Key Insights

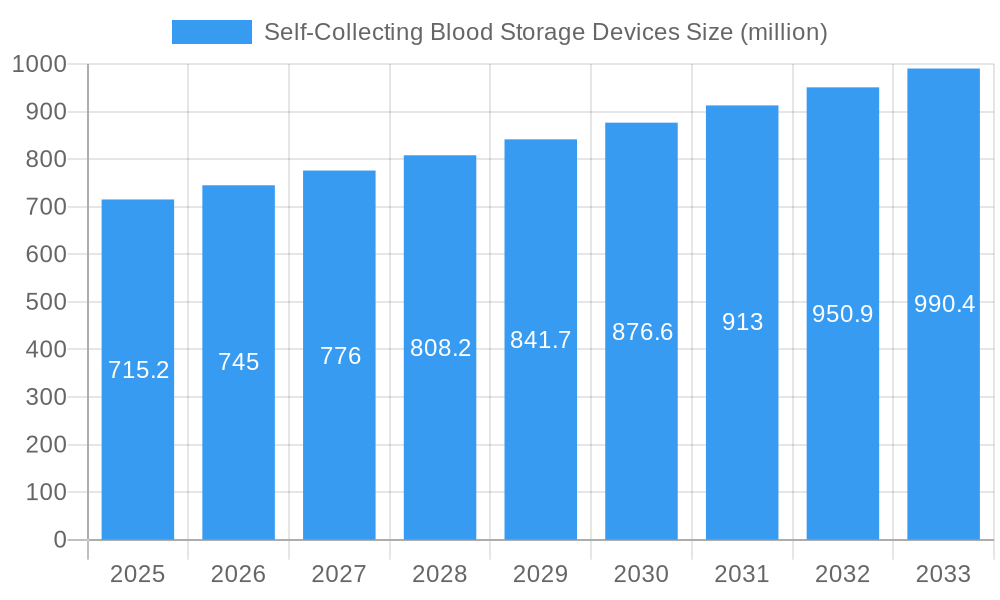

The global Self-Collecting Blood Storage Devices market is poised for significant expansion, projected to reach a substantial 715.2 million by 2025, driven by an impressive compound annual growth rate (CAGR) of 4.2%. This robust growth trajectory is underpinned by several compelling factors. The increasing prevalence of chronic diseases worldwide, coupled with a growing emphasis on proactive health management and wellness initiatives, is fueling demand for convenient and accessible blood collection methods. Furthermore, advancements in technology are enabling the development of more sophisticated and user-friendly self-collection devices, enhancing patient comfort and adherence. The burgeoning field of drug discovery and development, which relies heavily on biological samples, and the critical need for epidemiological studies to understand population health trends are also significant contributors to market expansion. The convenience offered by these devices for remote monitoring and personalized healthcare solutions is a key differentiator.

Self-Collecting Blood Storage Devices Market Size (In Million)

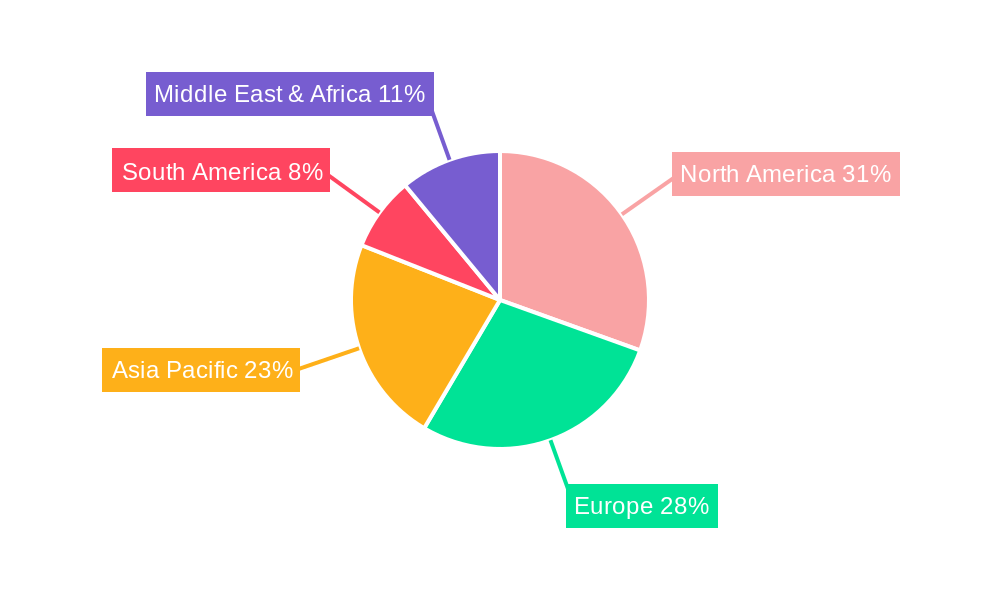

The market is segmented by application, with Disease Management and Health & Wellness emerging as dominant segments due to the rising awareness about preventative healthcare and the need for continuous patient monitoring. The Drug Discovery & Development segment also presents a substantial opportunity, as pharmaceutical companies increasingly adopt streamlined sample collection processes. In terms of types, both High-Dose and Low-Dose Blood Collection devices are expected to witness steady demand, catering to diverse diagnostic and research needs. Geographically, North America and Europe are anticipated to lead the market, owing to well-established healthcare infrastructures, high disposable incomes, and a strong focus on research and development. However, the Asia Pacific region is expected to exhibit the fastest growth, propelled by increasing healthcare expenditure, a growing population, and the rapid adoption of new medical technologies. Key players like Thermo Fisher Scientific, Haier Biomedical, and Vestfrost Solutions are actively innovating and expanding their product portfolios to capture market share.

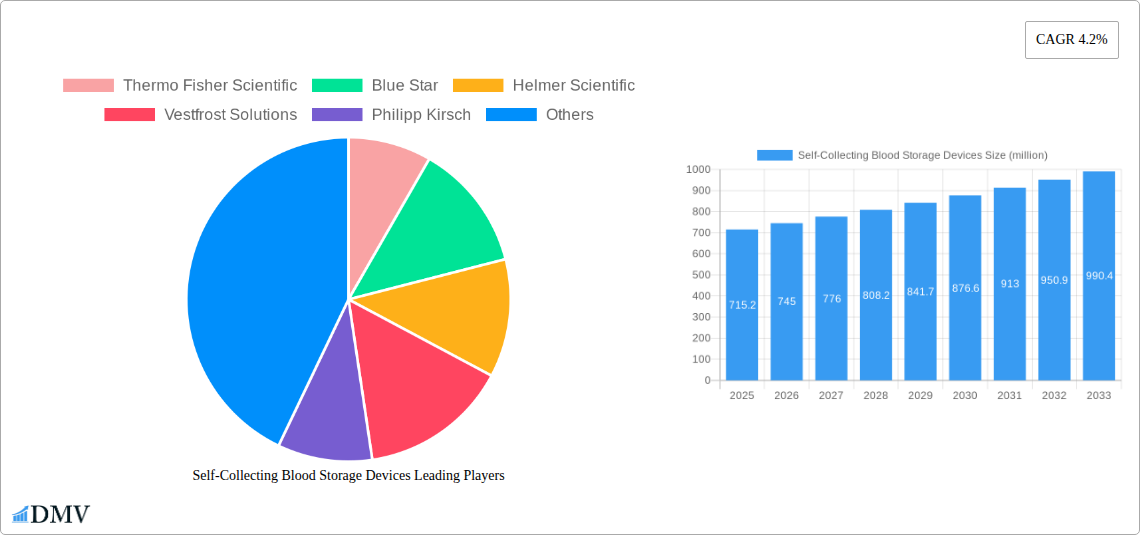

Self-Collecting Blood Storage Devices Company Market Share

Comprehensive Report: Self-Collecting Blood Storage Devices Market Analysis 2019–2033

This in-depth report offers a definitive analysis of the self-collecting blood storage devices market, providing critical insights for stakeholders seeking to understand market dynamics, future trends, and growth opportunities. Covering the study period of 2019–2033, with a base year of 2025, this research delves into market composition, industry evolution, regional dominance, product innovations, and key players shaping the future of remote blood sample collection and preservation.

Self-Collecting Blood Storage Devices Market Composition & Trends

The global self-collecting blood storage devices market exhibits a moderate to high concentration, with a few key players dominating a significant portion of the market share. Innovation catalysts are primarily driven by advancements in biosensor technology, miniaturization, and the increasing demand for at-home diagnostic solutions. The regulatory landscape is evolving, with a growing focus on ensuring the safety, efficacy, and data integrity of self-administered blood collection kits. Substitute products, while present in traditional laboratory settings, are increasingly being challenged by the convenience and accessibility offered by self-collection devices. End-user profiles are expanding beyond clinical settings to include individuals managing chronic conditions, health-conscious consumers seeking proactive wellness monitoring, and researchers involved in large-scale epidemiological studies. Merger and acquisition (M&A) activities within the market are indicative of consolidation efforts and strategic partnerships aimed at expanding product portfolios and market reach. Notable M&A deals in recent years have involved valuations in the hundreds of millions to billions of dollars, reflecting the perceived future growth potential.

- Market Share Distribution: A few dominant companies hold approximately XX% of the market share, with a gradual increase in smaller, specialized players.

- Innovation Catalysts: Focus on improved blood sample stability, user-friendliness, and integration with digital health platforms.

- Regulatory Landscape: Emerging guidelines from bodies like the FDA and EMA focusing on home-use medical devices and in-vitro diagnostics.

- M&A Deal Values: Recent transactions ranging from XXX million to XXX million, signaling strong investor confidence.

Self-Collecting Blood Storage Devices Industry Evolution

The self-collecting blood storage devices industry has witnessed remarkable evolution, driven by a confluence of technological breakthroughs and shifting healthcare paradigms. Over the historical period from 2019 to 2024, the market experienced steady growth, propelled by increased awareness of chronic disease management and the growing preference for personalized healthcare. The forecast period of 2025–2033 is poised for accelerated expansion, with projected compound annual growth rates (CAGRs) in the double digits. This surge is directly attributable to significant technological advancements, including the development of more sophisticated stabilization solutions that ensure sample integrity for extended periods, and the integration of smart technologies for real-time data tracking and transmission. Consumer demand has been a pivotal factor, with a growing segment of the population embracing the convenience, privacy, and accessibility of at-home blood testing. This trend is amplified by the increasing prevalence of chronic diseases, where regular monitoring is crucial for effective disease management. Furthermore, the burgeoning field of preventive health and wellness is fueling demand for proactive health assessments, making self-collection devices an attractive option for early detection and lifestyle monitoring. The COVID-19 pandemic also served as a significant catalyst, underscoring the importance of remote healthcare solutions and accelerating the adoption of technologies that facilitate testing outside traditional clinical environments. The development of user-friendly interfaces and educational resources further empowers individuals to confidently perform blood collection at home, thereby democratizing access to vital health information. The industry's evolution is marked by a continuous push towards greater accuracy, reduced invasiveness, and seamless integration with digital health ecosystems, creating a robust foundation for sustained growth and innovation. The estimated market size for the base year of 2025 is projected to reach XXX million, with an anticipated growth to XXX million by the end of the estimated year of 2025.

Leading Regions, Countries, or Segments in Self-Collecting Blood Storage Devices

The self-collecting blood storage devices market is experiencing dynamic shifts, with North America and Europe currently leading in terms of adoption and market penetration. Within these regions, the United States and Germany stand out as key countries driving growth, fueled by robust healthcare infrastructure, a high disposable income, and a proactive approach to health and wellness. The application segment of Disease Management is a dominant force, given the critical need for continuous monitoring of conditions such as diabetes, cardiovascular diseases, and infectious diseases. This segment alone accounts for an estimated XX% of the market revenue.

- Dominant Application Segment:

- Disease Management: Essential for regular monitoring of chronic conditions, including diabetes, hypertension, and autoimmune disorders.

- Key Drivers: Growing prevalence of chronic diseases, demand for convenient home monitoring solutions, and government initiatives promoting preventive healthcare.

- Market Share: Estimated at XX% of the total market.

- Disease Management: Essential for regular monitoring of chronic conditions, including diabetes, hypertension, and autoimmune disorders.

- Leading Types:

- Low-Dose Blood Collection: Ideal for routine testing and wellness monitoring, offering user convenience and minimal discomfort.

- Key Drivers: Increasing adoption for personal health tracking, affordability, and ease of use.

- Market Share: Expected to grow at a CAGR of XX% during the forecast period.

- High-Dose Blood Collection: Critical for specialized diagnostic tests and therapeutic drug monitoring, requiring precise sample volumes.

- Key Drivers: Advancements in diagnostic accuracy, increasing demand for precision medicine, and adoption in clinical research.

- Market Share: Contributes significantly to the diagnostics and research segments.

- Low-Dose Blood Collection: Ideal for routine testing and wellness monitoring, offering user convenience and minimal discomfort.

- Regional Dominance Factors:

- North America: High healthcare expenditure, strong presence of leading market players, and early adoption of innovative medical technologies.

- Europe: Favorable regulatory environments for medical devices, strong emphasis on preventative care, and a well-established pharmaceutical and biotechnology sector.

- Emerging Markets: Asia Pacific, particularly China and India, presents significant growth potential due to a rising middle class, increasing healthcare awareness, and a burgeoning demand for accessible healthcare solutions. The Epidemiological Population Health Studies segment is also gaining traction, particularly in countries investing heavily in public health research and disease surveillance.

Self-Collecting Blood Storage Devices Product Innovations

Product innovation in self-collecting blood storage devices is rapidly advancing, focusing on enhanced user experience, sample preservation, and data integration. Companies are developing novel microfluidic technologies for less invasive blood collection, alongside advanced preservative formulations that ensure sample stability for up to XX days at ambient temperatures. Unique selling propositions include integrated digital tracking capabilities, allowing users to monitor collection times, sample quality, and securely transmit data to healthcare providers or diagnostic labs. These advancements are crucial for applications ranging from disease management and health & wellness monitoring to facilitating drug discovery & development and large-scale epidemiological population health studies.

Propelling Factors for Self-Collecting Blood Storage Devices Growth

The growth of the self-collecting blood storage devices market is propelled by several key factors. Technologically, advancements in biosensor technology and miniaturization are enabling more accurate and user-friendly devices. Economically, increasing disposable incomes and a growing emphasis on preventive healthcare are driving consumer adoption. Regulatory bodies are also becoming more receptive to home-use medical devices, fostering a supportive environment. The increasing prevalence of chronic diseases necessitates frequent monitoring, a need perfectly met by self-collection solutions. Furthermore, the growing acceptance of telehealth and remote patient monitoring systems has created a fertile ground for these devices. The demand for personalized medicine and early disease detection further bolsters the market's expansion.

Obstacles in the Self-Collecting Blood Storage Devices Market

Despite the promising growth, the self-collecting blood storage devices market faces several obstacles. Regulatory hurdles in obtaining approvals for new devices can be time-consuming and costly, with varying requirements across different regions, potentially impacting market entry for new players. Supply chain disruptions, as evidenced in recent global events, can affect the availability of critical components and raw materials, leading to production delays and increased costs, impacting the XXX million market. Furthermore, intense competitive pressures from established players and emerging startups necessitate continuous innovation and strategic pricing, potentially leading to price wars that affect profit margins for companies like Thermo Fisher Scientific and Blue Star. User adoption can also be hindered by a lack of awareness, fear of needles, or concerns about sample accuracy, requiring significant investment in education and marketing.

Future Opportunities in Self-Collecting Blood Storage Devices

Emerging opportunities within the self-collecting blood storage devices market are substantial. The expansion into emerging economies presents a vast untapped market, driven by increasing healthcare awareness and the growing need for accessible diagnostic tools. Technological advancements in artificial intelligence (AI) and machine learning (ML) offer opportunities for enhanced data analysis and personalized health insights derived from collected samples. The integration of these devices with wearable technology and broader digital health platforms will create a more connected and proactive healthcare ecosystem. Furthermore, the increasing focus on companion diagnostics and pharmacogenomics opens up new avenues for specialized self-collection devices. The growing demand for at-home testing for rare diseases and infectious disease surveillance also represents a significant growth frontier, projected to contribute an additional XXX million to the market.

Major Players in the Self-Collecting Blood Storage Devices Ecosystem

- Thermo Fisher Scientific

- Blue Star

- Helmer Scientific

- Vestfrost Solutions

- Philipp Kirsch

- Zhongke Meiling Cryogenics

- LEC Medical

- Haier Biomedical

- Trajan Scientific and Medical

- Drawbridge Health

- Weavr Health

- Microdrop

Key Developments in Self-Collecting Blood Storage Devices Industry

- 2023 Q4: Drawbridge Health launched its updated sample collection device, improving user experience and sample stability for a wider range of analytes.

- 2023 Q3: Weavr Health secured XXX million in Series B funding to scale its manufacturing of advanced blood collection and stabilization solutions.

- 2023 Q2: Thermo Fisher Scientific expanded its portfolio with the acquisition of a leading developer of point-of-care diagnostic technologies, potentially impacting the self-collection market.

- 2023 Q1: Haier Biomedical introduced a new line of portable blood storage units designed for remote healthcare settings, enhancing sample integrity during transport.

- 2022 Q4: Trajan Scientific and Medical announced a strategic partnership to integrate its sample collection devices with emerging digital health platforms.

- 2022 Q3: Helmer Scientific unveiled a new generation of benchtop blood refrigerators featuring enhanced temperature monitoring and data logging capabilities.

- 2021 Q4: Blue Star invested XXX million in research and development for advanced cryogenic storage solutions for biological samples.

Strategic Self-Collecting Blood Storage Devices Market Forecast

The strategic self-collecting blood storage devices market forecast indicates a robust growth trajectory driven by increasing patient empowerment and the shift towards decentralized healthcare. Technological innovations in sample stabilization, user-friendly designs, and seamless digital integration will continue to be key growth catalysts. The expanding applications in disease management, preventive health, and drug discovery & development present substantial market potential, estimated to reach over XXX million by 2033. Investments in remote patient monitoring infrastructure and a growing demand for personalized health insights will further accelerate market expansion, solidifying the role of self-collecting blood storage devices as integral components of the future healthcare landscape.

Self-Collecting Blood Storage Devices Segmentation

-

1. Application

- 1.1. Disease Management

- 1.2. Health & Wellness

- 1.3. Drug Discovery & Development

- 1.4. Epidemiological Population Health Studies

- 1.5. Others

-

2. Types

- 2.1. High-Dose Blood Collection

- 2.2. Low-Dose Blood Collection

Self-Collecting Blood Storage Devices Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Self-Collecting Blood Storage Devices Regional Market Share

Geographic Coverage of Self-Collecting Blood Storage Devices

Self-Collecting Blood Storage Devices REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Self-Collecting Blood Storage Devices Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Disease Management

- 5.1.2. Health & Wellness

- 5.1.3. Drug Discovery & Development

- 5.1.4. Epidemiological Population Health Studies

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. High-Dose Blood Collection

- 5.2.2. Low-Dose Blood Collection

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Self-Collecting Blood Storage Devices Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Disease Management

- 6.1.2. Health & Wellness

- 6.1.3. Drug Discovery & Development

- 6.1.4. Epidemiological Population Health Studies

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. High-Dose Blood Collection

- 6.2.2. Low-Dose Blood Collection

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Self-Collecting Blood Storage Devices Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Disease Management

- 7.1.2. Health & Wellness

- 7.1.3. Drug Discovery & Development

- 7.1.4. Epidemiological Population Health Studies

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. High-Dose Blood Collection

- 7.2.2. Low-Dose Blood Collection

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Self-Collecting Blood Storage Devices Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Disease Management

- 8.1.2. Health & Wellness

- 8.1.3. Drug Discovery & Development

- 8.1.4. Epidemiological Population Health Studies

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. High-Dose Blood Collection

- 8.2.2. Low-Dose Blood Collection

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Self-Collecting Blood Storage Devices Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Disease Management

- 9.1.2. Health & Wellness

- 9.1.3. Drug Discovery & Development

- 9.1.4. Epidemiological Population Health Studies

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. High-Dose Blood Collection

- 9.2.2. Low-Dose Blood Collection

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Self-Collecting Blood Storage Devices Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Disease Management

- 10.1.2. Health & Wellness

- 10.1.3. Drug Discovery & Development

- 10.1.4. Epidemiological Population Health Studies

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. High-Dose Blood Collection

- 10.2.2. Low-Dose Blood Collection

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Thermo Fisher Scientific

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Blue Star

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Helmer Scientific

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Vestfrost Solutions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Philipp Kirsch

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Zhongke Meiling Cryogenics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LEC Medical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Haier Biomedical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Trajan Scientific and Medical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Drawbridge Health

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Weavr Health

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Microdrop

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Thermo Fisher Scientific

List of Figures

- Figure 1: Global Self-Collecting Blood Storage Devices Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Self-Collecting Blood Storage Devices Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America Self-Collecting Blood Storage Devices Revenue (million), by Application 2025 & 2033

- Figure 4: North America Self-Collecting Blood Storage Devices Volume (K), by Application 2025 & 2033

- Figure 5: North America Self-Collecting Blood Storage Devices Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Self-Collecting Blood Storage Devices Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Self-Collecting Blood Storage Devices Revenue (million), by Types 2025 & 2033

- Figure 8: North America Self-Collecting Blood Storage Devices Volume (K), by Types 2025 & 2033

- Figure 9: North America Self-Collecting Blood Storage Devices Revenue Share (%), by Types 2025 & 2033

- Figure 10: North America Self-Collecting Blood Storage Devices Volume Share (%), by Types 2025 & 2033

- Figure 11: North America Self-Collecting Blood Storage Devices Revenue (million), by Country 2025 & 2033

- Figure 12: North America Self-Collecting Blood Storage Devices Volume (K), by Country 2025 & 2033

- Figure 13: North America Self-Collecting Blood Storage Devices Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Self-Collecting Blood Storage Devices Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Self-Collecting Blood Storage Devices Revenue (million), by Application 2025 & 2033

- Figure 16: South America Self-Collecting Blood Storage Devices Volume (K), by Application 2025 & 2033

- Figure 17: South America Self-Collecting Blood Storage Devices Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America Self-Collecting Blood Storage Devices Volume Share (%), by Application 2025 & 2033

- Figure 19: South America Self-Collecting Blood Storage Devices Revenue (million), by Types 2025 & 2033

- Figure 20: South America Self-Collecting Blood Storage Devices Volume (K), by Types 2025 & 2033

- Figure 21: South America Self-Collecting Blood Storage Devices Revenue Share (%), by Types 2025 & 2033

- Figure 22: South America Self-Collecting Blood Storage Devices Volume Share (%), by Types 2025 & 2033

- Figure 23: South America Self-Collecting Blood Storage Devices Revenue (million), by Country 2025 & 2033

- Figure 24: South America Self-Collecting Blood Storage Devices Volume (K), by Country 2025 & 2033

- Figure 25: South America Self-Collecting Blood Storage Devices Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Self-Collecting Blood Storage Devices Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Self-Collecting Blood Storage Devices Revenue (million), by Application 2025 & 2033

- Figure 28: Europe Self-Collecting Blood Storage Devices Volume (K), by Application 2025 & 2033

- Figure 29: Europe Self-Collecting Blood Storage Devices Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Self-Collecting Blood Storage Devices Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Self-Collecting Blood Storage Devices Revenue (million), by Types 2025 & 2033

- Figure 32: Europe Self-Collecting Blood Storage Devices Volume (K), by Types 2025 & 2033

- Figure 33: Europe Self-Collecting Blood Storage Devices Revenue Share (%), by Types 2025 & 2033

- Figure 34: Europe Self-Collecting Blood Storage Devices Volume Share (%), by Types 2025 & 2033

- Figure 35: Europe Self-Collecting Blood Storage Devices Revenue (million), by Country 2025 & 2033

- Figure 36: Europe Self-Collecting Blood Storage Devices Volume (K), by Country 2025 & 2033

- Figure 37: Europe Self-Collecting Blood Storage Devices Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Self-Collecting Blood Storage Devices Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Self-Collecting Blood Storage Devices Revenue (million), by Application 2025 & 2033

- Figure 40: Middle East & Africa Self-Collecting Blood Storage Devices Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa Self-Collecting Blood Storage Devices Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa Self-Collecting Blood Storage Devices Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa Self-Collecting Blood Storage Devices Revenue (million), by Types 2025 & 2033

- Figure 44: Middle East & Africa Self-Collecting Blood Storage Devices Volume (K), by Types 2025 & 2033

- Figure 45: Middle East & Africa Self-Collecting Blood Storage Devices Revenue Share (%), by Types 2025 & 2033

- Figure 46: Middle East & Africa Self-Collecting Blood Storage Devices Volume Share (%), by Types 2025 & 2033

- Figure 47: Middle East & Africa Self-Collecting Blood Storage Devices Revenue (million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Self-Collecting Blood Storage Devices Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa Self-Collecting Blood Storage Devices Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Self-Collecting Blood Storage Devices Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Self-Collecting Blood Storage Devices Revenue (million), by Application 2025 & 2033

- Figure 52: Asia Pacific Self-Collecting Blood Storage Devices Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific Self-Collecting Blood Storage Devices Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Self-Collecting Blood Storage Devices Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Self-Collecting Blood Storage Devices Revenue (million), by Types 2025 & 2033

- Figure 56: Asia Pacific Self-Collecting Blood Storage Devices Volume (K), by Types 2025 & 2033

- Figure 57: Asia Pacific Self-Collecting Blood Storage Devices Revenue Share (%), by Types 2025 & 2033

- Figure 58: Asia Pacific Self-Collecting Blood Storage Devices Volume Share (%), by Types 2025 & 2033

- Figure 59: Asia Pacific Self-Collecting Blood Storage Devices Revenue (million), by Country 2025 & 2033

- Figure 60: Asia Pacific Self-Collecting Blood Storage Devices Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific Self-Collecting Blood Storage Devices Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Self-Collecting Blood Storage Devices Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Application 2020 & 2033

- Table 3: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Types 2020 & 2033

- Table 4: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Types 2020 & 2033

- Table 5: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Region 2020 & 2033

- Table 7: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Application 2020 & 2033

- Table 8: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Application 2020 & 2033

- Table 9: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Types 2020 & 2033

- Table 10: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Types 2020 & 2033

- Table 11: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Country 2020 & 2033

- Table 13: United States Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Application 2020 & 2033

- Table 20: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Application 2020 & 2033

- Table 21: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Types 2020 & 2033

- Table 22: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Types 2020 & 2033

- Table 23: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Application 2020 & 2033

- Table 32: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Application 2020 & 2033

- Table 33: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Types 2020 & 2033

- Table 34: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Types 2020 & 2033

- Table 35: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Country 2020 & 2033

- Table 36: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Germany Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: France Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Italy Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Spain Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Russia Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Application 2020 & 2033

- Table 56: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Application 2020 & 2033

- Table 57: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Types 2020 & 2033

- Table 58: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Types 2020 & 2033

- Table 59: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Country 2020 & 2033

- Table 60: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 64: Israel Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 66: GCC Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Application 2020 & 2033

- Table 74: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Application 2020 & 2033

- Table 75: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Types 2020 & 2033

- Table 76: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Types 2020 & 2033

- Table 77: Global Self-Collecting Blood Storage Devices Revenue million Forecast, by Country 2020 & 2033

- Table 78: Global Self-Collecting Blood Storage Devices Volume K Forecast, by Country 2020 & 2033

- Table 79: China Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 80: China Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 82: India Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 84: Japan Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Self-Collecting Blood Storage Devices Revenue (million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Self-Collecting Blood Storage Devices Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Self-Collecting Blood Storage Devices?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Self-Collecting Blood Storage Devices?

Key companies in the market include Thermo Fisher Scientific, Blue Star, Helmer Scientific, Vestfrost Solutions, Philipp Kirsch, Zhongke Meiling Cryogenics, LEC Medical, Haier Biomedical, Trajan Scientific and Medical, Drawbridge Health, Weavr Health, Microdrop.

3. What are the main segments of the Self-Collecting Blood Storage Devices?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 715.2 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Self-Collecting Blood Storage Devices," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Self-Collecting Blood Storage Devices report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Self-Collecting Blood Storage Devices?

To stay informed about further developments, trends, and reports in the Self-Collecting Blood Storage Devices, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence