Key Insights

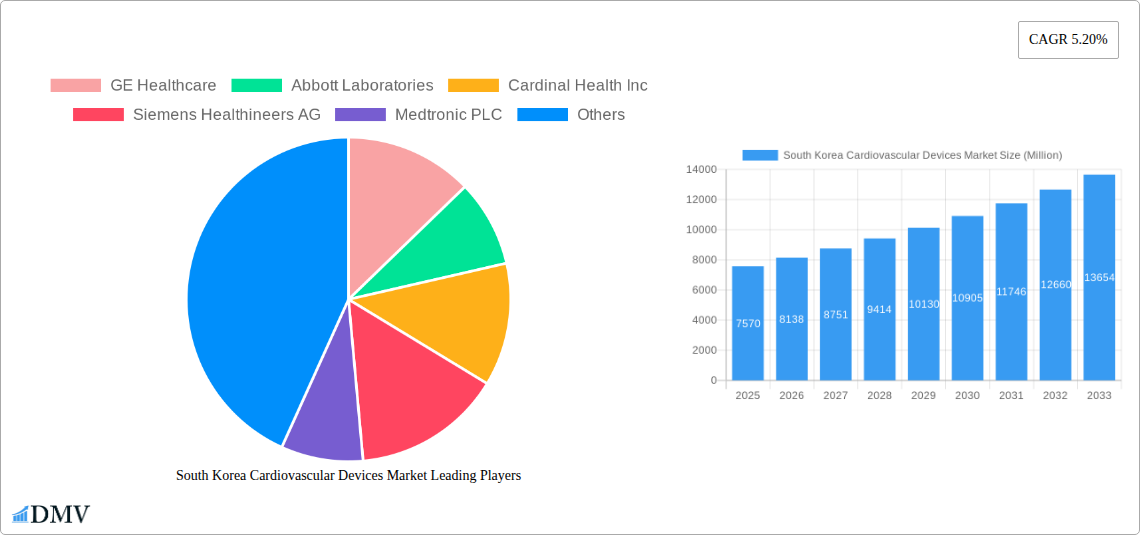

The South Korean cardiovascular devices market is poised for robust expansion, driven by an aging population and a growing prevalence of cardiovascular diseases. With a projected market size of $7.57 billion in 2025, the sector is expected to experience a significant compound annual growth rate (CAGR) of 7.5% through 2033. This upward trajectory is fueled by increasing demand for advanced treatments and diagnostic tools, particularly in areas like cardiac rhythm management, interventional cardiology, and prosthetic heart valves. The market's growth is further supported by advancements in minimally invasive surgical techniques and the wider adoption of sophisticated cardiac assist devices, reflecting a shift towards more effective and patient-centric healthcare solutions. Furthermore, a heightened awareness of cardiovascular health and proactive screening initiatives contribute to the sustained demand for a wide array of cardiovascular devices, from pacemakers and defibrillators to complex stenting solutions.

South Korea Cardiovascular Devices Market Market Size (In Billion)

The market's segmentation reveals a strong emphasis on both the types of devices and the underlying technologies. Within the 'By Type' segment, Cardiac Rhythm Management Devices, Interventional Cardiac Devices, and Prosthetics (Artificial) Heart Valves are anticipated to witness substantial growth due to their critical role in managing chronic heart conditions and improving patient outcomes. Similarly, the 'By Technology' segment, with a focus on Minimally Invasive Cardiac Surgery and Cardiac Assist Devices, highlights the trend towards less invasive procedures that offer faster recovery times and reduced patient trauma. Key industry players such as Medtronic PLC, Abbott Laboratories, and Boston Scientific Corporation are at the forefront of innovation, continuously introducing cutting-edge technologies that cater to the evolving needs of the South Korean healthcare system and its patient demographic. The continuous investment in research and development by these companies, coupled with supportive government initiatives aimed at enhancing cardiovascular care, will further propel the market forward.

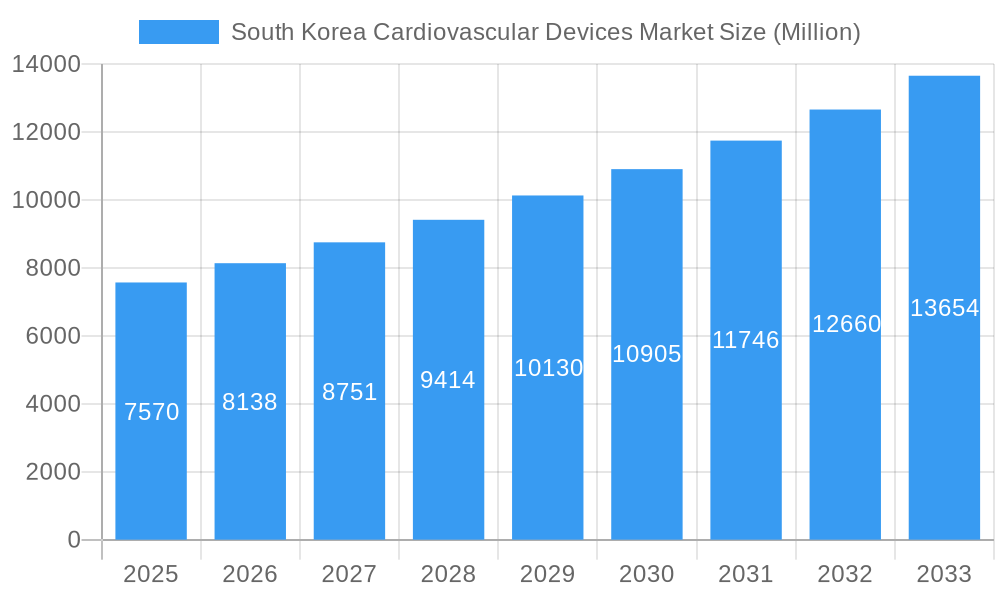

South Korea Cardiovascular Devices Market Company Market Share

This in-depth report provides a detailed examination of the South Korean cardiovascular devices market, a critical and rapidly evolving sector within the nation's healthcare industry. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this analysis delves into market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, and the key players shaping this dynamic landscape.

The report leverages cutting-edge market intelligence and extensive primary and secondary research to deliver actionable insights for stakeholders including device manufacturers, healthcare providers, investors, and regulatory bodies. With an estimated market size poised for significant growth, driven by an aging population, rising prevalence of cardiovascular diseases, and continuous technological advancements, understanding the nuances of this market is paramount. Our analysis focuses on key segments such as Cardiac Rhythm Management Devices, Interventional Cardiac Devices, and Prosthetic Heart Valves, alongside emerging technologies like AI-powered diagnostics and minimally invasive surgical techniques.

Keywords: South Korea Cardiovascular Devices Market, Cardiac Devices, Heart Valve Market, Stent Market, Pacemaker Market, ICD Market, Cardiovascular Technology, Medical Devices South Korea, Healthcare Market Analysis, Cardiac Rhythm Management, Interventional Cardiology, Minimally Invasive Cardiac Surgery, Cardiovascular Devices Forecast, Medical AI South Korea.

South Korea Cardiovascular Devices Market Market Composition & Trends

The South Korean cardiovascular devices market exhibits a moderately concentrated landscape, with a few key global players holding substantial market share, complemented by a growing number of innovative domestic companies. Innovation catalysts are primarily driven by the nation's robust R&D infrastructure, government initiatives supporting medical technology, and a highly skilled workforce. The regulatory landscape, governed by the Ministry of Food and Drug Safety (MFDS), is progressively aligning with global standards, fostering both innovation and market access. Substitute products, while present in the form of less invasive treatments or pharmaceutical interventions, are increasingly being superseded by advanced cardiovascular devices offering superior patient outcomes. End-user profiles are diverse, encompassing hospitals, specialized cardiac centers, and, with the advent of portable devices, individual patients. Merger and acquisition (M&A) activities are anticipated to increase as larger entities seek to acquire innovative technologies and expand their market reach, with estimated M&A deal values projected to reach into the billions of dollars over the forecast period. Market share distribution currently sees leading players dominating specific device categories.

- Market Concentration: Moderately concentrated, with established global players and emerging local innovators.

- Innovation Catalysts: Strong R&D, government support, skilled workforce, and increasing healthcare expenditure.

- Regulatory Landscape: MFDS oversight, with increasing alignment to international standards.

- Substitute Products: Traditional therapies and less invasive interventions; growing shift towards advanced devices.

- End-User Profiles: Hospitals, cardiac centers, clinics, and increasingly, home healthcare.

- M&A Activities: Expected to rise, driven by strategic acquisitions for technology and market expansion.

South Korea Cardiovascular Devices Market Industry Evolution

The South Korean cardiovascular devices market has witnessed a remarkable evolution, characterized by a consistent upward trajectory in growth rates and an accelerating adoption of sophisticated technologies. Historically, the market was dominated by imported devices, but sustained investment in domestic research and development has fostered a vibrant ecosystem of local manufacturers contributing significantly to market expansion. The prevalence of cardiovascular diseases, fueled by an aging demographic and lifestyle factors, has created a perpetual demand for advanced treatment solutions, thereby propelling market growth. Technological advancements have been a cornerstone of this evolution, with a discernible shift towards minimally invasive procedures, smart implantable devices, and AI-driven diagnostic tools. Cardiopulmonary bypass products, historically essential for open-heart surgeries, are now complemented by advanced cardiac assist devices and minimally invasive techniques that reduce recovery times and improve patient outcomes. The adoption of valve prosthesis and repair technologies has seen significant uptake, driven by an increasing number of elderly patients requiring complex interventions.

The market has moved from basic replacement devices to highly sophisticated, data-driven solutions. For instance, the integration of artificial intelligence in cardiac monitoring and diagnostics, as exemplified by VUNO's approval of their personal ECG equipment, Hativ Pro, signifies a leap towards personalized and accessible cardiac care. Furthermore, industry developments such as Osstem Implant's strategic ramp-up of its cardiac stent production base highlight the growing self-sufficiency and competitive prowess of domestic players. Growth rates in this sector have consistently outpaced general healthcare market growth, often registering double-digit figures in specific device segments. This sustained expansion is further supported by government initiatives aimed at fostering innovation and ensuring the availability of cutting-edge medical technologies for its citizens. The continuous refinement of implantable cardioverter defibrillators (ICDs) and pacemakers, offering longer battery life and enhanced diagnostic capabilities, reflects this drive towards superior patient management and disease prevention. The overall market size is projected to expand from its current estimated value of billions to tens of billions of dollars by 2033, driven by both increased unit sales and the introduction of higher-value, technologically advanced devices. The emphasis on early detection, proactive management, and improved quality of life for patients with cardiovascular conditions will continue to steer the industry's growth.

Leading Regions, Countries, or Segments in South Korea Cardiovascular Devices Market

Within the South Korean cardiovascular devices market, Interventional Cardiac Devices stand out as a dominant and rapidly expanding segment, demonstrating significant growth potential across the forecast period. This dominance is fueled by a confluence of factors including an aging population, the increasing incidence of coronary artery disease, and a strong preference for minimally invasive procedures that offer faster recovery times and reduced patient trauma. Within the Interventional Cardiac Devices segment, Stents represent a particularly strong sub-segment, driven by ongoing innovation in drug-eluting stent technology and the development of bioresorbable scaffolds. Cardiac Angioplasty Devices, including balloons and catheters, also play a crucial role in this segment's growth, supporting the widespread use of percutaneous coronary intervention (PCI).

The appeal of interventional cardiology is further amplified by technological advancements that allow for more complex procedures to be performed on a wider range of patients. Minimally Invasive Cardiac Surgery techniques, a key technology within this segment, are becoming increasingly standard, reducing the need for traditional open-heart surgery. Furthermore, the growing adoption of advanced valve prosthesis and repair technologies, such as transcatheter aortic valve implantation (TAVI), contributes significantly to the segment's market leadership. Investment trends within this segment are robust, with both domestic and international players channeling substantial capital into research, development, and manufacturing. Regulatory support from the MFDS has also been instrumental, with a streamlined approval process for innovative interventional devices encouraging market entry.

Key Drivers of Dominance in Interventional Cardiac Devices:

- Aging Population and Disease Prevalence: Increased incidence of cardiovascular diseases necessitates advanced interventional treatments.

- Technological Advancements: Development of drug-eluting stents, bioresorbable scaffolds, and sophisticated angioplasty devices.

- Minimally Invasive Procedures: Growing patient and physician preference for less invasive interventions leading to faster recovery.

- Investment Trends: Significant capital infusion into R&D and manufacturing of interventional devices.

- Regulatory Support: Favorable regulatory environment for innovative interventional technologies.

- Cost-Effectiveness: In the long run, minimally invasive procedures can be more cost-effective due to reduced hospital stays and complications.

- Growing Physician Expertise: Increased training and proficiency of cardiologists in performing complex interventional procedures.

The segment's growth is further bolstered by its direct impact on improving patient outcomes and quality of life, making it a focal point for healthcare providers and payers alike. The continuous innovation in this space ensures that South Korea remains at the forefront of cardiovascular care.

South Korea Cardiovascular Devices Market Product Innovations

The South Korean cardiovascular devices market is characterized by a relentless pursuit of product innovation, focusing on enhancing patient outcomes, reducing invasiveness, and improving device longevity. Recent advancements include the development of next-generation drug-eluting stents with improved elution profiles and reduced thrombogenicity, alongside bioresorbable vascular scaffolds that offer the potential for complete degradation over time. Innovations in cardiac rhythm management include miniaturized pacemakers with extended battery life and advanced diagnostic capabilities, as well as sophisticated implantable cardioverter defibrillators (ICDs) with remote monitoring features, allowing for proactive patient management. Prosthetic heart valves are seeing advancements in transcatheter technologies, enabling less invasive implantation with improved hemodynamic performance and durability. The application of artificial intelligence in diagnostic imaging and predictive analytics for cardiovascular disease is also a burgeoning area, paving the way for earlier detection and personalized treatment strategies. These innovations are driven by a commitment to patient-centric care and a desire to address unmet clinical needs, positioning South Korea as a leader in cardiovascular device technology.

Propelling Factors for South Korea Cardiovascular Devices Market Growth

Several key factors are propelling the growth of the South Korean cardiovascular devices market. The nation's rapidly aging population is a primary driver, leading to an increased prevalence of cardiovascular diseases and, consequently, a higher demand for advanced diagnostic and therapeutic devices. Technological innovation, supported by robust government funding and a strong R&D ecosystem, consistently introduces more sophisticated and effective cardiovascular solutions. Economic factors, including rising disposable incomes and increasing healthcare expenditure, enable greater access to these advanced medical technologies for patients. Furthermore, supportive regulatory frameworks and government initiatives aimed at promoting the medical device industry, such as the aforementioned Osstem Implant's expansion, foster a conducive environment for growth and market penetration. The growing awareness among the populace regarding cardiovascular health and the benefits of early detection and intervention also plays a crucial role.

Obstacles in the South Korea Cardiovascular Devices Market Market

Despite its promising growth, the South Korean cardiovascular devices market faces certain obstacles. Stringent regulatory approval processes, while ensuring patient safety, can sometimes lead to extended timelines for new product launches. The high cost of some advanced cardiovascular devices can pose a barrier to widespread adoption, particularly for public healthcare systems and lower-income populations. Intense competition from both established global players and emerging domestic manufacturers can lead to pricing pressures and market fragmentation. Supply chain disruptions, as experienced globally, can also impact the availability and cost of raw materials and finished products. Additionally, the need for continuous training and education for healthcare professionals to effectively utilize the latest complex cardiovascular technologies presents an ongoing challenge.

Future Opportunities in South Korea Cardiovascular Devices Market

The future of the South Korean cardiovascular devices market is ripe with opportunities. The burgeoning field of digital health and AI-driven cardiovascular diagnostics presents a significant avenue for growth, offering personalized monitoring and predictive insights. The increasing demand for home-use cardiovascular monitoring devices, fueled by the COVID-19 pandemic and a preference for remote care, opens new market segments. Expansion into emerging Asian markets, leveraging South Korea's technological expertise and established manufacturing capabilities, offers substantial international growth potential. Furthermore, ongoing advancements in regenerative medicine and biomaterials for cardiovascular applications hold promise for entirely new categories of therapeutic devices. The development of more affordable and accessible versions of existing advanced technologies will also unlock new patient populations and drive market expansion.

Major Players in the South Korea Cardiovascular Devices Market Ecosystem

- GE Healthcare

- Abbott Laboratories

- Cardinal Health Inc

- Siemens Healthineers AG

- Medtronic PLC

- B Braun Melsungen AG

- Canon Medical Systems Corporation

- Boston Scientific Corporation

- Integer Holdings Corporation

- St Jude Medical Inc

Key Developments in South Korea Cardiovascular Devices Market Industry

- September 2022: Osstem Implant reported the relocation of its unlisted subsidiary Osstem Cardiotec's headquarters and ramp-up to command the largest production base for cardiac stent products in Korea.

- August 2022: VUNO, a medical AI company, won approval from the South Korean Ministry of Food and Drug Safety for their personal ECG equipment. The portable medical device, called Hativ Pro, merely measures a user's heart rate and delivers the data to a connected mobile phone app.

Strategic South Korea Cardiovascular Devices Market Market Forecast

The strategic forecast for the South Korean cardiovascular devices market anticipates sustained and robust growth over the coming decade, driven by a powerful combination of demographic shifts, technological innovation, and supportive healthcare policies. The increasing prevalence of cardiovascular diseases among the aging population will continue to be a primary demand generator, necessitating advanced treatment and management solutions. Investments in R&D by both domestic and international players will yield next-generation devices, particularly in interventional cardiology and cardiac rhythm management, further stimulating market expansion. The growing adoption of AI and digital health technologies in cardiovascular care presents a significant opportunity for market leaders to introduce integrated solutions that enhance patient monitoring, diagnosis, and treatment efficacy. Economic growth and rising healthcare expenditure will ensure greater accessibility to these advanced medical devices, propelling market value into the billions. The strategic focus on improving patient outcomes and reducing healthcare burdens will further underpin the market's upward trajectory.

South Korea Cardiovascular Devices Market Segmentation

-

1. Cardiovascular Device

-

1.1. By Type

- 1.1.1. Cardiac Rhythm Management Devices

- 1.1.2. Interventional Cardiac Devices

- 1.1.3. Automated External Defibrillators (AED)

- 1.1.4. Cardiac Ablation Catheters

- 1.1.5. Cardiac Pacemakers

- 1.1.6. Cardiac Angioplasty Devices

- 1.1.7. Implantable Cardioverter Defibrillators (ICD)

- 1.1.8. Prosthetics (Artificial) Heart Valves

- 1.1.9. Stents

- 1.1.10. Ventricular Assist Devices

-

1.2. By Technology

- 1.2.1. Cardiopulmonary Bypass Products

- 1.2.2. Minimally Invasive Cardiac Surgery

- 1.2.3. Valve Prosthesis and Repair

- 1.2.4. Cardiac Assist Devices

-

1.1. By Type

South Korea Cardiovascular Devices Market Segmentation By Geography

- 1. South Korea

South Korea Cardiovascular Devices Market Regional Market Share

Geographic Coverage of South Korea Cardiovascular Devices Market

South Korea Cardiovascular Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Cardiovascular Diseases; Increased Preference for Minimally Invasive Procedures

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Policies and Product Recalls

- 3.4. Market Trends

- 3.4.1. Cardiac Pacemakers Expected to Witness Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Cardiovascular Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cardiovascular Device

- 5.1.1. By Type

- 5.1.1.1. Cardiac Rhythm Management Devices

- 5.1.1.2. Interventional Cardiac Devices

- 5.1.1.3. Automated External Defibrillators (AED)

- 5.1.1.4. Cardiac Ablation Catheters

- 5.1.1.5. Cardiac Pacemakers

- 5.1.1.6. Cardiac Angioplasty Devices

- 5.1.1.7. Implantable Cardioverter Defibrillators (ICD)

- 5.1.1.8. Prosthetics (Artificial) Heart Valves

- 5.1.1.9. Stents

- 5.1.1.10. Ventricular Assist Devices

- 5.1.2. By Technology

- 5.1.2.1. Cardiopulmonary Bypass Products

- 5.1.2.2. Minimally Invasive Cardiac Surgery

- 5.1.2.3. Valve Prosthesis and Repair

- 5.1.2.4. Cardiac Assist Devices

- 5.1.1. By Type

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Cardiovascular Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GE Healthcare

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abbott Laboratories

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cardinal Health Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens Healthineers AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 B Braun Melsungen AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Canon Medical Systems Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Scientific Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Integer Holdings Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 St Jude Medical Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GE Healthcare

List of Figures

- Figure 1: South Korea Cardiovascular Devices Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South Korea Cardiovascular Devices Market Share (%) by Company 2025

List of Tables

- Table 1: South Korea Cardiovascular Devices Market Revenue undefined Forecast, by Cardiovascular Device 2020 & 2033

- Table 2: South Korea Cardiovascular Devices Market Volume K Unit Forecast, by Cardiovascular Device 2020 & 2033

- Table 3: South Korea Cardiovascular Devices Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: South Korea Cardiovascular Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: South Korea Cardiovascular Devices Market Revenue undefined Forecast, by Cardiovascular Device 2020 & 2033

- Table 6: South Korea Cardiovascular Devices Market Volume K Unit Forecast, by Cardiovascular Device 2020 & 2033

- Table 7: South Korea Cardiovascular Devices Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: South Korea Cardiovascular Devices Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Cardiovascular Devices Market?

The projected CAGR is approximately 7.5%.

2. Which companies are prominent players in the South Korea Cardiovascular Devices Market?

Key companies in the market include GE Healthcare, Abbott Laboratories, Cardinal Health Inc, Siemens Healthineers AG, Medtronic PLC, B Braun Melsungen AG, Canon Medical Systems Corporation, Boston Scientific Corporation, Integer Holdings Corporation, St Jude Medical Inc.

3. What are the main segments of the South Korea Cardiovascular Devices Market?

The market segments include Cardiovascular Device.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Cardiovascular Diseases; Increased Preference for Minimally Invasive Procedures.

6. What are the notable trends driving market growth?

Cardiac Pacemakers Expected to Witness Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Policies and Product Recalls.

8. Can you provide examples of recent developments in the market?

September 2022: Osstem Implant reported the relocation of its unlisted subsidiary Osstem Cardiotec's headquarters and ramp-up to command the largest production base for cardiac stent products in Korea.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Cardiovascular Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Cardiovascular Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Cardiovascular Devices Market?

To stay informed about further developments, trends, and reports in the South Korea Cardiovascular Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence