Key Insights

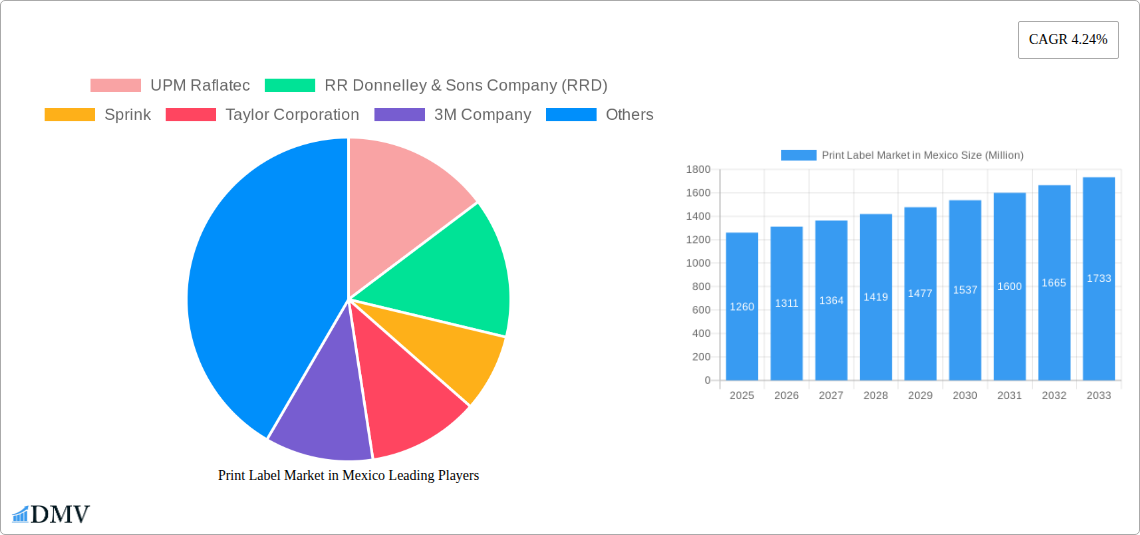

The Mexican print label market, valued at $1.26 billion in 2025, is projected to experience robust growth, driven by a burgeoning food and beverage sector, expanding e-commerce leading to increased demand for shipping labels, and the healthcare industry's reliance on intricate labeling for medication and medical devices. A compound annual growth rate (CAGR) of 4.24% from 2025 to 2033 forecasts a significant market expansion. Key growth drivers include the increasing adoption of pressure-sensitive labels (PSL) due to their ease of application and versatility across various end-use industries, the rising popularity of sustainable and eco-friendly label materials aligning with global environmental concerns, and the integration of advanced print technologies like digital printing for short-run label production and personalization. While increased competition and fluctuations in raw material prices pose challenges, the market's resilience is underpinned by continuous innovation in label materials and printing techniques, catering to diverse industry demands. The segmentation reveals a strong preference for PSL, followed by wet-glued labels, reflecting evolving packaging preferences. Major players like UPM Raflatec, CCL Industries, and Avery Dennison are likely to maintain their market dominance through strategic partnerships, product diversification, and technological advancements. The continued growth of Mexico's manufacturing sector will further fuel demand for high-quality and specialized print labels across diverse segments.

Print Label Market in Mexico Market Size (In Billion)

The strong performance of the Mexican print label market is anticipated to continue, with pressure-sensitive labels and the food & beverage and healthcare sectors serving as primary growth drivers. However, the market will need to adapt to evolving consumer preferences towards sustainable packaging solutions. This necessitates the adoption of eco-friendly materials and a shift towards more efficient and less wasteful production processes. This shift toward sustainability is expected to favor companies investing in research and development of biodegradable and recyclable label materials. Furthermore, increased automation and digitalization within the printing industry are also expected to influence the market structure, enabling greater efficiency and cost-effectiveness for label producers. The competitive landscape will necessitate innovation in product offerings, cost-optimization strategies and strong distribution networks to secure market share.

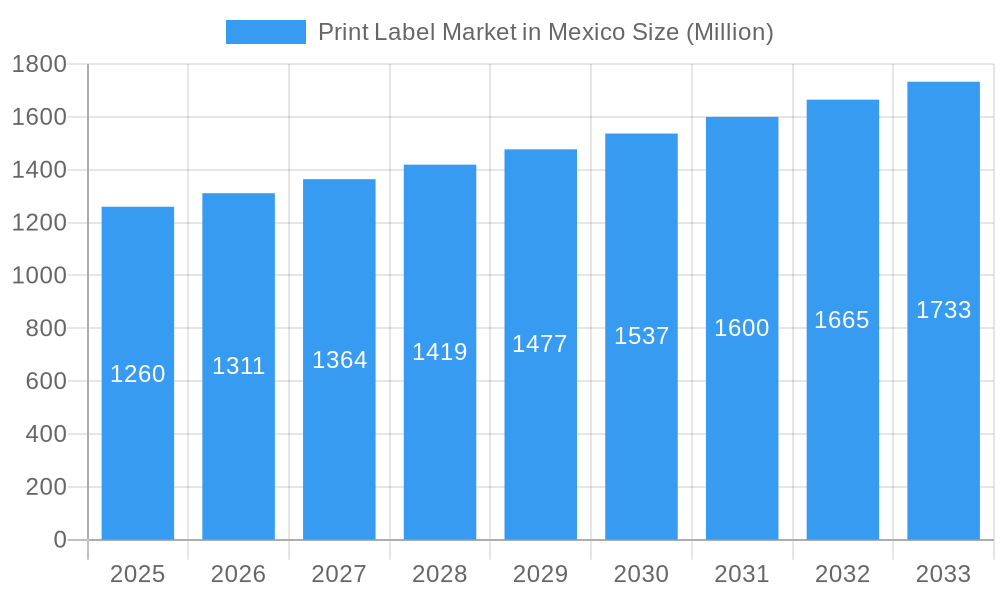

Print Label Market in Mexico Company Market Share

Print Label Market in Mexico: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the dynamic Print Label Market in Mexico, offering a comprehensive analysis of market trends, competitive landscape, and future growth projections from 2019 to 2033. With a base year of 2025 and an estimated year of 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this thriving sector. The study period covers 2019-2033, with a forecast period of 2025-2033 and a historical period of 2019-2024. The Mexican print label market, valued at xx Million USD in 2025, is poised for significant expansion, driven by robust growth across various end-user industries.

Print Label Market in Mexico Market Composition & Trends

This section evaluates the concentration of the Mexican print label market, identifying key players and their respective market share. We analyze the innovative forces shaping the market, including technological advancements and regulatory changes. Substitute products, end-user industry profiles (Food, Beverage, Healthcare & Pharmaceutical, Cosmetics, Household, Industrial, and Other), and recent mergers and acquisitions (M&A) activities are also examined. The report includes a detailed assessment of M&A deal values and their impact on market dynamics. Data on market share distribution among key players like UPM Raflatec, RR Donnelley & Sons Company (RRD), 3M Company, and Avery Dennison Corporation, will be presented, revealing the competitive intensity and strategic positioning of each firm. The regulatory landscape's influence on market growth, including import/export regulations and environmental standards, is also explored.

- Market Share Distribution: [Specific market share data for major players will be included here – e.g., 3M Company holds xx% market share, followed by Avery Dennison with xx%].

- M&A Activity: Analysis of significant M&A deals within the historical period, including deal values (in Millions USD). [Specific data on M&A deals will be detailed here].

- Innovation Catalysts: Examination of technological advancements influencing market trends, including digital printing technologies and sustainable materials.

- Substitute Products: Analysis of substitute packaging solutions and their impact on market growth.

Print Label Market in Mexico Industry Evolution

This section details the evolution of the Mexican print label market, charting its growth trajectory from 2019 to 2025 and beyond. We analyze the influence of technological advancements such as the rise of digital printing and the increasing adoption of pressure-sensitive labels (PSLs). This includes a detailed examination of growth rates (CAGR) for different label types and print technologies. Shifting consumer preferences towards sustainable and eco-friendly packaging are also considered. The evolving demand from diverse end-user industries, their specific label requirements, and the impact on market segmentation are explored. The section will showcase data points on the adoption rate of different technologies (e.g., digital printing's market penetration rate) and consumer preferences for different label types.

Leading Regions, Countries, or Segments in Print Label Market in Mexico

This section identifies the dominant regions, countries, or segments within the Mexican print label market. We analyze leading segments across print technology (Offset, Flexography, Rotogravure, Screen, Letterpress, Digital Printing), label type (Wet-glued Labels, Pressure Sensitive Labels (PSL), Linerless Labels, In-mold Labels, Shrink Sleeve Labels, Multi-part Tracking Labels), and end-user industry. Key drivers within each dominant segment are examined via bullet points, while in-depth analysis provides a thorough understanding of the factors contributing to their success.

Dominant Segment: [Specific data and analysis of the dominant segment will be included, for example: Pressure Sensitive Labels (PSL) accounts for the largest market share due to its versatility and wide applications across different end-user industries.]

Key Drivers (Examples):

- High demand from the food and beverage sector for PSLs.

- Government regulations promoting sustainable packaging solutions.

- Increased investment in advanced printing technologies.

Print Label Market in Mexico Product Innovations

This section highlights recent product innovations within the Mexican print label market, focusing on technological advancements. The analysis includes unique selling propositions (USPs) of newly introduced labels, emphasizing improved performance metrics (e.g., durability, adhesion, printability) and applications. The integration of smart technologies, such as RFID and NFC, into labels and its market impact will also be explored. Specific examples of innovative products with their key performance indicators will be given.

Propelling Factors for Print Label Market in Mexico Growth

Several factors contribute to the growth of the Mexican print label market. Technological advancements, such as the increasing adoption of digital printing technologies, offer greater flexibility and customization. Economic growth, coupled with rising consumer spending and a thriving manufacturing sector, drives demand for effective and attractive product packaging. Favorable government policies supporting local industries also play a vital role in market expansion.

Obstacles in the Print Label Market in Mexico Market

Despite its growth potential, the Mexican print label market faces challenges such as stringent regulatory requirements concerning labeling and sustainability, potentially impacting operational costs. Supply chain disruptions, particularly concerning raw materials and adhesives, can cause production delays and price fluctuations. Intense competition among established players and new entrants poses a significant challenge.

Future Opportunities in Print Label Market in Mexico

The future of the Mexican print label market looks bright. Opportunities exist in expanding into niche markets, such as specialized labels for pharmaceuticals and cosmetics. The adoption of advanced printing technologies, such as augmented reality (AR) and variable data printing, will also present new growth avenues. Rising consumer demand for sustainable and eco-friendly packaging materials offers substantial opportunities for companies offering innovative and environmentally conscious solutions.

Major Players in the Print Label Market in Mexico Ecosystem

- UPM Raflatec

- RR Donnelley & Sons Company (RRD)

- Sprink

- Taylor Corporation

- 3M Company

- STICKER'S PACK SA de CV

- CCL Industries Inc

- Clondalkin Group

- Avery Dennison Corporation

- Fuji Seal International Inc

- Multi-Color Mexico Corporation

- Papers and Conversions of Mexico

- Eximpro

- Brady Worldwide Inc

Key Developments in Print Label Market in Mexico Industry

October 2023: All4Labels' relocation to a larger facility in Mexico, significantly increasing production capacity (tripling) through the addition of five new printing lines focusing on pressure-sensitive labels and shrink sleeves. A further EUR 4 million (USD 4.32 million) investment is planned for phase two, incorporating digital, flexo, and gravure presses, and pre-press upgrades.

June 2022: Henkel's opening of a hot melt adhesive manufacturing plant in Guadalupe (Nuevo Leon, Mexico), boosting pressure-sensitive and non-pressurized hot melt adhesive production, including its high-performance SUPRA and COOL product lines.

Strategic Print Label Market in Mexico Market Forecast

The Mexican print label market is projected to experience robust growth over the forecast period (2025-2033), driven by increasing demand from various end-user industries and technological advancements. The continued adoption of pressure-sensitive labels and digital printing technologies will fuel market expansion. Opportunities in sustainable and eco-friendly labels are expected to drive significant future growth, along with innovative solutions integrating smart technologies. The market is poised for significant expansion, presenting attractive investment opportunities for both established players and new entrants.

Print Label Market in Mexico Segmentation

-

1. Print Technology

- 1.1. Offset

- 1.2. Flexography

- 1.3. Rotogravure

- 1.4. Screen

- 1.5. Letterpress

- 1.6. Digital Printing

-

2. Label Type

- 2.1. Wet-glued Labels

- 2.2. Pressure Sensitive Labels (PSL)

- 2.3. Liner less Labels

- 2.4. In-mold Labels

- 2.5. Shrink Sleeve Labels

- 2.6. Multi-part Tracking Label

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare and Pharmaceutical

- 3.4. Cosmetics

- 3.5. Household

- 3.6. Industrial

- 3.7. Other End-user Industries

Print Label Market in Mexico Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Print Label Market in Mexico Regional Market Share

Geographic Coverage of Print Label Market in Mexico

Print Label Market in Mexico REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Digital Print Technology; Technological Advancements Leading to Reduction in Cost and Run Length

- 3.3. Market Restrains

- 3.3.1. Lack of Products with Ability to Withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Flexographic Printing to Hold the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Print Technology

- 5.1.1. Offset

- 5.1.2. Flexography

- 5.1.3. Rotogravure

- 5.1.4. Screen

- 5.1.5. Letterpress

- 5.1.6. Digital Printing

- 5.2. Market Analysis, Insights and Forecast - by Label Type

- 5.2.1. Wet-glued Labels

- 5.2.2. Pressure Sensitive Labels (PSL)

- 5.2.3. Liner less Labels

- 5.2.4. In-mold Labels

- 5.2.5. Shrink Sleeve Labels

- 5.2.6. Multi-part Tracking Label

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare and Pharmaceutical

- 5.3.4. Cosmetics

- 5.3.5. Household

- 5.3.6. Industrial

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Print Technology

- 6. North America Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Print Technology

- 6.1.1. Offset

- 6.1.2. Flexography

- 6.1.3. Rotogravure

- 6.1.4. Screen

- 6.1.5. Letterpress

- 6.1.6. Digital Printing

- 6.2. Market Analysis, Insights and Forecast - by Label Type

- 6.2.1. Wet-glued Labels

- 6.2.2. Pressure Sensitive Labels (PSL)

- 6.2.3. Liner less Labels

- 6.2.4. In-mold Labels

- 6.2.5. Shrink Sleeve Labels

- 6.2.6. Multi-part Tracking Label

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food

- 6.3.2. Beverage

- 6.3.3. Healthcare and Pharmaceutical

- 6.3.4. Cosmetics

- 6.3.5. Household

- 6.3.6. Industrial

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Print Technology

- 7. South America Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Print Technology

- 7.1.1. Offset

- 7.1.2. Flexography

- 7.1.3. Rotogravure

- 7.1.4. Screen

- 7.1.5. Letterpress

- 7.1.6. Digital Printing

- 7.2. Market Analysis, Insights and Forecast - by Label Type

- 7.2.1. Wet-glued Labels

- 7.2.2. Pressure Sensitive Labels (PSL)

- 7.2.3. Liner less Labels

- 7.2.4. In-mold Labels

- 7.2.5. Shrink Sleeve Labels

- 7.2.6. Multi-part Tracking Label

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food

- 7.3.2. Beverage

- 7.3.3. Healthcare and Pharmaceutical

- 7.3.4. Cosmetics

- 7.3.5. Household

- 7.3.6. Industrial

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Print Technology

- 8. Europe Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Print Technology

- 8.1.1. Offset

- 8.1.2. Flexography

- 8.1.3. Rotogravure

- 8.1.4. Screen

- 8.1.5. Letterpress

- 8.1.6. Digital Printing

- 8.2. Market Analysis, Insights and Forecast - by Label Type

- 8.2.1. Wet-glued Labels

- 8.2.2. Pressure Sensitive Labels (PSL)

- 8.2.3. Liner less Labels

- 8.2.4. In-mold Labels

- 8.2.5. Shrink Sleeve Labels

- 8.2.6. Multi-part Tracking Label

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food

- 8.3.2. Beverage

- 8.3.3. Healthcare and Pharmaceutical

- 8.3.4. Cosmetics

- 8.3.5. Household

- 8.3.6. Industrial

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Print Technology

- 9. Middle East & Africa Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Print Technology

- 9.1.1. Offset

- 9.1.2. Flexography

- 9.1.3. Rotogravure

- 9.1.4. Screen

- 9.1.5. Letterpress

- 9.1.6. Digital Printing

- 9.2. Market Analysis, Insights and Forecast - by Label Type

- 9.2.1. Wet-glued Labels

- 9.2.2. Pressure Sensitive Labels (PSL)

- 9.2.3. Liner less Labels

- 9.2.4. In-mold Labels

- 9.2.5. Shrink Sleeve Labels

- 9.2.6. Multi-part Tracking Label

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food

- 9.3.2. Beverage

- 9.3.3. Healthcare and Pharmaceutical

- 9.3.4. Cosmetics

- 9.3.5. Household

- 9.3.6. Industrial

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Print Technology

- 10. Asia Pacific Print Label Market in Mexico Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Print Technology

- 10.1.1. Offset

- 10.1.2. Flexography

- 10.1.3. Rotogravure

- 10.1.4. Screen

- 10.1.5. Letterpress

- 10.1.6. Digital Printing

- 10.2. Market Analysis, Insights and Forecast - by Label Type

- 10.2.1. Wet-glued Labels

- 10.2.2. Pressure Sensitive Labels (PSL)

- 10.2.3. Liner less Labels

- 10.2.4. In-mold Labels

- 10.2.5. Shrink Sleeve Labels

- 10.2.6. Multi-part Tracking Label

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food

- 10.3.2. Beverage

- 10.3.3. Healthcare and Pharmaceutical

- 10.3.4. Cosmetics

- 10.3.5. Household

- 10.3.6. Industrial

- 10.3.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Print Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 UPM Raflatec

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RR Donnelley & Sons Company (RRD)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sprink

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Taylor Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3M Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STICKER'S PACK SA de CV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CCL Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Clondalkin Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Avery Dennison Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fuji Seal International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Multi-Color Mexico Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Papers and Conversions of Mexico*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eximpro

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Brady Worldwide Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 UPM Raflatec

List of Figures

- Figure 1: Global Print Label Market in Mexico Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 3: North America Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 4: North America Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 5: North America Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 6: North America Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 11: South America Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 12: South America Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 13: South America Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 14: South America Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 19: Europe Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 20: Europe Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 21: Europe Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 22: Europe Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 27: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 28: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 29: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 30: Middle East & Africa Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Print Label Market in Mexico Revenue (Million), by Print Technology 2025 & 2033

- Figure 35: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Print Technology 2025 & 2033

- Figure 36: Asia Pacific Print Label Market in Mexico Revenue (Million), by Label Type 2025 & 2033

- Figure 37: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Label Type 2025 & 2033

- Figure 38: Asia Pacific Print Label Market in Mexico Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific Print Label Market in Mexico Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific Print Label Market in Mexico Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Print Label Market in Mexico Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 2: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 3: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Print Label Market in Mexico Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 6: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 7: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 13: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 14: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 20: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 21: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 33: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 34: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Print Label Market in Mexico Revenue Million Forecast, by Print Technology 2020 & 2033

- Table 43: Global Print Label Market in Mexico Revenue Million Forecast, by Label Type 2020 & 2033

- Table 44: Global Print Label Market in Mexico Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Print Label Market in Mexico Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Print Label Market in Mexico Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Print Label Market in Mexico?

The projected CAGR is approximately 4.24%.

2. Which companies are prominent players in the Print Label Market in Mexico?

Key companies in the market include UPM Raflatec, RR Donnelley & Sons Company (RRD), Sprink, Taylor Corporation, 3M Company, STICKER'S PACK SA de CV, CCL Industries Inc, Clondalkin Group, Avery Dennison Corporation, Fuji Seal International Inc, Multi-Color Mexico Corporation, Papers and Conversions of Mexico*List Not Exhaustive, Eximpro, Brady Worldwide Inc.

3. What are the main segments of the Print Label Market in Mexico?

The market segments include Print Technology, Label Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Digital Print Technology; Technological Advancements Leading to Reduction in Cost and Run Length.

6. What are the notable trends driving market growth?

Flexographic Printing to Hold the Largest Market Share.

7. Are there any restraints impacting market growth?

Lack of Products with Ability to Withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

October 2023 - All4Labels relocated to a larger facility spanning over 12,000 square meters in Mexico. It is implementing various new technologies to enhance its nationwide footprint as part of its expansion strategy. The addition of five new printing lines, emphasizing pressure-sensitive labels and shrink sleeves, is set to triple production capacity at the site. In phase two, the company is investing EUR 4 million (USD 4.32 million) in equipment, encompassing digital, flexo, and gravure presses, along with a comprehensive upgrade of its pre-press capabilities. This strategic expansion, coupled with the integration of advanced technologies, solidifies its presence and plays a pivotal role in fueling the growth of the flourishing label market in Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Print Label Market in Mexico," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Print Label Market in Mexico report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Print Label Market in Mexico?

To stay informed about further developments, trends, and reports in the Print Label Market in Mexico, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence