Key Insights

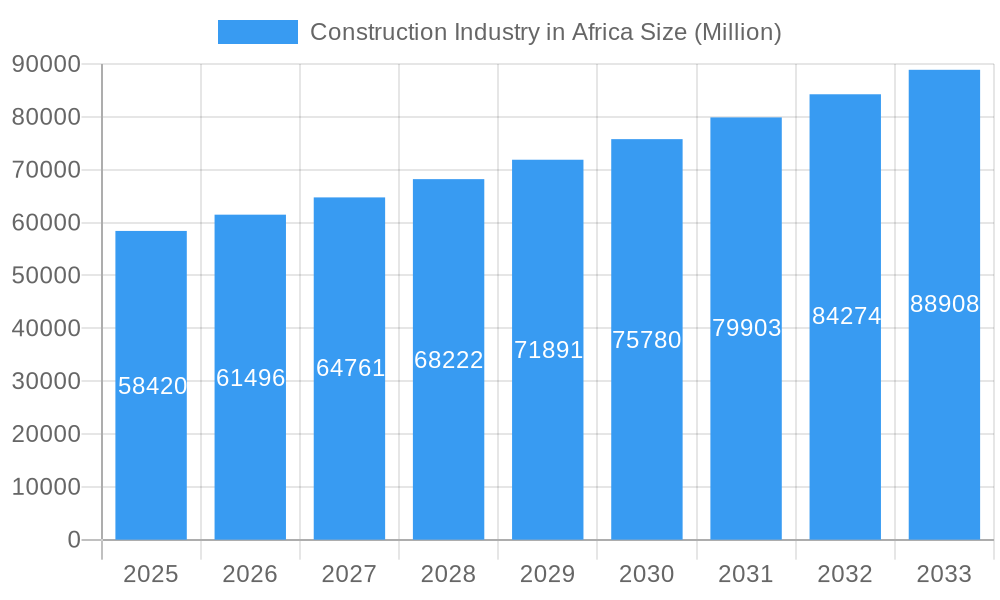

The African construction industry, valued at $58.42 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 5.07% from 2025 to 2033. This expansion is fueled by several key drivers. Significant investments in infrastructure development, particularly in transportation networks (roads, railways, ports) and energy projects (renewable energy and power grids), are crucial factors. Rapid urbanization across the continent is creating a surge in demand for residential and commercial construction, further propelling market growth. Furthermore, government initiatives promoting sustainable construction practices and attracting foreign direct investment are contributing to the sector's positive trajectory. The industry is segmented by sector (commercial, residential, industrial, infrastructure, energy & utilities), construction type (additions, demolition, new constructions), and region (Eastern, Western, Southern, and Northern Africa). South Africa, Sudan, Uganda, Tanzania, and Kenya represent key markets within the region, exhibiting varying levels of growth depending on their economic conditions and infrastructure priorities. Leading players include international giants like China National Machinery Industry Corp and China Railway Construction Corp Ltd, alongside regional and local firms.

Construction Industry in Africa Market Size (In Billion)

However, the industry also faces challenges. Economic volatility in some African nations can impact investment levels and project timelines. A shortage of skilled labor and the need for advanced technologies in construction management represent significant hurdles to overcome. Furthermore, ensuring sustainable and environmentally responsible construction practices remains a key concern for investors and stakeholders. Despite these restraints, the overall outlook for the African construction industry remains optimistic, with substantial opportunities for growth and development over the next decade. The industry's performance will depend heavily on sustained economic growth, effective policy implementation, and the successful mitigation of challenges related to labor and resources. The successful execution of large-scale infrastructure projects and a continued focus on sustainable practices will be critical to achieving the projected growth trajectory.

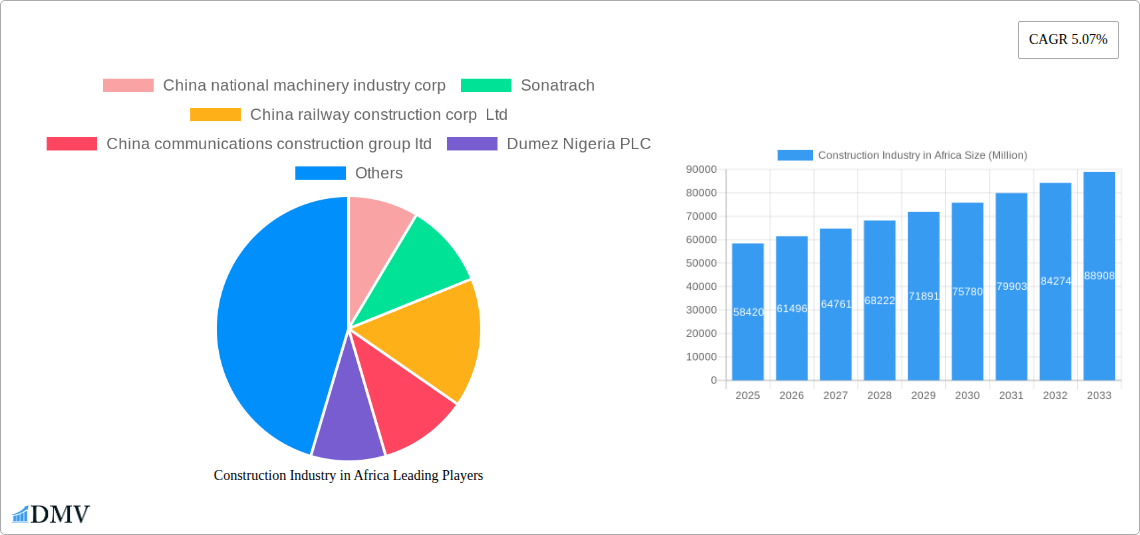

Construction Industry in Africa Company Market Share

Construction Industry in Africa: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the African construction industry, offering invaluable insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and make strategic investment decisions. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033. Market size estimations are provided in Millions of USD.

Construction Industry in Africa Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities within the African construction sector. The market's concentration is analyzed, revealing the market share distribution amongst key players. The impact of regulatory changes and technological advancements on market dynamics is assessed, alongside an examination of substitution effects and evolving consumer demands. M&A activity, including deal values and their strategic implications, is thoroughly documented. The report includes:

- Market Share Distribution: A detailed breakdown of market share held by leading companies, revealing concentration levels and competitive intensity. (e.g., China Railway Construction Corp Ltd holds an estimated xx% market share in Infrastructure construction).

- M&A Deal Values: Analysis of significant mergers and acquisitions, with deal values and their implications on market consolidation. (e.g., The total value of M&A deals in the African construction industry between 2019 and 2024 was estimated at xx Million.)

- Innovation Catalysts: Discussion of factors driving innovation, including technological advancements and government initiatives.

- Regulatory Landscape: Evaluation of the impact of various national and regional regulations.

Construction Industry in Africa Industry Evolution

This section delves into the growth trajectory of the African construction industry, examining historical trends (2019-2024), present-day market size (2025), and projecting future growth (2025-2033). The analysis incorporates technological advancements such as Building Information Modeling (BIM) and the adoption of sustainable building practices. Shifting consumer preferences and their influence on construction trends are also considered. Specific data points such as compound annual growth rates (CAGRs) and adoption rates of new technologies are provided. The report illustrates how factors like urbanization, infrastructure development, and economic growth shape the industry's evolution.

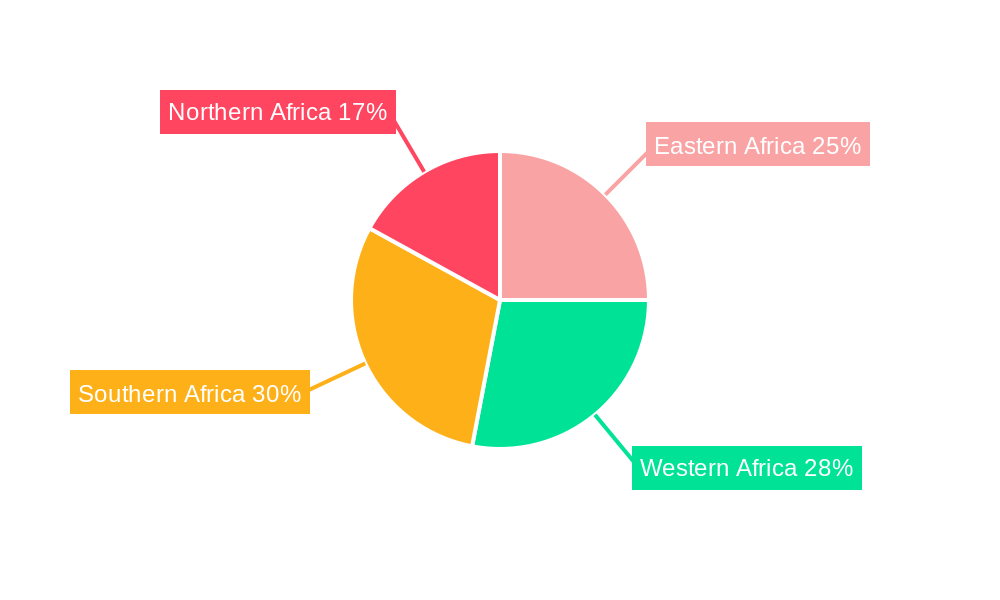

Leading Regions, Countries, or Segments in Construction Industry in Africa

This section identifies the leading regions, countries, and segments within the African construction industry across various sectors (Commercial, Residential, Industrial, Infrastructure, Energy & Utilities) and construction types (Additions, Demolition, New Constructions). The dominance of specific areas is analyzed, identifying key drivers such as:

- Eastern Africa: Growth fuelled by expanding infrastructure projects and increasing urbanization in countries like Kenya and Ethiopia.

- Western Africa: Driven by burgeoning populations and significant investment in oil and gas infrastructure.

- Southern Africa: Benefitting from mining and resource-related projects, with South Africa as a major hub.

- Northern Africa: Positive impact due to tourism and energy sector investments.

- Commercial Construction: Driven by growth in the service sector and business expansion.

- Residential Construction: Stimulated by population growth and rising urbanization across the continent.

- Infrastructure (Transportation) Construction: The importance of improving road, rail and air networks.

- Energy and Utilities Construction: Driven by growing energy demand, and the renewable energy sector boom.

Further analysis explores investment trends and government support impacting each segment's dominance.

Construction Industry in Africa Product Innovations

This section details recent product innovations within the construction industry in Africa. This includes the use of new materials such as prefabricated components and sustainable building materials. The report highlights the unique selling propositions (USPs) of these innovations and their associated performance metrics, such as reduced construction time and improved energy efficiency. Emphasis is placed on advancements in construction technology and their practical applications.

Propelling Factors for Construction Industry in Africa Growth

The growth of the African construction industry is propelled by several key factors: rapid urbanization, increasing population, substantial investments in infrastructure development (particularly in transportation and energy), and the growing adoption of sustainable construction practices. Government initiatives and supportive policies play a crucial role, along with the rising demand for commercial and residential spaces. The influx of foreign direct investment (FDI) further fuels this growth.

Obstacles in the Construction Industry in Africa Market

Despite significant growth potential, the African construction industry faces several challenges. These include regulatory hurdles (bureaucracy, permitting processes), supply chain disruptions (material shortages, logistical bottlenecks), and intense competition (both local and international). Skills shortages within the workforce present a significant obstacle. These issues can lead to project delays, cost overruns, and reduced profitability. The report quantifies these impacts to the extent possible.

Future Opportunities in Construction Industry in Africa

The African construction industry offers numerous opportunities for growth and innovation. Emerging markets within the renewable energy sector and the need for improved infrastructure create significant potential. The adoption of advanced technologies like BIM and 3D printing offers avenues for efficiency gains and cost reductions. The growing focus on sustainable and green construction practices presents further opportunities for environmentally conscious investors.

Major Players in the Construction Industry in Africa Ecosystem

- China National Machinery Industry Corp

- Sonatrach

- China Railway Construction Corp Ltd

- China Communications Construction Group Ltd

- Dumez Nigeria PLC

- TechnipFMC

- Sikhumba Construction (Pty) Ltd

- General Nile Company For Roads & Bridges

- Vinci

- Bouygues (List Not Exhaustive)

Key Developments in Construction Industry in Africa Industry

- December 2023: Scatec ASA completed the first 60 MW phase of the Mmadinare 120 MW Solar Complex in Botswana, signifying progress in renewable energy infrastructure development. This signals significant investment in the renewable energy sector and enhances the country's energy independence.

- November 2023: Teraco, South Africa’s largest data center provider, completed a major expansion of its Durban facility. This indicates a growing need for digital infrastructure and supports the growth of data centers across Africa.

Strategic Construction Industry in Africa Market Forecast

The African construction industry is poised for substantial growth over the forecast period (2025-2033), driven by ongoing urbanization, infrastructure development, and the burgeoning renewable energy sector. Opportunities exist across various segments, especially in sustainable construction and technological innovation. The market's expansion is expected to attract significant foreign investment and stimulate local economic activity, leading to a significant increase in market value. The report details these key drivers, providing quantifiable projections of market growth.

Construction Industry in Africa Segmentation

-

1. Sector

- 1.1. Commercial Construction

- 1.2. Residential Construction

- 1.3. Industrial Construction

- 1.4. Infrastructure (Transportation) Construction

- 1.5. Energy and Utilities Construction

-

2. Construction Type

- 2.1. Additions

- 2.2. Demolition

- 2.3. New Constructions

Construction Industry in Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Construction Industry in Africa Regional Market Share

Geographic Coverage of Construction Industry in Africa

Construction Industry in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid urbanization driving the market4.; Economic development

- 3.3. Market Restrains

- 3.3.1. 4.; Political and Regulatory challenges4.; Skills and Labor Shortages

- 3.4. Market Trends

- 3.4.1. Infrastructure construction projects driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Commercial Construction

- 5.1.2. Residential Construction

- 5.1.3. Industrial Construction

- 5.1.4. Infrastructure (Transportation) Construction

- 5.1.5. Energy and Utilities Construction

- 5.2. Market Analysis, Insights and Forecast - by Construction Type

- 5.2.1. Additions

- 5.2.2. Demolition

- 5.2.3. New Constructions

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Construction Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Commercial Construction

- 6.1.2. Residential Construction

- 6.1.3. Industrial Construction

- 6.1.4. Infrastructure (Transportation) Construction

- 6.1.5. Energy and Utilities Construction

- 6.2. Market Analysis, Insights and Forecast - by Construction Type

- 6.2.1. Additions

- 6.2.2. Demolition

- 6.2.3. New Constructions

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Construction Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Commercial Construction

- 7.1.2. Residential Construction

- 7.1.3. Industrial Construction

- 7.1.4. Infrastructure (Transportation) Construction

- 7.1.5. Energy and Utilities Construction

- 7.2. Market Analysis, Insights and Forecast - by Construction Type

- 7.2.1. Additions

- 7.2.2. Demolition

- 7.2.3. New Constructions

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Construction Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Commercial Construction

- 8.1.2. Residential Construction

- 8.1.3. Industrial Construction

- 8.1.4. Infrastructure (Transportation) Construction

- 8.1.5. Energy and Utilities Construction

- 8.2. Market Analysis, Insights and Forecast - by Construction Type

- 8.2.1. Additions

- 8.2.2. Demolition

- 8.2.3. New Constructions

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Construction Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Commercial Construction

- 9.1.2. Residential Construction

- 9.1.3. Industrial Construction

- 9.1.4. Infrastructure (Transportation) Construction

- 9.1.5. Energy and Utilities Construction

- 9.2. Market Analysis, Insights and Forecast - by Construction Type

- 9.2.1. Additions

- 9.2.2. Demolition

- 9.2.3. New Constructions

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Construction Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Commercial Construction

- 10.1.2. Residential Construction

- 10.1.3. Industrial Construction

- 10.1.4. Infrastructure (Transportation) Construction

- 10.1.5. Energy and Utilities Construction

- 10.2. Market Analysis, Insights and Forecast - by Construction Type

- 10.2.1. Additions

- 10.2.2. Demolition

- 10.2.3. New Constructions

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 China national machinery industry corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sonatrach

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 China railway construction corp Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China communications construction group ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dumez Nigeria PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TechnipFMC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sikhumba Construction (Pty) Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 General Nile Company For Roads & Bridges

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vinci

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bouygues**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 China national machinery industry corp

List of Figures

- Figure 1: Global Construction Industry in Africa Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Construction Industry in Africa Revenue (Million), by Sector 2025 & 2033

- Figure 3: North America Construction Industry in Africa Revenue Share (%), by Sector 2025 & 2033

- Figure 4: North America Construction Industry in Africa Revenue (Million), by Construction Type 2025 & 2033

- Figure 5: North America Construction Industry in Africa Revenue Share (%), by Construction Type 2025 & 2033

- Figure 6: North America Construction Industry in Africa Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Construction Industry in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Construction Industry in Africa Revenue (Million), by Sector 2025 & 2033

- Figure 9: South America Construction Industry in Africa Revenue Share (%), by Sector 2025 & 2033

- Figure 10: South America Construction Industry in Africa Revenue (Million), by Construction Type 2025 & 2033

- Figure 11: South America Construction Industry in Africa Revenue Share (%), by Construction Type 2025 & 2033

- Figure 12: South America Construction Industry in Africa Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Construction Industry in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Construction Industry in Africa Revenue (Million), by Sector 2025 & 2033

- Figure 15: Europe Construction Industry in Africa Revenue Share (%), by Sector 2025 & 2033

- Figure 16: Europe Construction Industry in Africa Revenue (Million), by Construction Type 2025 & 2033

- Figure 17: Europe Construction Industry in Africa Revenue Share (%), by Construction Type 2025 & 2033

- Figure 18: Europe Construction Industry in Africa Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Construction Industry in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Construction Industry in Africa Revenue (Million), by Sector 2025 & 2033

- Figure 21: Middle East & Africa Construction Industry in Africa Revenue Share (%), by Sector 2025 & 2033

- Figure 22: Middle East & Africa Construction Industry in Africa Revenue (Million), by Construction Type 2025 & 2033

- Figure 23: Middle East & Africa Construction Industry in Africa Revenue Share (%), by Construction Type 2025 & 2033

- Figure 24: Middle East & Africa Construction Industry in Africa Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Construction Industry in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Construction Industry in Africa Revenue (Million), by Sector 2025 & 2033

- Figure 27: Asia Pacific Construction Industry in Africa Revenue Share (%), by Sector 2025 & 2033

- Figure 28: Asia Pacific Construction Industry in Africa Revenue (Million), by Construction Type 2025 & 2033

- Figure 29: Asia Pacific Construction Industry in Africa Revenue Share (%), by Construction Type 2025 & 2033

- Figure 30: Asia Pacific Construction Industry in Africa Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Construction Industry in Africa Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 3: Global Construction Industry in Africa Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2020 & 2033

- Table 5: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 6: Global Construction Industry in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2020 & 2033

- Table 11: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 12: Global Construction Industry in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2020 & 2033

- Table 17: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 18: Global Construction Industry in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2020 & 2033

- Table 29: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 30: Global Construction Industry in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Construction Industry in Africa Revenue Million Forecast, by Sector 2020 & 2033

- Table 38: Global Construction Industry in Africa Revenue Million Forecast, by Construction Type 2020 & 2033

- Table 39: Global Construction Industry in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Construction Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Industry in Africa?

The projected CAGR is approximately 5.07%.

2. Which companies are prominent players in the Construction Industry in Africa?

Key companies in the market include China national machinery industry corp, Sonatrach, China railway construction corp Ltd, China communications construction group ltd, Dumez Nigeria PLC, TechnipFMC, Sikhumba Construction (Pty) Ltd, General Nile Company For Roads & Bridges, Vinci, Bouygues**List Not Exhaustive.

3. What are the main segments of the Construction Industry in Africa?

The market segments include Sector, Construction Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 58.42 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid urbanization driving the market4.; Economic development.

6. What are the notable trends driving market growth?

Infrastructure construction projects driving the market.

7. Are there any restraints impacting market growth?

4.; Political and Regulatory challenges4.; Skills and Labor Shortages.

8. Can you provide examples of recent developments in the market?

December 2023: Leading renewable energy provider Scatec ASA closed the first 60 MW of the Mmadinare 120 MW Solar Complex and is on track for the start of construction of the first utility-scale solar project in Botswana.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Industry in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Industry in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Industry in Africa?

To stay informed about further developments, trends, and reports in the Construction Industry in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence