Key Insights

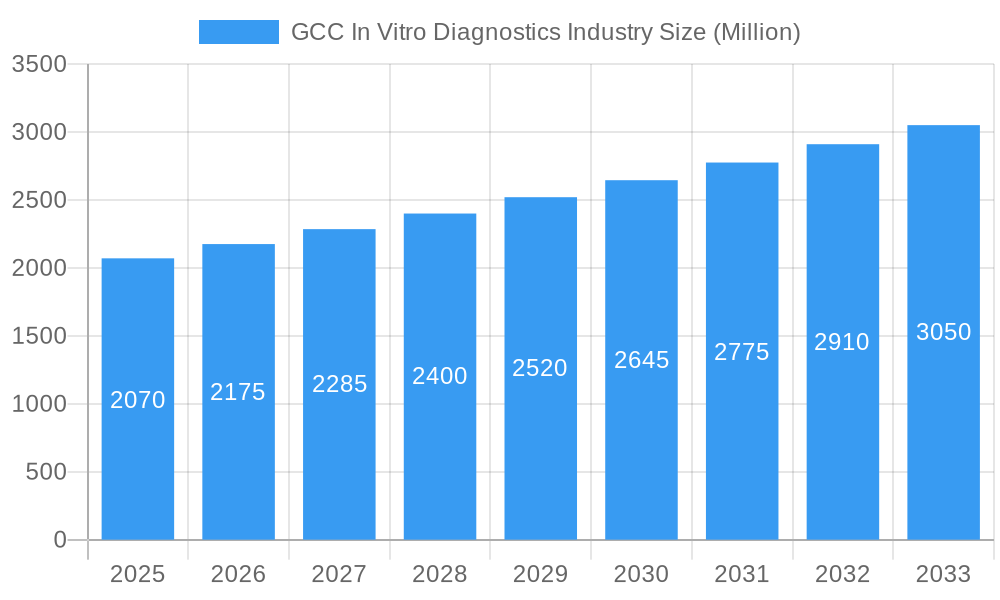

The GCC In Vitro Diagnostics (IVD) market is poised for significant expansion, driven by an increasing prevalence of chronic diseases, growing healthcare expenditure, and a strong focus on early disease detection and personalized medicine. With a current estimated market size of $2.07 billion in 2025, the region is projected to witness a robust Compound Annual Growth Rate (CAGR) of 5.10% through 2033. This growth is fueled by escalating investments in advanced diagnostic technologies and a rising demand for sophisticated diagnostic solutions across various applications, including infectious diseases, diabetes, and cancer. The market is further propelled by government initiatives aimed at enhancing healthcare infrastructure and promoting preventative healthcare measures, alongside a growing awareness among the population regarding the importance of regular health check-ups. Furthermore, the increasing adoption of molecular diagnostics and immunoassay techniques for more accurate and rapid disease identification contributes significantly to market buoyancy.

GCC In Vitro Diagnostics Industry Market Size (In Billion)

Key market segments contributing to this expansion include the Instruments and Reagents segments, with molecular diagnostics and immunochemistry techniques leading the charge in terms of technological advancement and adoption. The rising preference for Point-of-Care Diagnostics is also a notable trend, offering faster turnaround times and improved patient convenience, particularly in remote areas. Hospitals and clinics, along with diagnostic laboratories, represent the primary end-users, leveraging these advanced IVD solutions to improve patient outcomes and streamline healthcare delivery. While the market benefits from strong growth drivers, factors such as the high cost of advanced diagnostic equipment and the need for skilled personnel to operate and interpret complex IVD tests could present moderate restraints. However, the overarching trend of increasing healthcare access and the continuous innovation in IVD technologies are expected to outweigh these challenges, solidifying the GCC IVD market's upward trajectory.

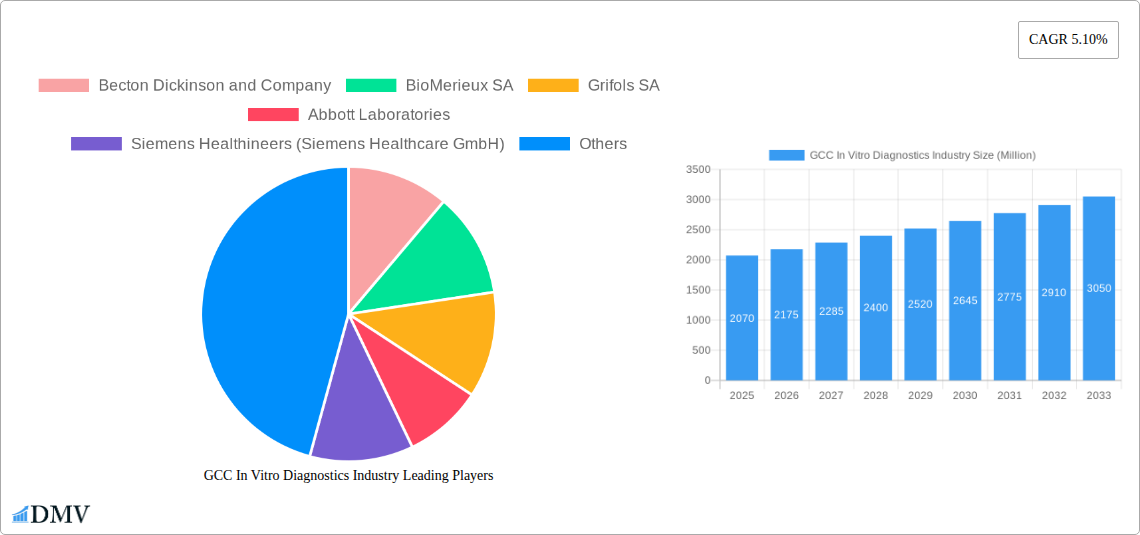

GCC In Vitro Diagnostics Industry Company Market Share

GCC In Vitro Diagnostics Industry: Market Analysis, Trends, and Forecast 2025-2033

This comprehensive report provides an in-depth analysis of the GCC In Vitro Diagnostics (IVD) market, a rapidly expanding sector driven by increasing healthcare expenditure, rising prevalence of chronic diseases, and advancements in diagnostic technologies. Spanning the historical period of 2019-2024, with a base year of 2025 and a forecast period extending to 2033, this study offers critical insights for stakeholders seeking to understand market dynamics, identify growth opportunities, and navigate the competitive landscape. The report covers key segments including Technique (Histochemistry, Molecular Diagnostics, Hematology, Self-blood Glucose Testing, Immunochemistry, Other Techniques), Product (Instrument, Reagent, Other Products), Usability (Disposable IVD Device, Reusable IVD Device), Application (Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Other Applications), End User (Diagnostic Laboratories, Hospitals and Clinics, Other End Users), and Diagnostic Approach (Point-of-Care Diagnostics, Centralized Laboratory-based Diagnostics). Leading companies analyzed include Abbott Laboratories, Siemens Healthineers, F Hoffmann-La Roche AG, Becton Dickinson and Company, Thermo Fischer Scientific Inc, BioMerieux SA, DiaSorin, Danaher Corporation, Qiagen NV, Grifols SA, Sysmex Corporation, and Bio-Rad Laboratories.

GCC In Vitro Diagnostics Industry Market Composition & Trends

The GCC In Vitro Diagnostics market exhibits a dynamic composition characterized by increasing market concentration among leading global players and a growing emphasis on innovation. Key innovation catalysts include the rising demand for rapid and accurate diagnostic solutions, particularly for infectious diseases and cancer/oncology. The regulatory landscape in the GCC is evolving, with countries actively working to harmonize standards and streamline approval processes, fostering greater market access for advanced IVD products. Substitute products, while present in some basic testing areas, are increasingly being outpaced by the superior performance and comprehensiveness of modern IVD techniques like molecular diagnostics. End-user profiles are diversifying, with a significant surge in demand from hospitals and clinics alongside established diagnostic laboratories. Mergers and Acquisitions (M&A) activities are a significant trend, with deal values in the multi-million dollar range indicative of strategic consolidation and expansion. For instance, the recent GCC IVD market has seen investments in new facilities and technology integration, with M&A deals estimated to be in the range of several tens to hundreds of millions of dollars annually.

- Market Share Distribution: Leading companies collectively hold a substantial portion of the market, with estimated shares ranging from 15% to 25% for the top three players.

- M&A Deal Values: Recent transactions in the broader MENA region for healthcare entities, including IVD components, have ranged from $50 Million to $200 Million.

- Innovation Focus: Key areas for innovation include AI-powered diagnostics, liquid biopsy, and point-of-care solutions for infectious disease detection.

GCC In Vitro Diagnostics Industry Industry Evolution

The GCC In Vitro Diagnostics industry has witnessed a remarkable evolution, characterized by robust market growth trajectories and transformative technological advancements. Over the historical period (2019-2024), the market has experienced a Compound Annual Growth Rate (CAGR) estimated between 8% and 12%, driven by a confluence of factors. The increasing prevalence of chronic conditions like diabetes and cardiovascular diseases has spurred demand for early and accurate diagnosis, making self-blood glucose testing and immunochemistry vital segments. Molecular diagnostics has emerged as a pivotal technology, revolutionizing the detection of infectious diseases and cancer/oncology, with adoption rates for PCR-based testing increasing by over 30% in key GCC nations. The shift towards point-of-care diagnostics is another significant trend, enabling faster turnaround times and improved patient outcomes, especially in remote areas or emergency settings. Consumer demand is increasingly aligning with precision medicine and personalized healthcare, pushing IVD manufacturers to develop more sophisticated and targeted diagnostic tools. The GCC IVD market is projected to continue its upward trajectory, with forecasts indicating sustained growth driven by government initiatives aimed at enhancing healthcare infrastructure and a growing awareness of preventative healthcare among the population. The adoption of next-generation sequencing (NGS) for genetic testing and oncology diagnostics is also expected to accelerate, further shaping the industry's future.

Leading Regions, Countries, or Segments in GCC In Vitro Diagnostics Industry

Within the GCC In Vitro Diagnostics industry, several regions, countries, and segments stand out due to significant market penetration and growth potential. Saudi Arabia and the United Arab Emirates consistently lead in terms of market size and investment, driven by their strong economic foundations and aggressive healthcare development agendas. Among the techniques, molecular diagnostics is experiencing explosive growth, projected to capture over 30% of the market share by 2030, fueled by its applications in infectious disease surveillance and personalized cancer treatment. Immunochemistry remains a stalwart, dominating segments like diabetes and cardiology diagnostics, accounting for approximately 25% of the market.

In terms of products, reagents represent the largest segment, comprising over 50% of the market revenue, owing to their recurring purchase nature and critical role in diagnostic assays. However, the demand for advanced instruments, particularly automated systems and point-of-care diagnostics devices, is rapidly increasing, with growth rates exceeding 15% annually. This surge is linked to the drive for efficiency and decentralization of testing.

When considering usability, disposable IVD devices are gaining traction due to their convenience and reduced risk of contamination, particularly in settings with high patient turnover. Applications in infectious disease diagnostics, especially post-pandemic, continue to be a primary driver, with market share estimated at over 20%. Similarly, cancer/oncology diagnostics are experiencing significant growth, driven by advancements in early detection and targeted therapies. Hospitals and clinics represent the dominant end-user segment, accounting for over 60% of the market, as they are at the forefront of patient care and diagnostic testing. The increasing adoption of point-of-care diagnostics is transforming the landscape, enabling faster decision-making and improving patient access to testing.

- Dominant Countries: Saudi Arabia and the United Arab Emirates (UAE).

- Key Drivers: High per capita healthcare spending, government investments in healthcare infrastructure, and supportive regulatory frameworks.

- Leading Techniques: Molecular Diagnostics and Immunochemistry.

- Growth Catalysts: Increasing incidence of chronic and infectious diseases, advancements in assay sensitivity and specificity.

- Largest Product Segment: Reagents.

- Sustaining Factors: Continuous need for consumables and disposables for routine testing.

- Fastest Growing Product Segment: Instruments (especially automated and POC devices).

- Market Influence: Drive for efficiency, automation, and decentralization of laboratory operations.

- Prominent Application: Infectious Diseases and Cancer/Oncology.

- Demand Factors: Global health concerns, increased screening programs, and personalized medicine initiatives.

- Primary End User: Hospitals and Clinics.

- Rationale: Central role in patient management and direct access to diagnostic services.

- Emerging Diagnostic Approach: Point-of-Care Diagnostics.

- Impact: Improved patient care access, reduced turnaround times, and enhanced resource utilization.

GCC In Vitro Diagnostics Industry Product Innovations

The GCC In Vitro Diagnostics industry is witnessing a wave of groundbreaking product innovations aimed at enhancing diagnostic accuracy, speed, and accessibility. Manufacturers are investing heavily in the development of highly sensitive molecular diagnostic platforms capable of detecting low viral loads and identifying genetic mutations for personalized cancer/oncology treatments. Advancements in immunochemistry have led to the creation of novel biomarkers for early detection of cardiovascular diseases and autoimmune diseases. The trend towards miniaturization and integration is evident in the development of compact, automated point-of-care diagnostics devices that can perform complex assays in minutes, directly at the patient’s bedside or in remote clinics. Furthermore, the introduction of AI-powered analysis software is augmenting the interpretation of diagnostic results, leading to more precise diagnoses and treatment recommendations. These innovations are crucial for addressing the growing demand for rapid, reliable, and user-friendly diagnostic solutions across the GCC region.

Propelling Factors for GCC In Vitro Diagnostics Industry Growth

Several key factors are propelling the GCC In Vitro Diagnostics industry forward. Firstly, significant government investments in healthcare infrastructure and a focus on improving public health outcomes are driving demand for advanced diagnostic technologies. Secondly, the rising prevalence of chronic diseases such as diabetes and cardiovascular conditions necessitates early and accurate detection, thereby boosting the market for relevant IVD tests and devices. Thirdly, technological advancements, particularly in molecular diagnostics and point-of-care diagnostics, are expanding the scope and efficiency of diagnostic capabilities. The increasing disposable income and growing awareness of preventative healthcare among the population also contribute to market expansion. Finally, the development of robust regulatory frameworks and the establishment of accredited diagnostic laboratories are fostering a conducive environment for market growth.

Obstacles in the GCC In Vitro Diagnostics Industry Market

Despite its strong growth trajectory, the GCC In Vitro Diagnostics industry faces several obstacles. Stringent and sometimes fragmented regulatory approval processes across different GCC countries can pose challenges and prolong market entry for new products. The high cost of advanced IVD instruments and specialized reagents can be a barrier, particularly for smaller healthcare facilities with limited budgets. Furthermore, a shortage of skilled laboratory technicians and diagnostic approach specialists to operate and maintain sophisticated equipment can hinder adoption. Supply chain disruptions, as experienced globally, can impact the availability of critical raw materials and finished products. Finally, intense competition among both global manufacturers and emerging local players can lead to price pressures and challenges in establishing market share.

Future Opportunities in GCC In Vitro Diagnostics Industry

The GCC In Vitro Diagnostics industry presents numerous promising future opportunities. The increasing focus on personalized medicine and precision healthcare creates a significant demand for advanced molecular diagnostics, including genetic testing and companion diagnostics for cancer/oncology. The growing elderly population and the rising incidence of chronic diseases will continue to drive the market for diabetes, cardiology, and auto-immune disease diagnostics. The expansion of point-of-care diagnostics into new settings, such as pharmacies and home care, offers a substantial growth avenue. Furthermore, ongoing investments in public health initiatives and the development of national health strategies will create a sustained demand for a wide range of IVD solutions. The potential for domestic manufacturing and R&D within the GCC region also represents a significant opportunity for local players to innovate and capture market share.

Major Players in the GCC In Vitro Diagnostics Industry Ecosystem

- Becton Dickinson and Company

- BioMerieux SA

- Grifols SA

- Abbott Laboratories

- Siemens Healthineers (Siemens Healthcare GmbH)

- Danaher Corporation

- F Hoffmann-La Roche AG

- DiaSorin

- Thermo Fischer Scientific Inc

- Qiagen NV

- Sysmex Corporation

- Bio-Rad Laboratories

Key Developments in GCC In Vitro Diagnostics Industry Industry

- July 2022: Saudi Arabia's Arabian International Healthcare Holding Company, TIBBIYAH, commenced a new Joint Venture (JV) with Swiss company Unilabs Diagnostics AB, aimed at expanding diagnostic services in the region.

- April 2022: United Arab Emirates Sheikh Shakhbout Medical City (SSMC), one of the first hospitals in the Middle East to launch a prominent point-of-care tool for antimicrobial management, significantly improving the speed of diagnosis for critical infections.

Strategic GCC In Vitro Diagnostics Industry Market Forecast

The GCC In Vitro Diagnostics industry is poised for robust growth, driven by strategic initiatives and evolving healthcare needs. The forecast period (2025–2033) will witness an accelerated adoption of molecular diagnostics and point-of-care diagnostics, catering to the increasing demand for precision medicine and rapid disease detection. Government-led healthcare infrastructure development and a growing emphasis on preventative healthcare will continue to fuel market expansion. Key applications such as infectious diseases, cancer/oncology, and diabetes diagnostics are expected to remain major growth engines. The market's trajectory suggests a sustained CAGR of over 9%, reaching an estimated market value of tens of billions of dollars by 2033. Strategic investments in technological advancements and a focus on expanding accessibility will be crucial for stakeholders aiming to capitalize on the significant opportunities within this dynamic market.

GCC In Vitro Diagnostics Industry Segmentation

-

1. Technique

- 1.1. Histochemistry

- 1.2. Molecular Diagnostics

- 1.3. Hematology

- 1.4. Self-blood Glucose Testing

- 1.5. Immunochemistry

- 1.6. Other Techniques

-

2. Product

- 2.1. Instrument

- 2.2. Reagent

- 2.3. Other Products

-

3. Usability

- 3.1. Disposable IVD Device

- 3.2. Reusable IVD Device

-

4. Application

- 4.1. Infectious Disease

- 4.2. Diabetes

- 4.3. Cancer/Oncology

- 4.4. Cardiology

- 4.5. Autoimmune Disease

- 4.6. Other Applications

-

5. End User

- 5.1. Diagnostic Laboratories

- 5.2. Hospitals and Clinics

- 5.3. Other End Users

-

6. Diagnostic Approach

- 6.1. Point-of-Care Diagnostics

- 6.2. Centralized Laboratory-based Diagnostics

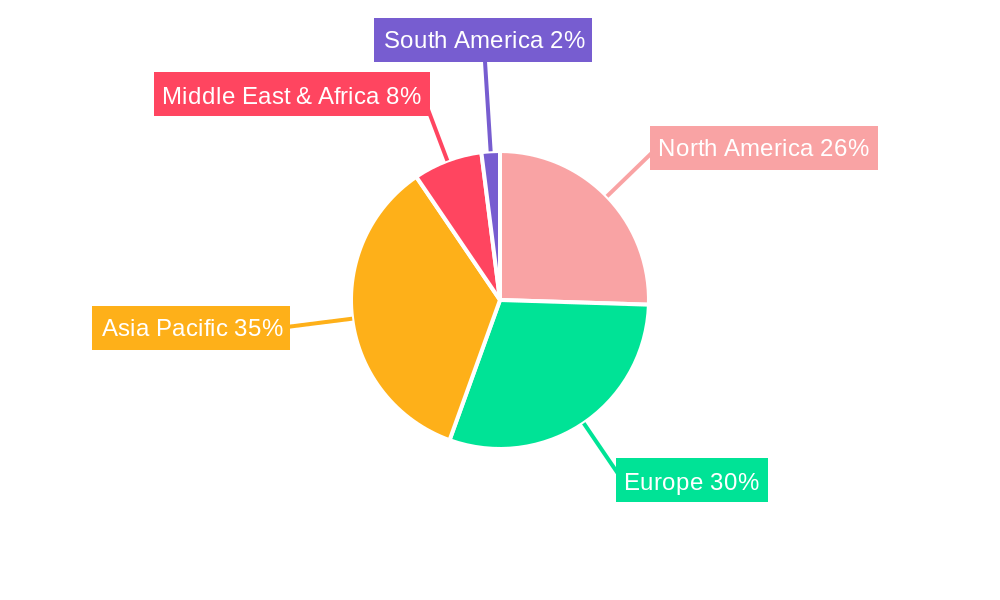

GCC In Vitro Diagnostics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC In Vitro Diagnostics Industry Regional Market Share

Geographic Coverage of GCC In Vitro Diagnostics Industry

GCC In Vitro Diagnostics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Chronic Diseases and Infectious Diseases; Increasing Healthcare Expenditure

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations

- 3.4. Market Trends

- 3.4.1. Point-of-care diagnostics Segment is Expected to Witness Growth Over The Forecast Period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC In Vitro Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technique

- 5.1.1. Histochemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Hematology

- 5.1.4. Self-blood Glucose Testing

- 5.1.5. Immunochemistry

- 5.1.6. Other Techniques

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Instrument

- 5.2.2. Reagent

- 5.2.3. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Usability

- 5.3.1. Disposable IVD Device

- 5.3.2. Reusable IVD Device

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Infectious Disease

- 5.4.2. Diabetes

- 5.4.3. Cancer/Oncology

- 5.4.4. Cardiology

- 5.4.5. Autoimmune Disease

- 5.4.6. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by End User

- 5.5.1. Diagnostic Laboratories

- 5.5.2. Hospitals and Clinics

- 5.5.3. Other End Users

- 5.6. Market Analysis, Insights and Forecast - by Diagnostic Approach

- 5.6.1. Point-of-Care Diagnostics

- 5.6.2. Centralized Laboratory-based Diagnostics

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Technique

- 6. North America GCC In Vitro Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technique

- 6.1.1. Histochemistry

- 6.1.2. Molecular Diagnostics

- 6.1.3. Hematology

- 6.1.4. Self-blood Glucose Testing

- 6.1.5. Immunochemistry

- 6.1.6. Other Techniques

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Instrument

- 6.2.2. Reagent

- 6.2.3. Other Products

- 6.3. Market Analysis, Insights and Forecast - by Usability

- 6.3.1. Disposable IVD Device

- 6.3.2. Reusable IVD Device

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Infectious Disease

- 6.4.2. Diabetes

- 6.4.3. Cancer/Oncology

- 6.4.4. Cardiology

- 6.4.5. Autoimmune Disease

- 6.4.6. Other Applications

- 6.5. Market Analysis, Insights and Forecast - by End User

- 6.5.1. Diagnostic Laboratories

- 6.5.2. Hospitals and Clinics

- 6.5.3. Other End Users

- 6.6. Market Analysis, Insights and Forecast - by Diagnostic Approach

- 6.6.1. Point-of-Care Diagnostics

- 6.6.2. Centralized Laboratory-based Diagnostics

- 6.1. Market Analysis, Insights and Forecast - by Technique

- 7. South America GCC In Vitro Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technique

- 7.1.1. Histochemistry

- 7.1.2. Molecular Diagnostics

- 7.1.3. Hematology

- 7.1.4. Self-blood Glucose Testing

- 7.1.5. Immunochemistry

- 7.1.6. Other Techniques

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Instrument

- 7.2.2. Reagent

- 7.2.3. Other Products

- 7.3. Market Analysis, Insights and Forecast - by Usability

- 7.3.1. Disposable IVD Device

- 7.3.2. Reusable IVD Device

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Infectious Disease

- 7.4.2. Diabetes

- 7.4.3. Cancer/Oncology

- 7.4.4. Cardiology

- 7.4.5. Autoimmune Disease

- 7.4.6. Other Applications

- 7.5. Market Analysis, Insights and Forecast - by End User

- 7.5.1. Diagnostic Laboratories

- 7.5.2. Hospitals and Clinics

- 7.5.3. Other End Users

- 7.6. Market Analysis, Insights and Forecast - by Diagnostic Approach

- 7.6.1. Point-of-Care Diagnostics

- 7.6.2. Centralized Laboratory-based Diagnostics

- 7.1. Market Analysis, Insights and Forecast - by Technique

- 8. Europe GCC In Vitro Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technique

- 8.1.1. Histochemistry

- 8.1.2. Molecular Diagnostics

- 8.1.3. Hematology

- 8.1.4. Self-blood Glucose Testing

- 8.1.5. Immunochemistry

- 8.1.6. Other Techniques

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Instrument

- 8.2.2. Reagent

- 8.2.3. Other Products

- 8.3. Market Analysis, Insights and Forecast - by Usability

- 8.3.1. Disposable IVD Device

- 8.3.2. Reusable IVD Device

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Infectious Disease

- 8.4.2. Diabetes

- 8.4.3. Cancer/Oncology

- 8.4.4. Cardiology

- 8.4.5. Autoimmune Disease

- 8.4.6. Other Applications

- 8.5. Market Analysis, Insights and Forecast - by End User

- 8.5.1. Diagnostic Laboratories

- 8.5.2. Hospitals and Clinics

- 8.5.3. Other End Users

- 8.6. Market Analysis, Insights and Forecast - by Diagnostic Approach

- 8.6.1. Point-of-Care Diagnostics

- 8.6.2. Centralized Laboratory-based Diagnostics

- 8.1. Market Analysis, Insights and Forecast - by Technique

- 9. Middle East & Africa GCC In Vitro Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technique

- 9.1.1. Histochemistry

- 9.1.2. Molecular Diagnostics

- 9.1.3. Hematology

- 9.1.4. Self-blood Glucose Testing

- 9.1.5. Immunochemistry

- 9.1.6. Other Techniques

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Instrument

- 9.2.2. Reagent

- 9.2.3. Other Products

- 9.3. Market Analysis, Insights and Forecast - by Usability

- 9.3.1. Disposable IVD Device

- 9.3.2. Reusable IVD Device

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Infectious Disease

- 9.4.2. Diabetes

- 9.4.3. Cancer/Oncology

- 9.4.4. Cardiology

- 9.4.5. Autoimmune Disease

- 9.4.6. Other Applications

- 9.5. Market Analysis, Insights and Forecast - by End User

- 9.5.1. Diagnostic Laboratories

- 9.5.2. Hospitals and Clinics

- 9.5.3. Other End Users

- 9.6. Market Analysis, Insights and Forecast - by Diagnostic Approach

- 9.6.1. Point-of-Care Diagnostics

- 9.6.2. Centralized Laboratory-based Diagnostics

- 9.1. Market Analysis, Insights and Forecast - by Technique

- 10. Asia Pacific GCC In Vitro Diagnostics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technique

- 10.1.1. Histochemistry

- 10.1.2. Molecular Diagnostics

- 10.1.3. Hematology

- 10.1.4. Self-blood Glucose Testing

- 10.1.5. Immunochemistry

- 10.1.6. Other Techniques

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Instrument

- 10.2.2. Reagent

- 10.2.3. Other Products

- 10.3. Market Analysis, Insights and Forecast - by Usability

- 10.3.1. Disposable IVD Device

- 10.3.2. Reusable IVD Device

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Infectious Disease

- 10.4.2. Diabetes

- 10.4.3. Cancer/Oncology

- 10.4.4. Cardiology

- 10.4.5. Autoimmune Disease

- 10.4.6. Other Applications

- 10.5. Market Analysis, Insights and Forecast - by End User

- 10.5.1. Diagnostic Laboratories

- 10.5.2. Hospitals and Clinics

- 10.5.3. Other End Users

- 10.6. Market Analysis, Insights and Forecast - by Diagnostic Approach

- 10.6.1. Point-of-Care Diagnostics

- 10.6.2. Centralized Laboratory-based Diagnostics

- 10.1. Market Analysis, Insights and Forecast - by Technique

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BioMerieux SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Grifols SA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens Healthineers (Siemens Healthcare GmbH)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danaher Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 F Hoffmann-La Roche AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 DiaSorin

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thermo Fischer Scientific Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qiagen NV

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Sysmex Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Bio-Rad Laboratories

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global GCC In Vitro Diagnostics Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global GCC In Vitro Diagnostics Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America GCC In Vitro Diagnostics Industry Revenue (Million), by Technique 2025 & 2033

- Figure 4: North America GCC In Vitro Diagnostics Industry Volume (K Unit), by Technique 2025 & 2033

- Figure 5: North America GCC In Vitro Diagnostics Industry Revenue Share (%), by Technique 2025 & 2033

- Figure 6: North America GCC In Vitro Diagnostics Industry Volume Share (%), by Technique 2025 & 2033

- Figure 7: North America GCC In Vitro Diagnostics Industry Revenue (Million), by Product 2025 & 2033

- Figure 8: North America GCC In Vitro Diagnostics Industry Volume (K Unit), by Product 2025 & 2033

- Figure 9: North America GCC In Vitro Diagnostics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: North America GCC In Vitro Diagnostics Industry Volume Share (%), by Product 2025 & 2033

- Figure 11: North America GCC In Vitro Diagnostics Industry Revenue (Million), by Usability 2025 & 2033

- Figure 12: North America GCC In Vitro Diagnostics Industry Volume (K Unit), by Usability 2025 & 2033

- Figure 13: North America GCC In Vitro Diagnostics Industry Revenue Share (%), by Usability 2025 & 2033

- Figure 14: North America GCC In Vitro Diagnostics Industry Volume Share (%), by Usability 2025 & 2033

- Figure 15: North America GCC In Vitro Diagnostics Industry Revenue (Million), by Application 2025 & 2033

- Figure 16: North America GCC In Vitro Diagnostics Industry Volume (K Unit), by Application 2025 & 2033

- Figure 17: North America GCC In Vitro Diagnostics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America GCC In Vitro Diagnostics Industry Volume Share (%), by Application 2025 & 2033

- Figure 19: North America GCC In Vitro Diagnostics Industry Revenue (Million), by End User 2025 & 2033

- Figure 20: North America GCC In Vitro Diagnostics Industry Volume (K Unit), by End User 2025 & 2033

- Figure 21: North America GCC In Vitro Diagnostics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: North America GCC In Vitro Diagnostics Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: North America GCC In Vitro Diagnostics Industry Revenue (Million), by Diagnostic Approach 2025 & 2033

- Figure 24: North America GCC In Vitro Diagnostics Industry Volume (K Unit), by Diagnostic Approach 2025 & 2033

- Figure 25: North America GCC In Vitro Diagnostics Industry Revenue Share (%), by Diagnostic Approach 2025 & 2033

- Figure 26: North America GCC In Vitro Diagnostics Industry Volume Share (%), by Diagnostic Approach 2025 & 2033

- Figure 27: North America GCC In Vitro Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 28: North America GCC In Vitro Diagnostics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 29: North America GCC In Vitro Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 30: North America GCC In Vitro Diagnostics Industry Volume Share (%), by Country 2025 & 2033

- Figure 31: South America GCC In Vitro Diagnostics Industry Revenue (Million), by Technique 2025 & 2033

- Figure 32: South America GCC In Vitro Diagnostics Industry Volume (K Unit), by Technique 2025 & 2033

- Figure 33: South America GCC In Vitro Diagnostics Industry Revenue Share (%), by Technique 2025 & 2033

- Figure 34: South America GCC In Vitro Diagnostics Industry Volume Share (%), by Technique 2025 & 2033

- Figure 35: South America GCC In Vitro Diagnostics Industry Revenue (Million), by Product 2025 & 2033

- Figure 36: South America GCC In Vitro Diagnostics Industry Volume (K Unit), by Product 2025 & 2033

- Figure 37: South America GCC In Vitro Diagnostics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 38: South America GCC In Vitro Diagnostics Industry Volume Share (%), by Product 2025 & 2033

- Figure 39: South America GCC In Vitro Diagnostics Industry Revenue (Million), by Usability 2025 & 2033

- Figure 40: South America GCC In Vitro Diagnostics Industry Volume (K Unit), by Usability 2025 & 2033

- Figure 41: South America GCC In Vitro Diagnostics Industry Revenue Share (%), by Usability 2025 & 2033

- Figure 42: South America GCC In Vitro Diagnostics Industry Volume Share (%), by Usability 2025 & 2033

- Figure 43: South America GCC In Vitro Diagnostics Industry Revenue (Million), by Application 2025 & 2033

- Figure 44: South America GCC In Vitro Diagnostics Industry Volume (K Unit), by Application 2025 & 2033

- Figure 45: South America GCC In Vitro Diagnostics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: South America GCC In Vitro Diagnostics Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: South America GCC In Vitro Diagnostics Industry Revenue (Million), by End User 2025 & 2033

- Figure 48: South America GCC In Vitro Diagnostics Industry Volume (K Unit), by End User 2025 & 2033

- Figure 49: South America GCC In Vitro Diagnostics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 50: South America GCC In Vitro Diagnostics Industry Volume Share (%), by End User 2025 & 2033

- Figure 51: South America GCC In Vitro Diagnostics Industry Revenue (Million), by Diagnostic Approach 2025 & 2033

- Figure 52: South America GCC In Vitro Diagnostics Industry Volume (K Unit), by Diagnostic Approach 2025 & 2033

- Figure 53: South America GCC In Vitro Diagnostics Industry Revenue Share (%), by Diagnostic Approach 2025 & 2033

- Figure 54: South America GCC In Vitro Diagnostics Industry Volume Share (%), by Diagnostic Approach 2025 & 2033

- Figure 55: South America GCC In Vitro Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 56: South America GCC In Vitro Diagnostics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 57: South America GCC In Vitro Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 58: South America GCC In Vitro Diagnostics Industry Volume Share (%), by Country 2025 & 2033

- Figure 59: Europe GCC In Vitro Diagnostics Industry Revenue (Million), by Technique 2025 & 2033

- Figure 60: Europe GCC In Vitro Diagnostics Industry Volume (K Unit), by Technique 2025 & 2033

- Figure 61: Europe GCC In Vitro Diagnostics Industry Revenue Share (%), by Technique 2025 & 2033

- Figure 62: Europe GCC In Vitro Diagnostics Industry Volume Share (%), by Technique 2025 & 2033

- Figure 63: Europe GCC In Vitro Diagnostics Industry Revenue (Million), by Product 2025 & 2033

- Figure 64: Europe GCC In Vitro Diagnostics Industry Volume (K Unit), by Product 2025 & 2033

- Figure 65: Europe GCC In Vitro Diagnostics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 66: Europe GCC In Vitro Diagnostics Industry Volume Share (%), by Product 2025 & 2033

- Figure 67: Europe GCC In Vitro Diagnostics Industry Revenue (Million), by Usability 2025 & 2033

- Figure 68: Europe GCC In Vitro Diagnostics Industry Volume (K Unit), by Usability 2025 & 2033

- Figure 69: Europe GCC In Vitro Diagnostics Industry Revenue Share (%), by Usability 2025 & 2033

- Figure 70: Europe GCC In Vitro Diagnostics Industry Volume Share (%), by Usability 2025 & 2033

- Figure 71: Europe GCC In Vitro Diagnostics Industry Revenue (Million), by Application 2025 & 2033

- Figure 72: Europe GCC In Vitro Diagnostics Industry Volume (K Unit), by Application 2025 & 2033

- Figure 73: Europe GCC In Vitro Diagnostics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 74: Europe GCC In Vitro Diagnostics Industry Volume Share (%), by Application 2025 & 2033

- Figure 75: Europe GCC In Vitro Diagnostics Industry Revenue (Million), by End User 2025 & 2033

- Figure 76: Europe GCC In Vitro Diagnostics Industry Volume (K Unit), by End User 2025 & 2033

- Figure 77: Europe GCC In Vitro Diagnostics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 78: Europe GCC In Vitro Diagnostics Industry Volume Share (%), by End User 2025 & 2033

- Figure 79: Europe GCC In Vitro Diagnostics Industry Revenue (Million), by Diagnostic Approach 2025 & 2033

- Figure 80: Europe GCC In Vitro Diagnostics Industry Volume (K Unit), by Diagnostic Approach 2025 & 2033

- Figure 81: Europe GCC In Vitro Diagnostics Industry Revenue Share (%), by Diagnostic Approach 2025 & 2033

- Figure 82: Europe GCC In Vitro Diagnostics Industry Volume Share (%), by Diagnostic Approach 2025 & 2033

- Figure 83: Europe GCC In Vitro Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 84: Europe GCC In Vitro Diagnostics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 85: Europe GCC In Vitro Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 86: Europe GCC In Vitro Diagnostics Industry Volume Share (%), by Country 2025 & 2033

- Figure 87: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue (Million), by Technique 2025 & 2033

- Figure 88: Middle East & Africa GCC In Vitro Diagnostics Industry Volume (K Unit), by Technique 2025 & 2033

- Figure 89: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue Share (%), by Technique 2025 & 2033

- Figure 90: Middle East & Africa GCC In Vitro Diagnostics Industry Volume Share (%), by Technique 2025 & 2033

- Figure 91: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue (Million), by Product 2025 & 2033

- Figure 92: Middle East & Africa GCC In Vitro Diagnostics Industry Volume (K Unit), by Product 2025 & 2033

- Figure 93: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 94: Middle East & Africa GCC In Vitro Diagnostics Industry Volume Share (%), by Product 2025 & 2033

- Figure 95: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue (Million), by Usability 2025 & 2033

- Figure 96: Middle East & Africa GCC In Vitro Diagnostics Industry Volume (K Unit), by Usability 2025 & 2033

- Figure 97: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue Share (%), by Usability 2025 & 2033

- Figure 98: Middle East & Africa GCC In Vitro Diagnostics Industry Volume Share (%), by Usability 2025 & 2033

- Figure 99: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue (Million), by Application 2025 & 2033

- Figure 100: Middle East & Africa GCC In Vitro Diagnostics Industry Volume (K Unit), by Application 2025 & 2033

- Figure 101: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 102: Middle East & Africa GCC In Vitro Diagnostics Industry Volume Share (%), by Application 2025 & 2033

- Figure 103: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue (Million), by End User 2025 & 2033

- Figure 104: Middle East & Africa GCC In Vitro Diagnostics Industry Volume (K Unit), by End User 2025 & 2033

- Figure 105: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 106: Middle East & Africa GCC In Vitro Diagnostics Industry Volume Share (%), by End User 2025 & 2033

- Figure 107: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue (Million), by Diagnostic Approach 2025 & 2033

- Figure 108: Middle East & Africa GCC In Vitro Diagnostics Industry Volume (K Unit), by Diagnostic Approach 2025 & 2033

- Figure 109: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue Share (%), by Diagnostic Approach 2025 & 2033

- Figure 110: Middle East & Africa GCC In Vitro Diagnostics Industry Volume Share (%), by Diagnostic Approach 2025 & 2033

- Figure 111: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 112: Middle East & Africa GCC In Vitro Diagnostics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 113: Middle East & Africa GCC In Vitro Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 114: Middle East & Africa GCC In Vitro Diagnostics Industry Volume Share (%), by Country 2025 & 2033

- Figure 115: Asia Pacific GCC In Vitro Diagnostics Industry Revenue (Million), by Technique 2025 & 2033

- Figure 116: Asia Pacific GCC In Vitro Diagnostics Industry Volume (K Unit), by Technique 2025 & 2033

- Figure 117: Asia Pacific GCC In Vitro Diagnostics Industry Revenue Share (%), by Technique 2025 & 2033

- Figure 118: Asia Pacific GCC In Vitro Diagnostics Industry Volume Share (%), by Technique 2025 & 2033

- Figure 119: Asia Pacific GCC In Vitro Diagnostics Industry Revenue (Million), by Product 2025 & 2033

- Figure 120: Asia Pacific GCC In Vitro Diagnostics Industry Volume (K Unit), by Product 2025 & 2033

- Figure 121: Asia Pacific GCC In Vitro Diagnostics Industry Revenue Share (%), by Product 2025 & 2033

- Figure 122: Asia Pacific GCC In Vitro Diagnostics Industry Volume Share (%), by Product 2025 & 2033

- Figure 123: Asia Pacific GCC In Vitro Diagnostics Industry Revenue (Million), by Usability 2025 & 2033

- Figure 124: Asia Pacific GCC In Vitro Diagnostics Industry Volume (K Unit), by Usability 2025 & 2033

- Figure 125: Asia Pacific GCC In Vitro Diagnostics Industry Revenue Share (%), by Usability 2025 & 2033

- Figure 126: Asia Pacific GCC In Vitro Diagnostics Industry Volume Share (%), by Usability 2025 & 2033

- Figure 127: Asia Pacific GCC In Vitro Diagnostics Industry Revenue (Million), by Application 2025 & 2033

- Figure 128: Asia Pacific GCC In Vitro Diagnostics Industry Volume (K Unit), by Application 2025 & 2033

- Figure 129: Asia Pacific GCC In Vitro Diagnostics Industry Revenue Share (%), by Application 2025 & 2033

- Figure 130: Asia Pacific GCC In Vitro Diagnostics Industry Volume Share (%), by Application 2025 & 2033

- Figure 131: Asia Pacific GCC In Vitro Diagnostics Industry Revenue (Million), by End User 2025 & 2033

- Figure 132: Asia Pacific GCC In Vitro Diagnostics Industry Volume (K Unit), by End User 2025 & 2033

- Figure 133: Asia Pacific GCC In Vitro Diagnostics Industry Revenue Share (%), by End User 2025 & 2033

- Figure 134: Asia Pacific GCC In Vitro Diagnostics Industry Volume Share (%), by End User 2025 & 2033

- Figure 135: Asia Pacific GCC In Vitro Diagnostics Industry Revenue (Million), by Diagnostic Approach 2025 & 2033

- Figure 136: Asia Pacific GCC In Vitro Diagnostics Industry Volume (K Unit), by Diagnostic Approach 2025 & 2033

- Figure 137: Asia Pacific GCC In Vitro Diagnostics Industry Revenue Share (%), by Diagnostic Approach 2025 & 2033

- Figure 138: Asia Pacific GCC In Vitro Diagnostics Industry Volume Share (%), by Diagnostic Approach 2025 & 2033

- Figure 139: Asia Pacific GCC In Vitro Diagnostics Industry Revenue (Million), by Country 2025 & 2033

- Figure 140: Asia Pacific GCC In Vitro Diagnostics Industry Volume (K Unit), by Country 2025 & 2033

- Figure 141: Asia Pacific GCC In Vitro Diagnostics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 142: Asia Pacific GCC In Vitro Diagnostics Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Technique 2020 & 2033

- Table 2: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Technique 2020 & 2033

- Table 3: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 4: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 5: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Usability 2020 & 2033

- Table 6: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2020 & 2033

- Table 7: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Diagnostic Approach 2020 & 2033

- Table 12: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Diagnostic Approach 2020 & 2033

- Table 13: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 14: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 15: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Technique 2020 & 2033

- Table 16: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Technique 2020 & 2033

- Table 17: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 18: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 19: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Usability 2020 & 2033

- Table 20: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2020 & 2033

- Table 21: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 24: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 25: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Diagnostic Approach 2020 & 2033

- Table 26: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Diagnostic Approach 2020 & 2033

- Table 27: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United States GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United States GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Canada GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Canada GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Mexico GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Technique 2020 & 2033

- Table 36: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Technique 2020 & 2033

- Table 37: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 39: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Usability 2020 & 2033

- Table 40: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2020 & 2033

- Table 41: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 43: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 44: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 45: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Diagnostic Approach 2020 & 2033

- Table 46: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Diagnostic Approach 2020 & 2033

- Table 47: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 49: Brazil GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Brazil GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Argentina GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Argentina GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of South America GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of South America GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Technique 2020 & 2033

- Table 56: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Technique 2020 & 2033

- Table 57: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 58: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 59: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Usability 2020 & 2033

- Table 60: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2020 & 2033

- Table 61: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 62: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 63: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 64: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 65: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Diagnostic Approach 2020 & 2033

- Table 66: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Diagnostic Approach 2020 & 2033

- Table 67: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 69: United Kingdom GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: United Kingdom GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Germany GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Germany GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: France GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: France GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Italy GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Italy GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Spain GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Spain GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Russia GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Russia GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Benelux GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Benelux GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Nordics GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Nordics GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: Rest of Europe GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Rest of Europe GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Technique 2020 & 2033

- Table 88: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Technique 2020 & 2033

- Table 89: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 90: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 91: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Usability 2020 & 2033

- Table 92: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2020 & 2033

- Table 93: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 94: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 95: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 96: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 97: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Diagnostic Approach 2020 & 2033

- Table 98: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Diagnostic Approach 2020 & 2033

- Table 99: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 100: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 101: Turkey GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Turkey GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Israel GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Israel GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 105: GCC GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 106: GCC GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 107: North Africa GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 108: North Africa GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 109: South Africa GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 110: South Africa GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 111: Rest of Middle East & Africa GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 112: Rest of Middle East & Africa GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 113: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Technique 2020 & 2033

- Table 114: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Technique 2020 & 2033

- Table 115: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 116: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 117: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Usability 2020 & 2033

- Table 118: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Usability 2020 & 2033

- Table 119: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 120: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 121: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 122: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 123: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Diagnostic Approach 2020 & 2033

- Table 124: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Diagnostic Approach 2020 & 2033

- Table 125: Global GCC In Vitro Diagnostics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 126: Global GCC In Vitro Diagnostics Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 127: China GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 128: China GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 129: India GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 130: India GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 131: Japan GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 132: Japan GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 133: South Korea GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 134: South Korea GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 135: ASEAN GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 136: ASEAN GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 137: Oceania GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 138: Oceania GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 139: Rest of Asia Pacific GCC In Vitro Diagnostics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 140: Rest of Asia Pacific GCC In Vitro Diagnostics Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC In Vitro Diagnostics Industry?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the GCC In Vitro Diagnostics Industry?

Key companies in the market include Becton Dickinson and Company, BioMerieux SA, Grifols SA, Abbott Laboratories, Siemens Healthineers (Siemens Healthcare GmbH), Danaher Corporation, F Hoffmann-La Roche AG, DiaSorin, Thermo Fischer Scientific Inc, Qiagen NV, Sysmex Corporation, Bio-Rad Laboratories.

3. What are the main segments of the GCC In Vitro Diagnostics Industry?

The market segments include Technique, Product, Usability, Application, End User, Diagnostic Approach.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Chronic Diseases and Infectious Diseases; Increasing Healthcare Expenditure.

6. What are the notable trends driving market growth?

Point-of-care diagnostics Segment is Expected to Witness Growth Over The Forecast Period..

7. Are there any restraints impacting market growth?

Stringent Regulations.

8. Can you provide examples of recent developments in the market?

July 2022: Saudi Arabia's Arabian International Healthcare Holding Company, TIBBIYAH, commenced a new Joint Venture (JV) with Swiss company Unilabs Diagnostics AB.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC In Vitro Diagnostics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC In Vitro Diagnostics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC In Vitro Diagnostics Industry?

To stay informed about further developments, trends, and reports in the GCC In Vitro Diagnostics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence