Key Insights

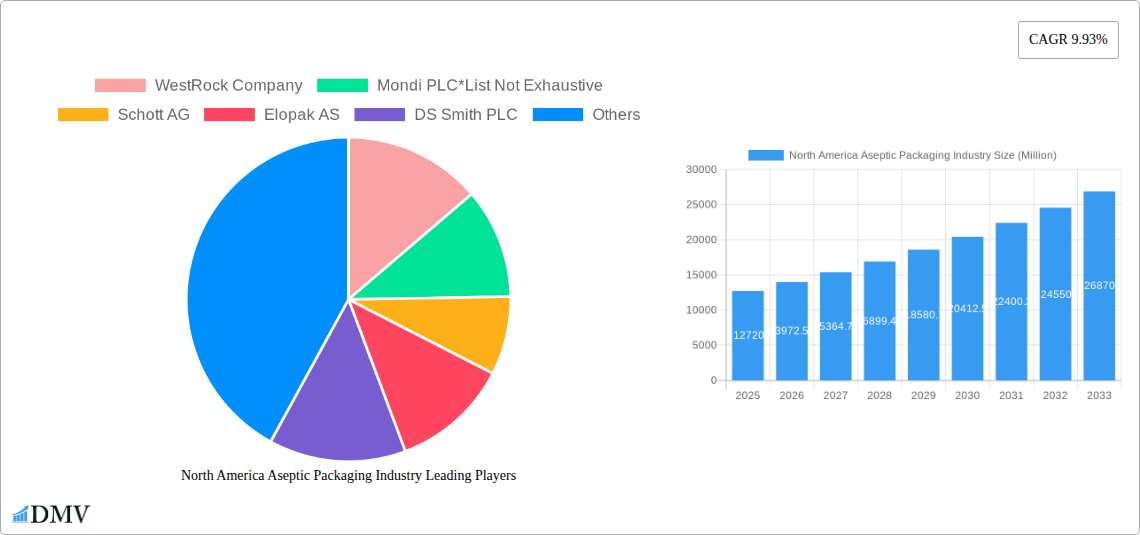

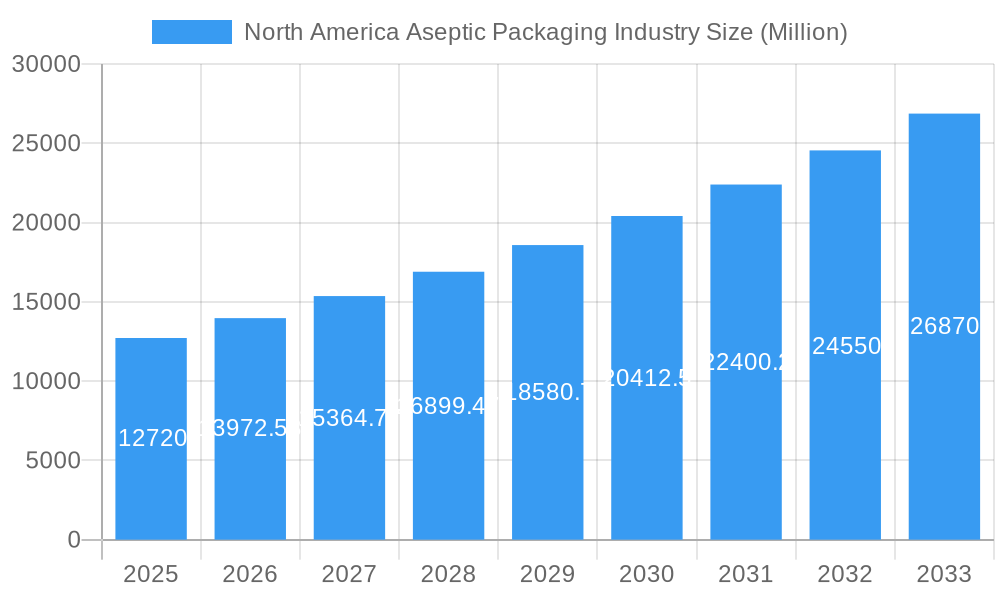

The North American aseptic packaging market, valued at $12.72 billion in 2025, is projected to experience robust growth, driven by increasing demand for extended shelf-life products in the food and beverage sectors, particularly within the pharmaceutical industry. The rising consumer preference for convenient, safe, and preservative-free food and beverages fuels this expansion. Growth is further accelerated by advancements in packaging technology, leading to more sustainable and efficient aseptic solutions. Key segments within the market include plastic bottles, prefillable syringes, vials and ampoules, bags and pouches, cartons, cups, and glass bottles, each catering to specific product needs and consumer preferences. The United States and Canada represent the largest markets within North America, benefiting from established infrastructure and a strong demand for aseptic packaging across diverse industries. Competition is significant, with major players like WestRock, Mondi, Schott, Elopak, DS Smith, Tetra Pak, Scholle IPN, SIG Combibloc, Amcor, and Sealed Air vying for market share through innovation and strategic partnerships.

North America Aseptic Packaging Industry Market Size (In Billion)

A compound annual growth rate (CAGR) of 9.93% from 2025 to 2033 indicates substantial market expansion. This growth trajectory is anticipated to continue due to the increasing adoption of aseptic packaging by smaller food and beverage manufacturers seeking to enhance their product offerings and compete with larger established brands. While regulatory hurdles and material cost fluctuations pose challenges, the overall market outlook remains positive, fueled by continuous advancements in aseptic technology, a growing health-conscious population, and a rising demand for extended shelf-life products across diverse sectors. The market's evolution will likely witness increasing focus on sustainable packaging materials and circular economy principles, aligning with growing environmental concerns.

North America Aseptic Packaging Industry Company Market Share

North America Aseptic Packaging Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America aseptic packaging market, offering invaluable insights for stakeholders across the industry value chain. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive dynamics, and future growth potential. The report forecasts a market value exceeding xx Million by 2033, driven by factors such as increased demand for hygienic food packaging and technological advancements in aseptic filling solutions.

North America Aseptic Packaging Industry Market Composition & Trends

This section delves into the intricate structure of the North America aseptic packaging market. We analyze market concentration, revealing the market share distribution amongst key players like Tetra Pak International S A, Amcor Limited, and SIG Combibloc Group. We assess the impact of innovation, including advancements in sustainable materials and filling technologies, on market dynamics. The regulatory landscape, including evolving food safety regulations and sustainability mandates, is thoroughly scrutinized. Furthermore, the report explores substitute products, end-user preferences across the pharmaceutical, beverage, and food industries, and the impact of mergers and acquisitions (M&A) activities, including deal values of xx Million in recent years.

- Market Concentration: Highly concentrated market with a few dominant players controlling significant market share.

- Innovation Catalysts: Advancements in barrier films, sustainable materials (e.g., plant-based polymers), and aseptic filling technologies are driving innovation.

- Regulatory Landscape: Stringent food safety regulations and growing emphasis on sustainability are shaping industry practices.

- Substitute Products: Competition from alternative packaging formats (e.g., retort pouches) is analyzed.

- End-User Profiles: Detailed analysis of consumption patterns across various end-use sectors (pharmaceutical, beverage, food).

- M&A Activities: Review of recent mergers and acquisitions, analyzing their impact on market consolidation and innovation.

North America Aseptic Packaging Industry Industry Evolution

This section traces the evolution of the North America aseptic packaging industry, examining historical growth trajectories from 2019-2024 and projecting future growth rates through 2033. We explore technological advancements, such as the introduction of new barrier materials and improved filling equipment, influencing production efficiency and packaging capabilities. Shifting consumer preferences towards convenience, sustainability, and extended shelf life are analyzed in the context of market evolution. The report incorporates specific data points such as Compound Annual Growth Rate (CAGR) for the forecast period and adoption rates of new technologies. For example, the adoption rate of sustainable aseptic packaging is expected to increase by xx% by 2033, driven by growing consumer demand for eco-friendly solutions. The impact of COVID-19 on market growth, including a surge in demand for aseptically packaged food items, is thoroughly examined.

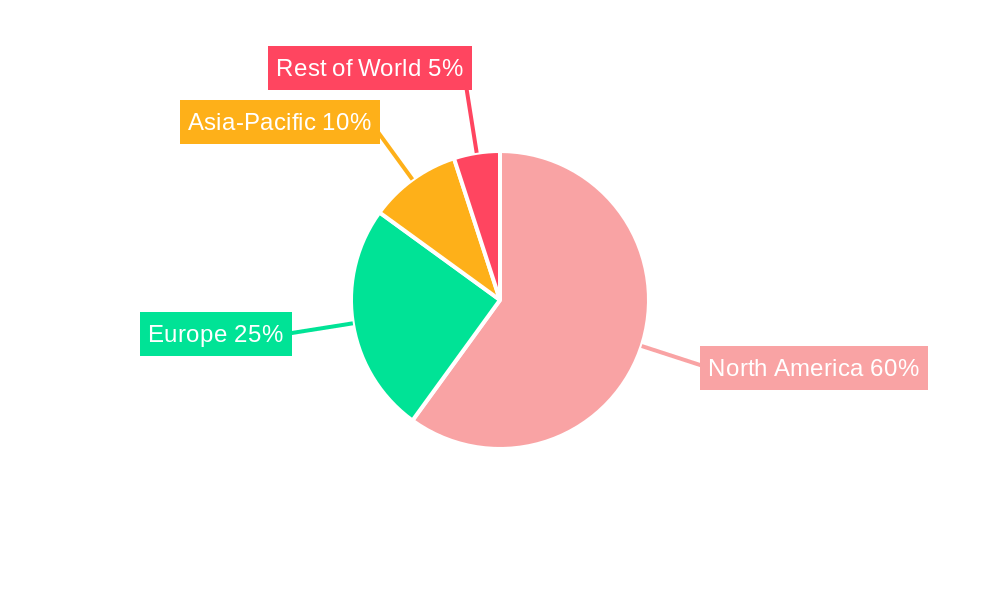

Leading Regions, Countries, or Segments in North America Aseptic Packaging Industry

This section identifies the leading regions, countries, and segments within the North American aseptic packaging market. The United States and Canada are analyzed individually, highlighting factors contributing to their market dominance. Across end-user segments (pharmaceutical, beverage, food), the analysis determines which segment exhibits the strongest growth drivers and market share. Similarly, leading product types (plastic bottles, prefillable syringes, vials and ampoules, bags and pouches, cartons, cups, glass bottles) are identified and analyzed, considering market demand, technological suitability, and cost-effectiveness.

- Key Drivers for Dominance:

- United States: Large and diverse consumer base, advanced infrastructure, and high technological adoption rates.

- Canada: Growing demand for food and beverage products, coupled with regulatory focus on food safety.

- Beverage Industry: High volume consumption and demand for extended shelf-life packaging.

- Food Industry: Concerns over food hygiene and safety, driving demand for aseptic packaging.

- Plastic Bottles: Cost-effectiveness and wide applicability across various end-user segments.

North America Aseptic Packaging Industry Product Innovations

This section highlights significant product innovations in aseptic packaging, including advancements in barrier materials, sustainable packaging options, and improved filling technologies. The focus is on unique selling propositions (USPs), technological advancements leading to enhanced product performance (e.g., extended shelf life, improved barrier properties), and new applications of aseptic packaging in emerging market segments. For example, the introduction of bio-based polymers has significantly enhanced the sustainability profile of aseptic packaging solutions, while innovative filling machinery, such as Tetra Pak's A1, allows for increased efficiency and lower unit costs.

Propelling Factors for North America Aseptic Packaging Industry Growth

Several key factors contribute to the growth of the North America aseptic packaging industry. Technological advancements, like the development of more sustainable and efficient packaging materials and improved filling machinery, are significantly impacting growth. Economic factors, such as rising disposable incomes and changing consumer preferences for convenience and longer shelf-life products, are also driving demand. Moreover, stricter food safety regulations are compelling manufacturers to adopt aseptic packaging.

Obstacles in the North America Aseptic Packaging Industry Market

Despite strong growth prospects, the North America aseptic packaging industry faces certain challenges. Regulatory hurdles, involving complex compliance requirements and constantly evolving standards, pose a significant obstacle. Supply chain disruptions, including fluctuations in raw material costs and potential logistical bottlenecks, are also a concern. Furthermore, intense competition among established players and the emergence of new entrants present ongoing challenges. These factors can impact overall growth trajectories and influence the market landscape.

Future Opportunities in North America Aseptic Packaging Industry

The North America aseptic packaging industry presents promising opportunities for future growth. The expansion into new market segments, particularly within the healthcare and personal care sectors, presents significant potential. The development and adoption of more sustainable and eco-friendly packaging solutions cater to increasing consumer demand for environmentally responsible products. Finally, leveraging technological advancements, such as smart packaging and digital printing, can further enhance the appeal and functionalities of aseptic packaging.

Major Players in the North America Aseptic Packaging Industry Ecosystem

Key Developments in North America Aseptic Packaging Industry Industry

- 2020: The COVID-19 pandemic fueled a significant surge in demand for aseptically packaged food and beverage products due to increased hygiene concerns and panic buying.

- 2021-2023: Several companies introduced new sustainable aseptic packaging solutions using bio-based polymers and recycled materials.

- Ongoing: Tetra Pak International SA continues to develop and launch new aseptic filling machinery, such as the A1, enhancing production efficiency and lowering unit costs.

Strategic North America Aseptic Packaging Industry Market Forecast

The North America aseptic packaging market is poised for substantial growth, driven by several key factors. The rising demand for convenient and shelf-stable food and beverage products, coupled with heightened concerns surrounding food safety and hygiene, will continue to drive adoption. Technological advancements in materials science and filling technologies promise to further enhance the performance and sustainability of aseptic packaging. Consequently, the market is projected to experience considerable expansion over the forecast period, presenting significant opportunities for market participants.

North America Aseptic Packaging Industry Segmentation

-

1. End- User Type

-

1.1. Pharmaceutical Industry

- 1.1.1. Prefillable Syringes

- 1.1.2. Bottles

- 1.1.3. Vials and Ampoules

- 1.1.4. Other Pharmaceutical Industry Types

-

1.2. Beverage Industry

- 1.2.1. Fruit-based

- 1.2.2. Milk and Other Dairy Beverages

- 1.2.3. Ready-to-Drink

- 1.2.4. Other Beverage Industry Types

-

1.3. Food Industry

- 1.3.1. Dairy Food

- 1.3.2. Processed Foods

- 1.3.3. Baby Foods

- 1.3.4. Soups and Broths

- 1.3.5. Other Food Industry Types

-

1.1. Pharmaceutical Industry

-

2. Product Type

- 2.1. Plastic Bottles

- 2.2. Prefillabe Syringes

- 2.3. Vials and Ampoules

- 2.4. Bags and Pouches

- 2.5. Cartons

- 2.6. Cups

- 2.7. Glass Bottles

North America Aseptic Packaging Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Aseptic Packaging Industry Regional Market Share

Geographic Coverage of North America Aseptic Packaging Industry

North America Aseptic Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand to Reduce the Cost of Cold Chain Logistics; Increasing Demand for the Longer Shelf Life of Products

- 3.3. Market Restrains

- 3.3.1. Manufacturing Complications & Lower ROI

- 3.4. Market Trends

- 3.4.1. Beverages Segment is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Aseptic Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End- User Type

- 5.1.1. Pharmaceutical Industry

- 5.1.1.1. Prefillable Syringes

- 5.1.1.2. Bottles

- 5.1.1.3. Vials and Ampoules

- 5.1.1.4. Other Pharmaceutical Industry Types

- 5.1.2. Beverage Industry

- 5.1.2.1. Fruit-based

- 5.1.2.2. Milk and Other Dairy Beverages

- 5.1.2.3. Ready-to-Drink

- 5.1.2.4. Other Beverage Industry Types

- 5.1.3. Food Industry

- 5.1.3.1. Dairy Food

- 5.1.3.2. Processed Foods

- 5.1.3.3. Baby Foods

- 5.1.3.4. Soups and Broths

- 5.1.3.5. Other Food Industry Types

- 5.1.1. Pharmaceutical Industry

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plastic Bottles

- 5.2.2. Prefillabe Syringes

- 5.2.3. Vials and Ampoules

- 5.2.4. Bags and Pouches

- 5.2.5. Cartons

- 5.2.6. Cups

- 5.2.7. Glass Bottles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End- User Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WestRock Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mondi PLC*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schott AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Elopak AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DS Smith PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tetra Pak International S A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Scholle IPN

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SIG Combibloc Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amcor Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sealed Air Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 WestRock Company

List of Figures

- Figure 1: North America Aseptic Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Aseptic Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Aseptic Packaging Industry Revenue Million Forecast, by End- User Type 2020 & 2033

- Table 2: North America Aseptic Packaging Industry Volume K Tons Forecast, by End- User Type 2020 & 2033

- Table 3: North America Aseptic Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: North America Aseptic Packaging Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 5: North America Aseptic Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Aseptic Packaging Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: North America Aseptic Packaging Industry Revenue Million Forecast, by End- User Type 2020 & 2033

- Table 8: North America Aseptic Packaging Industry Volume K Tons Forecast, by End- User Type 2020 & 2033

- Table 9: North America Aseptic Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: North America Aseptic Packaging Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: North America Aseptic Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Aseptic Packaging Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: United States North America Aseptic Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Aseptic Packaging Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Aseptic Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Aseptic Packaging Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Aseptic Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Aseptic Packaging Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Aseptic Packaging Industry?

The projected CAGR is approximately 9.93%.

2. Which companies are prominent players in the North America Aseptic Packaging Industry?

Key companies in the market include WestRock Company, Mondi PLC*List Not Exhaustive, Schott AG, Elopak AS, DS Smith PLC, Tetra Pak International S A, Scholle IPN, SIG Combibloc Group, Amcor Limited, Sealed Air Corporation.

3. What are the main segments of the North America Aseptic Packaging Industry?

The market segments include End- User Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand to Reduce the Cost of Cold Chain Logistics; Increasing Demand for the Longer Shelf Life of Products.

6. What are the notable trends driving market growth?

Beverages Segment is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Manufacturing Complications & Lower ROI.

8. Can you provide examples of recent developments in the market?

Owing to the spread of COVID-19, the market is expected to witness significant growth. Due to the pandemic, customers have shifted towards online retail and panic stocking, which led to an increased demand for essential food items such as milk, baby food, and vegetables. Moreover, the concerns regarding food hygiene due to Covid-19 have been increasing the demand for aseptic packaging. In the coming years, the customers are expected to prefer better packaging to prevent such diseases, which would compel the vendors to think on the lines of sustainable aseptic packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Aseptic Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Aseptic Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Aseptic Packaging Industry?

To stay informed about further developments, trends, and reports in the North America Aseptic Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence