Key Insights

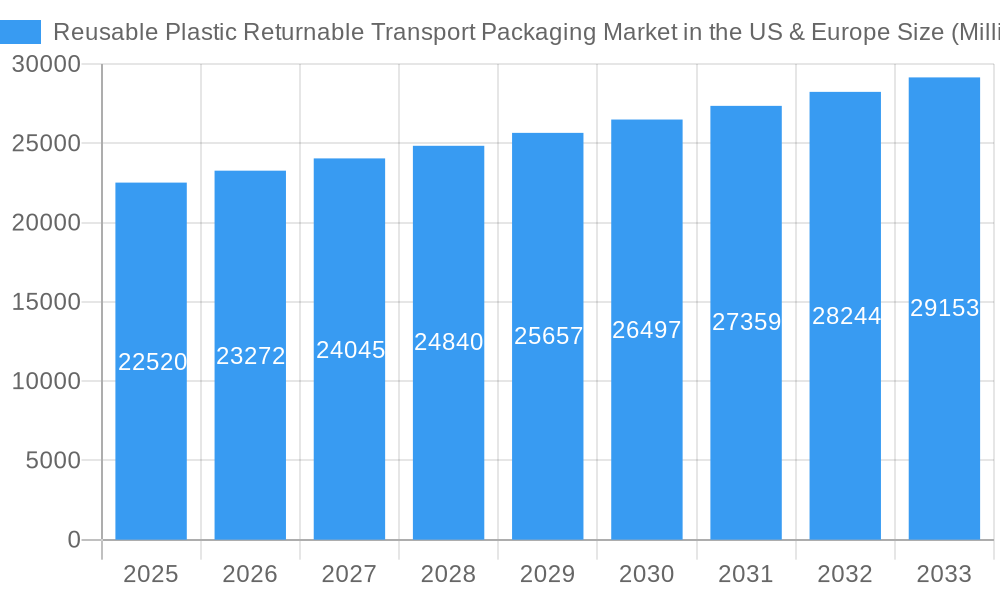

The Reusable Plastic Returnable Transport Packaging (RPTP) market in the US and Europe is experiencing robust growth, driven by increasing e-commerce activities, stringent environmental regulations promoting sustainability, and the rising demand for efficient supply chain solutions across various industries. The market, currently valued at approximately $22.52 billion (assuming this figure represents the combined US and European market in 2025 based on the provided global data), is projected to expand significantly over the forecast period (2025-2033). A 3.25% CAGR suggests a substantial increase in market value by 2033. Key growth drivers include the rising adoption of reusable packaging to minimize waste and reduce environmental impact, particularly within the food and beverage, automotive, and consumer durables sectors. Furthermore, the increasing focus on supply chain optimization and cost reduction is bolstering the demand for durable and efficient RPTP solutions. While the exact regional breakdown is not provided, we can assume a significant market share for both the US and Europe, given their developed economies and robust logistics networks. Competitive landscape analysis reveals a mix of established players and emerging companies, indicating healthy competition and ongoing innovation within the sector. The market is segmented by product type (reusable plastic containers, pallets, corrugated boxes, etc.) and end-user vertical, allowing for targeted market penetration strategies.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market Size (In Billion)

The European market, particularly in countries like Germany, France, and the UK, shows strong growth potential due to established environmental policies and a high concentration of manufacturing and logistics hubs. The US market is expected to witness considerable growth fueled by the e-commerce boom and the increasing focus on sustainable packaging practices across various sectors. Constraints might include the initial high investment costs associated with adopting reusable packaging systems and the need for efficient reverse logistics infrastructure to manage the return and cleaning processes. However, the long-term cost benefits and environmental advantages outweigh these challenges, driving sustained market growth. The ongoing development of innovative, durable, and customizable RPTP solutions will further shape market dynamics in the coming years.

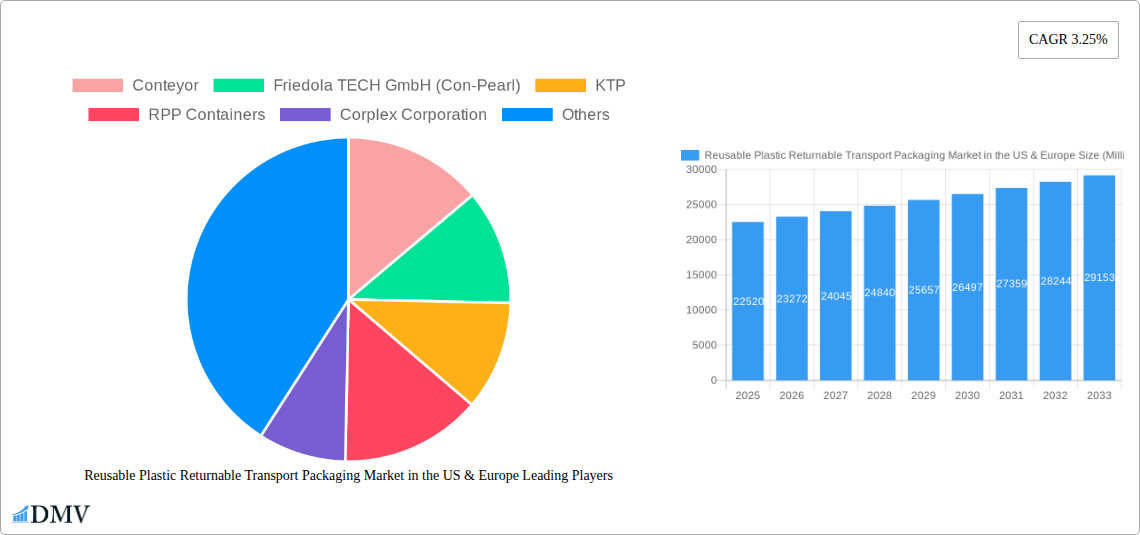

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Company Market Share

This comprehensive report delivers an in-depth analysis of the Reusable Plastic Returnable Transport Packaging market in the US & Europe, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. Covering the period 2019-2033, with a focus on 2025, this report provides a robust understanding of current market dynamics and future growth trajectories. The market is projected to reach xx Million by 2033.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market Composition & Trends

This section meticulously examines the competitive landscape of the reusable plastic returnable transport packaging market in the US and Europe. We analyze market concentration, identifying key players like Orbis Corporation, IFCO Systems, and others, and assess their respective market share distributions. Innovation catalysts, such as the increasing demand for sustainable packaging solutions and advancements in material science, are thoroughly explored. The report also delves into the regulatory landscape, including relevant environmental regulations and their impact on market growth. A detailed examination of substitute products and their competitive pressures is provided. Furthermore, the report profiles key end-users across diverse verticals, including food and beverage, automotive, and industrial sectors, providing granular insight into their packaging needs and preferences. Finally, the analysis encompasses recent mergers and acquisitions (M&A) activities within the industry, including deal values and their implications for market consolidation.

- Market Concentration: Highly fragmented with a few dominant players controlling approximately xx% of the market share.

- M&A Activity: xx Million in total deal value recorded between 2019 and 2024, reflecting increased consolidation.

- Key Players' Market Share: Orbis Corporation (xx%), IFCO Systems (xx%), and others.

- Regulatory Landscape: Stringent regulations concerning plastic waste management are driving market growth.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Industry Evolution

This section provides a comprehensive analysis of the evolutionary trajectory of the reusable plastic returnable transport packaging market in the US and Europe. We detail market growth rates, technological advancements driving efficiency and sustainability, and the evolving demands of consumers and businesses. The report charts the historical period (2019-2024) and projects the forecast period (2025-2033), providing data points on market size, growth rates, and adoption metrics for various product types and end-user verticals. The evolution of consumer preferences towards sustainable and environmentally friendly packaging is discussed in detail, analyzing its influence on market trends and innovation. Specific examples of technological advancements, such as the introduction of lighter, more durable plastics and improved tracking systems, are examined for their contributions to increased market adoption. Furthermore, the report incorporates an analysis of the impact of macroeconomic factors, such as economic growth and fluctuations in raw material prices, on market performance.

Leading Regions, Countries, or Segments in Reusable Plastic Returnable Transport Packaging Market in the US & Europe

The report identifies the dominant regions, countries, and segments within the US and European markets. Both the "By Product" and "By End-user Vertical" segmentations are comprehensively assessed, pinpointing the leading areas and driving forces behind their success.

By Product:

- Reusable Plastic Containers: This segment dominates the market due to its versatility and suitability across multiple industries. Drivers include increasing demand for efficient and hygienic packaging.

- Pallets: Significant growth driven by the e-commerce boom and the need for robust and reusable handling solutions in logistics and warehousing.

- Other Product Types: This segment includes crates, totes, and IBCs, showing steady growth supported by industry-specific requirements.

By End-user Vertical:

- Food and Beverage: This segment accounts for the largest market share due to stringent hygiene requirements and the increasing focus on sustainable packaging practices. Key drivers include traceability and improved supply chain efficiency.

- Automotive: Growing demand for reusable transport packaging stems from the need for efficient and damage-free transportation of automotive parts.

- Industrial (including Chemicals): This sector exhibits steady growth driven by the demand for durable and safe packaging solutions for chemical transport.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Product Innovations

Recent innovations in reusable plastic returnable transport packaging focus on enhancing durability, hygiene, and sustainability. New materials, designs, and integrated technologies are improving stackability, reducing weight, and enhancing traceability. These advancements optimize supply chain efficiency and minimize environmental impact. For example, the introduction of lighter-weight, high-strength plastics significantly lowers transportation costs and carbon emissions. Features like integrated RFID tags enable real-time tracking and inventory management, leading to improved logistics optimization.

Propelling Factors for Reusable Plastic Returnable Transport Packaging Market in the US & Europe Growth

Several factors drive market growth. Stringent environmental regulations incentivize the adoption of sustainable packaging solutions. The increasing focus on reducing carbon footprints across supply chains is boosting demand for reusable options. Technological advancements such as the integration of smart sensors for real-time tracking contribute to efficiency gains and cost savings. Growing e-commerce activities necessitate robust and reusable packaging to manage the increasing volume of shipments.

Obstacles in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market

Market growth faces challenges including the high initial investment costs for reusable packaging systems, which may deter some businesses, particularly smaller enterprises. Supply chain disruptions can impact the availability and timely delivery of reusable packaging, potentially leading to delays and increased costs. The competitive landscape, with established and new entrants, creates pricing pressures and requires companies to differentiate their offerings through innovation and value-added services. Fluctuations in raw material prices can also impact the overall cost of production and profitability.

Future Opportunities in Reusable Plastic Returnable Transport Packaging Market in the US & Europe

Future opportunities lie in expanding into new markets, particularly in developing economies with growing industrial and consumer sectors. The development and adoption of advanced materials with enhanced properties, such as improved durability and recyclability, will create new market segments. Integrating smart technologies, such as IoT sensors and blockchain solutions, will improve supply chain traceability and transparency. Growing demand for sustainable packaging solutions in various sectors presents significant potential for growth.

Major Players in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe Ecosystem

- Conteyor

- Friedola TECH GmbH (Con-Pearl)

- KTP

- RPP Containers

- Corplex Corporation

- Schaefer Systems International Inc

- Kiga

- Tosca Ltd

- CABKA

- Sohner Plastics LLC

- IFCO Systems

- Wellplast

- Soehner

- Sustainable Transport Packaging (Reusable Transport Packaging)

- WI Sales

- Wisechemann

- Orbis Corporation (Menasha Corporation)

- Duro-Therm

- Auer

Key Developments in Reusable Plastic Returnable Transport Packaging Market in the US & Europe Industry

- June 2022: Orbis Corporation introduces the new p3 Pallet, a durable, lightweight, and stackable solution for sustainable handling in various applications.

Strategic Reusable Plastic Returnable Transport Packaging Market in the US & Europe Market Forecast

The reusable plastic returnable transport packaging market in the US and Europe is poised for significant growth driven by the increasing adoption of sustainable practices and technological advancements. Expanding e-commerce and the demand for efficient logistics will fuel market expansion. The development of innovative materials and the integration of smart technologies will further enhance the value proposition of reusable packaging, creating substantial growth opportunities for market players. The market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a projected market value of xx Million by 2033.

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Segmentation

-

1. Product

- 1.1. Reusable Plastic Containers

- 1.2. Pallets

- 1.3. Corrugated Boxes and Panels

- 1.4. IBCs

- 1.5. Crates and Totes

- 1.6. Other Product Types

-

2. End-user Vertical

- 2.1. Food and Beverage

- 2.2. Automotive

- 2.3. Consumer Durables

- 2.4. Industrial (including Chemicals)

- 2.5. Other End-user verticals

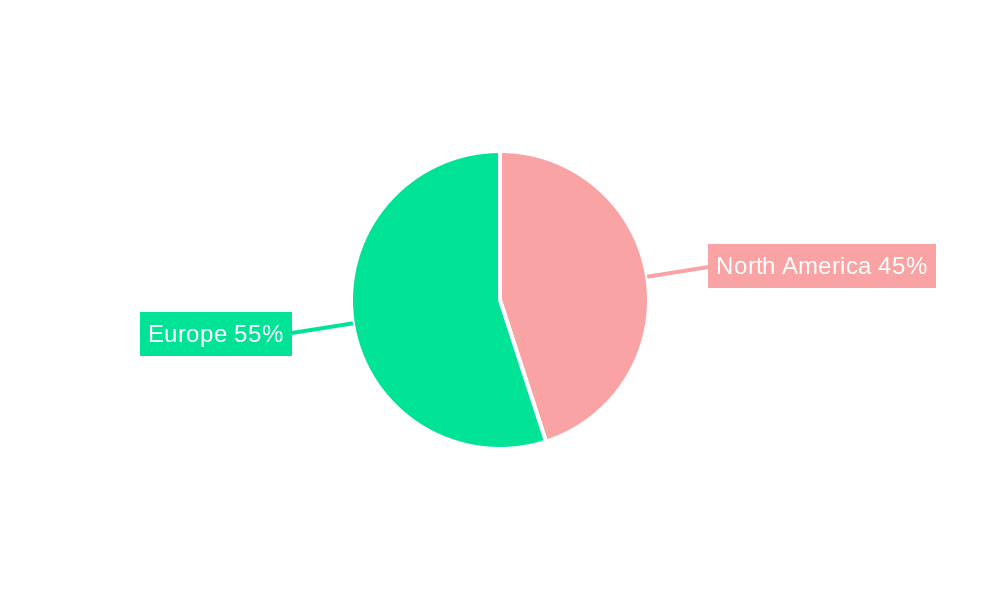

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Segmentation By Geography

- 1. United States

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

Reusable Plastic Returnable Transport Packaging Market in the US & Europe Regional Market Share

Geographic Coverage of Reusable Plastic Returnable Transport Packaging Market in the US & Europe

Reusable Plastic Returnable Transport Packaging Market in the US & Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Favorable Governmental Regulations; Automation to Increase the Demand for Reusable Plastic RTP

- 3.3. Market Restrains

- 3.3.1. Resistance to Process Change by Various Stakeholders; Availability of Alternative Materials

- 3.4. Market Trends

- 3.4.1. Pallets to Account for Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Reusable Plastic Containers

- 5.1.2. Pallets

- 5.1.3. Corrugated Boxes and Panels

- 5.1.4. IBCs

- 5.1.5. Crates and Totes

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food and Beverage

- 5.2.2. Automotive

- 5.2.3. Consumer Durables

- 5.2.4. Industrial (including Chemicals)

- 5.2.5. Other End-user verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. United States Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Reusable Plastic Containers

- 6.1.2. Pallets

- 6.1.3. Corrugated Boxes and Panels

- 6.1.4. IBCs

- 6.1.5. Crates and Totes

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Food and Beverage

- 6.2.2. Automotive

- 6.2.3. Consumer Durables

- 6.2.4. Industrial (including Chemicals)

- 6.2.5. Other End-user verticals

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Reusable Plastic Containers

- 7.1.2. Pallets

- 7.1.3. Corrugated Boxes and Panels

- 7.1.4. IBCs

- 7.1.5. Crates and Totes

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Food and Beverage

- 7.2.2. Automotive

- 7.2.3. Consumer Durables

- 7.2.4. Industrial (including Chemicals)

- 7.2.5. Other End-user verticals

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Competitive Analysis

- 8.1. Market Share Analysis 2025

- 8.2. Company Profiles

- 8.2.1 Conteyor

- 8.2.1.1. Overview

- 8.2.1.2. Products

- 8.2.1.3. SWOT Analysis

- 8.2.1.4. Recent Developments

- 8.2.1.5. Financials (Based on Availability)

- 8.2.2 Friedola TECH GmbH (Con-Pearl)

- 8.2.2.1. Overview

- 8.2.2.2. Products

- 8.2.2.3. SWOT Analysis

- 8.2.2.4. Recent Developments

- 8.2.2.5. Financials (Based on Availability)

- 8.2.3 KTP

- 8.2.3.1. Overview

- 8.2.3.2. Products

- 8.2.3.3. SWOT Analysis

- 8.2.3.4. Recent Developments

- 8.2.3.5. Financials (Based on Availability)

- 8.2.4 RPP Containers

- 8.2.4.1. Overview

- 8.2.4.2. Products

- 8.2.4.3. SWOT Analysis

- 8.2.4.4. Recent Developments

- 8.2.4.5. Financials (Based on Availability)

- 8.2.5 Corplex Corporation

- 8.2.5.1. Overview

- 8.2.5.2. Products

- 8.2.5.3. SWOT Analysis

- 8.2.5.4. Recent Developments

- 8.2.5.5. Financials (Based on Availability)

- 8.2.6 Schaefer Systems International Inc

- 8.2.6.1. Overview

- 8.2.6.2. Products

- 8.2.6.3. SWOT Analysis

- 8.2.6.4. Recent Developments

- 8.2.6.5. Financials (Based on Availability)

- 8.2.7 Kiga

- 8.2.7.1. Overview

- 8.2.7.2. Products

- 8.2.7.3. SWOT Analysis

- 8.2.7.4. Recent Developments

- 8.2.7.5. Financials (Based on Availability)

- 8.2.8 Tosca Ltd

- 8.2.8.1. Overview

- 8.2.8.2. Products

- 8.2.8.3. SWOT Analysis

- 8.2.8.4. Recent Developments

- 8.2.8.5. Financials (Based on Availability)

- 8.2.9 CABKA

- 8.2.9.1. Overview

- 8.2.9.2. Products

- 8.2.9.3. SWOT Analysis

- 8.2.9.4. Recent Developments

- 8.2.9.5. Financials (Based on Availability)

- 8.2.10 Sohner Plastics LLC

- 8.2.10.1. Overview

- 8.2.10.2. Products

- 8.2.10.3. SWOT Analysis

- 8.2.10.4. Recent Developments

- 8.2.10.5. Financials (Based on Availability)

- 8.2.11 IFCO Systems

- 8.2.11.1. Overview

- 8.2.11.2. Products

- 8.2.11.3. SWOT Analysis

- 8.2.11.4. Recent Developments

- 8.2.11.5. Financials (Based on Availability)

- 8.2.12 Wellplast

- 8.2.12.1. Overview

- 8.2.12.2. Products

- 8.2.12.3. SWOT Analysis

- 8.2.12.4. Recent Developments

- 8.2.12.5. Financials (Based on Availability)

- 8.2.13 Soehner

- 8.2.13.1. Overview

- 8.2.13.2. Products

- 8.2.13.3. SWOT Analysis

- 8.2.13.4. Recent Developments

- 8.2.13.5. Financials (Based on Availability)

- 8.2.14 Sustainable Transport Packaging (Reusable Transport Packaging)

- 8.2.14.1. Overview

- 8.2.14.2. Products

- 8.2.14.3. SWOT Analysis

- 8.2.14.4. Recent Developments

- 8.2.14.5. Financials (Based on Availability)

- 8.2.15 WI Sales*List Not Exhaustive

- 8.2.15.1. Overview

- 8.2.15.2. Products

- 8.2.15.3. SWOT Analysis

- 8.2.15.4. Recent Developments

- 8.2.15.5. Financials (Based on Availability)

- 8.2.16 Wisechemann

- 8.2.16.1. Overview

- 8.2.16.2. Products

- 8.2.16.3. SWOT Analysis

- 8.2.16.4. Recent Developments

- 8.2.16.5. Financials (Based on Availability)

- 8.2.17 Orbis Corporation (Menasha Corporation)

- 8.2.17.1. Overview

- 8.2.17.2. Products

- 8.2.17.3. SWOT Analysis

- 8.2.17.4. Recent Developments

- 8.2.17.5. Financials (Based on Availability)

- 8.2.18 Duro-Therm

- 8.2.18.1. Overview

- 8.2.18.2. Products

- 8.2.18.3. SWOT Analysis

- 8.2.18.4. Recent Developments

- 8.2.18.5. Financials (Based on Availability)

- 8.2.19 Auer

- 8.2.19.1. Overview

- 8.2.19.2. Products

- 8.2.19.3. SWOT Analysis

- 8.2.19.4. Recent Developments

- 8.2.19.5. Financials (Based on Availability)

- 8.2.1 Conteyor

List of Figures

- Figure 1: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Share (%) by Company 2025

List of Tables

- Table 1: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 10: United Kingdom Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Germany Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Reusable Plastic Returnable Transport Packaging Market in the US & Europe Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

Key companies in the market include Conteyor, Friedola TECH GmbH (Con-Pearl), KTP, RPP Containers, Corplex Corporation, Schaefer Systems International Inc, Kiga, Tosca Ltd, CABKA, Sohner Plastics LLC, IFCO Systems, Wellplast, Soehner, Sustainable Transport Packaging (Reusable Transport Packaging), WI Sales*List Not Exhaustive, Wisechemann, Orbis Corporation (Menasha Corporation), Duro-Therm, Auer.

3. What are the main segments of the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

The market segments include Product, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Favorable Governmental Regulations; Automation to Increase the Demand for Reusable Plastic RTP.

6. What are the notable trends driving market growth?

Pallets to Account for Major Market Share.

7. Are there any restraints impacting market growth?

Resistance to Process Change by Various Stakeholders; Availability of Alternative Materials.

8. Can you provide examples of recent developments in the market?

June 2022 - Orbis corporation has introduced the new p3 Pallet to its suite of reusable plastic pallet offerings to improve sustainable handling in primary packaging, food and beverage, and CPG applications. The size of the Pallet is 40,48 inches, a durable, lightweight, stackable, hygienic packaging solution that integrates seamlessly with both automatic and manual material handling equipment

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Reusable Plastic Returnable Transport Packaging Market in the US & Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe?

To stay informed about further developments, trends, and reports in the Reusable Plastic Returnable Transport Packaging Market in the US & Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence