Key Insights

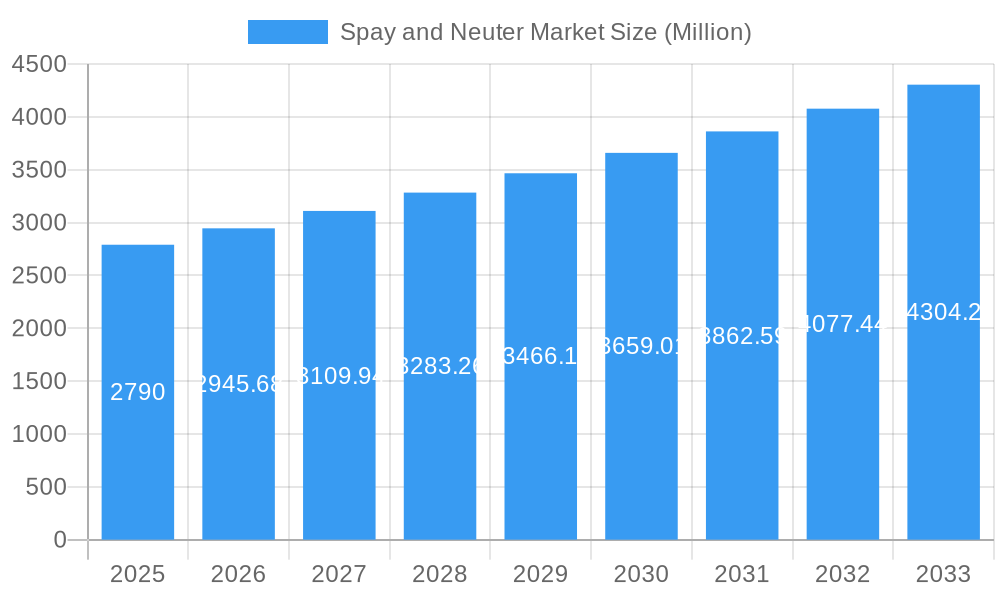

The global Spay and Neuter Market is poised for significant expansion, projected to reach USD 2.79 billion in 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.56% anticipated to continue through 2033. A primary driver for this upward trajectory is the escalating pet ownership trend worldwide, coupled with a growing awareness among pet owners regarding the health benefits and responsible pet management associated with spaying and neutering procedures. These benefits include reduced risks of certain cancers and behavioral issues, contributing to longer and healthier lives for companion animals. The market is further propelled by increasing government initiatives and animal welfare organizations' campaigns promoting pet population control and responsible breeding practices, which directly translate into higher demand for spay and neuter services.

Spay and Neuter Market Market Size (In Billion)

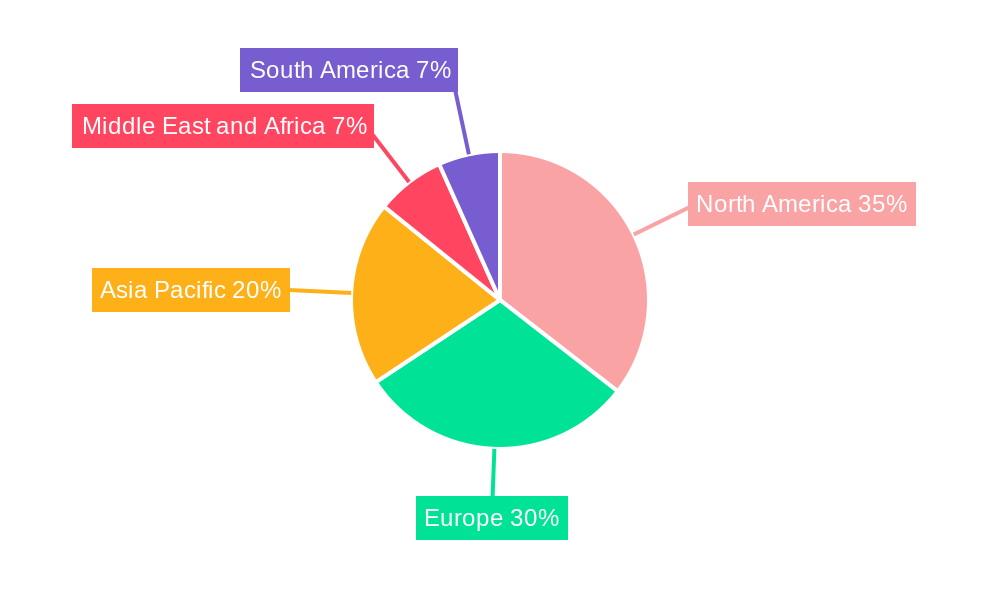

The market landscape is characterized by a strong focus on veterinary services, with veterinary hospitals and clinics being the dominant providers. Within species, dogs and cats constitute the largest segments due to their widespread adoption as pets. However, there's a discernible trend towards an increasing number of "other species" being brought in for these procedures as pet ownership diversifies. Geographically, North America and Europe currently lead the market, driven by established pet care infrastructure and high disposable incomes. Asia Pacific is emerging as a key growth region, fueled by rapid urbanization, rising pet humanization, and a burgeoning middle class with greater capacity to invest in pet healthcare. Challenges such as the cost of procedures and accessibility in certain underdeveloped regions do exist, but the overarching positive sentiment towards animal welfare and preventative healthcare is expected to mitigate these restraints and facilitate sustained market growth.

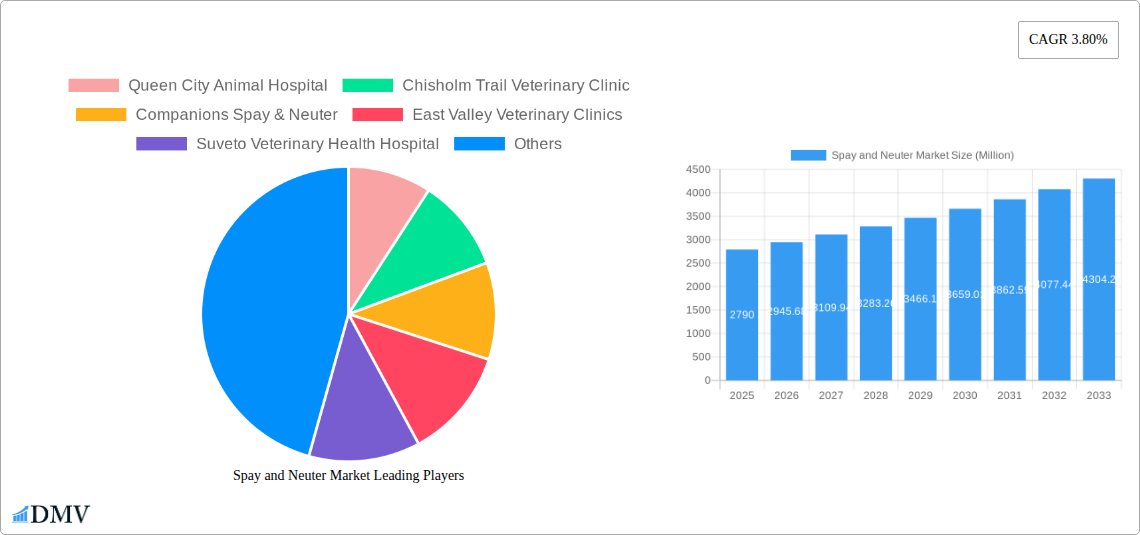

Spay and Neuter Market Company Market Share

Spay and Neuter Market Report Description

Unlock critical insights into the global Spay and Neuter Market with this comprehensive, SEO-optimized report. Delve into market dynamics, growth trajectories, and strategic opportunities across the forecast period of 2025–2033, with a detailed analysis of the historical period from 2019–2024 and a base year of 2025. This report is essential for stakeholders seeking to understand the evolving landscape of pet population control and animal welfare services. We provide an in-depth examination of market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, emerging opportunities, and key players. Our analysis covers vital segments including Dogs, Cats, and Other Species, provided by Veterinary Hospitals and Veterinary Clinics.

Spay and Neuter Market Market Composition & Trends

This section dissects the intricate composition and prevailing trends within the Spay and Neuter Market, valued at an estimated $XX billion in the base year of 2025. We examine market concentration, identifying dominant players and their respective market share distributions, projected to reach $XX billion by 2033. Innovation catalysts, including advancements in surgical techniques and anesthetic protocols, are explored for their impact on service delivery and adoption rates. The regulatory landscape, encompassing animal welfare laws and licensing requirements, is analyzed for its influence on market accessibility and operational standards. Substitute products, such as hormonal treatments or alternative population control methods, are evaluated for their competitive positioning. End-user profiles, ranging from individual pet owners to animal shelters and rescue organizations, are detailed to understand varying demand patterns. Mergers & Acquisitions (M&A) activities are a key focus, with estimated deal values reaching $XX billion during the forecast period, highlighting consolidation trends and strategic partnerships aimed at expanding service offerings and geographic reach.

- Market Share Distribution: Quantified analysis of leading providers and their projected market share growth.

- M&A Deal Values: Estimated aggregate value of mergers and acquisitions driving market consolidation.

- Innovation Catalysts: Identification of technological and procedural advancements enhancing spay and neuter services.

- Regulatory Landscape: Impact assessment of key animal welfare legislation and its effect on market operations.

Spay and Neuter Market Industry Evolution

The Spay and Neuter Market has undergone a significant evolution, driven by increasing awareness of pet overpopulation, advancements in veterinary medicine, and a growing emphasis on animal welfare. From 2019 to 2024, the industry has witnessed a steady upward trajectory, with an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This growth is fueled by a confluence of factors, including proactive government initiatives promoting responsible pet ownership and a surge in the number of pet owners actively seeking these essential services. Technological advancements have played a pivotal role, with the adoption of minimally invasive surgical techniques, improved anesthetic monitoring, and enhanced post-operative care protocols leading to reduced recovery times and improved patient outcomes. These innovations not only enhance the efficacy of spay and neuter procedures but also contribute to greater client confidence and willingness to proceed with the surgeries.

Shifting consumer demands have also reshaped the market. Pet owners are increasingly viewing their animals as integral family members, leading to a greater willingness to invest in their long-term health and well-being, which includes spaying and neutering. This sentiment is further amplified by widespread public awareness campaigns orchestrated by animal welfare organizations and veterinary associations. The demand for accessible and affordable spay and neuter services remains a critical driver, prompting a rise in low-cost clinics and mobile veterinary units, particularly in underserved areas. Furthermore, the growing recognition of the public health benefits, such as the prevention of zoonotic diseases and the reduction of stray animal populations, continues to bolster the market's importance. The industry's growth trajectory is thus intrinsically linked to its ability to adapt to these evolving demands, embracing innovation and prioritizing accessible, high-quality animal care solutions. The market is projected to reach an estimated $XX billion by 2033, reflecting sustained demand and ongoing industry development.

Leading Regions, Countries, or Segments in Spay and Neuter Market

The Spay and Neuter Market is characterized by distinct regional strengths and segment dominance, with Dogs and Cats emerging as the primary species driving demand, and Veterinary Hospitals and Veterinary Clinics leading as service providers. In terms of geographic dominance, North America, particularly the United States, holds a significant share of the global market, driven by a mature pet care industry, high pet ownership rates, and robust animal welfare legislation. The increasing number of households adopting pets, coupled with a strong emphasis on responsible pet ownership, directly translates into a higher demand for spay and neuter services.

Dominant Species and Provider Segments:

- Species: Dogs and Cats: These species consistently represent the largest segments due to their widespread ownership. The sheer volume of dog and cat populations globally, combined with widespread adoption of sterilization practices for health and population control reasons, solidifies their dominance. Market penetration for spaying and neutering in these segments is already high in developed nations, with growth opportunities arising from increased adoption in emerging economies and a focus on preventative health care.

- Providers: Veterinary Hospitals and Veterinary Clinics: These are the cornerstone of spay and neuter service delivery. Veterinary hospitals, often offering a wider range of advanced surgical and diagnostic capabilities, cater to more complex cases and specialized needs. Veterinary clinics, on the other hand, provide accessible, routine spay and neuter procedures, forming the bulk of service provision. Their widespread presence, particularly in urban and suburban areas, ensures accessibility for a large pet-owning population. The growth in this segment is further bolstered by the establishment of dedicated spay and neuter centers and the increasing integration of these services within general veterinary practices.

Key Drivers of Dominance:

- Investment Trends: Significant investments in veterinary infrastructure, advanced surgical equipment, and specialized training for veterinarians are concentrated in regions with high pet ownership and a strong demand for quality animal care. This investment fuels the expansion and enhancement of services offered by both veterinary hospitals and clinics.

- Regulatory Support: Government initiatives and animal welfare laws that mandate or strongly encourage spaying and neutering, alongside funding for subsidized programs, directly impact the growth and accessibility of these services. Regions with comprehensive animal control policies and support for low-cost sterilization programs tend to see higher adoption rates.

- Public Awareness Campaigns: Effective and sustained public awareness campaigns by animal welfare organizations and veterinary associations play a crucial role in educating pet owners about the benefits of spaying and neutering, thereby driving demand across all species, with a pronounced impact on dogs and cats.

- Economic Factors: The economic capacity of pet owners in a particular region directly influences their ability and willingness to pay for spay and neuter procedures. Regions with higher disposable incomes and established pet care markets often exhibit higher rates of sterilization.

Spay and Neuter Market Product Innovations

Product innovations in the Spay and Neuter Market are primarily focused on enhancing surgical efficiency, patient safety, and post-operative recovery. Advancements in anesthetic agents, such as isoflurane and sevoflurane, offer improved patient safety profiles and faster induction and recovery times, contributing to a smoother surgical experience for both the animal and the veterinarian. Minimally invasive surgical techniques, including laparoscopic spaying, are gaining traction, offering reduced pain, smaller incisions, and quicker healing for patients. Furthermore, novel absorbable suture materials and advanced wound closure techniques are minimizing complications and improving aesthetic outcomes. The development of specialized surgical instruments tailored for specific anatomical challenges also contributes to increased precision and reduced surgical duration. These innovations collectively aim to improve the overall quality of care and client satisfaction in spay and neuter procedures.

Propelling Factors for Spay and Neuter Market Growth

The Spay and Neuter Market is experiencing robust growth propelled by several key factors. Technologically, advancements in minimally invasive surgical techniques and improved anesthetic protocols are making procedures safer, quicker, and less painful for pets, thereby increasing owner acceptance. Economically, rising disposable incomes in many regions and the increasing humanization of pets mean owners are more willing and able to invest in their pets' long-term health and well-being. Regulatory influences are also significant; government mandates, subsidies for low-cost spay/neuter programs, and campaigns promoting responsible pet ownership are actively encouraging sterilization. The burgeoning pet adoption rates, particularly in emerging markets, also present a substantial opportunity for growth, as new pet owners seek to prevent unwanted litters and manage their pets' health effectively.

Obstacles in the Spay and Neuter Market Market

Despite its growth, the Spay and Neuter Market faces several significant obstacles. Regulatory challenges can arise from varying licensing requirements and differing standards of veterinary practice across regions, potentially complicating expansion for multi-location providers. Supply chain disruptions, particularly for essential veterinary drugs and surgical supplies, can impact service delivery and increase operational costs, with potential cost implications for consumers. Competitive pressures from a fragmented market, including a mix of private practices, non-profit organizations, and mobile clinics, can lead to price sensitivity and affect profitability for some providers. Furthermore, a shortage of trained veterinary professionals in certain areas can limit the capacity for service provision, creating access issues, especially in rural or underserved communities.

Future Opportunities in Spay and Neuter Market

Emerging opportunities in the Spay and Neuter Market are abundant. The growing adoption of pets in developing economies presents a significant untapped market for spay and neuter services, requiring tailored outreach and service models. Technological advancements, such as AI-assisted surgical planning and improved remote monitoring of post-operative care, offer avenues for enhanced efficiency and patient outcomes. The increasing consumer demand for comprehensive pet wellness packages will likely lead to the integration of spay and neuter services with other preventative health offerings. Furthermore, the development of innovative, non-surgical sterilization methods, though still in nascent stages, could revolutionize the market by offering alternatives for owners hesitant about traditional surgery. Expanding mobile veterinary services to reach remote and underserved populations also represents a substantial growth avenue.

Major Players in the Spay and Neuter Market Ecosystem

- Queen City Animal Hospital

- Chisholm Trail Veterinary Clinic

- Companions Spay & Neuter

- East Valley Veterinary Clinics

- Suveto Veterinary Health Hospital

- Willow Rock Pet Hospital

- Oakdale Veterinary Group

- Petco Animal Supplies Inc

- Houston Humane Society

- Naoi Animal Hospital

- Thornhill Veterinary Clinic

Key Developments in Spay and Neuter Market Industry

- March 2022: The Willamette Humane Society and Oregon Humane Society collaborated to offer advanced services and technology, including spaying and neutering, for community cats and dogs in the United States. This collaboration aims to address pet overpopulation and improve animal welfare by leveraging resources and expertise to provide high-quality spay and neuter services, alongside other veterinary services like vaccinations, microchipping, and dental care.

- February 2021: The Auburn Valley Humane Society and Northwest Spay and Neuter Center collaborated to provide spaying and neutering services at a comparatively low cost in the United States. This partnership aims to offer affordable services to pet owners in Washington state, focusing on income-qualified individuals and providing education on the importance of sterilization. The initiative also targets reducing feral and free-roaming cats through a trap-neuter-return program.

Strategic Spay and Neuter Market Market Forecast

The Spay and Neuter Market is poised for continued expansion, driven by a confluence of increasing pet ownership, heightened awareness of animal welfare, and ongoing technological advancements. The forecast period (2025–2033) anticipates significant growth, with market value projected to reach $XX billion. Key growth catalysts include the expansion of affordable and accessible spay/neuter initiatives in emerging markets, fostering a greater rate of sterilization among a burgeoning pet population. The increasing acceptance and adoption of advanced veterinary techniques, such as minimally invasive surgery, will further enhance service quality and patient outcomes. Furthermore, strategic collaborations between animal welfare organizations, veterinary providers, and governmental bodies will play a crucial role in driving widespread adoption and addressing pet overpopulation challenges effectively. The market's future potential is intrinsically linked to its capacity to innovate and adapt to evolving owner needs and animal health imperatives.

Spay and Neuter Market Segmentation

-

1. Species

- 1.1. Dogs

- 1.2. Cats

- 1.3. Other Species

-

2. Providers

- 2.1. Veterinary Hospitals

- 2.2. Veterinary Clinics

Spay and Neuter Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Spay and Neuter Market Regional Market Share

Geographic Coverage of Spay and Neuter Market

Spay and Neuter Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.86% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mergers and Acquisition Among the Key Players; Availability of Support from Non-Profit Organisations

- 3.3. Market Restrains

- 3.3.1. Risks Associated with Spay and Neutering

- 3.4. Market Trends

- 3.4.1. Cat Segment is Anticipated to Contribute a Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Spay and Neuter Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Species

- 5.1.1. Dogs

- 5.1.2. Cats

- 5.1.3. Other Species

- 5.2. Market Analysis, Insights and Forecast - by Providers

- 5.2.1. Veterinary Hospitals

- 5.2.2. Veterinary Clinics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Species

- 6. North America Spay and Neuter Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Species

- 6.1.1. Dogs

- 6.1.2. Cats

- 6.1.3. Other Species

- 6.2. Market Analysis, Insights and Forecast - by Providers

- 6.2.1. Veterinary Hospitals

- 6.2.2. Veterinary Clinics

- 6.1. Market Analysis, Insights and Forecast - by Species

- 7. Europe Spay and Neuter Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Species

- 7.1.1. Dogs

- 7.1.2. Cats

- 7.1.3. Other Species

- 7.2. Market Analysis, Insights and Forecast - by Providers

- 7.2.1. Veterinary Hospitals

- 7.2.2. Veterinary Clinics

- 7.1. Market Analysis, Insights and Forecast - by Species

- 8. Asia Pacific Spay and Neuter Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Species

- 8.1.1. Dogs

- 8.1.2. Cats

- 8.1.3. Other Species

- 8.2. Market Analysis, Insights and Forecast - by Providers

- 8.2.1. Veterinary Hospitals

- 8.2.2. Veterinary Clinics

- 8.1. Market Analysis, Insights and Forecast - by Species

- 9. Middle East and Africa Spay and Neuter Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Species

- 9.1.1. Dogs

- 9.1.2. Cats

- 9.1.3. Other Species

- 9.2. Market Analysis, Insights and Forecast - by Providers

- 9.2.1. Veterinary Hospitals

- 9.2.2. Veterinary Clinics

- 9.1. Market Analysis, Insights and Forecast - by Species

- 10. South America Spay and Neuter Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Species

- 10.1.1. Dogs

- 10.1.2. Cats

- 10.1.3. Other Species

- 10.2. Market Analysis, Insights and Forecast - by Providers

- 10.2.1. Veterinary Hospitals

- 10.2.2. Veterinary Clinics

- 10.1. Market Analysis, Insights and Forecast - by Species

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Queen City Animal Hospital

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Chisholm Trail Veterinary Clinic

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Companions Spay & Neuter

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 East Valley Veterinary Clinics

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Suveto Veterinary Health Hospital

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Willow Rock Pet Hospital

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oakdale Veterinary Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Petco Animal Supplies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Houston Humane Society

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Naoi Animal Hospital

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Thornhill Veterinary Clinic

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Queen City Animal Hospital

List of Figures

- Figure 1: Global Spay and Neuter Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Spay and Neuter Market Revenue (undefined), by Species 2025 & 2033

- Figure 3: North America Spay and Neuter Market Revenue Share (%), by Species 2025 & 2033

- Figure 4: North America Spay and Neuter Market Revenue (undefined), by Providers 2025 & 2033

- Figure 5: North America Spay and Neuter Market Revenue Share (%), by Providers 2025 & 2033

- Figure 6: North America Spay and Neuter Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Spay and Neuter Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Spay and Neuter Market Revenue (undefined), by Species 2025 & 2033

- Figure 9: Europe Spay and Neuter Market Revenue Share (%), by Species 2025 & 2033

- Figure 10: Europe Spay and Neuter Market Revenue (undefined), by Providers 2025 & 2033

- Figure 11: Europe Spay and Neuter Market Revenue Share (%), by Providers 2025 & 2033

- Figure 12: Europe Spay and Neuter Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Spay and Neuter Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Spay and Neuter Market Revenue (undefined), by Species 2025 & 2033

- Figure 15: Asia Pacific Spay and Neuter Market Revenue Share (%), by Species 2025 & 2033

- Figure 16: Asia Pacific Spay and Neuter Market Revenue (undefined), by Providers 2025 & 2033

- Figure 17: Asia Pacific Spay and Neuter Market Revenue Share (%), by Providers 2025 & 2033

- Figure 18: Asia Pacific Spay and Neuter Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Spay and Neuter Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Spay and Neuter Market Revenue (undefined), by Species 2025 & 2033

- Figure 21: Middle East and Africa Spay and Neuter Market Revenue Share (%), by Species 2025 & 2033

- Figure 22: Middle East and Africa Spay and Neuter Market Revenue (undefined), by Providers 2025 & 2033

- Figure 23: Middle East and Africa Spay and Neuter Market Revenue Share (%), by Providers 2025 & 2033

- Figure 24: Middle East and Africa Spay and Neuter Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Spay and Neuter Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Spay and Neuter Market Revenue (undefined), by Species 2025 & 2033

- Figure 27: South America Spay and Neuter Market Revenue Share (%), by Species 2025 & 2033

- Figure 28: South America Spay and Neuter Market Revenue (undefined), by Providers 2025 & 2033

- Figure 29: South America Spay and Neuter Market Revenue Share (%), by Providers 2025 & 2033

- Figure 30: South America Spay and Neuter Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: South America Spay and Neuter Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Spay and Neuter Market Revenue undefined Forecast, by Species 2020 & 2033

- Table 2: Global Spay and Neuter Market Revenue undefined Forecast, by Providers 2020 & 2033

- Table 3: Global Spay and Neuter Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Spay and Neuter Market Revenue undefined Forecast, by Species 2020 & 2033

- Table 5: Global Spay and Neuter Market Revenue undefined Forecast, by Providers 2020 & 2033

- Table 6: Global Spay and Neuter Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Spay and Neuter Market Revenue undefined Forecast, by Species 2020 & 2033

- Table 11: Global Spay and Neuter Market Revenue undefined Forecast, by Providers 2020 & 2033

- Table 12: Global Spay and Neuter Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Spay and Neuter Market Revenue undefined Forecast, by Species 2020 & 2033

- Table 20: Global Spay and Neuter Market Revenue undefined Forecast, by Providers 2020 & 2033

- Table 21: Global Spay and Neuter Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Spay and Neuter Market Revenue undefined Forecast, by Species 2020 & 2033

- Table 29: Global Spay and Neuter Market Revenue undefined Forecast, by Providers 2020 & 2033

- Table 30: Global Spay and Neuter Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: GCC Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: South Africa Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Spay and Neuter Market Revenue undefined Forecast, by Species 2020 & 2033

- Table 35: Global Spay and Neuter Market Revenue undefined Forecast, by Providers 2020 & 2033

- Table 36: Global Spay and Neuter Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Brazil Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Argentina Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Spay and Neuter Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spay and Neuter Market?

The projected CAGR is approximately 4.86%.

2. Which companies are prominent players in the Spay and Neuter Market?

Key companies in the market include Queen City Animal Hospital, Chisholm Trail Veterinary Clinic, Companions Spay & Neuter, East Valley Veterinary Clinics, Suveto Veterinary Health Hospital, Willow Rock Pet Hospital, Oakdale Veterinary Group, Petco Animal Supplies Inc, Houston Humane Society, Naoi Animal Hospital, Thornhill Veterinary Clinic.

3. What are the main segments of the Spay and Neuter Market?

The market segments include Species, Providers.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Mergers and Acquisition Among the Key Players; Availability of Support from Non-Profit Organisations.

6. What are the notable trends driving market growth?

Cat Segment is Anticipated to Contribute a Significant Share of the Market.

7. Are there any restraints impacting market growth?

Risks Associated with Spay and Neutering.

8. Can you provide examples of recent developments in the market?

March 2022: The Willamette Humane Society and Oregon Humane Society collaborated to offer advanced services and technology, including spaying and neutering, for community cats and dogs in the United States. The collaboration between the Willamette Humane Society and Oregon Humane Society is part of their joint efforts to address the challenges of pet overpopulation and improve animal welfare. The collaboration allows the organizations to leverage their resources and expertise to provide high-quality spay and neuter services to pet owners in their respective regions. In addition to spay and neuter services, the collaboration offers other veterinary services such as vaccinations, microchipping, and dental care.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spay and Neuter Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spay and Neuter Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spay and Neuter Market?

To stay informed about further developments, trends, and reports in the Spay and Neuter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence