Key Insights

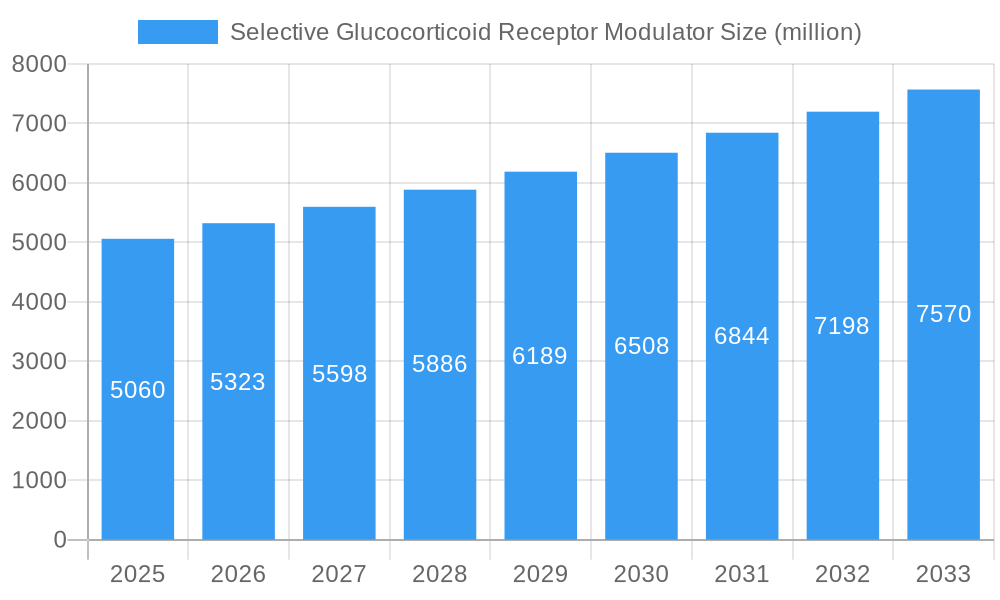

The Selective Glucocorticoid Receptor Modulator market is poised for significant expansion, projected to reach an estimated $5.06 billion in 2025. This robust growth is fueled by a projected Compound Annual Growth Rate (CAGR) of 5.2% through 2033. A primary driver for this market is the increasing prevalence of inflammatory and autoimmune diseases, where glucocorticoids play a crucial role in treatment. The development of selective modulators offers a more targeted approach, aiming to minimize the broad side effects associated with traditional glucocorticoid therapies, thus enhancing patient compliance and therapeutic outcomes. This refinement in drug development aligns with a global trend towards precision medicine and personalized treatment strategies. Furthermore, advancements in pharmaceutical research and development, coupled with substantial investments in novel drug discovery, are continually expanding the therapeutic potential and application areas for these modulators. The growing awareness and diagnosis of conditions that can be effectively managed by these modulators are also contributing to market buoyancy.

Selective Glucocorticoid Receptor Modulator Market Size (In Billion)

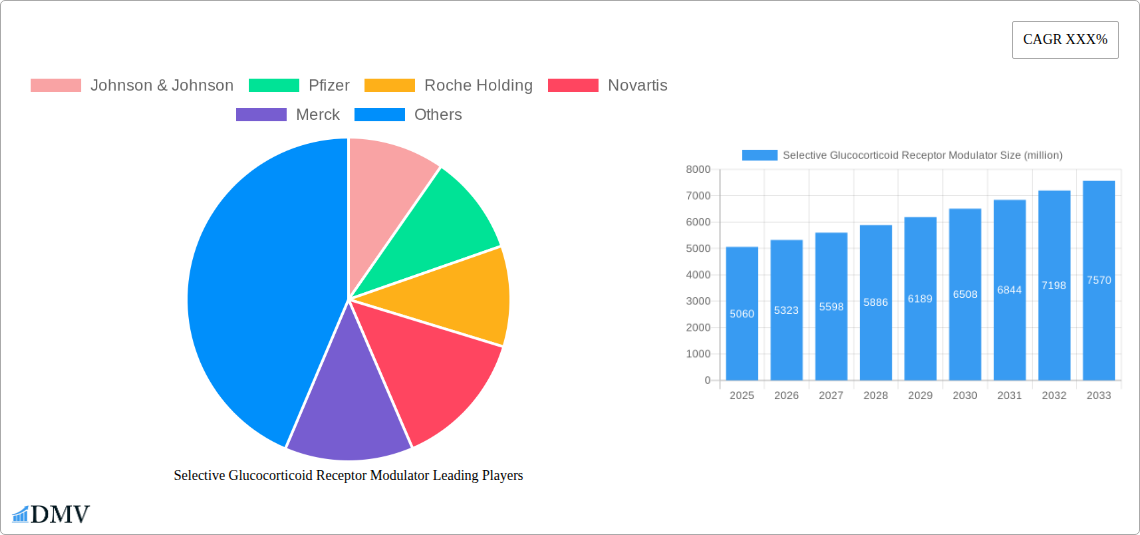

The market's trajectory is further supported by key trends such as the expanding applications beyond traditional inflammatory conditions into areas like metabolic disorders and oncology supportive care. The increasing adoption in various healthcare settings, including hospitals, clinics, and ambulatory surgical centers, underscores their therapeutic utility and market penetration. While the market is experiencing strong tailwinds, certain restraints need to be acknowledged. The high cost of research and development for novel molecules, coupled with stringent regulatory approval processes, can pose challenges. However, the inherent advantages of selective modulators in terms of improved safety profiles and efficacy are expected to outweigh these challenges, driving continued innovation and market growth. The competitive landscape features established pharmaceutical giants like Johnson & Johnson, Pfizer, and Roche Holding, alongside emerging players, all vying for market share through pipeline development and strategic collaborations.

Selective Glucocorticoid Receptor Modulator Company Market Share

Selective Glucocorticoid Receptor Modulator Market Composition & Trends

The global Selective Glucocorticoid Receptor Modulator (SGRM) market is characterized by a dynamic interplay of innovation, regulatory oversight, and evolving therapeutic applications. This report meticulously dissects the market composition, revealing key trends that are shaping its trajectory. We examine the market concentration, with leading pharmaceutical giants like Johnson & Johnson, Pfizer, Roche Holding, Novartis, Merck, Sanofi, AbbVie, Takeda Pharmaceutical Company, GlaxoSmithKline plc, and Teva Pharmaceuticals vying for significant market share. The report delves into the innovation catalysts, including advancements in drug discovery platforms and the increasing understanding of glucocorticoid receptor signaling pathways, which are driving the development of novel SGRMs.

Key aspects of market dynamics include:

- Market Share Distribution: Analysis of current market share held by key players and emerging entities, projected to reach billions in value.

- M&A Activities: Evaluation of Mergers & Acquisitions and partnership deals, with estimated deal values ranging from tens of millions to billions of dollars, indicating consolidation and strategic collaborations.

- Regulatory Landscape: A comprehensive overview of the evolving regulatory frameworks governing SGRM development and approval across major geographies, impacting market entry and product lifecycle.

- Substitute Products: Assessment of alternative therapeutic options and their potential impact on SGRM market penetration.

- End-User Profiles: Detailed understanding of the specific needs and treatment patterns of end-users, including Hospitals, Clinics, Ambulatory Surgical Centers, and other healthcare settings.

Selective Glucocorticoid Receptor Modulator Industry Evolution

The Selective Glucocorticoid Receptor Modulator (SGRM) industry has witnessed a profound evolution, transitioning from nascent research to a burgeoning therapeutic class with immense potential to address a wide spectrum of unmet medical needs. This evolution is marked by significant market growth trajectories, driven by escalating prevalence of inflammatory and autoimmune diseases, alongside metabolic disorders. Technological advancements have been instrumental, with breakthroughs in medicinal chemistry enabling the design of highly selective modulators, thereby minimizing off-target effects commonly associated with traditional glucocorticoids. These advancements have paved the way for improved efficacy and enhanced patient safety profiles, fostering greater adoption across diverse healthcare settings.

Shifting consumer demands, characterized by a growing preference for targeted therapies with fewer side effects and improved quality of life, have further propelled the SGRM market. Patients and healthcare providers are increasingly seeking treatment options that offer precise therapeutic benefits without the systemic adverse events associated with broad-acting corticosteroids. The study period from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, followed by a forecast period from 2025 to 2033, showcases a robust compound annual growth rate (CAGR) predicted to reach billions in market valuation. Specific data points such as predicted growth rates of xx% and adoption metrics indicating increasing prescription patterns highlight this upward trend. The historical period from 2019 to 2024 laid the foundation for this expansion, with early-stage clinical trials and initial product approvals setting the stage for future market dominance. The focus on developing SGRMs for conditions like Cushing's syndrome, inflammatory bowel disease, and certain types of cancer underscores the expanding therapeutic landscape and the industry's commitment to innovation.

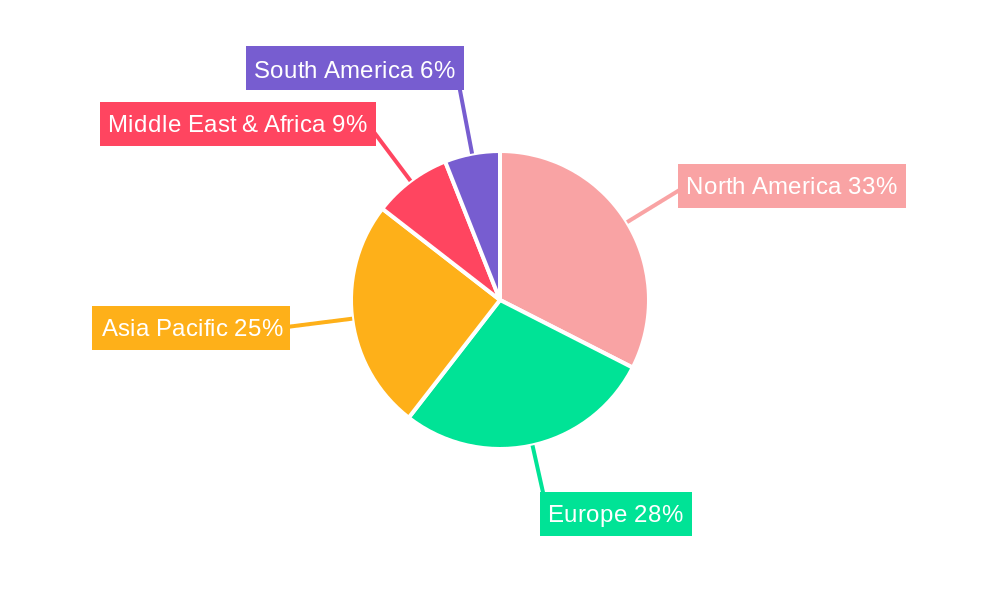

Leading Regions, Countries, or Segments in Selective Glucocorticoid Receptor Modulator

The global Selective Glucocorticoid Receptor Modulator (SGRM) market's dominance is not uniform, with specific regions, countries, and application segments exhibiting exceptional growth and strategic importance. North America, particularly the United States, currently leads the market, driven by a robust healthcare infrastructure, high R&D investment by major pharmaceutical companies, and a strong regulatory framework that supports innovation. The presence of leading companies such as Johnson & Johnson, Pfizer, and Merck, headquartered in this region, further solidifies its position.

Within the application segments, Hospitals represent the most significant end-user, owing to the complex and chronic nature of diseases treated with SGRMs, necessitating inpatient care and sophisticated treatment protocols. The demand for SGRMs in hospitals is further amplified by their role in managing acute exacerbations of inflammatory conditions and post-operative recovery.

Key drivers for this regional and segmental dominance include:

- Investment Trends: Substantial private and public investment in pharmaceutical R&D, with billions allocated annually towards the development of novel SGRMs.

- Regulatory Support: Favorable regulatory pathways and expedited review processes in key markets like the US and Europe, facilitating faster market entry for promising SGRMs.

- Prevalence of Target Diseases: A high incidence of inflammatory, autoimmune, and metabolic disorders that are primary indications for SGRM therapy.

- Technological Advancements: Early adoption and integration of advanced diagnostic and therapeutic technologies that complement SGRM treatments.

- Healthcare Expenditure: High per capita healthcare spending, enabling greater access to advanced medical treatments.

The segment of Selective Estrogen Receptor Modulators (SERMs), while distinct, shares a parallel market dynamic influenced by similar research and development paradigms, contributing to the broader understanding and application of selective receptor modulation technologies. The influence of these modulator types, including Selective Androgen Receptor Modulators (SARMs) and Selective Progesterone Receptor Modulators (SPRMs), on the overall SGRM market research and development cannot be understated, often leading to cross-disciplinary innovations and shared technological platforms.

Selective Glucocorticoid Receptor Modulator Product Innovations

Selective Glucocorticoid Receptor Modulator (SGRM) product innovation is rapidly advancing, focusing on enhancing therapeutic specificity and minimizing side effects. Recent breakthroughs include the development of next-generation SGRMs with significantly improved binding affinity and reduced interaction with other nuclear receptors, leading to fewer endocrine disruptions. These innovations are translating into novel applications for treating a wider array of inflammatory and autoimmune diseases, such as rheumatoid arthritis, asthma, and inflammatory bowel disease, with improved patient outcomes. Performance metrics in ongoing clinical trials are showcasing enhanced efficacy with reduced steroid-induced osteoporosis and metabolic disturbances, positioning these SGRMs as potential game-changers in chronic disease management, with market projections reaching billions.

Propelling Factors for Selective Glucocorticoid Receptor Modulator Growth

The growth of the Selective Glucocorticoid Receptor Modulator (SGRM) market is fueled by a confluence of powerful factors. Technological advancements in drug discovery and design are enabling the creation of highly targeted molecules with superior safety profiles compared to traditional glucocorticoids. The increasing prevalence of chronic inflammatory and autoimmune diseases globally, coupled with an aging population, creates a substantial and expanding patient pool requiring effective therapeutic interventions, with market valuations set to exceed billions. Furthermore, a favorable regulatory environment in key markets, characterized by streamlined approval pathways for innovative therapeutics, encourages pharmaceutical companies to invest heavily in SGRM development. Economic factors, including rising healthcare expenditures and a growing demand for personalized medicine, also contribute significantly to the market's upward trajectory.

Obstacles in the Selective Glucocorticoid Receptor Modulator Market

Despite its promising growth, the Selective Glucocorticoid Receptor Modulator (SGRM) market faces several obstacles. Regulatory hurdles remain a significant challenge, as the stringent approval processes for novel drug classes require extensive clinical trials, leading to high development costs and extended timelines. The potential for off-target effects, although minimized, still necessitates careful monitoring and patient selection, impacting widespread adoption. Supply chain disruptions and manufacturing complexities for highly specialized molecules can also pose challenges, potentially affecting product availability and cost. Moreover, intense competition from established steroid treatments and emerging alternative therapies, including biologics, puts pressure on market penetration, requiring substantial investment in market access and physician education. The estimated cost impact of these barriers is in the billions.

Future Opportunities in Selective Glucocorticoid Receptor Modulator

The future for Selective Glucocorticoid Receptor Modulators (SGRMs) is rich with opportunities. Emerging markets in Asia and Latin America, with their growing economies and increasing healthcare access, present significant untapped potential. Advancements in personalized medicine and companion diagnostics will enable more targeted SGRM therapies, improving patient stratification and treatment efficacy, leading to market expansion valued in the billions. The exploration of SGRMs for novel indications beyond inflammatory diseases, such as neurological disorders and certain cancers, opens new therapeutic frontiers. Furthermore, the development of oral SGRM formulations and combination therapies promises to enhance patient convenience and treatment outcomes, driving market growth.

Major Players in the Selective Glucocorticoid Receptor Modulator Ecosystem

- Johnson & Johnson

- Pfizer

- Roche Holding

- Novartis

- Merck

- Sanofi

- AbbVie

- Takeda Pharmaceutical Company

- GlaxoSmithKline plc

- Teva Pharmaceuticals

Key Developments in Selective Glucocorticoid Receptor Modulator Industry

- 2023/09: Launch of a Phase III clinical trial for a novel SGRM targeting severe asthma, indicating significant progress in respiratory applications.

- 2024/01: Acquisition of a promising SGRM early-stage pipeline by a major pharmaceutical company, signifying strategic investment in the therapeutic class.

- 2024/03: Positive results from a Phase II study of an SGRM for inflammatory bowel disease, demonstrating substantial reduction in disease activity.

- 2024/05: Regulatory submission for a new SGRM indication for Cushing's syndrome, potentially expanding market access.

- 2024/07: Strategic partnership announced between two leading biopharmaceutical firms to co-develop next-generation SGRMs, pooling resources and expertise.

Strategic Selective Glucocorticoid Receptor Modulator Market Forecast

The strategic forecast for the Selective Glucocorticoid Receptor Modulator (SGRM) market is exceptionally positive, projected to reach billions in valuation by 2033. Key growth catalysts include the expanding pipeline of highly selective SGRMs demonstrating improved safety and efficacy profiles, addressing significant unmet needs in inflammatory, autoimmune, and metabolic diseases. The increasing adoption in hospitals and clinics, supported by robust clinical evidence and favorable reimbursement policies, will drive substantial market expansion. Furthermore, the ongoing exploration of SGRMs for novel therapeutic applications and geographical penetration into emerging markets present immense untapped potential, solidifying the SGRM market's position as a critical and rapidly advancing segment of the pharmaceutical industry.

Selective Glucocorticoid Receptor Modulator Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Clinics

- 1.3. Ambulatory Surgical Centers

- 1.4. Others

-

2. Type

- 2.1. Selective Androgen Receptor Modulators

- 2.2. Selective Estrogen Receptor Modulators

- 2.3. Selective Progesterone Receptor Modulators

Selective Glucocorticoid Receptor Modulator Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Selective Glucocorticoid Receptor Modulator Regional Market Share

Geographic Coverage of Selective Glucocorticoid Receptor Modulator

Selective Glucocorticoid Receptor Modulator REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Selective Glucocorticoid Receptor Modulator Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Clinics

- 5.1.3. Ambulatory Surgical Centers

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Selective Androgen Receptor Modulators

- 5.2.2. Selective Estrogen Receptor Modulators

- 5.2.3. Selective Progesterone Receptor Modulators

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Selective Glucocorticoid Receptor Modulator Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Clinics

- 6.1.3. Ambulatory Surgical Centers

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Selective Androgen Receptor Modulators

- 6.2.2. Selective Estrogen Receptor Modulators

- 6.2.3. Selective Progesterone Receptor Modulators

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Selective Glucocorticoid Receptor Modulator Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Clinics

- 7.1.3. Ambulatory Surgical Centers

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Selective Androgen Receptor Modulators

- 7.2.2. Selective Estrogen Receptor Modulators

- 7.2.3. Selective Progesterone Receptor Modulators

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Selective Glucocorticoid Receptor Modulator Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Clinics

- 8.1.3. Ambulatory Surgical Centers

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Selective Androgen Receptor Modulators

- 8.2.2. Selective Estrogen Receptor Modulators

- 8.2.3. Selective Progesterone Receptor Modulators

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Selective Glucocorticoid Receptor Modulator Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Clinics

- 9.1.3. Ambulatory Surgical Centers

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Selective Androgen Receptor Modulators

- 9.2.2. Selective Estrogen Receptor Modulators

- 9.2.3. Selective Progesterone Receptor Modulators

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Selective Glucocorticoid Receptor Modulator Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Clinics

- 10.1.3. Ambulatory Surgical Centers

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Selective Androgen Receptor Modulators

- 10.2.2. Selective Estrogen Receptor Modulators

- 10.2.3. Selective Progesterone Receptor Modulators

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Johnson & Johnson

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Pfizer

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Roche Holding

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Novartis

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Merck

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sanofi

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AbbVie

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Takeda Pharmaceutical Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GlaxoSmithKline plc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Teva Pharmaceuticals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Johnson & Johnson

List of Figures

- Figure 1: Global Selective Glucocorticoid Receptor Modulator Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Selective Glucocorticoid Receptor Modulator Volume Breakdown (K, %) by Region 2025 & 2033

- Figure 3: North America Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Application 2025 & 2033

- Figure 4: North America Selective Glucocorticoid Receptor Modulator Volume (K), by Application 2025 & 2033

- Figure 5: North America Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Selective Glucocorticoid Receptor Modulator Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Type 2025 & 2033

- Figure 8: North America Selective Glucocorticoid Receptor Modulator Volume (K), by Type 2025 & 2033

- Figure 9: North America Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Selective Glucocorticoid Receptor Modulator Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Selective Glucocorticoid Receptor Modulator Volume (K), by Country 2025 & 2033

- Figure 13: North America Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Selective Glucocorticoid Receptor Modulator Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Application 2025 & 2033

- Figure 16: South America Selective Glucocorticoid Receptor Modulator Volume (K), by Application 2025 & 2033

- Figure 17: South America Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Application 2025 & 2033

- Figure 18: South America Selective Glucocorticoid Receptor Modulator Volume Share (%), by Application 2025 & 2033

- Figure 19: South America Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Type 2025 & 2033

- Figure 20: South America Selective Glucocorticoid Receptor Modulator Volume (K), by Type 2025 & 2033

- Figure 21: South America Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Selective Glucocorticoid Receptor Modulator Volume Share (%), by Type 2025 & 2033

- Figure 23: South America Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Country 2025 & 2033

- Figure 24: South America Selective Glucocorticoid Receptor Modulator Volume (K), by Country 2025 & 2033

- Figure 25: South America Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Selective Glucocorticoid Receptor Modulator Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Application 2025 & 2033

- Figure 28: Europe Selective Glucocorticoid Receptor Modulator Volume (K), by Application 2025 & 2033

- Figure 29: Europe Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Selective Glucocorticoid Receptor Modulator Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Type 2025 & 2033

- Figure 32: Europe Selective Glucocorticoid Receptor Modulator Volume (K), by Type 2025 & 2033

- Figure 33: Europe Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Type 2025 & 2033

- Figure 34: Europe Selective Glucocorticoid Receptor Modulator Volume Share (%), by Type 2025 & 2033

- Figure 35: Europe Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Country 2025 & 2033

- Figure 36: Europe Selective Glucocorticoid Receptor Modulator Volume (K), by Country 2025 & 2033

- Figure 37: Europe Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Selective Glucocorticoid Receptor Modulator Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Application 2025 & 2033

- Figure 40: Middle East & Africa Selective Glucocorticoid Receptor Modulator Volume (K), by Application 2025 & 2033

- Figure 41: Middle East & Africa Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Application 2025 & 2033

- Figure 42: Middle East & Africa Selective Glucocorticoid Receptor Modulator Volume Share (%), by Application 2025 & 2033

- Figure 43: Middle East & Africa Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Type 2025 & 2033

- Figure 44: Middle East & Africa Selective Glucocorticoid Receptor Modulator Volume (K), by Type 2025 & 2033

- Figure 45: Middle East & Africa Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Type 2025 & 2033

- Figure 46: Middle East & Africa Selective Glucocorticoid Receptor Modulator Volume Share (%), by Type 2025 & 2033

- Figure 47: Middle East & Africa Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East & Africa Selective Glucocorticoid Receptor Modulator Volume (K), by Country 2025 & 2033

- Figure 49: Middle East & Africa Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Selective Glucocorticoid Receptor Modulator Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Application 2025 & 2033

- Figure 52: Asia Pacific Selective Glucocorticoid Receptor Modulator Volume (K), by Application 2025 & 2033

- Figure 53: Asia Pacific Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Selective Glucocorticoid Receptor Modulator Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Type 2025 & 2033

- Figure 56: Asia Pacific Selective Glucocorticoid Receptor Modulator Volume (K), by Type 2025 & 2033

- Figure 57: Asia Pacific Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Type 2025 & 2033

- Figure 58: Asia Pacific Selective Glucocorticoid Receptor Modulator Volume Share (%), by Type 2025 & 2033

- Figure 59: Asia Pacific Selective Glucocorticoid Receptor Modulator Revenue (undefined), by Country 2025 & 2033

- Figure 60: Asia Pacific Selective Glucocorticoid Receptor Modulator Volume (K), by Country 2025 & 2033

- Figure 61: Asia Pacific Selective Glucocorticoid Receptor Modulator Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Selective Glucocorticoid Receptor Modulator Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Application 2020 & 2033

- Table 3: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Type 2020 & 2033

- Table 5: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Region 2020 & 2033

- Table 7: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Application 2020 & 2033

- Table 9: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Type 2020 & 2033

- Table 11: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Country 2020 & 2033

- Table 13: United States Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 15: Canada Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 17: Mexico Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 19: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Application 2020 & 2033

- Table 21: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Type 2020 & 2033

- Table 23: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Country 2020 & 2033

- Table 25: Brazil Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Brazil Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 27: Argentina Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Argentina Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 31: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Application 2020 & 2033

- Table 33: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Type 2020 & 2033

- Table 35: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 39: Germany Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Germany Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 41: France Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: France Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 43: Italy Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Italy Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 45: Spain Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Spain Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 47: Russia Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Russia Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 49: Benelux Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Benelux Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 51: Nordics Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Nordics Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 55: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Application 2020 & 2033

- Table 56: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Application 2020 & 2033

- Table 57: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Type 2020 & 2033

- Table 58: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Type 2020 & 2033

- Table 59: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Country 2020 & 2033

- Table 61: Turkey Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Turkey Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 63: Israel Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Israel Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 65: GCC Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: GCC Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 67: North Africa Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 68: North Africa Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 69: South Africa Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 70: South Africa Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 73: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Application 2020 & 2033

- Table 74: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Application 2020 & 2033

- Table 75: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Type 2020 & 2033

- Table 76: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Type 2020 & 2033

- Table 77: Global Selective Glucocorticoid Receptor Modulator Revenue undefined Forecast, by Country 2020 & 2033

- Table 78: Global Selective Glucocorticoid Receptor Modulator Volume K Forecast, by Country 2020 & 2033

- Table 79: China Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: China Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 81: India Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: India Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 83: Japan Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 84: Japan Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 85: South Korea Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 86: South Korea Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 89: Oceania Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Oceania Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Selective Glucocorticoid Receptor Modulator Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Selective Glucocorticoid Receptor Modulator Volume (K) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Selective Glucocorticoid Receptor Modulator?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Selective Glucocorticoid Receptor Modulator?

Key companies in the market include Johnson & Johnson, Pfizer, Roche Holding, Novartis, Merck, Sanofi, AbbVie, Takeda Pharmaceutical Company, GlaxoSmithKline plc, Teva Pharmaceuticals.

3. What are the main segments of the Selective Glucocorticoid Receptor Modulator?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Selective Glucocorticoid Receptor Modulator," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Selective Glucocorticoid Receptor Modulator report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Selective Glucocorticoid Receptor Modulator?

To stay informed about further developments, trends, and reports in the Selective Glucocorticoid Receptor Modulator, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence