Key Insights

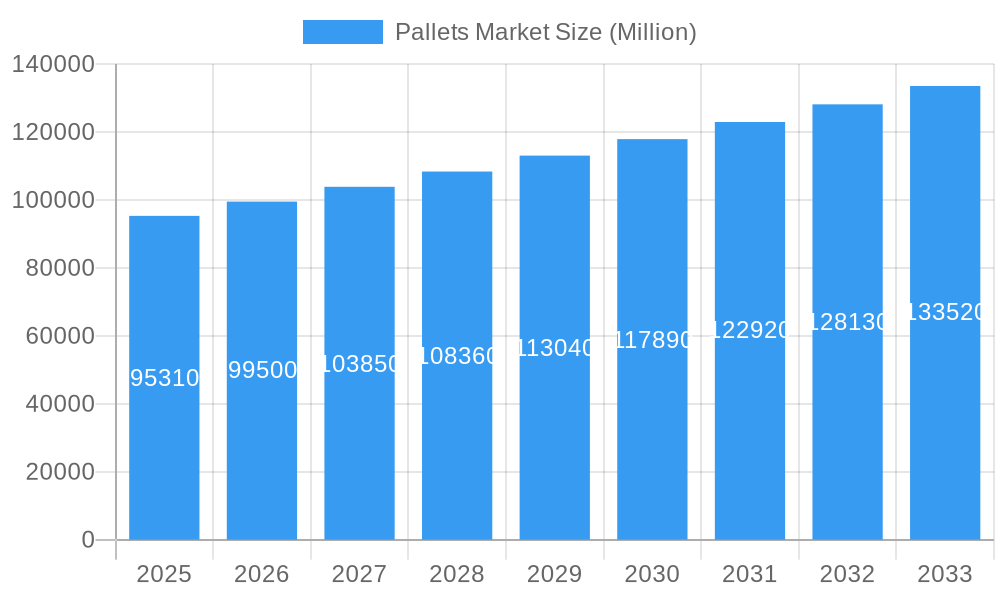

The global pallets market, valued at $95.31 billion in 2025, is projected to experience robust growth, driven by the expanding e-commerce sector and the increasing demand for efficient supply chain solutions across various industries. The market's Compound Annual Growth Rate (CAGR) of 4.37% from 2025 to 2033 indicates a steady expansion, fueled by factors such as the growing adoption of automation in warehousing and logistics, and the rising need for sustainable and reusable pallet solutions. The key segments driving this growth include the wood pallet type, given its cost-effectiveness and widespread availability, and the transportation and warehousing end-user segment due to its high pallet consumption. While the market faces constraints like fluctuating raw material prices and environmental concerns regarding disposal of non-biodegradable pallets, innovative solutions such as reusable plastic and recycled wood pallets are mitigating these challenges. The competitive landscape includes major players like CHEP, Brambles Limited, and Schoeller Allibert, who are investing in technological advancements and expanding their global reach to cater to the growing demand. Geographical expansion is also anticipated across regions including North America (particularly the US), Europe (led by Germany and the UK), and Asia (primarily China and India), reflecting the global nature of supply chains.

Pallets Market Market Size (In Billion)

The forecast period from 2025-2033 anticipates continued market expansion, with growth potentially exceeding the current CAGR if innovations in sustainable pallet materials and logistics automation accelerate. The pharmaceutical and food and beverage sectors are expected to contribute significantly due to their stringent hygiene and traceability requirements, preferring higher quality and more hygienic pallet options. Competition will likely intensify among established players and new entrants focusing on specialized pallet solutions tailored to specific industry needs. Strategic partnerships, mergers and acquisitions, and technological advancements will shape the future competitive landscape, driving the market towards improved efficiency, sustainability, and cost-effectiveness in supply chain operations.

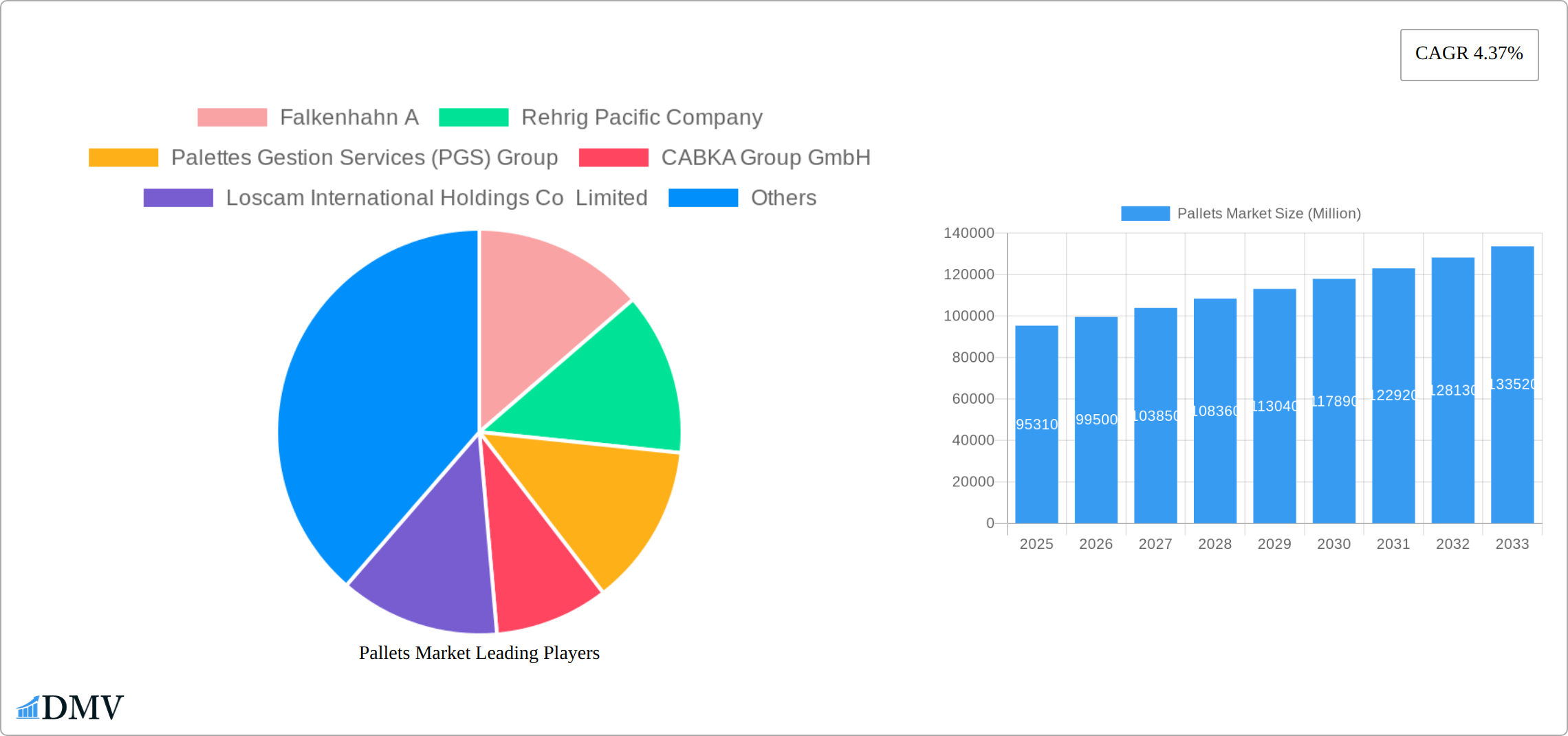

Pallets Market Company Market Share

Pallets Market Market Composition & Trends

The Pallets Market is characterized by a diverse yet concentrated landscape, with a few key players dominating the market share. Companies like Falkenhahn A, Rehrig Pacific Company, and Brambles Limited hold significant portions, collectively accounting for over 40% of the global market. Innovation is a major catalyst, driven by the need for sustainability and efficiency. The regulatory landscape is evolving, with stricter guidelines on materials and recycling, influencing companies to invest in R&D for eco-friendly solutions. Substitute products, such as reusable plastic pallets, are gaining traction, particularly in the food and beverage sector, where hygiene is paramount.

- Market Share Distribution: Falkenhahn A (15%), Rehrig Pacific Company (12%), Brambles Limited (13%), Others (60%)

- Innovation Catalysts: Demand for sustainability, efficiency improvements, and regulatory compliance.

- Regulatory Landscape: Increasing emphasis on recycling and sustainable materials, impacting product development.

- Substitute Products: Reusable plastic pallets are replacing traditional wood pallets in hygiene-sensitive sectors.

- End-User Profiles: Transportation and warehousing (30%), food and beverage (25%), pharmaceutical (15%), retail (15%), others (15%).

- M&A Activities: Notable deals include the acquisition of Palettes Gestion Services (PGS) Group by Brambles Limited for $xx Million, reflecting consolidation trends.

The market's dynamics are shaped by these factors, creating a competitive yet innovative environment.

Pallets Market Industry Evolution

The Pallets Market has experienced a dynamic evolution from 2019 to 2033, driven by a confluence of factors including technological advancements, evolving consumer preferences, and a growing emphasis on sustainability. The market's robust growth trajectory, exhibiting a compound annual growth rate (CAGR) of 4.5% during the projected period (2025-2033), reflects this ongoing transformation. Technological innovations, such as the development of lightweight yet exceptionally durable materials, have significantly reshaped the industry landscape. For example, the adoption of plastic pallets has surged by 20% over the past five years, underscoring a clear shift towards more sustainable and cost-effective solutions. This trend is further amplified by the increasing demand for reusable and recyclable options.

The shift in consumer demand towards eco-friendly and reusable pallets has spurred significant investment in research and development across the industry. The pharmaceutical sector, in particular, has witnessed a notable 15% increase in the utilization of corrugated paper pallets, driven by their inherent lightweight and hygienic properties. Despite the diversification of materials and applications, the transportation and warehousing sector continues to dominate as the largest end-user, commanding a substantial 30% market share. This reflects the crucial role pallets play in facilitating efficient and streamlined logistics operations. The ongoing evolution of the Pallets Market stands as a testament to the industry's remarkable adaptability and unwavering commitment to meeting the diverse and evolving needs of its clientele.

Leading Regions, Countries, or Segments in Pallets Market

The Pallets Market is dominated by the plastic segment, which has seen significant growth due to its durability, sustainability, and cost-effectiveness. The plastic segment accounts for 35% of the market share, driven by innovations such as reusable and recyclable pallets.

- Key Drivers for Plastic Segment:

- Investment Trends: Increased R&D investments in sustainable materials.

- Regulatory Support: Government incentives for eco-friendly products.

- Consumer Demand: Growing preference for durable and hygienic options.

In terms of end-users, the transportation and warehousing sector remains the leading segment, with a 30% market share. This dominance is attributed to the sector's need for efficient and reliable logistics solutions. The food and beverage sector follows closely, with a 25% share, driven by the demand for hygienic and sustainable packaging solutions.

The dominance of the plastic segment and the transportation and warehousing sector can be attributed to several factors. The plastic segment's growth is fueled by technological advancements, such as the development of lightweight and durable materials. These innovations have made plastic pallets a preferred choice for many industries, particularly those with stringent hygiene requirements. Additionally, the transportation and warehousing sector's need for efficient logistics solutions has led to the widespread adoption of pallets, with plastic pallets offering significant advantages over traditional wood pallets in terms of durability and sustainability.

Pallets Market Product Innovations

Recent product innovations in the Pallets Market include the launch of Dora by IFCO, a reusable plastic pallet designed to increase efficiency and safety in transportation and handling. Dora is over 25% lighter than conventional wood pallets, significantly reducing transportation costs. Orbis has also introduced a longer-life, reusable, and recyclable plastic pallet, addressing the growing demand for sustainability. These innovations highlight the industry's commitment to developing products that offer unique selling propositions such as cost savings, environmental benefits, and enhanced performance.

Propelling Factors for Pallets Market Growth

Several key factors are propelling the growth of the Pallets Market. Technological advancements, particularly the creation of lightweight and durable materials, are continuously enhancing product offerings and effectively addressing the rising consumer demand for sustainability. Economic influences, such as the persistent need for cost-effective logistics solutions, are significantly boosting the adoption of reusable pallets, reducing long-term expenditures for businesses. Furthermore, mounting regulatory pressures aimed at reducing waste and promoting recycling are acting as powerful catalysts for market growth, prompting companies to proactively invest in eco-friendly options to ensure compliance with evolving environmental standards.

Obstacles in the Pallets Market Market

The Pallets Market faces several obstacles that could hinder growth. Regulatory challenges, such as varying standards across regions, can complicate compliance and increase costs. Supply chain disruptions, particularly during global crises, can lead to shortages and delays. Competitive pressures are intense, with companies constantly innovating to maintain market share. These barriers can have a quantifiable impact, with potential cost increases of up to 10% due to regulatory compliance and supply chain issues.

Future Opportunities in Pallets Market

The Pallets Market presents a wealth of promising future opportunities. Emerging markets in the Asia-Pacific and Latin American regions offer substantial untapped potential for significant growth and expansion. Technological advancements, such as the integration of Internet of Things (IoT) technology for real-time pallet tracking, have the potential to revolutionize logistics and warehousing processes, enhancing efficiency and transparency. Moreover, the prevailing consumer trend towards sustainability and the adoption of circular economy practices are fueling the demand for reusable and recyclable pallets, creating exciting new avenues for market expansion and diversification.

Major Players in the Pallets Market Ecosystem

Key Developments in Pallets Market Industry

- January 2024: IFCO launched Dora, a reusable plastic pallet designed for widespread use across Europe. Dora significantly enhances efficiency and safety in transportation and handling, resulting in a reduction of transportation costs by over 25% due to its lighter weight compared to traditional wooden pallets.

- March 2024: Orbis introduced a longer-life, reusable, and recyclable plastic pallet. This development directly addresses the growing market demand for sustainable and environmentally responsible solutions, as explicitly stated by the company's director of marketing.

These recent developments are pivotal in shaping the evolving market dynamics, underscoring the increasing emphasis on product innovation and the crucial role of sustainability in the future of the Pallets Market.

Strategic Pallets Market Market Forecast

The Pallets Market is poised for significant growth, driven by future opportunities and market potential. The forecast period (2025–2033) is expected to see a continued rise in demand for sustainable and cost-effective solutions. Technological advancements, such as IoT integration, will further enhance logistics efficiency. Emerging markets in Asia-Pacific and Latin America will provide new avenues for expansion, while consumer trends towards sustainability will continue to drive the adoption of reusable and recyclable pallets. The market's strategic forecast underscores its potential for robust growth and innovation.

Pallets Market Segmentation

-

1. Types

- 1.1. Wood

- 1.2. Plastic

- 1.3. Metal

- 1.4. Corrugated Paper

-

2. End User

- 2.1. Transportation and Warehousing

- 2.2. Food and Beverage

- 2.3. Pharmaceutical

- 2.4. Retail

- 2.5. Other End Users

Pallets Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Mexico

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Egypt

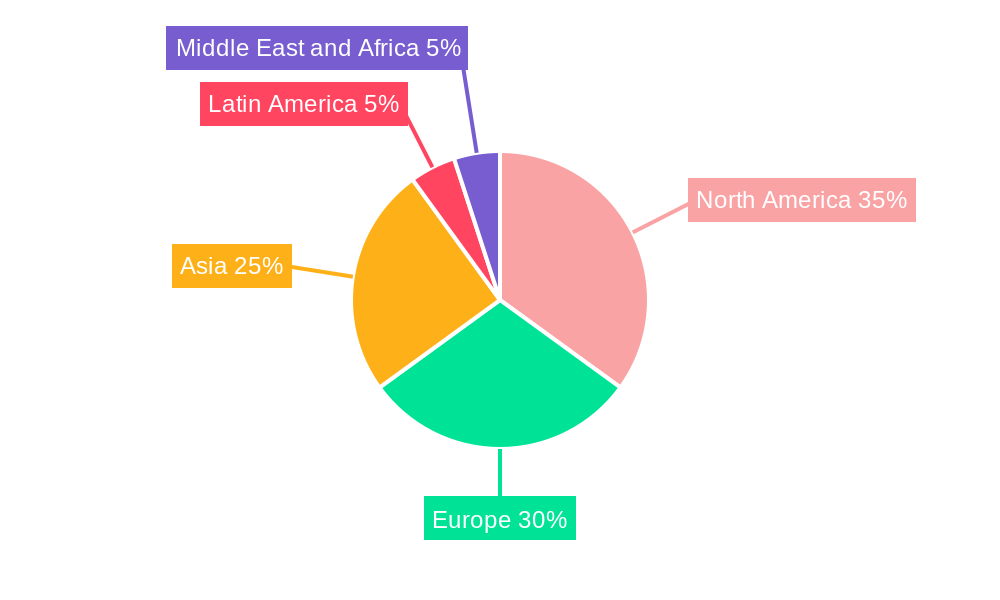

Pallets Market Regional Market Share

Geographic Coverage of Pallets Market

Pallets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.37% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Plastic Pallets Across the Industry Verticals; Adoption of Pallets for Transportation Purpose

- 3.3. Market Restrains

- 3.3.1. Limiting Availability and High Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Plastic Pallets Across the Industry Verticals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pallets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Wood

- 5.1.2. Plastic

- 5.1.3. Metal

- 5.1.4. Corrugated Paper

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Transportation and Warehousing

- 5.2.2. Food and Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Retail

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. North America Pallets Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Types

- 6.1.1. Wood

- 6.1.2. Plastic

- 6.1.3. Metal

- 6.1.4. Corrugated Paper

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Transportation and Warehousing

- 6.2.2. Food and Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Retail

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Types

- 7. Europe Pallets Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Types

- 7.1.1. Wood

- 7.1.2. Plastic

- 7.1.3. Metal

- 7.1.4. Corrugated Paper

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Transportation and Warehousing

- 7.2.2. Food and Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Retail

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Types

- 8. Asia Pallets Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Types

- 8.1.1. Wood

- 8.1.2. Plastic

- 8.1.3. Metal

- 8.1.4. Corrugated Paper

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Transportation and Warehousing

- 8.2.2. Food and Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Retail

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Types

- 9. Latin America Pallets Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Types

- 9.1.1. Wood

- 9.1.2. Plastic

- 9.1.3. Metal

- 9.1.4. Corrugated Paper

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Transportation and Warehousing

- 9.2.2. Food and Beverage

- 9.2.3. Pharmaceutical

- 9.2.4. Retail

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Types

- 10. Middle East and Africa Pallets Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Types

- 10.1.1. Wood

- 10.1.2. Plastic

- 10.1.3. Metal

- 10.1.4. Corrugated Paper

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Transportation and Warehousing

- 10.2.2. Food and Beverage

- 10.2.3. Pharmaceutical

- 10.2.4. Retail

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Types

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Falkenhahn A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rehrig Pacific Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Palettes Gestion Services (PGS) Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CABKA Group GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Loscam International Holdings Co Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CHEP

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Brambles Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Craemer Holding GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 World Steel Pallet Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 UFP Industries Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Schoeller Allibert

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 MENASHA Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Falkenhahn A

List of Figures

- Figure 1: Global Pallets Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Pallets Market Revenue (Million), by Types 2025 & 2033

- Figure 3: North America Pallets Market Revenue Share (%), by Types 2025 & 2033

- Figure 4: North America Pallets Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America Pallets Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Pallets Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Pallets Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Pallets Market Revenue (Million), by Types 2025 & 2033

- Figure 9: Europe Pallets Market Revenue Share (%), by Types 2025 & 2033

- Figure 10: Europe Pallets Market Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe Pallets Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Pallets Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Pallets Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pallets Market Revenue (Million), by Types 2025 & 2033

- Figure 15: Asia Pallets Market Revenue Share (%), by Types 2025 & 2033

- Figure 16: Asia Pallets Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pallets Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pallets Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pallets Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Pallets Market Revenue (Million), by Types 2025 & 2033

- Figure 21: Latin America Pallets Market Revenue Share (%), by Types 2025 & 2033

- Figure 22: Latin America Pallets Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Latin America Pallets Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Latin America Pallets Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Pallets Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Pallets Market Revenue (Million), by Types 2025 & 2033

- Figure 27: Middle East and Africa Pallets Market Revenue Share (%), by Types 2025 & 2033

- Figure 28: Middle East and Africa Pallets Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Middle East and Africa Pallets Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Middle East and Africa Pallets Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Pallets Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Pallets Market Revenue Million Forecast, by Types 2020 & 2033

- Table 2: Global Pallets Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global Pallets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Pallets Market Revenue Million Forecast, by Types 2020 & 2033

- Table 5: Global Pallets Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global Pallets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Pallets Market Revenue Million Forecast, by Types 2020 & 2033

- Table 10: Global Pallets Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: Global Pallets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Spain Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Pallets Market Revenue Million Forecast, by Types 2020 & 2033

- Table 18: Global Pallets Market Revenue Million Forecast, by End User 2020 & 2033

- Table 19: Global Pallets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: India Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Australia and New Zealand Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Pallets Market Revenue Million Forecast, by Types 2020 & 2033

- Table 25: Global Pallets Market Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Global Pallets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 27: Brazil Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Mexico Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Pallets Market Revenue Million Forecast, by Types 2020 & 2033

- Table 31: Global Pallets Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Global Pallets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Saudi Arabia Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Africa Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Egypt Pallets Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pallets Market?

The projected CAGR is approximately 4.37%.

2. Which companies are prominent players in the Pallets Market?

Key companies in the market include Falkenhahn A, Rehrig Pacific Company, Palettes Gestion Services (PGS) Group, CABKA Group GmbH, Loscam International Holdings Co Limited, CHEP, Brambles Limited, Craemer Holding GmbH, World Steel Pallet Co Ltd, UFP Industries Inc, Schoeller Allibert, MENASHA Corporation.

3. What are the main segments of the Pallets Market?

The market segments include Types, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 95.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Plastic Pallets Across the Industry Verticals; Adoption of Pallets for Transportation Purpose.

6. What are the notable trends driving market growth?

Increasing Demand for Plastic Pallets Across the Industry Verticals.

7. Are there any restraints impacting market growth?

Limiting Availability and High Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

January 2024: IFCO, a provider of reusable packaging containers (RPCs), launched Dora, a reusable plastic pallet, across Europe. The IFCO plastic pallet increases efficiency and safety in critical areas across transportation and handling. Transportation costs are significantly reduced because Dora is over 25% lighter than conventional wood pallets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pallets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pallets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pallets Market?

To stay informed about further developments, trends, and reports in the Pallets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence