Key Insights

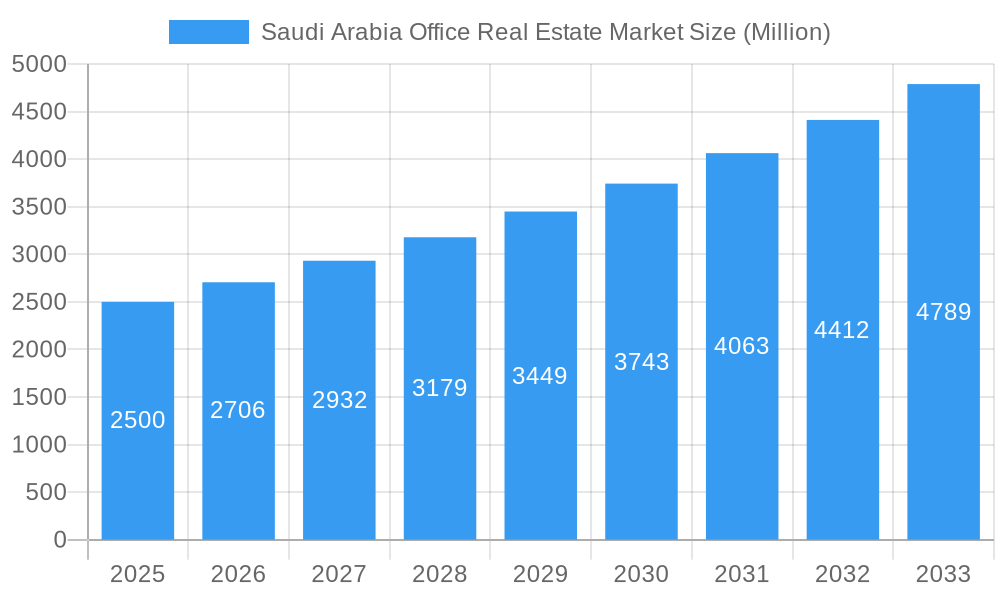

The Saudi Arabian office real estate market, valued at approximately 20874.6 million in 2025, is projected to experience substantial growth. With a Compound Annual Growth Rate (CAGR) of 6.75% from 2025 to 2033, this expansion is driven by Vision 2030's economic diversification strategy, attracting foreign investment and fostering demand for modern office spaces in key cities like Riyadh and Jeddah. The burgeoning technology sector and the rise of SMEs further contribute to office space requirements. Infrastructure development and enhanced ease of doing business also bolster market appeal. Geographically, Riyadh and Jeddah lead market share due to their established business environments and multinational corporate presence, though decentralized development initiatives are fostering growth in other cities. Challenges include potential oil price volatility impacting investor confidence and the imperative for sustainable, technologically advanced office solutions to attract talent. Intense competition among established entities like Nai Saudi Arabia and Kingdom Holding Company, alongside international firms such as JLL Riyadh, spurs innovation in design, technology integration, and property management.

Saudi Arabia Office Real Estate Market Market Size (In Billion)

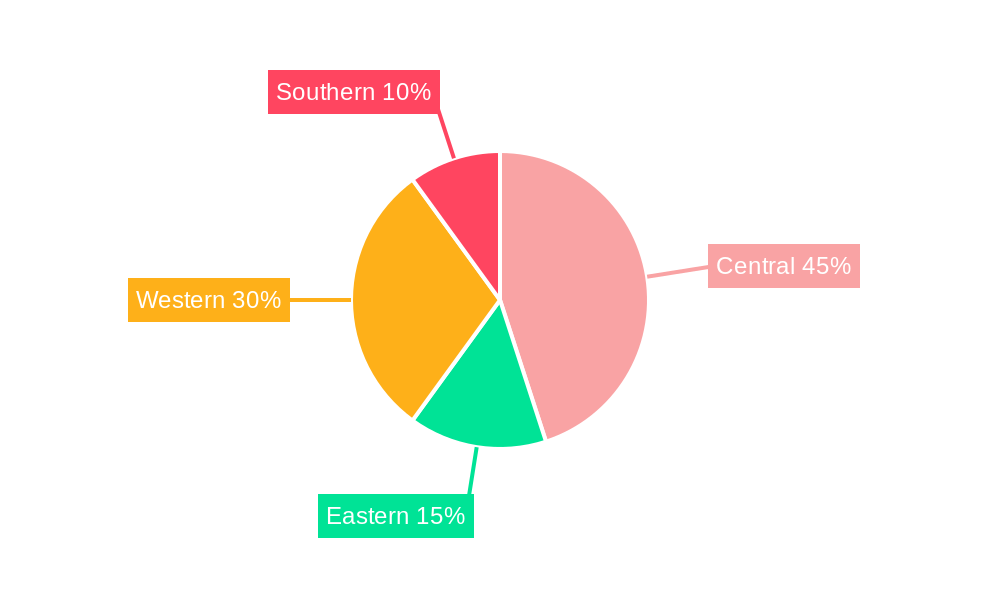

The forecast period (2025-2033) anticipates continued expansion, fueled by government initiatives promoting economic diversification and sector growth. The historical period (2019-2024) likely demonstrated moderate growth, influenced by global economic conditions and domestic policy changes. The Central region, led by Riyadh, is expected to retain the largest market share, followed by the Western region, encompassing Jeddah. Strategic investments in the Eastern and Southern regions are poised to increase their market shares during the forecast period. Analyzing key player performance provides a comprehensive understanding of the market's competitive dynamics and future trajectory. Success will hinge on adapting to evolving tenant demands, delivering sustainable and advanced solutions, and effectively navigating the competitive landscape.

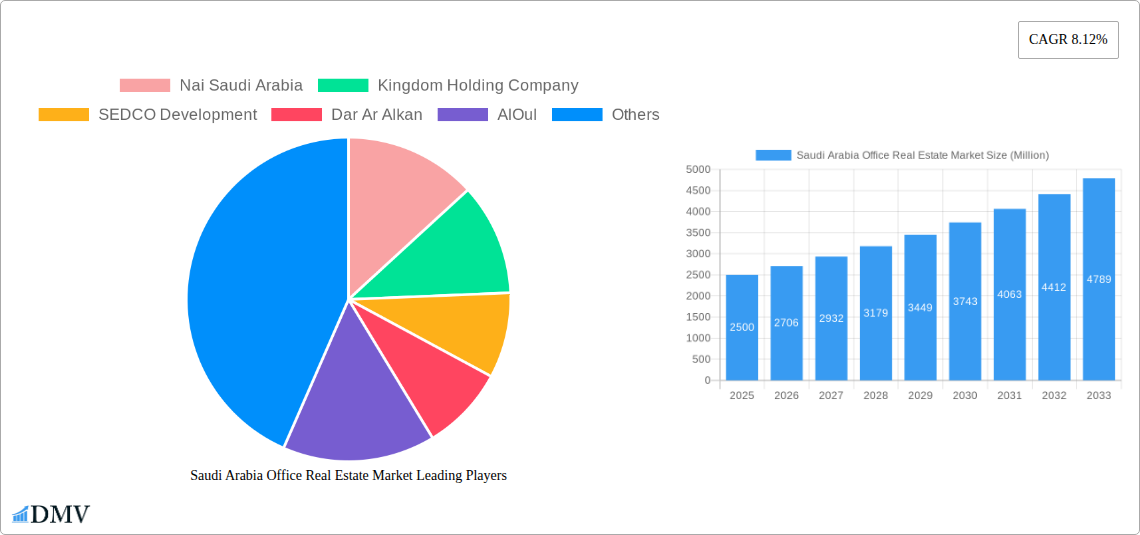

Saudi Arabia Office Real Estate Market Company Market Share

Saudi Arabia Office Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Saudi Arabia office real estate market, covering the period from 2019 to 2033. It examines market trends, leading players, key developments, and future opportunities, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The report uses 2025 as its base and estimated year, with a forecast period extending to 2033. Data for the historical period (2019-2024) provides crucial context for understanding current market conditions.

Saudi Arabia Office Real Estate Market Composition & Trends

This section delves into the competitive landscape of the Saudi Arabian office real estate market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activity. The analysis considers the market share distribution among major players and assesses the value of significant M&A deals. The market is characterized by a relatively concentrated landscape, with several large players holding significant market share. However, the entry of new players and increased investment is fostering competition. Innovation is driven by technological advancements like smart building technologies and sustainable designs. Regulatory changes, particularly those related to foreign investment and construction permits, significantly influence market dynamics. Substitute products, such as co-working spaces, are gaining traction, posing a challenge to traditional office spaces. End-user profiles are diverse, encompassing multinational corporations, SMEs, and government agencies. M&A activity has been robust in recent years, with deal values reaching xx Million, primarily driven by consolidation and expansion strategies. Key market participants include, but aren't limited to, companies like Nai Saudi Arabia, Kingdom Holding Company, SEDCO Development, Dar Al Arkan, AlOul, Abdul Latif Jameel, and others. The market share distribution shows xx% concentrated in the top 5 players in 2024. M&A deal values have averaged xx Million annually during the historical period.

Saudi Arabia Office Real Estate Market Industry Evolution

This section analyzes the evolution of Saudi Arabia's office real estate market from 2019 to 2033, exploring market growth trajectories, technological integration, and evolving consumer preferences. The Saudi Vision 2030 initiative has been a key driver of growth, stimulating investment in infrastructure and real estate development. Technological advancements such as smart building management systems and flexible workspace solutions are transforming the industry. The market is experiencing a shift toward demand for sustainable, energy-efficient, and technologically advanced office spaces. Growth rates have averaged xx% annually during the historical period, with projections indicating a sustained growth rate of xx% during the forecast period. Adoption of smart building technologies is growing at a rate of xx% annually, driven by the increasing demand for efficiency and sustainability. The increasing urbanization and population growth in major cities will continue to fuel the demand for office spaces, with the growth rates in these areas exceeding the national average.

Leading Regions, Countries, or Segments in Saudi Arabia Office Real Estate Market

Riyadh, Jeddah, and Makkah are the leading cities in the Saudi Arabian office real estate market. Riyadh maintains its dominant position due to its status as the capital city, housing major government institutions and corporate headquarters. Jeddah, a major commercial hub and gateway to the Red Sea, experiences robust demand from both domestic and international businesses. Makkah's importance as a religious center drives specialized office space demand.

- Riyadh: High concentration of government offices, major corporations, and substantial foreign direct investment (FDI) flows. Strong regulatory support for development and infrastructural investment.

- Jeddah: Major commercial port city, significant foreign investment, and strong tourism sector influence. High demand for modern and technologically advanced office spaces.

- Makkah: Specialized office spaces catering to religious tourism and related services, supported by government-led projects.

- Other Cities: Developing markets showcasing growth potential, driven by regional economic diversification and infrastructure development initiatives.

The dominance of Riyadh stems from its role as the political and economic center, attracting significant investment and driving robust demand for office spaces. Jeddah benefits from its strategic location as a major port and commercial hub. The strong support of the government for infrastructural projects and business growth significantly boosts these cities' office real estate markets.

Saudi Arabia Office Real Estate Market Product Innovations

Recent innovations in the Saudi Arabian office real estate market include the integration of smart building technologies, sustainable design features, and flexible workspace configurations. This trend is driven by a focus on enhancing energy efficiency, optimizing operational costs, and attracting tenants with preferences for environmentally friendly and technologically advanced spaces. Unique selling propositions include high-speed internet connectivity, advanced security systems, and on-site amenities such as fitness centers and recreational facilities.

Propelling Factors for Saudi Arabia Office Real Estate Market Growth

Several factors are propelling the growth of Saudi Arabia's office real estate market. These include Vision 2030, a national development plan emphasizing economic diversification and infrastructure development, which significantly stimulates investment in real estate. Strong government support for construction and regulatory reforms promotes a favorable business environment for real estate development. The increasing urbanization and population growth contribute to higher demand for office spaces, coupled with a growing number of both domestic and international companies establishing a presence. Technological advancements such as the implementation of smart building technologies and flexible workspaces further fuel demand for high-quality office accommodation.

Obstacles in the Saudi Arabia Office Real Estate Market

The Saudi Arabian office real estate market faces challenges such as fluctuating oil prices, which can impact overall economic growth and investment in the sector. The global economic slowdown, potential future disruptions to the supply chain, and competition from other real estate asset classes (e.g., residential, retail) pose challenges. Additionally, stringent regulations concerning building permits and land acquisition processes can add complexities and delays to development projects. These factors collectively impact market growth and lead to uncertainties.

Future Opportunities in Saudi Arabia Office Real Estate Market

Future opportunities lie in developing sustainable and technologically advanced office spaces to meet growing demand, and exploring specialized niche markets such as co-working spaces and serviced offices to cater to diverse business needs. Expansion into secondary cities fueled by regional economic diversification initiatives, and leveraging technological advancements for enhanced building efficiency and smart property management represent exciting avenues for future growth. The continued implementation of Vision 2030 will be a crucial driver of growth.

Major Players in the Saudi Arabia Office Real Estate Market Ecosystem

- Nai Saudi Arabia

- Kingdom Holding Company

- SEDCO Development

- Dar Al Arkan

- AlOul

- Abdul Latif Jameel

- JLL Riyadh

- Century 21 Saudi Arabia

- Saudi Real Estate Company

Key Developments in Saudi Arabia Office Real Estate Market Industry

- November 2022: Arabian Centres Company sold non-core assets worth 2 Billion Saudi Riyals to Adeer Real Estate for repurposing into residential or office spaces. This indicates a shift in market priorities towards diverse real estate development.

- October 2022: Ajdan Real Estate Development Company partnered with Al-Muhaidib Group to develop the 250 Million Saudi Riyals (USD 66.5 Million) Bayfront commercial project in Al-Khobar. This signifies an increase in commercial projects outside of major cities.

Strategic Saudi Arabia Office Real Estate Market Forecast

The Saudi Arabia office real estate market is poised for sustained growth over the forecast period (2025-2033), driven by Vision 2030, urbanization, technological advancements, and favorable government policies. Emerging opportunities in sustainable construction, smart building technologies, and specialized office spaces will shape future market dynamics. The continued influx of foreign investment and diversification of the national economy will contribute to a robust and dynamic office real estate sector.

Saudi Arabia Office Real Estate Market Segmentation

-

1. Key Cities

- 1.1. Riyadh

- 1.2. Jeddah

- 1.3. Makkah

- 1.4. Other Cities

Saudi Arabia Office Real Estate Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Office Real Estate Market Regional Market Share

Geographic Coverage of Saudi Arabia Office Real Estate Market

Saudi Arabia Office Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing geriatric population; Growing cases of chronic disease among senior citizens

- 3.3. Market Restrains

- 3.3.1. High cost of elderly care services; Lack of skilled staff

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Office Spaces in Key Commercial Cities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Office Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 5.1.1. Riyadh

- 5.1.2. Jeddah

- 5.1.3. Makkah

- 5.1.4. Other Cities

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Key Cities

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nai Saudi Arabia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kingdom Holding Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SEDCO Development

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dar Ar Alkan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AlOul

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Abdul Latif Jameel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JLL Riyadh

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Century 21 Saudi Arabia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Real Estate Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Nai Saudi Arabia

List of Figures

- Figure 1: Saudi Arabia Office Real Estate Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Office Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Office Real Estate Market Revenue million Forecast, by Key Cities 2020 & 2033

- Table 2: Saudi Arabia Office Real Estate Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Saudi Arabia Office Real Estate Market Revenue million Forecast, by Key Cities 2020 & 2033

- Table 4: Saudi Arabia Office Real Estate Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Office Real Estate Market?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Saudi Arabia Office Real Estate Market?

Key companies in the market include Nai Saudi Arabia, Kingdom Holding Company, SEDCO Development, Dar Ar Alkan, AlOul, Abdul Latif Jameel, JLL Riyadh, Century 21 Saudi Arabia, Saudi Real Estate Company.

3. What are the main segments of the Saudi Arabia Office Real Estate Market?

The market segments include Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 20874.6 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing geriatric population; Growing cases of chronic disease among senior citizens.

6. What are the notable trends driving market growth?

Increasing Demand for Office Spaces in Key Commercial Cities.

7. Are there any restraints impacting market growth?

High cost of elderly care services; Lack of skilled staff.

8. Can you provide examples of recent developments in the market?

November 2022: Arabian Centres Company, Saudi Arabia's largest mall operator, has agreed to sell non-core assets worth 2 billion Saudi riyals to Adeer Real Estate. A study determined that the assets were best suited for residential or office space development rather than supporting the mall operator's strategic priorities of developing lifestyle destinations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Office Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Office Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Office Real Estate Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Office Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence