Key Insights

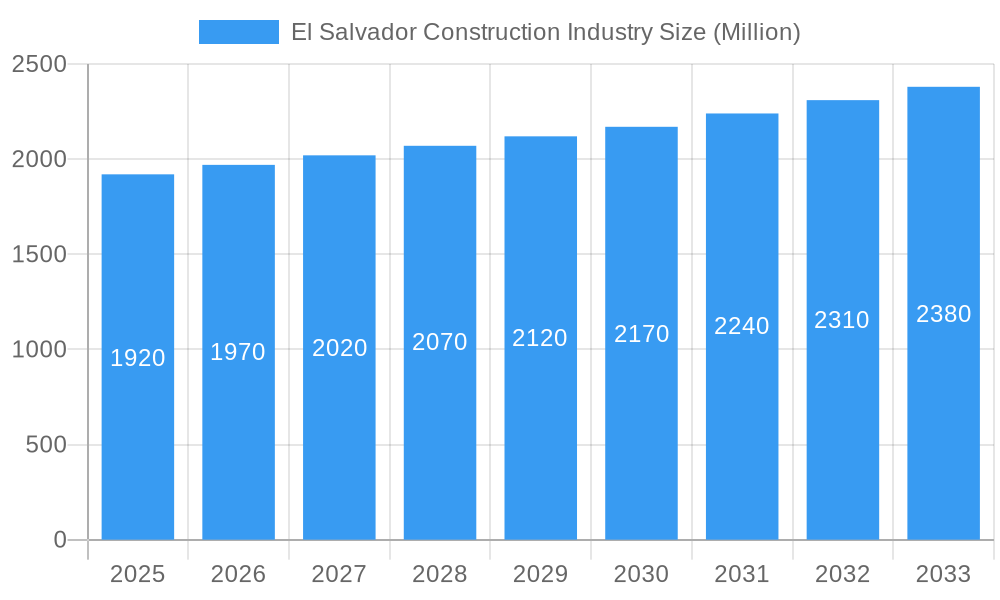

The El Salvador construction industry, valued at $1.92 billion in 2025, presents a nuanced picture. While the current Compound Annual Growth Rate (CAGR) stands at 0.00%, suggesting stagnation, a deeper analysis reveals a market poised for potential growth, albeit modest in the short term. The relatively flat CAGR might be attributed to several factors, including economic fluctuations impacting investment, infrastructure project delays, or a temporary lull in large-scale developments. However, the presence of diverse segments—commercial, industrial, residential, infrastructure (transportation), and energy and utilities—indicates a degree of resilience. The sector’s growth will likely be driven by ongoing needs for residential housing, particularly in urban areas, and government infrastructure initiatives aimed at improving transportation networks and utilities. Further growth could be spurred by private sector investment in commercial and industrial projects, particularly if economic conditions improve and investor confidence rises. Challenges may include securing financing, navigating bureaucratic processes, and ensuring the availability of skilled labor. The industry’s competitive landscape, while including notable players like B Construcciones Nabla S A de C V and American Industrial Park S A de C V, remains fragmented, presenting opportunities for both established and emerging firms. The long-term outlook depends on macroeconomic factors, government policy, and successful implementation of key infrastructure projects.

El Salvador Construction Industry Market Size (In Billion)

The forecast period (2025-2033) requires careful consideration of these factors. Assuming a moderate improvement in economic conditions and a gradual increase in construction activity, a conservative projected CAGR of 2-3% seems reasonable for the coming years. This would result in a market value exceeding $2.5 billion by 2033. However, this is a projection based on potential future dynamics and not a guarantee, and the actual growth may vary significantly depending on prevailing economic and political landscapes within El Salvador. Achieving this higher growth would necessitate increased investment, particularly in infrastructure development and sustainable housing solutions, to meet the growing demands of the country's population.

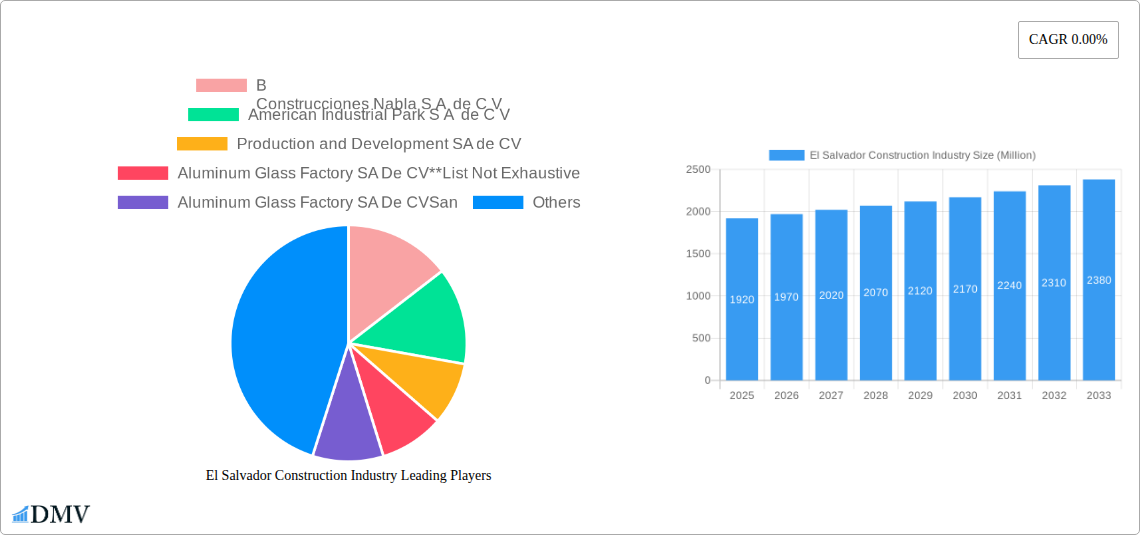

El Salvador Construction Industry Company Market Share

El Salvador Construction Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the El Salvador construction industry, offering valuable insights for stakeholders seeking to understand market trends, growth opportunities, and key players. The study period covers 2019-2033, with a focus on 2025 as the base and estimated year. The report examines market dynamics, technological advancements, and regulatory influences, forecasting robust growth throughout 2025-2033.

El Salvador Construction Industry Market Composition & Trends

This section evaluates the market concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and mergers and acquisitions (M&A) activity within the El Salvador construction industry from 2019-2024. The analysis includes market share distribution and M&A deal values, providing a comprehensive overview of the competitive landscape. The report finds that the market is moderately concentrated, with a few large players holding significant market share, while a number of smaller firms cater to niche segments.

- Market Concentration: The market share of the top 5 companies is estimated at xx%.

- Innovation Catalysts: Government initiatives promoting sustainable construction practices and technological advancements such as BIM (Building Information Modeling) are driving innovation.

- Regulatory Landscape: Regulations surrounding building codes, environmental protection, and worker safety significantly impact market operations. Streamlining of processes has been identified as key improvement area.

- Substitute Products: The increasing use of prefabricated building materials presents a degree of substitution, impacting traditional methods.

- End-User Profiles: Key end-users include commercial developers, industrial enterprises, residential builders, and government agencies.

- M&A Activity: Between 2019 and 2024, an estimated USD xx Million in M&A deals occurred, primarily involving smaller firms consolidating their presence.

El Salvador Construction Industry Industry Evolution

This section analyzes the evolutionary trajectory of the El Salvador construction market, encompassing market growth trajectories, technological advancements, and evolving consumer demands from 2019-2024, and projecting into the future. It presents data points like growth rates and adoption metrics across various segments. The construction industry witnessed an average annual growth rate (AAGR) of xx% during the historical period (2019-2024), driven by infrastructure development and private sector investment. Technological integration is accelerating, with increasing adoption of BIM and other digital tools enhancing project management and efficiency. Consumer demand is shifting toward sustainable and energy-efficient buildings, presenting both opportunities and challenges. The forecast period projects a more moderate but sustained growth rate due to several contributing factors discussed in subsequent sections.

Leading Regions, Countries, or Segments in El Salvador Construction Industry

This section identifies the dominant regions, countries, or sectors within the El Salvador construction industry. The analysis focuses on the key drivers influencing sector dominance.

- Infrastructure (Transportation): This segment is currently the leading sector, driven by significant government investment in road construction and expansion projects like the USD 410 Million Los Chorros highway extension. Continued investment in transportation infrastructure is a key driver for future growth.

- Commercial: The commercial sector is experiencing strong growth, fueled by foreign direct investment and the expansion of manufacturing and logistics industries.

- Residential: The residential sector exhibits moderate growth, impacted by fluctuating economic conditions and the accessibility of mortgages and other financing.

- Industrial: The industrial sector shows promise due to recent developments such as Grupo Ternova's USD 100 Million logistics park investment, indicating expansion of industrial space.

- Energy and Utilities: Growth in this sector is linked to government initiatives promoting renewable energy sources.

The dominance of the infrastructure sector is largely due to substantial government spending and the long-term strategic importance of enhancing transportation networks, connecting major cities and facilitating international trade. The other sectors contribute significantly to overall market value but lag behind infrastructure in terms of overall investment and project volume.

El Salvador Construction Industry Product Innovations

Recent innovations focus on sustainable building materials, prefabrication techniques, and the incorporation of smart technologies to improve energy efficiency and building management. These innovations aim to reduce construction timelines, enhance quality, and minimize environmental impact. The adoption of BIM (Building Information Modeling) is gaining momentum, contributing to better project planning and cost control.

Propelling Factors for El Salvador Construction Industry Growth

Key growth drivers include:

- Government Investment: Significant public spending on infrastructure projects fuels considerable expansion.

- Foreign Direct Investment: Investment in industrial parks and commercial developments stimulates private sector participation.

- Technological Advancements: Adoption of efficient construction techniques and materials accelerates project completion and lowers costs.

- Population Growth: Increased urbanization and the demand for housing contribute to the growth of the residential sector.

Obstacles in the El Salvador Construction Industry Market

Challenges include:

- Regulatory Hurdles: Bureaucratic processes and permitting delays can hamper project timelines.

- Supply Chain Disruptions: Fluctuations in material costs and availability can impact profitability.

- Competition: The presence of both local and international companies creates a competitive market environment. This competition keeps prices down but requires efficiency for profitability.

Future Opportunities in El Salvador Construction Industry

Opportunities lie in:

- Sustainable Construction: Growing demand for eco-friendly buildings presents a substantial market opportunity.

- Infrastructure Development: Continued government investment in transportation and utility projects offers substantial potential.

- Technological Integration: Adopting advanced construction technologies can enhance efficiency and competitiveness.

Major Players in the El Salvador Construction Industry Ecosystem

- B Construcciones Nabla S A de C V

- American Industrial Park S A de C V

- Production and Development SA de CV

- Aluminum Glass Factory SA De CV

- Consolidated Developments SA de CV

- Road and Industrial Signaling of El Salvador SA de CV

- Aggregates of El Salvador SA de CV

- Inversiones Roble S A de C V

- Salazar Romero Sociedad Anonima de Capital Variable

Key Developments in El Salvador Construction Industry Industry

- July 2023: Grupo Ternova begins construction of a USD 100 Million logistics park in Nejapa, boosting industrial development.

- April 2023: Dongbu Corporation completes the USD 410 Million Los Chorros highway extension, showcasing major infrastructure advancements.

- February 2023: Amdocs provides upgraded charging systems to Telefónica Móviles El Salvador, highlighting technological adoption within the telecommunications sector indirectly impacting construction of supporting infrastructure.

Strategic El Salvador Construction Industry Market Forecast

The El Salvador construction industry is poised for continued growth, driven by sustained government investment in infrastructure, rising private sector activity, and the adoption of innovative technologies. The forecast for 2025-2033 anticipates a stable growth trajectory, with potential for accelerated expansion in specific sectors like logistics and renewable energy, provided regulatory streamlining and supply chain stability are maintained. The industry's ability to adapt to evolving technological trends and sustainable development initiatives will significantly influence the realization of this growth potential.

El Salvador Construction Industry Segmentation

-

1. Sector

- 1.1. Commercial

- 1.2. Industrial

- 1.3. Residential

- 1.4. Infrastructure (Transportation)

- 1.5. Energy and Utilities

El Salvador Construction Industry Segmentation By Geography

- 1. El Salvador

El Salvador Construction Industry Regional Market Share

Geographic Coverage of El Salvador Construction Industry

El Salvador Construction Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Rise in road investment projects

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. El Salvador Construction Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial

- 5.1.2. Industrial

- 5.1.3. Residential

- 5.1.4. Infrastructure (Transportation)

- 5.1.5. Energy and Utilities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. El Salvador

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 B

Construcciones Nabla S A de C V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 American Industrial Park S A de C V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Production and Development SA de CV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aluminum Glass Factory SA De CV**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Aluminum Glass Factory SA De CVSan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Consolidated Developments SA de CV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Road and Industrial Signaling of El Salvador SA de CV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Aggregates of El Salvador SA de CV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Inversiones Roble S A de C V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Salazar Romero Sociedad Anonima de Capital Variable

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 B

Construcciones Nabla S A de C V

List of Figures

- Figure 1: El Salvador Construction Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: El Salvador Construction Industry Share (%) by Company 2025

List of Tables

- Table 1: El Salvador Construction Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: El Salvador Construction Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: El Salvador Construction Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 4: El Salvador Construction Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the El Salvador Construction Industry?

The projected CAGR is approximately 0.00%.

2. Which companies are prominent players in the El Salvador Construction Industry?

Key companies in the market include B Construcciones Nabla S A de C V, American Industrial Park S A de C V, Production and Development SA de CV, Aluminum Glass Factory SA De CV**List Not Exhaustive, Aluminum Glass Factory SA De CVSan, Consolidated Developments SA de CV, Road and Industrial Signaling of El Salvador SA de CV, Aggregates of El Salvador SA de CV, Inversiones Roble S A de C V, Salazar Romero Sociedad Anonima de Capital Variable.

3. What are the main segments of the El Salvador Construction Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Rise in road investment projects.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

July 2023: Grupo Ternova started construction of a USD 100 million logistics park in El Salvador. The park will be located in Nejapa municipality and will include four industrial warehouses between 17,700 m2 and 34,700 m2 in size. It will also include two-lane internal roads for transportation of containers and light-vehicle traffic.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "El Salvador Construction Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the El Salvador Construction Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the El Salvador Construction Industry?

To stay informed about further developments, trends, and reports in the El Salvador Construction Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence