Key Insights

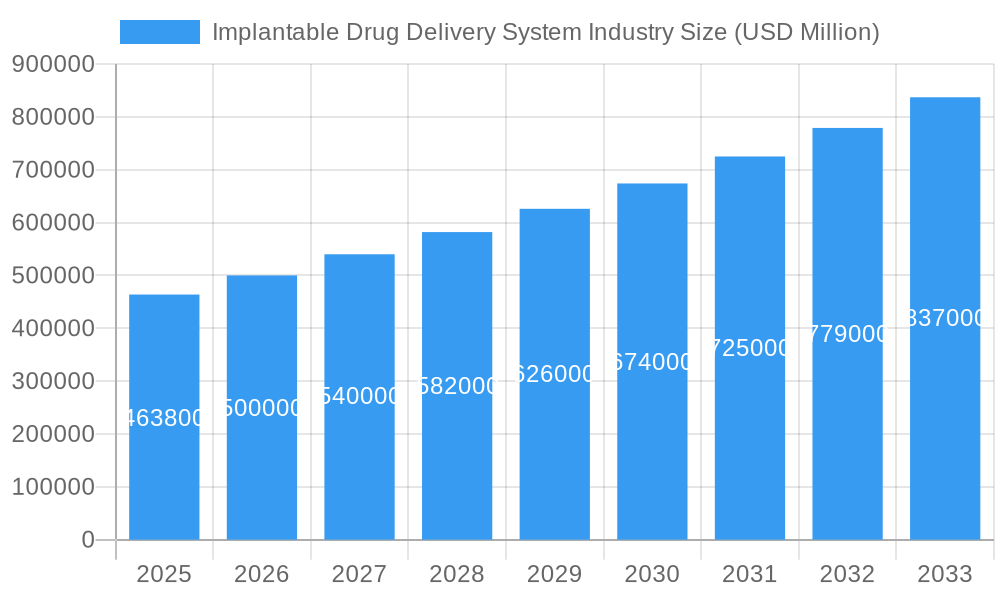

The Implantable Drug Delivery System Industry is projected for significant expansion, with a robust market size of USD 463.8 billion in 2025, expected to grow at a compelling CAGR of 7.8% through 2033. This growth is propelled by a confluence of factors, including advancements in drug delivery technologies and an increasing global prevalence of chronic diseases. The demand for sustained and localized drug administration, which implantable systems offer, is a primary driver. For instance, the growing burden of oncology, cardiovascular diseases, and autoimmune disorders necessitates more effective and patient-friendly treatment modalities. Furthermore, the aging global population, coupled with rising healthcare expenditures and an increased focus on preventative and long-term disease management, is creating a fertile ground for the adoption of these sophisticated medical devices. The inherent advantages of implantable systems, such as improved patient compliance, reduced systemic side effects, and precise dosage control, are increasingly being recognized by both healthcare professionals and patients, further fueling market penetration.

Implantable Drug Delivery System Industry Market Size (In Billion)

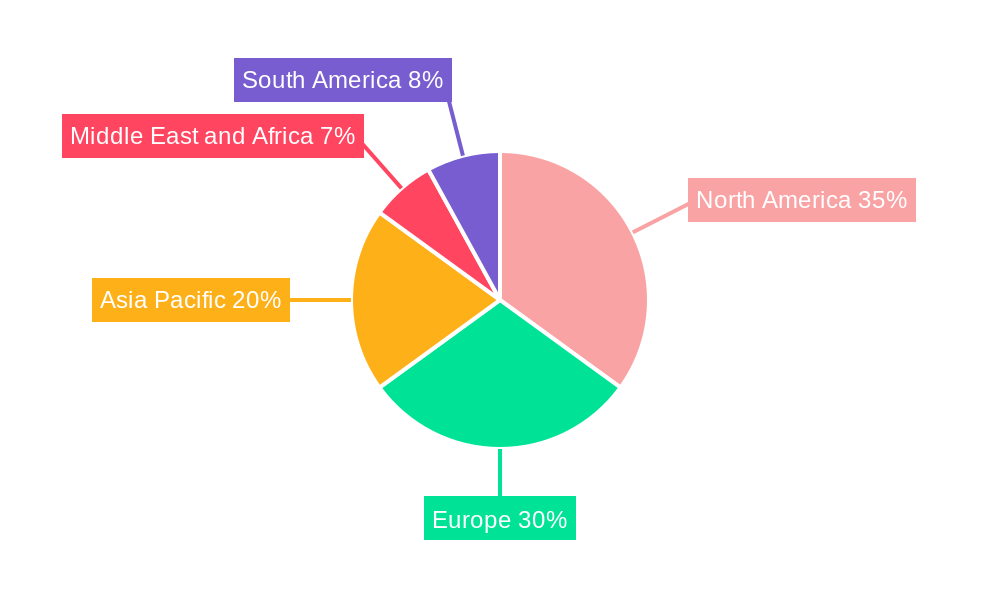

Key trends shaping the Implantable Drug Delivery System Industry include the rise of biodegradable implants, offering a less invasive removal process and reducing long-term complications. The integration of smart technologies, allowing for remote monitoring and adjustable drug release, is another significant development. Geographically, North America and Europe are anticipated to lead the market due to advanced healthcare infrastructure and high adoption rates of innovative medical technologies. However, the Asia Pacific region is expected to exhibit the fastest growth, driven by increasing healthcare investments, a large patient pool, and a burgeoning medical device manufacturing sector. While the market demonstrates strong growth potential, certain restraints, such as high research and development costs, stringent regulatory approvals, and the initial cost of implantation, may pose challenges. Nevertheless, the overarching benefits and ongoing technological innovations position the Implantable Drug Delivery System Industry for sustained and substantial growth in the coming years.

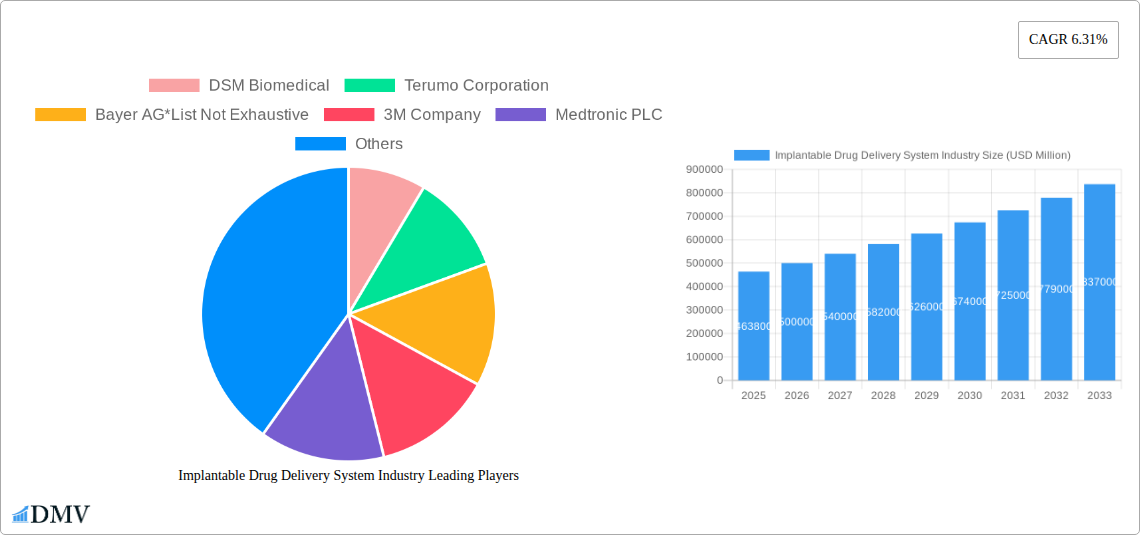

Implantable Drug Delivery System Industry Company Market Share

Implantable Drug Delivery System Industry Market Composition & Trends

The Implantable Drug Delivery System Market is characterized by a dynamic interplay of innovation, stringent regulatory oversight, and increasing demand for long-term therapeutic solutions. Market concentration remains moderate, with a few key players holding significant market share while a growing number of specialized companies and startups drive innovation. Key innovation catalysts include advancements in biomaterials for biodegradable implants, miniaturization of device technology, and the development of targeted drug release mechanisms. Regulatory bodies worldwide are actively shaping the market by implementing rigorous approval processes, emphasizing patient safety and device efficacy. Substitute products, such as oral medications and transdermal patches, continue to pose a competitive challenge, although implantable systems offer distinct advantages in terms of patient compliance and controlled drug release. End-user profiles are diverse, encompassing patients with chronic conditions like diabetes, cardiovascular diseases, and cancer, as well as those requiring long-term contraception. Mergers and acquisitions (M&A) activities are a significant trend, with major players strategically acquiring innovative technologies and smaller companies to expand their product portfolios and market reach. Deal values in recent years have reached multi-billion dollar figures, reflecting the strategic importance of this sector. The market share distribution is influenced by the prevalence of target diseases and the adoption rates of advanced drug delivery technologies.

Implantable Drug Delivery System Industry Industry Evolution

The Implantable Drug Delivery System Industry has witnessed substantial evolution, driven by persistent innovation and a growing imperative to improve patient outcomes and quality of life. Over the historical period from 2019 to 2024, the market experienced a steady upward trajectory, fueled by increasing awareness of the benefits of continuous and targeted drug administration. Base year projections for 2025 indicate a robust foundation for continued expansion, with the forecast period of 2025–2033 poised for accelerated growth. This evolution is marked by significant technological advancements. The shift from purely non-biodegradable implants to a greater emphasis on biodegradable implants has been a pivotal development, offering improved biocompatibility and reducing the need for surgical removal. Furthermore, the miniaturization of components and the integration of smart technologies for remote monitoring and adjustable dosage have transformed the landscape of drug infusion pumps and other implantable devices.

Consumer demand has also played a crucial role. Patients are increasingly seeking less invasive and more convenient treatment options that minimize the burden of frequent dosing. This demand is particularly evident in therapeutic areas such as oncology, where sustained drug delivery can optimize treatment efficacy and reduce side effects, and cardiovascular applications, where devices like drug-eluting stents continuously release medication to prevent restenosis. The growth rates observed throughout the study period, projected to continue through 2033, are indicative of a market that is not only expanding but also maturing. Adoption metrics for advanced implantable systems are on the rise, as healthcare providers recognize their potential to enhance treatment adherence and reduce overall healthcare costs associated with managing chronic diseases. The industry's evolution is a testament to its ability to adapt to the changing needs of patients and healthcare systems, consistently pushing the boundaries of medical technology for better therapeutic delivery. The market size is estimated to reach xx billion by 2033, reflecting a compound annual growth rate (CAGR) of xx% from the base year of 2025.

Leading Regions, Countries, or Segments in Implantable Drug Delivery System Industry

The Implantable Drug Delivery System Market exhibits distinct regional and segmental dominance, driven by a confluence of factors including healthcare infrastructure, disease prevalence, regulatory support, and technological adoption. Among the product types, Drug Infusion Pumps and Stents currently hold significant market share.

Product Type Dominance:

- Drug Infusion Pumps: These devices are crucial for chronic conditions requiring precise and continuous medication, such as diabetes management and pain control. High adoption rates in developed economies, coupled with ongoing technological enhancements for portability and intelligence, solidify their leadership.

- Stents: Particularly drug-eluting stents (DES) for cardiovascular applications, these have revolutionized the treatment of coronary artery disease. Their efficacy in preventing restenosis has led to widespread utilization, making them a dominant segment.

Technology Landscape:

- Non-biodegradable Implants: While historically dominant, these are gradually being complemented by biodegradable alternatives. However, their established efficacy and cost-effectiveness in certain applications ensure continued market presence.

- Biodegradable Implants: The growing focus on patient safety and reduced long-term foreign body response is driving the expansion of this segment. Innovations in polymer science are creating novel biodegradable materials with controlled drug release profiles, increasing their appeal.

Application Focus:

- Cardiovascular: This segment remains a primary driver due to the high global burden of cardiovascular diseases and the established role of implantable devices like pacemakers and drug-eluting stents.

- Oncology: The increasing demand for targeted and sustained chemotherapy delivery to minimize systemic toxicity positions this as a rapidly growing and significant application.

Regional Dominance:

- North America: This region leads the implantable drug delivery system market due to its advanced healthcare infrastructure, high disposable incomes, significant R&D investments, and a large patient population suffering from chronic diseases. Strong regulatory frameworks also encourage innovation and adoption of advanced medical devices. The United States, in particular, is a major hub for both product development and utilization.

- Europe: Close behind North America, Europe benefits from universal healthcare coverage, robust government funding for medical research, and a high prevalence of target diseases. Favorable reimbursement policies and a strong presence of leading pharmaceutical and medical device companies contribute to its significant market share.

Key drivers for this dominance include substantial government and private investment in healthcare, favorable reimbursement policies for advanced medical technologies, a high prevalence of target diseases like cardiovascular ailments and cancer, and an aging population with increased healthcare needs. Regulatory bodies in these leading regions often act as early adopters and facilitators of innovative medical devices, further propelling market growth and segment leadership.

Implantable Drug Delivery System Industry Product Innovations

Product innovation within the Implantable Drug Delivery System Industry is fundamentally reshaping therapeutic delivery. Key advancements focus on enhanced biocompatibility, extended drug release durations, and miniaturized designs for less invasive implantation. Biodegradable polymer-based implants are gaining significant traction, offering the advantage of in-situ degradation, thereby eliminating the need for explantation surgery. For instance, innovations in ocular drug delivery are leading to non-invasive devices that precisely target the eye, improving treatment efficacy for conditions like glaucoma and macular degeneration. Similarly, advancements in drug-eluting coatings for cardiovascular stents are not only preventing restenosis but also delivering novel therapeutic agents to promote healing and reduce inflammation. The integration of smart technologies, such as programmable release profiles and remote monitoring capabilities, is also a significant trend, empowering both patients and clinicians with greater control over treatment regimens. These innovations collectively aim to improve patient compliance, reduce treatment side effects, and ultimately achieve better therapeutic outcomes.

Propelling Factors for Implantable Drug Delivery System Industry Growth

Several key factors are propelling the growth of the Implantable Drug Delivery System Industry. Technological advancements are paramount, with the development of novel biomaterials enabling longer-lasting and more biocompatible implants, alongside sophisticated drug release mechanisms for precise therapeutic delivery. The increasing prevalence of chronic diseases, such as cardiovascular disorders, diabetes, and autoimmune conditions, fuels the demand for sustained and controlled drug administration, a forte of implantable systems. Furthermore, a growing aging global population translates to a larger patient base requiring long-term disease management. Supportive regulatory frameworks and increased government initiatives promoting medical device innovation and adoption also play a crucial role. Economic factors, including rising healthcare expenditure and evolving reimbursement policies that favor cost-effective, long-term treatment solutions, further bolster market expansion. For example, the widespread adoption of drug-eluting stents in cardiovascular care demonstrates the impact of technological innovation combined with clinical evidence of efficacy.

Obstacles in the Implantable Drug Delivery System Industry Market

Despite robust growth, the Implantable Drug Delivery System Market faces several significant obstacles. High development and manufacturing costs associated with these sophisticated devices pose a barrier, potentially leading to higher initial prices for patients and healthcare systems. Stringent and lengthy regulatory approval processes across different geographies can delay market entry and increase R&D expenses. Patient and physician reluctance to adopt invasive procedures, even for long-term benefits, remains a challenge, often stemming from concerns about surgical risks, infection, and the irreversibility of implantation. Technical challenges such as device longevity, potential for malfunction, and the need for specialized surgical expertise also present hurdles. Furthermore, supply chain disruptions and the need for specialized logistics for sensitive medical devices can impact availability and increase operational costs. The competitive landscape, with established traditional therapies and the constant emergence of new treatment modalities, also exerts pressure.

Future Opportunities in Implantable Drug Delivery System Industry

The Implantable Drug Delivery System Industry is ripe with future opportunities. The expanding applications in emerging therapeutic areas such as neurological disorders, fertility treatments, and wound healing present significant growth potential. The ongoing advancements in smart drug delivery systems with integrated biosensors and AI capabilities for personalized and adaptive therapy will unlock new market segments. The increasing focus on preventative medicine and early intervention for chronic diseases will drive the demand for long-term, proactive drug delivery solutions. Furthermore, the burgeoning healthcare markets in emerging economies offer substantial untapped potential due to growing healthcare expenditure and increasing access to advanced medical technologies. The development of minimally invasive and biodegradable implantable devices will cater to patient preference for less burdensome treatments, thereby expanding the overall market reach and acceptance.

Major Players in the Implantable Drug Delivery System Industry Ecosystem

- DSM Biomedical

- Terumo Corporation

- Bayer AG

- 3M Company

- Medtronic PLC

- Delpor Inc

- Allergan PLC

- Boston Scientific Corporation

- Alcon Inc

- Teleflex Incorporated

- Bausch and Lomb Inc

- Biotronik Inc

Key Developments in Implantable Drug Delivery System Industry Industry

- August 2022: Medtronic launched the drug-eluting coronary stent, the Onyx Frontier drug-eluting stent (DES), following CE Mark's approval. The Onyx Frontier DES offers an innovative delivery system and builds upon the acute performance and clinical data from the Resolute Onyx drug-eluting stent, enhancing treatment options for cardiovascular patients.

- May 2022: The Hong Kong startup Opharmic partnered with CeramTec to develop and produce a high-power non-invasive ocular drug delivery device. This strategic partnership allows Opharmic to leverage CeramTec's expertise in producing the high-power transducer essential for their innovative technology, paving the way for advanced ocular treatments.

Strategic Implantable Drug Delivery System Industry Market Forecast

The Implantable Drug Delivery System Industry is poised for significant expansion, driven by a confluence of strategic growth catalysts. The increasing demand for advanced therapeutic solutions in managing chronic diseases, coupled with ongoing innovation in biomaterials and device miniaturization, will continue to fuel market penetration. Favorable reimbursement policies and a growing global emphasis on patient-centric care, prioritizing long-term treatment efficacy and convenience, are expected to further accelerate adoption. Emerging applications in niche therapeutic areas and the integration of smart technologies for personalized medicine represent substantial untapped market potential. Strategic investments in research and development by key players will lead to the introduction of novel, less invasive, and more effective implantable drug delivery systems, solidifying the market's robust growth trajectory through 2033. The estimated market size is projected to reach xx billion by the end of the forecast period.

Implantable Drug Delivery System Industry Segmentation

-

1. Product Type

- 1.1. Drug Infusion Pumps

- 1.2. Intraocular Drug Delivery Devices

- 1.3. Contraceptive Drug Delivery Devices

- 1.4. Stents

- 1.5. Other Product Types

-

2. Technology

- 2.1. Biodegradable Implants

- 2.2. Non-biodegradable Implants

-

3. Application

- 3.1. Oncology

- 3.2. Cardiovascular

- 3.3. Autoimmune Diseases

- 3.4. Obstetrics and Gynecology

- 3.5. Other Applications

Implantable Drug Delivery System Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Implantable Drug Delivery System Industry Regional Market Share

Geographic Coverage of Implantable Drug Delivery System Industry

Implantable Drug Delivery System Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Minimally Invasive Procedures; Emergence of Novel Products; Increasing Prevalence of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices; Stringent Regulatory Requirements

- 3.4. Market Trends

- 3.4.1. Drug Infusion Pumps Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Implantable Drug Delivery System Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Drug Infusion Pumps

- 5.1.2. Intraocular Drug Delivery Devices

- 5.1.3. Contraceptive Drug Delivery Devices

- 5.1.4. Stents

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Biodegradable Implants

- 5.2.2. Non-biodegradable Implants

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oncology

- 5.3.2. Cardiovascular

- 5.3.3. Autoimmune Diseases

- 5.3.4. Obstetrics and Gynecology

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Implantable Drug Delivery System Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Drug Infusion Pumps

- 6.1.2. Intraocular Drug Delivery Devices

- 6.1.3. Contraceptive Drug Delivery Devices

- 6.1.4. Stents

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Biodegradable Implants

- 6.2.2. Non-biodegradable Implants

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Oncology

- 6.3.2. Cardiovascular

- 6.3.3. Autoimmune Diseases

- 6.3.4. Obstetrics and Gynecology

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Implantable Drug Delivery System Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Drug Infusion Pumps

- 7.1.2. Intraocular Drug Delivery Devices

- 7.1.3. Contraceptive Drug Delivery Devices

- 7.1.4. Stents

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Biodegradable Implants

- 7.2.2. Non-biodegradable Implants

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Oncology

- 7.3.2. Cardiovascular

- 7.3.3. Autoimmune Diseases

- 7.3.4. Obstetrics and Gynecology

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Implantable Drug Delivery System Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Drug Infusion Pumps

- 8.1.2. Intraocular Drug Delivery Devices

- 8.1.3. Contraceptive Drug Delivery Devices

- 8.1.4. Stents

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Biodegradable Implants

- 8.2.2. Non-biodegradable Implants

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Oncology

- 8.3.2. Cardiovascular

- 8.3.3. Autoimmune Diseases

- 8.3.4. Obstetrics and Gynecology

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Implantable Drug Delivery System Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Drug Infusion Pumps

- 9.1.2. Intraocular Drug Delivery Devices

- 9.1.3. Contraceptive Drug Delivery Devices

- 9.1.4. Stents

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Biodegradable Implants

- 9.2.2. Non-biodegradable Implants

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Oncology

- 9.3.2. Cardiovascular

- 9.3.3. Autoimmune Diseases

- 9.3.4. Obstetrics and Gynecology

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Implantable Drug Delivery System Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Drug Infusion Pumps

- 10.1.2. Intraocular Drug Delivery Devices

- 10.1.3. Contraceptive Drug Delivery Devices

- 10.1.4. Stents

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Biodegradable Implants

- 10.2.2. Non-biodegradable Implants

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Oncology

- 10.3.2. Cardiovascular

- 10.3.3. Autoimmune Diseases

- 10.3.4. Obstetrics and Gynecology

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DSM Biomedical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Terumo Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bayer AG*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3M Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Medtronic PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Delpor Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Allergan PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boston Scientific Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alcon Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Teleflex Incorporated

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bausch and Lomb Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Biotronik Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 DSM Biomedical

List of Figures

- Figure 1: Global Implantable Drug Delivery System Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Implantable Drug Delivery System Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Implantable Drug Delivery System Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Implantable Drug Delivery System Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 5: North America Implantable Drug Delivery System Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Implantable Drug Delivery System Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Implantable Drug Delivery System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Implantable Drug Delivery System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Implantable Drug Delivery System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Implantable Drug Delivery System Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: Europe Implantable Drug Delivery System Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Implantable Drug Delivery System Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 13: Europe Implantable Drug Delivery System Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Implantable Drug Delivery System Industry Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Implantable Drug Delivery System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Implantable Drug Delivery System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Implantable Drug Delivery System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Implantable Drug Delivery System Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Implantable Drug Delivery System Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Implantable Drug Delivery System Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 21: Asia Pacific Implantable Drug Delivery System Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Implantable Drug Delivery System Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: Asia Pacific Implantable Drug Delivery System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Implantable Drug Delivery System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Implantable Drug Delivery System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Implantable Drug Delivery System Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Implantable Drug Delivery System Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Implantable Drug Delivery System Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 29: Middle East and Africa Implantable Drug Delivery System Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Middle East and Africa Implantable Drug Delivery System Industry Revenue (undefined), by Application 2025 & 2033

- Figure 31: Middle East and Africa Implantable Drug Delivery System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East and Africa Implantable Drug Delivery System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Implantable Drug Delivery System Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Implantable Drug Delivery System Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 35: South America Implantable Drug Delivery System Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: South America Implantable Drug Delivery System Industry Revenue (undefined), by Technology 2025 & 2033

- Figure 37: South America Implantable Drug Delivery System Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: South America Implantable Drug Delivery System Industry Revenue (undefined), by Application 2025 & 2033

- Figure 39: South America Implantable Drug Delivery System Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: South America Implantable Drug Delivery System Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Implantable Drug Delivery System Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 7: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 13: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 23: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 24: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 25: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 33: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 34: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 35: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 40: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 41: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 42: Global Implantable Drug Delivery System Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Implantable Drug Delivery System Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Implantable Drug Delivery System Industry?

The projected CAGR is approximately 7.8%.

2. Which companies are prominent players in the Implantable Drug Delivery System Industry?

Key companies in the market include DSM Biomedical, Terumo Corporation, Bayer AG*List Not Exhaustive, 3M Company, Medtronic PLC, Delpor Inc, Allergan PLC, Boston Scientific Corporation, Alcon Inc, Teleflex Incorporated, Bausch and Lomb Inc, Biotronik Inc.

3. What are the main segments of the Implantable Drug Delivery System Industry?

The market segments include Product Type, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Minimally Invasive Procedures; Emergence of Novel Products; Increasing Prevalence of Chronic Diseases.

6. What are the notable trends driving market growth?

Drug Infusion Pumps Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices; Stringent Regulatory Requirements.

8. Can you provide examples of recent developments in the market?

In August 2022, Medtronic launched the drug-eluting coronary stent, the Onyx Frontier drug-eluting stent (DES), following CE Mark's approval. The Onyx Frontier DES offers an innovative delivery system and builds upon the acute performance and clinical data from the Resolute Onyx drug-eluting stent.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Implantable Drug Delivery System Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Implantable Drug Delivery System Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Implantable Drug Delivery System Industry?

To stay informed about further developments, trends, and reports in the Implantable Drug Delivery System Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence