Key Insights

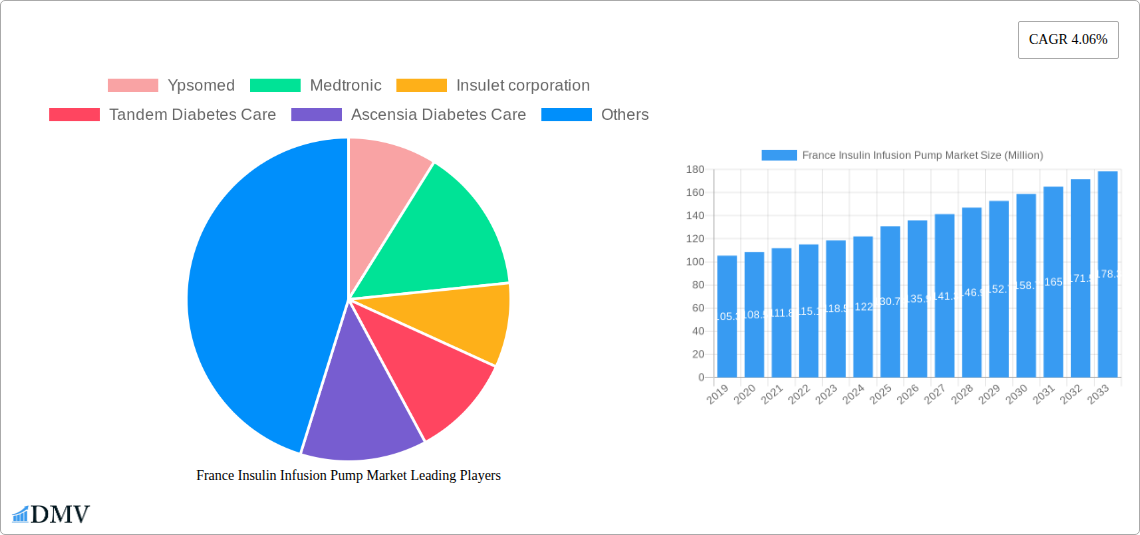

The French insulin infusion pump market is poised for substantial growth, projected to reach $130.74 million by 2025, with a healthy Compound Annual Growth Rate (CAGR) of 4.06% through 2033. This expansion is primarily driven by increasing diabetes prevalence in France, a growing awareness of advanced diabetes management solutions, and favorable reimbursement policies for insulin pumps. The market is witnessing a significant shift towards user-friendly and technologically advanced devices, including closed-loop systems and smart insulin pens, which enhance patient convenience and glycemic control. Furthermore, an aging population, a common demographic trend in Europe, contributes to the rising incidence of type 2 diabetes, thereby bolstering demand for insulin infusion pumps. The French healthcare system's proactive approach to managing chronic diseases, coupled with a strong emphasis on patient education and support programs for diabetes care, is also a key enabler for market growth. Innovations in pump technology, focusing on miniaturization, improved accuracy, and seamless integration with continuous glucose monitoring (CGM) systems, are expected to further accelerate adoption rates.

France Insulin Infusion Pump Market Market Size (In Million)

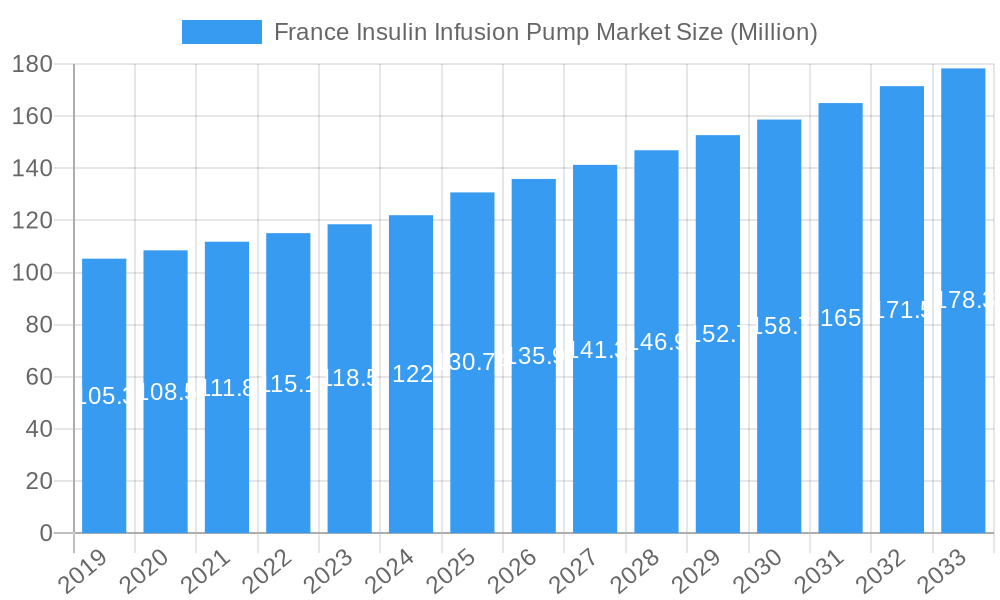

The insulin infusion pump market in France is segmented into Insulin Pump Devices, Infusion Sets, and Reservoirs. Within these, Insulin Pump Devices are anticipated to capture the largest market share, driven by continuous innovation and the introduction of next-generation pumps. Key market players such as Ypsomed, Medtronic, Insulet Corporation, Tandem Diabetes Care, and Ascensia Diabetes Care are actively investing in research and development to introduce sophisticated products. These companies are focusing on expanding their distribution networks and forging strategic partnerships to increase market penetration. Emerging trends include the development of wearable and discreet insulin delivery systems, alongside advancements in artificial intelligence for predictive insulin dosing. However, the market faces some restraints, including the initial high cost of insulin pump therapy and the need for specialized training for both healthcare professionals and patients, which can be a barrier to widespread adoption, especially in certain patient demographics. Nevertheless, the overall outlook for the France insulin infusion pump market remains robust, supported by ongoing technological advancements and a growing commitment to improving diabetes care outcomes.

France Insulin Infusion Pump Market Company Market Share

France Insulin Infusion Pump Market: Comprehensive Growth Analysis, Emerging Technologies, and Future Outlook (2019–2033)

This in-depth report delves into the dynamic France insulin infusion pump market, providing a strategic forecast and analysis of key trends, innovations, and growth drivers. Examining the period from 2019 to 2033, with a base and estimated year of 2025, this research offers stakeholders crucial insights into the evolving landscape of diabetes management solutions in France. The report covers market composition, industry evolution, leading segments, product innovations, growth propellants, obstacles, future opportunities, major players, and key industry developments.

France Insulin Infusion Pump Market Market Composition & Trends

The France insulin infusion pump market is characterized by a moderate to high level of concentration, with a few key players dominating market share. Innovation is a significant catalyst, driven by continuous advancements in device miniaturization, connectivity, and user-friendliness. Regulatory frameworks, overseen by bodies like the HAS (Haute Autorité de Santé), play a crucial role in product approval and reimbursement, influencing market access and adoption rates. The presence of substitute products, such as advanced insulin pens and emerging smart insulin delivery systems, necessitates ongoing innovation from infusion pump manufacturers. End-user profiles are diverse, encompassing pediatric, adult, and elderly populations with Type 1 and Type 2 diabetes, each with specific needs and preferences. Mergers and acquisitions (M&A) activities are strategic maneuvers for expanding product portfolios and market reach. For instance, an estimated XXX million in M&A deal values is projected to reshape market dynamics. Key trends include the increasing demand for closed-loop systems, remote monitoring capabilities, and personalized diabetes management.

- Market Share Distribution: Leading players collectively hold approximately 60-70% of the market share.

- Innovation Drivers: Miniaturization, AI-powered algorithms for glucose prediction, enhanced connectivity (Bluetooth, Wi-Fi), and user-centric design.

- Regulatory Landscape: Strict CE marking requirements, reimbursement policies influenced by health technology assessments, and data privacy regulations (GDPR).

- Substitute Products: Advanced pen injectors with integrated glucose monitoring, emerging smart inhalers for insulin delivery.

- End-User Profiles:

- Pediatric Patients: Emphasis on discretion, ease of use, and minimizing disruption to daily activities.

- Adults: Focus on convenience, autonomy, and integration with lifestyle.

- Elderly Patients: Prioritization of safety features, simplicity of operation, and reliable support.

- M&A Activities: Strategic acquisitions to gain access to novel technologies, expand distribution networks, and consolidate market position.

France Insulin Infusion Pump Market Industry Evolution

The France insulin infusion pump market has witnessed a remarkable evolution driven by a confluence of technological advancements, shifting patient demographics, and an increasing awareness of proactive diabetes management. Over the study period from 2019 to 2033, the market has transitioned from basic insulin delivery devices to sophisticated, connected systems that empower individuals with diabetes to achieve better glycemic control and improved quality of life. Early in the historical period (2019-2024), the market was primarily characterized by the adoption of traditional tethered pumps, which offered significant advantages over multiple daily injections by providing basal insulin delivery and on-demand boluses. However, a discernible shift began to emerge with the introduction and subsequent refinement of tubeless and patch pumps, offering enhanced discretion and mobility for users. This technological leap was spurred by a growing demand for less obtrusive and more integrated diabetes management solutions.

The forecast period (2025-2033) is poised to witness accelerated growth, driven by the increasing prevalence of diabetes in France and the growing acceptance of advanced diabetes technologies by both healthcare professionals and patients. The integration of continuous glucose monitoring (CGM) with insulin infusion pumps to create semi-closed-loop and eventually fully closed-loop systems represents a pivotal development. These advanced systems utilize sophisticated algorithms to automatically adjust insulin delivery based on real-time glucose readings, significantly reducing the burden of manual carbohydrate counting and bolus calculations, and minimizing the risk of hypo- and hyperglycemia. The adoption rate for these integrated systems is projected to surge as their benefits in improving glycemic control, reducing HbA1c levels, and enhancing patient satisfaction become more widely recognized and documented. Furthermore, the increasing focus on personalized medicine and the desire for data-driven insights into diabetes management are fueling the demand for connected devices that can seamlessly sync with smartphones and electronic health records. The regulatory environment in France, while rigorous, is also evolving to accommodate these innovative technologies, with ongoing efforts to streamline approval processes and ensure equitable reimbursement policies, thereby fostering wider market penetration. The estimated market growth rate for the France insulin infusion pump market is projected to be a robust xx% annually during the forecast period, a testament to the sustained innovation and increasing patient-centricity within the sector.

Leading Regions, Countries, or Segments in France Insulin Infusion Pump Market

Within the France insulin infusion pump market, the primary segmentation revolves around the core components of the infusion system: Insulin Pump Device, Infusion Set, and Reservoir. While the Insulin Pump Device segment currently holds the dominant market share due to its inherent value and technological sophistication, the Infusion Set and Reservoir segments are experiencing significant growth, driven by the increasing installed base of pumps and the recurring nature of their replacement.

Insulin Pump Device: This segment is the most lucrative, encompassing the core pump unit that houses the insulin, motor, and control circuitry. Its dominance is attributed to its higher price point and its role as the central component of any infusion therapy. Key drivers for its continued leadership include:

- Technological Innovation: Continuous development of smaller, smarter, and more user-friendly pump designs.

- Closed-Loop System Integration: The increasing demand for automated insulin delivery systems directly impacts the sales of advanced pump devices.

- Reimbursement Policies: Favorable reimbursement schemes in France for advanced insulin pumps encourage adoption.

- Investment Trends: Significant R&D investments by major players are focused on enhancing pump functionalities.

- Market Penetration: Growing awareness and acceptance of pump therapy among healthcare providers and patients.

Infusion Set: This segment comprises the tubing, cannula, and adhesive components that connect the pump to the body. While not as high-value as the pump itself, it is a critical consumable with a high replacement rate, making it a substantial contributor to the overall market revenue. The growth in this segment is propelled by:

- Recurring Purchase Cycle: Patients require regular replacement of infusion sets (typically every 2-3 days).

- Variety and Specialization: Development of different infusion set types to cater to diverse patient needs, such as varying cannula lengths and materials.

- Comfort and Discretion: Innovations aimed at improving user comfort, reducing skin irritation, and offering more discreet wear options.

- Connectivity Enhancements: Some advanced infusion sets are incorporating sensors for improved performance monitoring.

Reservoir (Insulin Cartridge/Vial): This segment represents the container that holds the insulin for the pump. Similar to infusion sets, reservoirs are consumables that are replaced regularly. Its growth is directly linked to the overall pump user base. Factors contributing to its importance include:

- Insulin Compatibility: A wide range of insulin types can be used, catering to different patient prescriptions.

- Ease of Filling and Replacement: Manufacturers focus on user-friendly designs for refilling or replacing reservoirs.

- Capacity and Longevity: Development of reservoirs with varying capacities to suit different daily insulin needs.

Geographically, while this report focuses on the entire France market, it's important to note that larger metropolitan areas and regions with higher concentrations of specialized diabetes clinics and research institutions tend to exhibit higher adoption rates for advanced insulin infusion pump technologies. Regulatory support and the presence of leading healthcare providers significantly influence regional market dynamics.

France Insulin Infusion Pump Market Product Innovations

Recent product innovations in the France insulin infusion pump market are focused on enhancing user experience, improving glycemic control, and increasing system connectivity. Companies are investing heavily in developing smaller, more discreet, and tubeless pump designs that integrate seamlessly into users' daily lives. Furthermore, advancements in algorithms for automated insulin delivery (AID) systems are a key area of innovation, allowing for more precise basal and bolus insulin adjustments based on real-time glucose data from connected CGMs. Many new devices boast intuitive user interfaces, smartphone integration for remote monitoring and control, and enhanced data logging capabilities for better therapy management. Performance metrics such as improved time-in-range (TIR) for glucose levels, reduced hypoglycemia events, and increased patient satisfaction are the ultimate indicators of successful product innovation.

Propelling Factors for France Insulin Infusion Pump Market Growth

The France insulin infusion pump market growth is being propelled by several key factors. The increasing prevalence of diabetes in France, driven by lifestyle changes and an aging population, creates a larger pool of potential users. Technological advancements, particularly in the development of automated insulin delivery (AID) systems and integrated continuous glucose monitoring (CGM) solutions, are making pump therapy more effective and user-friendly. Furthermore, favorable reimbursement policies and growing awareness among healthcare professionals and patients regarding the benefits of pump therapy over multiple daily injections are significant drivers. Finally, the rising demand for personalized and convenient diabetes management solutions further fuels market expansion.

Obstacles in the France Insulin Infusion Pump Market Market

Despite its promising growth, the France insulin infusion pump market faces several obstacles. The high initial cost of insulin infusion pumps and associated consumables can be a significant barrier to adoption for some patient populations. Stringent regulatory approval processes for new devices and software updates can lead to delays in market entry. While improving, patient and healthcare provider education on the effective use and benefits of advanced pump technologies remains crucial. Additionally, potential supply chain disruptions for critical components and the need for ongoing technical support for complex systems can pose challenges to consistent market access and user satisfaction.

Future Opportunities in France Insulin Infusion Pump Market

The future of the France insulin infusion pump market is ripe with opportunities. The continued development and widespread adoption of artificial pancreas (closed-loop) systems represent a major growth avenue, offering enhanced glycemic control and reduced patient burden. Expansion into underserved patient populations and the development of pumps tailored for specific needs, such as pediatric or geriatric users, present further opportunities. The integration of pumps with broader digital health ecosystems, including wearable fitness trackers and telehealth platforms, will also drive innovation and user engagement. Moreover, advancements in sensor technology for more accurate and less invasive glucose monitoring will be critical in shaping future product development.

Major Players in the France Insulin Infusion Pump Market Ecosystem

- Ypsomed

- Medtronic

- Insulet Corporation

- Tandem Diabetes Care

- Ascensia Diabetes Care

Key Developments in France Insulin Infusion Pump Market Industry

- June 2023: Novo Nordisk entered exclusive negotiations for a controlling stake in BIOCORP, which would be followed by a mandatory simplified tender offer on all remaining outstanding shares in BIOCORP. BIOCORP is a French company specializing in the design, development, and manufacturing of delivery systems and innovative medical devices, including Mallya, a Bluetooth-enabled smart add-on device for pen injectors. This development signifies a strategic move to enhance insulin delivery system offerings and potentially integrate advanced pen injector technologies with broader diabetes management solutions.

- May 2023: Medtronic plc announced it has entered into a set of definitive agreements to acquire EOFlow Co. Ltd., manufacturer of the EOPatch device - a tubeless, wearable, and fully disposable insulin delivery device. The addition of EOFlow, together with Medtronic's Meal Detection Technology algorithm and next-generation continuous glucose monitor (CGM), is expected to expand the company's ability to address the needs of more individuals with diabetes. This acquisition bolsters Medtronic's portfolio with innovative tubeless technology, enhancing its competitive position in the rapidly evolving insulin pump market.

Strategic France Insulin Infusion Pump Market Market Forecast

The strategic forecast for the France insulin infusion pump market indicates a period of robust growth, driven by the increasing demand for sophisticated diabetes management solutions. The escalating adoption of automated insulin delivery systems, seamlessly integrated with continuous glucose monitoring, will be a primary growth catalyst, offering improved glycemic control and enhanced quality of life for patients. Investments in research and development focused on miniaturization, enhanced connectivity, and user-centric design will further propel market expansion. Favorable reimbursement policies and a growing awareness of the benefits of pump therapy will continue to encourage wider patient access and uptake, solidifying the market's upward trajectory.

France Insulin Infusion Pump Market Segmentation

-

1. Insulin Infusion Pump

- 1.1. Insulin Pump Device

- 1.2. Infusion Set

- 1.3. Reservoir

France Insulin Infusion Pump Market Segmentation By Geography

- 1. France

France Insulin Infusion Pump Market Regional Market Share

Geographic Coverage of France Insulin Infusion Pump Market

France Insulin Infusion Pump Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques

- 3.3. Market Restrains

- 3.3.1. Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms

- 3.4. Market Trends

- 3.4.1. Insulin Pump is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Insulin Infusion Pump Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 5.1.1. Insulin Pump Device

- 5.1.2. Infusion Set

- 5.1.3. Reservoir

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by Insulin Infusion Pump

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ypsomed

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medtronic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Insulet corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tandem Diabetes Care

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ascensia Diabetes Care

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Ypsomed

List of Figures

- Figure 1: France Insulin Infusion Pump Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Insulin Infusion Pump Market Share (%) by Company 2025

List of Tables

- Table 1: France Insulin Infusion Pump Market Revenue Million Forecast, by Insulin Infusion Pump 2020 & 2033

- Table 2: France Insulin Infusion Pump Market Volume K Unit Forecast, by Insulin Infusion Pump 2020 & 2033

- Table 3: France Insulin Infusion Pump Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: France Insulin Infusion Pump Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: France Insulin Infusion Pump Market Revenue Million Forecast, by Insulin Infusion Pump 2020 & 2033

- Table 6: France Insulin Infusion Pump Market Volume K Unit Forecast, by Insulin Infusion Pump 2020 & 2033

- Table 7: France Insulin Infusion Pump Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: France Insulin Infusion Pump Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Insulin Infusion Pump Market?

The projected CAGR is approximately 4.06%.

2. Which companies are prominent players in the France Insulin Infusion Pump Market?

Key companies in the market include Ypsomed, Medtronic, Insulet corporation, Tandem Diabetes Care, Ascensia Diabetes Care.

3. What are the main segments of the France Insulin Infusion Pump Market?

The market segments include Insulin Infusion Pump.

4. Can you provide details about the market size?

The market size is estimated to be USD 130.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications of Cryosurgery; Technological Advancements in Cryotherapy Equipment; Rising Preference for Minimally Invasive Techniques.

6. What are the notable trends driving market growth?

Insulin Pump is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Hazardous Effects of Cryogenic Gases; Complexity of the Cryotherapy Mechanisms.

8. Can you provide examples of recent developments in the market?

June 2023: Novo Nordisk entered exclusive negotiations for a controlling stake in BIOCORP, which would be followed by a mandatory simplified tender offer on all remaining outstanding shares in BIOCORP. BIOCORP is a French company specializing in the design, development, and manufacturing of delivery systems and innovative medical devices, including Mallya, a Bluetooth-enabled smart add-on device for pen injectors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Insulin Infusion Pump Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Insulin Infusion Pump Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Insulin Infusion Pump Market?

To stay informed about further developments, trends, and reports in the France Insulin Infusion Pump Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence