Key Insights

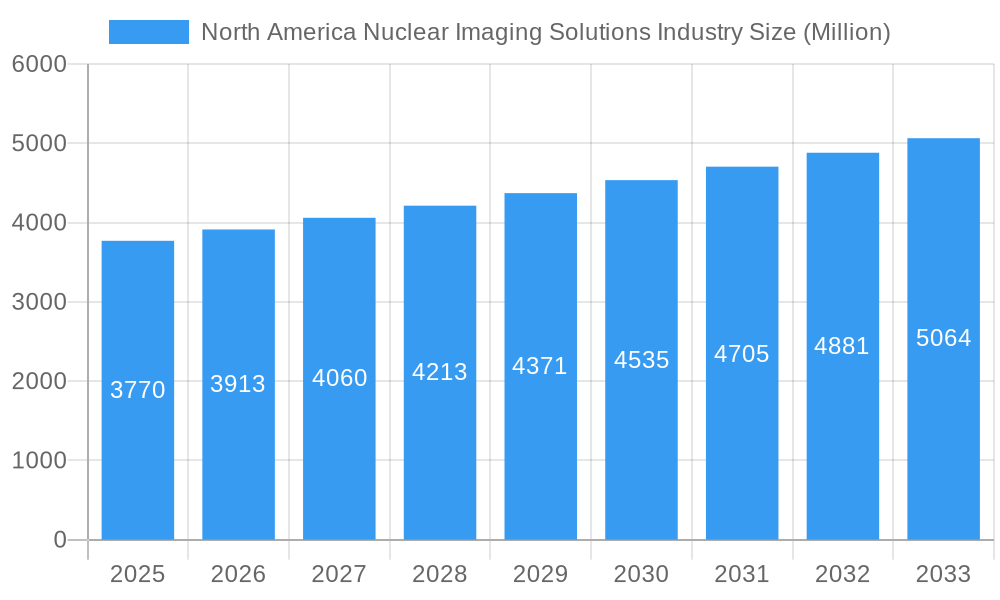

The North America Nuclear Imaging Solutions market is poised for significant expansion, projected to reach USD 3770 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 3.83% over the forecast period of 2025-2033. This growth is primarily fueled by the increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions, which necessitate advanced diagnostic imaging techniques. The rising adoption of PET and SPECT imaging across various medical specialties, including oncology, cardiology, and neurology, is a key driver. Furthermore, technological advancements leading to improved resolution, faster scan times, and enhanced radioisotope development are contributing to market expansion. The demand for early and accurate disease detection, coupled with a growing emphasis on personalized medicine, further underpins the positive trajectory of this market.

North America Nuclear Imaging Solutions Industry Market Size (In Billion)

Despite the promising outlook, the market faces certain restraints. The high cost of nuclear imaging equipment and radiopharmaceuticals, along with concerns regarding radiation exposure and the availability of skilled professionals, present challenges. However, strategic initiatives by market players, including research and development investments in novel imaging agents and less invasive techniques, alongside expanding reimbursement policies and increasing healthcare expenditure in the region, are expected to mitigate these restraints. The market is segmented by product (SPECT and PET radioisotopes), application (cardiology, neurology, oncology, thyroid), and geography (United States, Canada, Mexico). The United States is expected to dominate the market due to its advanced healthcare infrastructure and high adoption rate of nuclear imaging technologies.

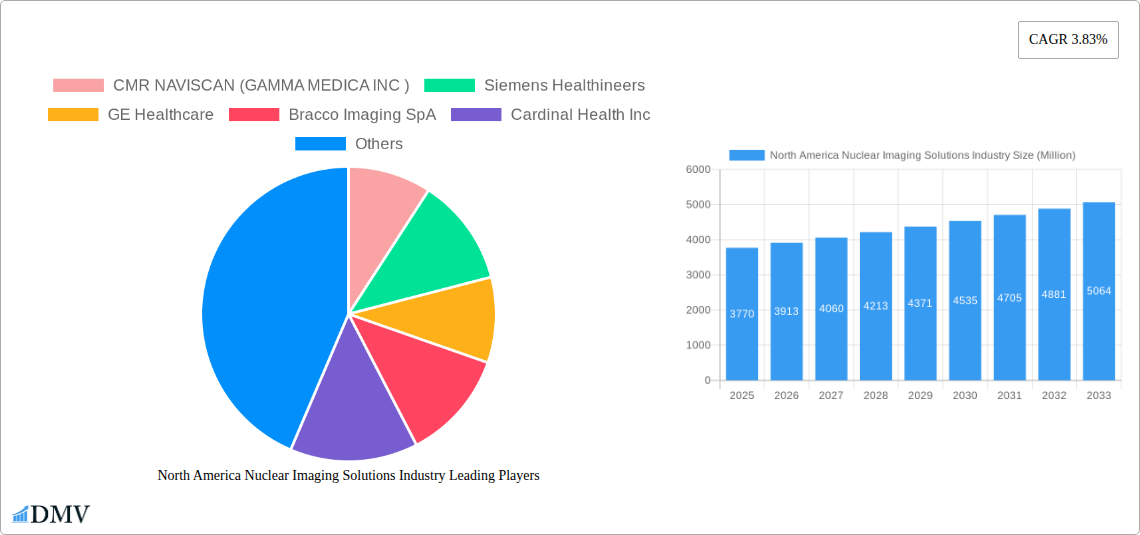

North America Nuclear Imaging Solutions Industry Company Market Share

North America Nuclear Imaging Solutions Industry Market Composition & Trends

The North America Nuclear Imaging Solutions industry is characterized by a moderate to highly concentrated market structure, driven by substantial R&D investments and significant capital expenditures from key players. Innovation remains a paramount catalyst, with continuous advancements in detector technology, radiotracer development, and image processing algorithms pushing the boundaries of diagnostic accuracy. The regulatory landscape, governed by bodies like the FDA in the United States and Health Canada, plays a crucial role in market entry and product approval, influencing the pace of innovation and market adoption. Substitute products, while not direct replacements, include advanced MRI and CT technologies, necessitating a focus on the unique diagnostic capabilities of nuclear imaging. End-user profiles are diverse, encompassing hospitals, specialized diagnostic centers, and research institutions, each with distinct purchasing criteria and application needs. Mergers and acquisitions (M&A) are active, driven by the pursuit of market consolidation, technology integration, and expanded geographical reach. Recent M&A activities indicate a trend towards strategic partnerships aimed at enhancing portfolio offerings and addressing unmet clinical needs. The estimated market share distribution among leading companies reflects a competitive environment where product differentiation and technological superiority are key differentiators.

- Market Concentration: Moderate to High, with a few dominant players.

- Innovation Catalysts: Advanced detector technology, novel radiotracers, AI-driven image analysis.

- Regulatory Landscape: FDA (US), Health Canada. Stringent approval processes.

- Substitute Products: Advanced MRI, CT.

- End-User Profiles: Hospitals, diagnostic centers, research institutions.

- M&A Activities: Active, focused on portfolio enhancement and market expansion. Estimated deal values for significant M&A activities are in the range of XXX Million.

North America Nuclear Imaging Solutions Industry Industry Evolution

The North America Nuclear Imaging Solutions industry has undergone a transformative evolution, marked by a consistent upward trajectory in market growth, propelled by increasing healthcare expenditures, a rising prevalence of chronic diseases, and an aging population. The historical period (2019-2024) witnessed steady growth, driven by the expanding applications of SPECT and PET imaging in cardiology, neurology, and oncology. These diagnostic modalities have become indispensable for early disease detection, treatment monitoring, and personalized medicine. The market's evolution is intrinsically linked to technological advancements. Early innovations focused on improving the resolution and sensitivity of imaging devices. More recently, the industry has seen significant strides in the development of novel radiotracers that target specific cellular processes, enhancing diagnostic precision and enabling the visualization of molecular pathways previously inaccessible. This has led to a surge in PET imaging applications, particularly in oncology, for identifying tumor metabolism and response to therapy.

The shift in consumer demand, influenced by greater patient awareness of advanced diagnostic options and a growing preference for less invasive procedures, has further fueled market expansion. The demand for faster, more accurate, and more accessible diagnostic tools is a key driver. The base year of 2025 is projected to see continued robust growth, with the forecast period (2025-2033) anticipating sustained expansion. This growth is attributed to several factors, including the increasing adoption of hybrid imaging systems (PET/CT, SPECT/CT), which offer complementary information, and the development of mobile PET units, expanding access to underserved areas. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) algorithms is revolutionizing nuclear imaging by improving image reconstruction, automating quantitative analysis, and aiding in the detection of subtle abnormalities. These advancements are not only enhancing diagnostic capabilities but also improving workflow efficiency in clinical settings. The overall market growth rate is estimated to be around XX% annually during the forecast period, reflecting the industry's dynamism and its critical role in modern healthcare. Adoption metrics for advanced SPECT and PET systems are showing a significant upward trend, particularly in leading research hospitals and cancer centers.

Leading Regions, Countries, or Segments in North America Nuclear Imaging Solutions Industry

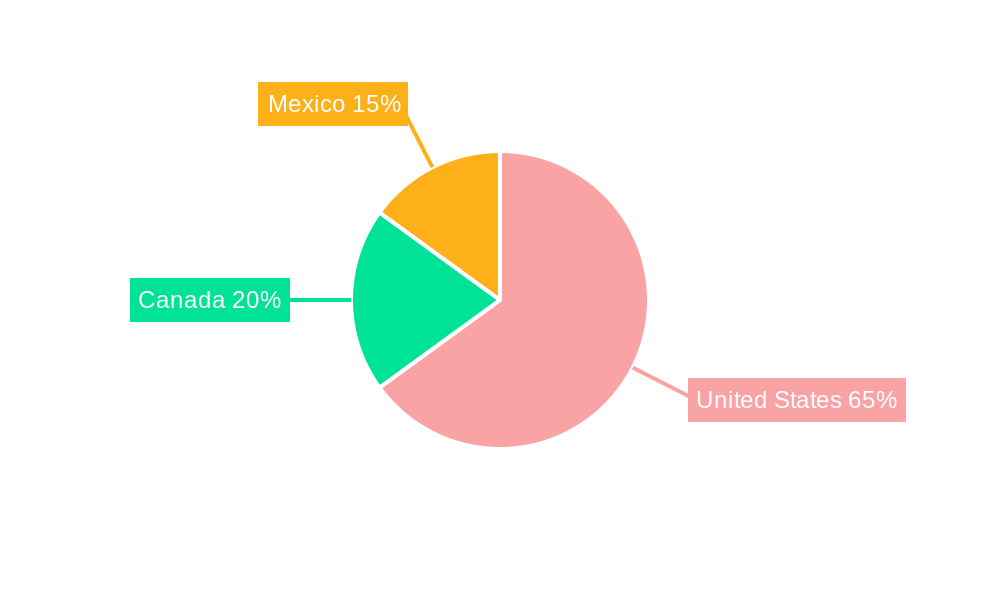

The North America Nuclear Imaging Solutions industry is largely dominated by the United States, which consistently represents the largest market share due to its robust healthcare infrastructure, substantial investment in medical research and development, and high adoption rate of advanced medical technologies. This dominance is further amplified by the presence of leading global nuclear imaging solution providers and research institutions driving innovation.

- Dominant Geography: United States

- Key Drivers:

- Investment Trends: Significant private and public investment in healthcare infrastructure and R&D, estimated to be in the hundreds of millions annually.

- Regulatory Support: A well-established regulatory framework (FDA) that, while stringent, facilitates market access for innovative technologies through clear pathways.

- High Prevalence of Chronic Diseases: A large patient population suffering from cancer, cardiovascular diseases, and neurological disorders, driving demand for diagnostic imaging.

- Technological Adoption: Early and widespread adoption of advanced SPECT and PET imaging technologies, including hybrid systems.

- Reimbursement Policies: Favorable reimbursement policies for nuclear imaging procedures in the US, encouraging their utilization.

- Leading Healthcare Providers: The presence of world-renowned hospitals and academic medical centers that are early adopters and key influencers of new technologies.

- Research & Development Hubs: A concentration of pharmaceutical and biotechnology companies actively developing new radiotracers, further stimulating the demand for imaging equipment.

- Key Drivers:

Beyond the United States, Canada and Mexico represent significant, albeit smaller, markets within North America. Canada benefits from a universal healthcare system that prioritizes diagnostic imaging, while Mexico's market is growing due to increasing healthcare expenditure and the expansion of private healthcare facilities.

Within the Product Segment, PET Radioisotopes have emerged as a critical growth driver, primarily due to the expanding applications of Fluorine-18 (F-18) in oncology for detecting and staging various cancers. The increasing demand for highly sensitive imaging of metabolic activity and tumor proliferation in oncology applications is a significant factor.

- Key Segment Driver: PET Radioisotopes

- Dominant Radioisotope: Fluorine-18 (F-18)

- Application Focus: Oncology, Neurology, Cardiology.

- Impact: Enables precise visualization of metabolic processes, crucial for early cancer detection, treatment response assessment, and disease management. The development of new F-18 labeled tracers is continuously expanding its diagnostic utility.

- Dominant Radioisotope: Fluorine-18 (F-18)

In terms of Application, PET Applications, particularly Oncology, are experiencing the most substantial growth. The ability of PET imaging to provide functional and metabolic information, complementing anatomical imaging, has made it indispensable in cancer diagnosis, staging, treatment planning, and monitoring.

- Dominant Application: PET Applications

- Primary Focus: Oncology

- Driving Factors:

- Early Cancer Detection: F-18 FDG PET/CT is a gold standard for detecting many types of cancer at their earliest stages.

- Treatment Response Monitoring: PET imaging allows clinicians to assess the effectiveness of cancer therapies in real-time, enabling adjustments to treatment plans.

- Restaging and Recurrence Detection: Crucial for identifying if cancer has returned after treatment.

- Personalized Medicine: Facilitates tailored treatment strategies based on tumor characteristics.

- Emerging Applications: Growing use in assessing inflammatory conditions and neurological disorders.

- Driving Factors:

- Primary Focus: Oncology

While SPECT imaging, particularly SPECT Applications in Cardiology and Neurology, remains vital, the rapid advancements and expanding indications for PET imaging are driving its faster growth trajectory in the North American market. The synergy between SPECT and PET technologies, often integrated into hybrid systems, further solidifies their collective importance.

North America Nuclear Imaging Solutions Industry Product Innovations

Product innovation in the North America Nuclear Imaging Solutions industry is primarily focused on enhancing detector sensitivity, improving image resolution, and developing more targeted radiotracers. For instance, advancements in solid-state detectors for PET systems are enabling faster scan times and higher photon detection efficiency, leading to improved image quality and reduced radiation exposure for patients. Furthermore, the development of novel PET radiotracers, such as those targeting specific biomarkers for neurodegenerative diseases or aggressive cancers, is expanding the clinical utility of these solutions. Performance metrics like improved signal-to-noise ratio, higher spatial resolution (e.g., down to XX mm), and reduced quantitative uncertainty are key selling propositions.

Propelling Factors for North America Nuclear Imaging Solutions Industry Growth

The North America Nuclear Imaging Solutions industry is propelled by a confluence of potent factors. Firstly, the escalating global burden of chronic diseases, including cancer, cardiovascular ailments, and neurological disorders, necessitates advanced diagnostic tools for early detection and effective management. Secondly, continuous technological advancements in imaging hardware, such as novel detector technologies and AI-powered image reconstruction, are enhancing diagnostic accuracy and operational efficiency. Thirdly, the development and commercialization of new, highly specific radiotracers are expanding the scope of nuclear imaging applications, particularly in personalized medicine. Fourthly, favorable reimbursement policies and increasing healthcare expenditure in countries like the United States and Canada provide a supportive economic environment for the adoption of these sophisticated solutions. The growing awareness among healthcare professionals and patients about the benefits of nuclear imaging further fuels demand.

Obstacles in the North America Nuclear Imaging Solutions Industry Market

Despite robust growth, the North America Nuclear Imaging Solutions industry faces several obstacles. High upfront costs associated with advanced SPECT and PET imaging systems, often exceeding XX Million, can be a significant barrier for smaller healthcare facilities. The complex regulatory approval process for new radiotracers and imaging devices can lead to lengthy market entry timelines. Supply chain disruptions, particularly for specialized radioisotopes and components, can impact product availability and operational continuity. Furthermore, the shortage of skilled nuclear medicine technologists and radiologists trained in interpreting advanced nuclear imaging can limit the widespread adoption and optimal utilization of these technologies. Intense competition among established players and emerging technologies also exerts price pressures.

Future Opportunities in North America Nuclear Imaging Solutions Industry

The future of the North America Nuclear Imaging Solutions industry is ripe with opportunities. The growing demand for precision medicine presents a significant avenue, as nuclear imaging can provide functional and metabolic insights crucial for tailoring treatments. The expansion of PET imaging into new therapeutic areas beyond oncology, such as infectious diseases and inflammatory conditions, offers substantial growth potential. Advancements in artificial intelligence (AI) and machine learning (ML) for image analysis and workflow optimization are poised to revolutionize the field, improving efficiency and diagnostic accuracy. Furthermore, the development of more cost-effective imaging solutions and increased accessibility through mobile imaging units could expand market penetration into underserved regions. The ongoing research into novel radiopharmaceuticals, including targeted alpha therapies, also presents exciting prospects for integrated imaging and therapeutic approaches.

Major Players in the North America Nuclear Imaging Solutions Industry Ecosystem

- CMR NAVISCAN (GAMMA MEDICA INC)

- Siemens Healthineers

- GE Healthcare

- Bracco Imaging SpA

- Cardinal Health Inc

- Koninklijke Philips NV

- Nordion (Canada) Inc

- MinFound Medical Systems Co Ltd

- Canon Medical Systems Corporation

- Curium

Key Developments in North America Nuclear Imaging Solutions Industry Industry

- May 2024: Blue Earth Diagnostics, a Bracco company, has inked a non-exclusive data-sharing pact with Siemens Healthineers. The agreement covers the sharing of anonymized clinical data and images of POSLUMA® (previously 18F-rhPSMA-7.3) injection from Blue Earth Diagnostics' Phase 3 LIGHTHOUSE trial, focusing on newly diagnosed prostate cancer. This development signifies a strategic collaboration aimed at advancing research and understanding of novel prostate cancer imaging agents, potentially impacting future diagnostic protocols and market adoption.

- March 2023: Positron Corporation signed a Clinical Study/Research Agreement with the Ochsner Clinic Foundation and Dr. Bober, Director of Molecular Imaging and Nuclear Cardiology at Ochsner Health. Under the agreement, the company and the organizations would carry out clinical studies of its new PET-CT imaging device, the Affinity PET-CT 4D. This collaboration highlights ongoing efforts to validate and demonstrate the clinical utility of next-generation PET-CT systems, potentially driving market adoption and influencing imaging technology trends.

Strategic North America Nuclear Imaging Solutions Industry Market Forecast

The strategic forecast for the North America Nuclear Imaging Solutions industry anticipates continued robust growth, driven by an increasing demand for early and accurate disease diagnosis, particularly in oncology, cardiology, and neurology. Technological advancements, including the integration of AI and the development of novel radiotracers, will be pivotal in unlocking new diagnostic capabilities and improving patient outcomes. Favorable reimbursement policies and rising healthcare expenditures in key markets like the United States will sustain market expansion. The industry's ability to address challenges such as high capital investment and the need for skilled personnel will be crucial. The growing emphasis on personalized medicine and the expanding applications of PET imaging beyond traditional domains present significant opportunities for market players to innovate and capture a larger share of this dynamic sector. The market is projected to reach approximately XXXX Million by 2033.

North America Nuclear Imaging Solutions Industry Segmentation

-

1. Product

- 1.1. By Equipment

-

1.2. By Radioisotope

-

1.2.1. SPECT Radioisotopes

- 1.2.1.1. Technetium-99m (TC-99m)

- 1.2.1.2. Thallium-201 (TI-201)

- 1.2.1.3. Gallium (Ga-67)

- 1.2.1.4. Iodine (I-123)

- 1.2.1.5. Other SPECT Radioisotopes

-

1.2.2. PET Radioisotopes

- 1.2.2.1. Fluorine-18 (F-18)

- 1.2.2.2. Rubidium-82 (RB-82)

- 1.2.2.3. Other PET Radioisotopes

-

1.2.1. SPECT Radioisotopes

-

2. Application

-

2.1. SPECT Applications

- 2.1.1. Cardiology

- 2.1.2. Neurology

- 2.1.3. Thyroid

- 2.1.4. Other SPECT Applications

-

2.2. PET Applications

- 2.2.1. Oncology

- 2.2.2. Other PET Applications

-

2.1. SPECT Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Nuclear Imaging Solutions Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Nuclear Imaging Solutions Industry Regional Market Share

Geographic Coverage of North America Nuclear Imaging Solutions Industry

North America Nuclear Imaging Solutions Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Prevalence of Cancer and Cardiac Disorders; Increase in Technological Advancements; Growth in Applications of Nuclear Medicine and Imaging

- 3.3. Market Restrains

- 3.3.1. Regulatory Issues; Lack of Reimbursement

- 3.4. Market Trends

- 3.4.1. The Oncology Segment of the PET Applications is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Nuclear Imaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Equipment

- 5.1.2. By Radioisotope

- 5.1.2.1. SPECT Radioisotopes

- 5.1.2.1.1. Technetium-99m (TC-99m)

- 5.1.2.1.2. Thallium-201 (TI-201)

- 5.1.2.1.3. Gallium (Ga-67)

- 5.1.2.1.4. Iodine (I-123)

- 5.1.2.1.5. Other SPECT Radioisotopes

- 5.1.2.2. PET Radioisotopes

- 5.1.2.2.1. Fluorine-18 (F-18)

- 5.1.2.2.2. Rubidium-82 (RB-82)

- 5.1.2.2.3. Other PET Radioisotopes

- 5.1.2.1. SPECT Radioisotopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. SPECT Applications

- 5.2.1.1. Cardiology

- 5.2.1.2. Neurology

- 5.2.1.3. Thyroid

- 5.2.1.4. Other SPECT Applications

- 5.2.2. PET Applications

- 5.2.2.1. Oncology

- 5.2.2.2. Other PET Applications

- 5.2.1. SPECT Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States North America Nuclear Imaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. By Equipment

- 6.1.2. By Radioisotope

- 6.1.2.1. SPECT Radioisotopes

- 6.1.2.1.1. Technetium-99m (TC-99m)

- 6.1.2.1.2. Thallium-201 (TI-201)

- 6.1.2.1.3. Gallium (Ga-67)

- 6.1.2.1.4. Iodine (I-123)

- 6.1.2.1.5. Other SPECT Radioisotopes

- 6.1.2.2. PET Radioisotopes

- 6.1.2.2.1. Fluorine-18 (F-18)

- 6.1.2.2.2. Rubidium-82 (RB-82)

- 6.1.2.2.3. Other PET Radioisotopes

- 6.1.2.1. SPECT Radioisotopes

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. SPECT Applications

- 6.2.1.1. Cardiology

- 6.2.1.2. Neurology

- 6.2.1.3. Thyroid

- 6.2.1.4. Other SPECT Applications

- 6.2.2. PET Applications

- 6.2.2.1. Oncology

- 6.2.2.2. Other PET Applications

- 6.2.1. SPECT Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Canada North America Nuclear Imaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. By Equipment

- 7.1.2. By Radioisotope

- 7.1.2.1. SPECT Radioisotopes

- 7.1.2.1.1. Technetium-99m (TC-99m)

- 7.1.2.1.2. Thallium-201 (TI-201)

- 7.1.2.1.3. Gallium (Ga-67)

- 7.1.2.1.4. Iodine (I-123)

- 7.1.2.1.5. Other SPECT Radioisotopes

- 7.1.2.2. PET Radioisotopes

- 7.1.2.2.1. Fluorine-18 (F-18)

- 7.1.2.2.2. Rubidium-82 (RB-82)

- 7.1.2.2.3. Other PET Radioisotopes

- 7.1.2.1. SPECT Radioisotopes

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. SPECT Applications

- 7.2.1.1. Cardiology

- 7.2.1.2. Neurology

- 7.2.1.3. Thyroid

- 7.2.1.4. Other SPECT Applications

- 7.2.2. PET Applications

- 7.2.2.1. Oncology

- 7.2.2.2. Other PET Applications

- 7.2.1. SPECT Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Mexico North America Nuclear Imaging Solutions Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. By Equipment

- 8.1.2. By Radioisotope

- 8.1.2.1. SPECT Radioisotopes

- 8.1.2.1.1. Technetium-99m (TC-99m)

- 8.1.2.1.2. Thallium-201 (TI-201)

- 8.1.2.1.3. Gallium (Ga-67)

- 8.1.2.1.4. Iodine (I-123)

- 8.1.2.1.5. Other SPECT Radioisotopes

- 8.1.2.2. PET Radioisotopes

- 8.1.2.2.1. Fluorine-18 (F-18)

- 8.1.2.2.2. Rubidium-82 (RB-82)

- 8.1.2.2.3. Other PET Radioisotopes

- 8.1.2.1. SPECT Radioisotopes

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. SPECT Applications

- 8.2.1.1. Cardiology

- 8.2.1.2. Neurology

- 8.2.1.3. Thyroid

- 8.2.1.4. Other SPECT Applications

- 8.2.2. PET Applications

- 8.2.2.1. Oncology

- 8.2.2.2. Other PET Applications

- 8.2.1. SPECT Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 CMR NAVISCAN (GAMMA MEDICA INC )

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Siemens Healthineers

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 GE Healthcare

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Bracco Imaging SpA

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Cardinal Health Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Koninklijke Philips NV

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Nordion (Canada) Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 MinFound Medical Systems Co Ltd

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Canon Medical Systems Corporation*List Not Exhaustive

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Curium

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 CMR NAVISCAN (GAMMA MEDICA INC )

List of Figures

- Figure 1: North America Nuclear Imaging Solutions Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Nuclear Imaging Solutions Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 6: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 7: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 10: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 14: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: North America Nuclear Imaging Solutions Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Nuclear Imaging Solutions Industry?

The projected CAGR is approximately 3.83%.

2. Which companies are prominent players in the North America Nuclear Imaging Solutions Industry?

Key companies in the market include CMR NAVISCAN (GAMMA MEDICA INC ), Siemens Healthineers, GE Healthcare, Bracco Imaging SpA, Cardinal Health Inc, Koninklijke Philips NV, Nordion (Canada) Inc, MinFound Medical Systems Co Ltd, Canon Medical Systems Corporation*List Not Exhaustive, Curium.

3. What are the main segments of the North America Nuclear Imaging Solutions Industry?

The market segments include Product, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.77 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Prevalence of Cancer and Cardiac Disorders; Increase in Technological Advancements; Growth in Applications of Nuclear Medicine and Imaging.

6. What are the notable trends driving market growth?

The Oncology Segment of the PET Applications is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Regulatory Issues; Lack of Reimbursement.

8. Can you provide examples of recent developments in the market?

May 2024: Blue Earth Diagnostics, a Bracco company, has inked a non-exclusive data-sharing pact with Siemens Healthineers. The agreement covers the sharing of anonymized clinical data and images of POSLUMA® (previously 18F-rhPSMA-7.3) injection from Blue Earth Diagnostics' Phase 3 LIGHTHOUSE trial, focusing on newly diagnosed prostate cancer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Nuclear Imaging Solutions Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Nuclear Imaging Solutions Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Nuclear Imaging Solutions Industry?

To stay informed about further developments, trends, and reports in the North America Nuclear Imaging Solutions Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence