Key Insights

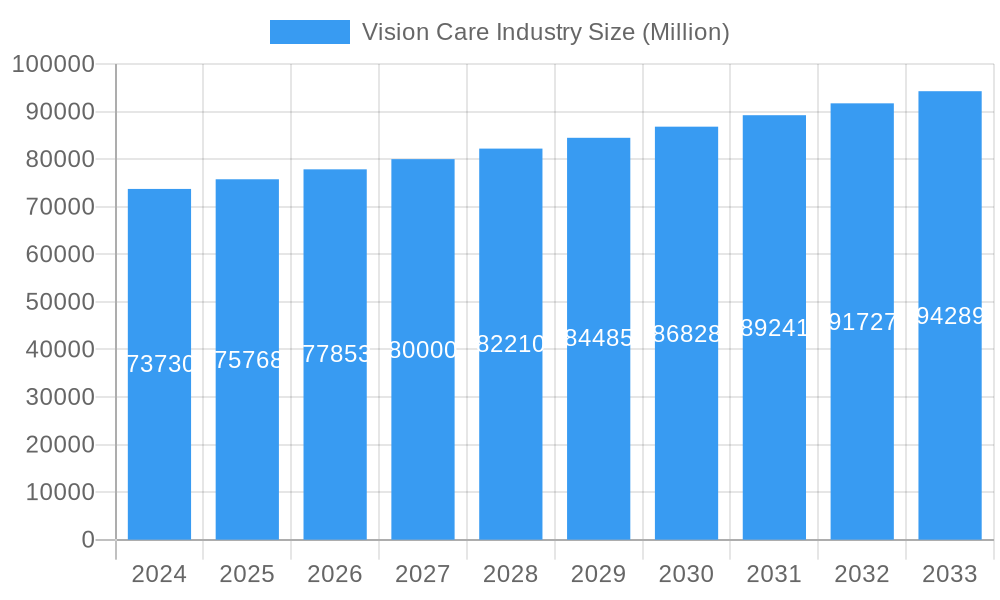

The global Vision Care Industry is poised for steady growth, driven by an increasing prevalence of eye disorders, rising awareness of preventative eye health, and advancements in diagnostic technologies. The market, valued at $73.73 billion in 2024, is projected to expand at a Compound Annual Growth Rate (CAGR) of 2.75% through 2033. This growth is largely fueled by the escalating demand for sophisticated vision screening tests and binocular testing devices, particularly within hospital and ambulatory surgical center settings. As populations age and digital screen usage intensifies, the incidence of refractive errors, cataracts, and glaucoma is expected to rise, consequently boosting the need for accurate and efficient diagnostic tools. Furthermore, a growing emphasis on early detection and management of visual impairments, especially in pediatric populations, is a significant contributor to market expansion. Investments in research and development for innovative ophthalmic instruments that offer greater precision and patient comfort are also playing a crucial role in shaping the market landscape.

Vision Care Industry Market Size (In Billion)

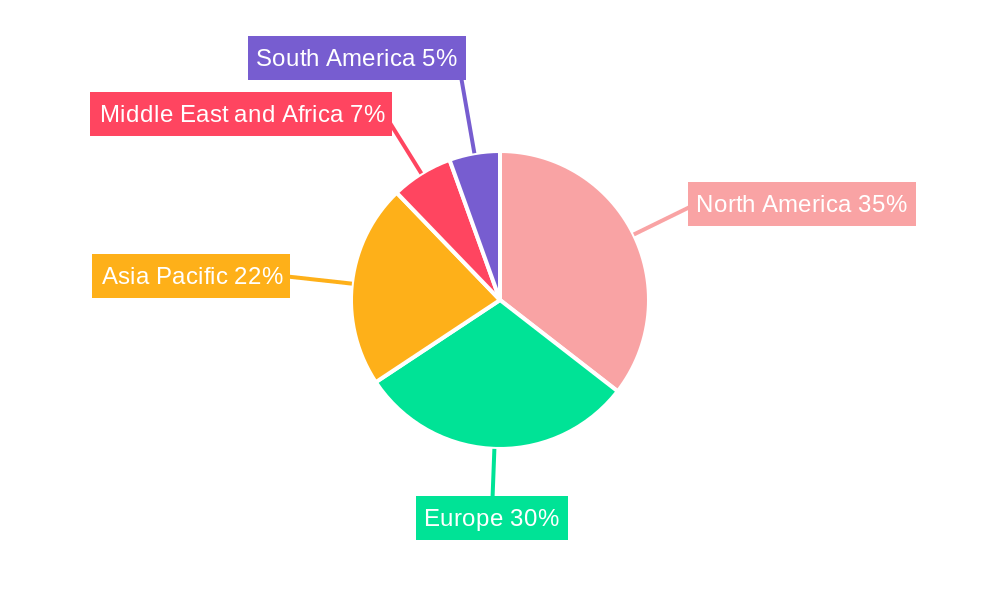

Despite the positive outlook, the industry faces certain restraints, including the high cost of advanced diagnostic equipment, which can limit adoption in resource-constrained regions, and a shortage of trained ophthalmic professionals. However, these challenges are being partially offset by the increasing accessibility of telehealth solutions for remote vision consultations and screenings, as well as the growing adoption of portable and user-friendly vision testing devices. The market is segmented by type, with Vision Screening Test, Binocular Testing, and Color Vision Testing emerging as key categories. End-users like Hospitals and Ambulatory Surgical Centers are leading the adoption of these technologies, reflecting a broader trend towards specialized eye care services. Geographically, North America and Europe currently dominate the market, owing to established healthcare infrastructures and higher healthcare spending, while the Asia Pacific region presents substantial growth opportunities driven by a burgeoning population and increasing healthcare expenditure.

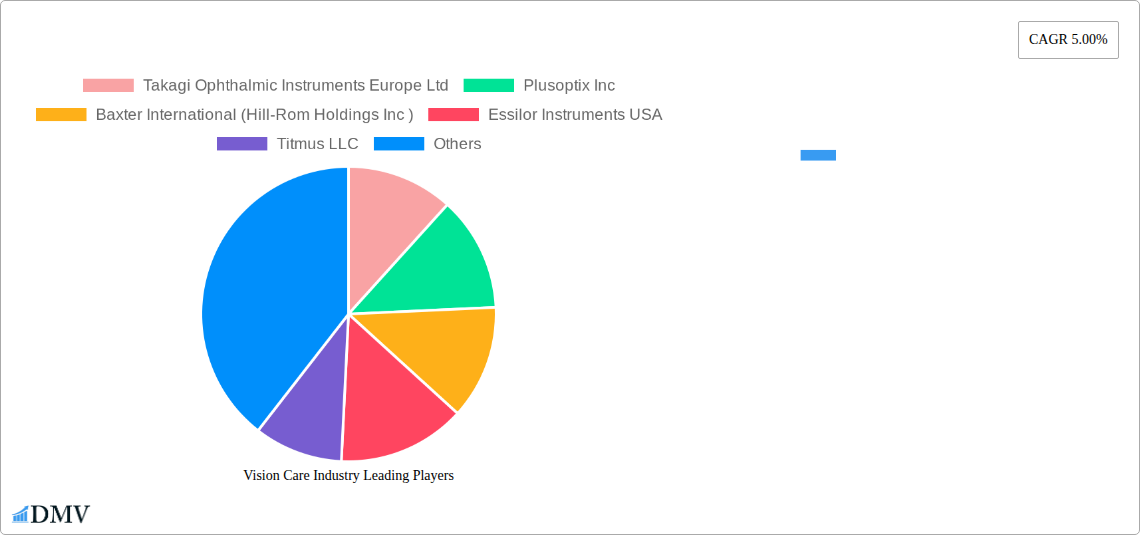

Vision Care Industry Company Market Share

Vision Care Industry Market Composition & Trends

The global Vision Care Industry is a dynamic and rapidly evolving market, projected to reach billions in value. This report delves into the intricate market composition, analyzing factors such as market concentration, innovation catalysts driving technological advancements, and the ever-changing regulatory landscapes that shape the industry. We assess the impact of substitute products, dissect end-user profiles including hospitals, ambulatory surgical centers, and other key stakeholders, and examine recent mergers and acquisitions (M&A) activities, which are critical for understanding market consolidation. With a market share distribution currently estimated to be highly competitive, the value of M&A deals is expected to escalate as larger players seek to acquire innovative technologies and expand their global footprint. Understanding these elements is crucial for navigating this complex ecosystem and capitalizing on its growth potential.

- Market Concentration: Fragmented with key players and emerging innovators.

- Innovation Catalysts: Driven by advancements in diagnostic technology and patient care.

- Regulatory Landscapes: Stringent quality and safety standards influence product development.

- Substitute Products: Limited direct substitutes for comprehensive vision diagnostic tools.

- End-User Profiles: Hospitals, Ambulatory Surgical Centers, Optometry Clinics, and Public Health Initiatives.

- M&A Activities: Strategic acquisitions aimed at portfolio expansion and technological integration.

- Estimated Market Share Distribution: Competitive landscape with significant growth potential for agile companies.

- M&A Deal Values: Expected to rise with increased focus on specialized vision technologies.

Vision Care Industry Industry Evolution

The Vision Care Industry has undergone a remarkable transformation, charting a significant growth trajectory from its historical period of 2019–2024, with robust projections extending through 2033. This evolution is fundamentally driven by a confluence of factors, primarily technological advancements and a noticeable shift in consumer demands. Historically, vision care was primarily reactive, focusing on correcting existing refractive errors. However, the paradigm has shifted towards proactive and preventative measures, spurred by the increasing awareness of the importance of early detection and management of various eye conditions, ranging from common refractive errors to more serious diseases like glaucoma and diabetic retinopathy.

Technological innovations have been the bedrock of this evolution. The introduction of sophisticated digital imaging systems, advanced diagnostic equipment, and AI-powered analytical tools has revolutionized how vision is assessed and treated. Devices capable of performing comprehensive eye examinations, including multimodal screening, retinal imaging, and anterior segment analysis, have become more accessible and efficient. This has not only improved diagnostic accuracy but also significantly reduced examination times, as exemplified by Visionix's second-generation VX 650, which features a "quick mode" that can halve screening time. The integration of artificial intelligence in analyzing imaging data is further enhancing early disease detection and personalized treatment plans.

Consumer demand has also played a pivotal role. There is a growing preference for non-invasive diagnostic procedures, faster turnaround times, and more personalized eye care solutions. Patients are increasingly seeking convenient and accessible vision care services, leading to the expansion of ambulatory surgical centers and specialized clinics. Furthermore, the rising prevalence of digital eye strain due to increased screen time has created a new segment of demand for solutions addressing this specific concern. Public health initiatives, such as school vision-screening campaigns, as demonstrated by the Dubai Health Authority’s efforts involving over 26,700 students, underscore the growing emphasis on early intervention and population-level eye health. The market is witnessing a surge in demand for advanced ophthalmic instruments that facilitate accurate, rapid, and cost-effective screening, thereby contributing to a substantial increase in the adoption rates of new technologies. The industry's evolution is thus characterized by a proactive, technologically driven, and patient-centric approach, promising sustained growth in the coming years.

Leading Regions, Countries, or Segments in Vision Care Industry

The Vision Screening Test segment within the Vision Care Industry is emerging as a dominant force, exhibiting exceptional growth and widespread adoption across key regions. This dominance is fueled by an increasing global emphasis on early detection of visual impairments, particularly in pediatric populations and among individuals at risk for chronic eye diseases. The Hospitals end-user segment is also a significant contributor to this growth, driven by the need for comprehensive diagnostic capabilities and the integration of advanced ophthalmic equipment into their patient care pathways.

Key Drivers for Dominance of Vision Screening Tests:

- Public Health Initiatives: Governments and health organizations worldwide are increasingly investing in widespread vision screening programs to address preventable vision loss. The six-month vision-screening campaign conducted by the Dubai Health Authority (DHA), involving over 26,700 students, exemplifies this trend. Such initiatives create a consistent demand for efficient and reliable vision screening tools.

- Technological Advancements: Innovations in portable and automated vision screening devices have made them more accessible and user-friendly. These advancements, including multimodal screeners with enhanced imaging capabilities like Visionix's VX 650, offer faster and more accurate results, driving adoption across various settings.

- Rising Prevalence of Eye Conditions: The increasing incidence of refractive errors, amblyopia, and other vision impairments, particularly in developing economies and among aging populations, necessitates early and regular screening.

- Cost-Effectiveness of Early Detection: Identifying vision problems at an early stage is significantly more cost-effective in terms of treatment and management, making screening tests a crucial investment for healthcare systems.

- Integration into Primary Care: Vision screening tests are increasingly being integrated into routine primary care check-ups, expanding their reach beyond specialized eye care settings.

The Hospitals segment's leading position is attributed to several factors. These institutions are at the forefront of adopting advanced medical technologies to provide comprehensive patient care. The growing volume of ophthalmic procedures and the trend towards consolidating diagnostic services within hospitals contribute to their significant market share. Furthermore, hospitals serve as key referral centers, necessitating advanced screening and diagnostic capabilities to manage a broad spectrum of eye conditions. The increasing number of ambulatory surgical centers also plays a crucial role, offering specialized and efficient outpatient eye care services, thereby driving demand for advanced vision screening and testing equipment. The strategic implementation of these tests within hospital settings ensures early intervention, leading to better patient outcomes and reduced long-term healthcare costs.

Vision Care Industry Product Innovations

Product innovation in the Vision Care Industry is characterized by the development of highly advanced and integrated diagnostic instruments. Leading companies are focusing on creating multimodal devices that combine multiple screening and diagnostic functionalities into a single unit, thereby enhancing efficiency and reducing examination time. Innovations such as Visionix's second-generation VX 650, an advanced anterior segment analyzer with multimodal imaging and a "quick mode" for reduced screening time, exemplify this trend. These innovations prioritize user-friendliness, portability, and AI-driven data analysis to improve diagnostic accuracy and personalize patient care. The focus is on devices that can detect a wider range of ocular conditions with greater precision, offering unique selling propositions through enhanced imaging resolution, faster processing speeds, and comprehensive diagnostic reports.

Propelling Factors for Vision Care Industry Growth

The Vision Care Industry is experiencing robust growth driven by several critical factors. Technologically, the continuous development of sophisticated ophthalmic diagnostic equipment, including AI-powered analyzers and advanced imaging systems, is a major catalyst. Economic factors, such as increasing disposable incomes in emerging economies and a growing awareness of the economic burden of untreated vision impairment, are also fueling demand. Regulatory support, in the form of government-backed vision screening programs and favorable reimbursement policies for diagnostic procedures, further propels market expansion. For instance, the emphasis on early detection in schools, like the Dubai DHA campaign, highlights the impact of public health-driven initiatives. These combined forces are creating a conducive environment for sustained growth in the vision care sector.

Obstacles in the Vision Care Industry Market

Despite its growth potential, the Vision Care Industry faces several obstacles. Regulatory challenges pose a significant hurdle, with stringent approval processes for new medical devices and evolving compliance standards in different regions. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of essential components and finished products. Furthermore, intense competitive pressures among established players and emerging innovators can lead to price wars and impact profit margins. The high cost of advanced diagnostic equipment can also be a barrier for smaller clinics and healthcare providers, particularly in developing markets, limiting widespread adoption. Addressing these restraints is crucial for unlocking the full potential of the vision care market.

Future Opportunities in Vision Care Industry

The future of the Vision Care Industry is brimming with exciting opportunities. The burgeoning demand for tele-ophthalmology and remote diagnostics presents a significant avenue for growth, particularly in underserved areas. Advancements in artificial intelligence and machine learning offer immense potential for developing more accurate and predictive diagnostic tools for early detection of eye diseases. The growing awareness of digital eye strain and the need for preventative solutions also opens up new market segments. Furthermore, the increasing global focus on preventative healthcare and population-level vision screening initiatives, especially in rapidly developing economies, will drive the demand for cost-effective and accessible vision care technologies.

Major Players in the Vision Care Industry Ecosystem

- Takagi Ophthalmic Instruments Europe Ltd

- Plusoptix Inc

- Baxter International (Hill-Rom Holdings Inc )

- Essilor Instruments USA

- Titmus LLC

- RODENSTOCK Instruments

- FIM Medical SAS

- Adaptica Srl

- Stereo Optical Company Inc

- Amplivox

- OCULUS Inc

Key Developments in Vision Care Industry Industry

- May 2023: The Public Health Protection Department of the Dubai Health Authority (DHA) completed a six-month-long vision-screening campaign in schools across Dubai. Over 26,700 students from various schools in Dubai participated in the basic vision tests (visual acuity) conducted by qualified optometrists from Al Jaber Optical's expertise team in collaboration with the DHA. This initiative highlights a significant push towards proactive vision health management in educational settings.

- March 2023: Visionix revealed its new multimodal screener device update with its second-generation VX 650. VX 650 is an advanced anterior segment analyzer with retinal imaging. The advanced wavefront-based aberrometer's "quick mode" and new capture flexibilities can significantly reduce the screening time by half, providing improved product efficiency. This development signifies a leap in diagnostic speed and comprehensive analysis capabilities for eye care professionals.

Strategic Vision Care Industry Market Forecast

The strategic forecast for the Vision Care Industry anticipates sustained and robust growth, propelled by an increasing global emphasis on preventative eye care and early disease detection. The integration of advanced technologies, including AI-driven diagnostics and multimodal imaging systems, will continue to redefine standards of care, enhancing both accuracy and efficiency. Opportunities lie in expanding tele-ophthalmology services to reach underserved populations and in developing solutions for the growing concern of digital eye strain. Furthermore, government-backed vision screening programs and growing healthcare expenditure in emerging economies are expected to be significant growth catalysts, solidifying the industry's trajectory towards a multi-billion dollar future and offering substantial market potential for innovative companies.

Vision Care Industry Segmentation

-

1. Type

- 1.1. Vision Screening Test

- 1.2. Binocular Testing

- 1.3. Color Vision Testing

- 1.4. Other Types

-

2. End-User

- 2.1. Hospitals

- 2.2. Ambulatory Surgical Centers

- 2.3. Other End-Users

Vision Care Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Vision Care Industry Regional Market Share

Geographic Coverage of Vision Care Industry

Vision Care Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Incidences of Eye Strain Disorder; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Hospital Segment is Expected to Witness a Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vision Care Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vision Screening Test

- 5.1.2. Binocular Testing

- 5.1.3. Color Vision Testing

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Hospitals

- 5.2.2. Ambulatory Surgical Centers

- 5.2.3. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Vision Care Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Vision Screening Test

- 6.1.2. Binocular Testing

- 6.1.3. Color Vision Testing

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Hospitals

- 6.2.2. Ambulatory Surgical Centers

- 6.2.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Vision Care Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Vision Screening Test

- 7.1.2. Binocular Testing

- 7.1.3. Color Vision Testing

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Hospitals

- 7.2.2. Ambulatory Surgical Centers

- 7.2.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Vision Care Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Vision Screening Test

- 8.1.2. Binocular Testing

- 8.1.3. Color Vision Testing

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Hospitals

- 8.2.2. Ambulatory Surgical Centers

- 8.2.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Vision Care Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Vision Screening Test

- 9.1.2. Binocular Testing

- 9.1.3. Color Vision Testing

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Hospitals

- 9.2.2. Ambulatory Surgical Centers

- 9.2.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Vision Care Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Vision Screening Test

- 10.1.2. Binocular Testing

- 10.1.3. Color Vision Testing

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Hospitals

- 10.2.2. Ambulatory Surgical Centers

- 10.2.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Takagi Ophthalmic Instruments Europe Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Plusoptix Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Baxter International (Hill-Rom Holdings Inc )

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Essilor Instruments USA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Titmus LLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RODENSTOCK Instruments*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 FIM Medical SAS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Adaptica Srl

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Stereo Optical Company Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amplivox

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 OCULUS Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Takagi Ophthalmic Instruments Europe Ltd

List of Figures

- Figure 1: Global Vision Care Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Vision Care Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Vision Care Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Vision Care Industry Revenue (undefined), by End-User 2025 & 2033

- Figure 5: North America Vision Care Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Vision Care Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Vision Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Vision Care Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Vision Care Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Vision Care Industry Revenue (undefined), by End-User 2025 & 2033

- Figure 11: Europe Vision Care Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Vision Care Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Vision Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Vision Care Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Pacific Vision Care Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Vision Care Industry Revenue (undefined), by End-User 2025 & 2033

- Figure 17: Asia Pacific Vision Care Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Vision Care Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Vision Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Vision Care Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Middle East and Africa Vision Care Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Vision Care Industry Revenue (undefined), by End-User 2025 & 2033

- Figure 23: Middle East and Africa Vision Care Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Middle East and Africa Vision Care Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Vision Care Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Vision Care Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: South America Vision Care Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Vision Care Industry Revenue (undefined), by End-User 2025 & 2033

- Figure 29: South America Vision Care Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 30: South America Vision Care Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Vision Care Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vision Care Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Vision Care Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 3: Global Vision Care Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Vision Care Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Vision Care Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 6: Global Vision Care Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Vision Care Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Vision Care Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 12: Global Vision Care Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Vision Care Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Vision Care Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 21: Global Vision Care Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Vision Care Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 29: Global Vision Care Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 30: Global Vision Care Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Vision Care Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 35: Global Vision Care Industry Revenue undefined Forecast, by End-User 2020 & 2033

- Table 36: Global Vision Care Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Vision Care Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vision Care Industry?

The projected CAGR is approximately 2.75%.

2. Which companies are prominent players in the Vision Care Industry?

Key companies in the market include Takagi Ophthalmic Instruments Europe Ltd, Plusoptix Inc, Baxter International (Hill-Rom Holdings Inc ), Essilor Instruments USA, Titmus LLC, RODENSTOCK Instruments*List Not Exhaustive, FIM Medical SAS, Adaptica Srl, Stereo Optical Company Inc, Amplivox, OCULUS Inc.

3. What are the main segments of the Vision Care Industry?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Incidences of Eye Strain Disorder; Technological Advancements.

6. What are the notable trends driving market growth?

Hospital Segment is Expected to Witness a Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices.

8. Can you provide examples of recent developments in the market?

May 2023: The Public Health Protection Department of the Dubai Health Authority (DHA) completed a six-month-long vision-screening campaign in schools across Dubai. Over 26,700 students from various schools in Dubai participated in the basic vision tests (visual acuity) conducted by qualified optometrists from Al Jaber Optical's expertise team in collaboration with the DHA.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vision Care Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vision Care Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vision Care Industry?

To stay informed about further developments, trends, and reports in the Vision Care Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence