Key Insights

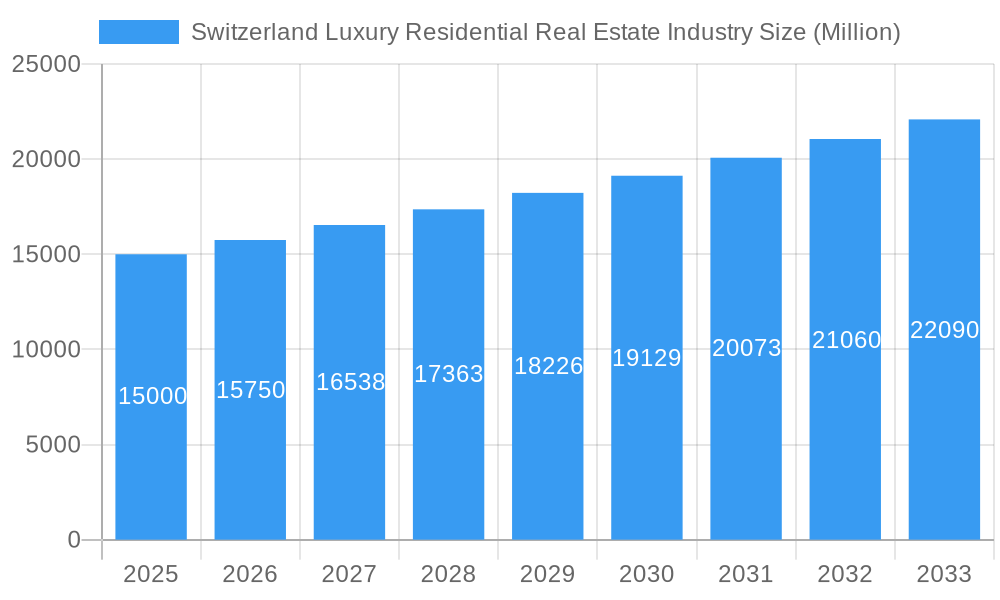

The Switzerland luxury residential real estate market is projected to reach $10 billion by 2024, with a CAGR of 4.8% expected through 2033. This growth is driven by Switzerland's stable political and economic climate, its strong currency attracting high-net-worth individuals (HNWIs), and sustained demand from both domestic and international buyers in prime locations such as Zurich, Geneva, and Bern. Limited supply of luxury properties, especially villas and landed houses, further fuels price appreciation. The trend towards modernized and sustainable construction also appeals to a broader luxury buyer base, while a strong tourism sector indirectly stimulates demand for second homes and investment properties.

Switzerland Luxury Residential Real Estate Industry Market Size (In Billion)

Challenges include stringent property regulations, high property taxes, and the overall cost of living, which may influence purchasing decisions. Despite these factors, strong market fundamentals and consistent HNWI investment indicate a positive outlook. Market segmentation by property type (villas/landed houses versus apartments/condominiums) and city reveals diverse dynamics, with key players like UM Real Estate Investment AG and Sotheby's International Realty shaping the competitive landscape.

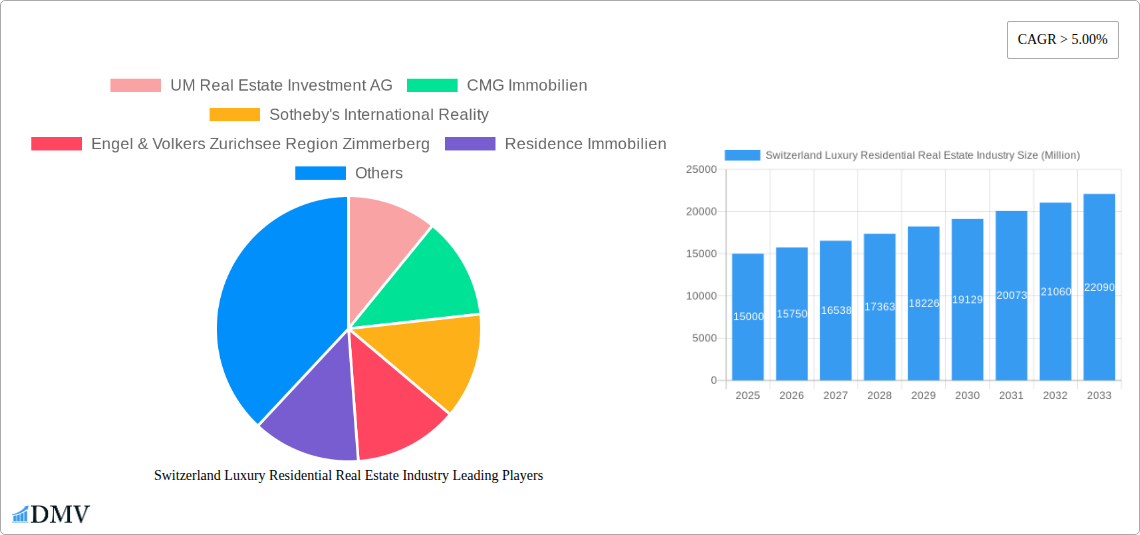

Switzerland Luxury Residential Real Estate Industry Company Market Share

Switzerland Luxury Residential Real Estate Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Switzerland luxury residential real estate market from 2019 to 2033, focusing on market trends, key players, and future growth prospects. The report utilizes data from the historical period (2019-2024), the base year (2025), and projects forecasts until 2033, offering invaluable insights for investors, developers, and industry stakeholders. With a total market value exceeding xx Million in 2025, the Swiss luxury real estate sector presents significant opportunities and challenges.

Switzerland Luxury Residential Real Estate Industry Market Composition & Trends

The Swiss luxury residential real estate market, valued at over xx Million in 2025, is characterized by a relatively concentrated landscape. Key players such as UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Realty, Engel & Volkers Zurichsee Region Zimmerberg, Residence Immobilien, Honeywell Immobilier, SJS ImmoArch AG, Swiss Capital Property, Luxury places SA, and La Roche Residential compete for a significant share of this lucrative market. Market share distribution among these companies varies, with some enjoying a larger presence in specific regions or property types. While precise figures are proprietary, it is estimated that the top five players collectively control approximately xx% of the market.

Innovation in the sector includes the integration of technology for virtual tours, enhanced marketing strategies, and sustainable building practices. The regulatory landscape, while generally stable, continues to evolve, impacting foreign investment and tax implications. Substitute products include high-end rental properties and alternative investment options. The end-user profile primarily comprises high-net-worth individuals (HNWIs), both domestic and international, seeking exclusive properties in prime locations.

M&A activity has been relatively moderate in recent years, with deal values ranging from xx Million to xx Million. However, increasing consolidation is anticipated as larger players seek to expand their market share and geographic reach.

- Market Concentration: Highly concentrated, with top players controlling a significant share.

- Innovation Catalysts: Technological advancements, sustainable building practices.

- Regulatory Landscape: Stable but evolving, influencing foreign investment.

- Substitute Products: High-end rentals, alternative investments.

- End-User Profiles: HNWIs, both domestic and international.

- M&A Activity: Moderate, with deal values ranging from xx Million to xx Million.

Switzerland Luxury Residential Real Estate Industry Industry Evolution

The Swiss luxury residential real estate market has demonstrated steady growth throughout the historical period (2019-2024), with an average annual growth rate (AAGR) of approximately xx%. This growth is driven by several factors, including strong economic performance, increasing HNWIs population, and a persistent demand for luxury properties in prime locations like Zurich, Geneva, and Lausanne. However, growth has not been uniform across all segments and regions. For instance, the demand for villas and landed houses in certain areas has outpaced that of apartments and condominiums. Technological advancements like virtual reality tours and online property portals have transformed how properties are marketed and showcased.

Shifting consumer demands are also reshaping the industry. Buyers are increasingly prioritizing sustainable features, smart home technologies, and properties located near amenities and public transportation. This has prompted developers to incorporate these features into new projects, driving innovation and enhancing the overall value proposition. The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace, projecting an AAGR of xx%, reaching a market value of xx Million by 2033. This moderation could be attributed to economic uncertainties and potential shifts in global investment patterns.

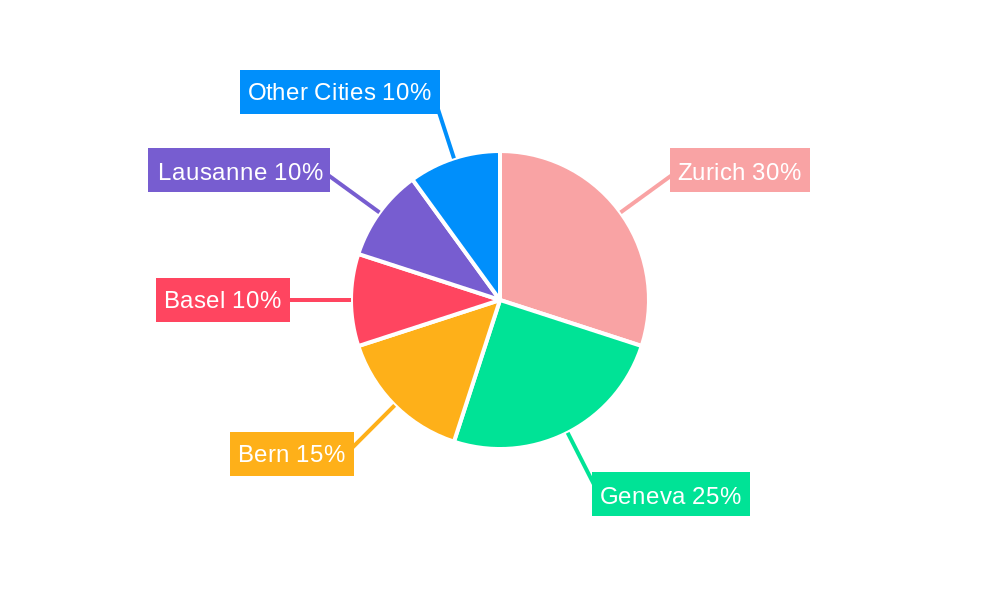

Leading Regions, Countries, or Segments in Switzerland Luxury Residential Real Estate Industry

The Swiss luxury residential real estate market is geographically concentrated, with Zurich, Geneva, and Lausanne emerging as leading cities. These cities benefit from strong economic activity, international connectivity, and a high concentration of HNWIs.

- Zurich: Strong financial sector, high demand for luxury apartments and penthouses.

- Geneva: International organizations, diplomatic presence, demand for lakefront properties.

- Lausanne: Olympic capital, attractive lifestyle, increasing demand for villas.

- Basel: Strong pharmaceutical and chemical industries, demand for high-end housing.

- Bern: Political center, stable market, less volatile than other regions.

In terms of property type, villas and landed houses maintain a higher average price point, reflecting the desirability of spacious living and prime locations. However, luxury apartments and condominiums continue to enjoy strong demand, especially in urban centers. The dominance of these segments is driven by a confluence of factors including:

- Investment trends: Strong capital appreciation and rental yields.

- Regulatory support: Relatively stable and predictable regulatory environment.

- Lifestyle preferences: Demand for high-quality amenities, security, and exclusivity.

Switzerland Luxury Residential Real Estate Industry Product Innovations

Recent innovations include the integration of smart home technology in luxury properties, enhancing energy efficiency and convenience. Virtual reality and augmented reality are employed in marketing, providing potential buyers with immersive experiences. Sustainable building materials and eco-friendly design features are gaining traction, appealing to environmentally conscious buyers. These innovations enhance the unique selling propositions of luxury properties, commanding premium prices. Specific performance metrics (e.g., energy efficiency ratings) are tracked and marketed as key selling points.

Propelling Factors for Switzerland Luxury Residential Real Estate Industry Growth

Several factors fuel the growth of the Swiss luxury residential real estate market. A robust economy, attracting significant foreign investment, is a key driver. The increasing number of HNWIs seeking properties in safe and politically stable environments contributes significantly. Furthermore, favorable tax regulations and a stable regulatory environment make Switzerland an attractive investment destination. Technological advancements in property marketing and construction contribute to enhancing the overall appeal and value of luxury properties.

Obstacles in the Switzerland Luxury Residential Real Estate Industry Market

Despite the positive outlook, the market faces challenges. Stringent building regulations and land scarcity limit supply, impacting price levels. Economic fluctuations and global uncertainties can impact demand, particularly from international buyers. Intense competition among developers and real estate agencies can lead to price wars and reduced profit margins. The impact of these obstacles is estimated to reduce the overall market growth by approximately xx% in the forecast period.

Future Opportunities in Switzerland Luxury Residential Real Estate Industry

The future holds several promising opportunities. The growing trend towards sustainable and eco-friendly living presents opportunities for developers to build and market properties with green certifications. The increasing use of technology in property management will improve efficiency and security. Exploring niche markets, such as wellness-focused properties, could provide unique value propositions. Expanding into secondary markets with untapped potential can also generate growth.

Major Players in the Switzerland Luxury Residential Real Estate Industry Ecosystem

- UM Real Estate Investment AG

- CMG Immobilien

- Sotheby's International Realty

- Engel & Volkers Zurichsee Region Zimmerberg

- Residence Immobilien

- Honeywell Immobilier

- SJS ImmoArch AG

- Swiss Capital Property

- Luxury places SA

- La Roche Residential

Key Developments in Switzerland Luxury Residential Real Estate Industry Industry

- January 2022: Engel & Volkers Zurichsee Region Zimmerberg announced expansion to over 50 locations in Switzerland, increasing market presence.

- March 2023: Honeywell Immobilier partnered with WOTR for soil and water conservation, showcasing commitment to sustainability.

Strategic Switzerland Luxury Residential Real Estate Industry Market Forecast

The Swiss luxury residential real estate market is poised for continued growth driven by economic stability, strong demand from HNWIs, and ongoing technological innovations. While challenges remain, the long-term outlook is positive, with significant opportunities for growth across various segments and regions. The projected market value of xx Million by 2033 underscores the market's potential for investors and stakeholders.

Switzerland Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

-

2. Cities

- 2.1. Bern

- 2.2. Zurich

- 2.3. Geneva

- 2.4. Basel

- 2.5. Lausanne

- 2.6. Other Cities

Switzerland Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Switzerland

Switzerland Luxury Residential Real Estate Industry Regional Market Share

Geographic Coverage of Switzerland Luxury Residential Real Estate Industry

Switzerland Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Bern

- 5.2.2. Zurich

- 5.2.3. Geneva

- 5.2.4. Basel

- 5.2.5. Lausanne

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UM Real Estate Investment AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CMG Immobilien

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sotheby's International Reality

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engel & Volkers Zurichsee Region Zimmerberg

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Residence Immobilien

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Honeywell Immobilier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SJS ImmoArch AG**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Swiss Capital Property

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Luxury places SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 La Roche Residential

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UM Real Estate Investment AG

List of Figures

- Figure 1: Switzerland Luxury Residential Real Estate Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Switzerland Luxury Residential Real Estate Industry Share (%) by Company 2025

List of Tables

- Table 1: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 3: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Cities 2020 & 2033

- Table 6: Switzerland Luxury Residential Real Estate Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Luxury Residential Real Estate Industry?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Switzerland Luxury Residential Real Estate Industry?

Key companies in the market include UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Reality, Engel & Volkers Zurichsee Region Zimmerberg, Residence Immobilien, Honeywell Immobilier, SJS ImmoArch AG**List Not Exhaustive, Swiss Capital Property, Luxury places SA, La Roche Residential.

3. What are the main segments of the Switzerland Luxury Residential Real Estate Industry?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 10 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

March 2023: Honeywell Immobilier recently entered into a partnership with Watershed Organization Trust (WOTR) to focus on soil and water conservation in rural ecosystems. WOTR is involved in restoring rural water bodies, boosting the water table and helping farmers and women with livelihood opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Switzerland Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence