Key Insights

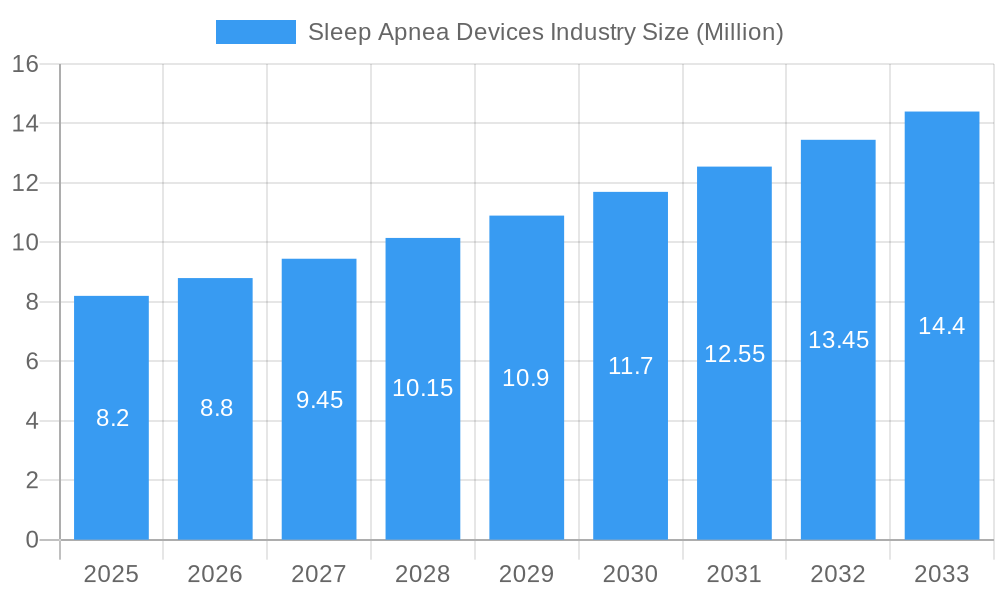

The global Sleep Apnea Devices market is projected to experience robust growth, with an estimated market size of $8.20 Million and a Compound Annual Growth Rate (CAGR) of 7.33% during the forecast period of 2025-2033. This expansion is primarily driven by a confluence of factors, including the increasing prevalence of sleep apnea disorders, heightened awareness among patients and healthcare providers, and significant advancements in diagnostic and therapeutic technologies. The growing elderly population, coupled with lifestyle factors such as obesity and sedentary habits, further contributes to the rising incidence of sleep-related breathing disorders. Consequently, the demand for effective sleep apnea management solutions, ranging from diagnostic tools to advanced therapeutic devices, is escalating. The market is poised for substantial gains as technological innovations make devices more user-friendly, portable, and effective, thereby improving patient compliance and overall treatment outcomes.

Sleep Apnea Devices Industry Market Size (In Million)

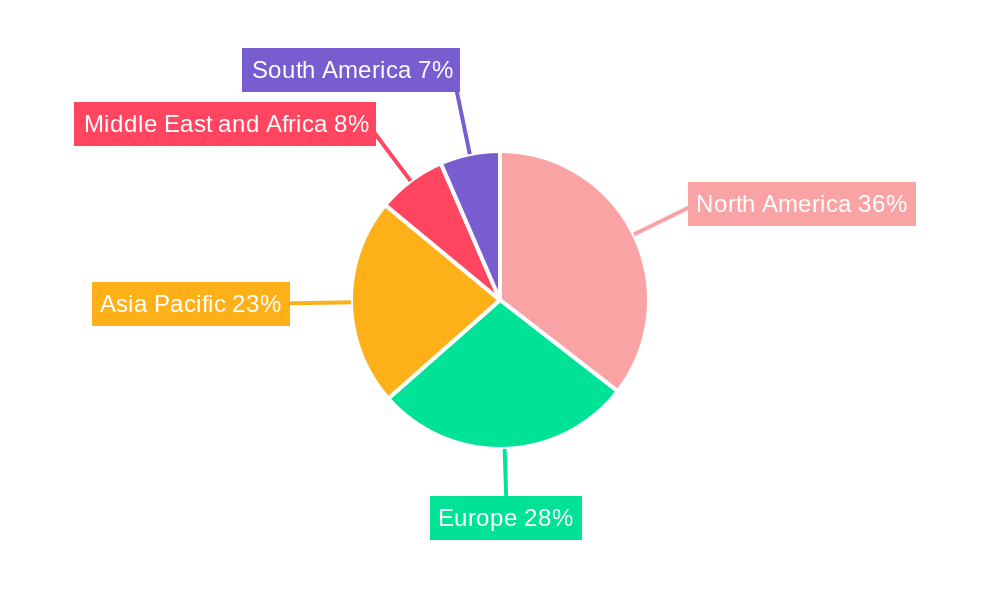

The sleep apnea devices market is segmented into diagnostic and therapeutic categories, with diagnostic devices like polysomnography (PSG) systems and pulse oximeters playing a crucial role in accurate diagnosis. Therapeutic devices, on the other hand, are witnessing strong demand, led by Positive Airway Pressure (PAP) devices, including CPAP and BiPAP machines, which remain the cornerstone of sleep apnea treatment. The market also encompasses oxygen devices, oral appliances, and adaptive servo-ventilation (ASV) systems, catering to a diverse range of patient needs. Geographically, North America currently holds a dominant share, driven by high healthcare expenditure and early adoption of advanced medical technologies. However, the Asia Pacific region is expected to emerge as the fastest-growing market due to increasing disposable incomes, expanding healthcare infrastructure, and a growing pool of undiagnosed sleep apnea patients. Key players in the market are actively investing in research and development to introduce innovative products and expand their global presence, further fueling market growth and competition.

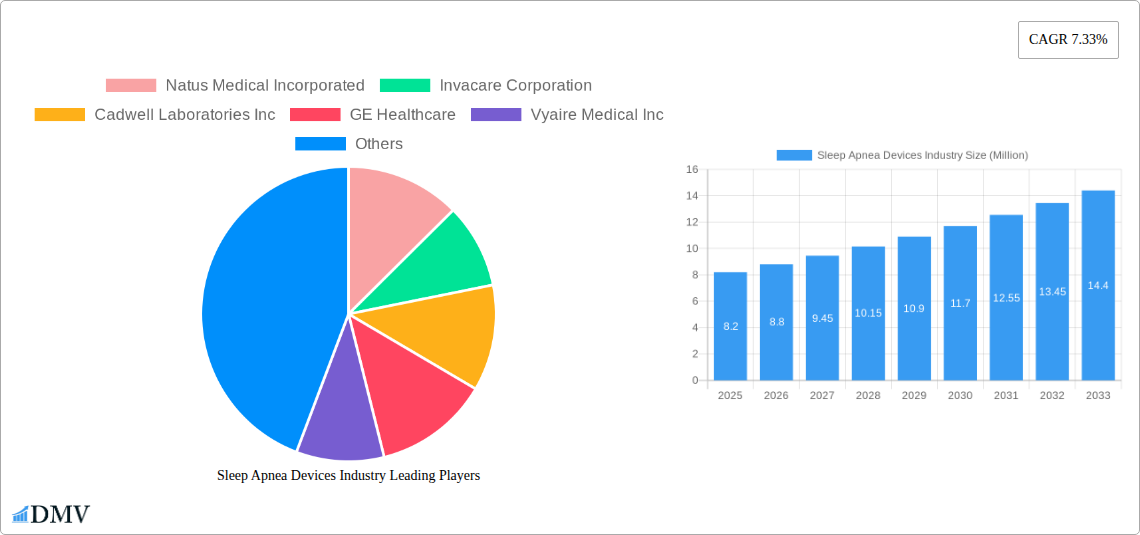

Sleep Apnea Devices Industry Company Market Share

Sleep Apnea Devices Market: Comprehensive Industry Analysis and Forecast (2019–2033)

This in-depth report provides a definitive analysis of the global Sleep Apnea Devices market, offering critical insights into its current state, historical trends, and future trajectory. Spanning the study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this report is an indispensable resource for stakeholders seeking to understand the dynamics of this rapidly evolving industry. We delve into market composition, technological advancements, regional dominance, product innovations, growth drivers, obstacles, and emerging opportunities, culminating in a strategic market forecast. Our analysis leverages high-ranking keywords such as "sleep apnea treatment devices," "CPAP machines," "biPAP devices," "oxygen concentrators," "oral appliances for sleep apnea," and "diagnosing sleep disorders" to enhance search visibility and captivate industry leaders.

Sleep Apnea Devices Industry Market Composition & Trends

The sleep apnea devices market is characterized by a moderate to high level of concentration, driven by a few key players but with a growing number of innovative disruptors. Innovation is a significant catalyst, fueled by advancements in sensor technology, artificial intelligence, and miniaturization, leading to more effective and user-friendly sleep apnea diagnostic tools and therapeutic devices. The regulatory landscape, governed by bodies like the FDA and EMA, plays a crucial role in product approval and market access, ensuring patient safety and device efficacy. Substitute products, such as lifestyle modifications and alternative therapies, exist but are largely complementary rather than direct replacements for established sleep apnea treatment solutions. End-user profiles range from individuals suffering from mild to severe sleep apnea to healthcare providers, hospitals, and home healthcare agencies. Mergers and acquisitions (M&A) activities are observed as companies seek to expand their product portfolios, geographic reach, and technological capabilities. For instance, recent M&A deals have involved companies specializing in CPAP masks and accessories and advanced ASV devices, consolidating market share and fostering innovation. The market share distribution highlights the dominance of Positive Airway Pressure (PAP) Devices, particularly CPAP devices, which hold a substantial portion due to their established efficacy and widespread adoption.

Sleep Apnea Devices Industry Industry Evolution

The sleep apnea devices industry has witnessed substantial evolution throughout the historical period of 2019–2024 and is poised for significant growth in the forecast period of 2025–2033. Market growth trajectories have been consistently upward, propelled by increasing awareness of sleep disorders, a growing aging population susceptible to sleep apnea, and improved diagnostic capabilities. Technological advancements have been pivotal, moving from cumbersome and intrusive devices to more compact, intelligent, and patient-centric solutions. The development of smart CPAP machines with integrated data tracking and remote monitoring features has revolutionized patient care. Furthermore, the integration of AI and machine learning in sleep apnea diagnostic devices like polysomnography (PSG) devices is enhancing accuracy and efficiency in diagnosis. Shifting consumer demands are also playing a crucial role. Patients are increasingly seeking discreet, portable, and comfortable sleep apnea treatment options, driving innovation in areas like oral appliances for sleep apnea and advanced portable oxygen concentrators. The adoption metrics for therapeutic devices, especially bi-level positive airway pressure (BiPAP) devices for more complex cases, are on an upward trend. The market’s expansion is also influenced by a growing emphasis on preventative healthcare and the recognition of sleep apnea's link to other serious health conditions, such as cardiovascular disease and diabetes. This has spurred greater investment in research and development, leading to a continuous stream of novel products designed to improve patient outcomes and enhance quality of life. The estimated market size for sleep apnea devices is projected to reach trillions of dollars by 2025, reflecting the immense potential and growing need for effective interventions.

Leading Regions, Countries, or Segments in Sleep Apnea Devices Industry

The North America region currently stands as a dominant force in the global sleep apnea devices market, driven by a confluence of robust healthcare infrastructure, high disposable incomes, and a proactive approach to public health awareness regarding sleep disorders. The United States, in particular, exhibits a high prevalence of diagnosed sleep apnea and a significant adoption rate of advanced sleep apnea treatment devices.

Key Drivers for Dominance in North America:

- High Disease Prevalence: A substantial portion of the population suffers from undiagnosed or diagnosed sleep apnea, creating a large and consistent demand for diagnostic and therapeutic solutions.

- Advanced Healthcare Infrastructure: Well-established healthcare systems, extensive insurance coverage, and a high density of sleep clinics facilitate access to sleep apnea diagnosis and treatment.

- Technological Adoption: North American consumers and healthcare providers are early adopters of new technologies, driving demand for innovative CPAP machines, biPAP devices, and sophisticated diagnostic devices like polysomnography (PSG) systems and actigraphy devices.

- Government Initiatives and Awareness Campaigns: Public health initiatives and increased media coverage have significantly raised awareness about the health risks associated with untreated sleep apnea.

- Strong Presence of Key Players: Major global manufacturers of sleep apnea devices have a strong presence and extensive distribution networks in this region, further fueling market growth.

Within the Therapeutic Devices segment, Positive Airway Pressure (PAP) Devices command the largest market share. This includes Continuous Positive Airway Pressure (CPAP) Devices and Bi-level Positive Airway Pressure (BiPAP) Devices. The widespread clinical acceptance, proven efficacy, and continuous product innovation in PAP therapy contribute to its market leadership. CPAP devices remain the first-line treatment for many individuals with obstructive sleep apnea due to their effectiveness in maintaining an open airway. BiPAP devices are increasingly being adopted for patients requiring higher pressure support or with more complex breathing patterns. The segment of Masks and Accessories also represents a significant portion of the market, as these are crucial components for effective PAP therapy, with a constant demand for comfortable, well-fitting, and durable options. The Diagnostic Devices segment, including Polysomnography Devices (PSG), Pulse Oximeters, and Actigraphy Devices, is also experiencing steady growth as accurate diagnosis is the first step towards effective management. The Oxygen Devices segment, particularly Portable Oxygen Concentrators, is gaining traction, especially among elderly patients and those with co-existing respiratory conditions. The Oral Appliances segment, while smaller, is growing due to advancements in custom-fit technology and increasing patient preference for non-intrusive alternatives for mild to moderate sleep apnea.

Sleep Apnea Devices Industry Product Innovations

Product innovation is a cornerstone of the sleep apnea devices industry, with a relentless focus on enhancing patient comfort, efficacy, and ease of use. Recent advancements include the development of quieter and more compact CPAP machines, incorporating intelligent algorithms that adapt to individual breathing patterns and sleep stages. Innovations in CPAP masks and accessories emphasize hypoallergenic materials, improved sealing technologies to prevent air leaks, and lighter, more flexible designs for enhanced user experience. Furthermore, the integration of smart connectivity and data analytics allows for remote patient monitoring, enabling healthcare providers to track treatment adherence and make timely adjustments. Emerging technologies in oral appliances are utilizing advanced 3D printing and digital impression techniques for highly personalized and comfortable fits, offering a discreet alternative for managing snoring and mild to moderate obstructive sleep apnea.

Propelling Factors for Sleep Apnea Devices Industry Growth

Several key factors are propelling the growth of the sleep apnea devices industry. Firstly, the increasing global prevalence of sleep disorders, driven by an aging population, rising obesity rates, and sedentary lifestyles, creates a continuously expanding patient pool. Secondly, technological advancements in diagnostic and therapeutic devices, such as the miniaturization of CPAP machines, the development of AI-powered sleep diagnostic tools, and the innovation in oral appliances, are improving treatment efficacy and patient compliance. Thirdly, growing health consciousness and increased awareness campaigns about the adverse health consequences of untreated sleep apnea, including cardiovascular disease and diabetes, are encouraging early diagnosis and treatment. Finally, favorable reimbursement policies in many developed nations and the expanding healthcare infrastructure in emerging economies are making sleep apnea treatment more accessible and affordable, thereby driving market expansion for sleep apnea solutions.

Obstacles in the Sleep Apnea Devices Industry Market

Despite robust growth, the sleep apnea devices industry faces several obstacles. Regulatory hurdles and stringent approval processes for new devices, particularly advanced PAP devices and adaptive servo ventilation (ASV) devices, can slow down market entry and increase development costs. Supply chain disruptions, as witnessed in recent global events, can impact the availability and pricing of critical components for sleep apnea diagnostic devices and therapeutic devices. The high cost of advanced sleep apnea treatment technologies, such as sophisticated polysomnography (PSG) systems and premium CPAP machines, can be a barrier to adoption, especially in price-sensitive markets. Furthermore, a lack of trained healthcare professionals for accurate diagnosis and device management in some regions can limit market penetration. Competitive pressures among established players and emerging startups also necessitate continuous innovation, potentially leading to price erosion for certain product categories.

Future Opportunities in Sleep Apnea Devices Industry

The sleep apnea devices industry is brimming with future opportunities. The growing demand for home-use sleep diagnostic devices and remote monitoring solutions presents a significant avenue for growth, leveraging advancements in telemedicine and AI. The untapped potential in emerging economies, where awareness and access to sleep apnea treatment are rapidly increasing, offers substantial market expansion opportunities for all categories of sleep apnea devices, from oxygen concentrators to CPAP accessories. The development of more personalized and integrated treatment pathways, combining oral appliances, PAP therapy, and even novel sleep apnea drugs, represents another promising frontier. Furthermore, the increasing focus on preventative healthcare and the recognition of sleep apnea as a contributing factor to other chronic diseases will drive further innovation in sleep apnea screening tools and early intervention technologies, including advanced actigraphy devices.

Major Players in the Sleep Apnea Devices Industry Ecosystem

- Natus Medical Incorporated

- Invacare Corporation

- Cadwell Laboratories Inc

- GE Healthcare

- Vyaire Medical Inc

- Resmed

- Oventus Medical

- Fisher & Paykel Healthcare Limited

- Koninklijke Philips NV

- Somnomed

- Teleflex Incorporated

- Nihon Kohden Corporation

Key Developments in Sleep Apnea Devices Industry Industry

- November 2022: ResMed and Alphabet's life science offshoot Verily announced the formation of Primasun, an end-to-end solution to help employers and healthcare providers identify populations at risk for complex sleep disorders. This strategic alliance aims to leverage data analytics and advanced diagnostics to improve early detection and management of sleep apnea.

- October 2022: Airway Management, manufacturer of the most globally researched custom oral appliances, announced the launch of flexTAP, a premium lab-made oral appliance designed to treat patients with snoring and mild to moderate obstructive sleep apnea. This launch signifies innovation in non-CPAP treatment options, catering to a growing segment of patients seeking alternative therapies.

Strategic Sleep Apnea Devices Industry Market Forecast

The sleep apnea devices market is projected for substantial growth, driven by escalating prevalence rates of sleep disorders globally and continuous technological advancements. The forecast period (2025–2033) anticipates a significant surge in demand for both diagnostic devices like polysomnography systems and therapeutic solutions, particularly CPAP and biPAP machines. Emerging markets present a fertile ground for expansion, as awareness and healthcare infrastructure improve. The integration of AI and IoT in sleep apnea treatment devices will further enhance patient adherence and remote care capabilities. Investment in research and development of innovative oral appliances, portable oxygen concentrators, and ASV devices will continue to shape market dynamics, creating a favorable environment for stakeholders and improving the quality of life for millions affected by sleep apnea. The market is expected to reach hundreds of billions of dollars by the end of the forecast period.

Sleep Apnea Devices Industry Segmentation

-

1. Diagnostic Devices

- 1.1. Polysomnography Devices (PSG)

- 1.2. Pulse Oximeters

- 1.3. Actigraphy Devices

-

2. Therapeutic Devices

-

2.1. Positive Airway Pressure (PAP) Devices

- 2.1.1. Continuous Positive Airway Pressure (CPAP) Devices

- 2.1.2. Bi-level Positive Airway Pressure (BiPAP) Devices

-

2.2. Oxygen Devices

- 2.2.1. Oxygen Concentrators

- 2.2.2. Portable Oxygen Concentrators

- 2.2.3. Liquid Portable Oxygen

- 2.3. Oral Appliances

- 2.4. Adaptive Servo Ventilation (ASV) Devices

- 2.5. Masks and Accessories

-

2.1. Positive Airway Pressure (PAP) Devices

Sleep Apnea Devices Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Sleep Apnea Devices Industry Regional Market Share

Geographic Coverage of Sleep Apnea Devices Industry

Sleep Apnea Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness Among the Patient Population in the Developing Countries; Increase in Prevalence of Obesity and Hypertension; Upcoming Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Cpap Machines

- 3.4. Market Trends

- 3.4.1. Pulse Oximeters are Expected to Register the Highest CAGR in the Diagnostic Devices Category

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sleep Apnea Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 5.1.1. Polysomnography Devices (PSG)

- 5.1.2. Pulse Oximeters

- 5.1.3. Actigraphy Devices

- 5.2. Market Analysis, Insights and Forecast - by Therapeutic Devices

- 5.2.1. Positive Airway Pressure (PAP) Devices

- 5.2.1.1. Continuous Positive Airway Pressure (CPAP) Devices

- 5.2.1.2. Bi-level Positive Airway Pressure (BiPAP) Devices

- 5.2.2. Oxygen Devices

- 5.2.2.1. Oxygen Concentrators

- 5.2.2.2. Portable Oxygen Concentrators

- 5.2.2.3. Liquid Portable Oxygen

- 5.2.3. Oral Appliances

- 5.2.4. Adaptive Servo Ventilation (ASV) Devices

- 5.2.5. Masks and Accessories

- 5.2.1. Positive Airway Pressure (PAP) Devices

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 6. North America Sleep Apnea Devices Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 6.1.1. Polysomnography Devices (PSG)

- 6.1.2. Pulse Oximeters

- 6.1.3. Actigraphy Devices

- 6.2. Market Analysis, Insights and Forecast - by Therapeutic Devices

- 6.2.1. Positive Airway Pressure (PAP) Devices

- 6.2.1.1. Continuous Positive Airway Pressure (CPAP) Devices

- 6.2.1.2. Bi-level Positive Airway Pressure (BiPAP) Devices

- 6.2.2. Oxygen Devices

- 6.2.2.1. Oxygen Concentrators

- 6.2.2.2. Portable Oxygen Concentrators

- 6.2.2.3. Liquid Portable Oxygen

- 6.2.3. Oral Appliances

- 6.2.4. Adaptive Servo Ventilation (ASV) Devices

- 6.2.5. Masks and Accessories

- 6.2.1. Positive Airway Pressure (PAP) Devices

- 6.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 7. Europe Sleep Apnea Devices Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 7.1.1. Polysomnography Devices (PSG)

- 7.1.2. Pulse Oximeters

- 7.1.3. Actigraphy Devices

- 7.2. Market Analysis, Insights and Forecast - by Therapeutic Devices

- 7.2.1. Positive Airway Pressure (PAP) Devices

- 7.2.1.1. Continuous Positive Airway Pressure (CPAP) Devices

- 7.2.1.2. Bi-level Positive Airway Pressure (BiPAP) Devices

- 7.2.2. Oxygen Devices

- 7.2.2.1. Oxygen Concentrators

- 7.2.2.2. Portable Oxygen Concentrators

- 7.2.2.3. Liquid Portable Oxygen

- 7.2.3. Oral Appliances

- 7.2.4. Adaptive Servo Ventilation (ASV) Devices

- 7.2.5. Masks and Accessories

- 7.2.1. Positive Airway Pressure (PAP) Devices

- 7.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 8. Asia Pacific Sleep Apnea Devices Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 8.1.1. Polysomnography Devices (PSG)

- 8.1.2. Pulse Oximeters

- 8.1.3. Actigraphy Devices

- 8.2. Market Analysis, Insights and Forecast - by Therapeutic Devices

- 8.2.1. Positive Airway Pressure (PAP) Devices

- 8.2.1.1. Continuous Positive Airway Pressure (CPAP) Devices

- 8.2.1.2. Bi-level Positive Airway Pressure (BiPAP) Devices

- 8.2.2. Oxygen Devices

- 8.2.2.1. Oxygen Concentrators

- 8.2.2.2. Portable Oxygen Concentrators

- 8.2.2.3. Liquid Portable Oxygen

- 8.2.3. Oral Appliances

- 8.2.4. Adaptive Servo Ventilation (ASV) Devices

- 8.2.5. Masks and Accessories

- 8.2.1. Positive Airway Pressure (PAP) Devices

- 8.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 9. Middle East and Africa Sleep Apnea Devices Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 9.1.1. Polysomnography Devices (PSG)

- 9.1.2. Pulse Oximeters

- 9.1.3. Actigraphy Devices

- 9.2. Market Analysis, Insights and Forecast - by Therapeutic Devices

- 9.2.1. Positive Airway Pressure (PAP) Devices

- 9.2.1.1. Continuous Positive Airway Pressure (CPAP) Devices

- 9.2.1.2. Bi-level Positive Airway Pressure (BiPAP) Devices

- 9.2.2. Oxygen Devices

- 9.2.2.1. Oxygen Concentrators

- 9.2.2.2. Portable Oxygen Concentrators

- 9.2.2.3. Liquid Portable Oxygen

- 9.2.3. Oral Appliances

- 9.2.4. Adaptive Servo Ventilation (ASV) Devices

- 9.2.5. Masks and Accessories

- 9.2.1. Positive Airway Pressure (PAP) Devices

- 9.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 10. South America Sleep Apnea Devices Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 10.1.1. Polysomnography Devices (PSG)

- 10.1.2. Pulse Oximeters

- 10.1.3. Actigraphy Devices

- 10.2. Market Analysis, Insights and Forecast - by Therapeutic Devices

- 10.2.1. Positive Airway Pressure (PAP) Devices

- 10.2.1.1. Continuous Positive Airway Pressure (CPAP) Devices

- 10.2.1.2. Bi-level Positive Airway Pressure (BiPAP) Devices

- 10.2.2. Oxygen Devices

- 10.2.2.1. Oxygen Concentrators

- 10.2.2.2. Portable Oxygen Concentrators

- 10.2.2.3. Liquid Portable Oxygen

- 10.2.3. Oral Appliances

- 10.2.4. Adaptive Servo Ventilation (ASV) Devices

- 10.2.5. Masks and Accessories

- 10.2.1. Positive Airway Pressure (PAP) Devices

- 10.1. Market Analysis, Insights and Forecast - by Diagnostic Devices

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Natus Medical Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Invacare Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cadwell Laboratories Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vyaire Medical Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Resmed

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oventus Medical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fisher & Paykel Healthcare Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koninklijke Philips NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Somnomed

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Teleflex Incorporated

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nihon Kohden Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Natus Medical Incorporated

List of Figures

- Figure 1: Global Sleep Apnea Devices Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Sleep Apnea Devices Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Sleep Apnea Devices Industry Revenue (Million), by Diagnostic Devices 2025 & 2033

- Figure 4: North America Sleep Apnea Devices Industry Volume (K Unit), by Diagnostic Devices 2025 & 2033

- Figure 5: North America Sleep Apnea Devices Industry Revenue Share (%), by Diagnostic Devices 2025 & 2033

- Figure 6: North America Sleep Apnea Devices Industry Volume Share (%), by Diagnostic Devices 2025 & 2033

- Figure 7: North America Sleep Apnea Devices Industry Revenue (Million), by Therapeutic Devices 2025 & 2033

- Figure 8: North America Sleep Apnea Devices Industry Volume (K Unit), by Therapeutic Devices 2025 & 2033

- Figure 9: North America Sleep Apnea Devices Industry Revenue Share (%), by Therapeutic Devices 2025 & 2033

- Figure 10: North America Sleep Apnea Devices Industry Volume Share (%), by Therapeutic Devices 2025 & 2033

- Figure 11: North America Sleep Apnea Devices Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Sleep Apnea Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Sleep Apnea Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Sleep Apnea Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Sleep Apnea Devices Industry Revenue (Million), by Diagnostic Devices 2025 & 2033

- Figure 16: Europe Sleep Apnea Devices Industry Volume (K Unit), by Diagnostic Devices 2025 & 2033

- Figure 17: Europe Sleep Apnea Devices Industry Revenue Share (%), by Diagnostic Devices 2025 & 2033

- Figure 18: Europe Sleep Apnea Devices Industry Volume Share (%), by Diagnostic Devices 2025 & 2033

- Figure 19: Europe Sleep Apnea Devices Industry Revenue (Million), by Therapeutic Devices 2025 & 2033

- Figure 20: Europe Sleep Apnea Devices Industry Volume (K Unit), by Therapeutic Devices 2025 & 2033

- Figure 21: Europe Sleep Apnea Devices Industry Revenue Share (%), by Therapeutic Devices 2025 & 2033

- Figure 22: Europe Sleep Apnea Devices Industry Volume Share (%), by Therapeutic Devices 2025 & 2033

- Figure 23: Europe Sleep Apnea Devices Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Sleep Apnea Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Sleep Apnea Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Sleep Apnea Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Sleep Apnea Devices Industry Revenue (Million), by Diagnostic Devices 2025 & 2033

- Figure 28: Asia Pacific Sleep Apnea Devices Industry Volume (K Unit), by Diagnostic Devices 2025 & 2033

- Figure 29: Asia Pacific Sleep Apnea Devices Industry Revenue Share (%), by Diagnostic Devices 2025 & 2033

- Figure 30: Asia Pacific Sleep Apnea Devices Industry Volume Share (%), by Diagnostic Devices 2025 & 2033

- Figure 31: Asia Pacific Sleep Apnea Devices Industry Revenue (Million), by Therapeutic Devices 2025 & 2033

- Figure 32: Asia Pacific Sleep Apnea Devices Industry Volume (K Unit), by Therapeutic Devices 2025 & 2033

- Figure 33: Asia Pacific Sleep Apnea Devices Industry Revenue Share (%), by Therapeutic Devices 2025 & 2033

- Figure 34: Asia Pacific Sleep Apnea Devices Industry Volume Share (%), by Therapeutic Devices 2025 & 2033

- Figure 35: Asia Pacific Sleep Apnea Devices Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Sleep Apnea Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Sleep Apnea Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Sleep Apnea Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Sleep Apnea Devices Industry Revenue (Million), by Diagnostic Devices 2025 & 2033

- Figure 40: Middle East and Africa Sleep Apnea Devices Industry Volume (K Unit), by Diagnostic Devices 2025 & 2033

- Figure 41: Middle East and Africa Sleep Apnea Devices Industry Revenue Share (%), by Diagnostic Devices 2025 & 2033

- Figure 42: Middle East and Africa Sleep Apnea Devices Industry Volume Share (%), by Diagnostic Devices 2025 & 2033

- Figure 43: Middle East and Africa Sleep Apnea Devices Industry Revenue (Million), by Therapeutic Devices 2025 & 2033

- Figure 44: Middle East and Africa Sleep Apnea Devices Industry Volume (K Unit), by Therapeutic Devices 2025 & 2033

- Figure 45: Middle East and Africa Sleep Apnea Devices Industry Revenue Share (%), by Therapeutic Devices 2025 & 2033

- Figure 46: Middle East and Africa Sleep Apnea Devices Industry Volume Share (%), by Therapeutic Devices 2025 & 2033

- Figure 47: Middle East and Africa Sleep Apnea Devices Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Sleep Apnea Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Sleep Apnea Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Sleep Apnea Devices Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Sleep Apnea Devices Industry Revenue (Million), by Diagnostic Devices 2025 & 2033

- Figure 52: South America Sleep Apnea Devices Industry Volume (K Unit), by Diagnostic Devices 2025 & 2033

- Figure 53: South America Sleep Apnea Devices Industry Revenue Share (%), by Diagnostic Devices 2025 & 2033

- Figure 54: South America Sleep Apnea Devices Industry Volume Share (%), by Diagnostic Devices 2025 & 2033

- Figure 55: South America Sleep Apnea Devices Industry Revenue (Million), by Therapeutic Devices 2025 & 2033

- Figure 56: South America Sleep Apnea Devices Industry Volume (K Unit), by Therapeutic Devices 2025 & 2033

- Figure 57: South America Sleep Apnea Devices Industry Revenue Share (%), by Therapeutic Devices 2025 & 2033

- Figure 58: South America Sleep Apnea Devices Industry Volume Share (%), by Therapeutic Devices 2025 & 2033

- Figure 59: South America Sleep Apnea Devices Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Sleep Apnea Devices Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Sleep Apnea Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Sleep Apnea Devices Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Diagnostic Devices 2020 & 2033

- Table 2: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Diagnostic Devices 2020 & 2033

- Table 3: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Therapeutic Devices 2020 & 2033

- Table 4: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Therapeutic Devices 2020 & 2033

- Table 5: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Diagnostic Devices 2020 & 2033

- Table 8: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Diagnostic Devices 2020 & 2033

- Table 9: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Therapeutic Devices 2020 & 2033

- Table 10: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Therapeutic Devices 2020 & 2033

- Table 11: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Diagnostic Devices 2020 & 2033

- Table 20: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Diagnostic Devices 2020 & 2033

- Table 21: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Therapeutic Devices 2020 & 2033

- Table 22: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Therapeutic Devices 2020 & 2033

- Table 23: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Diagnostic Devices 2020 & 2033

- Table 38: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Diagnostic Devices 2020 & 2033

- Table 39: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Therapeutic Devices 2020 & 2033

- Table 40: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Therapeutic Devices 2020 & 2033

- Table 41: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Diagnostic Devices 2020 & 2033

- Table 56: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Diagnostic Devices 2020 & 2033

- Table 57: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Therapeutic Devices 2020 & 2033

- Table 58: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Therapeutic Devices 2020 & 2033

- Table 59: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: GCC Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Diagnostic Devices 2020 & 2033

- Table 68: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Diagnostic Devices 2020 & 2033

- Table 69: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Therapeutic Devices 2020 & 2033

- Table 70: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Therapeutic Devices 2020 & 2033

- Table 71: Global Sleep Apnea Devices Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Sleep Apnea Devices Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Sleep Apnea Devices Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Sleep Apnea Devices Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sleep Apnea Devices Industry?

The projected CAGR is approximately 7.33%.

2. Which companies are prominent players in the Sleep Apnea Devices Industry?

Key companies in the market include Natus Medical Incorporated, Invacare Corporation, Cadwell Laboratories Inc, GE Healthcare, Vyaire Medical Inc, Resmed, Oventus Medical, Fisher & Paykel Healthcare Limited, Koninklijke Philips NV, Somnomed, Teleflex Incorporated, Nihon Kohden Corporation.

3. What are the main segments of the Sleep Apnea Devices Industry?

The market segments include Diagnostic Devices, Therapeutic Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness Among the Patient Population in the Developing Countries; Increase in Prevalence of Obesity and Hypertension; Upcoming Technological Advancements.

6. What are the notable trends driving market growth?

Pulse Oximeters are Expected to Register the Highest CAGR in the Diagnostic Devices Category.

7. Are there any restraints impacting market growth?

High Cost of Cpap Machines.

8. Can you provide examples of recent developments in the market?

In November 2022, ResMed and Alphabet's life science offshoot Verily announced the formation of Primasun, an end-to-end solution to help employers and healthcare providers identify populations at risk for complex sleep disorders.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sleep Apnea Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sleep Apnea Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sleep Apnea Devices Industry?

To stay informed about further developments, trends, and reports in the Sleep Apnea Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence