Key Insights

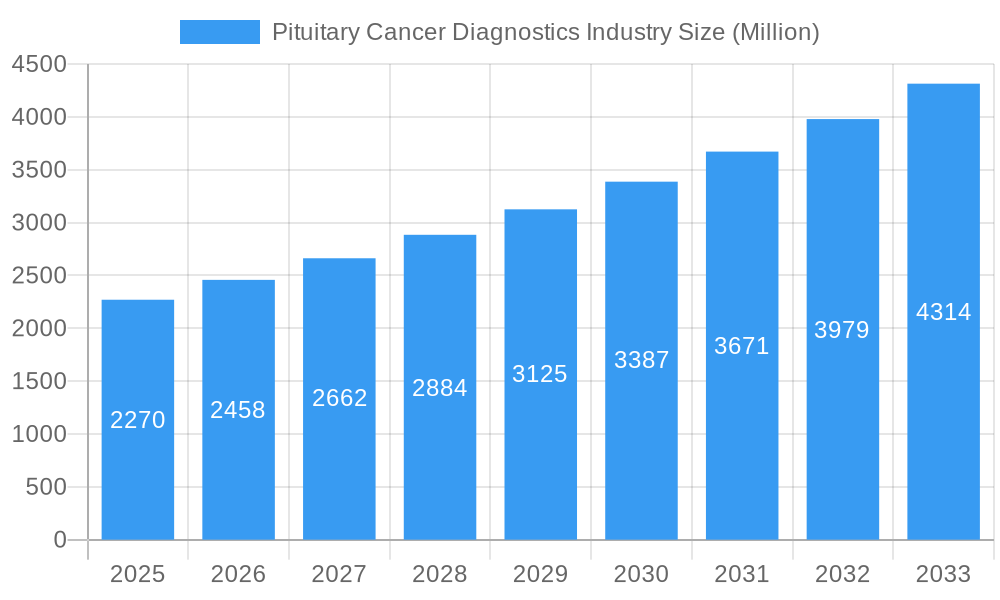

The global Pituitary Cancer Diagnostics market is projected for robust growth, estimated at USD 2.27 billion in the base year of 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 8.30% throughout the forecast period of 2025-2033. This significant expansion is primarily fueled by increasing awareness of pituitary disorders, advancements in diagnostic imaging technologies, and a growing emphasis on early detection and personalized treatment strategies. The rising incidence of hormonal imbalances and neurological symptoms often associated with pituitary tumors is also driving demand for sophisticated diagnostic tools. Key growth drivers include the expanding capabilities of MRI and CT scans for precise tumor localization and characterization, coupled with the increasing adoption of molecular testing for identifying genetic predispositions and refining treatment protocols. Furthermore, the growing prevalence of research initiatives focused on understanding pituitary cancer biology is expected to lead to the development of more effective and targeted diagnostic approaches.

Pituitary Cancer Diagnostics Industry Market Size (In Billion)

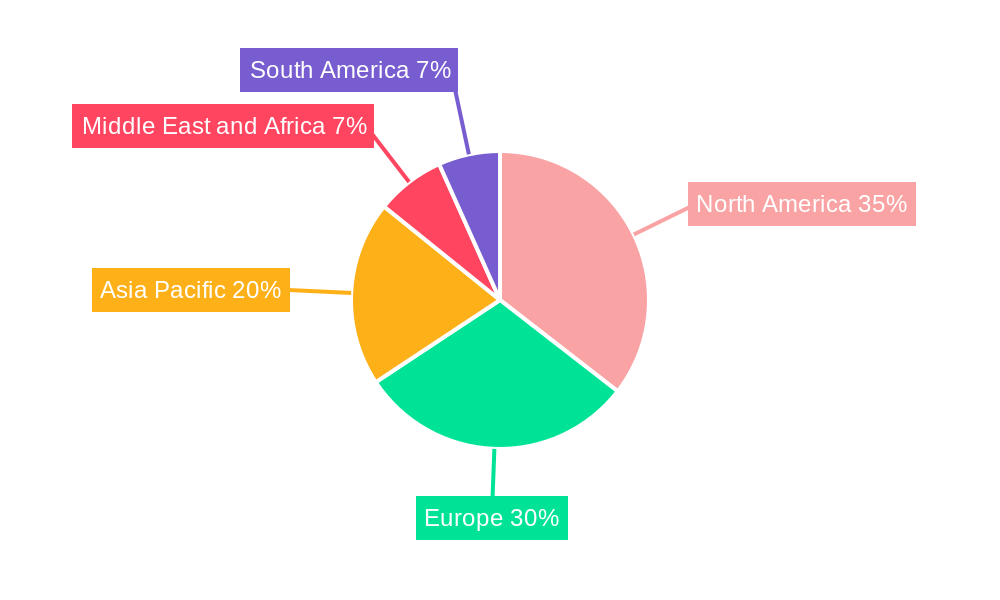

The market segmentation reveals a dynamic landscape. Imaging tests, encompassing MRI and CT scans, are expected to dominate the Diagnostic Type segment due to their non-invasive nature and superior resolution in visualizing pituitary abnormalities. Tumor Type segmentation highlights the prevalence of metastatic pituitary cancers, meningiomas, and glioblastomas, each requiring specific diagnostic pathways. The End User segment is largely driven by hospitals and diagnostics centers, which are investing in state-of-the-art equipment and expertise to cater to the growing demand for accurate pituitary cancer diagnoses. Geographically, North America and Europe are anticipated to hold significant market shares due to advanced healthcare infrastructure, high disposable incomes, and early adoption of new diagnostic technologies. However, the Asia Pacific region is poised for substantial growth, driven by improving healthcare access, increasing medical tourism, and a rising burden of chronic diseases. Restraints such as high diagnostic costs and the availability of less sophisticated diagnostic tools in certain developing regions may pose challenges, but are likely to be overcome by technological advancements and strategic market penetrations by leading companies.

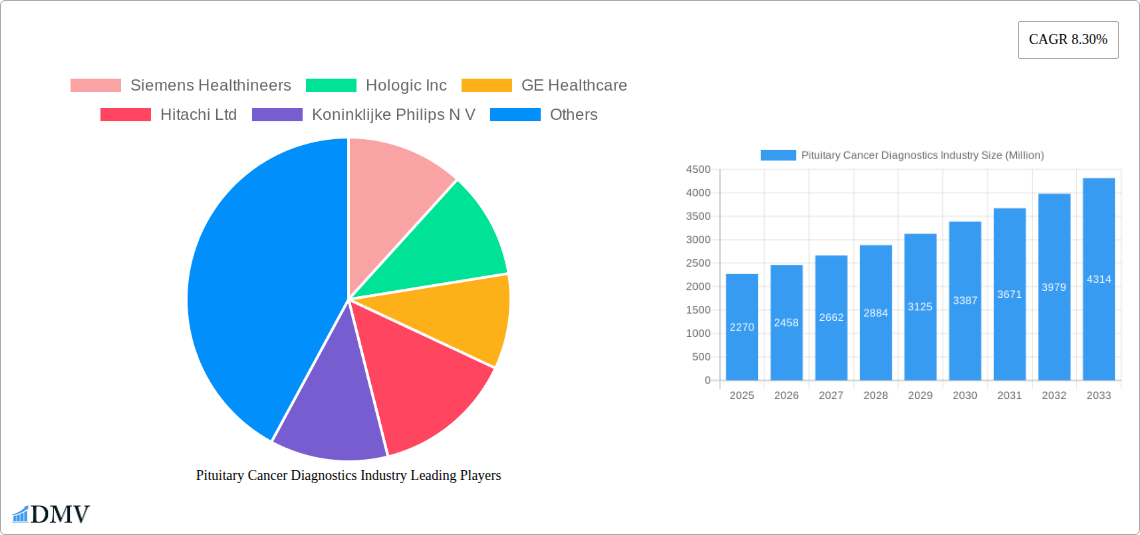

Pituitary Cancer Diagnostics Industry Company Market Share

This in-depth report provides a definitive analysis of the global Pituitary Cancer Diagnostics market, encompassing its current landscape, historical performance, and future trajectory. Delve into the intricate dynamics of this critical sector, understanding market segmentation, technological advancements, competitive strategies, and emerging opportunities. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period extending to 2033, this report offers unparalleled insights for stakeholders seeking to navigate and capitalize on the evolving pituitary cancer diagnostics arena. The market is segmented by diagnostic type including Imaging Tests (MRI, CT Scan, Other), Lumbar Puncture, Biopsy, Molecular Testing, and Others. Tumor types analyzed include Metastatic, Meningioma, Glioblastoma, Pituitary Endoma, and Others, serving End Users such as Hospitals, Diagnostics Centers, and Others.

Pituitary Cancer Diagnostics Industry Market Composition & Trends

The pituitary cancer diagnostics market exhibits a moderately consolidated structure, with key players like Siemens Healthineers, Hologic Inc, GE Healthcare, Hitachi Ltd, Koninklijke Philips N V, Fujifilm Corporation, Thermo Fisher Scientific, and NantOmics actively driving innovation. Innovation is primarily fueled by advancements in imaging technology and the increasing demand for molecular diagnostics. The regulatory landscape, while stringent, is supportive of diagnostic advancements, encouraging further R&D. Substitute products, such as less invasive screening methods, are emerging but do not yet pose a significant threat to established diagnostic pathways. End-user profiles reveal a strong reliance on hospitals for advanced diagnostic procedures, followed by specialized diagnostics centers. Merger and acquisition activities are expected to continue, with recent M&A deals valued in the hundreds of millions of dollars, aiming to expand market reach and technological portfolios. Market share distribution is dynamic, with major imaging providers holding a significant portion, while molecular diagnostics players are steadily gaining traction.

Pituitary Cancer Diagnostics Industry Industry Evolution

The evolution of the pituitary cancer diagnostics industry is a testament to relentless technological progress and an ever-growing awareness of early disease detection. Over the historical period (2019–2024), the market has witnessed a steady upward trajectory, driven by a confluence of factors including an increasing incidence of pituitary tumors, advancements in imaging resolution, and the burgeoning field of precision medicine. The base year (2025) stands as a pivotal point, reflecting a mature market segment poised for accelerated growth. The forecast period (2025–2033) is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% to 9.0%, fueled by enhanced diagnostic accuracy and the development of novel therapeutic targets identified through advanced diagnostics. Technological advancements have been transformative, moving beyond traditional imaging to incorporate sophisticated molecular testing. The adoption of AI-powered image analysis has begun to revolutionize the interpretation of MRI and CT scans, leading to faster and more accurate diagnoses. Furthermore, the integration of liquid biopsy techniques for detecting circulating tumor DNA (ctDNA) is gaining momentum, offering a less invasive alternative to traditional biopsies for certain pituitary tumor types, particularly metastatic variants. Shifting consumer demands, driven by patient empowerment and a greater emphasis on personalized healthcare, are pushing for more accurate, less invasive, and quicker diagnostic solutions. This has spurred investment in research and development for next-generation sequencing (NGS) panels tailored for pituitary tumor characterization, identifying specific mutations and genetic predispositions. The growing understanding of the genetic underpinnings of pituitary adenomas, meningiomas, and glioblastomas is directly translating into demand for more refined diagnostic tools.

Leading Regions, Countries, or Segments in Pituitary Cancer Diagnostics Industry

The Imaging Test segment, encompassing MRI, CT Scan, and Other advanced imaging modalities, currently dominates the Pituitary Cancer Diagnostics market. This dominance is underscored by its foundational role in initial diagnosis, tumor localization, and size assessment, crucial for all pituitary tumor types.

- Key Drivers for Imaging Test Dominance:

- Ubiquitous Infrastructure: Hospitals globally are equipped with advanced MRI and CT scanners, ensuring widespread accessibility.

- Technological Advancements: Continuous improvements in resolution, speed, and contrast agent development enhance diagnostic accuracy for meningioma, pituitary endoma, and glioblastoma detection.

- Early Detection Capabilities: Imaging remains the primary modality for identifying suspect lesions, making it indispensable for early diagnosis.

- Reimbursement Policies: Established reimbursement frameworks for diagnostic imaging procedures contribute to their consistent utilization.

North America, particularly the United States, leads the global market due to substantial healthcare expenditure, a high prevalence of brain and endocrine disorders, and a robust ecosystem for medical device innovation. The region benefits from significant investments in research and development, coupled with a proactive regulatory environment that facilitates the adoption of novel diagnostic technologies. Government initiatives aimed at improving cancer care and early detection further bolster its leadership. The presence of major diagnostic equipment manufacturers and advanced research institutions fosters a competitive landscape that drives continuous product improvement.

Europe follows closely, driven by advanced healthcare systems in countries like Germany, the UK, and France, where there is a strong emphasis on specialized diagnostics and patient outcomes. Increasing awareness campaigns and a growing aging population prone to various tumor types, including pituitary endoma and metastatic brain cancers, contribute to market growth.

The Molecular Testing segment, while smaller in market share compared to imaging, is poised for the most significant growth. This is driven by its ability to provide detailed genetic and molecular profiling, crucial for personalized treatment strategies, particularly for aggressive tumors like glioblastoma and certain metastatic cancers. The increasing understanding of tumor heterogeneity and the identification of actionable mutations are propelling the adoption of NGS and other advanced molecular diagnostic techniques.

Pituitary Cancer Diagnostics Industry Product Innovations

Product innovation in pituitary cancer diagnostics is sharply focused on enhancing accuracy and reducing invasiveness. Recent advancements include higher-resolution MRI and CT scanners with faster scan times, improving patient comfort and diagnostic throughput for detecting pituitary endoma and meningioma. Furthermore, the development of advanced contrast agents is refining the visualization of subtle tumor margins and vascularity. On the molecular diagnostics front, innovative platforms for liquid biopsy are emerging, offering the potential to detect circulating tumor DNA (ctDNA) for non-invasive tumor profiling and monitoring treatment response in metastatic pituitary cancers. These innovations aim to provide earlier, more precise diagnoses and facilitate personalized treatment regimens.

Propelling Factors for Pituitary Cancer Diagnostics Industry Growth

The pituitary cancer diagnostics industry is propelled by several key factors. Firstly, the increasing global incidence of pituitary tumors and other brain cancers, coupled with a growing aging population, directly translates to higher demand for diagnostic services. Secondly, significant technological advancements in imaging technologies, such as ultra-high field MRI and advanced CT protocols, are enhancing diagnostic accuracy and enabling earlier detection of smaller lesions. Thirdly, the burgeoning field of molecular diagnostics, including next-generation sequencing (NGS) and liquid biopsy, is providing deeper insights into tumor genetics, paving the way for personalized treatment strategies, particularly for complex cases like glioblastoma. Government initiatives and increased healthcare spending in emerging economies are also contributing to market expansion.

Obstacles in the Pituitary Cancer Diagnostics Industry Market

Despite its growth, the pituitary cancer diagnostics industry faces several obstacles. High development and manufacturing costs for advanced diagnostic equipment and molecular assays can limit accessibility, especially in resource-constrained regions. Stringent regulatory approval processes for novel diagnostic technologies, while ensuring safety and efficacy, can lead to prolonged market entry timelines. Furthermore, the need for specialized expertise to interpret complex molecular data and operate advanced imaging equipment poses a challenge for widespread adoption. Reimbursement complexities and variations across different healthcare systems can also impact market penetration and affordability for patients.

Future Opportunities in Pituitary Cancer Diagnostics Industry

The future of pituitary cancer diagnostics presents numerous opportunities. The increasing integration of artificial intelligence (AI) and machine learning (ML) in image analysis promises to further enhance diagnostic accuracy and efficiency, particularly in identifying subtle abnormalities in MRI and CT scans. The continued development and validation of liquid biopsy techniques offer a significant opportunity for less invasive diagnosis and monitoring of various pituitary tumor types, including metastatic. Expansion into emerging markets with growing healthcare infrastructure and increasing awareness of oncological diagnostics also represents a substantial growth avenue. Furthermore, the growing emphasis on personalized medicine will drive demand for sophisticated molecular diagnostics to guide targeted therapies.

Major Players in the Pituitary Cancer Diagnostics Industry Ecosystem

Siemens Healthineers Hologic Inc GE Healthcare Hitachi Ltd Koninklijke Philips N V Fujifilm Corporation Thermo Fisher Scientific NantOmics

Key Developments in Pituitary Cancer Diagnostics Industry Industry

- February 2023: Roche announced the launch of the IDH1 R132H (MRQ-67) Rabbit Monoclonal Primary Antibody and the ATRX Rabbit Polyclonal Antibody to identify mutation status in patients diagnosed with brain cancer. This development signifies a crucial step towards enhanced molecular characterization for brain tumors, impacting the diagnostic approach for certain pituitary cancers with similar genetic profiles.

- January 2023: Datar Cancer Genetics Inc. received FDA breakthrough device designation for the TriNetra-Glio blood test to help in the diagnosis of brain tumors. This signifies a significant advancement in liquid biopsy, offering a less invasive diagnostic pathway that could be applied to various brain and pituitary tumor diagnoses in the future.

Strategic Pituitary Cancer Diagnostics Industry Market Forecast

The strategic forecast for the pituitary cancer diagnostics market is exceptionally promising, driven by an accelerating pace of technological innovation and a growing global imperative for early and precise cancer detection. The expanding application of artificial intelligence in medical imaging analysis for identifying subtle pituitary adenomas, meningiomas, and glioblastomas will be a key growth catalyst. Concurrently, the maturation and wider adoption of molecular diagnostics, including advanced next-generation sequencing and the development of more robust liquid biopsy platforms, will unlock personalized treatment avenues. The increasing prevalence of pituitary-related endocrine disorders and a heightened focus on neuro-oncology research will further amplify the demand for sophisticated diagnostic tools. Emerging markets, with their rapidly developing healthcare infrastructures and increasing disposable incomes, represent significant untapped potential, promising substantial market expansion in the coming years.

Pituitary Cancer Diagnostics Industry Segmentation

-

1. Diagnostic Type

-

1.1. Imaging Test

- 1.1.1. MRI

- 1.1.2. CT Scan

- 1.1.3. Other

- 1.2. Lumbar Puncture

- 1.3. Biopsy

- 1.4. Molecular Testing

- 1.5. Others

-

1.1. Imaging Test

-

2. Tumor Type

- 2.1. Metastatic

- 2.2. Meningioma

- 2.3. Glioblastoma

- 2.4. Pituitary Endoma

- 2.5. Others

-

3. End User

- 3.1. Hospitals

- 3.2. Diagnostics Centers

- 3.3. Others

Pituitary Cancer Diagnostics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Pituitary Cancer Diagnostics Industry Regional Market Share

Geographic Coverage of Pituitary Cancer Diagnostics Industry

Pituitary Cancer Diagnostics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Neurological Disorders and Cancers; Rising Number of Smokers

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Diagnosis

- 3.4. Market Trends

- 3.4.1. MRI segment is Expected to Hold a Significant Share in the Brain Tumor Diagnostics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pituitary Cancer Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 5.1.1. Imaging Test

- 5.1.1.1. MRI

- 5.1.1.2. CT Scan

- 5.1.1.3. Other

- 5.1.2. Lumbar Puncture

- 5.1.3. Biopsy

- 5.1.4. Molecular Testing

- 5.1.5. Others

- 5.1.1. Imaging Test

- 5.2. Market Analysis, Insights and Forecast - by Tumor Type

- 5.2.1. Metastatic

- 5.2.2. Meningioma

- 5.2.3. Glioblastoma

- 5.2.4. Pituitary Endoma

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Diagnostics Centers

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 6. North America Pituitary Cancer Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 6.1.1. Imaging Test

- 6.1.1.1. MRI

- 6.1.1.2. CT Scan

- 6.1.1.3. Other

- 6.1.2. Lumbar Puncture

- 6.1.3. Biopsy

- 6.1.4. Molecular Testing

- 6.1.5. Others

- 6.1.1. Imaging Test

- 6.2. Market Analysis, Insights and Forecast - by Tumor Type

- 6.2.1. Metastatic

- 6.2.2. Meningioma

- 6.2.3. Glioblastoma

- 6.2.4. Pituitary Endoma

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Diagnostics Centers

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 7. Europe Pituitary Cancer Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 7.1.1. Imaging Test

- 7.1.1.1. MRI

- 7.1.1.2. CT Scan

- 7.1.1.3. Other

- 7.1.2. Lumbar Puncture

- 7.1.3. Biopsy

- 7.1.4. Molecular Testing

- 7.1.5. Others

- 7.1.1. Imaging Test

- 7.2. Market Analysis, Insights and Forecast - by Tumor Type

- 7.2.1. Metastatic

- 7.2.2. Meningioma

- 7.2.3. Glioblastoma

- 7.2.4. Pituitary Endoma

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Diagnostics Centers

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 8. Asia Pacific Pituitary Cancer Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 8.1.1. Imaging Test

- 8.1.1.1. MRI

- 8.1.1.2. CT Scan

- 8.1.1.3. Other

- 8.1.2. Lumbar Puncture

- 8.1.3. Biopsy

- 8.1.4. Molecular Testing

- 8.1.5. Others

- 8.1.1. Imaging Test

- 8.2. Market Analysis, Insights and Forecast - by Tumor Type

- 8.2.1. Metastatic

- 8.2.2. Meningioma

- 8.2.3. Glioblastoma

- 8.2.4. Pituitary Endoma

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Diagnostics Centers

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 9. Middle East and Africa Pituitary Cancer Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 9.1.1. Imaging Test

- 9.1.1.1. MRI

- 9.1.1.2. CT Scan

- 9.1.1.3. Other

- 9.1.2. Lumbar Puncture

- 9.1.3. Biopsy

- 9.1.4. Molecular Testing

- 9.1.5. Others

- 9.1.1. Imaging Test

- 9.2. Market Analysis, Insights and Forecast - by Tumor Type

- 9.2.1. Metastatic

- 9.2.2. Meningioma

- 9.2.3. Glioblastoma

- 9.2.4. Pituitary Endoma

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Diagnostics Centers

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 10. South America Pituitary Cancer Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 10.1.1. Imaging Test

- 10.1.1.1. MRI

- 10.1.1.2. CT Scan

- 10.1.1.3. Other

- 10.1.2. Lumbar Puncture

- 10.1.3. Biopsy

- 10.1.4. Molecular Testing

- 10.1.5. Others

- 10.1.1. Imaging Test

- 10.2. Market Analysis, Insights and Forecast - by Tumor Type

- 10.2.1. Metastatic

- 10.2.2. Meningioma

- 10.2.3. Glioblastoma

- 10.2.4. Pituitary Endoma

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Diagnostics Centers

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Diagnostic Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Siemens Healthineers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hologic Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Koninklijke Philips N V

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujifilm Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Thermo Fisher Scientific

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NantOmics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Siemens Healthineers

List of Figures

- Figure 1: Global Pituitary Cancer Diagnostics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pituitary Cancer Diagnostics Industry Revenue (Million), by Diagnostic Type 2025 & 2033

- Figure 3: North America Pituitary Cancer Diagnostics Industry Revenue Share (%), by Diagnostic Type 2025 & 2033

- Figure 4: North America Pituitary Cancer Diagnostics Industry Revenue (Million), by Tumor Type 2025 & 2033

- Figure 5: North America Pituitary Cancer Diagnostics Industry Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 6: North America Pituitary Cancer Diagnostics Industry Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Pituitary Cancer Diagnostics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Pituitary Cancer Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Pituitary Cancer Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Pituitary Cancer Diagnostics Industry Revenue (Million), by Diagnostic Type 2025 & 2033

- Figure 11: Europe Pituitary Cancer Diagnostics Industry Revenue Share (%), by Diagnostic Type 2025 & 2033

- Figure 12: Europe Pituitary Cancer Diagnostics Industry Revenue (Million), by Tumor Type 2025 & 2033

- Figure 13: Europe Pituitary Cancer Diagnostics Industry Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 14: Europe Pituitary Cancer Diagnostics Industry Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Pituitary Cancer Diagnostics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Pituitary Cancer Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Pituitary Cancer Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Pituitary Cancer Diagnostics Industry Revenue (Million), by Diagnostic Type 2025 & 2033

- Figure 19: Asia Pacific Pituitary Cancer Diagnostics Industry Revenue Share (%), by Diagnostic Type 2025 & 2033

- Figure 20: Asia Pacific Pituitary Cancer Diagnostics Industry Revenue (Million), by Tumor Type 2025 & 2033

- Figure 21: Asia Pacific Pituitary Cancer Diagnostics Industry Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 22: Asia Pacific Pituitary Cancer Diagnostics Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Pituitary Cancer Diagnostics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Pituitary Cancer Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Pituitary Cancer Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Pituitary Cancer Diagnostics Industry Revenue (Million), by Diagnostic Type 2025 & 2033

- Figure 27: Middle East and Africa Pituitary Cancer Diagnostics Industry Revenue Share (%), by Diagnostic Type 2025 & 2033

- Figure 28: Middle East and Africa Pituitary Cancer Diagnostics Industry Revenue (Million), by Tumor Type 2025 & 2033

- Figure 29: Middle East and Africa Pituitary Cancer Diagnostics Industry Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 30: Middle East and Africa Pituitary Cancer Diagnostics Industry Revenue (Million), by End User 2025 & 2033

- Figure 31: Middle East and Africa Pituitary Cancer Diagnostics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Pituitary Cancer Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Pituitary Cancer Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Pituitary Cancer Diagnostics Industry Revenue (Million), by Diagnostic Type 2025 & 2033

- Figure 35: South America Pituitary Cancer Diagnostics Industry Revenue Share (%), by Diagnostic Type 2025 & 2033

- Figure 36: South America Pituitary Cancer Diagnostics Industry Revenue (Million), by Tumor Type 2025 & 2033

- Figure 37: South America Pituitary Cancer Diagnostics Industry Revenue Share (%), by Tumor Type 2025 & 2033

- Figure 38: South America Pituitary Cancer Diagnostics Industry Revenue (Million), by End User 2025 & 2033

- Figure 39: South America Pituitary Cancer Diagnostics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Pituitary Cancer Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Pituitary Cancer Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Diagnostic Type 2020 & 2033

- Table 2: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Tumor Type 2020 & 2033

- Table 3: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Diagnostic Type 2020 & 2033

- Table 6: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Tumor Type 2020 & 2033

- Table 7: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Diagnostic Type 2020 & 2033

- Table 13: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Tumor Type 2020 & 2033

- Table 14: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Diagnostic Type 2020 & 2033

- Table 23: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Tumor Type 2020 & 2033

- Table 24: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 25: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Diagnostic Type 2020 & 2033

- Table 33: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Tumor Type 2020 & 2033

- Table 34: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 35: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Diagnostic Type 2020 & 2033

- Table 40: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Tumor Type 2020 & 2033

- Table 41: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 42: Global Pituitary Cancer Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Pituitary Cancer Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pituitary Cancer Diagnostics Industry?

The projected CAGR is approximately 8.30%.

2. Which companies are prominent players in the Pituitary Cancer Diagnostics Industry?

Key companies in the market include Siemens Healthineers, Hologic Inc, GE Healthcare, Hitachi Ltd, Koninklijke Philips N V, Fujifilm Corporation, Thermo Fisher Scientific, NantOmics.

3. What are the main segments of the Pituitary Cancer Diagnostics Industry?

The market segments include Diagnostic Type, Tumor Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Neurological Disorders and Cancers; Rising Number of Smokers.

6. What are the notable trends driving market growth?

MRI segment is Expected to Hold a Significant Share in the Brain Tumor Diagnostics Market.

7. Are there any restraints impacting market growth?

High Costs Associated with Diagnosis.

8. Can you provide examples of recent developments in the market?

February 2023: Roche announced the launch of the IDH1 R132H (MRQ-67) Rabbit Monoclonal Primary Antibody and the ATRX Rabbit Polyclonal Antibody to identify mutation status in patients diagnosed with brain cancer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pituitary Cancer Diagnostics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pituitary Cancer Diagnostics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pituitary Cancer Diagnostics Industry?

To stay informed about further developments, trends, and reports in the Pituitary Cancer Diagnostics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence