Key Insights

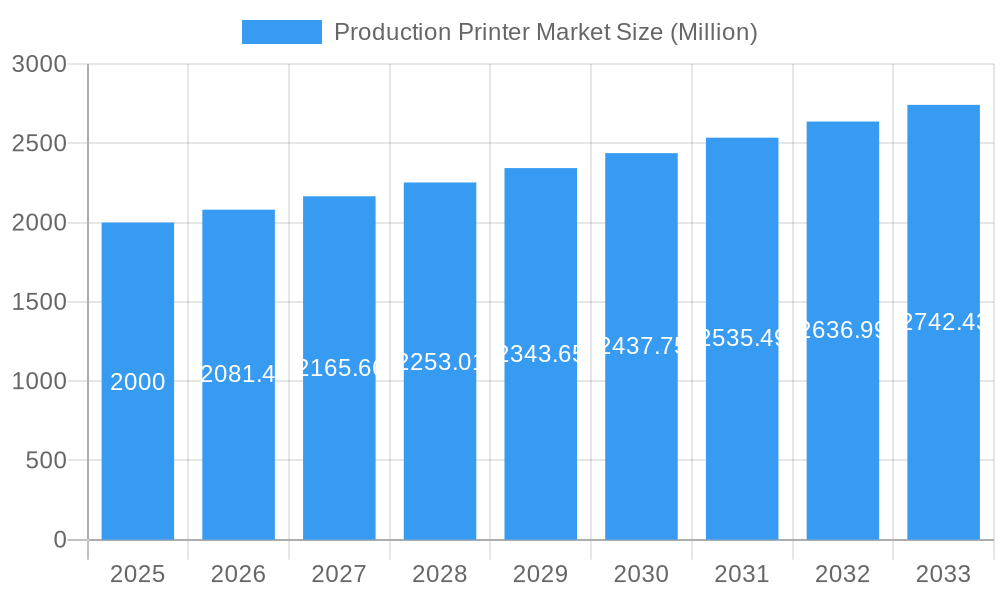

The global Production Printer Market is poised for significant expansion, projected to reach $6.61 billion by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 3.96% from 2025 to 2033. Key growth drivers include escalating demand for high-volume, high-quality printing in commercial, publishing, and packaging industries. Technological advancements in inkjet and toner technologies, offering enhanced speed, superior image fidelity, and improved cost efficiency, are further propelling market growth. The prevailing trend towards digital printing solutions, which provide greater customization and flexibility than conventional methods, is also a substantial contributor. The market is segmented by printer type (monochrome, color), production method (cut-fed, continuous feed), technology (inkjet, toner), and application (commercial, publishing, packaging). The color and inkjet segments are expected to exhibit particularly robust growth, aligning with the rising demand for vivid and detailed printed outputs. However, challenges such as increasing raw material costs and competition from digital printing alternatives may present growth constraints in specific market segments.

Production Printer Market Market Size (In Billion)

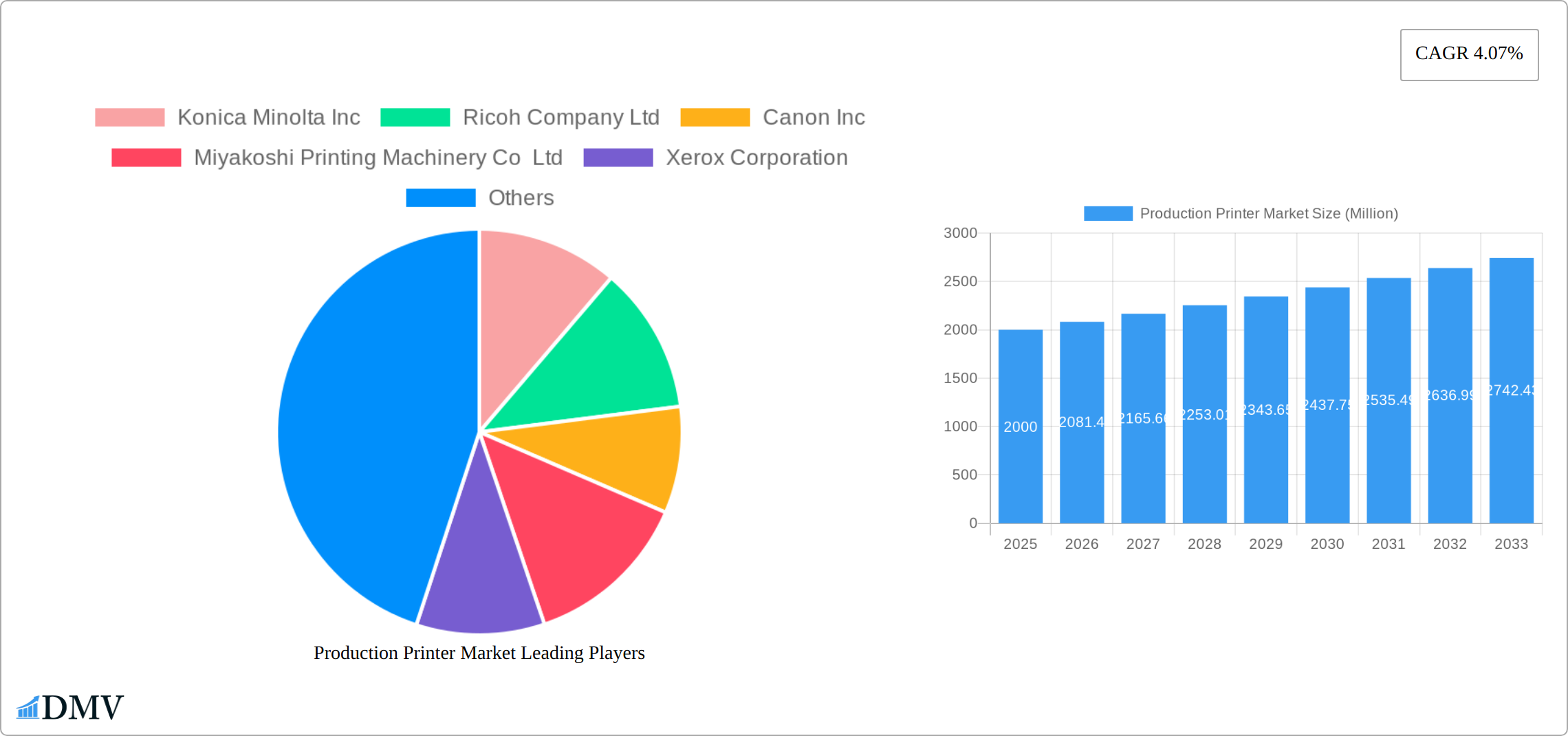

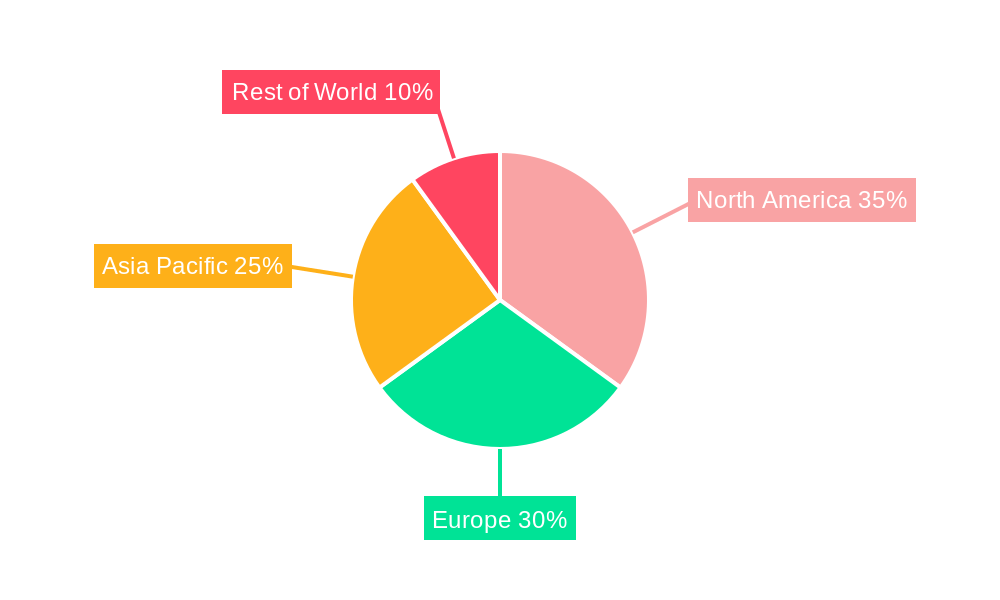

Geographically, North America and Europe currently dominate the Production Printer Market, owing to mature printing industries and high adoption of cutting-edge technologies. Nonetheless, the Asia-Pacific region, especially China and India, is forecasted to experience the most rapid expansion during the forecast period. This surge is attributed to swift economic development, growing disposable incomes, and increased investments in printing infrastructure. Leading companies like Konica Minolta, Ricoh, Canon, and Xerox are strategically prioritizing research and development to innovate their product offerings and secure competitive advantages. Initiatives include the development of sustainable printing solutions and the integration of advanced automation for improved operational efficiency and cost reduction. The future trajectory of the market will be shaped by continuous technological innovation, evolving consumer preferences, and prevailing economic conditions across diverse regions.

Production Printer Market Company Market Share

Production Printer Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the Production Printer Market, offering a comprehensive analysis of its current state and future trajectory. Valued at $xx Million in 2025 (estimated), the market is poised for significant growth, reaching $xx Million by 2033. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is an invaluable resource for stakeholders seeking to understand market dynamics, identify opportunities, and make informed strategic decisions.

Production Printer Market Composition & Trends

The Production Printer Market is a dynamic landscape characterized by moderate concentration, with key players like Konica Minolta Inc, Ricoh Company Ltd, Canon Inc, and Xerox Corporation holding significant market share. However, the market exhibits a competitive environment with numerous smaller players and continuous innovation driving shifts in market share distribution. The estimated market share of the top five players in 2025 is approximately xx%, leaving ample space for smaller players to compete based on niche offerings and specialized technologies.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2025.

- Innovation Catalysts: Ongoing advancements in inkjet and toner technologies, coupled with the increasing demand for high-speed, high-quality printing.

- Regulatory Landscape: Varying regional regulations impacting environmental compliance and data security.

- Substitute Products: Digital printing technologies and online publishing platforms present competitive alternatives.

- End-User Profiles: A diverse range of end-users including commercial printers, publishers, packaging companies, and industrial businesses.

- M&A Activities: The market has witnessed several mergers and acquisitions in the past five years, with total deal values estimated at $xx Million. These activities have primarily focused on consolidating market share and expanding technological capabilities.

Production Printer Market Industry Evolution

The Production Printer Market has experienced a dramatic transformation over the past decade. Fueled by advancements in inkjet technology, the rise of continuous feed systems, and a growing demand for personalized, high-quality prints, the market has shown consistent growth. While exhibiting a compound annual growth rate (CAGR) of xx% between 2019 and 2024, projections indicate a slightly moderated yet sustained expansion, with a projected CAGR of xx% anticipated between 2025 and 2033. This growth is driven by several key factors: the increasing adoption of color printing technologies, the integration of cloud-based solutions and workflow automation, and significant improvements in print resolution, speed, and media compatibility. Furthermore, substantial investments in the commercial printing sector and government initiatives promoting digital printing infrastructure are contributing to market expansion. The shift towards on-demand and personalized print applications significantly influences this growth trajectory.

Leading Regions, Countries, or Segments in Production Printer Market

The North American region currently dominates the Production Printer Market, driven by high levels of investment in digital printing technologies, and a robust commercial printing industry. Within the market segments:

- By Type: Color printing holds a larger market share than monochrome, driven by growing demand for high-quality prints.

- By Production Method: Continuous feed systems are gaining traction due to their high-speed printing capabilities, while cut-fed systems remain popular for short-run jobs.

- By Technology: Inkjet technology is rapidly gaining popularity due to its cost-effectiveness and high-quality output, posing a challenge to traditional toner-based printing.

- By Application: The commercial printing sector is currently the largest application segment, followed by packaging and publishing.

Key Drivers:

- High levels of technological advancements and investments in the commercial printing sector in North America.

- Stricter environmental regulations driving demand for eco-friendly printing solutions.

- Government support programs for businesses investing in digital printing infrastructure.

Production Printer Market Product Innovations

Recent innovations in the production printer market underscore a clear trend: faster, more efficient, and environmentally conscious solutions. Manufacturers are actively responding to evolving customer needs and sustainability concerns. Kodak's introduction of water-based inks and primers for its high-speed inkjet technologies exemplifies this commitment to eco-friendly and high-performance solutions. New printer models, such as Canon's imagePRESS V1000 and V900, showcase advancements in media versatility, high-volume printing capabilities, and superior print quality, providing compelling selling points in a competitive market. These improvements, coupled with broader media support, allow for greater flexibility and cater to a wider range of applications and customer requirements, including short-run and highly customized print jobs.

Propelling Factors for Production Printer Market Growth

Several factors are driving the growth of the Production Printer Market. Technological advancements like the development of more efficient and cost-effective inkjet and toner technologies are crucial. Increased demand for high-quality, personalized printed materials across various industries further fuels market growth. Favorable regulatory environments in certain regions promoting digital printing also contribute significantly. Economically, increasing investments in commercial and industrial printing sectors and the expansion of e-commerce are notable drivers.

Obstacles in the Production Printer Market

Despite the positive growth trajectory, the production printer market faces several challenges. Stringent environmental regulations are driving up production costs, necessitating continuous innovation to meet evolving consumer demands and sustainability goals. Supply chain disruptions and fluctuating raw material prices introduce significant uncertainty. The market landscape is further complicated by intense competition among established players and the emergence of new entrants, creating a dynamic and demanding environment.

Future Opportunities in Production Printer Market

Significant growth opportunities exist for the production printer market in emerging markets and new application areas. The development and adoption of environmentally sustainable printing solutions represent a substantial opportunity, along with the integration of smart technologies, including automation and artificial intelligence (AI). The burgeoning demand for personalized and on-demand printing services presents a particularly large and rapidly expanding market segment. Further innovation in areas like variable data printing and integrated finishing solutions will be key factors driving future growth.

Major Players in the Production Printer Market Ecosystem

- Konica Minolta Inc

- Ricoh Company Ltd

- Canon Inc

- Miyakoshi Printing Machinery Co Ltd

- Xerox Corporation

- Hewlett-Packard Development Company LP

- Inca Digital Printers Ltd (Dainippon Screen Mfg Co Ltd)

- Eastman Kodak Company

Key Developments in Production Printer Market Industry

- September 2023: Kodak launches new water-based ink and primer products (Kodak Ektacolor Inks and Kodak Optimax Primers) optimized for KODAK Stream and KODAK ULTRASTREAM Technology. This enhancement expands the capabilities of its high-speed continuous inkjet technology across a diverse range of applications, furthering its commitment to sustainable printing practices.

- March 2023: Canon India introduces the imagePRESS V1000 and V900 models. These models significantly enhance media versatility and productivity for light and mid-production print environments, providing businesses with greater efficiency and expanded printing capabilities.

Strategic Production Printer Market Forecast

The Production Printer Market is projected for continued growth driven by technological innovations and increasing demand. The emergence of new applications, particularly in the packaging and personalized printing sectors, is expected to open up considerable market potential. Companies that embrace sustainability and digital transformation will be best positioned to capitalize on future opportunities.

Production Printer Market Segmentation

-

1. Type

- 1.1. Monochrome

- 1.2. Color

-

2. Production Method

- 2.1. Cut Fed

- 2.2. Continuous Feed

-

3. Technology

- 3.1. Inkjet

- 3.2. Toner

-

4. Application

- 4.1. Commercial

- 4.2. Publishing

- 4.3. Packaging

Production Printer Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Production Printer Market Regional Market Share

Geographic Coverage of Production Printer Market

Production Printer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Printing Applications in Packaging is Expected to Drive Growth; Increasing Inkjet Sales Due to Introduction of High-performance Inkjet Printers

- 3.3. Market Restrains

- 3.3.1. Growth of Digital Marketing and the Practice of Online Reading

- 3.4. Market Trends

- 3.4.1. Packaging Segmented is Expected to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Production Printer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Monochrome

- 5.1.2. Color

- 5.2. Market Analysis, Insights and Forecast - by Production Method

- 5.2.1. Cut Fed

- 5.2.2. Continuous Feed

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Inkjet

- 5.3.2. Toner

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Commercial

- 5.4.2. Publishing

- 5.4.3. Packaging

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Production Printer Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Monochrome

- 6.1.2. Color

- 6.2. Market Analysis, Insights and Forecast - by Production Method

- 6.2.1. Cut Fed

- 6.2.2. Continuous Feed

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. Inkjet

- 6.3.2. Toner

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Commercial

- 6.4.2. Publishing

- 6.4.3. Packaging

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Production Printer Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Monochrome

- 7.1.2. Color

- 7.2. Market Analysis, Insights and Forecast - by Production Method

- 7.2.1. Cut Fed

- 7.2.2. Continuous Feed

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. Inkjet

- 7.3.2. Toner

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Commercial

- 7.4.2. Publishing

- 7.4.3. Packaging

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Production Printer Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Monochrome

- 8.1.2. Color

- 8.2. Market Analysis, Insights and Forecast - by Production Method

- 8.2.1. Cut Fed

- 8.2.2. Continuous Feed

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. Inkjet

- 8.3.2. Toner

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Commercial

- 8.4.2. Publishing

- 8.4.3. Packaging

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Production Printer Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Monochrome

- 9.1.2. Color

- 9.2. Market Analysis, Insights and Forecast - by Production Method

- 9.2.1. Cut Fed

- 9.2.2. Continuous Feed

- 9.3. Market Analysis, Insights and Forecast - by Technology

- 9.3.1. Inkjet

- 9.3.2. Toner

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Commercial

- 9.4.2. Publishing

- 9.4.3. Packaging

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Konica Minolta Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ricoh Company Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Canon Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Miyakoshi Printing Machinery Co Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Xerox Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hewlett-Packard Development Company LP

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Inca Digital Printers Ltd (Dainippon Screen Mfg Co Ltd)*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eastman Kodak Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Konica Minolta Inc

List of Figures

- Figure 1: Global Production Printer Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Production Printer Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Production Printer Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Production Printer Market Revenue (billion), by Production Method 2025 & 2033

- Figure 5: North America Production Printer Market Revenue Share (%), by Production Method 2025 & 2033

- Figure 6: North America Production Printer Market Revenue (billion), by Technology 2025 & 2033

- Figure 7: North America Production Printer Market Revenue Share (%), by Technology 2025 & 2033

- Figure 8: North America Production Printer Market Revenue (billion), by Application 2025 & 2033

- Figure 9: North America Production Printer Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Production Printer Market Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Production Printer Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Production Printer Market Revenue (billion), by Type 2025 & 2033

- Figure 13: Europe Production Printer Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Production Printer Market Revenue (billion), by Production Method 2025 & 2033

- Figure 15: Europe Production Printer Market Revenue Share (%), by Production Method 2025 & 2033

- Figure 16: Europe Production Printer Market Revenue (billion), by Technology 2025 & 2033

- Figure 17: Europe Production Printer Market Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe Production Printer Market Revenue (billion), by Application 2025 & 2033

- Figure 19: Europe Production Printer Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Production Printer Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Production Printer Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Production Printer Market Revenue (billion), by Type 2025 & 2033

- Figure 23: Asia Pacific Production Printer Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Asia Pacific Production Printer Market Revenue (billion), by Production Method 2025 & 2033

- Figure 25: Asia Pacific Production Printer Market Revenue Share (%), by Production Method 2025 & 2033

- Figure 26: Asia Pacific Production Printer Market Revenue (billion), by Technology 2025 & 2033

- Figure 27: Asia Pacific Production Printer Market Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Asia Pacific Production Printer Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Asia Pacific Production Printer Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Production Printer Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Production Printer Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Production Printer Market Revenue (billion), by Type 2025 & 2033

- Figure 33: Rest of the World Production Printer Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Rest of the World Production Printer Market Revenue (billion), by Production Method 2025 & 2033

- Figure 35: Rest of the World Production Printer Market Revenue Share (%), by Production Method 2025 & 2033

- Figure 36: Rest of the World Production Printer Market Revenue (billion), by Technology 2025 & 2033

- Figure 37: Rest of the World Production Printer Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Rest of the World Production Printer Market Revenue (billion), by Application 2025 & 2033

- Figure 39: Rest of the World Production Printer Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Rest of the World Production Printer Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of the World Production Printer Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Production Printer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Production Printer Market Revenue billion Forecast, by Production Method 2020 & 2033

- Table 3: Global Production Printer Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 4: Global Production Printer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Production Printer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Production Printer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Global Production Printer Market Revenue billion Forecast, by Production Method 2020 & 2033

- Table 8: Global Production Printer Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 9: Global Production Printer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Global Production Printer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Production Printer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Production Printer Market Revenue billion Forecast, by Production Method 2020 & 2033

- Table 15: Global Production Printer Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 16: Global Production Printer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Production Printer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Germany Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Italy Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of Europe Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Global Production Printer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 24: Global Production Printer Market Revenue billion Forecast, by Production Method 2020 & 2033

- Table 25: Global Production Printer Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 26: Global Production Printer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 27: Global Production Printer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: India Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: China Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Japan Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Production Printer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Production Printer Market Revenue billion Forecast, by Type 2020 & 2033

- Table 33: Global Production Printer Market Revenue billion Forecast, by Production Method 2020 & 2033

- Table 34: Global Production Printer Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 35: Global Production Printer Market Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Production Printer Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Production Printer Market?

The projected CAGR is approximately 3.96%.

2. Which companies are prominent players in the Production Printer Market?

Key companies in the market include Konica Minolta Inc, Ricoh Company Ltd, Canon Inc, Miyakoshi Printing Machinery Co Ltd, Xerox Corporation, Hewlett-Packard Development Company LP, Inca Digital Printers Ltd (Dainippon Screen Mfg Co Ltd)*List Not Exhaustive, Eastman Kodak Company.

3. What are the main segments of the Production Printer Market?

The market segments include Type, Production Method, Technology, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.61 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of Printing Applications in Packaging is Expected to Drive Growth; Increasing Inkjet Sales Due to Introduction of High-performance Inkjet Printers.

6. What are the notable trends driving market growth?

Packaging Segmented is Expected to Witness Major Growth.

7. Are there any restraints impacting market growth?

Growth of Digital Marketing and the Practice of Online Reading.

8. Can you provide examples of recent developments in the market?

September 2023: Kodak unveiled its cutting-edge water-based ink and primer products meticulously designed to optimize its high-speed continuous inkjet technologies, namely KODAK Stream and KODAK ULTRASTREAM Technology. These innovations significantly amplify the advantages of both technologies across a wide spectrum of applications. To underscore Kodak's rich legacy in advanced materials, chemicals, and color, the company is proud to introduce two new brands: Kodak Ektacolor Inks and Kodak OptimaxPrimers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Production Printer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Production Printer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Production Printer Market?

To stay informed about further developments, trends, and reports in the Production Printer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence