Key Insights

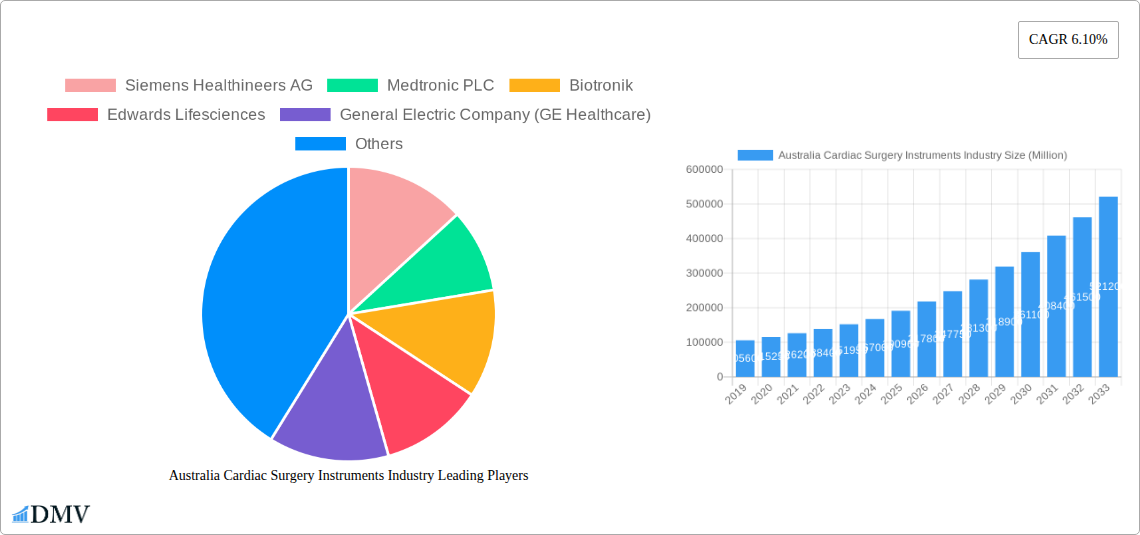

The Australian cardiac surgery instruments market is poised for significant expansion, projected to reach an estimated USD 190.96 billion by 2025, driven by a robust compound annual growth rate (CAGR) of 11.5% through 2033. This dynamic growth is underpinned by several key factors. An aging population, coupled with an increasing prevalence of cardiovascular diseases (CVDs) such as coronary artery disease and heart failure, is escalating the demand for advanced cardiac interventions. Technological advancements are also playing a pivotal role, with the introduction of minimally invasive surgical techniques, sophisticated diagnostic and monitoring devices like advanced ECG monitors and remote cardiac monitoring systems, and innovative therapeutic and surgical instruments such as novel cardiac assist devices, sophisticated rhythm management systems, and improved grafts and stents. These innovations are not only enhancing patient outcomes but also contributing to the overall market expansion by making procedures safer and more effective.

Australia Cardiac Surgery Instruments Industry Market Size (In Billion)

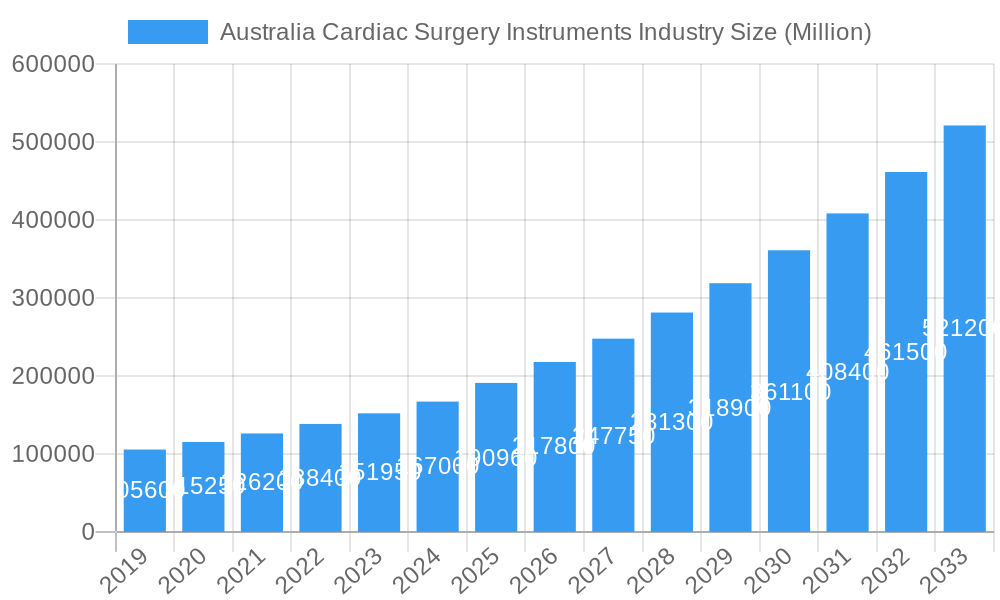

The market is witnessing a burgeoning demand for both diagnostic and monitoring devices, including high-precision electrocardiogram (ECG) machines and sophisticated remote cardiac monitoring solutions, as well as therapeutic and surgical instruments. Within the therapeutic and surgical segment, cardiac assist devices, cardiac rhythm management solutions, advanced catheters, and innovative grafts and valves are experiencing substantial uptake. Leading global players such as Siemens Healthineers AG, Medtronic PLC, and Boston Scientific Corporation are actively investing in research and development, expanding their product portfolios, and forging strategic partnerships within Australia to capitalize on this growing market. While the market demonstrates strong growth potential, potential challenges such as high equipment costs and the need for specialized training for healthcare professionals need to be effectively addressed by stakeholders to ensure sustained and inclusive growth.

Australia Cardiac Surgery Instruments Industry Company Market Share

Australia Cardiac Surgery Instruments Industry Market Composition & Trends

The Australian cardiac surgery instruments market, projected to reach an estimated $XX billion by 2025 and grow substantially through 2033, is characterized by a dynamic interplay of established players and emerging innovations. Market concentration is moderate, with key global giants like Siemens Healthineers AG, Medtronic PLC, and Edwards Lifesciences holding significant shares. However, niche players and domestic manufacturers are contributing to innovation catalysts, driving advancements in minimally invasive surgical techniques and diagnostic precision. The regulatory landscape, governed by the Therapeutic Goods Administration (TGA), presents a stringent yet supportive environment for the adoption of high-quality medical devices. Substitute products, while present in terms of alternative treatment modalities, are increasingly being supplanted by sophisticated cardiac surgical instruments that offer improved patient outcomes. End-user profiles are diverse, encompassing hospitals, specialized cardiac centers, and research institutions, each with specific purchasing criteria and adoption timelines. Mergers and acquisitions (M&A) activities, valued at approximately $XX billion historically and forecast to reach $XX billion by 2033, are anticipated to consolidate the market and foster technological integration.

- Market Share Distribution: Dominant players like Medtronic PLC and Edwards Lifesciences are estimated to hold XX% and XX% respectively by 2025.

- M&A Deal Values: Historical M&A activities have averaged $XX billion annually, with projected growth to $XX billion by 2033.

- Innovation Catalysts: Focus on miniaturization, AI-powered diagnostics, and robotic-assisted surgery.

Australia Cardiac Surgery Instruments Industry Industry Evolution

The Australia cardiac surgery instruments industry has witnessed a remarkable evolution driven by continuous technological advancements, a growing burden of cardiovascular diseases, and an aging population. Over the historical period (2019-2024), the market demonstrated a steady growth trajectory, largely fueled by increased diagnostic capabilities and a rising demand for minimally invasive procedures. The forecast period (2025-2033) is poised for even more accelerated expansion, with an anticipated compound annual growth rate (CAGR) of XX%. This surge is directly linked to sophisticated product innovations, including advanced cardiac assist devices, precision catheters, and biocompatible heart valves. Shifting consumer demands, influenced by patient preference for faster recovery times and reduced hospital stays, are pushing the adoption of less invasive surgical instruments. Furthermore, the increasing prevalence of conditions like atrial fibrillation and congestive heart failure necessitates sophisticated cardiac rhythm management devices. The Australian government's commitment to enhancing healthcare infrastructure and access to advanced medical technologies is a significant factor in this evolution. Investments in research and development for novel materials and smart diagnostic tools are creating a fertile ground for sustained industry growth. The adoption of remote monitoring solutions for cardiac patients is also on the rise, indicating a broader trend towards integrated cardiac care.

Leading Regions, Countries, or Segments in Australia Cardiac Surgery Instruments Industry

Within the Australian cardiac surgery instruments industry, the Therapeutic and Surgical Devices segment stands out as the dominant force, driven by the critical need for interventional and procedural solutions. Within this broad segment, Heart Valves and Catheters are expected to exhibit the highest growth rates and market penetration through 2033. This dominance is underpinned by several key drivers, including a significant and aging population experiencing a higher incidence of valvular heart disease and complex coronary artery blockages requiring intricate catheter-based interventions. The technological sophistication of newer generations of prosthetic heart valves, offering improved durability and reduced invasiveness, further propels their market share. Similarly, advancements in catheter technology, enabling precise navigation and treatment of previously inaccessible areas of the heart, are critical to this segment's leadership.

Dominant Segment: Therapeutic and Surgical Devices.

- Key Drivers:

- Increasing prevalence of cardiovascular diseases, particularly valvular heart disease and coronary artery disease.

- Technological advancements in minimally invasive surgical techniques, reducing patient recovery times.

- Growing preference for durable and patient-specific implantable devices like heart valves.

- Government initiatives and private sector investments in advanced cardiac care infrastructure.

- Innovation in drug-eluting stents and bioresorbable scaffolds within the Catheters sub-segment.

- Key Drivers:

Dominant Sub-Segments: Heart Valves and Catheters.

- Analysis of Dominance Factors for Heart Valves: The demand for both aortic and mitral valve replacements is consistently high due to the aging demographic. Innovations such as transcatheter aortic valve implantation (TAVI) have revolutionized treatment, making it accessible to a broader patient population, thereby significantly boosting the market for these devices. The development of bioprosthetic valves with enhanced longevity and reduced thromboembolic risks further solidifies their leadership.

- Analysis of Dominance Factors for Catheters: The versatility of catheters in diagnostic procedures (angiography) and therapeutic interventions (angioplasty, stenting, ablation) makes them indispensable. The continuous refinement in catheter design for enhanced flexibility, steerability, and imaging capabilities allows for the treatment of increasingly complex cardiac anatomies. The expanding use of percutaneous coronary interventions (PCI) and complex electrophysiology procedures directly translates to substantial market demand for specialized catheters.

Australia Cardiac Surgery Instruments Industry Product Innovations

Product innovation in the Australian cardiac surgery instruments market is characterized by a relentless pursuit of enhanced patient outcomes and procedural efficiency. Recent advancements include ultra-thin, flexible catheters for navigating tortuous vascular pathways, sophisticated cardiac rhythm management devices with advanced sensing capabilities and extended battery life, and next-generation heart valves offering superior hemodynamic performance and long-term durability. Novel diagnostic imaging technologies integrated into surgical instruments are also emerging, providing real-time feedback and improving surgical precision. These innovations are driven by the application of advanced materials science, miniaturization technologies, and artificial intelligence to create safer, more effective, and less invasive cardiac interventions.

Propelling Factors for Australia Cardiac Surgery Instruments Industry Growth

Several key factors are propelling the growth of the Australia cardiac surgery instruments industry.

- Technological Advancements: Continuous innovation in areas like minimally invasive surgical tools, advanced imaging, and implantable devices is expanding treatment options and improving patient outcomes.

- Rising Cardiovascular Disease Burden: An aging population and lifestyle factors contribute to a growing prevalence of heart conditions, increasing the demand for cardiac interventions and associated instruments.

- Government Healthcare Initiatives: Investments in healthcare infrastructure, medical technology adoption, and public health awareness campaigns are creating a supportive market environment.

- Increased Healthcare Expenditure: Both public and private spending on healthcare is rising, allowing for greater access to advanced cardiac procedures and the sophisticated instruments they require.

- Demand for Minimally Invasive Procedures: Patient preference for reduced recovery times and less pain drives the adoption of instruments that facilitate less invasive surgical approaches.

Obstacles in the Australia Cardiac Surgery Instruments Industry Market

Despite robust growth, the Australian cardiac surgery instruments market faces certain obstacles.

- Stringent Regulatory Approvals: The TGA's rigorous approval processes for new medical devices can lead to extended market entry timelines and significant compliance costs for manufacturers.

- High Cost of Advanced Technology: Cutting-edge cardiac surgery instruments often come with a substantial price tag, which can pose challenges for reimbursement and affordability for some healthcare providers and patients.

- Skilled Workforce Shortage: A lack of highly trained cardiac surgeons and technicians proficient in operating the latest sophisticated instrumentation can limit adoption and impact procedural success rates.

- Supply Chain Disruptions: Global geopolitical events and logistical challenges can lead to disruptions in the supply of critical components and finished goods, impacting availability and increasing costs.

- Reimbursement Policies: Evolving and sometimes uncertain reimbursement policies for novel cardiac procedures and devices can create market access challenges for manufacturers.

Future Opportunities in Australia Cardiac Surgery Instruments Industry

The Australian cardiac surgery instruments market is ripe with future opportunities.

- Expansion of Telehealth and Remote Monitoring: The growing adoption of remote cardiac monitoring devices presents a significant opportunity for companies to develop integrated diagnostic and therapeutic solutions that can be managed remotely.

- Advancements in AI and Robotics: The integration of artificial intelligence in surgical planning and robotics in surgical procedures opens avenues for highly precise and efficient interventions.

- Biomaterials and Regenerative Medicine: Innovations in biocompatible materials and regenerative medicine for cardiac repair and tissue engineering will create new categories of therapeutic instruments.

- Focus on Preventive Cardiology: A shift towards preventive cardiology may lead to increased demand for advanced diagnostic and screening tools.

- Growing Demand for Pediatric Cardiac Devices: As medical advancements improve survival rates for congenital heart defects, there is an emerging market for specialized pediatric cardiac surgery instruments.

Major Players in the Australia Cardiac Surgery Instruments Industry Ecosystem

- Siemens Healthineers AG

- Medtronic PLC

- Biotronik

- Edwards Lifesciences

- General Electric Company (GE Healthcare)

- Canon Medical Systems Corporation

- Boston Scientific Corporation

- B Braun SE

- Abbott Laboratories

- W L Gore & Associates Inc

- Cardinal Health Inc

Key Developments in Australia Cardiac Surgery Instruments Industry Industry

- June 2022: Teleflex Incorporated launched its Arrow Pressure Injectable Midline Catheter in Australia, enhancing its Midline portfolio to improve patient safety and address clinician needs by reducing catheter identification confusion and potential infusion errors.

- March 2022: The Australian government allocated USD 17.2 million over four years to establish five mobile health clinics providing consultations and diagnoses, including cardiology services, in Queensland, indicating a commitment to expanding accessible healthcare.

Strategic Australia Cardiac Surgery Instruments Industry Market Forecast

The strategic forecast for the Australian cardiac surgery instruments industry points towards sustained and significant growth, driven by a confluence of technological innovation, evolving patient needs, and supportive healthcare policies. The increasing prevalence of cardiovascular diseases, coupled with an aging demographic, will continue to fuel demand for advanced diagnostic and monitoring devices and sophisticated therapeutic and surgical devices. Investments in research and development for minimally invasive techniques, robotic surgery, and AI-integrated tools are expected to reshape the market landscape, leading to improved patient outcomes and greater procedural efficiency. The market's trajectory is also influenced by government initiatives aimed at enhancing healthcare access and the growing trend towards personalized medicine, creating substantial opportunities for companies that can offer innovative, cost-effective, and patient-centric solutions.

Australia Cardiac Surgery Instruments Industry Segmentation

-

1. Device Type

-

1.1. Diagnostic and Monitoring Devices

- 1.1.1. Electrocardiogram (ECG)

- 1.1.2. Remote Cardiac Monitoring

- 1.1.3. Other Diagnostic and Monitoring Devices

-

1.2. Therapeutic and Surgical Devices

- 1.2.1. Cardiac Assist Devices

- 1.2.2. Cardiac Rhythm Management Devices

- 1.2.3. Catheters

- 1.2.4. Grafts

- 1.2.5. Heart Valves

- 1.2.6. Stents

- 1.2.7. Other Therapeutic and Surgical Devices

-

1.1. Diagnostic and Monitoring Devices

Australia Cardiac Surgery Instruments Industry Segmentation By Geography

- 1. Australia

Australia Cardiac Surgery Instruments Industry Regional Market Share

Geographic Coverage of Australia Cardiac Surgery Instruments Industry

Australia Cardiac Surgery Instruments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Cardiovascular Diseases; Increased Preference for Minimally Invasive Procedures and Technological Advancements in Cardiovascular Devices

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies and Product Recalls

- 3.4. Market Trends

- 3.4.1. Electrocardiogram (ECG) Segment is Expected to Witness Growth Over The Forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Cardiac Surgery Instruments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Diagnostic and Monitoring Devices

- 5.1.1.1. Electrocardiogram (ECG)

- 5.1.1.2. Remote Cardiac Monitoring

- 5.1.1.3. Other Diagnostic and Monitoring Devices

- 5.1.2. Therapeutic and Surgical Devices

- 5.1.2.1. Cardiac Assist Devices

- 5.1.2.2. Cardiac Rhythm Management Devices

- 5.1.2.3. Catheters

- 5.1.2.4. Grafts

- 5.1.2.5. Heart Valves

- 5.1.2.6. Stents

- 5.1.2.7. Other Therapeutic and Surgical Devices

- 5.1.1. Diagnostic and Monitoring Devices

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Siemens Healthineers AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medtronic PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Biotronik

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Edwards Lifesciences

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 General Electric Company (GE Healthcare)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Canon Medical Systems Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boston Scientific Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 B Braun SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Abbott Laboratories

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 W L Gore & Associates Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Cardinal Health Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Siemens Healthineers AG

List of Figures

- Figure 1: Australia Cardiac Surgery Instruments Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Australia Cardiac Surgery Instruments Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 2: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 3: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Device Type 2020 & 2033

- Table 6: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Device Type 2020 & 2033

- Table 7: Australia Cardiac Surgery Instruments Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Australia Cardiac Surgery Instruments Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Cardiac Surgery Instruments Industry?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Australia Cardiac Surgery Instruments Industry?

Key companies in the market include Siemens Healthineers AG, Medtronic PLC, Biotronik, Edwards Lifesciences, General Electric Company (GE Healthcare), Canon Medical Systems Corporation, Boston Scientific Corporation, B Braun SE, Abbott Laboratories, W L Gore & Associates Inc, Cardinal Health Inc.

3. What are the main segments of the Australia Cardiac Surgery Instruments Industry?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Cardiovascular Diseases; Increased Preference for Minimally Invasive Procedures and Technological Advancements in Cardiovascular Devices.

6. What are the notable trends driving market growth?

Electrocardiogram (ECG) Segment is Expected to Witness Growth Over The Forecast period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies and Product Recalls.

8. Can you provide examples of recent developments in the market?

June 2022: Teleflex Incorporated, a leading global provider of medical technologies, launched its Arrow Pressure Injectable Midline Catheter in Australia. The addition of the pressure injectable catheter further enhances the Midline portfolio to meet the expanded needs of clinicians and is designed to improve patient safety. The new 20 cm Arrow Pressure Injectable Midline with brightly colored yellow hubs and labeling will help clinicians overcome catheter identification confusion, which can lead to infusion mistakes that can harm patients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Cardiac Surgery Instruments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Cardiac Surgery Instruments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Cardiac Surgery Instruments Industry?

To stay informed about further developments, trends, and reports in the Australia Cardiac Surgery Instruments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence