumer demand.

The market has witnessed consistent, albeit fluctuating, growth over the period 2019-2024. Factors influencing this include economic growth, changing demographics, urbanization, and government policies. Technological advancements, particularly in Proptech, are streamlining processes, increasing efficiency and attracting investment. The shift towards sustainable and smart homes is a major influencing trend. Projected annual growth rate (CAGR) for 2025-2033 is estimated at xx%. Increased adoption of digital tools by both buyers and sellers is also transforming the market. Further details on specific growth rates and adoption metrics are presented within the full report.

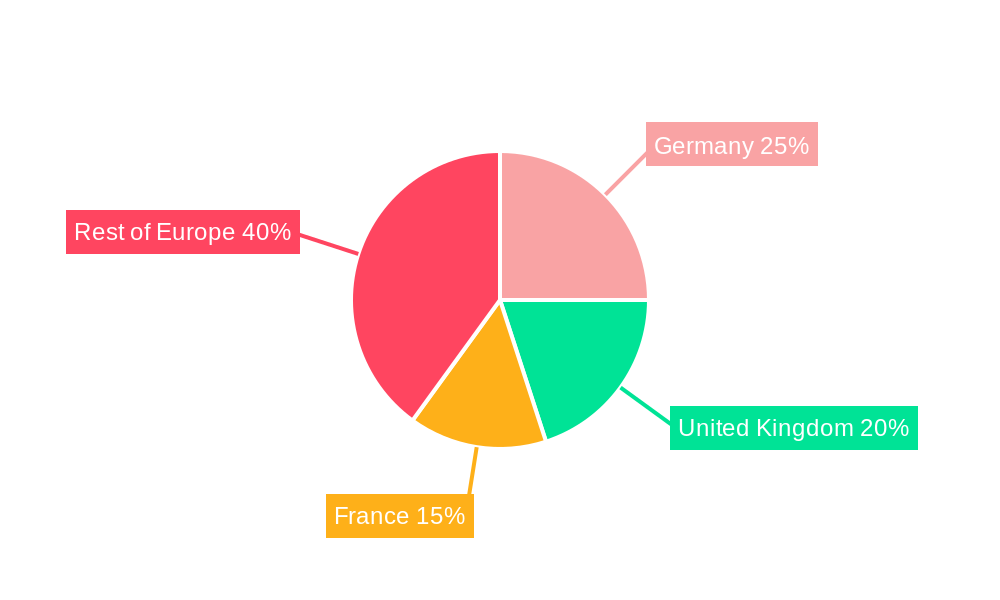

Leading Regions, Countries, or Segments in Europe Residential Real Estate Market

This section identifies the dominant regions, countries, and property types within the European residential real estate market, providing a detailed analysis of the factors contributing to their prominence.

Dominant Regions and Countries:

- Germany: Strong economic performance and robust infrastructure contribute to Germany's leading position.

- United Kingdom: Despite Brexit-related uncertainties, London and other major cities remain significant investment hubs.

- France: A relatively stable economy and government support for housing initiatives contribute to market strength.

Dominant Property Types:

- Condominiums and Apartments: This segment consistently demonstrates high demand, driven by urbanization and a preference for low-maintenance living.

- Villas and Landed Houses: This segment maintains a strong position, particularly in affluent areas and suburban regions.

Key Drivers:

- Investment Trends: Consistent inflow of both domestic and international investment fuels market growth.

- Regulatory Support: Government initiatives to promote housing affordability and development contribute to growth.

Europe Residential Real Estate Market Product Innovations

The European residential real estate market is witnessing a surge in product innovation, driven by Proptech advancements and evolving consumer preferences. Smart home technology integration, sustainable building materials, and innovative design solutions are reshaping the sector. These innovations offer enhanced functionality, energy efficiency, and lifestyle benefits, creating unique selling propositions and capturing a significant market share. Examples include building-integrated solar panels, automated lighting systems, and enhanced security features. These advancements are contributing to increased property values and attracting higher premiums.

Propelling Factors for Europe Residential Real Estate Market Growth

Several factors are driving the growth of the European residential real estate market. Technological advancements in construction techniques and materials are enhancing efficiency and reducing costs. Favorable economic conditions in many European countries, increasing urbanization, and shifting demographic trends, including a growing population and increased household formations, are contributing significantly to increased demand. Furthermore, supportive government policies and initiatives aimed at promoting sustainable housing development are fostering growth.

Obstacles in the Europe Residential Real Estate Market Market

The European residential real estate market faces several challenges. Stringent regulatory requirements concerning building permits and environmental regulations can slow down development projects. Supply chain disruptions impacting construction materials have resulted in increased costs and delays. Competition from both established players and new entrants is also fierce. These factors can collectively lead to reduced profitability for businesses operating in this sector. The impact of these restraints is estimated to reduce the overall market growth by xx% in 2025.

Future Opportunities in Europe Residential Real Estate Market

Significant opportunities exist within the European residential real estate market. The increasing popularity of sustainable and energy-efficient housing presents a substantial opportunity for developers. Demand for rental housing in major urban centers is growing steadily, creating an attractive segment for investment. Advancements in technology, such as the use of blockchain and AI, offer new opportunities to improve efficiency and transparency across transactions. Finally, expanding into underserved markets across Europe remains a significant avenue for growth.

Major Players in the Europe Residential Real Estate Market Ecosystem

- CPI Property Group

- Aroundtown Property Holdings

- Elm Group

- Places for People Group Limited

- Segro

- LEG Immobilien AG

- Unibail-Rodamco

- Covivio

- Gecina

- 7 3 Other Companies

- Consus Real Estate AG

Key Developments in Europe Residential Real Estate Market Industry

November 2023: DoorFeed, a Proptech company, secured EUR 12 million (USD 13.24 million) in seed funding, signifying growing investor confidence in Proptech solutions for residential real estate. This funding will drive expansion across Europe.

October 2023: H.I.G.'s investment in The Grounds Real Estate Development AG highlights increased institutional interest in German residential development, particularly in major metropolitan areas. This is expected to accelerate the development of new residential projects in Germany.

Strategic Europe Residential Real Estate Market Market Forecast

The European residential real estate market is poised for continued growth, driven by robust economic fundamentals, urbanization, and technological innovation. Emerging opportunities in sustainable housing, rental markets, and Proptech will shape the sector's future. Despite potential challenges, the long-term outlook remains positive, with significant potential for further expansion and investment. The market is expected to see sustained growth across various segments, with specific growth rates varying depending on regional and economic conditions. The report provides a detailed forecast considering various scenarios and their potential impacts.

Europe Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Condominiums and Apartments

- 1.2. Villas and Landed Houses

-

2. Countries

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

Europe Residential Real Estate Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Residential Real Estate Market Regional Market Share

Geographic Coverage of Europe Residential Real Estate Market

Europe Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Developments in the Residential Segment; Investments in the Senior Living Units

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Land Hindering the Market

- 3.4. Market Trends

- 3.4.1. Student Housing to Gain Traction

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums and Apartments

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Countries

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Rest of Europe

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CPI Property Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aroundtown Property Holdings

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elm Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Places for People Group Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Segro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LEG Immobilien AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Unibail-Rodamco

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Covivio

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Gecina**List Not Exhaustive 7 3 Other Companie

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Consus Real Estate AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CPI Property Group

List of Figures

- Figure 1: Europe Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Residential Real Estate Market Revenue Million Forecast, by Countries 2020 & 2033

- Table 3: Europe Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Residential Real Estate Market Revenue Million Forecast, by Countries 2020 & 2033

- Table 6: Europe Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Residential Real Estate Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Residential Real Estate Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Europe Residential Real Estate Market?

Key companies in the market include CPI Property Group, Aroundtown Property Holdings, Elm Group, Places for People Group Limited, Segro, LEG Immobilien AG, Unibail-Rodamco, Covivio, Gecina**List Not Exhaustive 7 3 Other Companie, Consus Real Estate AG.

3. What are the main segments of the Europe Residential Real Estate Market?

The market segments include Type, Countries.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.95 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Developments in the Residential Segment; Investments in the Senior Living Units.

6. What are the notable trends driving market growth?

Student Housing to Gain Traction.

7. Are there any restraints impacting market growth?

Limited Availability of Land Hindering the Market.

8. Can you provide examples of recent developments in the market?

November 2023: DoorFeed, a Proptech company, raised EUR 12 million (USD 13.24 million) in seed funding, led by Motive Ventures and Stride and supported by renowned investors, including Seedcamp. Founded by veteran proptech entrepreneur and ex-Uber employee James Kirimi, DoorFeed aims to be the first choice for institutional investors seeking to invest in residential real estate. The company is looking to expand its footprint across Europe, with a focus on Spain, Germany, and the United Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Europe Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence