Key Insights

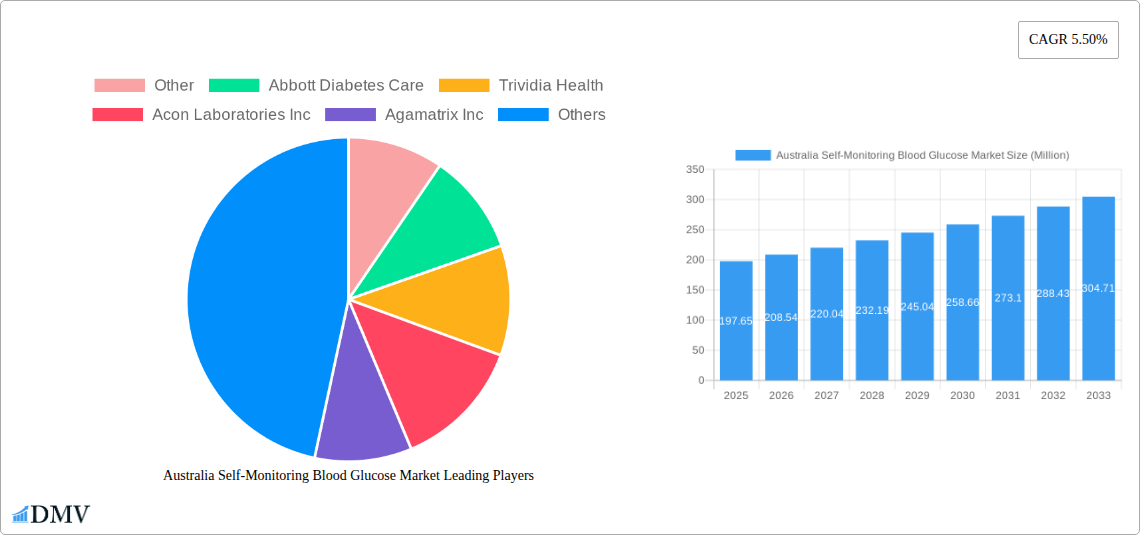

The Australian Self-Monitoring Blood Glucose (SMBG) market is projected for robust expansion, demonstrating a healthy CAGR of 5.50% from an estimated USD 197.65 million in 2025. This growth is fueled by an increasing prevalence of diabetes in Australia, driven by lifestyle changes and an aging population. The rising awareness among individuals about proactive diabetes management, coupled with supportive government initiatives and healthcare policies promoting regular glucose monitoring, are significant catalysts. The demand for advanced and user-friendly glucometer devices is escalating, as is the continuous need for test strips and lancets, which form the core components of SMBG. Technological advancements are also playing a crucial role, with the introduction of connected devices and integrated digital platforms enhancing user experience and data management for both patients and healthcare providers.

Australia Self-Monitoring Blood Glucose Market Market Size (In Million)

Key market drivers include the growing burden of diabetes and pre-diabetes, leading to a higher demand for home-based monitoring solutions. Trends like the shift towards personalized diabetes care, the increasing adoption of connected health devices, and a greater focus on preventative healthcare are shaping the market landscape. Restraints such as the evolving reimbursement policies and the emergence of continuous glucose monitoring (CGM) technologies, which offer an alternative to traditional SMBG, need to be carefully navigated. However, the affordability and widespread accessibility of SMBG devices ensure their continued relevance, especially in supporting routine blood glucose checks. The market is segmented primarily by components: Glucometer Devices, Test Strips, and Lancets, all experiencing steady demand to support the ongoing needs of the Australian diabetic population.

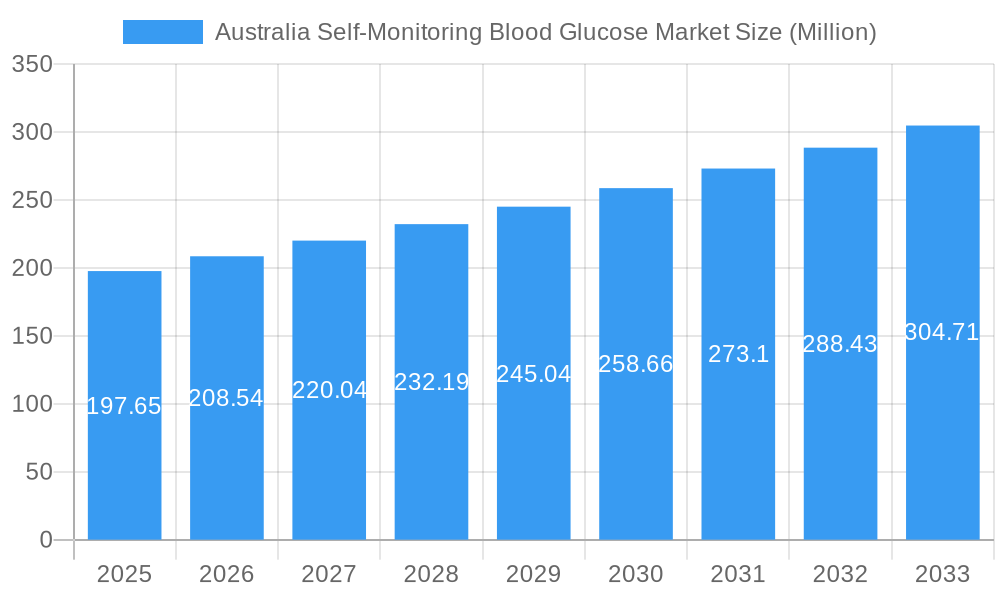

Australia Self-Monitoring Blood Glucose Market Company Market Share

Gain unparalleled insights into the burgeoning Australia Self-Monitoring Blood Glucose (SMBG) market with this in-depth report. Spanning a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this analysis delves into market dynamics, key trends, and future projections. Discover the critical factors driving the Australian diabetes management landscape and understand the competitive forces shaping the SMBG device market in Australia. This report is an indispensable resource for diabetes care product manufacturers, healthcare providers, pharmaceutical companies, investors, and policymakers seeking to capitalize on the significant opportunities within this vital sector.

Australia Self-Monitoring Blood Glucose Market Market Composition & Trends

The Australia Self-Monitoring Blood Glucose market exhibits a moderate level of concentration, with key players like Abbott Diabetes Care and Roche Holding AG holding significant market share. Innovation is a primary catalyst, driven by advancements in continuous glucose monitoring (CGM) technology and the integration of digital health solutions. Regulatory frameworks, while generally supportive of diabetes management, can influence product approvals and market access. The availability of substitute products, such as HbA1c testing, poses a challenge, but the convenience and immediate feedback offered by SMBG devices maintain their prominence. End-user profiles are diverse, ranging from individuals diagnosed with Type 1 and Type 2 diabetes to those at risk, pregnant women with gestational diabetes, and increasingly, health-conscious individuals seeking proactive health monitoring. Merger and acquisition activities, though not highly frequent, are strategic moves aimed at expanding product portfolios and market reach. For instance, historical M&A deal values in related global markets have ranged from tens to hundreds of millions of dollars, signaling potential consolidation within the Australian SMBG sector as well.

Australia Self-Monitoring Blood Glucose Market Industry Evolution

The Australian Self-Monitoring Blood Glucose market has undergone a significant evolutionary journey, marked by consistent growth trajectories fueled by a rising prevalence of diabetes and a growing awareness of proactive health management. Historically, the market has witnessed an upward trend in the adoption of SMBG devices, driven by technological advancements and increasing accessibility. The study period from 2019 to 2024 saw a steady compound annual growth rate (CAGR) of approximately 6.5%, propelled by factors such as an aging population and lifestyle-related health issues contributing to the diabetes epidemic. Consumer demand has progressively shifted towards more user-friendly, accurate, and connected devices. The introduction of Bluetooth-enabled glucometers and smartphone integration has been a game-changer, enabling seamless data logging and sharing with healthcare professionals. This technological evolution has not only enhanced patient convenience but also empowered individuals with diabetes to gain better control over their glycemic levels. Furthermore, the increasing penetration of private health insurance and government initiatives promoting diabetes self-management have further bolstered market expansion. By 2025, the market is projected to reach an estimated value of AUD 350 million, with a projected CAGR of 7.2% during the forecast period (2025-2033). This growth is underpinned by continuous innovation in biosensor technology, leading to more precise readings, and the integration of AI-powered insights for personalized diabetes management plans. The adoption metrics for smart SMBG devices have seen a notable increase, with over 40% of new device purchases in the past two years incorporating connectivity features, indicating a strong consumer preference for integrated health solutions.

Leading Regions, Countries, or Segments in Australia Self-Monitoring Blood Glucose Market

Within the Australian Self-Monitoring Blood Glucose market, the Component segment plays a crucial role in defining market dominance and growth patterns.

Glucometer Devices

- Market Dominance: Glucometer devices represent the largest segment by value and volume within the Australian SMBG market. Their foundational role in blood glucose monitoring makes them the primary entry point for individuals managing diabetes.

- Key Drivers:

- Technological Advancements: Continuous innovation in sensor technology, accuracy, and portability drives consistent demand.

- Increasing Diabetes Prevalence: The rising incidence of diabetes necessitates a greater number of individuals requiring regular blood glucose testing.

- Government and Private Health Initiatives: Programs aimed at early detection and management of diabetes encourage the adoption of glucometer devices.

- User-Friendly Design: Manufacturers are focusing on intuitive interfaces and ease of use, broadening the appeal to a wider demographic, including the elderly.

- Dominance Factors: The widespread availability of various glucometer models, from basic to advanced smart devices, caters to diverse needs and budgets. The Medicare Benefits Schedule (MBS) also offers rebates for certain diabetes-related items, including some glucose monitoring equipment, indirectly supporting glucometer sales. Furthermore, strategic partnerships between device manufacturers and healthcare providers facilitate increased adoption and prescription of these devices. The trend towards connected devices, allowing for data synchronization with mobile apps and healthcare providers, is further solidifying the dominance of glucometer devices in the market.

Test Strips

- Market Growth: Test strips are the most significant consumable segment, directly correlated with glucometer device usage. Their recurring purchase nature makes them a steady revenue stream for manufacturers.

- Key Drivers:

- Frequency of Testing: The recommended frequency of blood glucose testing for individuals with diabetes directly influences test strip consumption.

- Accuracy and Reliability: The demand for highly accurate and reliable test strips remains paramount for effective diabetes management.

- Technological Integration: The development of test strips compatible with advanced glucometers, including those with improved sample-taking capabilities, fuels market growth.

- Dominance Factors: While a vital segment, the market for test strips is characterized by intense competition and a focus on cost-effectiveness. Innovations in strip technology, such as requiring smaller blood samples or offering longer shelf lives, are key differentiators.

Lancets

- Market Stability: Lancets, essential for obtaining blood samples, form a stable segment within the SMBG market. While their innovation cycle is slower compared to glucometers and test strips, consistent demand is assured.

- Key Drivers:

- Basic Requirement: Lancets are a fundamental necessity for all individuals using traditional finger-prick blood glucose monitoring.

- Comfort and Safety Features: Advancements focusing on pain reduction and safety, such as retractable lancets and finer gauges, are key drivers.

- Dominance Factors: The market is driven by the need for reliable and sterile lancets. Manufacturers focus on offering ergonomic designs and multi-use lancet devices to enhance user experience and safety.

Australia Self-Monitoring Blood Glucose Market Product Innovations

The Australia Self-Monitoring Blood Glucose market is experiencing a wave of innovative product introductions aimed at enhancing accuracy, convenience, and data connectivity. Leading companies are developing smart glucometers that seamlessly integrate with mobile applications, offering real-time data tracking, trend analysis, and personalized insights. These innovations include devices with smaller blood sample requirements, faster testing times, and improved accuracy compared to traditional models. The integration of Bluetooth technology allows for effortless data synchronization, enabling patients and healthcare providers to monitor glycemic trends remotely. Furthermore, advancements in biosensor technology are leading to more durable and efficient test strips, while new lancet designs focus on minimizing pain and improving user comfort. These product innovations are crucial in empowering individuals with diabetes to achieve better self-management outcomes and improve their quality of life.

Propelling Factors for Australia Self-Monitoring Blood Glucose Market Growth

The Australia Self-Monitoring Blood Glucose market is propelled by several key factors. Technological advancements in digital health, including connected glucometers and mobile diabetes management applications, are enhancing user experience and data accessibility. The increasing prevalence of diabetes, driven by lifestyle changes and an aging population, directly fuels demand for SMBG devices. Government initiatives and healthcare policies that promote diabetes awareness and self-management also play a crucial role. Furthermore, the growing adoption of preventive healthcare practices and the rising health consciousness among the Australian population are contributing significantly to market expansion. For instance, the Australian government's commitment to reducing the burden of chronic diseases through targeted programs directly impacts the SMBG market.

Obstacles in the Australia Self-Monitoring Blood Glucose Market Market

Despite robust growth, the Australia Self-Monitoring Blood Glucose market faces several obstacles. High upfront costs associated with advanced smart glucometers and associated subscription services can be a barrier for some consumers. Limited insurance coverage for certain cutting-edge SMBG devices and consumables can also hinder adoption. Regulatory complexities and the time-consuming approval processes for new medical devices can delay market entry for innovative products. Furthermore, supply chain disruptions, as experienced during global health crises, can impact the availability and pricing of essential SMBG components. Finally, user education and digital literacy remain critical, as a segment of the population may struggle with adopting and effectively utilizing technologically advanced SMBG solutions.

Future Opportunities in Australia Self-Monitoring Blood Glucose Market

The future of the Australia Self-Monitoring Blood Glucose market presents significant opportunities. The growing demand for integrated diabetes management solutions that combine SMBG devices with telemedicine platforms and AI-powered coaching will create new market niches. Expansion into emerging market segments, such as pre-diabetic individuals and those with gestational diabetes, offers substantial growth potential. The development of non-invasive or minimally invasive glucose monitoring technologies remains a long-term aspiration that, if realized, could revolutionize the market. Furthermore, partnerships between SMBG manufacturers and wearable technology companies can lead to synergistic product offerings, enhancing the overall diabetes care ecosystem. The increasing focus on personalized medicine will also drive demand for SMBG devices that provide granular data for tailored treatment plans.

Major Players in the Australia Self-Monitoring Blood Glucose Market Ecosystem

- Abbott Diabetes Care

- Roche Holding AG

- LifeScan

- Ascensia Diabetes Care

- Trividia Health

- Agamatrix Inc

- Arkray Inc

- Acon Laboratories Inc

- Bionime Corporation

- Other

Key Developments in Australia Self-Monitoring Blood Glucose Market Industry

- January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published "Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes," detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes - one of the largest combined blood glucose meter and mobile diabetes app datasets ever published. This development highlights the growing evidence base for connected SMBG systems and their impact on glycemic control.

- February 2022: Zurich Australia launched an Australian-first pilot of a new mobile health app that enables life insurance customers with diabetes to monitor their blood sugar levels and self-manage their diabetes. "Pops" is a first-of-its-kind integrated health management system with a simple glucose meter attached to a smartphone. Paired with the Pops app and AI health coach, it wirelessly records blood sugar results, making it one of the most discreet and easy-to-use diabetes self-management tools available. This initiative showcases the increasing integration of SMBG technology within broader health insurance and wellness programs.

Strategic Australia Self-Monitoring Blood Glucose Market Market Forecast

The strategic forecast for the Australia Self-Monitoring Blood Glucose market is overwhelmingly positive, driven by the persistent rise in diabetes prevalence and an ever-increasing demand for advanced, user-friendly monitoring solutions. Growth catalysts include the continued integration of smart technologies, enabling seamless data sharing and personalized insights, which is expected to drive a significant shift towards connected SMBG devices. The focus on preventive healthcare and proactive diabetes management further bolsters market potential, encouraging wider adoption among at-risk populations. Opportunities arising from new market segments, such as pre-diabetes and gestational diabetes, alongside the development of innovative non-invasive monitoring techniques, will shape the future landscape, promising sustained expansion and a significant impact on improving the quality of life for individuals managing diabetes in Australia.

Australia Self-Monitoring Blood Glucose Market Segmentation

-

1. Component (Value and Volume, 2017 - 2028)

- 1.1. Glucometer Devices

- 1.2. Test Strips

- 1.3. Lancets

Australia Self-Monitoring Blood Glucose Market Segmentation By Geography

- 1. Australia

Australia Self-Monitoring Blood Glucose Market Regional Market Share

Geographic Coverage of Australia Self-Monitoring Blood Glucose Market

Australia Self-Monitoring Blood Glucose Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment

- 3.3. Market Restrains

- 3.3.1. High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Australia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Self-Monitoring Blood Glucose Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component (Value and Volume, 2017 - 2028)

- 5.1.1. Glucometer Devices

- 5.1.2. Test Strips

- 5.1.3. Lancets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Component (Value and Volume, 2017 - 2028)

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Other

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abbott Diabetes Care

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trividia Health

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Acon Laboratories Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Agamatrix Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bionime Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LifeScan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roche Holding AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ascensia Diabetes Care

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Arkray Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Other

List of Figures

- Figure 1: Australia Self-Monitoring Blood Glucose Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Self-Monitoring Blood Glucose Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Component (Value and Volume, 2017 - 2028) 2020 & 2033

- Table 2: Australia Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Component (Value and Volume, 2017 - 2028) 2020 & 2033

- Table 3: Australia Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Australia Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Component (Value and Volume, 2017 - 2028) 2020 & 2033

- Table 6: Australia Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Component (Value and Volume, 2017 - 2028) 2020 & 2033

- Table 7: Australia Self-Monitoring Blood Glucose Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Australia Self-Monitoring Blood Glucose Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Self-Monitoring Blood Glucose Market?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Australia Self-Monitoring Blood Glucose Market?

Key companies in the market include Other, Abbott Diabetes Care, Trividia Health, Acon Laboratories Inc, Agamatrix Inc, Bionime Corporation, LifeScan, Roche Holding AG, Ascensia Diabetes Care, Arkray Inc .

3. What are the main segments of the Australia Self-Monitoring Blood Glucose Market?

The market segments include Component (Value and Volume, 2017 - 2028).

4. Can you provide details about the market size?

The market size is estimated to be USD 197.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Cancer Worldwide; Technological Advancements in Diagnostic Testing; Increasing Demand for Point-of-care Treatment.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Australia.

7. Are there any restraints impacting market growth?

High Cost of Molecular Diagnostic Tests; Lack of Skilled Workforce and Stringent Regulatory Framework.

8. Can you provide examples of recent developments in the market?

January 2023: LifeScan announced that the peer-reviewed Journal of Diabetes Science and Technology published Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes, detailing results from a retrospective analysis of real-world data from over 144,000 people with diabetes - one of the largest combined blood glucose meter and mobile diabetes app datasets ever published.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Self-Monitoring Blood Glucose Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Self-Monitoring Blood Glucose Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Self-Monitoring Blood Glucose Market?

To stay informed about further developments, trends, and reports in the Australia Self-Monitoring Blood Glucose Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence