Key Insights

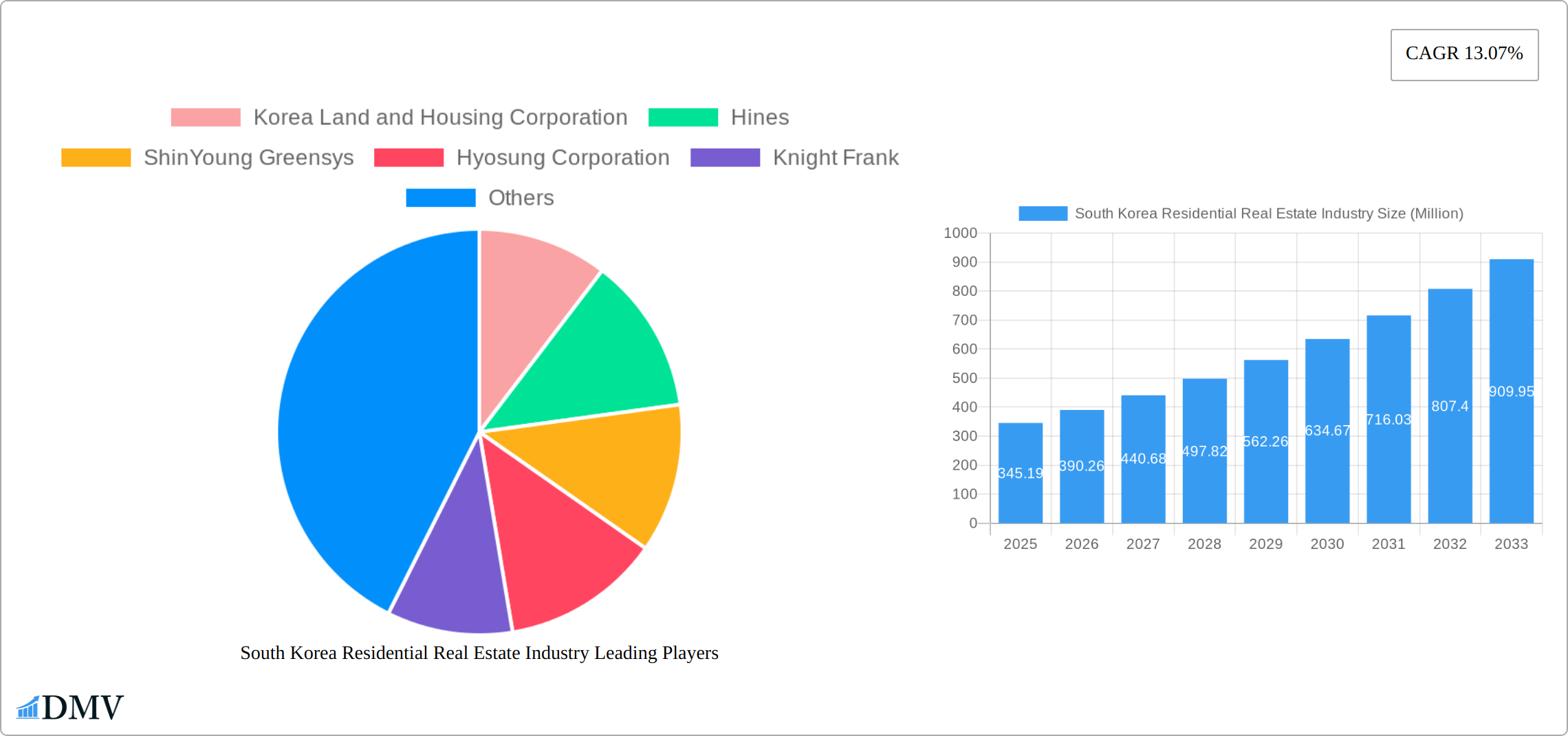

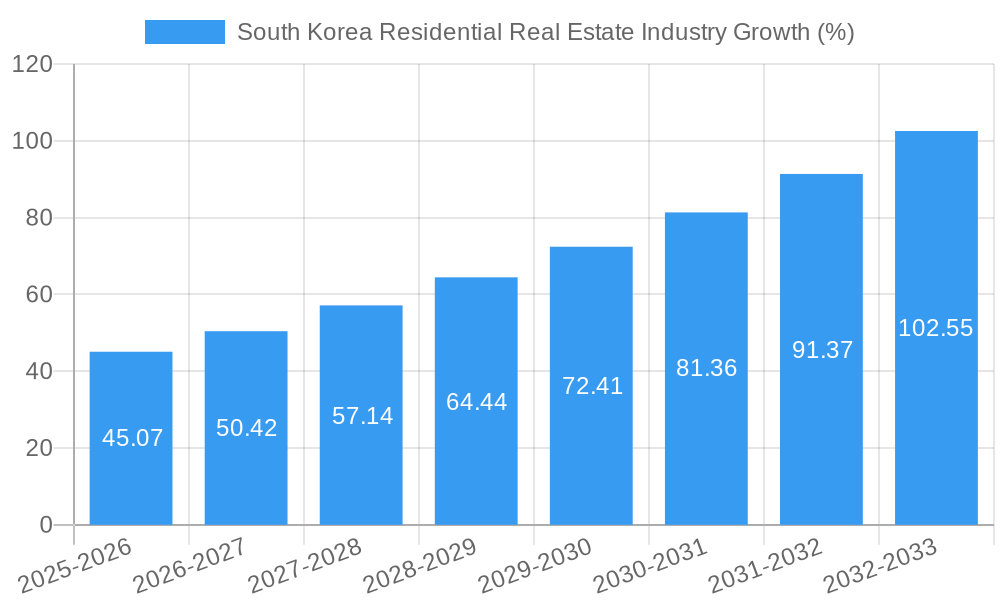

The South Korean residential real estate market, valued at $345.19 million in 2025, is projected to experience robust growth, driven by a combination of factors. A consistently strong CAGR of 13.07% indicates a significant expansion over the forecast period (2025-2033). This growth is likely fueled by several key drivers: a growing urban population seeking modern housing, increasing disposable incomes leading to higher purchasing power, and government initiatives aimed at stimulating the construction sector. Furthermore, evolving consumer preferences towards larger, more sustainable, and technologically advanced homes are shaping the market's trajectory. While potential restraints such as fluctuating interest rates and land scarcity exist, the overall outlook remains positive, particularly for apartment and condominium segments which typically dominate in high-density urban areas like Seoul. The market's segmentation into apartments/condominiums and landed houses/villas provides insight into consumer preferences and allows developers to target specific needs. Key players like Korea Land and Housing Corporation, Hines, and others play a significant role in shaping market dynamics through their development projects and influence on pricing and supply.

The South Korean residential market's future growth is dependent on maintaining economic stability and addressing potential challenges. Careful monitoring of interest rates and government policies will be crucial. The success of large developers in balancing supply with demand will largely determine the market's trajectory. The continued preference for apartments and condominiums, coupled with the potential for growth in the landed houses/villas segment in areas outside major cities, points to a diverse and dynamic market with opportunities for both developers and investors. The historical period (2019-2024) likely saw fluctuating growth rates based on broader economic conditions. The forecast period assumes continued steady economic growth and stable government support for the real estate sector. Further analysis of specific regional variations within South Korea would offer a more granular understanding of market dynamics.

South Korea Residential Real Estate Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the South Korea residential real estate industry, covering the period 2019-2033, with a focus on market trends, key players, and future growth potential. The report leverages extensive data analysis and expert insights to offer stakeholders a clear understanding of this dynamic market. With a base year of 2025 and an estimated year of 2025, this report projects market value through 2033, providing crucial information for investment decisions and strategic planning.

South Korea Residential Real Estate Industry Market Composition & Trends

The South Korean residential real estate market, valued at xx Million in 2024, demonstrates a complex interplay of factors shaping its evolution. Market concentration is relatively high, with a few major players like Korea Land and Housing Corporation, Hines, and Hyosung Corporation commanding significant market share. However, the market also displays pockets of strong competition, particularly in the luxury segment. The regulatory landscape, characterized by government policies aimed at affordability and sustainable development, significantly impacts market dynamics. Substitute products, such as rental housing and co-living spaces, are gaining traction, while mergers and acquisitions (M&A) activity is moderate, with deal values fluctuating between xx Million and xx Million annually.

- Market Share Distribution (2024): Korea Land and Housing Corporation (xx%), Hines (xx%), Hyosung Corporation (xx%), Others (xx%).

- M&A Deal Value (2019-2024): Average annual deal value: xx Million. Largest deal: xx Million (xx).

- Innovation Catalysts: Growing demand for sustainable and smart homes, technological advancements in construction, and increasing urbanization.

- End-User Profiles: Primarily first-time homebuyers, young professionals, and families. A growing segment of high-net-worth individuals drives demand in the luxury market.

South Korea Residential Real Estate Industry Industry Evolution

The South Korean residential real estate market has experienced fluctuating growth over the historical period (2019-2024). Factors such as government regulations, economic conditions, and global events have influenced market growth trajectories. While the market faced challenges during certain periods, exhibiting growth rates ranging from xx% to xx% annually, it has shown resilience and potential for future expansion. Technological advancements, such as the adoption of Building Information Modeling (BIM) and prefabrication techniques like that employed by GS E&C's XiGEIST modular housing, are transforming construction processes and improving efficiency. Consumer demands are shifting toward sustainable, technologically advanced, and amenity-rich housing. The increasing popularity of smart home features and eco-friendly building materials reflects this trend. Growth in the luxury segment is driven by rising disposable incomes and a preference for high-quality living spaces.

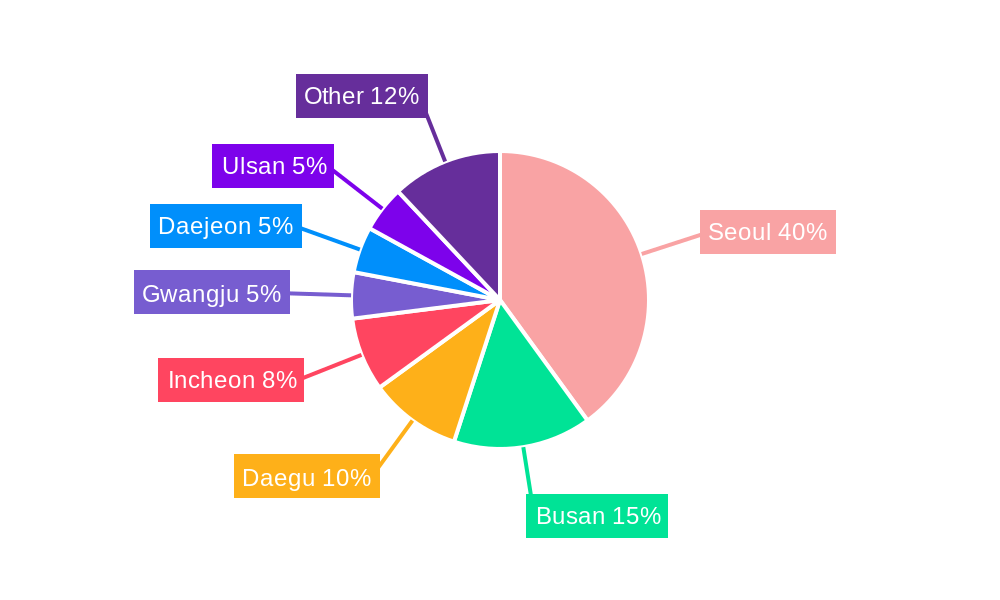

Leading Regions, Countries, or Segments in South Korea Residential Real Estate Industry

The South Korean residential real estate market is significantly shaped by the dominance of apartments and condominiums, which comprised approximately 75% of the total market value in 2024. This strong market share is attributable to several key factors:

- Key Drivers for Apartments and Condominiums:

- High Population Density and Urbanization: Major cities like Seoul exhibit extremely high population density, driving demand for high-rise, space-efficient living solutions.

- Government Support for Affordable Housing: Government policies actively promoting affordable housing through targeted apartment development initiatives have significantly influenced market trends.

- Preference for Modern Amenities and Convenience: Apartments and condominiums generally offer convenient access to amenities and modern features, appealing to a broad demographic.

- Strong Investment Potential: The segment offers historically strong investment returns, attracting both domestic and international investors.

- Efficient Land Utilization: High-rise buildings maximize land use in densely populated areas, a critical factor in land-scarce South Korea.

While smaller in overall market share, the Landed Houses and Villas segment demonstrates consistent growth, driven primarily by the increasing demand for spacious living, privacy, and proximity to nature amongst high-income households and families. This segment is experiencing a resurgence, particularly in areas offering scenic views or access to green spaces outside major urban centers.

South Korea Residential Real Estate Industry Product Innovations

Recent innovations in the South Korean residential real estate market include the integration of smart home technologies, eco-friendly building materials, and modular construction techniques. The launch of GS E&C's XiGEIST modular housing division marks a significant step towards faster and more sustainable construction. These innovations offer unique selling propositions such as increased energy efficiency, enhanced security features, and reduced construction timelines.

Propelling Factors for South Korea Residential Real Estate Industry Growth

Several factors are driving the growth of the South Korean residential real estate industry. Government initiatives promoting affordable housing and sustainable development play a crucial role. Technological advancements in construction and smart home integration are boosting efficiency and enhancing consumer appeal. Furthermore, steady economic growth and rising disposable incomes contribute to increased demand.

Obstacles in the South Korea Residential Real Estate Industry Market

The South Korean residential real estate market faces challenges such as stringent regulations, land scarcity, and rising construction costs. Supply chain disruptions and global economic uncertainty also pose potential risks, impacting affordability and project timelines. Competition among developers is intense, especially in the high-demand areas.

Future Opportunities in South Korea Residential Real Estate Industry

Future opportunities lie in developing sustainable and smart housing solutions, targeting the growing demand for eco-friendly and technologically advanced homes. Expansion into secondary and tertiary cities, exploring niche markets like senior living communities, and incorporating advanced construction technologies presents promising avenues for growth.

Major Players in the South Korea Residential Real Estate Industry Ecosystem

- Korea Land and Housing Corporation

- Hines

- ShinYoung Greensys

- Hyosung Corporation

- Knight Frank

- Booyoung Group

- Dongbu Corporation

- Daelim Corporation

- Hyundai Development Company

Key Developments in South Korea Residential Real Estate Industry Industry

- January 2023: Unveiling of Parkside Seoul, a large-scale mixed-use development showcasing innovative design and sustainable features. This project significantly impacts the luxury market segment.

- April 2023: Launch of GS E&C's XiGEIST modular housing division, poised to revolutionize construction timelines and processes, potentially disrupting the industry landscape.

Strategic South Korea Residential Real Estate Industry Market Forecast

The South Korean residential real estate market is projected to experience steady growth over the forecast period (2025-2033), driven by sustained urbanization, technological advancements, and ongoing government support for housing development. The focus on sustainable and smart homes will continue to shape market trends. The market potential is significant, with opportunities for both established players and new entrants to capitalize on emerging trends and unmet needs.

South Korea Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Geography

- 2.1. Seoul

- 2.2. Other Locations

South Korea Residential Real Estate Industry Segmentation By Geography

- 1. Seoul

- 2. Other Locations

South Korea Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government's Plans to Supply New Homes

- 3.3. Market Restrains

- 3.3.1. Rising Interest Rates

- 3.4. Market Trends

- 3.4.1. Urbanization in the Country is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Seoul

- 5.2.2. Other Locations

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Seoul

- 5.3.2. Other Locations

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Seoul South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Seoul

- 6.2.2. Other Locations

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Other Locations South Korea Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Seoul

- 7.2.2. Other Locations

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2024

- 8.2. Company Profiles

- 8.2.1 Korea Land and Housing Corporation

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Hines

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 ShinYoung Greensys

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 Hyosung Corporation

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Knight Frank

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Booyoung Group

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Dongbu Corporation

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Daelim Corporation

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 Hyundai Development Company

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.1 Korea Land and Housing Corporation

List of Figures

- Figure 1: South Korea Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: South Korea Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Korea Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: South Korea Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Korea Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 10: South Korea Residential Real Estate Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 11: South Korea Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Residential Real Estate Industry?

The projected CAGR is approximately 13.07%.

2. Which companies are prominent players in the South Korea Residential Real Estate Industry?

Key companies in the market include Korea Land and Housing Corporation, Hines, ShinYoung Greensys, Hyosung Corporation, Knight Frank, Booyoung Group, Dongbu Corporation, Daelim Corporation, Hyundai Development Company.

3. What are the main segments of the South Korea Residential Real Estate Industry?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 345.19 Million as of 2022.

5. What are some drivers contributing to market growth?

Government's Plans to Supply New Homes.

6. What are the notable trends driving market growth?

Urbanization in the Country is Driving the Market.

7. Are there any restraints impacting market growth?

Rising Interest Rates.

8. Can you provide examples of recent developments in the market?

January 2023: International architecture office KPF has unveiled the design for Parkside Seoul, a new mixed-use neighborhood planned for the South Korean capital to complement the surrounding natural elements and pay homage to Yongsan Park. The 482,600 square meter development is composed of a layered exterior envelope encompassing various programs and public amenities to enhance the residents’ experience of space. Besides the residential units, the complex includes office and retail spaces, hospitality facilities, and public and green spaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the South Korea Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence