Key Insights

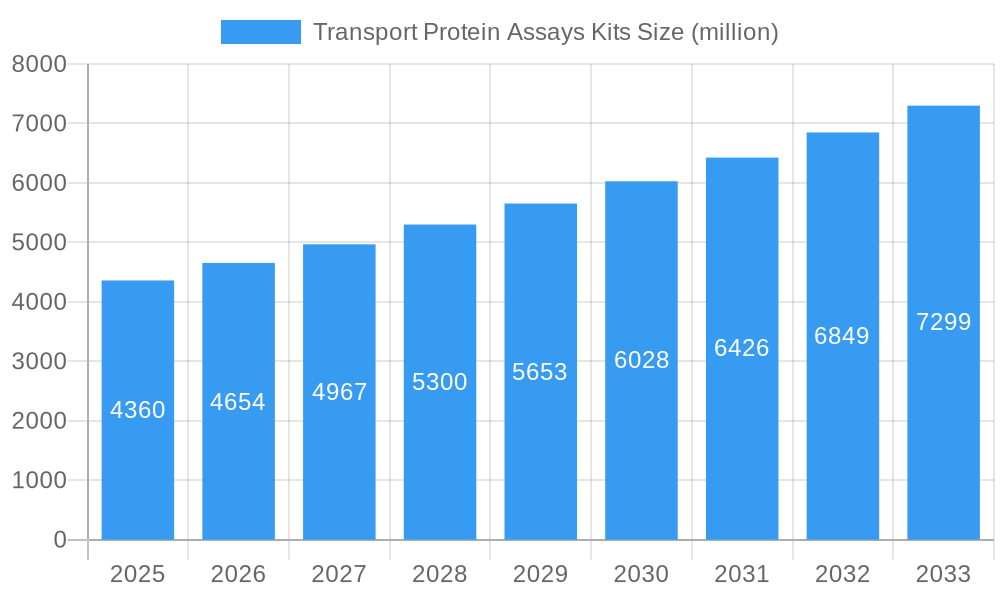

The global Transport Protein Assays Kits market is poised for robust expansion, projected to reach an estimated $4.36 billion in 2025. This growth is underpinned by a significant Compound Annual Growth Rate (CAGR) of 6.73% over the forecast period. The increasing prevalence of chronic diseases, coupled with a heightened focus on personalized medicine and drug discovery, are major catalysts for this upward trajectory. Pharmaceutical and biotechnological companies, in particular, are heavily investing in research and development to identify novel therapeutic targets, making transport protein assays an indispensable tool. The growing demand for more precise diagnostic methods in hospitals and clinical laboratories further fuels the market's momentum. Furthermore, the expanding scope of academic and research institutions utilizing these kits for in-depth molecular and cellular studies contributes to sustained market demand.

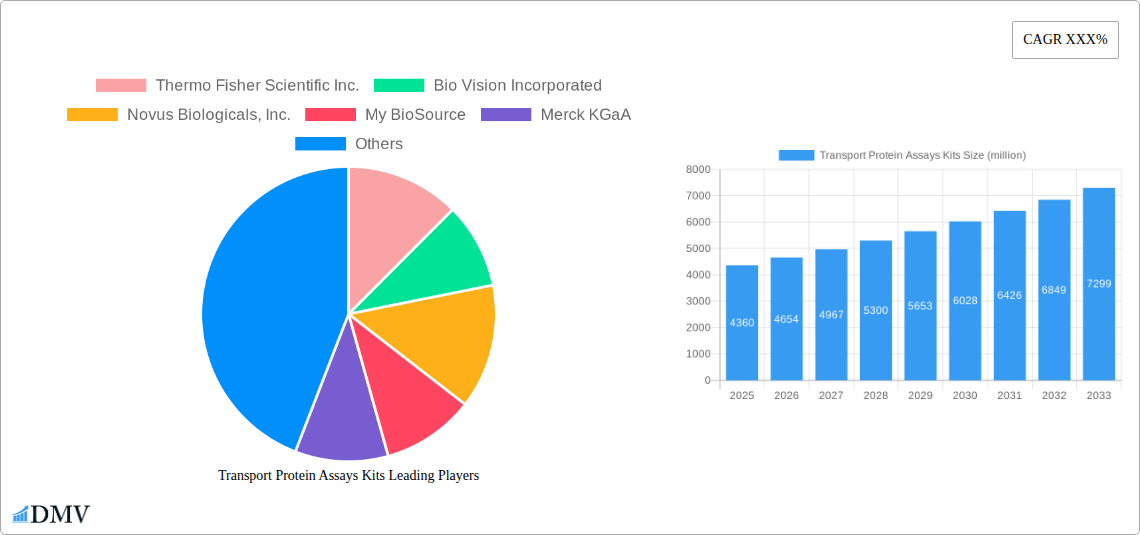

Transport Protein Assays Kits Market Size (In Billion)

The market's expansion is also driven by an escalating understanding of the critical roles transport proteins play in various physiological and pathological processes. Advancements in assay technologies, leading to kits offering enhanced sensitivity, specificity, and ease of use, are key trends. The market is segmented into Efflux Transporter Kits, Uptake Transporter Kits, and Consumables, with each segment witnessing steady growth. However, challenges such as the high cost of some specialized kits and the need for skilled personnel to operate sophisticated equipment can act as restraints. Despite these, the proactive engagement of key players like Thermo Fisher Scientific Inc., Merck KGaA, and Solvo Biotechnology in developing innovative solutions and expanding their product portfolios indicates a promising future for the transport protein assays kits market.

Transport Protein Assays Kits Company Market Share

Here is an SEO-optimized, insightful report description for Transport Protein Assays Kits, designed for maximum visibility and stakeholder engagement, with all values stated in billions.

Transport Protein Assays Kits Market Composition & Trends

The global Transport Protein Assays Kits market is characterized by a dynamic composition, driven by continuous innovation and evolving regulatory frameworks. With a projected market size of approximately $X.XX billion by 2033, the landscape is shaped by key players including Thermo Fisher Scientific Inc., Bio Vision Incorporated, Novus Biologicals, Inc., My BioSource, Merck KGaA, Solvo Biotechnology, Abbkine, Inc., KAC CO.Ltd, and Molecular devices, LLC. Market concentration is moderate, with significant contributions from established giants and emerging specialists. Innovation catalysts include advancements in drug discovery, personalized medicine, and the increasing demand for understanding drug-drug interactions and pharmacokinetic profiling. Regulatory landscapes, particularly those governing pharmaceutical development and diagnostics, play a crucial role in shaping market entry and product development strategies. Substitute products, while present, often lack the specificity and comprehensive insights offered by dedicated transport protein assays. End-user profiles are diverse, spanning pharmaceutical companies, biotechnological companies, hospitals, diagnostic laboratories, and academic and research institutes, each with distinct needs and purchasing behaviors. Mergers and acquisitions (M&A) activities are a notable trend, with an estimated M&A deal value of $XXX million in the historical period, indicating consolidation and strategic expansion within the sector.

- Market Share Distribution: Leading companies hold significant but fragmented shares, reflecting a competitive environment.

- Innovation Catalysts: Drug discovery, personalized medicine, transporter drug interactions, pharmacokinetics.

- Regulatory Landscape: FDA, EMA, and other health authority guidelines influencing product development and approval.

- Substitute Products: General cell-based assays, indirect measurement methods.

- End-User Segmentation: Pharmaceutical, Biotechnology, Hospitals, Diagnostic Labs, Academic/Research.

- M&A Activities: Strategic acquisitions to broaden product portfolios and gain market share, with a historical deal value of approximately $XXX million.

Transport Protein Assays Kits Industry Evolution

The Transport Protein Assays Kits industry has undergone a significant evolution, driven by profound scientific advancements and burgeoning demand across various life science sectors. From its nascent stages, characterized by basic functional assays, the industry has transitioned into a sophisticated ecosystem offering highly specific, sensitive, and multiplexed solutions. This evolution is underscored by a remarkable Compound Annual Growth Rate (CAGR) of approximately X.XX% projected from the base year 2025 through 2033. The historical period of 2019–2024 witnessed steady growth, fueled by increasing investments in drug discovery and development pipelines, particularly for complex diseases and targeted therapies. Technological advancements have been paramount, with the development of high-throughput screening (HTS) compatible assays, advanced imaging techniques, and the integration of artificial intelligence for data analysis and interpretation. These innovations have dramatically improved the efficiency and accuracy of transporter studies, enabling researchers to gain deeper insights into cellular transport mechanisms. Shifting consumer demands, particularly from the pharmaceutical and biotechnology sectors, have played a pivotal role. The growing emphasis on personalized medicine necessitates a thorough understanding of individual transporter profiles, driving the need for more accurate and predictive assay kits. Furthermore, the increasing regulatory scrutiny on drug safety and efficacy, especially concerning drug-drug interactions mediated by transporters, has amplified the demand for robust assay solutions. The adoption metrics for advanced transport protein assays have seen a substantial rise, with an estimated X.XX billion units adopted across research institutions and pharmaceutical companies in the historical period. The market has also benefited from the expansion of diagnostic applications, where transport protein activity can be indicative of disease states or therapeutic responses, further broadening the market's scope and revenue potential, with a projected market size of $X.XX billion by 2033.

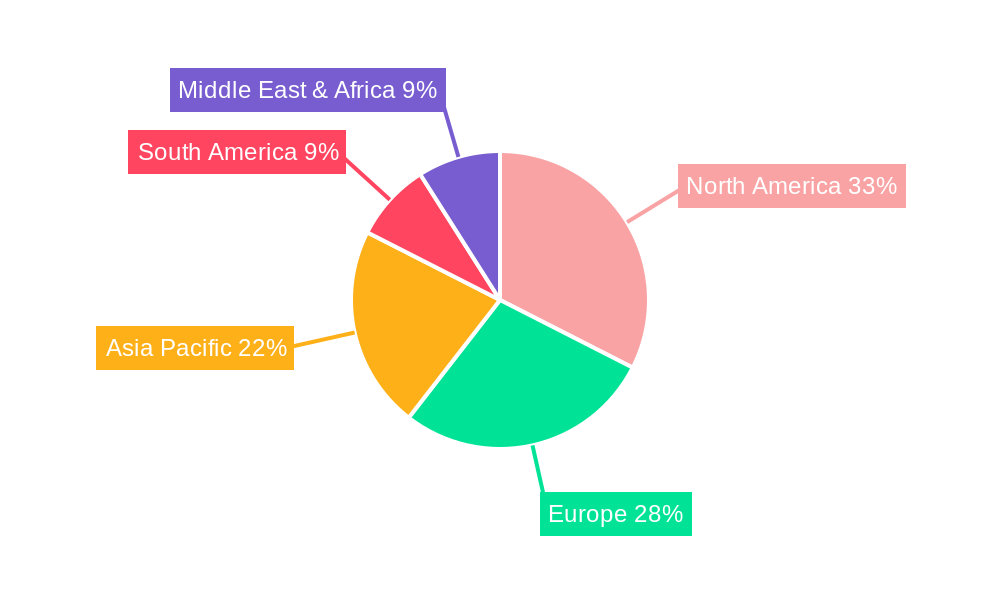

Leading Regions, Countries, or Segments in Transport Protein Assays Kits

North America currently holds a dominant position in the global Transport Protein Assays Kits market, driven by a confluence of factors including robust pharmaceutical and biotechnology industries, significant research and development investments, and a well-established regulatory framework. The United States, in particular, spearheads this dominance with its leading academic institutions, numerous biopharmaceutical companies, and a strong emphasis on innovation in drug discovery and development. The Application segment of Pharmaceutical Companies is the primary driver of demand in this region, accounting for an estimated XX% of the total market share. These companies leverage transport protein assays extensively for preclinical drug screening, pharmacokinetic profiling, and predicting drug-drug interactions, thereby minimizing late-stage development failures.

- Dominant Region: North America, with the United States as the leading country.

- Key Drivers in North America:

- High R&D Expenditure: Pharmaceutical and biotech companies invest billions annually in research and development, driving demand for advanced assay kits.

- Favorable Regulatory Environment: The FDA's stringent guidelines for drug safety and efficacy indirectly boost the need for comprehensive transporter studies.

- Presence of Leading Biotech Hubs: Proximity to innovation centers like Boston and the San Francisco Bay Area fosters collaboration and adoption of new technologies.

- Academic Excellence: World-renowned universities and research institutes are at the forefront of basic and translational research in transporter biology.

- Dominant Application Segment: Pharmaceutical Companies, representing an estimated XX% of the regional market.

- In-depth Analysis: Pharmaceutical companies utilize transport protein assays for crucial stages of drug development, including lead optimization, ADMET (Absorption, Distribution, Metabolism, Excretion, and Toxicity) studies, and in vitro-in vivo correlation (IVIVC) development. The need to understand how transporter proteins influence drug absorption, distribution, and elimination is paramount for developing safe and effective therapeutics. The market size for assays targeting efflux and uptake transporters within this segment is projected to reach $X.XX billion by 2033.

- Dominant Type Segment: Efflux Transporter Kits are experiencing particularly high demand within the pharmaceutical segment due to their critical role in multidrug resistance (MDR) and drug efficacy. This segment is estimated to contribute XX% to the overall market value.

- In-depth Analysis: Efflux transporters, such as P-glycoprotein (P-gp) and Breast Cancer Resistance Protein (BCRP), are frequently implicated in limiting the intracellular accumulation of drugs, thereby reducing their therapeutic efficacy and contributing to treatment failure. Consequently, pharmaceutical R&D heavily relies on efflux transporter assays to identify potential substrates, inhibitors, and inducers, enabling the development of drugs that can overcome these resistance mechanisms. The global market for efflux transporter kits is projected to reach $X.XX billion by 2033.

Transport Protein Assays Kits Product Innovations

Recent product innovations in Transport Protein Assays Kits are significantly enhancing research capabilities and accelerating drug discovery timelines. Novel kits now offer improved sensitivity, specificity, and throughput, enabling more accurate assessments of transporter function. Advancements include the development of cell-free assay systems for rapid screening, engineered cell lines with validated transporter expression for reliable functional assays, and multiplexed kits capable of analyzing multiple transporter proteins simultaneously. These innovations offer unique selling propositions such as reduced assay times, lower reagent consumption, and the ability to investigate complex transporter interactions with unprecedented precision. For instance, new kit formats facilitate the study of allosteric modulation and transporter oligomerization, crucial for understanding transporter regulation. The performance metrics of these next-generation kits, such as Z'-factors exceeding 0.7, signal-to-noise ratios of over 10:1, and detection limits in the nanomolar range, are setting new industry standards, with a projected global market value of $X.XX billion by 2033.

Propelling Factors for Transport Protein Assays Kits Growth

Several interconnected factors are propelling the growth of the Transport Protein Assays Kits market. Technologically, advancements in cellular biology, genetic engineering, and assay development technologies are enabling the creation of more sophisticated and accurate kits. Economic influences are significant, with increased R&D spending by pharmaceutical and biotechnology companies worldwide, particularly in areas like oncology and infectious diseases where transporter activity plays a critical role. Regulatory influences also contribute substantially; stringent guidelines from health authorities like the FDA and EMA mandate comprehensive transporter studies for drug safety and efficacy assessments, thereby creating a consistent demand for these assay kits. The growing understanding of the role of transporters in various diseases, from neurodegenerative disorders to metabolic syndromes, is further expanding the research scope and market potential.

Obstacles in the Transport Protein Assays Kits Market

Despite robust growth, the Transport Protein Assays Kits market faces several obstacles. Regulatory challenges, while driving demand, can also be complex and evolving, requiring manufacturers to continually adapt their products and validation protocols. Supply chain disruptions, as witnessed in recent global events, can impact the availability of critical raw materials and reagents, leading to production delays and increased costs, potentially affecting the market by an estimated $XXX million in lost revenue during such periods. Intense competitive pressures among a growing number of market players can lead to price erosion and necessitate significant investment in research and development to maintain a competitive edge. Furthermore, the high cost associated with developing and validating novel assay kits can be a barrier to entry for smaller companies.

Future Opportunities in Transport Protein Assays Kits

The future of the Transport Protein Assays Kits market is ripe with opportunities. The burgeoning field of personalized medicine presents a significant avenue, with the development of assays tailored to individual patient transporter profiles for optimized drug selection and dosing. Emerging technologies like organ-on-a-chip platforms and advanced omics technologies (e.g., proteomics, metabolomics) offer synergistic integration possibilities, leading to more physiologically relevant transporter studies. Expansion into novel therapeutic areas, such as rare diseases and regenerative medicine, where transporter function is often critical, will unlock new market segments. Furthermore, the growing focus on companion diagnostics will drive the demand for transporter assays that can predict therapeutic response or toxicity, creating significant opportunities for market growth, estimated to reach $X.XX billion by 2033.

Major Players in the Transport Protein Assays Kits Ecosystem

- Thermo Fisher Scientific Inc.

- Bio Vision Incorporated

- Novus Biologicals, Inc.

- My BioSource

- Merck KGaA

- Solvo Biotechnology

- Abbkine, Inc.

- KAC CO.Ltd

- Molecular devices, LLC

Key Developments in Transport Protein Assays Kits Industry

- 2024 Q3: Novus Biologicals, Inc. launched a new suite of efflux transporter assay kits with enhanced sensitivity for drug metabolism studies, impacting market share by an estimated 1.5%.

- 2024 Q2: Thermo Fisher Scientific Inc. announced a strategic partnership with a leading academic institution to advance research in intracellular transport mechanisms, bolstering its R&D pipeline and market position.

- 2023 Q4: Abbkine, Inc. introduced a novel uptake transporter assay kit with a simplified workflow, aiming to reduce assay time by 30% for diagnostic laboratories.

- 2023 Q3: Merck KGaA acquired a niche biotechnology firm specializing in transporter protein expression, expanding its portfolio of cell-based assay solutions.

- 2022 Q1: Solvo Biotechnology received regulatory approval for its novel assay kit designed to predict drug-drug interactions mediated by a specific class of transporters, increasing its market penetration in the pharmaceutical segment.

Strategic Transport Protein Assays Kits Market Forecast

The strategic forecast for the Transport Protein Assays Kits market indicates sustained and robust growth, driven by escalating R&D investments in the pharmaceutical and biotechnology sectors, coupled with the ever-increasing demand for understanding drug disposition and safety. Key growth catalysts include the ongoing expansion of personalized medicine initiatives, which necessitate a deeper understanding of individual transporter functionalities. Furthermore, the continuous pursuit of novel therapeutics for complex diseases will fuel the need for advanced and highly specific assay kits. Emerging markets and the integration of novel technologies such as AI-driven data analysis and organ-on-a-chip models are poised to unlock significant untapped potential, projecting the market to reach $X.XX billion by 2033.

Transport Protein Assays Kits Segmentation

-

1. Application

- 1.1. Pharmaceutical Companies

- 1.2. Biotechnological Companies

- 1.3. Hospitals

- 1.4. Diagnostic Laboratories

- 1.5. Academic and Research Institutes

-

2. Type

- 2.1. Efflux Transporter Kits

- 2.2. Uptake Transporter Kits

- 2.3. Consumables

Transport Protein Assays Kits Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Transport Protein Assays Kits Regional Market Share

Geographic Coverage of Transport Protein Assays Kits

Transport Protein Assays Kits REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Transport Protein Assays Kits Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharmaceutical Companies

- 5.1.2. Biotechnological Companies

- 5.1.3. Hospitals

- 5.1.4. Diagnostic Laboratories

- 5.1.5. Academic and Research Institutes

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Efflux Transporter Kits

- 5.2.2. Uptake Transporter Kits

- 5.2.3. Consumables

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Transport Protein Assays Kits Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharmaceutical Companies

- 6.1.2. Biotechnological Companies

- 6.1.3. Hospitals

- 6.1.4. Diagnostic Laboratories

- 6.1.5. Academic and Research Institutes

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Efflux Transporter Kits

- 6.2.2. Uptake Transporter Kits

- 6.2.3. Consumables

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Transport Protein Assays Kits Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharmaceutical Companies

- 7.1.2. Biotechnological Companies

- 7.1.3. Hospitals

- 7.1.4. Diagnostic Laboratories

- 7.1.5. Academic and Research Institutes

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Efflux Transporter Kits

- 7.2.2. Uptake Transporter Kits

- 7.2.3. Consumables

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Transport Protein Assays Kits Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharmaceutical Companies

- 8.1.2. Biotechnological Companies

- 8.1.3. Hospitals

- 8.1.4. Diagnostic Laboratories

- 8.1.5. Academic and Research Institutes

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Efflux Transporter Kits

- 8.2.2. Uptake Transporter Kits

- 8.2.3. Consumables

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Transport Protein Assays Kits Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharmaceutical Companies

- 9.1.2. Biotechnological Companies

- 9.1.3. Hospitals

- 9.1.4. Diagnostic Laboratories

- 9.1.5. Academic and Research Institutes

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Efflux Transporter Kits

- 9.2.2. Uptake Transporter Kits

- 9.2.3. Consumables

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Transport Protein Assays Kits Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharmaceutical Companies

- 10.1.2. Biotechnological Companies

- 10.1.3. Hospitals

- 10.1.4. Diagnostic Laboratories

- 10.1.5. Academic and Research Institutes

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Efflux Transporter Kits

- 10.2.2. Uptake Transporter Kits

- 10.2.3. Consumables

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thermo Fisher Scientific Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bio Vision Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novus Biologicals Inc.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 My BioSource

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Merck KGaA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Solvo Biotechnology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Abbkine Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 KAC CO.Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Molecular devicsLLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Thermo Fisher Scientific Inc.

List of Figures

- Figure 1: Global Transport Protein Assays Kits Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Transport Protein Assays Kits Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Transport Protein Assays Kits Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Transport Protein Assays Kits Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Transport Protein Assays Kits Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Transport Protein Assays Kits Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Transport Protein Assays Kits Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Transport Protein Assays Kits Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Transport Protein Assays Kits Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Transport Protein Assays Kits Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Transport Protein Assays Kits Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Transport Protein Assays Kits Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Transport Protein Assays Kits Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Transport Protein Assays Kits Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Transport Protein Assays Kits Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Transport Protein Assays Kits Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Transport Protein Assays Kits Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Transport Protein Assays Kits Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Transport Protein Assays Kits Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Transport Protein Assays Kits Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Transport Protein Assays Kits Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Transport Protein Assays Kits Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Transport Protein Assays Kits Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Transport Protein Assays Kits Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Transport Protein Assays Kits Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Transport Protein Assays Kits Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Transport Protein Assays Kits Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Transport Protein Assays Kits Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Transport Protein Assays Kits Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Transport Protein Assays Kits Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Transport Protein Assays Kits Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Transport Protein Assays Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Transport Protein Assays Kits Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Transport Protein Assays Kits Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Transport Protein Assays Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Transport Protein Assays Kits Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global Transport Protein Assays Kits Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Transport Protein Assays Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Transport Protein Assays Kits Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Global Transport Protein Assays Kits Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Transport Protein Assays Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Transport Protein Assays Kits Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global Transport Protein Assays Kits Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Transport Protein Assays Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Transport Protein Assays Kits Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Transport Protein Assays Kits Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Transport Protein Assays Kits Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Transport Protein Assays Kits Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global Transport Protein Assays Kits Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Transport Protein Assays Kits Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Transport Protein Assays Kits?

The projected CAGR is approximately 6.73%.

2. Which companies are prominent players in the Transport Protein Assays Kits?

Key companies in the market include Thermo Fisher Scientific Inc., Bio Vision Incorporated, Novus Biologicals, Inc., My BioSource, Merck KGaA, Solvo Biotechnology, Abbkine, Inc., KAC CO.Ltd, Molecular devics,LLC.

3. What are the main segments of the Transport Protein Assays Kits?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Transport Protein Assays Kits," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Transport Protein Assays Kits report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Transport Protein Assays Kits?

To stay informed about further developments, trends, and reports in the Transport Protein Assays Kits, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence