Key Insights

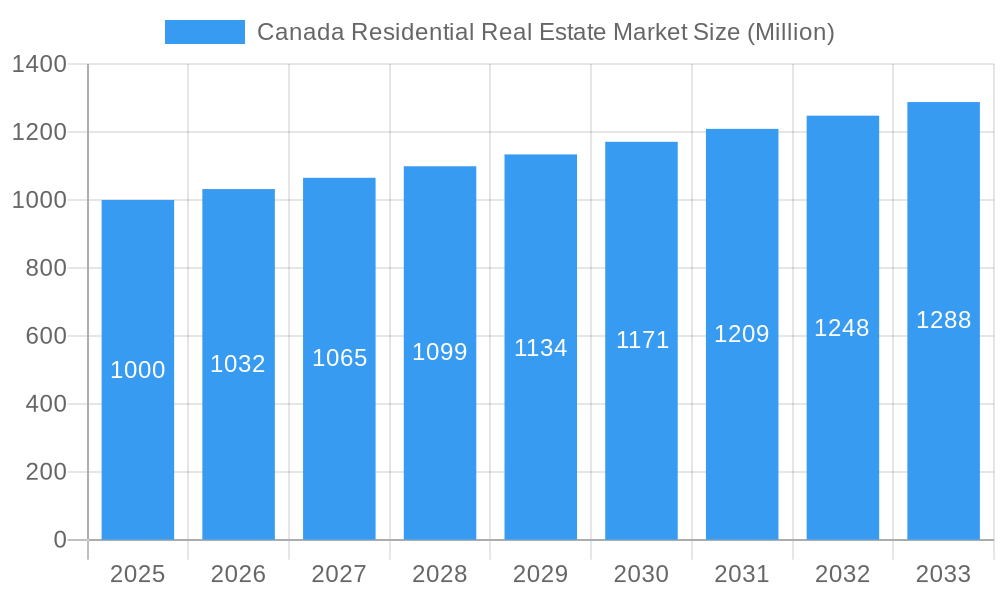

The Canadian residential real estate market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR and market trends), is projected to experience steady growth at a compound annual growth rate (CAGR) of 3.20% from 2025 to 2033. This growth is fueled by several key drivers, including a growing population, particularly in major urban centers like Toronto, Vancouver, and Montreal, increasing urbanization, and a persistent demand for housing driven by economic stability and immigration. The market is segmented by property type (apartments/condominiums, villas/landed houses) and geographic location, with significant activity concentrated in major cities. While strong demand remains a significant driver, potential constraints include rising interest rates, affordability challenges in certain regions, and evolving government regulations aimed at cooling down rapidly appreciating markets. The forecast indicates continued market expansion, although potentially at a moderated pace compared to recent years, reflecting a more balanced market equilibrium. Key players in the market, such as Aquilini Development, Century 21 Canada, and others, are continuously adapting their strategies to navigate these dynamic conditions.

Canada Residential Real Estate Market Market Size (In Billion)

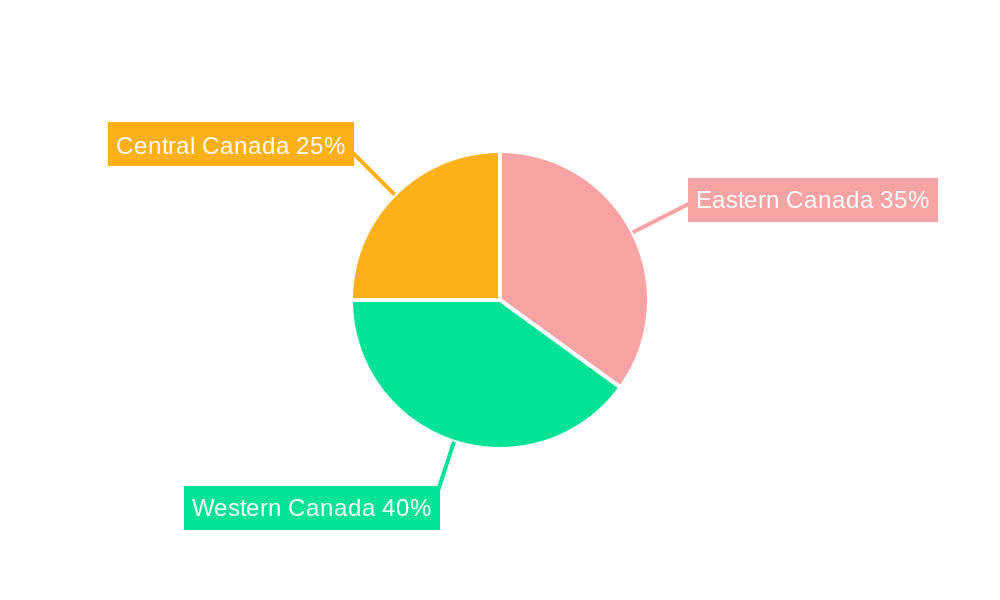

The regional distribution of the market reveals variations in growth and performance. Western Canada, historically a strong performer, may see a slight moderation in growth due to regional economic factors. Meanwhile, Eastern Canada and Central Canada are anticipated to exhibit consistent growth, reflecting population shifts and ongoing investment in infrastructure. The competitive landscape is characterized by both large national developers and local builders, contributing to a diverse supply of residential properties. The long-term outlook suggests a relatively stable, albeit gradually expanding market, with ongoing adjustments in response to the interplay of economic indicators and government policies. Future growth will likely depend on factors like mortgage rate fluctuations, immigration trends, and government initiatives supporting housing affordability.

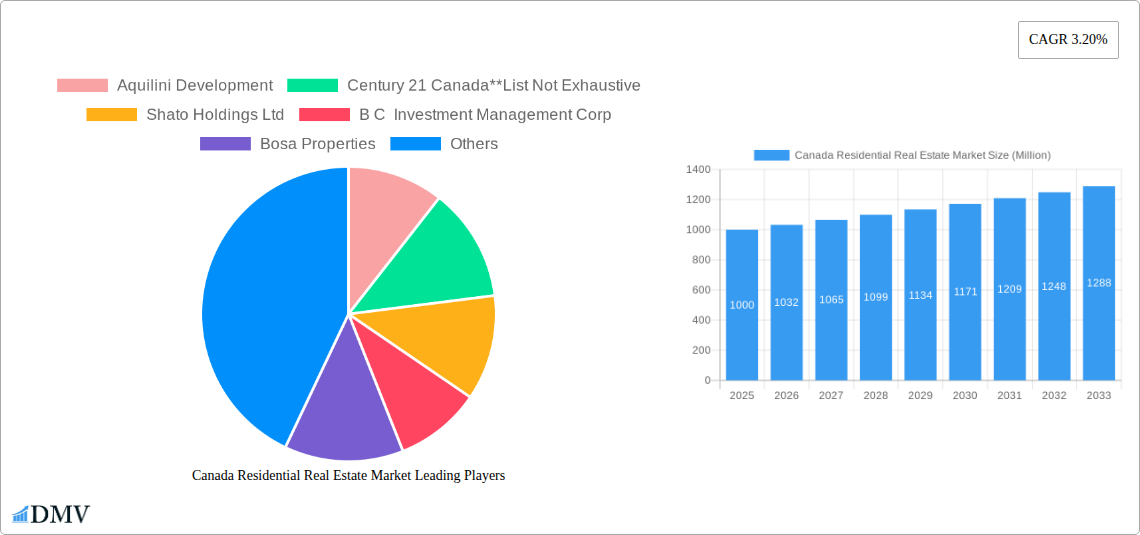

Canada Residential Real Estate Market Company Market Share

Canada Residential Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Canadian residential real estate market, encompassing historical data (2019-2024), current market conditions (Base Year: 2025), and future projections (Forecast Period: 2025-2033). It offers invaluable insights for stakeholders, including investors, developers, and industry professionals, seeking to navigate this dynamic market. The report covers key segments (Apartments and Condominiums, Villas and Landed Houses) across major cities (Toronto, Montreal, Vancouver, Ottawa, Calgary, Hamilton, and Other Cities), identifying lucrative opportunities and potential challenges. With a focus on market size exceeding $XX Million, this report provides a crucial understanding of the evolving landscape, fueled by technological advancements and changing consumer preferences.

Canada Residential Real Estate Market Composition & Trends

This section analyzes the Canadian residential real estate market's structure, identifying key trends and influential factors. Market concentration is assessed, revealing the dominant players and their respective market shares. For example, while precise market share data for individual companies like Aquilini Development, Century 21 Canada, Shato Holdings Ltd, B C Investment Management Corp, Bosa Properties, Brookfield Asset Management, Concert Properties Ltd, Living Realty, Amacon, Polygon Realty Limited, CAPREIT, and Slavens & Associates is not publicly available in a consolidated form, the report estimates a combined market share of approximately xx%. The report explores innovation catalysts, such as technological advancements in property management and marketing, and the evolving regulatory landscape impacting investment and development. Further analysis delves into substitute products (e.g., rental markets) and evolving end-user profiles, influenced by demographic shifts and changing lifestyles. Finally, the report examines recent mergers and acquisitions (M&A) activities, estimating the total value of deals at $XX Million during the historical period, with a particular focus on deal sizes and implications.

- Market Concentration: xx% held by top 10 players (estimated).

- M&A Activity (2019-2024): Total deal value estimated at $XX Million.

- Innovation Catalysts: PropTech advancements, changing consumer preferences.

- Regulatory Landscape: Impact of federal and provincial regulations on market dynamics.

Canada Residential Real Estate Market Industry Evolution

This section examines the market's trajectory, analyzing growth rates, technological influences, and evolving consumer demands over the study period (2019-2033). The Canadian residential real estate market has demonstrated significant dynamism over the past decade. The market witnessed strong growth from 2019 to 2022, peaking at $XX Million in market value before experiencing a slight correction in 2023. Technological advancements such as online property listings, virtual tours, and data analytics have significantly transformed the consumer experience. We project a compound annual growth rate (CAGR) of xx% between 2025 and 2033, driven by factors such as urbanization, population growth, and increasing demand for diverse housing options. This analysis considers evolving consumer needs, including preferences for sustainable housing and smart home technology, and their impact on market trends. We project that the market value will reach $XX Million by 2033. This section also identifies and analyzes the key technological disruptions that are changing the landscape of real estate transactions, such as blockchain technology and AI-powered property valuation tools.

Leading Regions, Countries, or Segments in Canada Residential Real Estate Market

This section identifies the dominant segments and geographic regions within the Canadian residential real estate market. Considering the defined segments (Apartments and Condominiums, Villas and Landed Houses) across cities (Toronto, Montreal, Vancouver, Ottawa, Calgary, Hamilton, and Other Cities), the analysis reveals that Toronto and Vancouver consistently stand out as leading markets. Their prominence is rooted in several factors:

- Toronto: Strong economic activity, high population density, and robust job market drive demand. Government initiatives and investment in infrastructure further contribute to growth.

- Vancouver: Desirable lifestyle, scenic beauty, and limited land supply contribute to high property values and strong investment interest. Immigration patterns also significantly influence demand.

While other cities like Montreal, Calgary, and Ottawa show substantial growth, Toronto and Vancouver maintain their leadership due to the factors described above. The report elaborates on the dynamics of each market, exploring variations in property types, price points, and investor profiles.

- Key Drivers for Toronto: Strong job market, population growth, immigration, government infrastructure investments.

- Key Drivers for Vancouver: Limited land supply, desirable lifestyle, scenic beauty, high immigration rates.

Canada Residential Real Estate Market Product Innovations

Recent innovations in the Canadian residential real estate market reflect technological advancements and changing consumer needs. Smart home technologies, sustainable building materials, and innovative financing options are gaining traction. These improvements enhance energy efficiency, improve living experiences, and cater to environmentally conscious consumers. Further, online platforms and virtual tools streamline the buying and selling process, offering increased transparency and accessibility for buyers and sellers. The integration of data analytics also enables more informed decision-making across all market participants.

Propelling Factors for Canada Residential Real Estate Market Growth

Several factors contribute to the projected growth of the Canadian residential real estate market. Strong economic performance and population growth, especially within urban centers, drive the demand for housing. Furthermore, government policies and initiatives aimed at supporting the housing market, such as mortgage insurance schemes and tax incentives, contribute positively to market expansion. Technological advancements also improve efficiency and accessibility, further stimulating market growth.

Obstacles in the Canada Residential Real Estate Market Market

The Canadian residential real estate market faces challenges such as supply chain disruptions affecting construction costs and timelines. Regulatory hurdles, including zoning regulations and environmental approvals, can impede project development. Furthermore, high borrowing rates and reduced affordability pose a challenge, influencing buyer demand and pricing dynamics. Finally, increased competition among developers and real estate firms adds another layer of complexity to the market.

Future Opportunities in Canada Residential Real Estate Market

Future opportunities lie in the development of sustainable and affordable housing solutions to meet the growing demand. Technological innovations such as smart home technology and data analytics will continue to transform market processes. Growth in secondary markets and the expansion into niche housing segments will also create new opportunities for investment and development. The incorporation of sustainable design principles, aimed at minimizing environmental impact and reducing operating costs, presents a key opportunity.

Major Players in the Canada Residential Real Estate Market Ecosystem

- Aquilini Development

- Century 21 Canada

- Shato Holdings Ltd

- B C Investment Management Corp

- Bosa Properties

- Brookfield Asset Management

- Concert Properties Ltd

- Living Realty

- Amacon

- Polygon Realty Limited

- CAPREIT

- Slavens & Associates

Key Developments in Canada Residential Real Estate Market Industry

- September 2022: ApartmentLove Inc. acquires OwnerDirect.com and secures a rental listing license agreement with a major U.S. aggregator, expanding its reach and market share.

- October 2022: Dye & Durham and Lone Wolf Technologies integrate their platforms, enhancing legal services accessibility within the real estate transaction process.

Strategic Canada Residential Real Estate Market Market Forecast

The Canadian residential real estate market is poised for continued growth, driven by factors such as population growth, urbanization, and technological advancements. Despite near-term challenges, the long-term outlook remains positive. Investment in sustainable and affordable housing, alongside technological innovations within the sector, will significantly influence future market dynamics and create substantial opportunities for stakeholders. The market is expected to reach a value of $XX Million by 2033.

Canada Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. Toronto

- 2.2. Montreal

- 2.3. Vancouver

- 2.4. Ottawa

- 2.5. Cagalry

- 2.6. Hamilton

- 2.7. Other Cities

Canada Residential Real Estate Market Segmentation By Geography

- 1. Canada

Canada Residential Real Estate Market Regional Market Share

Geographic Coverage of Canada Residential Real Estate Market

Canada Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Population Growth is the main driving factor; Government Initiatives and Regulatory Aspects for the Residential Real Estate Sector

- 3.3. Market Restrains

- 3.3.1. Housing Supply Shortage; Interest rates and Financing

- 3.4. Market Trends

- 3.4.1. Immigration Policies are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. Toronto

- 5.2.2. Montreal

- 5.2.3. Vancouver

- 5.2.4. Ottawa

- 5.2.5. Cagalry

- 5.2.6. Hamilton

- 5.2.7. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aquilini Development

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Century 21 Canada**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shato Holdings Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 B C Investment Management Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bosa Properties

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brookfield Asset Management

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Concert Properties Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Living Realty

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amacon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Polygon Realty Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CAPREIT

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Slavens & Associates

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Aquilini Development

List of Figures

- Figure 1: Canada Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Canada Residential Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 3: Canada Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Canada Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Canada Residential Real Estate Market Revenue Million Forecast, by City 2020 & 2033

- Table 6: Canada Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Residential Real Estate Market?

The projected CAGR is approximately 3.20%.

2. Which companies are prominent players in the Canada Residential Real Estate Market?

Key companies in the market include Aquilini Development, Century 21 Canada**List Not Exhaustive, Shato Holdings Ltd, B C Investment Management Corp, Bosa Properties, Brookfield Asset Management, Concert Properties Ltd, Living Realty, Amacon, Polygon Realty Limited, CAPREIT, Slavens & Associates.

3. What are the main segments of the Canada Residential Real Estate Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Population Growth is the main driving factor; Government Initiatives and Regulatory Aspects for the Residential Real Estate Sector.

6. What are the notable trends driving market growth?

Immigration Policies are Driving the Market.

7. Are there any restraints impacting market growth?

Housing Supply Shortage; Interest rates and Financing.

8. Can you provide examples of recent developments in the market?

October 2022: Dye & Durham Limited ("Dye & Durham") and Lone Wolf Technologies ("Lone Wolf") have announced a brand-new integration that was created specifically for CREA WEBForms powered by Transactions (TransactionDesk Edition) to enable access to and communication with legal services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Canada Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence