Key Insights

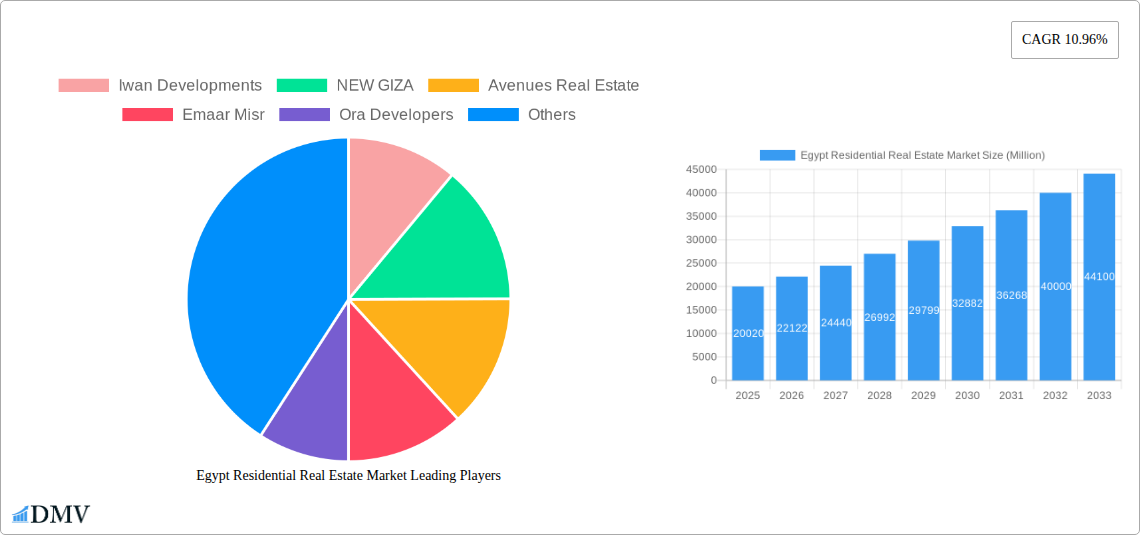

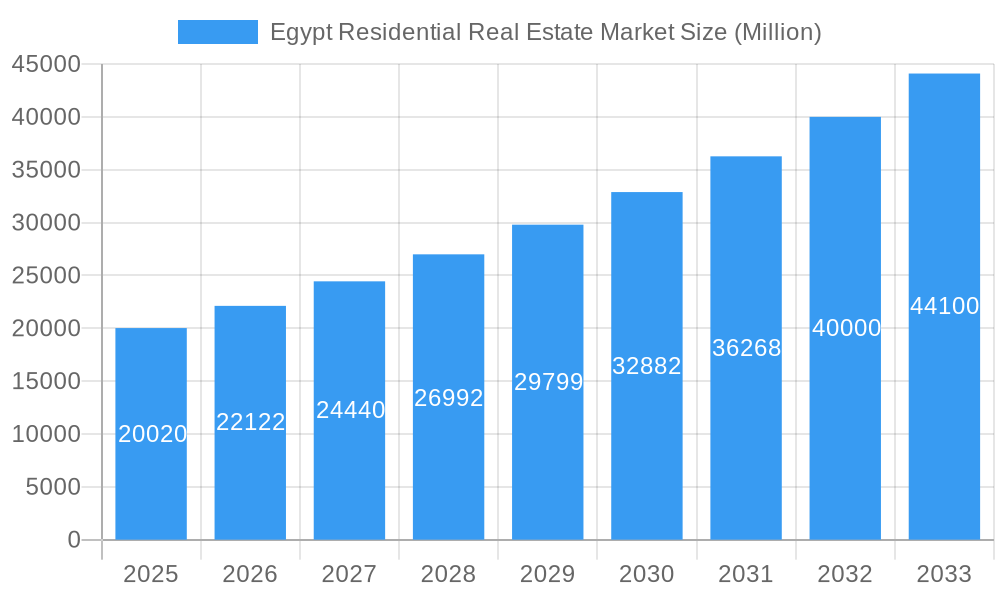

The Egypt residential real estate market is experiencing robust growth, projected to reach $20.02 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.96% from 2025 to 2033. This expansion is fueled by several key drivers. A burgeoning population, particularly within the younger demographics, is increasing the demand for housing. Furthermore, rising urbanization and improved infrastructure, including enhanced transportation networks and utilities, are making residential areas more attractive. Government initiatives aimed at stimulating the construction sector, including tax incentives and streamlined permitting processes, are also contributing significantly. The market is segmented primarily by property type, with apartments and condominiums dominating the market share due to affordability and location convenience, followed by villas and landed houses appealing to a higher-income segment seeking more space and privacy. Key players in the market, including Iwan Developments, NEW GIZA, Avenues Real Estate, Emaar Misr, and Ora Developers, are actively shaping the market through their large-scale projects and innovative designs.

Egypt Residential Real Estate Market Market Size (In Billion)

However, challenges remain. Inflation and fluctuating currency exchange rates can impact material costs and project financing. A shortage of skilled labor and regulatory complexities can also hinder the pace of development. Despite these challenges, the long-term outlook for the Egyptian residential real estate market remains optimistic. Sustained economic growth, coupled with the government's focus on infrastructure development and affordable housing initiatives, positions the sector for continued expansion throughout the forecast period. The market is expected to see continued growth driven by factors like tourism, foreign investment, and an improving local economy. The increasing preference for sustainable and technologically advanced housing solutions is also creating new opportunities for developers.

Egypt Residential Real Estate Market Company Market Share

Egypt Residential Real Estate Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Egypt residential real estate market, offering invaluable insights for stakeholders from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this study meticulously examines market trends, growth drivers, challenges, and future opportunities. The report leverages data from the historical period (2019-2024) to provide a robust foundation for forecasting the market's trajectory. Key players like Iwan Developments, NEW GIZA, Avenues Real Estate, Emaar Misr, Ora Developers, Coldwell Banker Egypt, La Vista, Wadi Degla Developments, Orascom Development Egypt, and Hassan Allam Properties are analyzed, among others. This report is designed to empower strategic decision-making within the dynamic Egyptian real estate landscape.

Egypt Residential Real Estate Market Composition & Trends

This section analyzes the competitive landscape, regulatory environment, and market dynamics of Egypt's residential real estate sector. We delve into market concentration, identifying key players and their respective market share distributions (xx%). Innovation catalysts, such as the adoption of sustainable building practices and technological advancements in property management, are examined. The regulatory landscape, including zoning laws and building codes, is scrutinized for its impact on market growth. The report also explores substitute products and their market penetration (xx%) and analyzes end-user profiles, including demographics and purchasing preferences. Finally, a detailed overview of recent mergers and acquisitions (M&A) activities, including notable deals such as the USD 125 Million SODIC offer for Orascom Real Estate in October 2022, will be presented, along with an analysis of their impact on market consolidation and future trends. Deal values will be presented in Millions of USD.

- Market Concentration: Analysis of market share held by top players (xx% for top 5).

- M&A Activity: Detailed review of significant transactions, including deal values and strategic implications.

- Regulatory Landscape: Impact of building codes, zoning laws, and other regulations on market development.

- Substitute Products: Analysis of alternative housing options and their market share.

- End-User Profiles: Demographic breakdown of buyers and renters.

Egypt Residential Real Estate Market Industry Evolution

This section details the evolution of the Egyptian residential real estate market from 2019 to 2033, charting growth trajectories and key transformative factors. We examine market growth rates (xx% CAGR 2025-2033), analyzing factors driving expansion, including urbanization, population growth, and economic development. Technological advancements, such as the rise of PropTech and the increasing use of data analytics in real estate investment decisions, are analyzed, alongside their impact on market efficiency and accessibility. The evolving consumer demands, including preferences for sustainable housing, smart home technology, and improved amenities, are also investigated. The influence of government policies and initiatives aimed at promoting affordable housing is also discussed. Data points on adoption rates for new technologies and changes in consumer preferences will be provided.

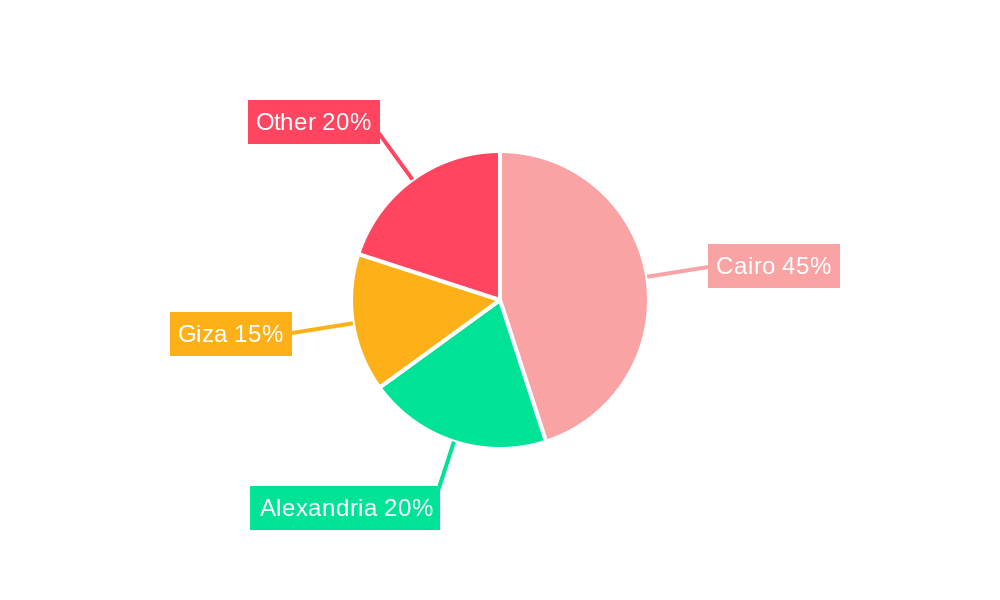

Leading Regions, Countries, or Segments in Egypt Residential Real Estate Market

This section identifies the leading segments within the Egyptian residential real estate market: Apartments and Condominiums, and Villas and Landed Houses. The dominance of each segment is analyzed based on factors such as investment trends, regulatory support, and market demand.

- Apartments and Condominiums:

- Key Drivers: High demand from young professionals and urban populations, affordability compared to villas, and government initiatives to promote urban development.

- Dominance Factors: High population density in urban centers, availability of land suitable for high-rise construction, and favorable government policies.

- Villas and Landed Houses:

- Key Drivers: Growing preference for spacious living, increased disposable incomes among high-net-worth individuals, and the appeal of gated communities and suburban lifestyle.

- Dominance Factors: Expansion of suburban areas, increased disposable incomes, and preference for larger living spaces with private amenities.

Egypt Residential Real Estate Market Product Innovations

This section explores recent product innovations within the Egyptian residential real estate market, focusing on features such as sustainable building materials, smart home technology integration, and unique design elements tailored to local preferences. We will analyze the market performance of these innovations, including their adoption rates and consumer feedback. The unique selling propositions (USPs) driving the success of these innovations will be highlighted. Emphasis will be placed on the technological advancements which are transforming the industry.

Propelling Factors for Egypt Residential Real Estate Market Growth

Several factors are driving the growth of the Egyptian residential real estate market. These include: increasing urbanization leading to higher demand for housing, economic growth resulting in increased purchasing power, and government initiatives aimed at stimulating the construction sector. Furthermore, improved infrastructure and investment in new urban developments are contributing to market expansion.

Obstacles in the Egypt Residential Real Estate Market

Despite the positive outlook, certain challenges hinder the Egyptian residential real estate market. These include regulatory complexities that can delay projects, supply chain disruptions affecting material costs and construction timelines, and the competitive pressure among developers. Quantifiable impacts of these obstacles will be provided, such as delays in project completion and increased costs.

Future Opportunities in Egypt Residential Real Estate Market

The Egyptian residential real estate market presents various promising opportunities. The growth of the middle class and the development of new cities and residential zones will continue to drive demand. Furthermore, the increasing adoption of sustainable building practices and smart home technology will create new niche markets and boost the overall sector's competitiveness.

Major Players in the Egypt Residential Real Estate Market Ecosystem

- Iwan Developments

- NEW GIZA

- Avenues Real Estate

- Emaar Misr

- Ora Developers

- Coldwell Banker Egypt

- La Vista

- Wadi Degla Developments

- Orascom Development Egypt

- Hassan Allam Properties

Key Developments in Egypt Residential Real Estate Market Industry

- November 2022: Wadi Degla Developments launched the Club Town project (USD 61 Million investment), a three-phase development with 550 residential units. Phase I (Breeze) is slated for delivery between 2024 and 2026. More than 1,500 units were planned for completion between 2022 and 2023.

- October 2022: SODIC's USD 125 Million offer to acquire Orascom Real Estate reflects the ongoing consolidation within the market and the influx of Gulf investment into Egypt.

Strategic Egypt Residential Real Estate Market Forecast

The Egyptian residential real estate market is poised for continued growth, driven by strong underlying demand, increasing investment, and government support. The focus on sustainable development and technological integration will shape future market trends, presenting considerable opportunities for both established players and new entrants. The market's potential is substantial, with significant scope for expansion across various segments and geographical locations.

Egypt Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

Egypt Residential Real Estate Market Segmentation By Geography

- 1. Egypt

Egypt Residential Real Estate Market Regional Market Share

Geographic Coverage of Egypt Residential Real Estate Market

Egypt Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Private Investment in Real Estate Sector; Growth in the Luxury Housing Market

- 3.3. Market Restrains

- 3.3.1. Increase in primary and secondary rents in the market

- 3.4. Market Trends

- 3.4.1. Increasing Private Investment in Real Estate Sector Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iwan Developments

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NEW GIZA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avenues Real Estate

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emaar Misr

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ora Developers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coldwell Banker Egypt

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 La Vista**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wadi Degla Developments

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orascom Development Egypt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hassan Allam Properties

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Iwan Developments

List of Figures

- Figure 1: Egypt Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Egypt Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Egypt Residential Real Estate Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Egypt Residential Real Estate Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Egypt Residential Real Estate Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Residential Real Estate Market?

The projected CAGR is approximately 10.96%.

2. Which companies are prominent players in the Egypt Residential Real Estate Market?

Key companies in the market include Iwan Developments, NEW GIZA, Avenues Real Estate, Emaar Misr, Ora Developers, Coldwell Banker Egypt, La Vista**List Not Exhaustive, Wadi Degla Developments, Orascom Development Egypt, Hassan Allam Properties.

3. What are the main segments of the Egypt Residential Real Estate Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Private Investment in Real Estate Sector; Growth in the Luxury Housing Market.

6. What are the notable trends driving market growth?

Increasing Private Investment in Real Estate Sector Driving the Market.

7. Are there any restraints impacting market growth?

Increase in primary and secondary rents in the market.

8. Can you provide examples of recent developments in the market?

November 2022: Wadi Degla Developments, an Egyptian developer, launched the Club Town new residential project in New Degla, Maadi, South Cairo, for EGP 1.5 billion (USD 61 million). The three-phase project spans 70 acres and includes 550 residential units and a commercial area. Breeze, part of Club Town's Phase I, is expected to be delivered between 2024 and 2026, according to the statement. Between 2022 and 2023, the developer intended to complete more than 1,500 units.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the Egypt Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence